Vetoquinol: Sales 3rd Quarter 2023

2023年10月27日 - 12:45AM

ビジネスワイヤ(英語)

Q3 Sales: €136m (+5.1% at constant exchange rates) Q3

Essentials Sales: €81m (+12.2% at constant exchange rates)

Regulatory News:

Matthieu Frechin, Chairman and CEO of Vetoquinol

(Paris:VETO), commented: "Our sales in Q3 2023 were marked by a

dynamic activity and stronger negative currency impacts than in the

first half. In a global animal health market still driven by

prices, we are pursuing the launches and ramp-up of our new

Essentials, the drivers of our long-term strategy."

The Vetoquinol Group posted sales of €136 million in Q3 2023,

up +1.3% on a reported basis and +5.1% at constant exchange

rates. Over the same period, Vetoquinol recorded a negative

currency impact of -€5 million, linked to the Americas and Asia

Pacific/Rest of World territories.

Sales of Essential products totaled €81 million, up +9% on a

reported basis and +12.2% at constant exchange rates. This

dynamic performance was driven by the development of the existing

portfolio and the ongoing launches of Felpreva®, an antiparasitic

solution for cats in Europe, and Simplera®, a drug indicated for

the treatment of otitis in dogs, in the United States. Sales of

Essentials products accounted for 60% of Vetoquinol’s sales in Q3

2023, compared with 56% for the same period in 2022.

At constant exchange rates, the strategic territories of the

Americas and Europe grew by +13.7% and +4.3% respectively; the

Asia-Pacific/Rest of the World territory was down by -10.5%, mainly

related to the distributor business.

Sales of companion animals products (€96 million) rose by +7.3%

at constant exchange rates, representing 70.6% of the Group’s total

sales. Sales of farm animals products came to €40 million, stable

at constant exchange rates.

At the end of September 2023, Vetoquinol sales totaled €392

million, down

-3.2% on a reported basis and -1.4% at constant exchange

rates. Foreign exchange had a negative impact of -€7 million

(-1.8%). Essential products accounted for 59% of Group sales, up

+3.3% at constant exchange rates.

The Group's cash position at the end of September 2023 remains

solid.

Sales for the first 9 months of 2023 have not been audited by

the Statutory Auditors.

Next update: Annual Sales 2023, January 24th, 2024 after

market close

ABOUT VETOQUINOL

Vetoquinol is a leading global animal health company that

supplies drugs and non-medicinal products for the farm animals

(cattle and pigs) and pet (dogs and cats) markets. As an

independent pure player, Vetoquinol designs, develops and sells

veterinary drugs and non-medicinal products in Europe, the Americas

and the Asia Pacific region. Since its foundation in 1933,

Vetoquinol has pursued a strategy combining innovation with

geographical diversification. The Group’s hybrid growth is driven

by the reinforcement of its product portfolio coupled with

acquisitions in high potential growth markets. Vetoquinol employed

2,497 people as of June 30th, 2023.

Vetoquinol has been listed on Euronext Paris since 2006 (symbol:

VETO).

The Vetoquinol share is eligible for the French PEA and PEA-PME

personal equity plans.

ANNEX

€m

2023

2022

Change (reported data)

Change (constant exchange

rates)

Q1 Sales

145.4

135.0

+7.7%

+7.2%

Q2 Sales

110.8

135.8

-18.3%

-16.3%

Q3 Sales

135.8

134.1

+1.3%

+5.1%

YTD Sep Sales

392.0

404.9

-3.2%

-1.4%

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management considers that these indicators,

which are not defined by IFRS, provide additional information that

is relevant for shareholders seeking to analyze underlying trends

and Group performance and financial position. They are used by

management for performance analysis.

Essentials products: The products referred to as

“Essentials” comprise veterinary drugs and non-medical products

sold by the Vetoquinol Group. They are existing or potential

market-leading products designed to meet the daily requirements of

vets in the companion animal or livestock sector. They are intended

for sale worldwide and their scale effect improves their economic

performance.

Constant exchange rates: Application of the previous

period’s exchange rates to the current financial year, all other

things remaining equal.

Like-for-like (LFL) growth: Year-on-year sales growth in

terms of volume and/or price at constant consolidation scope and

exchange rates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231026741450/en/

VETOQUINOL

Investor Relations Fanny Toillon Tel.: +33 (0)3 84

62 59 88 relations.investisseurs@vetoquinol.com

KEIMA COMMUNICATION

Investor & Media Relations Emmanuel Dovergne

Tel.: +33 (0)1 56 43 44 63 emmanuel.dovergne@keima.fr

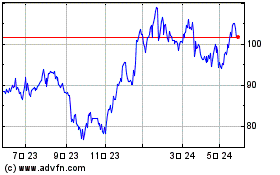

Vetoquinol (EU:VETO)

過去 株価チャート

から 10 2024 まで 11 2024

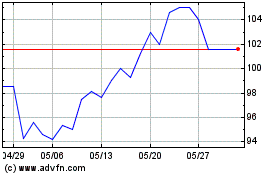

Vetoquinol (EU:VETO)

過去 株価チャート

から 11 2023 まで 11 2024