Explosive Growth: NEAR Protocol Caters To 3 Million Daily Users

2024年10月11日 - 1:00AM

NEWSBTC

As of Q3 2024, CryptoRank stated that 3 million addresses were

active every day on NEAR Protocol, making it a major player in the

blockchain world. This huge number is higher than both Tron (2

million daily active addresses) and Solana (2.4 million daily

active addresses) during the same time period. Related Reading: $6

Million ETH Sale: Ethereum Foundation Joins Whale Liquidation

Frenzy The growth of NEAR is in line with a larger trend in the AI

cryptocurrency market. This shows that blockchain and AI are

becoming more and more intertwined. This point of contact is

driving more and more technological progress and user engagement

across these channels. Surge In The AI-Cryptocurrency Sector One of

the most important factors influencing user engagement on NEAR is

the rapid growth in AI-related decentralized applications or dApps.

As DappRadar reported, AI dApps increased by 70% compared with the

previous quarter in Q3. The survey indicated that AI dApps garnered

4.3 million daily unique active wallets, illustrating the growing

interest in this sector of the cryptocurrency industry. NEAR

Protocol has swiftly leveraged this trend by establishing

collaborations with major corporations such as Nvidia and Alibaba

to augment its AI capabilities. With this further integration with

AI, in addition to NEAR’s strong growing ecosystem, the network

finds itself at the helm of innovation in this emerging blockchain

landscape. Although the ecosystem is still experiencing positive

growth, market sentiment remains cautious as the price of the

protocol decreased by 2.36% to $4.87, along with a more than 30%

decrease in trading volume. NEAR Protocol: Price Fluctuations Amid

Market Ambiguity The current price difficulties of NEAR can be

ascribed to overarching market conditions rather than the

protocol’s intrinsic value. Despite the optimistic outlook

suggested by daily active addresses and collaborations, recent data

indicates a 0.4% reduction in NEAR’s circulating supply, now

totaling 1.11 billion tokens. The protocol’s market capitalization

now stands at $5.42 billion, ranking it 23rd overall in the market.

Related Reading: Could XRP Finally Hit $1? Key Factors To Consider,

According To Analysts Price Forecast Indicates Rebound Potential

The medium-term prognosis for NEAR is predominantly favorable.

Technical analysis forecasts an upward trend in the forthcoming

seven days, with the token presently trading 220% beneath its

projected value for the subsequent month. During a three-month

interval, the price is anticipated to rise by 240%, indicative of

favorable market sentiment and heightened adoption. Prolonged

projections are similarly positive, with a six-month growth

anticipated at 178% and a one-year projection indicating a 165%

increase. Although short-term price fluctuations may indicate

general market instability, the long-term prospects for NEAR are

clear. Investors must keep tabs of forthcoming ecosystem

advancements and AI trends to assess the protocol’s price

trajectory. Featured image from Pexels, chart from Avark

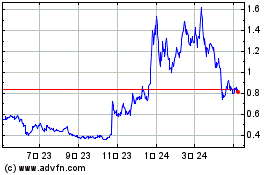

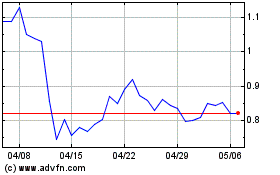

Mina (COIN:MINAUSD)

過去 株価チャート

から 11 2024 まで 12 2024

Mina (COIN:MINAUSD)

過去 株価チャート

から 12 2023 まで 12 2024