Chainlink: Market Panic Shaves 23% Off LINK Price – Details

2024年8月5日 - 10:30PM

NEWSBTC

Chainlink suffers losses as the token continues to follow the

broader market wave of bearish pressure. According to Coingecko,

the token is down 23% in the past 24 hours, representing a

significant wipe in value after the price stabilized in the $13 to

$14 price range. The crypto market continues to be influenced

by outside forces in the short to medium term, with the anxieties

of private equity bleeding into the crypto market turning the

correction into an absolute bloodbath. Related Reading:

MATIC: Market Nosedive Leads To 30% Wipe In Value What’s In It for

Chainlink? LINK’s niche of capturing and streaming price feed data

to partners has been shaken by the recent groundbreaking market

movements that have shown that the token fails to capture any

value. In a recent X post detailing recent developments that

may affect the crypto world, supporters of Chainlink left comments

that show their skepticism of its relevance to the LINK

token. Capital markets news: Mercedes, Siemens, and other

major German enterprises test commercial bank money tokens (CBMT).

“Robots could be paid automatically for the work they perform for

other companies or customers with the help of tokens,” noted the

Proof of Concept (PoC).… pic.twitter.com/KqhV5CcNAh — Chainlink

(@chainlink) August 2, 2024 “What does any of this have to do with

the $Link token? The token is what funded you guys from the very

beginning to [the] present day. How is it capturing value?” a user

on X said in their comment. What does any of this have to do with

the $Link token? The token is what funded you guys from the very

beginning to present day. How is it capturing value? — TT 🥭 &

FUD Farmer (@TTLinkie3299) August 2, 2024 Despite the skepticism of

the follower base in Chainlink, the organization continues to

receive positive news at the start of the month. Last week,

Concero, a blockchain infrastructure platform, announced its

selection of Chainlink’s CCIP for “secure cross-chain

interoperability.” Concero also joined Chainlink Build, a

partnership program that grants them enhanced access to Chainlink

services which guarantees the quality of the data stream they’ll

receive. Another addition to the Chainlink Build family is

Rivalz AI, the “first AI intel layer”, which will help the latter

in the security of its AI-driven data network. Since the Build

program is a two-way street, Rivalz made 3% of its token supply

available to Chainlink stakers and providers which is an enticing

offer to would-be stakers on Chainlink. However, sell pressure

continues to plague LINK completely negating the attractiveness of

the new additions to Chainlink’s growing Build program. The

platform also suffered a massive outflow of staked crypto.

According to DeFiLlama, Chainlink suffered a 20% decrease in total

value locked (TVL). Related Reading: Binance Coin In Turmoil:

Nearly 10% Value Erased In Market Shake-Up More Losses In The Short

To Medium Term For LINK At its current position, LINK will continue

to face losses if the token falls well beyond its October 2023

level. LINK bulls should keep defending the $8.3 support as

this will enable them to secure better positions in the long term.

However, the current environment of anxiety and fear will hinder

efforts to retake lost ground. Investors and traders should

then exercise caution as the market might follow the downward

spiral that started with the correction phase that started last

week. Featured image from Pixabay, chart from TradingView

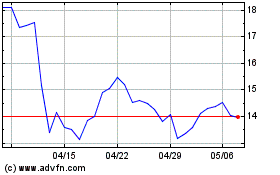

ChainLink Token (COIN:LINKUSD)

過去 株価チャート

から 10 2024 まで 11 2024

ChainLink Token (COIN:LINKUSD)

過去 株価チャート

から 11 2023 まで 11 2024