Apple Wins Battle With Banks Over Mobile Payments

2016年11月29日 - 4:40PM

Dow Jones News

Apple Inc. won the first round of a battle with Australia's

largest banks, which have been trying to force the tech company to

offer them access to its Apple Pay technology that allows

smartphones and tablets to communicate with payment terminals.

The decision could help smooth Apple Pay's difficult entry into

Australia, where mobile-payment technology is more advanced than in

the U.S.—chip-and-pin payments, widely rolled out in America only

in the past year, are virtually passé in Australia—and where most

consumers simply wave a debit or credit card near a reader to make

everyday payments.

In a draft ruling on Tuesday, Australia's antitrust watchdog

said it wouldn't allow Commonwealth Bank of Australia Ltd., Westpac

Banking Corp., National Australia Bank Ltd. and regional lender

Bendigo & Adelaide Bank Ltd. to collectively boycott Apple's

mobile-payments platform. The lenders, which together account for

about two-thirds of household deposits and issued credit in the

country, had sought permission to negotiate collectively with Apple

to avoid antitrust action. The regulator, the Australian

Competition and Consumer Commission, will make a final decision in

March.

Apple has defended its hold over access to its technology and

characterized the banks' action as an attempt to blunt Apple Pay's

entry into the Australian market. It said in a statement it

welcomed the draft decision and would work with individual banks to

bring Apple Pay to their customers.

Only one of the country's big four banks, Australia & New

Zealand Banking Group Ltd., has signed a deal with Apple to use

Apple Pay, which launched Down Under in late 2015 with American

Express Co.

Apple doesn't allow any entity direct access to its near-field

communications controller—technology that communicates with payment

terminals in stores—for reasons, it says, of privacy and security.

Banks can make use of it through Apple's digital wallet—for a

fee.

The banks argued that they should be able to offer competing

wallets on Apple's iOS platform, increasing competition and

innovation in digital wallets and apps, and that by being able to

negotiate collectively increased their chance of doing so.

Rod Sims, chairman of the competition regulator, said Australian

banks can already offer digital wallets on iPhones through their

own banking apps, without direct access to Apple's near-field

communications system. Some banks, including National Australia

Bank, already offer mobile-banking applications on Apple devices

that allow users to check their balances, control their credit

cards and make online payments. Australian banks can also offer

their wallets on rival phones that use the Android operating

system.

"Apple Wallet and other nonbank digital wallets could represent

a disruptive technology that may increase competition between the

banks by making it easier for consumers to switch between card

providers and limiting any 'lock in' effect bank digital wallets

may cause," he said.

In its submission to the regulator, Apple said authorization for

a cartel among the banks would perpetuate "oligopolistic" banking

conditions in Australia, and that Apple Pay was an example of

competition that the banks wrongly perceived as a threat. It said

it couldn't agree to the terms the banks were seeking, including

allowing them to charge customers for using Apple Pay.

The banks, in a joint statement, said that if the regulator's

ruling stands it would mean iPhone users have no choice on the

digital wallet they use for payments, and the industry would be

denied the chance to compete with Apple. They said their

application wasn't about preventing Apple Pay from coming to

Australia or reducing competition, but about providing consumer

choice.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

November 29, 2016 02:25 ET (07:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

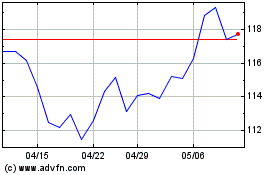

Commonwealth Bank Of Aus... (ASX:CBA)

過去 株価チャート

から 10 2024 まで 11 2024

Commonwealth Bank Of Aus... (ASX:CBA)

過去 株価チャート

から 11 2023 まで 11 2024