TIDMAXS

RNS Number : 1161U

Accsys Technologies PLC

21 November 2023

AIM: AXS

Euronext Amsterdam: AXS

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES OF AMERICA, CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF

SOUTH AFRICA OR SWITZERLAND OR INTO ANY OTHER JURISDICTION WHERE TO

DO SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT

CONSTITUTE AN OFFER OF SECURITIES IN ANY JURISDICTION

ACCSYS TECHNOLOGIES PLC

("Accsys" or the "Company" or "Group")

Capital Raise to raise gross proceeds of approximately EUR34

million and extension of debt facilities

Proceeds to complete US project, strengthen the balance sheet

and increase liquidity

Accsys, the fast-growing company that enhances the natural

properties of wood to make high performance and sustainable

building products, today announces that it proposes to raise gross

proceeds of approximately EUR34 million (of which approximately

EUR24 million is new money for the Company):

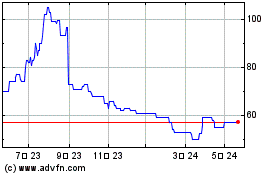

-- A Placing and Subscription (the "Issue") of new ordinary

shares of 0.05 euro cents nominal value each ("New Ordinary

Shares") to raise gross proceeds of approximately EUR13 million

(the "Placing and Subscription") at a fixed price of 69.35 Euro

cents ( 61.00 GBP pence) per New Ordinary Share (the "Issue

Price").

-- The issue of between approximately EUR19 million and

approximately EUR21 million new Convertible Loan Notes ("New

CLNs"), which includes the refinancing and discharge of the

existing 2022 EUR10 million convertible loan with De Engh BV

Limited (" De Engh ") (the "2022 Convertible Loan"). The issuance

of the New CLNs (including those which refinance the 2022

Convertible Loan) will raise gross new proceeds for the Company of

between approximately EUR9 and approximately EUR11 million (the

"CLN Issuance" and together with the Issue, the "Capital

Raise").

-- The Company has also negotiated an extension of its existing

main debt facilities with ABN AMRO to 31 March 2026 on terms which

support the business with the provision of additional funding and

covenant headroom (the "Debt Extension Package").

The net new proceeds of the Capital Raise along with the Debt

Extension Package allow Accsys to commence commercial operations of

its Accoya plant, currently under construction Kingsport, US, in

mid-2024, strengthen its balance sheet and increase working capital

headroom in the face of a challenging macro trading environment.

Decisive action has been taken to ensure the Company has the

funding platform necessary to execute its growth strategy.

Placing and Subscription

-- The placing of New Ordinary Shares with Placees will be

conducted at a fixed price of 69.35 Euro cents ( 61.00 GBP pence)

through an accelerated bookbuild on the terms and conditions set

out in Appendix II (the "Placing")

-- The Issue Price represents a discount of approximately 3.7%

to the closing price of the Ordinary Shares on Euronext Amsterdam

of 72 Euro cents, and a discount of approximately 3.2% to the

closing price of the Ordinary Shares on the AIM of 63 pence as at

20 November 2023.

-- Certain of the Company's major shareholders, including Teslin

Participates Coöperatief U.A. ("Teslin"), De Engh and BGF

Investments LP ("BGF") have committed to provide, in aggregate,

approximately EUR13 million of new equity through the Placing, at

the Issue Price (the "Committed Undertakings").

-- The aggregate amount to be raised by the Placing may be

increased from approximately EUR13 million to approximately EUR15

million depending on the outcome of the bookbuild.

-- In addition, Steven Salo, (CFO) intends to subscribe for

16,393 New Ordinary Shares at the Issue Price for an aggregate

amount of GBP10,000 (the "Subscription").

-- The Placing and Subscription are expected to represent in

aggregate between approximately 8.6 % and approximately 9.8% of the

Company's current issued ordinary share capital.

CLN Issuance

Proposed issue of between approximately EUR19 million and

approximately EUR21 million fixed rate unsecured Convertible Loan

Notes (in minimum denominations of EUR500,000) concurrently with

the Placing, which includes the refinancing and discharge of the

existing EUR10 million 2022 Convertible Loan, to raise new proceeds

for the Company of between approximately EUR9 and approximately

EUR11 million.

-- Teslin, De Engh, BGF and certain other shareholders of the

Company have agreed to subscribe for New CLNs with a 6 year term

and carrying a fixed rate coupon of 9.5%. For the first 2.5 years

the coupon will be rolled up and deferred and following that 2.5

year period, the deferred interest can either be converted into

ordinary shares of the Company ("Ordinary Shares") or paid in cash

over the remaining 3.5 years at the option of the holders of the

New CLNs. Following that 2.5 year period, interest shall be payable

in cash.

-- The New CLN holders will have the right to convert the New

CLNs they hold into Ordinary Shares of the Company at a price of

83.22 Euro cents per share (the "Conversion Price"), representing a

20% premium to the Issue Price.

-- The amount raised through the CLN Issuance will be scaled

back depending on the quantum raised in the Placing. The final

amount raised by the CLN Issuance will be known following the

completion of the Placing bookbuild, expected to be later today,

and will be announced by the Company together with the results of

the Placing bookbuild.

-- The New CLNs are unsecured and non-transferrable (except to

certain related parties and affiliates) and no application will be

made for their admission to trading on any recognised securities

exchange.

-- The New CLNs will be issued by Skyespring Funding Limited (a

wholly owned Jersey incorporated subsidiary of the Company) and

will benefit from a guarantee granted by the Company.

-- The New CLNs will be issued upon admission of the Placing and

Subscription New Ordinary Shares to listing and trading on Euronext

Amsterdam and to trading on AIM ("Admission").

The Board is of the belief that the Capital Raise is in the best

interests of the Company and strengthens the Company's funding

position during a key period of investment.

Amendments to borrowing facilities

The Company has reached an agreement with ABN AMRO to extend the

Company's main borrowing facilities (being a EUR40.5 million term

loan facility (the "Term Loan Facility") and EUR25 million

revolving credit facility (the "RCF")) by 18 months from October

2024 to 31 March 2026 providing the business with greater financing

certainty. ABN AMRO has also provided support to the Company

through the release of cash collateral currently provided by Accsys

to ABN AMRO of EUR10 million, with EUR2.5 million being available

for Accsys' general liquidity purposes and the remaining EUR7.5

million applied to repay the Term Loan Facility. As part of the

Debt Extension Package, ABN AMRO have provided an amortisation

holiday for future scheduled repayments so that there are no

scheduled repayments of the term loan until 30 June 2025.

The Term Loan Facility interest rate will vary between 4.34% and

5.34%, with additional rolled up interest of 3% accruing on EUR2.25

million for the period from 5 April 2024 to 4 October 2024, EUR4.5

million for the period from 5 October 2024 to 4 April 2025 and

EUR6.75 million from 5 April 2025, representing the Term Loan

Facility amortisation payments that have been deferred under the

amortisation holiday. The RCF interest rate will vary between 3%

and 4% above the relevant reference rate. The margin under the Term

Loan Facility and RCF will start at 3.00%, increasing to 3.50% from

1 April 2024 and 4.00% from 1 October 2024.

This support has the net benefit of increasing the Company's

cash liquidity position by approximately EUR7.2 million over the

next 12 months and then providing extended liquidity for the

following 18 months. In addition, the Company will benefit from

greater headroom under the net leverage covenant for the 12 month

periods ending 30 September 2024, 31 December 2024 and 31 March

2025, set at 2.75x for those periods. All other financial covenants

levels will remain the same. As part of the Debt Extension Package,

the Company has agreed to certain minimum liquidity covenants, in

addition to the net leverage and interest cover covenants, all of

which are based upon the results and assets (as applicable) of the

relevant Group entities.

This Debt Extension Package is conditional on the Company

raising new money of EUR24 million through the Capital Raise and

will become effective upon completion of the Capital Raise.

The Company expects to begin the process of refinancing the Term

Loan Facility and RCF in H2 2024.

Rationale for the Capital Raise and Use of Proceeds

New gross proceeds of EUR24 million from the Capital Raise will

allow the Company to strengthen its balance sheet, providing

additional liquidity and covenant headroom during a key investment

period as it delivers the Accoya USA plant in Kingsport with its JV

partner Eastman. Use of proceeds from the Capital Raise will be as

follows:

-- Approximately EUR22 million will be used to fund the

Company's share of the US JV. The US plant is progressing well with

construction now approximately 78% complete and equipment settings

approximately 87% complete. The total construction cost for the US

plant is now expected to be approximately $160 million, reflecting

a more realistic build cost schedule and construction cost

inflation. It is expected that approximately EUR15.5m of the

Capital Raise proceeds will be used to complete construction and

approximately EUR6.5m to fund operations as the US plant targets a

steady ramp up in volume and operations.

-- Approximately EUR2 million will be used for general liquidity

and working capital purposes to provide the Company with additional

headroom given the current challenging macro trading

environment.

In light of ongoing challenging trading conditions, the Accsys

Management team has taken decisive actions to reduce operating

costs, optimise working capital and implement incremental cost

saving initiatives, targeting annual cost savings of more than

EUR3.0m per annum.

The Board has consulted with a number of the Company's

shareholders on the rationale for, and the structure of, the

Capital Raise. The structure has been chosen as it minimises time

to completion at an important time for the Company due to the

challenging trading environment and macroeconomic conditions.

Feedback from this consultation has been highly supportive and the

Board would like to thank the Company's stakeholders for their

support. The Directors believe that the Capital Raise is in the

best interests of shareholders, as well as wider stakeholders in

the Group.

Outlook and current trading

The Board believes that the combination of the proposed Capital

Raise, Debt Extension Package and Accsys Management cost saving

actions to date, will provide the business with enough liquidity

and covenant headroom to deliver on the Company's strategy. As

announced within the H1 FY24 results published today, current

market conditions remain challenging, reflecting ongoing difficult

macro conditions across the Company's markets, with sales volumes

under continued pressure as distributors reduce their inventory

levels ahead of the upcoming holiday period. Sales performance by

region remains mixed. Despite the economic environment, the Company

has continued to maintain its premium price point on both its

Accoya and Tricoya products, reflecting their sustainable, durable

and high-performance qualities.

The Board does not expect trading conditions to improve

materially until the middle of the 2024 calendar year. The second

half of the financial year is typically stronger than H1, due to

increased sales in the Northern Hemisphere in anticipation of the

peak construction season. Accordingly, the Board believes there

will be an improvement in product demand in Q4 FY24, aided by the

unwind of distributor destocking that has taken place in recent

months. However, despite these factors, given the current market

backdrop and expected sales volume for the remainder of this

financial year, the Board believes that the FY24 results will be

below current market expectations.

The remainder of the current financial year will see continued

focus on completion of the Kingsport plant and on building demand

for Accoya globally, as FY24 will see an increase in Company's

capacity in conjunction with the transfer of volumes from Arnhem to

Kingsport. The Company will also focus on delivering continuous

operational improvements at Arnhem. With its unique product

portfolio set in a growth industry, increased capacity at Arnhem

and future capacity coming from the new plant in Kingsport, the

Board believes that Accsys is well positioned for future growth.

The Company is broadening its global distributor network,

developing its Approved Manufacturers Programme ("AMP") and

accelerating its sales & marketing activity, particularly in

the US, which will support its regional growth. While Accsys

continues to believe in the attractive market and growth potential

for Tricoya, in view of the current operating environment and shift

of company focus on the Accoya USA project, the Board is

undertaking a review of the viability, strategic interest and

financial capabilities of its Tricoya UK plant in Hull. The review

will be conducted in early calendar year 2024.

Dr Jelena Arsic van Os, CEO, commented:

" Today we announce a fundraising and refinancing package that

will strengthen our balance sheet and improve Accsys funding

position, which is essential for our growth. I would like to thank

our shareholders for their continued support and belief in Accsys.

Like many other businesses, while we are actively managing very

challenging near-term headwinds, our confidence in our premium

products remains unwavering. Accoya's premium offering set Accsys

apart in the marketplace, strongly positioning our business for

success. The proceeds from the Capital Raise will support

completion of our US Accoya plant, enabling us to fully target our

largest addressable market."

For further information, please contact: Accsys Technologies PLC ir@accsysplc.com

Katharine Rycroft, Investor Relations

========================================= ======================

Deutsche Numis (London)

Nominated Adviser, Joint Bookrunner

and Broker

Oliver Hardy (NOMAD), Ben Stoop +44 (0) 20 7260 1000

========================================= ======================

ABN AMRO Bank N.V. (Amsterdam)

Joint Bookrunner

Julie Wakkie, Diederik Berend +31 20 628 5789

========================================= ======================

FTI - PR

Matthew O'Keeffe, Alex Le May, Georgia

Badcock +44 (0) 20 3727 1340

========================================= ======================

Strategic review by new Management team

Review of Accsys business

Following the appointment of a new Chief Executive Officer in

July 2023 and new Chief Financial Officer in April 2023, the

Company has conducted a review of the Accsys business, assessing

its strengths, progress and challenges. Following this review, the

Company has identified five new strategic priorities for growth to

drive shareholder value over the medium term.

Background

As Accoya and Tricoya grow as global brands, the outstanding

qualities of the Company's ultra-high performance and sustainable

wood products are becoming more widely recognised by customers,

manufacturers and distributors. Accsys' expertise in innovation has

enabled it to transform fast-growing softwood into some of the most

durable, stable and low maintenance wood products in the world.

Accsys' products are positioned within the global wood products

market, which produces over 800 million cubic metres annually

(source: The UN Food & Agriculture Organization) across lumber

and engineered wood products. The market is estimated to be worth

$748 billion in 2023 and is expected to grow to $964 billion from

2023 to 2027 at a CAGR of 6.6% (source: The Business Research

Company).

Macro-economic trends, wider societal 'megatrends' and market

penetration opportunities provide the Company with significant

growth and demand drivers. Increasing the Company's production

capacity, as has been achieved at the plant in Arnhem, is central

to sales growth. As the Company's products compete with and

displace other non-wood building materials from concrete to

plastics, the Board believes the market opportunity is

significant.

Strengths and progress

Accsys has a highly attractive portfolio of premium products

positioned in a growth market. Accsys is best in class in

successfully commercialising the technology of acetylating wood,

the process of which is protected with extensive intellectual

property, including c.388 patents and patent applications in 45

countries at the end of FY23.

The Company places a strong emphasis on innovation, which

includes the development of Accoya Color, made initially in the

same way as regular Accoya wood but which then undergoes a

secondary manufacturing process during which it is coloured. Accoya

Color is proving to be very attractive to customers in the

Company's target markets, particularly in the decking category

where the surface-to-core grey colour requires less maintenance

over the long term.

The Company's premium wood products continue to attract some of

the world's leading brands and major heritage sites (including the

new Google HQ in London and Caernarfon Castle in Wales). The

Company's products have significant product benefits compared to

substitute products in the industry and are becoming more relevant

globally. The market opportunity is sizeable, with the Company's

largest addressable market being North America. The Company's loyal

customer base and premium pricing enables it to achieve solid gross

margins with a target of 30%.

Following the expansion of the Company's Accoya plant in Arnhem

through the addition of a new fourth reactor, Accsys produced

record volumes in Q3 FY23 and Q4 FY23. Construction of Accsys' new

Accoya USA plant in Kingsport with its JV partner, Eastman, is a

key focus area for the Company and an exciting market opportunity.

Further improvements at Arnhem and completion of Kingsport will

provide a step change in capacity, significantly enhancing Accsys'

growth opportunities over the next 18-24 months.

The Company continues to expand its market reach and customer

penetration and widen its distribution channels. Today, it has 67

distributors of its products and 661 AMPs world-wide, of which 111

AMPs and 8 distributors are in the Americas. In H1 FY24, the

Company added 56 AMPs to its global network, bringing a total of 85

new AMPs in the year to date.

Challenges

Accsys has grown product demand, practised manufacturing

excellence, developed its technology and built organisational

capability. Most recently, trading has been impacted by a

challenging economic environment, with construction headwinds and

distributor destocking becoming a market wide phenomenon and

resulting in weaker demand for its products.

The execution of multiple, large projects in parallel (including

the Tricoya UK plant in Hull) has impacted focus and operational

delivery historically. Historic production capacity constraints

have also limited growth in the Company's customer base. Going

forward, Accsys has identified a number of operational improvement

opportunities, including at Arnhem, alongside targeted investment

in sales & marketing capabilities which Management believes

will deliver higher growth.

Strategic priorities

Management believes that further investment will be required to

support the business and achieve five strategic priorities, which

are:

1. Successful delivery of its Accoya USA JV Project - the

Kingsport plant is targeted to commence operations in mid-2024.

Post completion, Accsys will implement a steady and controlled

ramp-up to capacity to respond to demand, increasing total Group

production capacity by 50%;

2. Continuous improvement on operational efficiencies at Arnhem

- focus on further operational continuous improvement of the

Company's key plant will improve performance and returns and

maximise the plant's full potential.

3. Right-size the cost base - Accsys' new management team has

begun to re-set the organisation and optimise its cost base,

targeting annual cost savings of more than EUR3.0m;

4. Grow market reach - Accsys has accelerated the process of

targeting attractive distributors in key target markets, with

discussions currently underway with a select number of major

manufacturers and direct business opportunities. Accsys will

continue to invest in core areas to support growth such as sales

& marketing; and

5. Strengthen the balance sheet for growth - the Company has

today announced a Capital Raise for new funding of approximately

EUR24 million supported by extended and more favourable amendments

to the Company's existing ABN AMRO bank facilities.

Details of the Placing and Subscription

The Placing is being conducted through an accelerated bookbuild

(the "Bookbuild") by ABN AMRO Bank N.V. (acting in collaboration

with ODDO BHF SCA) (" ABN AMRO ") and Numis Securities Limited ("

Deutsche Numis ") (ABN AMRO together with Deutsche Numis the "Joint

Bookrunners") to reflect Accsys' dual-listing on the London (AIM)

and Euronext Amsterdam stock exchanges. The Bookbuild will be

launched immediately following the release of this announcement by

the Joint Bookrunners. The timing of the closing of the Bookbuild

and allocations are at the discretion of the Joint Bookrunners and

the Company. A further announcement will be made by the Company

following completion of the Bookbuild.

Application will be made for the New Ordinary Shares to be

admitted to trading on the AIM market of London Stock Exchange plc

and Euronext Amsterdam on 23 November 2023 ("Admission"). No

prospectus is required in respect of the Issue and no prospectus or

similar document will be published in connection with the Issue.

Admission is expected to take place on or before start of trading

on 23 November 2023 and settlement of the New Ordinary Shares is

expected to take place on the same date. The Placing and

Subscription are conditional upon, among other things, Admission

becoming effective and the Placing Agreement not being terminated

in accordance with its terms. Appendix II sets out further

information relating to the Bookbuild and the terms and conditions

of the Placing. By choosing to participate in the Placing and by

making an oral or written offer to acquire New Ordinary Shares,

Placees will be deemed to have read and understood this

Announcement in its entirety (including the Appendices) and to be

making a legally binding offer on, and subject to, the terms and

conditions in it, and to be providing the representations,

warranties and acknowledgements contained in Appendix II.

Current and potential investors in Accsys are reminded of the

non-exhaustive summary of the principal risks facing the Group set

out on pages 50 to 55 of the Company's annual report for FY23, as

well as those described elsewhere in this announcement. Current and

potential investors are also advised to review the Company's H2

2024 interim results, published today. Members of the public are

not permitted to participate in the Placing.

Summary of terms of the CLN Issuance

The New CLNs will be issued by Skyespring Funding Limited, a

wholly owned subsidiary of the Company incorporated in Jersey (the

"Issuer") andguaranteed by the Company.

The New CLNs will be issued at par and will carry a coupon of

9.5 per cent. per annum payable semi-annually in arrear in equal

instalments. For the period of 30 months following the issuance of

the New CLNs, payment of cash interest on the New CLNs shall be

deferred and shall compound (the "PIK Period"). Following expiry of

the PIK Period, the holder of a New CLN may elect to have all

deferred interest owing to it either converted into Ordinary Shares

at the Conversion Price (in accordance with the conditions of the

New CLNs) or cash settled, with 50% of such amount paid by the

Issuer on or around expiry of the PIK Period and the residual 50%

of such amount paid in equal instalments on each interest payment

date following expiry of the PIK Period.

The New CLNs will carry rights to enable the New CLNs to be

converted into Ordinary Shares at the Conversion Price. On

conversion, holders will be issued with preference shares in the

Issuer which will be automatically exchanged for Ordinary Shares at

the Conversion Price. The terms of the New CLNs include customary

provisions for certain adjustments to be made to the conversion

terms, including in the event of changes to the Company's share

capital (such as a sub-division or consolidation of the Ordinary

Shares), a downround (future placings below the Issue Price which

represent more than 10 per cent. of the Company's issued share

capital when aggregated with other equity raises in the preceding

12 months), or to ensure that no holder of the New CLNs would

acquire an interest in voting shares in the Company (in aggregate

with those held by persons acting in concert with it) exceeding

29.99% of the total voting rights in the Company upon conversion of

the New CLNs into Ordinary Shares.

Settlement and delivery of the New CLNs will take place on the

date of Admission. If not previously converted, redeemed or

purchased and cancelled, the New CLNs will be redeemed at par on

the date that is 6 years after the date of issuance of the New CLNs

(the "CLN Issue Date").

The Issuer will have the option to redeem any of the New CLNs

prior to maturity, together with accrued but unpaid interest,

subject to payment of the applicable early redemption payment. Such

early redemption payment shall be (i) for the period up to the

fourth anniversary of the CLN Issue Date, a make whole amount in

respect of the relevant New CLNs (ii) for the period from the

fourth anniversary of the CLN Issue Date to the fifth anniversary

of the CLN Issue Date, 4.75 per cent. of the principal amount of

the relevant New CLNs and (iii) thereafter, 2.375 per cent. of the

principal amount of the relevant New CLNs.

The New CLN holder's rights are subordinated to those of the

lenders under the Company's main borrowing facilities with ABN AMRO

(described above).

Holders of the New CLNs will have the option to require the

early redemption of its New CLNs at par, together with accrued but

unpaid interest, following the occurrence of a change of control of

the Company.

The Company has agreed that holders of an aggregate principal

amount of New CLNs of EUR5 million or more shall have a consent

right in respect of certain actions, including the following:

-- making a substantial change to the general nature of the

business of the Company, the Group or the Issuer;

-- other than any refinancing of existing financing arrangements

in place as at the Issue Date, entering into any new debt financing

arrangements pursuant to any loan, bond, loan note or similar

instrument in connection with the incurrence of debt for borrowed

money for an aggregate principal amount in excess of EUR10 million;

and

-- undertaking any reduction of the Company's share capital for

the purposes of facilitating the payment of a dividend to

shareholders.

Summary of certain agreements entered into in connection with

the Capital Raise

Relationship Agreement with Teslin and De Engh

In connection with the Capital Raise and their commitment to

provide up to EUR19 million in new funding through the Placing and

CLN Issuance (including through the cancellation of 2022

Convertible Loan), the Company has entered into a relationship

agreement with its largest shareholders Teslin and De Engh (the

"Major Shareholders"), on customary terms and conditions for a

substantial shareholding of this nature (the "Relationship

Agreement"). Pursuant to the terms of the Relationship Agreement

the Major Shareholders shall have the right to appoint one new

non-executive director to the Board of the Company for so long as

they hold an interest in shares representing 15 per cent. or more

of the issued ordinary share capital of the Company in aggregate

and a second non-executive director for so long as they hold in

aggregate an interest in shares representing 22.5 per cent. or more

of the issued ordinary share capital of the Company (the

"Nominee(s)"), in each case subject to prior consultation with the

Board and provided the relevant candidates fit the Board profile at

the relevant time. It is therefore envisaged that any individuals

appointed will have experience and skills relevant to Accsys. Any

appointment will be subject to the approval of the Company's

Nominated Adviser following completion of customary regulatory due

diligence in

accordance with the AIM Rules for Nominated Advisers. It is

expected that one Nominee will initially be nominated by Major

Shareholders. Any reduction in the Major Shareholders' interest in

shares as a result of a non pre-emptive share issuance by the

Company in which they are not offered the ability to participate

shall be disregarded to the extent it causes the Major

Shareholder's interest in shares in the Company to drop below these

thresholds. The Nominee(s) will also be appointed to the Company's

Remuneration Committee and Audit Committee. Customary conflict of

interest provisions will apply in the event of a dispute between

the Major Shareholders and the Company. The Relationship Agreement

contains customary provisions governing the sharing of information

by the Company with the Major Shareholder.

The Company has also agreed that it will not increase the size

of its Board beyond two executive directors, three independent

non-executive directors and the Major Shareholder's appointees

unless this is approved by a majority of non-executive directors in

office at the time.

The Major Shareholders have undertaken to ensure that: (i) all

transactions and arrangements between the Major Shareholders and

the Company will be conducted at arm's length and on normal

commercial terms; (ii) they will not take any action or propose any

shareholder resolution that would prevent the Company from

complying with its obligations under the AIM Rules or circumvent

the proper application of the AIM Rules; and (iii) they will not,

without the prior consent of the Company, call a general meeting or

publicly seek to control the Board of the Company, nor make or

participate in a public offer for Ordinary Shares where this is not

recommended by the Board.

Related Party Transactions

Pursuant to the Capital Raise, Teslin and De Engh will be

investing up to EUR11.5 million (EUR3.5 million and EUR8 million

respectively) in the new CLNs and up to EUR7.5 million (EUR0.5

million and EUR7 million respectively) in the Placing . The

participation of Teslin and De Engh in the Capital Raise (pursuant

to the Placing and the CLN Issuance) and the entry into by them of

the Relationship Agreement is considered a related party

transaction for the purposes of AIM Rule 13 of the AIM Rules for

Companies. The Board of Accsys consider, having consulted the

Company's Nominated Adviser Deutsche Numis, that the terms of the

New CLNs and Teslin and De Engh's participation in the CLN Issuance

and entry into the Relationship Agreement, along with their

participation in the Placing, are fair and reasonable in so far as

shareholders of the Company are concerned.

Agreement with BGF

In addition, in connection with the Capital Raise and their

commitment to provide up to EUR8.5 million in the new CLNs (subject

to scale back by up to EUR2.5 million, depending on the outcome of

the Bookbuild) and up to EUR1.5 million in the Placing, the Company

has agreed certain commitments in favour of BGF, including that (1)

it will, subject to BGF acquiring a shareholding of at least 15 per

cent. in the issued ordinary share capital of the Company and

subject to prior agreement of a relationship agreement on customary

terms, grant BGF the right to appoint one non-executive director to

the Board of the Company; and (2) it will not move its HQ outside

the UK or seek to de-list its shares from AIM for as long as the

New CLNs held by BGF remain outstanding (and, to the extent that

this covenant is not complied with, all amounts outstanding under

BGF's New CLNs will be repayable ( together with the Make

Whole).

This announcement comprises inside information for the purposes

of EU MAR and UK MAR. The person responsible for making this

announcement is Nick Hartigan, General Counsel and Company

Secretary, Accsys Technologies PLC.

IMPORTANT NOTICES

This announcement including its appendices (the "Announcement")

and the information contained in it is not for publication,

release, transmission distribution or forwarding, in whole or in

part, directly or indirectly, in or into the United States,

Australia, Canada, Japan, Switzerland or the Republic of South

Africa or any other jurisdiction in which publication, release or

distribution would be unlawful. This Announcement is for

information purposes only and does not constitute an offer to sell

or issue, or the solicitation of an offer to buy, acquire or

subscribe for shares in the capital of the Company in the United

States, Australia, Canada, Japan, Switzerland or the Republic of

South Africa or any other state or jurisdiction. This Announcement

has not been approved by the FCA, the London Stock Exchange or the

AFM. Any failure to comply with the restrictions set out in this

Announcement may constitute a violation of the securities laws of

such jurisdictions.

The New Ordinary Shares have not been and will not be registered

under the US Securities Act or under the securities law or with any

securities regulatory authority of any state or other jurisdiction

of the United States and may not be offered, sold, pledged, taken

up, exercised, resold, renounced, transferred or delivered,

directly or indirectly, in or into the United States absent

registration under the US Securities Act, except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the US Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States. The New Ordinary Shares

are being offered and sold outside of the United States in offshore

transactions in accordance with Regulation S under the US

Securities Act. The New Ordinary Shares have not been approved,

disapproved or recommended by the U.S. Securities and Exchange

Commission, any state securities commission in the United States or

any other U.S. regulatory authority, nor have any of the foregoing

authorities passed upon or endorsed the merits of the offering of

the New Ordinary Shares. Subject to certain exceptions, the

securities referred to herein may not be offered or sold in the

United States, Australia, Canada, Japan, Switzerland or the

Republic of South Africa or to, or for the account or benefit of,

any national, resident or citizen of the United States, Australia,

Canada, Japan, Switzerland or the Republic of South Africa.

No public offering of securities is being made in the United

States, the United Kingdom or elsewhere.

All offers of New Ordinary Shares will be made pursuant to an

exemption under the EU Prospectus Regulation and the UK Prospectus

Regulation (as applicable) from the requirement to produce a

prospectus. This Announcement is being distributed to persons in

the United Kingdom only in circumstances in which section 21(1) of

FSMA does not apply.

No prospectus will be made available in connection with the

Placing and no such prospectus is required (in accordance with the

EU Prospectus Regulation or the UK Prospectus Regulation) to be

published. This Announcement and the terms and conditions set out

herein are for information purposes only. The Placing is directed

only at persons who are: (a) if in a member state of the European

Economic Area, persons who are qualified investors within the

meaning of article 2(e) of the EU Prospectus Regulation; (b) if in

the United Kingdom, persons who (i) are "investment professionals"

specified in article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (the "Order") and/or (ii)

fall within article 49(2)(a) to (d) of the Order (and only where

the conditions contained in those articles have been, or will at

the relevant time be, satisfied), and, in each case, who are also

qualified investors within the meaning of article 2 of the UK

Prospectus Regulation; or (c) persons to whom it may otherwise be

lawfully communicated (all such persons together being referred to

as "Relevant Persons").

This Announcement and the terms and conditions set out herein

must not be acted on or relied on by persons who are not Relevant

Persons. Persons distributing this Announcement must satisfy

themselves that it is lawful to do so. Any investment or investment

activity to which this Announcement and the terms and conditions

set out herein relates is available only to Relevant Persons and

will be engaged in only with Relevant Persons. This Announcement

does not itself constitute an offer for sale or subscription of any

securities in Accsys.

The contents of this Announcement are not to be construed as

legal, business, financial or tax advice. Each investor or

prospective investor should consult his, her or its own legal

adviser, business adviser, financial adviser or tax adviser for

legal, financial, business or tax advice. The contents of this

Announcement have not been reviewed by any regulatory authority in

the United Kingdom or elsewhere. Each Shareholder or prospective

Shareholder is advised to exercise caution in relation to the

Issue.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by any of

the Joint Bookrunners, or by any of their respective partners,

directors, officers, employees, advisers, consultants, affiliates

or agents as to or in relation to, the accuracy, fairness or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

Notice to all investors

Deutsche Numis is authorised and regulated in the United Kingdom

by the FCA. Deutsche Numis and ABN AMRO are acting for Accsys and

are acting for no one else in connection with the Issue and will

not regard any other person (whether or not a recipient of this

Announcement) as a client in relation to the Issue and will not be

responsible to anyone other than Accsys for providing the

protections afforded to their respective clients, nor for providing

advice in connection with the Issue or any other matter,

transaction or arrangement referred to herein.

Deutsche Numis' responsibilities as the Company's nominated

adviser under the AIM Rules for Nominated Advisers are owed solely

to the London Stock Exchange and are not owed to the Company or to

any Director or to any other person.

None of the information in this Announcement has been

independently verified by any of the Joint Bookrunners or any of

their respective partners, directors, officers, employees,

advisers, consultants, agents or affiliates. Apart from the

responsibilities and liabilities, if any, which may be imposed upon

the Joint Bookrunners by FSMA, neither of the Joint Bookrunners nor

any of their subsidiary undertakings, affiliates or any of their

directors, officers, employees, consultants, advisers or agents

accept any responsibility or liability whatsoever (whether arising

in tort, contract or otherwise) for the contents of the information

contained in this Announcement (including, but not limited to, any

errors, omissions or inaccuracies in the information or any

opinions) or for any other statement made or purported to be made

by or on behalf of any of the Joint Bookrunners or any of their

respective partners, directors, officers, employees, advisers,

consultants, agents or affiliates in connection with Accsys or the

New Ordinary Shares or the Issue and nothing in this Announcement

is, or shall be relied upon as, a promise or representation in this

respect, whether as to the past or future. The Joint Bookrunners

accept no liability or responsibility for any loss, costs or damage

suffered or incurred howsoever arising, directly or indirectly,

from any use of this Announcement or its content or otherwise in

connection therewith or any acts or omissions by the Company. Each

of the Joint Bookrunners and their subsidiary undertakings,

affiliates or any of their directors, officers, employees, advisers

and agents accordingly disclaims to the fullest extent permitted by

law all and any responsibility and liability whether arising in

tort, contract or otherwise (save as referred to above) which it

might otherwise have in respect of this Announcement or any such

statement and no representation, warranty, express or implied, is

made by any of the Joint Bookrunners or any of their respective

partners, directors, officers, employees, advisers, consultants,

agents or affiliates as to the accuracy, fairness, completeness or

sufficiency of the information contained in this Announcement.

In connection with the Issue, the Joint Bookrunners and any of

their affiliates, acting as investors for their own accounts, may

subscribe for or purchase New Ordinary Shares as a principal

position and in that capacity may retain, purchase, sell, offer to

sell or otherwise deal for their own accounts in such New Ordinary

Shares and other securities of the Company or related investments

in connection with the Issue or otherwise. Accordingly, references

to the New Ordinary Shares being offered, subscribed, acquired,

placed or otherwise dealt in should be read as including any offer

to, or subscription, acquisition, placing or dealing by the Joint

Bookrunners and any of their affiliates acting as investors for

their own accounts. In addition, the Joint Bookrunners or their

affiliates may enter into financing arrangements and swaps in

connection with which they or their affiliates may from time to

time acquire, hold or dispose of New Ordinary Shares. The Joint

Bookrunners have no intention to disclose the extent of any such

investment or transactions otherwise than in accordance with any

legal or regulatory obligations to do so.

Cautionary statement regarding forward-looking statements

This Announcement contains certain "forward-looking statements".

Words such as "believes", "anticipates", "estimates", "expects",

"intends", "aims", "potential", "will", "would", "could",

"considered", "likely", "estimate" and variations of these words

and similar future or conditional expressions are intended to

identify forward-looking statements but are not the exclusive means

of identifying such statements. All statements other than

statements of historical fact included in this Announcement are

forward-looking statements. Forward-looking statements appear in a

number of places throughout this Announcement and include

statements regarding the Directors' or the Company's intentions,

beliefs or current expectations concerning, among other things,

operating results, financial condition, prospects, growth,

expansion plans, strategies, the industry in which the Group

operates and the general economic outlook.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend upon

circumstances that may or may not occur in the future and are

therefore based on current beliefs and expectations about future

events. Forward-looking statements are not guarantees of future

performance. Investors are therefore cautioned that a number of

important factors could cause actual results or outcomes to differ

materially from those expressed in any forward-looking

statements.

Neither the Company, nor any member of the Group, nor any of the

Joint Bookrunners undertakes any obligation to update or revise any

of the forward-looking statements, whether as a result of new

information, future events or otherwise, save in respect of any

requirement under applicable law or regulation (including, without

limitation, FSMA, the AIM Rules for Companies, UK MAR, the Dutch

Financial Supervision Act and EU MAR).

Information to Distributors

EU Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended (" MiFID II "); (b) Articles 9

and 10 of Commission Delegated Directive (EU) 2017/593

supplementing MiFID II; and (c) local implementing measures

(together, the " MiFID II Product Governance Requirements "), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the MiFID II Product Governance Requirements) may otherwise have

with respect thereto, the New Ordinary Shares have been subject to

a product approval process, which has determined that the New

Ordinary Shares are: (i) compatible with an end target market of

retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined

in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the " Target

Market Assessment "). Notwithstanding the Target Market Assessment,

distributors should note that: the price of the New Ordinary Shares

may decline and investors could lose all or part of their

investment; the New Ordinary Shares offer no guaranteed income and

no capital protection; and an investment in the New Ordinary Shares

is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction

with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have

sufficient resources to be able to bear any losses that may result

therefrom. The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Issue. Furthermore, it is noted

that, notwithstanding the Target Market Assessment, the Joint

Bookrunners will only procure investors who meet the criteria of

professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the New Ordinary

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any 'manufacturer' (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the New Ordinary Shares have been subject to a product

approval process, which has determined that such New Ordinary

Shares are: (i) compatible with an end target market of: (a)

investors who meet the criteria of professional clients as defined

in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it

forms part of domestic UK law by virtue of the European Union

(Withdrawal) Act 2018 and the European Union (Withdrawal Agreement)

Act 2020; (b) eligible counterparties, as defined in the FCA

Handbook Conduct of Business Sourcebook ("COBS"); and (c) retail

clients who do not meet the definition of professional client under

(b) or eligible counterparty per (c); and (ii) eligible for

distribution through all distribution channels as are permitted by

Directive 2014/65/EU (the "UK target market assessment").

Notwithstanding the UK target market assessment, distributors

should note that: the price of the New Ordinary Shares may decline

and investors could lose all or part of their investment; the New

Ordinary Shares offer no guaranteed income and no capital

protection; and an investment in the New Ordinary Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The UK target market assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the UK target market assessment, the Joint

Bookrunners will only procure investors who meet the criteria of

professional clients and eligible counterparties. For the avoidance

of doubt, the UK target market assessment does not constitute: (a)

an assessment of suitability or appropriateness for the purposes of

COBS 9A and COBS 10A, respectively; or (b) a recommendation to any

investor or group of investors to invest in, or purchase or take

any other action whatsoever with respect to the New Ordinary

Shares.

Each distributor is responsible for undertaking its own UK

target market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

Market Abuse Regulation

This Announcement contains inside information for the purposes

of EU MAR and UK MAR (together, "MAR"). In addition, market

soundings (as defined in MAR) were taken in respect of the matters

contained in this Announcement, with the result that certain

persons became aware of such inside information as permitted by

MAR. That inside information is set out in this Announcement and

has been disclosed as soon as possible in accordance with paragraph

7 of article 17 of both EU MAR and UK MAR. Upon the publication of

this Announcement, the inside information is now considered to be

in the public domain and such persons shall therefore cease to be

in possession of inside information in relation to the Company and

its securities.

The person responsible for making this Announcement on behalf of

Accsys is Nick Hartigan, General Counsel & Company

Secretary.

APPIX I

DEFINITIONS

In addition to the terms defined elsewhere in this Announcement,

the following definitions apply throughout this Announcement

(unless the context otherwise requires):

"2022 Convertible Loan" the EUR10 million convertible loan

agreement between the Company and

De Engh BV dated 3 March 2022;

"ABN AMRO" ABN AMRO Bank N.V.;

"Admission" the admission of the New Ordinary

Shares to listing and trading on Euronext

Amsterdam and to trading on AIM;

"AFM" the Dutch Authority for the Financial

Markets (Stichting Autoriteit Financiële

Markten);

"AIM" AIM, a market operated by the London

Stock Exchange;

"AIM Rules for Companies" the rules published by the London

Stock Exchange governing admission

to AIM and the regulation of companies

whose securities are admitted to trading

on AIM (including any guidance notes),

as each may be amended or reissued

from time to time;

"Amendment and Restatement the amendment and restatement deed

Deed" entered into by the Company with ABN

AMRO on the date of this Announcement,

providing for the amendment of the

Term Loan Facility and the RCF;

"BGF" BGF Investments LP;

"Board" or "Directors" the directors of the Company at the

date of this Announcement;

"Bookbuild" the accelerated bookbuild to be launched

immediately following release of this

Announcement;

"CFO " Steven Salo, the Chief Financial Officer

of Accsys;

"Capital Raise" the CLN Issuance together with the

Issue;

"CJA" the Criminal Justice Act 1993;

" Committed Undertakings the commitments received from certain

" of the Company's major shareholders,

including Teslin, De Engh and BGF,

to provide, in aggregate, c.EUR13

million of new equity through the

Placing, at the Issue Price;

"Company" or "Accsys" Accsys Technologies PLC;

"Convertible Loan Note the subscription agreements entered

Subscription Agreements" into in connection with the CLN Issuance

on the date of this Announcement;

Conversion Pirce the price at which the CLN will convert

into new Ordinary Shares;

"CLN Issuance" CLN issued to raise gross new proceeds

for the Company;

"CREST" the United Kingdom paperless share

settlement system and system for the

holding of shares in uncertificated

form in respect of which Euroclear

UK is the operator;

"Data Protection Law" applicable data protection legislation

and regulations;

"Deutsche Numis" or "Nominated Numis Securities Limited;

Adviser"

"Debt Extension Package" the extension of the Company's existing

main debt facilities with ABN AMRO

to 31 March 2026;

"Eastman" Eastman Chemical Company;

"EEA" the European Economic Area;

"EU" the European Union;

"EU MAR" the EU Market Abuse Regulation (Regulation

(EU) 596/2014), together with any

related implementing legislation;

"EU Prospectus Regulation" the EU Prospectus Regulation (Regulation

(EU) 2017/1129), together with any

related implementing legislation;

"Euroclear Nederland" Nederlands Centraal Instituut voor

Giraal Effectenverkeer B.V.;

"Euroclear UK" Euroclear UK & Ireland Limited, the

operator of CREST;

"Euronext Amsterdam" Euronext Amsterdam N.V. or the regulated

market operated by Euronext Amsterdam

N.V. (as the context requires);

"Exchange Information" any information previously or subsequently

published by or on behalf of the Company,

including, without limitation, any

information required to be published

by the Company pursuant to applicable

laws;

"Financial Conduct Authority" the Financial Conduct Authority of

or "FCA" the UK;

"FSMA" the Financial Services and Markets

Act 2000 (as amended);

"FY23" the twelve months ending 31 March

2023;

"FY24" the twelve months ending 31 March

2024;

"Group" Accsys and its existing subsidiary

undertakings (and, where the context

permits, each of them);

H1 FY24 the Company's interim results for

the six months ending 30 September

2023 published on 21 November 2023;

"Issue" together, the Placing and the Subscription;

"Issue Price" the single price per share payable

by Placees, pursuant to the Placing

under the terms and conditions set

out in Appendix II hereto, the CFO,

pursuant to the Subscription, being

69.35 Euro cents (61.00 pence) per

new ordinary share;

"Joint Bookrunners" Deutsche Numis and ABN AMRO;

"London Stock Exchange" London Stock Exchange plc;

"MAR" UK MAR and EU MAR, as applicable;

"MiFID II" EU Directive 2014/65/EU on markets

in financial instruments, as amended;

"MiFID II Product Governance (a) MiFID II; (b) Articles 9 and 10

Requirements" of Commission Delegated Directive

(EU) 2017/593 supplementing MiFID

II; and (c) local implementing measures,

together;

"New Ordinary Shares" the new Ordinary Shares to be issued

pursuant to the Issue;

"New CLNs" the new Convertible Loan Notes to

be issued pursuant to the Issue;

"Order" the Financial Services And Markets

Act 2000 (Financial Promotion) Order

2005;

"Ordinary Shares" the ordinary shares of 0.05 Euro cents

each in the capital of Accsys;

"Placee" any person who has agreed to subscribe

for Placing Shares pursuant to the

Placing;

"Placing" the placing of New Ordinary Shares

with Placees subject to, and in accordance

with, the terms and conditions set

out in Appendix II to this Announcement;

"Placing and Subscription" the placing of New Ordinary Shares

with Placees and potential subscription

for New Ordinary Shares by certain

of the Directors as part of the Issue

subject to, and in accordance with,

the terms and conditions set out in

Appendix II to this Announcement;

"Placing Agreement" the agreement dated 21 November 2023

between the Company and the Joint

Bookrunners relating to the Issue;

"Placing Results" the results of the Placing, to be

released promptly following completion

of the Bookbuild;

"Placing Shares" the New Ordinary Shares which are

the subject of the Placing;

"RCF" the Group's revolving credit facility;

"Registrar" the Company's registrars;

"Regulation S" Regulation S under the US Securities

Act;

"Relevant Persons" and has the meaning given to it in Appendix

"Qualified Investors" and II;

related terms

"Restricted Territory" United States, Canada, Australia,

South Africa, Japan, Switzerland,

New Zealand and any other jurisdiction

where the extension or availability

of the Issue would breach applicable

law;

"RIS" a regulatory information service;

"Shareholder" a holder of Ordinary Shares;

"Subscription" the potential subscription for New

Ordinary Shares by the CFO as part

of the Issue;

"Target Market Assessment" the MiFID II target market assessment

undertaken by the Joint Bookrunners;

Term Loan Facility the Group's term loan facility;

"Terms of Sale" the terms of sale to be signed under

the Placing Agreement following completion

of the Bookbuild;

"Teslin" Teslin Participates Coöperatief

U.A;

"UK" or "United Kingdom" the United Kingdom of Great Britain

and Northern Ireland;

"UK MAR" the EU MAR, as it forms part of retained

EU law as defined in the European

Union (Withdrawal) Act 2018;

"UK Prospectus Regulation" the EU Prospectus Regulation, as it

forms part of retained EU law as defined

in the European Union (Withdrawal)

Act 2018;

"US" or "United States" the United States of America, its

possessions and territories, any state

of the United States of America and

the District of Columbia; and

"US Securities Act" the United States Securities Act of

1933, as amended.

APPIX II

TERMS AND CONDITIONS OF THE PLACING

IMPORTANT INFORMATION ON THE PLACING FOR INVITED PLACEES

ONLY

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING (AS DEFINED BELOW). THIS ANNOUNCEMENT AND THE TERMS AND

CONDITIONS SET OUT IN THIS APPIX (TOGETHER, THE "ANNOUNCEMENT") ARE

FOR INFORMATION PURPOSES ONLY AND ARE DIRECTED ONLY AT PERSONS

WHOSE ORDINARY ACTIVITIES INVOLVE THEM IN ACQUIRING, HOLDING,

MANAGING AND DISPOSING OF INVESTMENTS (AS PRINCIPAL OR AGENT) FOR

THE PURPOSES OF THEIR BUSINESS AND WHO HAVE PROFESSIONAL EXPERIENCE

IN MATTERS RELATING TO INVESTMENTS AND ARE: (A) IF IN A MEMBER

STATE OF THE EUROPEAN ECONOMIC AREA (THE "EEA"), PERSONS WHO ARE

QUALIFIED INVESTORS ("EU QUALIFIED INVESTORS") WITHIN THE MEANING

OF ARTICLE 2I OF PROSPECTUS REGULATION (EU) 2017/1129 (THE "EU

PROSPECTUS REGULATION"); (B) IF IN THE UNITED KINGDOM, PERSONS WHO

(I) ARE "INVESTMENT PROFESSIONALS" SPECIFIED IN ARTICLE 19(5) OF

THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION)

ORDER 2005 (THE "ORDER") AND/OR (II) FALL WITHIN ARTICLE 49(2)(A)

TO (D) OF THE ORDER (AND ONLY WHERE THE CONDITIONS CONTAINED IN

THOSE ARTICLES HAVE BEEN, OR WILL AT THE RELEVANT TIME BE,

SATISFIED) AND, IN EACH CASE, WHO ARE ALSO QUALIFIED INVESTORS

(WITH PERSONS FALLING IN THIS PART (B) BEING "UK QUALIFIED

INVESTORS" AND, TOGETHER WITH EU QUALIFIED INVESTORS, "QUALIFIED

INVESTORS") WITHIN THE MEANING OF ARTICLE 2 OF THE EU PROSPECTUS

REGULATION AS AMED AND TRANSPOSED INTO THE LAWS OF THE UNITED

KINGDOM PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 AND

THE EUROPEAN UNION (WITHDRAWAL AGREEMENT) ACT 2020 (THE "UK

PROSPECTUS REGULATION"); OR (C) PERSONS TO WHOM IT MAY OTHERWISE BE

LAWFULLY COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO

AS "RELEVANT PERSONS").

THIS ANNOUNCEMENT MUST NOT BE ACTED ON OR RELIED ON BY PERSONS

WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY

TO WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT

PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA,

CANADA, SOUTH AFRICA, SWITZERLAND, JAPAN, NEW ZEALAND OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT DOES NOT ITSELF CONSTITUTE AN OFFER FOR SALE

OR SUBSCRIPTION OF ANY SECURITIES IN ACCSYS TECHNOLOGIES PLC (THE

"COMPANY").

THE SECURITIES REFERRED TO IN THIS ANNOUNCEMENT HAVE NOT BEEN

AND WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT

OF 1933, AS AMED (THE "US SECURITIES ACT"), OR UNDER THE SECURITIES

LAWS OR WITH ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE OR

OTHER JURISDICTION OF THE UNITED STATES, AND MAY NOT BE OFFERED,

SOLD, TAKEN UP, RESOLD TRANSFERRED OR DELIVERED DIRECTLY OR

INDIRECTLY IN OR INTO THE UNITED STATES EXCEPT PURSUANT TO AN

EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE

REGISTRATION REQUIREMENTS OF THE US SECURITIES ACT AND IN

COMPLIANCE WITH THE SECURITIES LAWS OF ANY STATE OR ANY OTHER

JURISDICTION OF THE UNITED STATES. THE SECURITIES REFERRED TO IN

THIS ANNOUNCEMENT ARE BEING OFFERED AND SOLD OUTSIDE THE UNITED

STATES IN OFFSHORE TRANSACTIONS IN ACCORDANCE WITH REGULATION S

UNDER THE US SECURITIES ACT. NO PUBLIC OFFERING OF THE SHARES

REFERRED TO IN THIS ANNOUNCEMENT IS BEING MADE IN THE UNITED

STATES, THE UNITED KINGDOM OR ELSEWHERE.

THE CONTENTS OF THIS ANNOUNCEMENT HAVE NOT BEEN REVIEWED BY ANY

REGULATORY AUTHORITY IN THE UNITED KINGDOM, THE NETHERLANDS OR

ELSEWHERE. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE

PLACING. IF YOU ARE IN ANY DOUBT ABOUT ANY OF THE CONTENTS OF THIS

ANNOUNCEMENT, YOU SHOULD OBTAIN INDEPENT PROFESSIONAL ADVICE.

Neither the Company, Numis Securities Limited ("Deutsche Numis")

nor ABN AMRO Bank N.V. ("ABN AMRO"), nor any of their respective

affiliates, agents, directors, officers, consultants or employees,

makes any representation or warranty (whether express or implied)

to persons who are invited to and who choose to participate in the

placing ("Placees") of new Ordinary Shares in the capital of the

Company (the "Placing") of nominal value of EUR 0.05 (the "Placing

Shares") regarding an investment in the securities referred to in

this Announcement under the laws applicable to such Placees. Each

Placee should consult its own advisers as to the legal, tax,

business, financial and related aspects of an investment in the

Placing Shares.

Certain Directors have indicated an intention to subscribe for

new ordinary shares (the "Subscription Shares") to be issued

pursuant to a subscription (the "Subscription").

By participating in the Placing, Placees will be deemed to have

read and understood this Announcement, including this Appendix, in

its entirety, and to be participating, making an offer and

acquiring Placing Shares on the terms and conditions contained

herein and to be providing the representations, warranties,

indemnities, acknowledgments and undertakings contained herein.

In particular each such Placee represents, warrants, undertakes,

agrees and acknowledges that:

1. it is a Relevant Person and undertakes that it will acquire,

hold, manage or dispose of any Placing Shares that are allocated to

it for the purposes of its business;

2. it is and, at the time the Placing Shares are acquired, will

be outside the United States and acquiring the Placing Shares in an

"offshore transaction" in accordance with Regulation S under the US

Securities Act ("Regulation S"); and

3. if it is a financial intermediary, as that term is used in

Article 2(d) of the EU Prospectus Regulation or the UK Prospectus

Regulation, as applicable, any Placing Shares acquired by it in the

Placing will not be acquired on a non-discretionary basis on behalf

of, nor will they be acquired with a view to their offer or resale

to, persons in circumstances which may give rise to an offer of

securities to the public other than an offer or resale to Qualified

Investors in a member state of the EEA or in the UK, as applicable,

or in circumstances in which the prior consent of the Joint

Bookrunners (as defined below) has been given to each such proposed

offer or resale.

For the purposes of this Appendix, Deutsche Numis and ABN AMRO

are each a "Joint Bookrunner" and together the "Joint

Bookrunners".

The Company and each of the Joint Bookrunners will rely upon the

truth and accuracy of the foregoing representations, warranties and

acknowledgements.

The distribution of this Announcement and the Placing and/or the

offer or sale of the Placing Shares in certain jurisdictions may be

restricted by law. No action has been taken by the Company or by

the Joint Bookrunners or any of its or their respective affiliates

or any of its or their respective agents, directors, officers or

employees which would, or is intended to, permit an offer of the

Placing Shares or possession or distribution of this Announcement

or any other offering or publicity material relating to such

Placing Shares in any country or jurisdiction where any such action

for that purpose is required. The information in this Announcement

may not be forwarded or distributed to any other person and may not

be reproduced in any manner whatsoever. Any forwarding,

distribution, dissemination, reproduction, or disclosure of this

information in whole or in part is unauthorised. Failure to comply

with this directive may result in a violation of the US Securities

Act or the applicable laws of other jurisdictions.

Details of the Placing Agreement

The Company and the Joint Bookrunners have today entered into an

agreement with respect to the Placing (the "Placing Agreement")

under which, on the terms and subject to the conditions set out

therein, the Joint Bookrunners have agreed to (i) use their

respective reasonable endeavours, as agents of the Company, to

procure Placees for the Placing Shares in such number, if any, as

may be agreed between the Joint Bookrunners and the Company and

recorded in the executed terms of sale (the "Terms of Sale") and

(ii) to the extent that any Placee fails to pay the Issue Price (as

defined below) in respect of any of the Placing Shares which have

been allocated to it, to (severally and not jointly or jointly and

severally) subscribe for such Placing Shares at the Issue

Price.

The Placing Shares

The Placing Shares have been duly authorised and will, when

issued, be credited as fully paid and will rank pari passu in all

respects with the existing ordinary shares in the Company,

including the right to receive all dividends and other

distributions declared, made or paid in respect of the ordinary

shares of the Company (the "Ordinary Shares") after the date of

issue of the Placing Shares.

Applications for admission to trading

Applications will be made for the Placing Shares to be admitted

to the regulated market operated by Euronext Amsterdam N.V.

("Euronext Amsterdam") and to the London Stock Exchange's AIM

market ("Admission"). It is expected that Admission will become

effective on or around 8.00 a.m. (London time) and 9.00 a.m.

(Central European time) on 23 November2023 (or on such later date

as may be agreed between the Company and the Joint Bookrunners) and

that dealings in the Placing Shares will commence at that time.

Bookbuild

The Joint Bookrunners will commence with immediate effect a

bookbuilding process in relation to the Placing (the "Bookbuild")

to establish demand for participation in the Placing by Placees at

a fixed price of 69.35 Euro cents (61.00 GBP pence) per new

ordinary share (the "Issue Price"). This Appendix gives details of

the terms and conditions of, and the mechanics of participation in,

the Placing. No commissions will be paid to Placees or by Placees

in respect of any Placing Shares.

The Joint Bookrunners and the Company shall be entitled to

effect the Placing by such alternative method to the Bookbuild as

they may, in their absolute discretion, determine.

Participation in, and principal terms of, the Placing

1. Deutsche Numis and ABN AMRO are acting severally, and not

jointly, or jointly and severally, as joint bookrunners and agents

of the Company in connection with the Placing.

2. Participation in the Placing will only be available to

Relevant Persons who may lawfully be, and are, invited by the Joint

Bookrunners to participate. The Joint Bookrunners and any of their

affiliates may, acting as investors for their own account,

subscribe for Placing Shares in the Placing.

3. The Placing shall be conducted by way of a bookbuild to

establish the number of Placing Shares to be allocated to Placees

at the Issue Price, which will comprise their allocation of Placing

Shares.

4. The Bookbuild will commence on the release of this

Announcement and will close at a time to be determined by the Joint

Bookrunners in their absolute discretion (after consultation with

the Company), expected to be no later than 4.00 p.m. (London time)

on 21 November 2023. The Joint Bookrunners may, in agreement with

the Company, accept bids that are received after the Bookbuild has

closed.

5. The number of Placing Shares to be issued will be agreed

between the Joint Bookrunners and the Company following completion

of the Bookbuild. The number of Placing Shares to be issued will be

announced by the Company via a Regulatory Information Service

("RIS") following the completion of the Bookbuild (the "Placing

Results").

6. To bid in the Bookbuild, Placees should communicate their bid

by telephone and/or in writing to their usual sales contact at ABN

AMRO if they are resident in the Netherlands or at Deutsche Numis

if they are resident in the United Kingdom or elsewhere within the

EEA. Each bid should state the number of Placing Shares which the

prospective Placee wishes to subscribe for at the Issue Price. Bids

may also be scaled down by the Joint Bookrunners on the basis

referred to in paragraph 11 below.

7. A bid in the Bookbuild will be made on the terms and subject

to the conditions in this Announcement and will be legally binding

on the Placee on behalf of which it is made and, except with the

consent of the Joint Bookrunners, will not be capable of variation

or revocation after the time at which it is submitted.

8. Each prospective Placee's allocation will be agreed between

the Joint Bookrunners and the Company and will be confirmed orally

or in writing by one of the Joint Bookrunners (each as agent for

the Company) following the close of the Bookbuild and a trade

confirmation or contract note will be despatched thereafter. This

oral or written confirmation from a Joint Bookrunner to a Placee

will constitute an irrevocable legally binding commitment upon that

person (who will at that point become a Placee) in favour of

Deutsche Numis, ABN AMRO and the Company to subscribe for the

number of Placing Shares allocated to it at the Issue Price on the

terms and conditions set out in this Appendix and in accordance

with the Company's articles of association. The terms and

conditions of this Announcement will be deemed to be incorporated

in that trade confirmation, contract note or such other (oral or

written) confirmation and will be legally binding on the Placee on

behalf of which it is made. All obligations under the Bookbuild and

Placing will be subject to fulfilment of the conditions referred to

below under "Conditions of the Placing" and to the Placing not

being terminated on the basis referred to below under "Termination

of the Placing Agreement". By participating in the Bookbuild, each