Q10000096793false--06-3026,502http://fasb.org/us-gaap/2024#OperatingLeaseLiabilityCurrenthttp://fasb.org/us-gaap/2024#OperatingLeaseLiabilityCurrenthttp://fasb.org/us-gaap/2024#OperatingLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2024#OperatingLeaseLiabilityNoncurrent0000096793us-gaap:AdditionalPaidInCapitalMember2024-09-300000096793ssy:SaleOfTraceRegionalHealthSystemsIncMember2024-01-222024-01-220000096793ssy:SelfPayorMember2023-07-012023-09-300000096793srt:ManagementMember2024-09-300000096793srt:ManagementMember2024-06-300000096793ssy:SaleOfTraceRegionalHealthSystemsIncMember2023-07-012024-06-300000096793ssy:CommonSharesMember2023-06-300000096793us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-3000000967932024-07-012024-09-3000000967932023-07-012023-09-300000096793ssy:MedicaidMember2023-07-012023-09-300000096793us-gaap:RetainedEarningsMember2024-09-300000096793ssy:AccumulatedOtherComprehensiveLossMember2023-06-300000096793ssy:SaleOfTraceRegionalHealthSystemsIncMember2023-07-012023-12-310000096793us-gaap:ProductMember2024-07-012024-09-300000096793ssy:MedicareMember2023-07-012023-09-300000096793ssy:MedicareMember2024-07-012024-09-300000096793us-gaap:ServiceMember2024-07-012024-09-300000096793ssy:LifeSciencesAndEngineeringSegmentMember2023-07-012023-09-300000096793ssy:PrivateInsuranceMember2024-07-012024-09-3000000967932024-11-120000096793ssy:CommonSharesMember2024-09-300000096793us-gaap:RetainedEarningsMember2023-06-300000096793ssy:AccumulatedOtherComprehensiveLossMember2023-07-012023-09-300000096793srt:ManagementMember2024-07-012024-09-300000096793us-gaap:AdditionalPaidInCapitalMember2023-06-300000096793ssy:LifeSciencesAndEngineeringSegmentMember2024-09-300000096793ssy:LifeSciencesAndEngineeringSegmentMember2024-06-300000096793ssy:RetailAndInstitutionalPharmacyMember2024-07-012024-09-300000096793ssy:SelfPayorMember2024-07-012024-09-300000096793ssy:MedicaidMember2024-07-012024-09-300000096793us-gaap:RetainedEarningsMember2024-06-3000000967932024-06-300000096793us-gaap:AdditionalPaidInCapitalMember2024-06-3000000967932024-09-300000096793ssy:TraceSeniorCareFacilitySaleMember2023-07-012024-06-300000096793ssy:PrivateInsuranceMember2023-07-012023-09-300000096793us-gaap:ProductMember2023-07-012023-09-300000096793us-gaap:RetainedEarningsMember2024-07-012024-09-300000096793us-gaap:SubsequentEventMember2024-10-092024-10-090000096793us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000096793ssy:OtherMember2023-07-012023-09-300000096793us-gaap:AdditionalPaidInCapitalMember2023-09-300000096793ssy:RetailAndInstitutionalPharmacyMember2023-07-012023-09-3000000967932023-09-300000096793us-gaap:RetainedEarningsMember2023-09-300000096793us-gaap:RetainedEarningsMember2023-07-012023-09-300000096793ssy:AccumulatedOtherComprehensiveLossMember2023-09-300000096793srt:ManagementMember2023-07-012023-09-300000096793ssy:SaleOfTraceRegionalHealthSystemsIncMember2024-06-032024-06-030000096793ssy:CommonSharesMember2024-06-300000096793ssy:OtherMember2024-07-012024-09-3000000967932024-09-062024-09-060000096793us-gaap:ServiceMember2023-07-012023-09-300000096793ssy:AccumulatedOtherComprehensiveLossMember2024-07-012024-09-3000000967932023-06-300000096793ssy:AccumulatedOtherComprehensiveLossMember2024-09-300000096793ssy:SaleOfTraceRegionalHealthSystemsIncMemberus-gaap:SubsequentEventMember2024-10-090000096793ssy:CommonSharesMember2023-07-012023-09-300000096793ssy:CommonSharesMember2024-07-012024-09-300000096793ssy:SaleOfTraceRegionalHealthSystemsIncMember2024-01-220000096793ssy:LifeSciencesAndEngineeringSegmentMember2024-07-012024-09-3000000967932024-08-022024-08-020000096793ssy:SaleOfTraceRegionalHealthSystemsIncMember2024-09-300000096793ssy:CommonSharesMember2023-09-300000096793ssy:AccumulatedOtherComprehensiveLossMember2024-06-30xbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-12607

SUNLINK HEALTH SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Georgia |

|

31-0621189 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

900 Circle 75 Parkway, Suite 690, Atlanta, Georgia 30339

(Address of principal executive offices)

(Zip Code)

(770) 933-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered Symbol(s) |

Common Shares without par value |

|

SSY |

|

NYSE American |

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filings requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (of for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

The number of Common Shares, without par value, outstanding as of November 12, 2024 was 7,040,603.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

SUNLINK HEALTH SYSTEMS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

|

|

|

|

2024 |

|

|

June 30, |

|

|

|

(unaudited) |

|

|

2024 |

|

ASSETS |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

7,529 |

|

|

$ |

7,170 |

|

Receivables - net |

|

|

3,011 |

|

|

|

3,371 |

|

Inventory |

|

|

1,547 |

|

|

|

1,553 |

|

Current assets held for sale |

|

|

1,915 |

|

|

|

1,959 |

|

Prepaid expense and other assets |

|

|

1,614 |

|

|

|

1,611 |

|

Total current assets |

|

|

15,616 |

|

|

|

15,664 |

|

Property, plant and equipment, at cost |

|

|

12,498 |

|

|

|

12,683 |

|

Less accumulated depreciation |

|

|

(10,182 |

) |

|

|

(9,874 |

) |

Property, plant and equipment - net |

|

|

2,316 |

|

|

|

2,809 |

|

Noncurrent Assets: |

|

|

|

|

|

|

Intangible asset |

|

|

1,180 |

|

|

|

1,180 |

|

Right of use assets |

|

|

473 |

|

|

|

516 |

|

Other noncurrent assets |

|

|

44 |

|

|

|

443 |

|

Total noncurrent assets |

|

|

1,697 |

|

|

|

2,139 |

|

TOTAL ASSETS |

|

$ |

19,629 |

|

|

$ |

20,612 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,338 |

|

|

$ |

1,905 |

|

Accrued payroll and related taxes |

|

|

1,351 |

|

|

|

955 |

|

Current operating lease liabilities |

|

|

339 |

|

|

|

331 |

|

Other accrued expenses |

|

|

823 |

|

|

|

1,022 |

|

Total current liabilities |

|

|

3,851 |

|

|

|

4,213 |

|

Long-Term Liabilities |

|

|

|

|

|

|

Noncurrent liability for professional liability risks |

|

|

139 |

|

|

|

49 |

|

Long-term operating lease liabilities |

|

|

146 |

|

|

|

197 |

|

Other noncurrent liabilities |

|

|

69 |

|

|

|

180 |

|

Total long-term liabilities |

|

|

354 |

|

|

|

426 |

|

Commitments and Contingencies |

|

|

|

|

|

|

Shareholders’ Equity |

|

|

|

|

|

|

Preferred Shares, authorized and unissued, 2,000 shares |

|

|

0 |

|

|

|

0 |

|

Common Shares, without par value: |

|

|

|

|

|

|

Issued and outstanding, 7,041 shares at September 30, 2024 and 7,041 at June 30, 2024 |

|

|

3,521 |

|

|

|

3,521 |

|

Additional paid-in capital |

|

|

10,747 |

|

|

|

10,747 |

|

Retained earnings |

|

|

929 |

|

|

|

1,478 |

|

Accumulated other comprehensive income |

|

|

227 |

|

|

|

227 |

|

Total Shareholders’ Equity |

|

|

15,424 |

|

|

|

15,973 |

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

19,629 |

|

|

$ |

20,612 |

|

See notes to condensed consolidated financial statements.

SUNLINK HEALTH SYSTEMS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE EARNINGS (LOSS)

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Net revenues |

|

$ |

7,923 |

|

|

$ |

8,555 |

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

Cost of goods sold |

|

|

4,475 |

|

|

|

4,771 |

|

|

Salaries, wages and benefits |

|

|

3,078 |

|

|

|

2,617 |

|

|

Supplies |

|

|

34 |

|

|

|

34 |

|

|

Purchased services |

|

|

319 |

|

|

|

286 |

|

|

Other operating expenses |

|

|

804 |

|

|

|

906 |

|

|

Rent and lease expense |

|

|

94 |

|

|

|

91 |

|

|

Depreciation and amortization |

|

|

313 |

|

|

|

300 |

|

|

Operating Loss |

|

|

(1,194 |

) |

|

|

(450 |

) |

|

Other Income (Expense): |

|

|

|

|

|

|

|

Gains on sale of assets |

|

|

694 |

|

|

|

2 |

|

|

Interest income, net |

|

|

58 |

|

|

|

22 |

|

|

Loss from Continuing Operations before income taxes |

|

|

(442 |

) |

|

|

(426 |

) |

|

Income Tax Expense |

|

|

0 |

|

|

|

2 |

|

|

Loss from Continuing Operations |

|

|

(442 |

) |

|

|

(428 |

) |

|

Loss from Discontinued Operations, net of tax |

|

|

(107 |

) |

|

|

(916 |

) |

|

Net Loss |

|

|

(549 |

) |

|

|

(1,344 |

) |

|

Other comprehensive income |

|

|

0 |

|

|

|

0 |

|

|

Comprehensive Loss |

|

$ |

(549 |

) |

|

$ |

(1,344 |

) |

|

Loss Per Share: |

|

|

|

|

|

|

|

Continuing Operations: |

|

|

|

|

|

|

|

Basic |

|

$ |

(0.06 |

) |

|

$ |

(0.06 |

) |

|

Diluted |

|

$ |

(0.06 |

) |

|

$ |

(0.06 |

) |

|

Discontinued Operations: |

|

|

|

|

|

|

|

Basic |

|

$ |

(0.02 |

) |

|

$ |

(0.13 |

) |

|

Diluted |

|

$ |

(0.02 |

) |

|

$ |

(0.13 |

) |

|

Net Loss: |

|

|

|

|

|

|

|

Basic |

|

$ |

(0.08 |

) |

|

$ |

(0.19 |

) |

|

Diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.19 |

) |

|

Weighted-Average Common Shares Outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

7,041 |

|

|

|

7,033 |

|

|

Diluted |

|

|

7,041 |

|

|

|

7,033 |

|

|

See notes to condensed consolidated financial statements.

SUNLINK HEALTH SYSTEMS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares |

|

|

Additional

Paid-in

Capital |

|

|

Retained

Earnings |

|

|

Accumulated

Other

Comprehensive

Income |

|

|

Total

Shareholders’

Equity |

|

|

|

Shares |

|

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

JUNE 30, 2024 |

|

|

7,041 |

|

|

$ |

3,521 |

|

|

$ |

10,747 |

|

|

$ |

1,478 |

|

|

$ |

227 |

|

|

$ |

15,973 |

|

Net loss |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

(549 |

) |

|

|

0 |

|

|

|

(549 |

) |

SEPTEMBER 30, 2024 |

|

|

7,041 |

|

|

$ |

3,521 |

|

|

$ |

10,747 |

|

|

$ |

929 |

|

|

$ |

227 |

|

|

$ |

15,424 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JUNE 30, 2023 |

|

|

7,032 |

|

|

$ |

3,516 |

|

|

$ |

10,746 |

|

|

$ |

3,005 |

|

|

$ |

150 |

|

|

$ |

17,417 |

|

Share options exercised |

|

|

9 |

|

|

|

5 |

|

|

|

1 |

|

|

|

0 |

|

|

|

0 |

|

|

|

6 |

|

Net loss |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

(1,344 |

) |

|

|

0 |

|

|

|

(1,344 |

) |

SEPTEMBER 30, 2023 |

|

$ |

7,041 |

|

|

$ |

3,521 |

|

|

$ |

10,747 |

|

|

$ |

1,661 |

|

|

$ |

150 |

|

|

$ |

16,079 |

|

See notes to condensed consolidated financial statements.

SUNLINK HEALTH SYSTEMS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

Net Cash Used in Operating Activities |

|

$ |

(915 |

) |

|

$ |

(1,137 |

) |

Cash Flows Provided by (Used in) Investing Activities: |

|

|

|

|

|

|

Expenditures for property, plant and equipment - continuing operations |

|

|

(191 |

) |

|

|

(476 |

) |

Expenditures for property, plant and equipment - discontinued operations |

|

|

0 |

|

|

|

(53 |

) |

Proceeds from sale of property, plant and equipment - continuing operations |

|

|

401 |

|

|

|

5 |

|

Proceeds from sale of investment in minority owned equity investment |

|

|

1,064 |

|

|

|

0 |

|

Net Cash Provided by (Used in) Investing Activities |

|

|

1,274 |

|

|

|

(524 |

) |

Cash Flows Provided by (Used in) Financing Activities: |

|

|

|

|

|

|

Proceeds from share options exercises |

|

|

0 |

|

|

|

6 |

|

Payments on long-term debt - discontinued operations |

|

|

0 |

|

|

|

(11 |

) |

Net Cash Used in Financing Activities |

|

|

0 |

|

|

|

(5 |

) |

Net Increase (Decrease) in Cash and Cash Equivalents |

|

|

359 |

|

|

|

(1,666 |

) |

Cash and Cash Equivalents Beginning of Period |

|

|

7,170 |

|

|

|

4,486 |

|

Cash and Cash Equivalents End of Period |

|

$ |

7,529 |

|

|

$ |

2,820 |

|

Supplemental Disclosure of Cash Flow Information: |

|

|

|

|

|

|

Cash Paid (Received) for: |

|

|

|

|

|

|

Interest |

|

$ |

(58 |

) |

|

$ |

(22 |

) |

Income taxes |

|

$ |

0 |

|

|

$ |

43 |

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

Right-of-use assets obtained in exchange for operating lease liabilities |

|

$ |

37 |

|

|

$ |

18 |

|

See notes to condensed consolidated financial statements.

SUNLINK HEALTH SYSTEMS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

THREE MONTHS ENDED SEPTEMBER 30, 2024

(all dollar amounts in thousands except per share amounts)

(Unaudited)

Note 1. –Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements as of September 30, 2024 and for the three month periods ended September 30, 2024 and 2023 have been prepared in accordance with Rule 8-03 and Article 8-03 of Regulation S-X of the Securities and Exchange Commission (“SEC”) and, as such, do not include all information required by accounting principles generally accepted in the United States of America (“GAAP”). The condensed consolidated June 30, 2024 balance sheet included in this interim filing has been derived from the audited consolidated financial statements at that date but does not include all the information and related notes required by GAAP for complete consolidated financial statements. These Condensed Consolidated Financial Statements should be read in conjunction with the audited consolidated financial statements included in the SunLink Health Systems, Inc. (“SunLink”, “we”, “our”, “ours”, “us” or the “Company”) Annual Report on Form 10-K for the fiscal year ended June 30, 2024, filed with the SEC on September 30, 2024. In the opinion of management, the Condensed Consolidated Financial Statements, which are unaudited, include all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the financial position and results of operations for the periods indicated. The results of operations for the three month period ended September 30, 2024 are not necessarily indicative of the results that may be expected for the entire fiscal year or any other interim period.

Throughout these notes to the condensed consolidated financial statements, SunLink Health Systems, Inc., and its consolidated subsidiaries are referred to on a collective basis as “SunLink”, “we”, “our”, “ours”, “us” or the “Company.” This drafting style is not meant to indicate that SunLink Health Systems, Inc. or any particular subsidiary of the Company owns or operates any particular asset, business or property. Each operation and business described in this filing is owned and operated by a distinct and indirect subsidiary of SunLink Health Systems, Inc.

Note 2. – Business Operations

The Company’s continuing operations are composed of a pharmacy business and an information technology (“IT”) business.

The pharmacy business, is composed of four operational areas conducted in three locations in southwest Louisiana:

· Retail pharmacy products and services, consisting of retail pharmacy sales.

· Institutional pharmacy services consisting of the provision of specialty and non-specialty pharmaceutical and biological products to institutional clients or to patients in institutional settings, such as extended care and rehabilitation centers, nursing homes, assisted living facilities, behavioral and specialty hospitals, hospice, and correctional facilities.

· Non-institutional pharmacy services consisting of the provision of specialty and non-specialty pharmaceutical and biological products to clients or patients in non-institutional settings including private residential homes.

· Durable medical equipment products and services (“DME”), consisting primarily of the sale and rental of products for institutional clients or to patients in institutional settings and patient-administered home care.

A subsidiary, SunLink Health Systems Technology (“SHST Technology”), provides information technology (“IT”) services to outside customers, primarily in rural healthcare settings, and to SunLink subsidiaries.

COVID-19 Pandemic

The Company’s operations for the three months ended September 30, 2024 continued to be negatively impacted by the effects of the aftermath of the COVID-19 pandemic, although mitigated somewhat from prior quarters, including among other factors, difficulty hiring qualified employees, rising labor and supply costs, and supply chain challenges resulting in inability to obtain pharmacy and DME products on a timely, cost effective basis.

Note 3. – Discontinued Operations

All of the businesses discussed below are reported as discontinued operations and the condensed consolidated financial statements for all prior periods have been adjusted to reflect this presentation.

Sale of Trace Regional Hospital, medical office building, three patient clinics, and Trace Extended Care operations – On January 22, 2024, the Company's indirect subsidiary, Southern Health Corporation of Houston, Inc. (“Southern”), reached revised agreements (the "Revised Agreements") for the sale of Trace Regional Hospital, a vacant medical office building and three (3) patient clinics in Chickasaw County, MS, (collectively “Trace”) to Progressive Health of Houston, LLC (“Progressive”) pursuant to which (i) Southern sold certain personal and intangible property to Progressive for $500 under to an asset purchase agreement ('Trace Hospital Assets Sale"), (ii) entered into a six-month net lease of the real property of the hospital, medical office building and the clinics real property (the "Trace Real Estate") for $20 per month, (iii) entered into a contract to sell the Trace real estate to Progressive (the "Trace Real Estate Sale") for $2,000 and (iv) engaged Progressive under a management agreement to manage the operations of Trace pending receipt of certain regulatory approvals, which were received February 29, 2024. The Company recorded a loss of $962 on the Trace Hospital Assets Sale during the year ended June 30, 2024, which included sale expenses of $174. The Trace Real Estate Sale was completed on October 9, 2024. The Company reported an additional asset impairment reserve of $44 in the quarter ended September 30, 2024 for transaction expenses incurred at the sale date. SunLink earlier reported an impairment loss of $1,974 at December 31, 2023 to reduce the net value of the Trace hospital assets to the estimated sale proceeds under the revised agreement. An impairment reserve of $1,739 remains at September 30, 2024 for the Trace Real Estate Sale assets. On June 3, 2024, the Company's indirect subsidiary, Southern Health Corporation of Houston, Inc. and an affiliate completed the sale of its Trace Extended Care & Rehab senior care facility ('Trace Extended Care") and related real estate in Houston, Mississippi for approximately $7,100 (the "Trace Extended Care Facility Sale"). The net proceeds of approximately $6,522 have been retained for working capital and general corporate purposes. The Company recorded a gain of $5,584 during the fiscal year ended June 30, 2024 on the Trace Extended Care Facility Sale, which included sale expenses of $578.

Sold Hospitals– Subsidiaries of the Company have sold substantially all the assets of five (5) other hospitals (“Sold Facilities”) during the period July 2, 2012 to March 17, 2019. The loss before income taxes of the Sold Facilities results primarily from the effects of retained professional liability insurance and claims expenses and settlement of a lawsuit.

Life Sciences and Engineering Segment —SunLink retained a defined benefit retirement plan which covered substantially all the employees of this segment when the segment was sold in fiscal year 1998. Effective February 28, 1997, the plan was amended to freeze participant benefits and close the plan to new participants. Pension expense and related tax benefit or expense is reflected in the results of discontinued operations for this segment for the three months ended September 30, 2024 and 2023, respectively.

The components of pension expense for the three months ended September 30, 2024 and 2023, respectively, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Interest cost |

|

$ |

9 |

|

|

$ |

11 |

|

|

Expected return on assets |

|

|

(13 |

) |

|

|

(9 |

) |

|

Amortization of prior service cost |

|

|

0 |

|

|

|

0 |

|

|

Net pension (income) expense |

|

$ |

(4 |

) |

|

$ |

2 |

|

|

Per the Actuarial Valuation Report for the plan year beginning July 1, 2024, no minimum contribution amount is required for the pension plan year ended June 30, 2025. As such SunLink did not make any contributions to the plan during the three months ended September 30, 2024 and does not plan contribute any funds during the last nine months of the fiscal year ending June 30, 2025.

Statements of operations from discontinued operations for the three months ended September 30, 2024 and 2023. The results below primarily reflect the reporting of Trace as discontinued operations as a result of the Company's Revised agreement to sell Trace and its sale of Trace Extended Care, are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Net Revenues |

|

$ |

16 |

|

|

$ |

2,672 |

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

Salaries, wages and benefits |

|

|

11 |

|

|

|

1,898 |

|

|

Supplies |

|

|

0 |

|

|

|

289 |

|

|

Purchased services |

|

|

44 |

|

|

|

706 |

|

|

Other operating expense |

|

|

24 |

|

|

|

528 |

|

|

Rent and lease expense |

|

|

0 |

|

|

|

34 |

|

|

Depreciation and amortization |

|

|

0 |

|

|

|

133 |

|

|

Operating Loss |

|

|

(63 |

) |

|

|

(916 |

) |

|

Other Income (Expense): |

|

|

|

|

|

|

|

Impairment loss of Trace Hospital Real Estate and related sale expenses |

|

|

(44 |

) |

|

|

0 |

|

|

Loss from Discontinued Operations before income taxes |

|

|

(107 |

) |

|

|

(916 |

) |

|

Income Tax Expense |

|

|

0 |

|

|

|

0 |

|

|

Loss from Discontinued Operations, net of tax |

|

$ |

(107 |

) |

|

$ |

(916 |

) |

|

Details of assets and liabilities held for sale at September 30, 2024 and June 30, 2024, are as follows:

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

June 30, |

|

|

|

2024 |

|

|

2024 |

|

Property, plant and equipment, net |

|

$ |

3,654 |

|

|

$ |

3,654 |

|

Impairment reserve |

|

|

(1,739 |

) |

|

|

(1,695 |

) |

Total assets held for sale |

|

$ |

1,915 |

|

|

$ |

1,959 |

|

Note 4. – Shareholders’ Equity

Stock-Based Compensation – For the three months ended September 30, 2024 and 2023, the Company recognized no stock-based compensation for options issued to employees and directors of the Company. There were no shares issued as a result of options exercised during the three months ended September 30, 2024. There were 9,000 shares issued as a result of options exercised during the three months ended September 30, 2023.

Note 5. – Revenue and Accounts Receivable

Disaggregation of Revenue

The Company disaggregates revenue from contracts with its patients by payors. The Company determines that disaggregating revenue into these categories achieves the disclosure objectives to depict how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors. A reconciliation of disaggregated revenue is shown below.

Revenues by payor were as follows for the three months ended September 30, 2024 and 2023:

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Medicare |

|

$ |

3,719 |

|

|

$ |

3,830 |

|

|

Medicaid |

|

|

1,726 |

|

|

|

1,650 |

|

|

Retail and Institutional Pharmacy |

|

|

1,796 |

|

|

|

1,704 |

|

|

Private Insurance |

|

|

467 |

|

|

|

1,170 |

|

|

Self-pay |

|

|

197 |

|

|

|

180 |

|

|

Other |

|

|

18 |

|

|

|

21 |

|

|

Total Net Revenues |

|

$ |

7,923 |

|

|

$ |

8,555 |

|

|

The revenues for the three months ended September 30, 2023 includes $321 of prior period sales tax refunds.

The Company’s service specific revenue recognition policies are as follows:

Pharmacy

The Company’s revenue is derived primarily from providing pharmacy goods and services to patients and is recognized on the date goods and services are provided at amounts billable to individual patients, adjusted for estimates for variable consideration. Revenue is recognized when control of the promised goods or services are transferred to customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services. Each prescription claim represents a separate performance obligation of the Company, separate and distinct from other prescription claims under customer arrangements. Significant portions of the revenue from sales of pharmaceutical and medical products are reimbursed by the federal Medicare Part D program and, to a lesser extent, state Medicaid programs. The Company monitors its revenues and receivables from these reimbursement sources, as well as other third-party insurance payors, and reduces revenue at the revenue recognition date, to properly account for the variable consideration due to anticipated differences between billed and reimbursed amounts. Accordingly, the total net revenues and receivables reported in the Company’s condensed consolidated financial statements are recorded at the amount expected to be ultimately received from these payors.

Receivables and Provision for Credit Losses

The Company adopted Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 326, Financial Statements – Credit Losses (“Topic 326”) with an adoption date of July 1, 2023. This standard requires a financial asset (or a group of financial assets) measured at amortized cost basis, to be presented at the net amount expected to be collected. The allowance for credit losses is a valuation account that is deducted from the amortized cost basis of the financial asset(s) to present the net carrying value at the amount expected to be collected on the financial assets. The Company evaluates the valuation of accounts receivable concessions allowances based upon its historical collection trends, as well as its understanding of the nature and collectability of accounts based on their age and other factors. The model is based on the credit losses expected to arise over the life of the asset based on the Company’s expectations as of the balance sheet date through analyzing historical customer data as well as taking into consideration current and estimated future economic trends. The Company adopted Topic 326 and determined it did not have a material financial impact.

The roll forward of the allowance for credit losses for the three months ended September 30, 2024 and 2023, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

September 30, |

|

|

September 30, |

|

|

2024 |

|

|

2023 |

|

June 30, balance |

$ |

240 |

|

|

$ |

532 |

|

Concession allowance expense |

|

61 |

|

|

|

79 |

|

Write-offs |

|

(45 |

) |

|

|

(203 |

) |

September 30, balance |

$ |

256 |

|

|

$ |

408 |

|

Note 6. – Intangible Assets

As of September 30, 2024 and June 30, 2024, intangible assets consist solely of an indefinite-lived trade name of $1,180 relating to its Carmichael acquisition.

Note 7. – Asset Sales

On August 2, 2024, the Company sold its all its minority equity ownership investment in a subsidiary to the majority owner for cash of $1,064 which resulted in a pre-tax gain on the sale of $665 for the quarter ended September 30, 2024.

On September 6, 2024, the Company sold 24.7 acres of undeveloped land in Ellijay, GA, for cash of $401 which resulted in a pre-tax gain on the sale of $29 for the quarter ended September 30, 2024.

Note 8. – Income Taxes

No income tax expense was recorded for continuing operations for the three months ended September 30 2024. Income tax expense of $2 (all state income taxes) was recorded for continuing operations for the three months ended September 30, 2023.

In accordance with the Financial Accounting Standards Board Accounting Standards Codification (“ASC”) 740, we evaluate our deferred taxes quarterly to determine if adjustments to our valuation allowance are required based on the consideration of available positive and negative evidence using a “more likely than not” standard with respect to whether deferred tax assets will be realized. Our evaluation considers, among other factors, our historical operating results, our expectation of future results of operations, the duration of applicable statuary carryforward periods and conditions of the healthcare industry. The ultimate realization of our deferred tax assets depends primarily on our ability to generate future taxable income during the periods in which the related temporary differences in the financial basis and the tax basis of the assets become deductible. The value of our deferred tax assets will depend on applicable income tax rates.

At September 30, 2024, consistent with the above process, we evaluated the need for a valuation allowance against our deferred tax assets and determined that it was more likely than not that none of our deferred tax assets would be realized. As a result, in accordance with ASC 740, we recognized a valuation allowance of $8,183 against the deferred tax asset so that there is no net long-term deferred income tax asset at September 30, 2024. We conducted our evaluation by considering available positive and negative evidence to determine our ability to realize our deferred tax assets. In our evaluation, we gave more significant weight to evidence that was objective in nature as compared to subjective evidence. A long-term deferred tax liability of $69 is recorded within other noncurrent liabilities in the accompanying condensed consolidated balance sheet of September 30, 2024 to reflect the deferred tax liability for the non-amortizing trade name intangible asset.

The principal negative evidence that led us to determine at September 30, 2024 that all the deferred tax assets should have full valuation allowances was historical tax losses and the projected current fiscal year tax loss. For purposes of evaluating our valuations allowances, the Company’s history of losses represent significant historical negative evidence and we have recognized none of our federal income tax net operating loss carry-forward of approximately $26,502.

For federal income tax purposes, at September 30, 2024, the Company had approximately $26,502 of estimated net operating loss carry-forwards available for use in future years subject to the possible limitations of the provisions of Internal Revenue Code Section 382. These net operating loss carryforwards expire primarily in fiscal year 2025 through fiscal year 2038; however, with the enactment of the Tax Cut and Jobs Act on December 22, 2017, federal net operating loss carryforwards generated in taxable years beginning after December 31, 2017 now have no expiration date. The Company’s returns for the periods prior to the fiscal year ended June 30, 2020 are no longer subject to potential federal and state income tax examination. Net operating loss carry-forwards generated in tax years prior to June 30, 2020 are still subject to redetermination in potential federal income tax examination.

Note 9. – Leases

The Company, as lessee, has operating leases relating to its pharmacy operations, certain medical equipment, and office equipment. All lease agreements generally require the Company to pay maintenance, repairs, property taxes and insurance costs, all of which are variable amounts based on actual costs. Variable lease costs also include escalating rent payments that are not fixed at commencement but are based on an index determined in future periods over the lease term based on changes in the Consumer Price Index or other measure of cost inflation. Some leases include one or more options to renew the lease at the end of the initial term, with renewal terms that generally extend the lease at the then market rental rates. Leases may also include an option to buy the underlying asset at or a short time prior to the termination of the lease. All such options are at the Company’s discretion and are evaluated at the commencement of the lease, with only those that are reasonably certain of exercise included in determining the appropriate lease term. The components of lease cost and rent expense for the three months ended September 30, 2024 and 2023 are as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

Lease Cost |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

Operating lease cost: |

|

|

|

|

|

|

Operating lease cost |

|

$ |

85 |

|

|

$ |

85 |

|

Short-term rent expense |

|

|

8 |

|

|

|

5 |

|

Variable lease cost |

|

|

1 |

|

|

|

1 |

|

Total operating lease cost |

|

$ |

94 |

|

|

$ |

91 |

|

Supplemental balance sheet information relating to leases was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

As of |

|

|

|

|

|

September 30, |

|

June 30, |

|

|

|

|

|

2024 |

|

2024 |

|

Operating Leases: |

|

Balance Sheet Classifications |

|

|

|

|

|

Operating lease ROU Assets |

|

ROU Assets |

|

$ |

473 |

|

$ |

516 |

|

Current operating lease liabilities |

|

Current operating lease liabilities |

|

|

339 |

|

|

331 |

|

Long-term operating lease liabilities |

|

Long-term operating lease liabilities |

|

$ |

146 |

|

$ |

197 |

|

Supplemental cash flow and other information related to leases as of and for the three months ended September 30, 2024 and 2023 are as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Other information |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

Cash paid for amounts included in the measurement of lease liabilities: |

|

|

|

|

|

|

Operating cash flows of operating leases |

|

$ |

87 |

|

|

$ |

85 |

|

Right-of-use assets obtained in exchange for new operating lease liabilities |

|

|

37 |

|

|

|

18 |

|

Weighted-average remaining lease term: |

|

|

|

|

|

|

Operating leases |

|

1.58 years |

|

|

2.29 years |

|

Weighted-average discount rate: |

|

|

|

|

|

|

Operating leases |

|

|

1.24 |

% |

|

|

0.99 |

% |

Commitments relating to non-cancellable operating leases as of September 30, 2024 for each of the next five years and thereafter are as follows:

|

|

|

|

|

|

Payments due within |

|

Operating Leases |

|

|

1 year |

|

$ |

339 |

|

|

2 years |

|

|

122 |

|

|

3 years |

|

|

23 |

|

|

4 years |

|

|

4 |

|

|

5 years |

|

|

0 |

|

|

Over 5 years |

|

|

0 |

|

|

Total minimum future payments |

|

|

488 |

|

|

Less: Imputed interest |

|

|

(3 |

) |

|

Total liabilities |

|

|

485 |

|

|

Less: Current portion |

|

|

(339 |

) |

|

Long-term liabilities |

|

$ |

146 |

|

|

Note 10. – Sales Tax Payable

During the fiscal year ended June 30, 2019, the pharmacy business amended its sales tax position with four different taxing authorities to avail its business of exemptions from state and local sales taxes in Louisiana on revenues from the sales of products and services to beneficiaries of government insurance programs to the extent reimbursed by the administrators of such programs. No such sales taxes for any period subsequent to June 30, 2019 have been paid on the related reimbursement received from the government insurance payers’ programs with respect to sales of such products and services. The Company has filed amended sales tax returns for periods still open under the applicable

statutes of limitations claiming refunds of such sales taxes paid. During the three months ended September 30, 2023, the Company recorded a refund received of $321 as revenue for a sales tax refund which was received in October 2023.

Note 11. – Commitments and Contingencies

The Company has no contractual obligations, commitments and contingencies related to outstanding debt and interest (excluding operating leases, see Note 9) at September 30, 2024.

Note 13. – Related Party Transactions

A former director of the Company, who resigned in July 2024, is senior counsel in a law firm which provides services to SunLink. The Company expensed an aggregate of $161 and $187 for legal services to this law firm in the three months ended September 30, 2024 and 2023. Included in the Company’s condensed consolidated balance sheets at September 30, 2024 and June 30, 2024 is outstanding legal expenses to this firm $173 and $156, respectively.

Note 14. – Subsequent Events

On October 9, 2024, the Company sold its Trace Real Estate for net proceeds of approximately of $1,932 and expects to report no additional gain or loss on the sale as a result of the $44 impairment loss reported related to the sale in the quarter ended September 30, 2024 (see Note 3 - Discontinued Operations).

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

(Dollars in thousands, except per share and admissions data)

Forward-Looking Statements

This Quarterly Report and the documents that are incorporated by reference in this Quarterly Report contain certain forward-looking statements within the meaning of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and may be identified by the use of words such as “may,” “believe,” “will,” “seeks to”, “expect,” “project,” “estimate,” “anticipate,” “plan” or “continue.” Throughout this quarterly report and the notes to the condensed consolidated financial statements, SunLink Health Systems, Inc., and its consolidated subsidiaries are referred to on a collective basis as “SunLink”, “we”, “our”, “ours”, “us” or the “Company.” This drafting style is not meant to indicate that SunLink Health Systems, Inc. or any particular subsidiary of SunLink Health Systems, Inc. owns or operates any asset, business, or property. Healthcare services, pharmacy operations and other businesses described in this filing are owned and operated by distinct and indirect subsidiaries of SunLink Health System, Inc. These forward-looking statements are based on current plans and expectations and are subject to a number of risks, uncertainties and other factors that could significantly affect current plans and expectations and our future financial condition and results. These factors, which could cause actual results, performance, and achievements to differ materially from those anticipated, include, but are not limited to:

General Business Conditions

•general economic and business conditions in the U.S., both nationwide and in the states in which we operate;

•the continuing after-effects of the COVID-19 pandemic, both nationwide and in the states in which we operate, including among other things, on demand for our pharmacy services, the efficiency of such services, availability of staffing, availability of supplies, costs and financial results. Changes in the communicability, mortality rate, and vaccine resistances for COVID-19 and its variants or pandemics of other contagious diseases could result in the unavailability of personnel to provide services, regulatory bans on certain services, increased costs, reduced revenues or other adverse effects on our business;

•the competitive nature of the U.S. pharmacy business;

•demographic characteristics and changes in areas where we operate variants;

•the availability of cash or borrowings to fund working capital, renovations, replacements, expansions, and capital improvements at existing pharmacy facilities and for acquisitions and replacement of such pharmacy facilities or acquisitions of other healthcare facilities;

•changes in accounting principles generally accepted in the U.S.;

•the impact of inflation on our patients, operating costs, ability and feasibility of raising funds, and on our ability to achieve cash flow and profitability, including our inability to cover cost increases because most of our revenue is from government programs whose payments are fixed; and

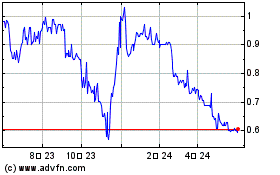

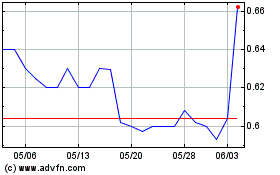

•fluctuations in the market value of equity securities including SunLink common shares, including fluctuations based on actual or feared inflation or recession.

Operational Factors

•the ability or inability to operate profitably in the pharmacy or other healthcare businesses;

•the availability of, and our ability to attract and retain, sufficient qualified management, pharmacists, and staff personnel for our operations;

•timeliness and amount and conditions of reimbursement payments received under government programs;

•the lack of availability of future governmental support that may be required to offset the after effects of future pandemics or an inability to meet the requirements relating to such support;

•the ability or inability to fund our obligations under capital leases or new or existing obligations and/or any potential defaults under future indebtedness;

•restrictions imposed by existing or future contractual obligations including any new indebtedness;

•the cost and availability of insurance coverage including professional liability (e.g., medical malpractice) and general, employment, fiduciary, other liability insurance and changes in estimates of our self-insurance claims and reserves;

•the efforts of governmental authorities, insurers, healthcare providers, and others to contain and reduce healthcare costs;

•changes in medical and other technology;

•increases in prices of materials and services utilized in our pharmacy business;

•increases in wages as a result of inflation or competition for pharmacy, management, and staff positions;

•any impairment in our ability to collect accounts receivable, including deductibles and co-pay amounts;

•the functionality of or costs with respect to our information systems for our pharmacy business and our corporate office, including both software and hardware;

•the availability of and competition from alternative drugs or treatments to those provided by our pharmacy business; and

•the restrictions, clawbacks, processes, and conditions relating to our pharmacy business imposed by pharmacy benefit managers, drug manufacturers, and distributors.

Liabilities, Claims, Obligations and Other Matters

•claims under leases, guarantees, disposition agreements, and other obligations relating to previous and future asset sales or discontinued operations, including claims from sold or leased facilities and services, retained liabilities or retained subsidiaries, and failure of buyers to satisfy liabilities for which the Company remains liable, pursuant to the disposition agreements;

•potential adverse consequences of any known and unknown government investigations;

•claims for medical malpractice product, environmental or other liabilities from continuing and discontinued operations;

•professional, general, and other claims which may be asserted against us, including claims currently unknown to us;

•potential damages and consequences of natural disasters and weather-related events such as tornados, earthquakes, hurricanes, flooding, snow, ice and wind damage, and population evacuations affecting areas in which we operate; and

•potential adverse contingencies of terrorist acts, crime or civil unrest.

Regulation and Governmental Activity

•negative consequences of existing and proposed governmental budgetary constraints or modification or termination of existing government programs or the implementation and related costs and disruptions of new government programs such as environmental, social and governance programs;

•negative consequences of Federal and state insurance exchanges and their rules relating to reimbursement terms;

•the regulatory environment for our businesses, including pharmacy licensing laws and regulations and rules and judicial cases relating thereto;

•the failure of government and private reimbursement to cover our increasing costs;

•changes in or failure to comply with Federal, state and local laws and regulations and enforcement interpretations of such laws and regulations affecting our pharmacy business; and

•the possible enactment of additional Federal healthcare reform laws or reform laws or regulations in states where our subsidiaries operate pharmacy facilities or additional healthcare facilities (including Medicaid waivers, bundled payments, managed care programs, accountable care and similar organizations, competitive bidding and other reforms).

Strategic Initiatives - Merger, Dispositions, Acquisition and Renovation Related Matters

•the inability to complete a strategic transaction such as a merger;

•the inability to dispose of underperforming businesses on acceptable terms;

•the inability to complete the sale of assets pursuant to disposition agreements or the inability to collect proceeds expected pursuant to such agreements;

•the availability of cash and the availability and terms of borrowed or equity capital to fund acquisitions or replacement or upgraded facilities, and improvements or renovations to existing facilities; and

•competition in the market for acquisitions of pharmacy facilities, and other healthcare businesses;

The foregoing are significant factors we think could cause our actual results to differ materially from expected results. However, there could be additional factors besides those listed herein that also could affect SunLink in an adverse manner. You should read our annual report and quarterly reports completely and with the understanding that future results may be materially different from what we expect. You are cautioned not to unduly rely on forward-looking statements when evaluating the information presented in annual and quarterly reports or our other disclosures because current plans, anticipated actions, and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on behalf of SunLink.

We have not undertaken any obligation to publicly update or revise any forward-looking statements. All of our forward-looking statements speak only as of the date of the document in which they are made or, if a date is specified, as of such date. We disclaim any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in our expectations or any changes in events, conditions, circumstances or information on which the forward-looking statement is based, except as required by applicable law. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing factors and the other risk factors set forth elsewhere in this report. on which the forward-looking statement is based, except as required by applicable law. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing factors and the other risk factors set forth elsewhere in this report.

Business Strategy: Operations, Dispositions and Acquisitions

The Board of Directors of SunLink (the "Board of Directors" or the "Board") believes management of the Company should, among other things, actively pursue one or more extraordinary corporate transactions, any of which transactions may involve merger or consolidation with a third party, as a result of which the Company's shareholders may not hold a majority of the equity in, or otherwise control the resulting entity. The Company is seeking to achieve a merger or other transaction which, among other things, provides the potential for growth in shareholder value on what it believes is a reasonable risk/reward basis.

On January 22, 2024, the Company's indirect subsidiary, Southern Health Corporation of Houston, Inc. (“Southern”), reached revised agreements (the "Revised Agreements") for the sale of Trace Regional Hospital, a vacant medical office building and three (3) patient clinics in Chickasaw County, MS, (collectively “Trace”) to Progressive Health of Houston, LLC (“Progressive”) pursuant to which (i) Southern sold certain personal and intangible property to Progressive for $500 under to an asset purchase agreement ('Trace Hospital Assets Sale"), (ii) entered into a six-month

net lease of the real property of the hospital, medical office building and the clinics real property (the "Trace Real Estate") for $20 per month, (iii) entered into a contract to sell the Trace Real Estate to Progressive (the "Trace Real Estate Sale") for $2,000 and (iv) engaged Progressive under a management agreement to manage the operations of Trace pending receipt of certain regulatory approvals, which were received February 29, 2024. The Company recorded a loss of $962 on the Trace Hospital Assets Sale during the year ended June 30, 2024, which included sale expenses of $174. The Trace Real Estate Sale was completed on October 9, 2024. The Company reported an additional asset impairment reserve of $44 in the quarter ended September 30, 2024 for transaction expenses incurred at the sale date. SunLink earlier reported an impairment loss of $1,974 at December 31, 2023 to reduce the net value of the Trace hospital assets to the estimated sale proceeds under the revised agreement. An impairment reserve of $1,739 remains at September 30, 2024 for the Trace Real Estate Sale assets. On June 3, 2024, the Company's indirect subsidiary, Southern Health Corporation of Houston, Inc. and an affiliate completed the sale of its Trace Extended Care & Rehab senior care facility and related real estate in Houston, Mississippi for approximately $7,100 (the "Trace Extended Care Facility Sale"). The net proceeds of approximately $6,522 have been retained for working capital and general corporate purposes. The Company recorded a gain of $5,584 during the fiscal year ended June 30, 2024 on the Trace Extended Care Facility Sale, which included sale expenses of $578.

The Company expects to use existing cash primarily to sustain its operations and to fund activities related to such extraordinary transactions when available and appropriate, and for other general corporate purposes. The Company believes certain portions of its businesses continue to under-perform and the Company periodically entertains overtures for the sale of one or more of its businesses when deemed appropriate, including to better position the company for an extraordinary corporate business transaction such as a merger or consolidation.

Critical Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires us to make estimates and assumptions that affect reported amounts and related disclosures. We consider an accounting estimate to be critical if it requires assumptions to be made that were uncertain at the time the estimate was made; and changes in the estimate or different estimates that could have been made could have a material impact on our consolidated results of operations or financial condition.

Our critical accounting estimates are more fully described in our 2024 Annual Report on Form 10-K and continue to include the following areas: receivables – net and provision for doubtful accounts; revenue recognition and net patient service revenues; goodwill, intangible assets and accounting for business combinations; professional and general liability claims; and accounting for income taxes. There have been no material changes in our critical accounting estimates for the periods presented other than amounts readily computable from the financial statements included in this form 10-Q.

Financial Summary

Results of Operations

The Company’s operations for the three months ended September 30, 2024 continued to be negatively impacted by the effects of the aftermath of the COVID-19 pandemic, although mitigated somewhat from prior quarters, including among other factors, difficulty hiring qualified employees, rising labor and supply costs and supply chain challenges resulting in inability to obtain pharmacy and DME products on a timely, cost effective basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

Net Revenues |

|

$ |

7,923 |

|

|

$ |

8,555 |

|

|

|

(7.4 |

)% |

|

Costs and expenses |

|

|

(9,117 |

) |

|

|

(9,005 |

) |

|

|

1.2 |

% |

|

Operating loss |

|

|

(1,194 |

) |

|

|

(450 |

) |

|

|

165.3 |

% |

|

Interest income (expense) - net |

|

|

58 |

|

|

|

22 |

|

|

|

163.6 |

% |

|

Gain on sale of assets |

|

|

694 |

|

|

|

2 |

|

|

NA |

|

|

Loss from continuing operations before income taxes |

|

$ |

(442 |

) |

|

$ |

(426 |

) |

|

|

3.8 |

% |

|

Our net revenues are from two businesses, pharmacy and a subsidiary which provides information technology services to outside customers and SunLink subsidiaries. The Company’s revenues by payor were as follows for the three months ended September 30, 2024 and 2023:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

Medicare |

|

$ |

3,719 |

|

|

$ |

3,830 |

|

Medicaid |

|

|

1,726 |

|

|

|

1,650 |

|

Retail and Institutional Pharmacy |

|

|

1,796 |

|

|

|

1,704 |

|

Private Insurance |

|

|

467 |

|

|

|

1,170 |

|

Self-pay |

|

|

197 |

|

|

|

180 |

|

Other |

|

|

18 |

|

|

|

21 |

|

Total Net Revenues |

|

$ |

7,923 |

|

|

$ |

8,555 |

|

Pharmacy net revenues for the three month period ended September 30, 2024 decreased $632 or 7% from the three month period ended September 30, 2023. The revenues for the three months ended September 30, 2023 include $321 of prior period sales tax refunds. The decrease in pharmacy net revenues for the three months period ended September 30, 2024 compared to the same period last fiscal year resulted from lower retail pharmacy scripts filled and lower durable medical equipment ("DME") orders shipped. Institutional pharmacy scripts filled increased 10% in the three months ended September 30, 204 compared to the three months ended September 30, 2023.

Costs and expenses, including depreciation and amortization, were $9,117 and $9,005 for the three months ended September 30, 2024 and 2023, respectively.

|

|

|

|

|

|

|

|

|

|

|

Cost and Expenses

as a % of Net Revenues |

|

|

|

Three Months Ended |

|

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

Cost of goods sold |

|

|

56.5 |

% |

|

|

55.8 |

% |

Salaries, wages and benefits |

|

|

38.9 |

% |

|

|

30.6 |

% |

Supplies |

|

|

0.4 |

% |

|

|

0.4 |

% |

Purchased services |

|

|

4.1 |

% |

|

|

3.3 |

% |

Other operating expenses |

|

|

10.2 |

% |

|

|

10.6 |

% |

Rent and lease expense |

|

|

1.2 |

% |

|

|

1.1 |

% |

Depreciation and amortization expense |

|

|

4.0 |

% |

|

|

3.5 |

% |

Almost all categories of costs and expenses increased as a percent of net revenues in the three ended September 30, 2024 compared to the prior fiscal year due to the decreased net revenues this year. Cost of goods sold decreased 6% in total due to the reduced volume. Salaries, wages and benefits ("SWB") increased in total for the three ended September 30, 2024 compared to the prior period last year due to higher salaries and wages required in connection with current labor markets and operating challenges of labor allocation relating to the pandemic aftereffects, including the use of contract labor and higher employee benefit costs. Depreciation expense also increased this year due to the $1,467 of capital expenditures last fiscal year.

Operating Profit (Loss)

The Company reported an operating loss of $1,194 for the three months period ended September 30, 2024 compared to an operating loss of $450 for the three months period ended September 30, 2023. The increased operating loss for the three months ended September 30, 2024 compared to the three months period ended September 30, 2023 resulted from the 7% decrease in net revenues this quarter and increased costs as a percentage of net revenues.

Gain on Sale of Assets

On August 2, 2024, the Company sold its all its minority equity ownership investment in a subsidiary to the majority owner for cash of $1,064 which resulted in a pre-tax gain on the sale of $665 for the quarter ended

September 30, 2024. On September 6, 2024, the Company sold 24.7 acres of undeveloped land for cash of $401 which resulted in a pre-tax gain on the sale of $29 for the quarter ended September 30, 2024.

Income Taxes

No income tax expense was recorded for continuing operations for the three months ended September 30 2024. Income tax expense of $2 (all state income taxes) was recorded for continuing operations for the three months ended September 30 2023.

In accordance with the Financial Accounting Standards Board Accounting Standards Codification (“ASC”) 740, we evaluate our deferred taxes quarterly to determine if adjustments to our valuation allowance are required based on the consideration of available positive and negative evidence using a “more likely than not” standard with respect to whether deferred tax assets will be realized. Our evaluation considers, among other factors, our historical operating results, our expectation of future results of operations, the duration of applicable statuary carryforward periods and conditions of the healthcare industry. The ultimate realization of our deferred tax assets depends primarily on our ability to generate future taxable income during the periods in which the related temporary differences in the financial basis and the tax basis of the assets become deductible. The value of our deferred tax assets will depend on applicable income tax rates.

At September 30, 2024, consistent with the above process, we evaluated the need for a valuation allowance against our deferred tax assets and determined that it was more likely than not that none of our deferred tax assets would be realized. As a result, in accordance with ASC 740, we recognized a valuation allowance of $8,183 against the deferred tax asset so that there is no net long-term deferred income tax asset at September 30, 2024. We conducted our evaluation by considering available positive and negative evidence to determine our ability to realize our deferred tax assets. In our evaluation, we gave more significant weight to evidence that was objective in nature as compared to subjective evidence. A long-term deferred tax liability of $69 is recorded within other noncurrent liabilities in the accompanying condensed consolidated balance sheet of September 30, 2024 to reflect the deferred tax liability for the non-amortizing trade name intangible asset.

The principal negative evidence that led us to determine at September 30, 2024 that all the deferred tax assets should have full valuation allowances was historical tax losses and the projected current fiscal year tax loss. For purposes of evaluating our valuations allowances, the Company’s history of losses represent significant historical negative evidence and we have recognized none of our federal income tax net operating loss carry-forward of approximately $26,502.

For federal income tax purposes, at September 30, 2024, the Company had approximately $26,502 of estimated net operating loss carry-forwards available for use in future years subject to the possible limitations of the provisions of Internal Revenue Code Section 382. These net operating loss carryforwards expire primarily in fiscal year 2025 through fiscal year 2038; however, with the enactment of the Tax Cut and Jobs Act on December 22, 2017, federal net operating loss carryforwards generated in taxable years beginning after December 31, 2017 now have no expiration date. The Company’s returns for the periods prior to the fiscal year ended June 30, 2020 are no longer subject to potential federal and state income tax examination. Net operating loss carry-forwards generated in tax years prior to June 30, 2020 are still subject to redetermination in potential federal income tax examination.

Loss from Continuing Operations after Income Taxes

The loss from continuing operations after income taxes was $442 for the three month period ended September 30, 2024 compared to a loss from continuing operations after income taxes of $428 for the three month period ended September 30,2023. The decreased loss in the current quarter resulted from the $694 of gains on asset sales.

Loss from Discontinued Operations after Income Taxes

The loss from discontinued operations after income taxes was $107 for the quarter September 30, 2024 compared to a loss from discontinued operations after income taxes of $916 for the three month period ended September 30, 2023. The loss this year results from transaction costs for the sale of the Trace Real Estate which was closed on October 9, 2024 and additional reserves for uncollectible receivables retained on the sale of the nursing home last fiscal year. The

loss for the three months ended September 30, 2023 results from primarily from the loss incurred by the operations of the Trace hospital and nursing home.

Discontinued Operations

All of the businesses discussed below are reported as discontinued operations and the condensed consolidated financial statements for all prior periods have been adjusted to reflect this presentation.