0000893538false00008935382024-07-182024-07-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 18, 2024

SM Energy Company

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-31539 | 41-0518430 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| 1700 Lincoln Street, Suite 3200 | | 80203 |

Denver, Colorado | | (Zip Code) |

| (Address of principal executive offices) | | |

Registrant's telephone number, including area code: (303) 861-8140

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Common stock, $0.01 par value | SM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On July 18, 2024, SM Energy Company (the “Company”) issued a press release announcing that the Company priced an upsized private offering of $750,000,000.00 aggregate principal amount of senior notes due 2029 and $750,000,000.00 aggregate principal amount of senior notes due 2032. A copy of the press release is furnished hereto as Exhibit 99.1. In accordance with General Instruction B.2. of Form 8-K, this press release is deemed “furnished” and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information or Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and included as Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | SM ENERGY COMPANY |

| | | |

| Date: | July 18, 2024 | By: | /s/ JAMES B. LEBECK |

| | | James B. Lebeck |

| | | Executive Vice President and General Counsel |

| | | |

EXHIBIT 99.1

SM ENERGY PRICES AN UPSIZED PRIVATE OFFERING OF $750 MILLION OF SENIOR NOTES DUE 2029 AND $750 MILLION OF SENIOR NOTES DUE 2032

DENVER, CO — July 18, 2024 — SM Energy Company (“SM Energy”) (NYSE: SM) announced today that it has priced an upsized offering of $750,000,000.00 aggregate principal amount of its 6.750% senior notes due 2029 (the “2029 Notes”), and $750,000,000.00 aggregate principal amount of its 7.000% senior notes due 2032 (the “2032 Notes,” and together with the 2029 Notes, the “Notes”). The Notes will be issued at par. The offering of the Notes is expected to close on July 25, 2024, subject to customary closing conditions.

SM Energy intends to use the net proceeds from the offering of the Notes, together with cash on hand and borrowings under its Credit Agreement, to fund the purchase price for SM Energy’s recently announced pending acquisition of certain oil and gas properties, interests, and related assets located in the Uinta Basin from certain entities affiliated with XCL Resources, LLC (the "XCL Sellers" and such acquisition, the “XCL Acquisition”), to redeem all of its outstanding 5.625% Notes due 2025 (the “2025 Notes”), and to pay related fees and expenses.

The 2029 Notes will be subject to a “special mandatory redemption” if the consummation of the XCL Acquisition does not occur on or before July 1, 2025, or if the Company notifies the trustee of the 2029 Notes that it will not pursue the consummation of the XCL Acquisition.

The Notes offered will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or under any state or other securities laws, and the Notes will be issued pursuant to an exemption therefrom, and may not be offered or sold within the United States, or to or for the account or benefit of any U.S. person, absent registration or an applicable exemption from registration requirements. The Notes were being offered only to persons reasonably believed to be qualified institutional buyers under Rule 144A under the Securities Act and non-U.S. persons outside the United States in accordance with Regulation S under the Securities Act.

This press release does not constitute an offer to sell, a solicitation, to buy or an offer to purchase or sell any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. This press release is not a notice of redemption with respect to the 2025 Notes.

INFORMATION ON FORWARD LOOKING STATEMENTS

This release contains forward-looking statements within the meaning of securities laws. Forward-looking statements in this release include, among other things, the consummation of the XCL Acquisition, the contingencies related to the special mandatory redemption, the intended use of offering proceeds and other aspects of the Notes offering. These statements involve known and unknown risks, including market conditions, customary offering closing conditions and other factors described in the Confidential Offering Memorandum and Purchase Agreement, which may cause SM Energy's actual results to differ materially from results expressed or implied by the forward-looking statements. Future results may be impacted by the risks discussed in the Risk Factors section of SM Energy's most recent Annual Report on Form 10-K for the year ended December 31, 2023, as such risk factors may be updated from time to

time in the Company's other periodic and current reports filed with the Securities and Exchange Commission. These risks also include risks associated with the XCL Acquisition, including the risk that we may fail to consummate the XCL Acquisition on the terms or timing currently contemplated, or at all, the risk that Northern Oil and Gas, Inc., may fail to consummate its purchase of an undivided 20% of the purchase and sale agreement for the XCL Acquisition, the risk that we may fail to realize the expected benefits of the XCL Acquisition, including as it relates to the number of net acres to be acquired, the number of expected drilling locations, reserves estimates and producing formations, and risks related to the integration of the XCL Acquisition or business disruptions that could result from the XCL Acquisition. The forward-looking statements contained herein speak as of the date of this release. Although SM Energy may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so, except as required by applicable securities laws.

ABOUT THE COMPANY

SM Energy Company is an independent energy company engaged in the acquisition, exploration, development, and production of oil, gas, and NGLs in the state of Texas.

SM ENERGY INVESTOR CONTACTS

Jennifer Martin Samuels, jsamuels@sm-energy.com, 303-864-2507

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

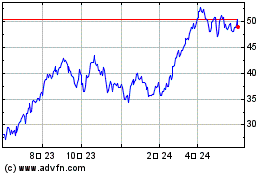

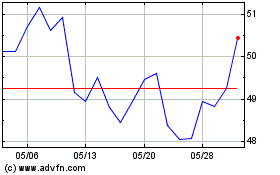

SM Energy (NYSE:SM)

過去 株価チャート

から 6 2024 まで 7 2024

SM Energy (NYSE:SM)

過去 株価チャート

から 7 2023 まで 7 2024