UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | |

FORM SD SPECIALIZED DISCLOSURE REPORT |

| | |

SIGNET JEWELERS LIMITED (Exact name of Registrant as specified in its charter) |

| | | | | | | | |

| Bermuda | 1-32349 | Not Applicable |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

Clarendon House, 2 Church Street, Hamilton HM11, Bermuda

(Address of principal executive offices and zip code)

Matthew Swibel, VP Sustainability and Social Impact, +1 301-569-3950

(Name and telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

x Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

Introduction:

Signet Jewelers Limited (“Signet” or the “Company”) is the largest specialty jewelry retailer in the United States (“US”), Canada, and the United Kingdom (“UK”).

In accordance with Section 13(p) of the Securities Exchange Act of 1934 (“Exchange Act”) and Rule 13p-1 thereunder, Signet has filed this Specialized Disclosure Form (“Form SD”) and the Conflict Minerals Report (“Report”), attached hereto as Exhibit 1.01, and posted this Form SD and the attached Conflict Minerals Report to the Company’s public website at www.signetjewelers.com.

Signet has adopted a Conflict Minerals Policy (“Policy”) to support our Company’s goal of ensuring that none of the “conflict minerals” designated under Section 13(p) of the Exchange Act – which are gold, tin, tantalum and tungsten (“3TGS”) – that are necessary to the functionality or production of any of the products that Signet manufactures or contracts with other entities to manufacture, specifically jewelry, gift products and associated products (together, “Products”) contribute to armed conflict anywhere in the world, but most particularly in the Democratic Republic of Congo (“DRC”) and the adjoining countries of the Republic of the Congo, the Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia and Angola (together, “Covered Countries”).

As part of this Policy, Signet has established and implemented a Responsible Sourcing Protocol (“SRSP”) for all suppliers of Products. These measures, along with other due diligence measures described in the Conflict Minerals Report attached hereto as Exhibit 1.01, are designed to conform to the internationally-recognized framework set forth in the Organisation for Economic Co-operation and Development Due Diligence Guidance for Responsible Supply Chain of Minerals from Conflict-Affected and High Risk Areas: Third Edition, including the related supplements on gold, tin, tantalum and tungsten (together, “OECD Due Diligence Guidance”), and reflected in other industry due diligence frameworks that are commonly considered to be compliant with the OECD Due Diligence Guidance.

Signet’s Conflict Minerals Policy and the SRSPs can be found on the Company’s website at https://www.signetjewelers.com/corporate-responsibility/responsible-sourcing/.

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Signet Products

In accordance with the requirements of Exchange Act Section 13(p), and Rule 13p-1 and Form SD thereunder, Signet has determined in good faith with respect to all Products manufactured in calendar-year 2023 either directly or indirectly (via contract) through third parties by Signet that, during calendar year 2023:

a) Signet has manufactured or contracted with other entities for the manufacture of Products to which certain “Conflict Minerals” (now defined as gold, columbite-tantalite (coltan), cassiterite, wolframite or their derivatives, which means in addition to gold, tantalum, tin and tungsten) are necessary to the functionality or production of such Products (“necessary Conflict Minerals”).

b) Signet conducted a good-faith reasonable country of origin inquiry (“RCOI”) that was reasonably designed to determine whether any of the Company’s necessary Conflict Minerals originated in the Covered Countries and/or came from recycled or scrap sources. Based on this RCOI, which included the use of SRSP surveys as described more fully in the accompanying Conflict Minerals Report, Signet knows or has reason to believe that a portion of its necessary Conflict Minerals originated or may have originated in the DRC or an adjoining country. With respect to all other necessary Conflict Minerals contained in the Products, based on its RCOI, Signet has determined that it has no reason to believe that any such materials may have originated in the DRC or an adjoining country, or did not come from recycled or scrap sources.

c) Signet exercised due diligence on the source and chain of custody of its necessary Conflict Minerals, as described more fully in the attached Conflict Minerals Report.

As previously noted, both this Form SD and the attached Conflict Minerals Report are posted on Signet’s website at https://www.signetjewelers.com/corporate-responsibility/responsible-sourcing/.

Item 1.02 Exhibit

Signet has hereby filed, as Exhibit 1.01 to this Form SD, the Conflict Minerals Report for its Signet Products, or products containing necessary Conflict Minerals that were manufactured, or contracted with third parties to be manufactured, in calendar year 2023 by Signet, as required by Items 1.01 and Item 1.02 of this Form SD.

Section 2 – Exhibits

Item 2.01 Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Signet Jewelers Limited |

| | | |

Date: | | May 29, 2024 | | By: | | /s/ Stash Ptak |

| | | | Name: | | Stash Ptak |

| | | | Title: | | General Counsel and SVP of Legal, Compliance and Risk |

SIGNET JEWELERS LIMITED

CONFLICT MINERALS REPORT

FOR THE REPORTING PERIOD FROM

JANUARY 1 TO DECEMBER 31, 2023

1: INTRODUCTION AND SUMMARY OF CONFLICT MINERALS REPORT

This Conflict Minerals Report demonstrates how Signet Jewelers Limited (“Signet” or the "Company") has been at the forefront of responsible sourcing in all of retail and especially in the global jewelry supply chain. Signet has developed and implemented rigorous protocols for sourcing, including its supplies of gold, tin, tungsten and tantalum (each deemed a “Conflict Mineral” as further discussed below).

Signet believes that a responsible, conflict-free supply chain is fundamental to the reputation of the jewelry industry. Signet is, therefore, committed to continuing its longstanding efforts to advance responsible sourcing throughout the global jewelry industry supply chain.

This Conflict Minerals Report for Signet is provided, in accordance with Exchange Act Section 13(p) and Rule 13p-1 and Form SD thereunder, for the reporting period from January 1 to December 31, 2023. Rule 13p-1 and Form SD were adopted by the Securities and Exchange Commission (the "SEC") in 2012 to implement reporting and disclosure requirements related to conflict minerals as directed by Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”), much of which is now codified as Section 13(p) of the Exchange Act.

Exchange Act Section 13(p), Rule 13p-1 and Form SD together impose certain reporting obligations on SEC registrants whose manufactured products contain gold, tin, tantalum or tungsten (defined by Section 13(p), Rule 13p-1 and Item 1.01(d)(3) of Form SD as “Conflict Minerals”), and who have reason to believe that the products they manufacture, or contract to manufacture, contain conflict minerals that are necessary to the production or functionality of those products (“necessary Conflict Minerals”). If the SEC registrant has reason to believe that any of those necessary conflict minerals did originate, or may have originated, in the Democratic Republic of the Congo (“DRC”) or an adjoining country (together with DRC, the “Covered Countries”) and did not come from recycled or scrap materials, or is unable to determine the country of origin of those conflict minerals, the SEC registrant is required to file a Conflict Minerals Report with the SEC under cover of Form SD that includes a description of the measures it took to exercise due diligence on the conflict minerals’ source and chain of custody. In addition, this Report must be posted on the registrant’s website.

Signet has adopted a Conflict Minerals Policy and, as part of that Policy, established the Responsible Sourcing Protocol (“SRSP”) for suppliers of products that Signet manufactures or contracts with third parties to manufacture, specifically jewelry, gift products and associated products, along with any components thereof (“Products”) that contain gold and/or tin, tantalum or tungsten (“3TS”). In 2017, Signet introduced a SRSP for diamonds as a compliance requirement for all suppliers, followed by a SRSP for silver and platinum group metals in 2018, and for colored gemstones in 2019. Also, in 2019 Signet introduced the SRSP for diamonds in the supply chain for R2Net, an acquisition which was completed in September 2017. In 2020, Signet implemented compliance requirements for lab grown diamonds. Note that diamonds, silver, platinum group metals and colored gemstones are not defined as “Conflict Minerals” subject to the filing and disclosure requirements of Exchange Act 13(p) and Rule 13p-1 and Form SD adopted thereunder. In 2021, Signet acquired Diamonds Direct and Rocksbox both of which were added to compliance reporting requirements in 2022. In August 2022, Signet acquired Blue Nile which was added to reporting requirements for 2023.

The SRSP is designed not only to conform to the internationally-recognized due diligence framework designated by the SEC, the Organisation for Economic Co-operation and Development’s Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition, and Supplements for gold and the 3TS, respectively (collectively, “OECD Due Diligence Guidance”), as discussed below, but also to ensure that none of the gold or 3TS (collectively “3TG”) included in Products sold by Signet contributes to conflict anywhere in the world, including but not limited to the Covered Countries. In March 2022, to address the Russia / Ukraine conflict, Signet specifically included within the requirements of the SRSP a ban on any precious metals or minerals originating from Russia. All of Signet’s global suppliers of Products are required to comply with the SRSP through an annual reporting procedure.

Suppliers providing these annual SRSP compliance reports may be required by Signet to undertake an independent third-party audit of the SRSP compliance report by accredited audit companies (“Signet SRSP Audit”).

Signet’s Conflict Minerals Policy and the SRSPs can be found on the Company’s website at https://www.signetjewelers.com/corporate-responsibility/responsible-sourcing/

As reflected in the Conflict Minerals Policy and our actions thereunder as described herein, Signet is fully committed to the responsible sourcing of its products and the respect of human rights, and Signet expects the same from its suppliers around the world. Signet continually strives to assure its customers, employees, investors and other stakeholders that its supply chain avoids action that may directly or indirectly finance armed conflict and serious human rights violations around the world, including but not limited to the Covered Countries.

Signet has been at the forefront of responsible sourcing in all of retail and especially in the global jewelry supply chain. Signet is a Founding and Certified Member of the Responsible Jewellery Council (“RJC”), an organization that is committed to promoting responsible ethical, human rights, social and environmental practices throughout the jewelry supply chain. As a founding member and active participant, Signet fully supports the RJC’s membership Code of Practices and Chain of Custody standards and recognizes the RJC’s certification audit as equivalent to the Signet SRSP Audit for purposes of compliance with the SRSP. Accordingly, Signet suppliers which are RJC Certified Members and are audited against the RJC Code of Practices (CoP) 2019 are not invited to undergo Signet SRSP Audits.

When Section 1502 of the Dodd-Frank Act was enacted in 2010, most of which has been codified in Exchange Act Section 13(p), Signet publicly supported the policy reflected in this legislation. During the comment period on the SEC’s proposed implementing rules under Exchange Act Section 13(p), Signet worked actively with the SEC to provide constructive input that sought to balance the objectives of the legislation with practical considerations applicable to the jewelry industry.

Beginning in 2014 (for the calendar-year reporting period ending December 31, 2013), Signet has filed a Form SD and an accompanying, independently audited Conflict Minerals Report (CMR) stating that, after conducting the OECD-prescribed due diligence called for under Exchange Act Section 13(p), and Rule 13p-1 and Form SD adopted thereunder.

Signet also supports cross-sector coalitions and working groups that reach beyond the jewelry industry, such as the Retail Industry Leadership Association (“RILA”) to ensure that companies in a variety of industries respect human rights and avoid contributing to armed conflict. Signet supports the OECD Due Diligence Guidance, which is the foundation for SEC-prescribed conflict minerals due diligence, the London Bullion Market Association’s (“LBMA”) Responsible Gold Guidance, the Responsible Minerals Initiative (“RMI”), and the RJC Code of Practices and Chain of Custody standards. Finally, as discussed above, Signet has long been committed to full compliance with the Dodd-Frank conflict mineral due diligence and reporting requirements as implemented by SEC rulemaking. Based on these regulatory requirements and complementary international standards and guidance, Signet developed the SRSP.

The purpose of the SRSP is to outline practical procedures that will reasonably ensure that any “necessary Conflict Minerals” contained in our Products qualify as “DRC conflict-free”. Under the terms of the SRSP, suppliers must ensure and warrant that the sources (including refineries and smelters) used to process 3TG contained in Products supplied to or manufactured for Signet are in conformance with the SRSP, pursuant to standards and protocols which are widely recognized as being consistent with OECD Due Diligence Guidance, such as those offered by LBMA, RMI and RJC. The SRSP was established as Company policy effective January 1, 2013 and require Signet’s suppliers to certify and independently verify that supplies of Products (including components thereof) to Signet are compliant with the SRSP.

Signet does not specify which individual gold refiners or 3TS smelters the suppliers or participants in its supply chain must use, but instead requires all its suppliers to source 3TG from refiners and/or smelters which are certified under accredited standards and certification procedures, designed to conform to or be consistent with the OECD Due Diligence Guidance framework. Such procedures include (but are not limited to) the LBMA’s “Good Delivery” and Responsible Gold standards, the China Chamber of Commerce of Metals, Minerals and Chemicals Importers & Exports Chinese Due Diligence Guidelines for Responsible Mineral Supply Chains, the RMI’s Conflict Free Smelter Program (“CFSP”) and the RJC’s Code of Practices and Chain of Custody standards.

For the calendar year reporting period from January 1 through December 31, 2023, through the implementation of the SRSP, Signet conducted a good faith reasonable country of origin inquiry (“RCOI”) and exercised due diligence on the source and chain of custody of the Conflict Minerals that are necessary to the production or functionality of the Products (“necessary Conflict Minerals”) that Signet manufactured or contracted with others to manufacture and that were so manufactured from January 1, 2023 through December 31, 2023, for which the results were as follows:

Signet determined that its suppliers of Products containing necessary Conflict Minerals complied with the SRSP, and through this RCOI and performance of due diligence as discussed further below, Signet reasonably determined that no Products manufactured by or for Signet in calendar-year 2023 contain necessary Conflict Minerals that directly or indirectly finance or benefit armed groups in the Covered Countries.

Because Signet’s SRSP for gold is aligned with the LBMA’s Responsible Gold Guidance, Signet had reason to believe that some gold supplies provided through the LBMA “good delivery” system may have originated in one or more of the Covered Countries. However, Signet determined that all such supplies, were refined by refineries which are certified as “conflict-

free” as defined by the LBMA’s Responsible Gold Guidance and accredited by the LBMA as a “Good Delivery” refiner after an independent third-party audit obtained by LBMA. This means that the refiner has undertaken an annual audit of its due diligence in accordance with OECD Due Diligence Guidance, and exercised controls and transparency over its gold supply chains, including traceability and identification of other supply chain actors.

2: DUE DILIGENCE MEASURES

Signet conducted due diligence on the source and chain of custody of its Products to ascertain whether such Products containing necessary Conflict Minerals originated in the DRC or any of its adjoining countries and, if so, whether they directly or indirectly financed or benefited “armed groups”, as defined in Exchange Act Section 13(p), Rule 13p-1 and Form SD, Item1.01(d)(2), in any of these countries. This due diligence, a process that has been developed and improved since 2010, which required a rigorous analysis of Signet’s supply chains, and consultation with Signet’s suppliers, as well as leading global organizations such as the OECD, the RJC, the LBMA, the RMI and the US Jewelers Vigilance Committee (“JVC”). From this analysis and these consultations, Signet designed and implemented the SRSP, introduced as Company policy in early 2013 and continuously updated and improved, which have led the jewelry industry in providing guidance to suppliers to ensure Products supplied to Signet, which include “necessary” 3TGs do not directly or indirectly finance or benefit armed groups or contribute to human rights abuses.

A: Design of Due Diligence Measures: How the SRSP Was Originally Developed

The Conflict Minerals due diligence measures in Signet’s SRSP were designed to conform with and exceed the OECD Due Diligence Guidance framework as applicable for tin, tantalum, tungsten, and gold for downstream companies (as the term is defined in the OECD Due Diligence Guidance), in all material respects.

Specifically, Signet designed its due diligence measures in accordance with the five-step framework of the OECD Due Diligence Guidance. Focusing on the design of Signet’s due diligence framework:

1. Signet established strong Company management systems for Conflict Minerals supply chain due diligence and reporting compliance in its supply chain as follows:

a. established a dedicated project team, including representatives from various internal departments such as Legal, Corporate Affairs, Merchandising, Supply Chain and Internal Audit, as well as external experts with relevant experience in the supply chains of Conflict Minerals to develop and publicly communicate a Company Conflict Minerals Policy, design and implement the SRSP, engage with and support industry-driven programs relating to supply chain guidance and standards developed by the private sector to conform to the OECD Due Diligence Guidance, and developed and implemented internal policies and procedures to support the implementation of the SRSP.

b. ensured the development and implementation of the SRSP was harmonized with the OECD Due Diligence Guidance and also with other established international guidance and standards developed within or compatible with the OECD due diligence

framework, all of which stipulated the criteria for (and mechanisms for achieving) a “conflict free” designation for gold, tin, tantalum and tungsten, such as the LBMA’s Responsible Gold Guidance and Good Delivery List, and the RMI’s List of RMAP Conformant Smelters & Refiners (formerly the Conflict-Free Smelter List published by the CFSI).

c. conducted a detailed international consultation process to review the SRSP with suppliers, industry organizations, trade associations, standards and certification bodies, auditors, civil society and governments.

d. incorporated an express contractual obligation to comply with the SRSP into supplier contracts, both to define and facilitate enforcement of Signet’s expectations of suppliers regarding sourcing of Conflict Minerals and reporting of information to Signet.

e. created and maintained records relating to Signet’s conflict minerals program in accordance with Signet’s record retention policies and procedures.

f. created and made available resources for suppliers to contact Signet with questions, concerns, grievances or the identification and warning of risks in Signet’s supply chain. These resources include a dedicated website, email and web-based contact form, webinars and direct consultations with the Signet project team.

g. implemented a policy whereby the largest suppliers and all new suppliers to Signet are required to be members of the RJC and be certified by RJC’s accredited third-party auditors at the earliest opportunity as compliant with the RJC’s Code of Practices. This certification by RJC is harmonized with Signet’s audit policy, so such RJC-certified suppliers are exempt from independent social, ethical audits of factories. This policy constitutes a major contribution to Signet’s supply chain risk assessment, due diligence process and independent third-party verification and audit. Moreover, these harmonization efforts have benefited the jewelry industry as a whole by facilitating compliance with the OECD Due Diligence Guidance.

2. Signet identified and assessed Conflict Minerals risks in its supply chain as below:

a. conducted a review of Company records to identify direct suppliers of Products containing necessary Conflict Minerals (as previously noted, 3TG). At the time, Signet’s Products were supplied by approximately 700 direct suppliers based on individual supplier vendor numbers. However, through a review of Company and supplier records, Signet was able to determine that more than 100 of its direct suppliers do not supply Signet with Products containing any 3TG whatsoever.

b. developed a SRSP compliance report and sent notices to all suppliers of Products that they should complete the SRSP report. The SRSP compliance report is a reporting tool for suppliers to describe the sourcing methods they use to comply with the requirements of the SRSP. The SRSP requires Signet’s direct suppliers to validate and certify that all sources of 3TG used in Signet products, including all subcontractors, are

supplied in conformance with the SRSP. Suppliers are likewise notified that their validation of their own supply chains and the veracity of their SRSP compliance report may be subject to a third-party independent Signet SRSP Audit.

c. reviewed the SRSP compliance reports submitted by suppliers to determine if further information is required or if any risks were identified for further examination and inquiry; followed up with suppliers of Products regarding the accuracy and completeness of their reports, particularly those suppliers that supply significant amounts of Products containing necessary 3TG to Signet, to ensure that there is a reasonable basis for their claimed compliance with the SRSP.

d. notified all suppliers of Products containing 3TG that their SRSP compliance claims are subject to independent third-party Signet SRSP Audit and notified a representative sample of suppliers that they were required to have their compliance report independently audited by accredited third party auditors.

e. Since 2013, as supporters of industry initiatives such as the OECD Due Diligence Guidance, LBMA Responsible Gold Standard, RJC, and the RMI, Signet, through the implementation of the SRSP, leveraged the due diligence conducted on smelters and refiners, especially through (i) the LBMA’s Responsible Gold Guidance and (ii) the RMI’s RMAP.

i. LBMA’s Responsible Gold Guidance for “Good Delivery” Refiners follows the five-step framework for risk-based due diligence set forth in the OECD Due Diligence Guidance, including in particular the requirements detailed in the OECD Gold Supplement adopted on 17 July 2012. All refiners producing LBMA “good delivery” gold must comply with this LBMA Responsible Gold Guidance in order to remain on the LBMA Good Delivery List. Any refiner applying to be a LBMA Good Delivery accredited Gold Refiner after 1 January 2012 must implement the LBMA Responsible Gold Guidance and pass an audit prior to becoming a member of the Good Delivery List (see http://www.lbma.org.uk/responsible-sourcing).

ii. The RMI’s RMAP uses independent private sector auditors to audit the source, including mines of origin, and chain of custody of the Conflict Minerals used by smelters and refiners that agree to participate in the RMAP. The smelters and refiners that are found to be “RMAP conformant” are those for which the independent auditor has verified that the smelter or refiner conforms to the RMAP’s assessment protocols.

3. Since 2013, Signet designed and implemented strategies to respond to Conflict Minerals risks identified by verifying that smelters and refineries in Signet’s supply chain that source 3TG from the Covered Countries qualify as “conflict free” as defined under established international guidance and standards, such as the LBMA’s Responsible Gold Guidance and Good Delivery List, and the list of RMAP Conformant Smelters & Refiners published by the RMI (see section 2.B.1a below). Signet responded to identified risks through direct intervention by the Signet project team with suppliers, trade associations, standards and

certification organizations and/or other identified participants in Signet’s supply chain, as demonstrated in the Summary of Conflict Minerals Report above.

4. Signet contributed to independent third-party audits of the due diligence practices of Conflict Minerals smelters and refiners by participating in industry organizations such as the LBMA, the RJC and the RMI (see 2.B.2 below), and through notification of the requirement for independent audit of compliance with the SRSP by Signet suppliers (see section 2.B.3 below).

5. Signet reported on its Conflict Minerals supply chain due diligence activities (as per this Report and further information, including Signet’s SRSP and Conflict Minerals Policy, available on the Signet website at https://www.signetjewelers.com/corporate-responsibility/responsible-sourcing/.

B: Due Diligence Measures Performed

Signet’s due diligence measures performed for Products containing necessary Conflict Minerals whose manufacture was completed in calendar year 2023 was conducted based on the following activities:

1) Throughout 2023, Signet contacted 1,672 suppliers based on individual supplier vendor numbers to complete compliance reports relating to the SRSP, receiving 1,494 replies as described in A.2.c. This represented 961 companies of which 834 replied as described in A.2.c. Suppliers were required to identify any changes and potential risks in their supply chains and how any identified risks were mitigated.

a. As a result of these compliance reports and the alignment of the SRSPs for gold with the LBMA’s Responsible Gold Guidance, Signet had reason to believe that some gold supplies provided through the LBMA’s “good delivery” system may have originated in a Covered Country, all of which were refined by refineries certified and audited by LBMA as “conflict free” as defined by the LBMA Responsible Gold Guidance.

b. Through the 2023 SRSP compliance reporting process, Signet was able to determine that more than 99% of the 3TG minerals in its Products were from suppliers claiming to have supply chains that are in compliance with the SRSP.

2) Signet continues to adhere to programs such as the OECD Due Diligence Guidance, the RJC’s Chain of Custody Standard and Code of Practices (CoP) 2019, LBMA’s Responsible Gold Guidance, the Dubai Multi Commodities Centre’s (“DMCC”) Good Delivery Standard and the RMI’s RMAP.

3) As explained in Section A:1:g “Design of Due Diligence Measures”, Signet’s policy whereby suppliers join and become certified under the RJC’s Code of Practices (CoP) 2019 has resulted in 85% of all Signet’s purchases in 2023 being sourced from RJC members. Signet reviewed the RJC membership list on a monthly basis to verify Signet suppliers’ membership and certification status. From 2018, Signet’s primary third-party audit assurance has been through the suppliers’ RJC certification scheme, based upon the metals or minerals they supply to

Signet. In 2023, 53 RJC certification audits were conducted. For non-RJC members, Signet identified 14 suppliers to undertake an independent audit of their 2023 Compliance Report, based on Signet’s risk assessment of that supplier and/or the supplier’s SRSP compliance report.

3: DUE DILIGENCE DETERMINATION

Signet determined that both the sourcing and production of these products was in accordance with the SRSP. As discussed above, the SRSP is both designed and implemented to adhere to the OECD Due Diligence Guidance. We have no reason to believe that Signet’s supplies of these necessary Conflict Minerals financed or otherwise benefited “armed groups” (as the term is defined in Exchange Act Section 13(p), Rule 13p-1 and Item 1.01(d)(2) of Form SD), in any of the Covered Countries.

4: INDEPENDENT PRIVATE SECTOR AUDIT

Signet’s due diligence processes for the Products that contain necessary Conflict Minerals found to be “conflict free” were audited by SGS, an independent private sector auditing body. SGS is the world’s leading inspection, verification, testing and certification company. SGS is recognized as the global benchmark for quality and integrity, with more than 2,600 offices and laboratories worldwide. SGS’s report can be found at the end of this Conflict Minerals Report.

INDEPENDENT AUDIT REPORT

INDEPENDENT AUDIT REPORT

INDEPENDENT PRIVATE SECTOR AUDIT ON SIGNET JEWELERS LIMITED’S CONFLICT MINERALS REPORT

SCOPE, OBJECTIVE AND METHODOLOGY OF THE AUDIT

SGS was commissioned by Signet Jewelers Ltd. (Signet) to conduct an independent audit of their Conflict Minerals Report for the reporting period from January 1 to December 31, 2023. The scope of this audit was limited to the following sections of this report:

2: DUE DILIGENCE MEASURES

A: Design of Due Diligence Measures

B: Due Diligence Measures Performed

This audit did not attempt to evaluate the accuracy of the conclusions of Signet’s due diligence process as described in the Conflict Minerals Report section 3: DUE DILIGENCE DETERMINATION.

We conducted this performance audit in accordance with US GAO Performance Audit standards and thereby in accordance with the US Generally Accepted Government Auditing Standards (GAGAS). Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained, through a combination of pre-audit research, remote interviews with relevant representatives of Signet USA, as well as documentation and record review, provides a reasonable basis for our findings and conclusions based on our audit objectives.

The audit’s objective was established in accordance with the Final Rule of Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act 2010 relating to the use of conflict minerals and is to evaluate the information available and express an opinion or conclusion as to whether (A) the design of Signet’s due diligence framework as described in the Conflict Minerals Report, with respect to the period covered by the report, is in conformity with, in all material respects, the criteria set forth in the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (Third Edition), and (B) whether Signet’s description of the due diligence measures it performed as set forth in the Conflict Minerals Report, with respect to the period covered by the report, is consistent with the due diligence process that Signet undertook.

The verification performed comprised a combination of desktop research, interviews with relevant employees, responsible sourcing team members, and senior management, documentation and record review and examination. This included the following activities:

•Desk study and evaluation of the Signet due diligence framework as described in the CMR against OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (Third Edition),

•Planning of interviews and preparation of bespoke checklists for evaluation of described due diligence measures performed and accuracy of associated reported information,

•Interviews carried out by Microsoft Teams with key individuals in USA and review of documentation and records to complete the evaluation.

STATEMENT OF INDEPENDENCE AND COMPETENCE

The SGS Group of companies is the world leader in inspection, testing, certification and verification, operating in more than 140 countries and providing services including management systems and service certification; quality, environmental, social and ethical auditing and training; environmental, social and sustainability report assurance. SGS affirm our independence from Signet Jewelers Ltd, being free from bias and conflicts of interest with the organization, its subsidiaries and stakeholders according to the GAGAS Conceptual Framework for Independence. The audit team was assembled based on their knowledge, experience and qualifications for this assignment and conducted the performance audit in accordance with the SGS Code of Integrity.

AUDIT CONCLUSIONS AND OPINION

On the basis of the methodology described and the verification work performed we are satisfied that the design of Signet’s due diligence framework, as described in their Conflict Minerals Report section 2.A is in conformity with the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (Third Edition) in all material respects.

We are satisfied that the due diligence measures undertaken by Signet during the reporting period are consistent with the due diligence process described in their Conflict Minerals Report section 2.B.

Our audit was conducted as planned. Interviewees were open and willing to assist in supplying evidence requested, including documentation and supporting records which were provided promptly.

Signet has well established, robust management systems and underlying processes for Conflict Minerals supply chain due diligence and reporting compliance in its supply chain through the implementation of their SRSPs, integration of these into daily business practices and ongoing evaluation of compliance through their supply chain. Signet has fully harmonized their due diligence practices through the SRSPs with other internationally recognised initiatives, thereby enabling efficient uptake through their supply chain.

Our performance audit results indicate that Signet clearly takes a progressive and pioneering approach in the management of supply chain due diligence as a leader in this field.

Signed:

For and on behalf of SGS North America Inc.

| | | | | | | | |

| /s/ Rebecca Bowens | | /s/ Jing Wang |

| | |

| Rebecca Bowens | | Jing Wang |

| Senior Advisor | | Global Technical Project Manager |

| Sustainability Assurance Solutions | | Sustainability Assurance Solutions |

| SGS United Kingdom Ltd. | | SGS United Kingdom Ltd. |

| | |

| 15 May 2024 | | |

| | |

| WWW.SGS.COM | | |

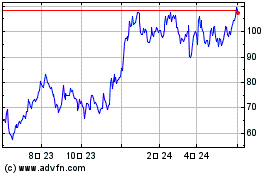

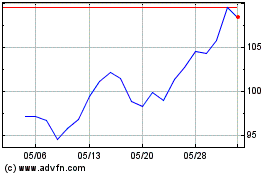

Signet Jewelers (NYSE:SIG)

過去 株価チャート

から 5 2024 まで 6 2024

Signet Jewelers (NYSE:SIG)

過去 株価チャート

から 6 2023 まで 6 2024