December 10, 2024 -- InvestorsHub NewsWire -- via NetworkNewsWire

Editorial Coverage: The sports industry is undergoing

significant transformation, driven by shifts in ownership models,

global branding strategies, and increasing investment in

community-focused initiatives. Multi-club ownership, a rising trend

in professional football (soccer), is gaining attention as

organizations seek to optimize resources, develop talent, and

expand market reach. Simultaneously, major players in sportswear

and event management are realigning priorities to capture evolving

consumer demands and enhance operational efficiency. These dynamics

are creating opportunities for companies across the sector, from

football clubs to global brands. Organizations such

as Manchester United PLC (NYSE:

MANU), Nike

Inc. (NYSE: NKE), Under Armour Inc. (NYSE: UA),

and Madison Square Garden Sports Corp. (NYSE:

MSGS) are leveraging strategic investments,

innovative branding, and organizational restructuring to strengthen

their positions. In this context, one emerging

player, Brera Holdings PLC (NASDAQ: BREA), is

making waves with its unique approach to the multi-club ownership

model.

An Ireland-based international holding company, Brera Holdings

recently announced a strategic

investment in Juve Stabia, a professional football club

competing in Italy’s Serie B. Known as “The Second Team of Naples,”

Juve Stabia represents an exciting addition to Brera’s broader

vision of creating operational efficiencies and fostering

meaningful community connections across its sports portfolio.

Juve Stabia, affectionately referred to as “Le Vespe” (The

Wasps), has a storied history dating back to its founding in 1907

in Castellammare di Stabia, a town in the Naples metropolitan area.

The club has become a symbol of pride for the local community,

embodying a competitive spirit and resilience that resonate with

football enthusiasts across the region. Although it operates in the

shadow of Serie A giants Napoli, Juve Stabia holds its own as a

critical player in the development of talent and regional

engagement in Italian football.

Brera Holdings’ investment comes amid growing interest in the

multi-club ownership model, a structure that has gained traction

globally for its ability to streamline operations, promote talent

development, and expand market opportunities. This trend has been

exemplified by City Football Group, owners of Manchester City and

multiple other clubs worldwide. With this acquisition, Brera

appears poised to leverage Juve Stabia’s existing infrastructure

and community ties, aligning with the industry’s broader evolution

toward interconnected and socially impactful sports ownership.

A Socially Conscious Multi-Club Model

Brera Holdings is not just about sports ownership; it brings a

unique focus on social responsibility to its operations. As

highlighted in a recent BBC Sport

article, Brera’s approach integrates community engagement and

philanthropic initiatives as core components of its business

strategy. The company’s tagline, “Football Beyond Borders,”

reflects this mission, which emphasizes creating positive impacts

in the communities where its clubs operate.

For instance, Brera’s portfolio includes clubs in North

Macedonia, Mozambique, and Mongolia – all regions with distinct

challenges and opportunities. By investing in these locations,

Brera aims to use sports as a tool for cultural exchange, economic

development, and youth empowerment. This is particularly relevant

in the case of Juve Stabia, where the club’s deep-rooted connection

to its local community aligns well with Brera’s emphasis on

fostering regional pride and economic vitality.

The BBC article also sheds light on Brera’s

broader ambitions to challenge traditional football ownership

models. Unlike larger conglomerates that often prioritize revenue

generation above all else, Brera places significant weight on

sustainability and long-term impact. This approach not only sets

Brera apart from competitors but also positions the company as a

pioneer in redefining what it means to own and operate sports

organizations in the modern era.

Drawing Parallels with Industry Leaders

To contextualize Brera’s strategy, it is helpful to examine how

established players in the sports and business world navigate

similar challenges and opportunities.

Manchester United PLC (NYSE:

MANU) recently announced a significant leadership

change under Sir Jim Ratcliffe, who described the club’s current

state as “mediocre.” Ratcliffe has emphasized the need for

structural reforms to elevate the club back to its elite status.

This mirrors Brera’s strategy of identifying underperforming but

promising clubs like Juve Stabia and implementing operational

improvements to unlock their potential. By focusing on fostering

talent and strengthening community ties, Brera could replicate a

similar transformation on a smaller scale.

Nike

Inc. (NYSE: NKE), a global leader in sportswear,

offers lessons in brand scalability. Recent reports indicate that

Nike is shutting down its digital sneaker division, RTFKT, as part

of a broader effort to realign its priorities under new CEO Elliott

Hill. This highlights the importance of adaptability in the sports

business. For Brera, maintaining flexibility and responsiveness to

market trends will be critical as it expands its portfolio and

integrates new clubs into its framework.

Under Armour Inc. (NYSE: UA) is

also undergoing significant changes, including a leadership

overhaul with Noreen Naroo-Pucci now at the helm of product

development. Under Armour’s shift reflects the ongoing need for

innovation and differentiation in competitive markets. Brera can

draw parallels here, as its strategy relies on bringing fresh ideas

and a socially conscious perspective to the traditional world of

sports club ownership.

Madison Square Garden Sports Corp. (NYSE:

MSGS), known for its ownership of iconic teams like

the New York Knicks and Rangers, highlights the importance of

strategic oversight in managing high-value sports assets. MSGS’s

ongoing focus on aligning operations with long-term objectives

reflects the need for robust governance and adaptability in the

dynamic sports industry. Similarly, Brera’s ability to establish

clear oversight and efficient management practices across its

diverse portfolio will be pivotal as it expands its footprint in

the multi-club ownership model.

The Road Ahead for Brera Holdings

Brera Holdings’ investment in Juve Stabia underscores its bold

ambition to expand its global sports portfolio while championing

social responsibility. By combining insights from industry leaders

with its innovative multi-club ownership model, Brera is uniquely

positioned to become a trailblazer in the competitive world of

sports management. As the company continues to grow, its thoughtful

approach to balancing financial success with meaningful community

impact sets the stage for a bright and influential future in the

industry.

For more information, please visit Brera

Holdings PLC (NASDAQ: BREA).

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a specialized

communications platform with a focus on financial news and content

distribution for private and public companies and the investment

community. It is one of 60+ brands within the Dynamic Brand

Portfolio @ IBN that

delivers: (1) access to a vast network of

wire solutions via InvestorWire to efficiently and effectively reach

a myriad of target markets, demographics and diverse

industries; (2) article and editorial

syndication to 5,000+ outlets; (3)

enhanced press

release enhancement to ensure maximum

impact; (4) social media

distribution via IBN to millions of social media

followers; and (5) a full array of

tailored corporate

communications solutions. With broad reach and a seasoned team

of contributing journalists and writers, NNW is uniquely positioned

to best serve private and public companies that want to reach a

wide audience of investors, influencers, consumers, journalists and

the general public. By cutting through the overload of information

in today’s market, NNW brings its clients unparalleled recognition

and brand awareness. NNW is where breaking news, insightful content

and actionable information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: https://www.NetworkNewsWire.com/Disclaimer

NetworkNewsWire

New York, NY

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is powered by IBN

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

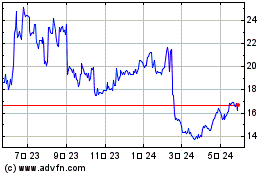

Manchester United (NYSE:MANU)

過去 株価チャート

から 11 2024 まで 12 2024

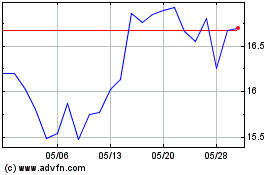

Manchester United (NYSE:MANU)

過去 株価チャート

から 12 2023 まで 12 2024