FALSE000178976900017897692024-08-132024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2024

Instil Bio, Inc.

(Exact name of registrant as specified in its Charter)

| | | | | | | | |

| Delaware | 001-40215 | 83-2072195 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

| | |

3963 Maple Avenue, Suite 350 Dallas, Texas | | 75219 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(972) 499-3350

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.000001 par value | | TIL | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 13, 2024, Instil Bio, Inc. (the “Company”) provided a corporate update and announced its financial results for the quarter ended June 30, 2024 in the press release attached hereto as Exhibit 99.1, which is incorporated herein by reference.

The information in this Item 2.02, including the attached Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) Exhibits | | |

| | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | the cover page of this report has been formatted in Inline XBRL. |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Instil Bio, Inc. |

| | | |

Dated: August 13, 2024 | | | | By: | | /s/ Sandeep Laumas, M.D. |

| | | | | | Sandeep Laumas, M.D. |

| | | | | | Chief Financial Officer and Chief Business Officer

(Principal Financial Officer and Principal Accounting Officer) |

Instil Bio Reports Second Quarter 2024 Financial Results and

Provides Corporate Update

–In-licensed SYN-2510/IMM2510, a potentially best-in-class PD-L1xVEGF bispecific antibody, and SYN-27M/IMM27M, a next-generation ADCC-enhanced anti-CTLA-4 antibody

–Entered into a 15-year lease for our cell therapy manufacturing facility to AstraZeneca Pharmaceuticals LP

DALLAS, TX, August 13, 2024 (GLOBE NEWSWIRE) Instil Bio, Inc. (“Instil”) (Nasdaq: TIL), a clinical-stage biopharmaceutical company focused on developing a pipeline of novel therapies, today reported its second quarter 2024 financial results and provided a corporate update.

“We have expanded our pipeline with a pair of clinical-stage, potentially best-in-class therapeutics by in-licensing SYN-2510 and SYN-27M,” said Bronson Crouch, CEO of Instil. “By executing a 15-year lease of our Tarzana cell therapy manufacturing facility, we have strengthened our financial foundation to support Instil’s near-term clinical development of these assets.”

Recent Highlights:

•In-licensed SYN-2510 and SYN-27M: In August 2024, SynBioTx, Inc., a wholly owned subsidiary of Instil, entered into a license and collaboration agreement with ImmuneOnco (HKEX:1541) for the exclusive global development and commercialization rights outside of Greater China of SYN-2510, a potentially best-in-class PD-L1xVEGF bispecific antibody, and SYN-27M, a next-generation ADCC-enhanced CTLA-4 antibody. SYN-2510 and SYN-27M have completed Phase 1a dose escalation studies in multiple solid tumor types in China, and ImmuneOnco is continuing patient enrollment in both programs to support dose optimization and dose expansion.

•Executed lease of our cell therapy manufacturing facility to AstraZeneca Pharmaceuticals LP: In July 2024, Instil reported the execution of a lease of its U.S. cell therapy manufacturing facility to AstraZeneca Pharmaceuticals LP. Under the terms of the agreement, initial base rent is greater than $7.5 million annually, and escalates at 3% per annum, with the tenant also required to pay certain operating expenses and tax expenses, subject to certain rent abatement in the first year of the 15-year lease term.

•Exploring further opportunities to in-license or acquire novel therapeutic candidates: Instil continues to explore further opportunities to in-license or otherwise acquire novel therapeutic candidates with first-in-class or best-in-class potential.

•Cash runway expected beyond 2026.

Second Quarter 2024 Financial and Operating Results:

As of June 30, 2024, Instil had cash, cash equivalents, marketable securities and long-term investments of $152.6 million, which consisted of $6.8 million in cash and cash equivalents, $141.8 million in marketable securities, and $4.0 million in long-term investments, compared to $175.0 million in cash, cash equivalents, marketable securities and long-term investments as of December 31, 2023, consisting of $9.2 million in cash and cash equivalents, $1.5 million in restricted cash, $141.2 million in marketable securities, and $23.2 million in long-term investments. Instil expects that its cash, cash equivalents,

marketable securities and long-term investments as of June 30, 2024 will enable it to fund its operating plan beyond 2026.

Research and development expenses were $2.9 million and $10.2 million for the three and six months ended June 30, 2024, respectively, compared to $8.5 million and $29.1 million for the three and six months ended June 30, 2023, respectively.

General and administrative expenses were $10.7 million and $23.1 million for the three and six months ended June 30, 2024, respectively, compared to $11.5 million and $24.7 million for the three and six months ended June 30, 2023, respectively.

Restructuring and impairment charges were $0.5 million and $4.8 million for the three and six months ended June 30, 2024, respectively, compared to $1.0 million and $25.6 million for three and six months ended June 30, 2023, respectively.

Net loss per share, basic and diluted were $2.29 and $6.03 for the three and six months ended June 30, 2024, respectively, compared to $2.87 and $11.64 for the three and six months ended June 30, 2023, respectively. Non-GAAP net loss per share, basic and diluted, were $1.57 and $3.95 for the three and six months ended June 30, 2024, respectively, compared to $2.03 and $6.33 for the three and six months ended June 30, 2023, respectively.

Note Regarding Use of Non-GAAP Financial Measures

In this press release, Instil has presented certain financial information that has not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures include non-GAAP net loss and non-GAAP net loss per share, which are defined as net loss and net loss per share, respectively, excluding non-cash stock-based compensation expense and restructuring and impairment charges. Instil believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of Instil’s financial performance. The non-GAAP financial measures are included with the intent of providing investors with a more complete understanding of Instil’s operating results. In addition, these non-GAAP financial measures are among the indicators Instil’s management uses for planning purposes and to measure Instil’s performance. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The non-GAAP financial measures used by Instil may be calculated differently from, and therefore may not be comparable to, non-GAAP financial measures used by other companies. Please refer to the below reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures.

About Instil Bio

Instil Bio is a clinical-stage biopharmaceutical company focused on developing a pipeline of novel therapies. Instil’s lead asset, SYN-2510, is a novel and differentiated PD-L1xVEGF bispecific antibody in development for the treatment of multiple solid tumor cancers. For more information visit www.instilbio.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “expects,” “expected,”

“exploring,” “future,” “intends,” “may,” “plans,” “potential,” “projects,” and “will” or similar expressions are intended to identify forward-looking statements. Forward-looking statements include express or implied statements regarding our expectations with respect to the license and collaboration agreement with ImmuneOnco, the therapeutic potential of SYN-2510 and SYN-27M, clinical development of SYN-2510 and SYN-27M and the generation of clinical data for SYN-2510 and SYN-27M; concerning or implying our ability to acquire and develop additional product candidates; our research, development and regulatory plans for our product candidates; our expectations regarding our capital position, resources, and balance sheet and the expected impact of the lease of our U.S. manufacturing facility with respect thereto, and the potential impact thereof on the development of any product candidates; and other statements that are not historical fact. Forward-looking statements are based on management's current expectations and are subject to various risks and uncertainties that could cause actual results to differ materially and adversely from those expressed or implied by such forward-looking statements, including risks and uncertainties associated with acquiring additional product candidates, the costly and time-consuming drug product development process and the uncertainty of clinical success; the risks inherent in relying on collaborators and other third parties, including for manufacturing and generating clinical data, and the ability to rely on any such data from clinical trials in China in regulatory filings submitted to regulatory authorities outside of China; the risks and uncertainties related to successfully initiating, enrolling, completing and reporting data from clinical studies, particularly collaborator-led clinical trials, as well as the risks that results obtained in any clinical trials to date may not be indicative of results obtained in ongoing or future trials and that our product candidates may otherwise not be effective treatments in their planned indications; risks related to macroeconomic conditions, including as a result of international conflicts and U.S.-China trade and political tensions, as well as interest rates, inflation, and other factors, which could materially and adversely affect our business and operations; the risks and uncertainties associated with the time-consuming and uncertain regulatory approval process and the sufficiency of our cash resources; and other risks and uncertainties affecting us and our plans and development programs, including those discussed in the section titled “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 to be filed with the SEC, as well as our other filings with the SEC. Additional information will be made available in other filings that we make from time to time with the SEC. Accordingly, these forward-looking statements do not constitute guarantees of future performance, and you are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements speak only as the date hereof, and we disclaim any obligation to update these statements except as may be required by law.

Contacts:

Investor Relations:

1-972-499-3350

investorrelations@instilbio.com

www.instilbio.com

INSTIL BIO, INC.

SELECTED FINANCIAL DATA

(Unaudited; in thousands, except share and per share amounts)

Selected Condensed Consolidated Balance Sheet Data

| | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| Cash, cash equivalents, restricted cash, marketable securities and long-term investments | $ | 152,578 | | | $ | 175,018 | |

| Total assets | $ | 294,316 | | | $ | 325,630 | |

| Total liabilities | $ | 99,297 | | | $ | 99,801 | |

| Total stockholders’ equity | $ | 195,019 | | | $ | 225,829 | |

Condensed Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Operating expenses: | | | | | | | |

| Research and development | $ | 2,921 | | | $ | 8,459 | | | $ | 10,177 | | | $ | 29,129 | |

| General and administrative | 10,706 | | | 11,518 | | | 23,130 | | | 24,740 | |

| Restructuring and impairment charges | 508 | | | 1,010 | | | 4,783 | | | 25,564 | |

| Total operating expenses | 14,135 | | | 20,987 | | | 38,090 | | | 79,433 | |

| Loss from operations | (14,135) | | | (20,987) | | | (38,090) | | | (79,433) | |

| Interest income | 1,919 | | | 2,287 | | | 3,981 | | | 4,358 | |

| Interest expense | (1,999) | | | (590) | | | (3,980) | | | (1,226) | |

| Other (expense) income, net | (702) | | | 628 | | | (1,130) | | | 571 | |

| Net loss | $ | (14,917) | | | $ | (18,662) | | | $ | (39,219) | | | $ | (75,730) | |

| Net loss per share, basic and diluted | $ | (2.29) | | | $ | (2.87) | | | $ | (6.03) | | | $ | (11.64) | |

| Weighted-average shares used in computing net loss per share, basic and diluted | 6,503,913 | | | 6,503,913 | | | 6,503,913 | | | 6,503,913 | |

INSTIL BIO, INC.

Reconciliation of GAAP to Non-GAAP Net Loss and Net Loss per Share

(Unaudited; in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (14,917) | | | $ | (18,662) | | | $ | (39,219) | | | $ | (75,730) | |

| Adjustments: | | | | | | | |

| Non-cash stock-based compensation expense | 4,173 | | | 4,413 | | | 8,688 | | | 8,943 | |

| Restructuring and impairment charges | 508 | | | 1,010 | | | 4,783 | | | 25,564 | |

| Non-GAAP net loss | $ | (10,236) | | | $ | (13,239) | | | $ | (25,748) | | | $ | (41,223) | |

| Net loss per share, basic and diluted | $ | (2.29) | | | $ | (2.87) | | | $ | (6.03) | | | $ | (11.64) | |

| Adjustments: | | | | | | | |

| Non-cash stock-based compensation expense per share | 0.64 | | | 0.68 | | | 1.34 | | | 1.38 | |

| Restructuring and impairment charges per share | 0.08 | | | 0.16 | | | 0.74 | | | 3.93 | |

| Non-GAAP net loss per share, basic and diluted* | $ | (1.57) | | | $ | (2.03) | | | $ | (3.95) | | | $ | (6.33) | |

| Weighted-average shares outstanding, basic and diluted | 6,503,913 | | | 6,503,913 | | | 6,503,913 | | | 6,503,913 | |

* Non-GAAP net loss per share, basic and diluted may not total due to rounding.

###

v3.24.2.u1

Cover

|

Aug. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 13, 2024

|

| Entity Registrant Name |

Instil Bio, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40215

|

| Entity Tax Identification Number |

83-2072195

|

| Entity Address, Address Line One |

3963 Maple Avenue

|

| Entity Address, Address Line Two |

Suite 350

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75219

|

| City Area Code |

972

|

| Local Phone Number |

499-3350

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.000001 par value

|

| Trading Symbol |

TIL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001789769

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

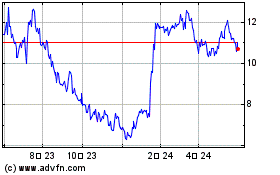

Instill Bio (NASDAQ:TIL)

過去 株価チャート

から 10 2024 まで 11 2024

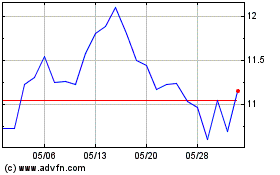

Instill Bio (NASDAQ:TIL)

過去 株価チャート

から 11 2023 まで 11 2024