false

0001083446

0001083446

2024-03-29

2024-03-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 29, 2024

ASTRANA HEALTH, INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801

(Address of Principal Executive Offices) (Zip Code)

(626) 282-0288

Registrant’s Telephone Number, Including

Area Code

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

ASTH |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On

November 7, 2023, Astrana Health, Inc. (the “Company”) filed a Current Report on Form 8-K reporting that

it entered into an Asset and Equity Purchase Agreement (as amended, the “Purchase Agreement”) to acquire (i) all of the outstanding

general and limited partnership interests of Advanced Health Management Systems, L.P. (“AHMS”) and (ii) substantially all

the assets of Community Family Care Medical Group IPA, Inc. (“CFC”). Also on November 7, 2023, Astrana Health Management,

Inc. (f/k/a Network Medical Management, Inc.), a wholly-owned subsidiary of the Company,

entered into a Stock Purchase Agreement (the “I Health Purchase Agreement”) to purchase 25% of the outstanding shares of

common stock of I Health, Inc.

As

previously announced in a Current Report on Form 8-K filed on February 2, 2024, on January 31, 2024, the first closing under the

Purchase Agreement occurred, and the Company completed its acquisition of CFC’s assets pursuant to the terms of the Purchase Agreement.

On March 31, 2024, the Company completed both the second closing under the Purchase Agreement, thus acquiring the outstanding general

and limited partnership interests of AHMS, and the closing of the I Health Purchase Agreement.

In

connection with the closing of the Purchase Agreement, the parties to the Purchase Agreement entered into Amendment No. 2 to the Purchase

Agreement (the “CFC Amendment”) on March 29, 2024, which provided for minor modifications to the Purchase Agreement. In addition,

in connection with the closing of the I Health Purchase Agreement, the parties to the I Health Purchase Agreement entered

into Amendment No. 1 to the I Health Purchase Agreement (the “I Health Amendment” and, together with the CFC Amendment, the

“Amendments”) on March 31, 2024, which amended the I Health Purchase Agreement by, among other things, adjusting the purchase

price and providing for a contingent payment to I Health payable within 90 days of closing. The foregoing description of the Amendments

does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Amendments, copies of which

are filed as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

|

Description |

| 10.1 |

|

Amendment No. 2 to Asset and Equity Purchase Agreement, dated as of March 29, 2024, by and among Metropolitan IPA, a California professional corporation, Astrana Health Enablement of CA LLC (f/k/a ApolloCare Enablement of CA, LLC), Astrana Health Management, Inc. (f/k/a Network Medical Management, Inc.), Astrana Health, Inc. (f/k/a Apollo Medical Holdings, Inc.), Community Family Care Medical Group IPA, Inc., Advanced Health Management Systems, L.P., Accie M. Mitchell and Gloria C. Mitchell, as Co-Trustees of the Mitchell Family Trust dated July 2, 2003, CFC Management, LLC, the other parties thereto and Marc Mitchell, as the Equityholder Representative. |

| 10.2* |

|

Amendment No. 1 to Stock Purchase Agreement, dated as of March 31, 2024, by and among Astrana Health Management, Inc. (f/k/a Network Medical Management, Inc.), I Health, Inc., Ronald Brandt and Allison Brandt. |

| 104 |

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document). |

* Certain of the exhibits and schedules to this exhibit have been omitted

in accordance with Regulation S-K Item 601(a)(5). The Company agrees to furnish a copy of all omitted exhibits and schedules to the Securities

and Exchange Commission upon its request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ASTRANA

HEALTH, INC. |

| |

|

| Date: April 2, 2024 |

By: |

/s/

Brandon Sim |

| |

Name: |

Brandon Sim |

| |

Title: |

Chief Executive Officer

and President |

Exhibit 10.1

AMENDMENT NO. 2

to

ASSET AND EQUITY PURCHASE AGREEMENT

THIS

AMENDMENT (this “Amendment”), is entered into as of March 29, 2024, by and among Metropolitan

IPA, a California professional corporation (“PC Buyer”); ASTRANA HEALTH ENABLEMENT OF CA LLC, a California

limited liability company (“MSO GP Buyer”); ASTRANA HEALTH MANAGEMENT, INC., a California corporation (“MSO

LP Buyer” and, together with MSO GP Buyer, the “MSO Buyers” and together with PC Buyer, the “Buyers”

and each a, “Buyer”); ASTRANA HEALTH, INC., a Delaware corporation the stock of which is publicly traded on the

Nasdaq (“Buyer Parent” and together with Buyers, “Buyer Parties” and each, a “Buyer Party”);

ACCIE M. MITCHELL, M.D., a California professional corporation (“CFC IPA”); ADVANCED HEALTH MANAGEMENT SYSTEMS, L.P.,

a California limited partnership (“AHMS” and together with the CFC IPA, the “Companies” and each,

a “Company”); ACCIE M. MITCHELL AND GLORIA C. MITCHELL, AS CO-TRUSTEES OF THE MITCHELL FAMILY TRUST DATED JULY 2,

2003 ( “IPA Equityholder”); ACCIE M. MITCHELL, M.D. (“IPA Beneficial Owner”); CFC MANAGEMENT, LLC,

a California limited liability company and the general partner of AHMS (“AHMS General Partner”); the other limited

partners of AHMS set forth in the signature page hereto (collectively, the “AHMS Limited Partners” and each,

an “AHMS Limited Partner”) (AHMS General Partner and the AHMS Limited Partners are referred to collectively herein

as the “AHMS Equityholders” and together with the IPA Equityholder, the “Equityholders”, and together

with CFC IPA, the “Sellers”); and MARC MITCHELL, as an authorized representative of the Sellers (“Equityholder

Representative”); and solely for purposes of Section 6.9, I Health, Inc., a California corporation (“I

Health”). The Buyer Parties, the Companies, the Equityholders, and the Equityholder Representative are referred to collectively

herein as the “Parties” and, each individually, as a “Party”). Capitalized terms used and not defined

elsewhere in this Amendment shall have the meanings given them in the Agreement.

WHEREAS,

Buyer Parties, the Companies, the Equityholders, IPA Beneficial Owner, the Equityholder Representative and I Health are parties

to that certain Asset and Equity Purchase Agreement (as amended, the “Agreement”), dated as of November 7, 2023;

and

WHEREAS,

pursuant to Section 12.7 of the Agreement, the Agreement may only be amended, modified or supplemented by an agreement in writing

signed by each Party hereto.

NOW,

THEREFORE, in consideration of the premises, the mutual agreements hereinafter set forth, and other good and valuable consideration,

the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

Section 1. Section 1.4(b)(ii) (Purchase

Price and Closing Payments At the Second Closing) shall be deleted in its entirety and replaced with the following:

“(ii) on behalf

of the AHMS Equityholders, the applicable MSO Buyer shall deliver, by wire transfer of immediately available funds, Three Million and

Four Hundred and Fifty Thousand Dollars ($3,450,000.00) (the “AHMS Representative Fund” and together with the IPA

Representative Fund, the “Equityholder Representative Fund”) to the account(s) specified in the Closing Payments

Schedule;”

Section 2. Section 8.6

of the Agreement is hereby amended as follows:

“8.6. Second Closing

Conditions to Obligations of the Plan Companies and the AHMS Equityholders: “The obligations of the Plan Companies and the AHMS

Equityholders to consummate the Transactions shall be subject to the fulfillment or the Equityholder Representative’s waiver, at

or prior to the Second Closing, of each of the following conditions; provided, that the condition in subsection (e) below shall

be satisfied no later than the Next Business Day following the Second Closing Date:”

Section 3. The

following shall be added as Section 10.3.1 (Indemnification by the Buyer Parties) of the Agreement:

“Subject to the other terms and conditions

of this Article 10, the Buyer Parties shall, jointly and severally, indemnify and defend CFC IPA against, and shall hold it harmless

from and against, and shall pay and reimburse each of them for, any and all Damages incurred or sustained by, or imposed upon, CFC IPA

based upon, arising out of, with respect to or by breach on or after the Second Closing Date by the Buyer Parties (including, after the

Second Closing Date, AHMS, CFCH or CFCHP) of the Undertakings applicable to the Buyer Parties or the Plan Companies. For the avoidance

of doubt, the foregoing will not be deemed to be any obligation of any Buyer Party (or after the Second Closing Date, AHMS, CFCH or CFCHP)

with respect to CFC IPA’s (or its owners’) compliance with or failure to comply with applicable Law. For purposes hereof,

“Undertakings” means the Department of Managed Health Care Undertakings to Notice of Material Modification eFile number

20234948, filed on December 13, 2023, executed by the parties on March 28, 2024.”

Section 4. Continuation

of Agreement. As of and after the date hereof, each reference in the Agreement to “this

Agreement”, “hereunder”, “hereof”, “herein”, “hereby” or words of like import referring

to the Agreement shall mean and be a reference to the Agreement as amended by this Amendment. The Agreement, as amended hereby, shall

continue in full force and effect. Except as expressly amended by this Amendment, the Agreement is hereby ratified and confirmed in all

respects.

Section 5. Governing

Law. This Amendment shall be governed in all respects in accordance with the provisions

of Section 12.9 of the Agreement.

Section 6. Counterparts.

This Amendment may be executed in any number of counterparts, each of which when executed, shall be deemed to be an original and all

of which together will be deemed to be one and the same instrument binding upon all of the parties hereto notwithstanding the fact that

all parties are not signatory to the original or the same counterpart. For purposes of this Amendment, facsimile signatures and electronically

delivered signatures shall be deemed originals.

[Remainder of page intentionally left

blank.]

IN

WITNESS WHEREOF, the parties have executed this Amendment as of the date first above written.

| |

BUYER PARTIES: |

| |

|

| |

“PC Buyer” |

| |

|

| |

METROPOLITAN IPA |

| |

|

| |

|

| |

By: |

/s/ Brandon Sim |

| |

Name: Brandon Sim |

| |

Title: Chief Executive Officer |

| |

|

| |

|

| |

“MSO LP Buyer” |

| |

|

| |

ASTRANA HEALTH MANAGEMENT, INC. |

| |

|

|

| |

By: |

/s/ Chandan Basho |

| |

Name: Chandan Basho |

| |

Title: Chief Financial Officer |

| |

|

|

| |

|

|

| |

“MSO GP Buyer” |

| |

|

| |

ASTRANA HEALTH ENABLEMENT OF CA, LLC |

| |

|

|

| |

By: |

/s/ Brandon Sim |

| |

Name: Brandon Sim |

| |

Title: Manager |

| |

|

| |

|

| |

“Buyer Parent” |

| |

|

| |

APOLLO MEDICAL HOLDINGS, Inc. |

| |

|

|

| |

By: |

/s/ Brandon Sim |

| |

Name: Brandon Sim |

| |

Title: Chief Executive Officer |

[Signature Page to Amendment No. 2

to Asset and Equity Purchase Agreement]

IN WITNESS WHEREOF, each

Party has duly executed and delivered this Amendment as of the date first above written.

| |

COMPANIES: |

| |

|

| |

“CFC IPA” |

| |

|

| |

Accie M. Mitchell, M.D., a California professional corporation (f/k/a

Community Family Care Medical Group IPA) |

| |

|

| |

|

| |

By: |

/s/ Accie Mitchell |

| |

Name: Accie Mitchell, M.D. |

| |

Title: Chief Executive Officer |

| |

|

| |

|

| |

“AHMS” |

| |

|

| |

Advanced Health Management Systems, L.P. |

| |

|

| |

By: CFC Management, LLC |

| |

Its: General Partner |

| |

|

| |

|

| |

By: |

/s/ Marc L. Mitchell |

| |

Name: Marc L. Mitchell |

| |

Title: Manager |

[Signature Page to Amendment No. 2

to Asset and Equity Purchase Agreement]

IN WITNESS WHEREOF, each

Party has duly executed and delivered this Amendment as of the date first above written.

|

EQUITYHOLDER REPRESENTATIVE: |

| |

|

| |

/s/ Marc Mitchell |

| |

Name: Marc Mitchell |

| |

|

| |

|

| |

EQUITYHOLDERS: |

| |

|

| |

“IPA Equityholder” |

| |

|

| |

Accie M. Mitchell and Gloria C. Mitchell,

as co-trustees of the Mitchell Family Trust dated July 2, 2003 |

| |

|

| |

|

| |

/s/ Accie Mitchell |

| |

Accie Mitchell, M.D. |

| |

Co-Trustee |

| |

|

| |

/s/ Gloria Mitchell |

| |

Gloria Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

“IPA Beneficial Owner” |

| |

|

| |

/s/ Accie M. Mitchell |

| |

Accie M. Mitchell, M.D. |

| |

|

| |

|

| |

“AHMS General Partner” |

| |

|

| |

By: CFC Management, LLC |

| |

Its: Manager |

| |

|

| |

By: |

/s/ Marc L. Mitchell |

| |

|

Name: Marc L. Mitchell |

| |

|

Title: Manager |

[Signature Page to Amendment No. 2

to Asset and Equity Purchase Agreement]

| |

“AHMS Limited Partners” |

| |

|

| |

Mitchell Family Trust |

| |

|

| |

/s/ Accie Mitchell, M.D. |

| |

Accie M. Mitchell, M.D. |

| |

Co-Trustee |

| |

|

| |

/s/ Gloria C. Mitchell |

| |

Gloria C. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Mitchell Children’s Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Marc Mitchell Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Trustee |

| |

|

| |

|

| |

Alex Mitchell Irrevocable Trust |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Trustee |

[Signature Page to Amendment No. 2

to Asset and Equity Purchase Agreement]

| |

Cynthia Heard Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Tracy Mitchell Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Lori Konsker Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Jason Heard Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

[Signature Page to Amendment No. 2

to Asset and Equity Purchase Agreement]

| |

Briella Konsker Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Eliana Konsker Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Harrison Konsker Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Bennet Mitchell Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

[Signature Page to Amendment No. 2

to Asset and Equity Purchase Agreement]

| |

August Mitchell Irrevocable

Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Langston Mitchell Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Co-Trustee |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Co-Trustee |

| |

|

| |

|

| |

Josephine Mitchell Irrevocable Trust |

| |

|

| |

/s/ Marc L. Mitchell |

| |

Marc L. Mitchell |

| |

Trustee |

| |

|

| |

|

| |

William Calder Mitchell Irrevocable Trust |

| |

|

| |

/s/ Alex M. Mitchell |

| |

Alex M. Mitchell |

| |

Trustee |

| |

|

| |

|

| |

AHMS Trust |

| |

|

| |

/s/ Christopher Hori |

| |

Premier Trust |

| |

Trust Officer |

| |

|

| |

/s/ Ronald L. Brandt |

| |

Name: Ronald L. Brandt |

[Signature Page to Amendment No. 2

to Asset and Equity Purchase Agreement]

IN WITNESS WHEREOF, each

Party has duly executed and delivered this Amendment as of the date first above written.

| |

I

HEALTH: |

| |

|

| |

I Health Inc. |

| |

|

| |

|

| |

/s/ Ronald L. Brandt |

| |

Name: Ronald L. Brandt |

| |

Title: President |

[Signature Page to Amendment No. 2

to Asset and Equity Purchase Agreement]

Exhibit 10.2

AMENDMENT NO. 1

to

STOCK PURCHASE AGREEMENT

THIS

AMENDMENT (this “Amendment”), is entered into as of March 31, 2024, by and among ASTRANA HEALTH MANAGEMENT, INC.,

a California corporation f/k/a Network Medical Management, Inc. (“Buyer”);

RONALD BRANDT (“Ron Brandt”) and ALLISON BRANDT (“Allison Brandt”), each in their individual capacities

(as, the “Beneficial Owners”) and in their capacities as Co-Trustees of the Ronald Lee Brandt and Allison Leigh Brandt

Family Trust dated December 16, 2003 (the “Equityholder”); and I HEALTH, INC., a California corporation

(the “Company”). The Buyer, the Company, the Beneficial Owners and the Equityholder are referred to collectively herein

as the “Parties” and, each individually, as a “Party”).

WHEREAS,

the Buyer Parties, the Beneficial Owners, the Company and the Equityholder are parties to that certain Stock Purchase Agreement (the

“Agreement”), dated as of November 7, 2023;

WHEREAS,

pursuant to Section 10.5 of the Agreement, the Agreement may only be amended, modified or supplemented by an agreement in writing

signed by each Party hereto; and

WHEREAS,

capitalized terms used and not defined elsewhere in this Amendment shall have the meanings given them in the Agreement.

NOW,

THEREFORE, in consideration of the premises, the mutual agreements hereinafter set forth, and other good and valuable consideration,

the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

Section 1. Section 1.1(b) (Purchase

Price) shall be deleted in its entirety and replaced with the following:

“(b) Closing

Payment. Subject to the adjustments set forth in Section 1.6, the aggregate consideration for the sale, transfer, conveyance,

assignment and delivery of the Purchased Shares pursuant to Section 1.1(a) shall be an amount in cash equal to $[*]

(the “Purchase Price”). At the Closing, Buyer shall pay to the Equityholder cash in immediately available funds in

an amount equal to the Purchase Price minus the Holdback Amount (the “Closing Payment”).”

Section 2. Section 1.5

(Holdback Amount) shall be added after Section 1.4 (Disclosure of Excluded Property) as follows:

“1.5 Holdback

Amount. After the Closing, $[*] (the “Holdback Amount”) shall, by wire transfer of immediately available funds,

be released to the Equityholder within ten (10) Business Days of the final determination of the Final Purchase Price pursuant to

Section 1.6; provided, however, that (a) if there is no balance of the Holdback Amount remaining after satisfaction

of the Equityholder and Beneficial Owners’ obligations under Section 5.6 or Section 8.2, or (b) the

amount of outstanding indemnification claims against the Equityholder or Beneficial Owners exceed the unreleased balance of the Holdback

Amount on such date, no payment will be released to the Equityholder on such date. The Equityholder and Beneficial Owners each acknowledge

and agree that Buyer shall have the right to offset against the Holdback Amount any and all amounts for payments to any Indemnified Person

with respect to the indemnification obligations under Section 5.6 or Section 8.2. The Equityholder and Beneficial

Owners each acknowledge and agree that Buyer’s right to offset against the Holdback Amount shall not be Buyer’s exclusive

method of receiving indemnification from the Equityholder or Beneficial Owners pursuant to Section 5.6 or Section 8.2.

Within two (2) Business Days following receipt of the Holdback Amount, the Company will enter into a promissory note with Apollo

Care (in the same form as the Note) having a principal amount equal to the received amount of the Holdback Amount and remit the same

to Apollo Care.”

Section 3. Section 1.6

(Purchase Price Adjustment) shall be added after Section 1.5 (Holdback Amount) as follows:

“1.6 Purchase

Price Adjustment.”

(a) Closing

Date Adjustment. No fewer than two (2) days prior to the Closing Date, the Equityholder will prepare and deliver to Buyer, a

certificate (the “Pre-Closing Certificate”) signed by Ron Brandt that contains (i) the Equityholder’s reasonable

good faith estimate (as of the Closing Date) of the Net Contingent Payment expected by the Company (the “Estimated Net Contingent

Payment”), and (ii) the Equityholder’s confirmation that the cash amount set forth on Schedule 8.2 (the “Target

Cash Amount”) plus the Net Contingent Payment will remain in the Company’ bank account(s) at and following the Closing,

and (iii) based on items (i) and (ii), the Equityholder’s calculation of the Estimated Purchase Price. Each of the foregoing

calculations will be accompanied by reasonable supporting detail therefor and the Equityholder will provide Buyer with reasonable access

during normal business hours to any working papers, documents, and data from the Company, Beneficial Owners and Equityholder that were

used to prepare the Pre-Closing Certificate. The Pre-Closing Certificate will be in form and substance reasonably satisfactory to Buyer.

(b) Post-Closing

Adjustment.

(i) No

later than the 90th day following the Closing Date, the Equityholder will prepare and deliver to Buyer, a certificate (the “Post-Closing

Certificate”) setting forth (A) a calculation of the aggregate amount of the Net Contingent Payment (the “Final

Net Contingent Payment”), (B) the amount of cash remaining in the Company’s bank account(s) as of the Closing

Date (the “Final Cash Amount”) , and (C) based on items (A) and (B), the Equityholder’s calculation

of the Final Purchase Price. The Company, Beneficial Owners and Equityholder and its auditors will make available to Buyer and its auditors

all records and work papers used in preparing the Post-Closing Certificate.

(ii) If

Buyer has any objections to the Post-Closing Certificate prepared by the Equityholder, then Buyer will deliver a written statement (the

“Objections Statement”) specifying in reasonable detail the particulars of such disagreement within 60 days after

delivery of the Post-Closing Certificate. If Buyer fails to deliver an Objections Statement within such 60-day period, then the Post-Closing

Certificate will become final and binding on all Parties.

(iii) If

Buyer delivers an Objections Statement within such 60-day period, then Buyer and the Equityholder will use commercially reasonable efforts

to resolve any such disputes, but if a final resolution is not obtained within 30 days after Buyer has submitted any Objections Statements,

any remaining matters which are in dispute will be resolved by Deloitte or, if Deloitte is unable to serve, Buyer and the Equityholder

Representative, as applicable, shall appoint by mutual agreement an independent accounting firm of nationally recognized standing (the

“Accountant”). The Accountant will prepare and deliver a written report to Buyer and the Equityholder and will submit

a proposed resolution of such unresolved disputes promptly, but in any event within 30 days after the dispute is submitted to the Accountant.

The Accountant’s determination of such unresolved disputes will be final and binding upon all Parties; provided, however, that

no such determination will be any more favorable to the Equityholder than is set forth in the Post-Closing Certificate or any more favorable

to Buyer than is proposed in the Objections Statement. The costs, expenses, and fees of the Accountant will be allocated between Buyer,

on the one hand, and the Equityholder, on the other hand, pro-rata based upon the difference between each such Party’s calculation

of the Final Purchase Price from the Final Purchase Price as determined by the Accountant under this Section 1.6(b). The

final Post-Closing Certificate, however determined pursuant to this Section 1.6, will be final and binding on the Parties

and will be used for all purposes of this Section 1.6 for the final calculations of Final Net Contingent Payment, Final Cash

Amount, and Final Purchase Price.

(c) If

the Purchase Price Adjustment Amount finally determined pursuant to Section 1.6(b)(ii) or Section 1.6(b)(iii),

is a positive number, then Buyer shall promptly pay to the Equityholder an amount equal to the Purchase Price Adjustment Amount within

ten (10) Business Days from the final determination thereof under Section 1.6(b)(ii) or Section 1.6(b)(iii).

If the Purchase Price Adjustment Amount is a negative number, then Buyer will deduct an amount equal to the Purchase Price Adjustment

Amount from the Holdback Amount, which will be withheld from any amounts released to the Equityholder under Section 1.5.

In the event the Holdback Amount is insufficient to satisfy the payment of a Purchase Price Adjustment Amount to Buyer pursuant to Section 1.6(b)(ii) or

Section 1.6(b)(iii), the Equityholder shall promptly pay to Buyer an amount equal to the Purchase Price Adjustment Amount

minus the Holdback Amount to Buyer within ten (10) Business Days from the final determination thereof. All payments made pursuant

to this Section 1.6(c) will be treated as an adjustment to the Purchase Price for the Purchased Shares, including for

Tax purposes.

(d) For

purposes of this Section 1.6, the following terms have the following meanings:

“Estimated

Purchase Price” means an amount equal to (i) the Closing Payment plus (ii) the Estimated Net Contingent Payment.

“Final Purchase

Price” means an amount equal to (i) the Closing Payment, plus (ii) any amounts by which the Final Net Contingent

Payment exceeds the Estimated Net Contingent Payment, minus (iii) any amounts by which the Estimated Net Contingent Payment exceeds

the Final Net Contingent Payment, plus (iv) any amounts by which the Final Cash Amount exceeds the Target Cash Amount, minus (v) any

amounts by which the Target Cash Amount exceeds the Final Cash Amount.

“Net Contingent

Payment” means an amount equal to (i) the amount of cash received by the Company after the Closing Date pursuant to that

certain Services Agreement (as amended, the “CFC Services Agreement”), by and among the Company, AHMS, Ron Brandt

and CFC IPA, minus (ii) the amount of Taxes payable with respect thereto.

“Purchase

Price Adjustment Amount” shall mean the amount equal to (i) Final Purchase Price minus (b) the Estimated Purchase

Price set forth in the Pre-Closing Certificate. For sake of clarity, the Purchase Price Adjustment Amount may be either a positive or

negative number.

(e) The

Equityholder and each Beneficial Owner shall, jointly and severally, indemnify the Buyer Indemnitees against, and shall hold each of

them harmless from and against, and shall pay and reimburse each of them for, any and all Damages incurred or sustained by, or imposed

upon, the Buyer Indemnitees based upon, arising out of, with respect to or by reason of the CFC Services Agreement (including without

limitation any amounts required to be repaid by the Company to CFC IPA).”

Section 4. Section 4.10

(Termination of 401(k) Plan) is hereby deleted in its entirety and replaced with the following:

“4.10 Reserved.”

Section 5. Section 6.2(d)(xii) (evidence

of termination of 401(k) Plan) is hereby deleted in its entirety and replaced with the following:

“(xii) reserved;”

Section 6. Schedule

8.2 (Cash at Closing) is hereby deleted in its entirety and replaced with Schedule A to this Amendment.

Section 7. Continuation

of Agreement. As of and after the date hereof, each reference in the Agreement to “this

Agreement”, “hereunder”, “hereof”, “herein”, “hereby” or words of like import referring

to the Agreement shall mean and be a reference to the Agreement as amended by this Amendment. The Agreement, as amended hereby, shall

continue in full force and effect. Except as expressly amended by this Amendment, the Agreement is hereby ratified and confirmed in all

respects.

Section 8. Governing

Law. This Amendment shall be governed in all respects in accordance with the provisions

of Section 10.7 of the Agreement.

Section 9. Counterparts.

This Amendment may be executed in any number of counterparts, each of which when executed, shall be deemed to be an original and all

of which together will be deemed to be one and the same instrument binding upon all of the parties hereto notwithstanding the fact that

all parties are not signatory to the original or the same counterpart. For purposes of this Amendment, facsimile signatures and electronically

delivered signatures shall be deemed originals.

[Remainder of page intentionally left

blank.]

IN

WITNESS WHEREOF, the parties have executed this Amendment as of the date first above written.

| |

BUYER: |

| |

|

| |

ASTRANA HEALTH MANAGEMENT, INC. |

| |

|

| |

|

| |

By: |

/s/ Chandan Basho |

| |

Name: Chandan Basho |

| |

Title: Chief Financial Officer |

[Signature Page to Amendment No. 1

to Stock Purchase Agreement]

IN WITNESS WHEREOF, each

Party has duly executed and delivered this Amendment as of the date first above written.

| |

COMPANY: |

| |

|

| |

I HEALTH, INC. |

| |

|

| |

|

| |

By: |

/s/ Ronald Brandt |

| |

Name: Ronald Brandt |

| |

Title: Chief Executive Officer |

| |

|

| |

|

| |

BENEFICIAL OWNERS: |

| |

|

| |

/s/ Ronald Brandt |

| |

RONALD BRANDT |

| |

|

| |

/s/ Allison Brandt |

| |

ALLISON BRANDT |

| |

|

| |

|

| |

EQUITYHOLDER: |

| |

|

| |

Ronald Lee Brandt

and Allison Leigh Brandt Family Trust dated December 16, 2003 |

| |

|

| |

|

| |

/s/ Ronald Brandt |

| |

Ronald Brandt, Co-Trustee |

| |

|

| |

/s/ Allison Brandt |

| |

Allison Brandt, Co-Trustee |

[Signature Page to Amendment No. 1

to Stock Purchase Agreement]

v3.24.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

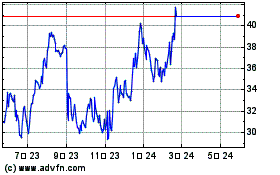

Apollo Medical (NASDAQ:AMEH)

過去 株価チャート

から 10 2024 まで 11 2024

Apollo Medical (NASDAQ:AMEH)

過去 株価チャート

から 11 2023 まで 11 2024