NEAR Investors Hope New Projects Will Help Coin Rebound From 21% Loss

2024年9月3日 - 10:30PM

NEWSBTC

While the market has rebounded following a poor start to the month

in September, some altcoins are still struggling with the leftover

bearishness. NEAR continues with the list of altcoins that keep up

their losses even as the majors, including Bitcoin and Ethereum,

recover from their respective slumps. According to CoinGecko, the

token fell by 21% since last week despite the market’s 3%uptick

today. Related Reading: SUI Crashes 23% As September

Unleashes Market Panic—Is A Comeback Possible? Although NEAR is

underperforming, developments on-chain continue to offset the

market’s bearishness. One of the most notable developments on NEAR

is Libre Capital offering tokenized real-world assets (RWAs) on

chain, bringing institutional interest to the platform RWAs

Create Buzz For The Protocol Libre Capital is a new crypto asset

management firm supported by market giants like Brevan Howard,

Hamilton Lane, and Nomura’s Laser Digital. It was founded four

months ago and has since experienced huge upward momentum.

According to Libre Capital Founder and CEO Avtar Sehra, Libre

surpassed the $100 million asset under management mark, cementing

the firm as one of the fastest-rising crypto asset management

companies on the market. Libre has achieved many milestones

since our MVP launch four months ago, surpassing our $100 million

aum target and expanding to multiple chains. Launch on

@NEARProtocol marks a crucial step towards our multichain wealth

strategy. Learn more here: https://t.co/dGCqKENTXu — Avtar Sehra

(@avtarsehra) September 2, 2024 NEAR and Libre’s partnership will

enable NEAR users to access tokenized versions of RWAs. As of

writing, users have access to Hamilton Lane’s credit Fund, Brevan

Howard’s Master Fund, and Blackrock’s ICS Money Market Fund,

bridging the gap between crypto and the traditional finance

space. According to Sehra, the launch of Libre on NEAR is “a

crucial step towards our multichain wealth strategy” which hints at

future support for more blockchains other than NEAR. But for now,

this development might help bring in more institutional investors

on the platform. NEAR On Goldilocks Zone Trading Range As of

writing, the bears experienced a strong rejection on the $3.8 price

floor giving the bulls time to regroup and bounce. NEAR is now

trying to stabilize between the $3.8-$4.3 trading range, allowing

investors and traders to target $5.2 in the long term.

Related Reading: Ripple Unleashes 1 Billion XRP: Could This Trigger

A Price Tsunami? NEAR continues to experience a strong bearish

momentum in the short term, but the bulls have since gathered

enough momentum to cancel out the token’s decline. The problem now

is when will NEAR have enough push to break through $4.3 in the

medium term. The relative strength index (RSI) suggests that

the token might experience a period of low volatility where the

bears and the bulls will have an equally strong momentum. But after

this, NEAR will have enough push to drive the bears out of the

market, breaking through $4.3 in the medium term before settling on

the $4.3-$4.7 trading range. However, this price movement is

completely dependent on the broader market momentum. If Bitcoin and

Ethereum continue to struggle, NEAR will have a lot of ground to

retake if the bears succeed in breaking through $3.8. Featured

image from Electromechanical Contractor Philippines, chart from

TradingView

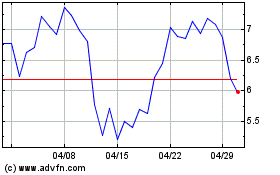

NEAR Protocol (COIN:NEARUSD)

過去 株価チャート

から 12 2024 まで 1 2025

NEAR Protocol (COIN:NEARUSD)

過去 株価チャート

から 1 2024 まで 1 2025