0001366868FALSE00013668682024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2024

GLOBALSTAR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-33117 | 41-2116508 |

| (State or Other Jurisdiction of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

1351 Holiday Square Blvd.

Covington, LA 70433

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (985) 335-1500

N/A

(Former Name or Former Address, if Changed Since Last Report)

| | | | | | | | | | | | | | |

| Securities registered pursuant to section 12(b) of the Act: | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, par value $0.0001 per share | | GSAT | | NYSE American |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, Globalstar, Inc. (the "Company") issued a press release announcing the Company's financial and operating results for the three months ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1, is furnished pursuant to the rules and regulations of the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| 99.1 | |

| | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| GLOBALSTAR, INC. | |

| | |

| | |

| /s/ Rebecca S. Clary | |

| Rebecca S. Clary | |

| Chief Financial Officer | |

| | |

Date: May 8, 2024

GLOBALSTAR ANNOUNCES FIRST QUARTER 2024

FINANCIAL RESULTS AND OPERATIONAL UPDATES

Covington, LA, May 8, 2024 -- Globalstar, Inc. (NYSE American: GSAT) today announced its operating and financial results for the first quarter ended March 31, 2024.

Rebecca Clary, Chief Financial Officer, commented, “We are pleased with our financial results for the first quarter, which generally exceeded our expectations with total revenue higher on a sequential basis as well as compared to the prior year quarterly average. As previously disclosed, the prior year’s first quarter included nonrecurring service revenue, as well as a spike in subscriber equipment sales when inventory was replenished after supply chain disruptions were resolved. Since we anticipated these factors, today we re-iterate our full year 2024 revenue and Adjusted EBITDA guidance issued in February. We are excited about how 2024 has started and even more excited about what we expect to come in the balance of the year.”

Dr. Paul E. Jacobs, Chief Executive Officer, said, “Since our last earnings report, Globalstar has made significant progress on our new initiatives that we expect to drive future revenue growth: by signing and starting the first phase of a new government contract, by testing a new technology on our satellite constellation, and by commencing commercial shipments of our XCOM RAN products. In addition, we are seeing customer interest in the combination of XCOM RAN and our terrestrial n53 spectrum holdings. We will continue developing these products over the coming year. We have also improved our going forward margins on a number of products by optimizing our global manufacturing footprint.”

Dr. Jacobs continued, "Globalstar’s satellite services business has proven that it can innovate and define entirely new categories, first with SPOT a generation ago and more recently with our wholesale capacity services. Furthermore, we expect the replenishment MDA satellites to launch next year to ensure quality services beyond the next decade. Optimizing the long term financial impact from the retained satellite capacity is important to the company and we will continue to offer differentiated and valuable services while monetizing our capacity."

OPERATIONAL HIGHLIGHTS

•In February, we initiated the proof-of-concept (POC) phase for a government services company to utilize our satellite network for mission critical applications with over-the-air testing expected this quarter. Assuming successful completion of the POC, we expect to commence a five-year agreement that contains annual minimum revenue commitments escalating to $20 million in the fifth year, with the expectation of significant upside through a revenue share arrangement. This opportunity represents a creative use of our satellite and spectrum assets, which does not require utilization of material amounts of our capacity, so that we may deploy it for other customers.

•In February, we announced an important customer win for our XCOM RAN product. One of the world’s largest retailers selected the XCOM RAN for deployment in certain of their Micro Fulfillment Centers (MFC). These MFCs are very difficult wireless environments, supporting hundreds of fast-moving robots that cannot risk losing connectivity. XCOM RAN solves significant MFC pain points, and we expect to roll out our technology to more of their locations and to provide similar solutions for others. In April, we began commercial deliveries under this contract.

•Globalstar recently conducted over-the-air testing for XCOM RAN running on 10MHz bandwidth, demonstrating its ability to support hundreds of robots for MFC. In capacity tests, the system showed gains of 4x to 5x for downlink and uplink, respectively, compared to traditional small cell implementations and we expect these gains will double in the coming year. XCOM RAN turns processing power into wireless throughput. When using a narrower bandwidth, we can apply more processing per MHz without increasing cost. Globalstar will demonstrate these results directly on n53 when radios are available.

•In April, we were notified that Globalstar’s XCOMP technology will be utilized as part of the first phase of a government funded study for applying advanced open based 5G technologies in challenging environments. The intent of the effort is to accelerate the inclusion of advanced applications, such as automated logistics, where conventional WiFi and cellular technologies may fall short.

•Globalstar’s terrestrial wireless business continues to offer outsized potential, and our early wins validate this view. Our combination of greenfield 5G spectrum and the capacity gains offered by XCOM RAN are individually and collectively exciting and offer multinational companies border spanning solutions. We believe this offering is unique with no other company currently possessing greenfield spectrum focused on private 5G across multiple geographies. We believe this is an untapped resource, with a now thriving ecosystem supported by Qualcomm’s major device and infrastructure chipsets. Going forward, our goal with Band n53 is to generate recurring revenue from as many places as we can. We expect nominal incremental expense for Globalstar associated with Band n53 and believe it can generate sustainable and growing cash flows at scale.

•In 2023, we filed an application with the Federal Communications Commission (FCC) to authorize a replacement constellation for our HIBLEO-4 filing, including a new 15-year license term. The FCC accepted our application for filing, and it has completed a public comment cycle. We are pleased with the progress we have made and expect to receive the requested replacement authorization soon. Most recently, the FCC dismissed another company’s application to operate in our same licensed frequencies and reaffirmed that, like Iridium, Globalstar is exclusively licensed in its portion of the Big LEO band.

FINANCIAL REVIEW

Service Revenue

Service revenue increased $0.5 million during the first quarter of 2024 from the first quarter of 2023. After excluding the nonrecurring revenue item recorded in the prior year period, service revenue would have increased by $3.7 million, or 7%.

Earlier this year, we executed an agreement with a government services company to utilize our satellite network for a mission critical service for government applications. The one-year $2.5 million POC phase commenced in February 2024 and is progressing as planned. This agreement has a five-year term and, if the project is implemented, contains annual minimum revenue commitments escalating to $20 million in the fifth year, with potential for significant upside through the agreement's revenue share arrangement.

For subscriber-driven revenue, Commercial IoT continues to grow. During the first quarter of 2024, Commercial IoT service revenue increased 24% from the first quarter of 2023, due to increases in both ARPU and the subscriber base. 2023 was a record year for gross subscriber activations, contributing to increased revenue during the first quarter of 2024 from these new subscribers.

Service revenue associated with legacy services was lower due to fewer Duplex and SPOT subscribers. SPOT subscribers have been unfavorably impacted by competitive pressure as well as supply chain disruptions that have now been resolved, but reduced the amount of inventory in retail locations that was available to be sold to customers for several quarters. Duplex service revenue declined at an expected rate due to attrition in the subscriber base, offset partially by an ARPU increase.

Subscriber Equipment Sales

Revenue generated from subscriber equipment sales was down $2.7 million from the prior year's quarter due to the timing of Commercial IoT and SPOT device sales. In the first quarter of 2023, we recovered from significant inventory shortages and experienced higher sales as a result of product availability. To illustrate this point, the first quarter of 2023 was a record high for any first quarter in the Company's history for both SPOT and Commercial IoT.

(Loss) Income from Operations

Loss from operations was $4.7 million during the first quarter of 2024, compared to income from operations of $7.2 million during the first quarter of 2023. Higher operating expenses coupled with lower equipment revenue (discussed above) drove the loss during the first quarter of 2024.

Stock-based compensation increased from the prior year's first quarter due primarily to restricted stock units granted in connection with the XCOM License Agreement in September 2023.

Cost of services increased from higher gateway operating costs - maintenance, security, IT and personnel expenses - have increased in line with our expanded global ground infrastructure necessitated by our wholesale agreement. A significant portion of these costs are reimbursed to us, and this consideration is recognized as revenue when earned in the subsequent

year. Cost of services also increased due to non-cash costs associated with the Support Services Agreement (the “SSA”) we entered into in August 2023 in connection with the XCOM License Agreement.

Management, general and administrative costs (MG&A) costs were higher due to increased legal and professional fees for various short-term efforts as well as non-cash costs associated with the SSA (discussed above).

Net Loss

Net loss was $13.2 million for the first quarter of 2024, compared to net loss of $3.5 million for the first quarter of 2023. This variance was due primarily to a loss from operations (for the reasons discussed above). During the first quarter of 2023, we recognized a nonrecurring, non-cash loss on extinguishment of debt; this favorable fluctuation was offset by unfavorable fluctuations in foreign currency gains and losses and higher interest expense.

Adjusted EBITDA

Adjusted EBITDA was $29.6 million during the first quarter of 2024 compared to $32.6 million during the prior year's first quarter, due primarily to lower subscriber equipment revenue. Adjusted EBITDA is a non-GAAP financial measure. For more information on its usage and presentation, as well as a reconciliation to GAAP net income (loss), refer to “Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA”.

Liquidity

As of March 31, 2024, we held cash and cash equivalents of $59.3 million, compared to $56.7 million as of December 31, 2023. During the first quarter, net cash flows generated from operations of $29.8 million and net cash flows from financing activities of $27.1 million were used to fund capital expenditures of $54.2 million.

Operating cash flows include cash receipts from the performance of wholesale capacity services as well as cash received from subscribers related to the purchase of equipment and satellite voice and data services. We use cash in operating activities primarily for network costs, personnel costs, inventory purchases and other general corporate expenditures. Investing outflows largely relate to network upgrades associated with the Service Agreements, including milestone work under the satellite procurement agreement with MDA and the launch services agreement with SpaceX. Financing inflows related to proceeds from the 2023 Funding Agreement.

Over the next twelve months, our sources of cash are also expected to include operating cash flows generated from the business. These sources of cash will be used to pay capital expenditures associated with the new satellites and associated launch costs as well as debt service costs.

FINANCIAL OUTLOOK

We reiterate our financial outlook for 2024.

•Total revenue between $225 million and $250 million

•Adjusted EBITDA margin of approximately 50%

CONFERENCE CALL INFORMATION

As previously announced, the Company will host a conference call to discuss its results at 5:00 p.m. Eastern Time (ET) on Wednesday, May 8, 2024. Details are as follows:

| | | | | |

| Earnings Call: | The earnings call will be hosted via teleconference. Participants should dial in using the information below:

Toll Free (+1) 800 717 1738 Local (+1) 646 307 1865

Please provide the conference ID 36209 when dialing in for the call.

|

| Audio Replay: | For those unable to participate in the live call, a replay of the webcast will be available in the Investor Relations section of the Company's website.

|

About Globalstar, Inc.

Globalstar empowers its customers to connect, transmit, and communicate in smarter ways – easily, quickly, securely, and affordably – offering reliable satellite and terrestrial connectivity services as an international telecom infrastructure provider. The Company’s LEO satellite constellation assures secure data transmission for connecting and protecting assets, transmitting critical operational data, and saving lives for consumers, businesses, and government agencies across the globe. Globalstar’s terrestrial spectrum, Band 53, and its 5G variant, n53, offers carriers, cable companies, and system integrators a versatile, fully licensed channel for private networks with a growing ecosystem to improve customer wireless connectivity, while Globalstar’s XCOM RAN product offers significant capacity gains in dense wireless deployments. In addition to SPOT GPS messengers, Globalstar offers next-generation IoT hardware and software products for efficiently tracking and monitoring assets, processing smart data at the edge, and managing analytics with cloud-based telematics solutions to drive safety, productivity, and profitability.

Note that all SPOT products described in this press release are the products of SPOT LLC, which is not affiliated in any manner with Spot Image of Toulouse, France or Spot Image Corporation of Chantilly, Virginia.

For more information, visit www.globalstar.com.

Investor Contact Information:

investorrelations@globalstar.com

Safe Harbor Language for Globalstar Releases

This press release contains certain statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Forward-looking statements, such as the statements regarding our ability to identify and realize opportunities and to generate the expected revenues and other benefits of the XCOM License Agreement, our ability to integrate the licensed technology into our current line of business, the ability of Dr. Jacobs and other new employees to drive innovation and growth, our expectations with respect to the pursuit of terrestrial spectrum authorities globally, the success of current and potential future applications for our terrestrial spectrum, future increases in our revenue and profitability, our ability to meet our obligations under, and profit from, the Service Agreements, and other statements contained in this release regarding matters that are not historical facts, involve predictions. Any forward-looking statements made in this press release are believed to be accurate as of the date made and are not guarantees of future performance. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements, and we undertake no obligation to update any such statements. Additional information on factors that could influence our financial results is included in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

GLOBALSTAR, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | |

| March 31, | | | |

| 2024 | | 2023 | | | | | |

| Revenue: | | | | | | | | |

| Service revenue | $ | 53,465 | | | $ | 52,954 | | | | | | |

| Subscriber equipment sales | 3,015 | | | 5,690 | | | | | | |

| Total revenue | 56,480 | | | 58,644 | | | | | | |

| Operating expenses: | | | | | | | | |

| Cost of services (exclusive of depreciation, amortization, and accretion shown separately below) | 16,759 | | | 11,820 | | | | | | |

| Cost of subscriber equipment sales | 2,158 | | | 4,309 | | | | | | |

| | | | | | | | |

| Marketing, general and administrative | 10,646 | | | 9,631 | | | | | | |

Stock-based compensation | 9,227 | | | 3,760 | | | | | | |

| Reduction in the value of long-lived assets | 305 | | | — | | | | | | |

| Depreciation, amortization, and accretion | 22,097 | | | 21,933 | | | | | | |

| Total operating expenses | 61,192 | | | 51,453 | | | | | | |

| (Loss) income from operations | (4,712) | | | 7,191 | | | | | | |

| Other (expense) income: | | | | | | | | |

| Loss on extinguishment of debt | — | | | (10,403) | | | | | | |

| Interest income and expense, net of amounts capitalized | (3,785) | | | (2,032) | | | | | | |

| Foreign currency (loss) gain | (3,842) | | | 1,907 | | | | | | |

| Other | (849) | | | (99) | | | | | | |

| Total other expenses | (8,476) | | | (10,627) | | | | | | |

Loss before income taxes | (13,188) | | | (3,436) | | | | | | |

| Income tax expense | 8 | | | 44 | | | | | | |

| Net loss | $ | (13,196) | | | $ | (3,480) | | | | | | |

| | | | | | | | |

| Net loss attributable to common shareholders | (15,840) | | | (6,095) | | | | | | |

| Net loss per common share: | | | | | | | | |

| Basic | $ | (0.01) | | | $ | (0.00) | | | | | | |

| Diluted | (0.01) | | | (0.00) | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | |

| Basic | 1,882,605 | | | 1,811,831 | | | | | | |

| Diluted | 1,882,605 | | | 1,811,831 | | | | | | |

GLOBALSTAR, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except par value and share data)

(Unaudited)

| | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 59,282 | | | $ | 56,744 | |

Accounts receivable, net of allowance for credit losses of $1,585 and $2,312, respectively | 42,830 | | | 48,743 | |

| Inventory | 14,407 | | | 14,582 | |

| Prepaid expenses and other current assets | 19,458 | | | 22,584 | |

| Total current assets | 135,977 | | | 142,653 | |

| Property and equipment, net | 625,515 | | | 624,002 | |

| Operating lease right of use assets, net | 33,573 | | | 34,164 | |

| Prepaid satellite costs and customer receivable | 12,482 | | | 12,443 | |

Intangible and other assets, net of accumulated amortization of $12,798 and $12,385, respectively | 109,459 | | | 111,047 | |

| Total assets | $ | 917,006 | | | $ | 924,309 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 34,600 | | | $ | 34,600 | |

| Accounts payable and accrued expenses | 28,268 | | | 28,985 | |

| Accrued satellite construction costs | 18,796 | | | 58,187 | |

| Payables to affiliates | 261 | | | 459 | |

| Deferred revenue, net | 53,757 | | | 53,677 | |

| Total current liabilities | 135,682 | | | 175,908 | |

| Long-term debt | 364,123 | | | 325,700 | |

| Operating lease liabilities | 28,497 | | | 29,244 | |

| Deferred revenue, net | 1,543 | | | 3,213 | |

| Other non-current liabilities | 10,107 | | | 11,265 | |

| Total non-current liabilities | 404,270 | | | 369,422 | |

| | | |

| Stockholders’ equity: | | | |

Preferred Stock of $0.0001 par value; 99,700,000 shares authorized and none issued and outstanding at March 31, 2024 and December 31, 2023, respectively | — | | | — | |

Series A Preferred Convertible Stock of $0.0001 par value; 300,000 shares authorized and 149,425 issued and outstanding at March 31, 2024 and December 31, 2023, respectively | — | | | — | |

Voting Common Stock of $0.0001 par value; 2,150,000,000 shares authorized; 1,883,934,020 and 1,881,194,682 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 188 | | | 188 | |

| Additional paid-in capital | 2,447,581 | | | 2,438,703 | |

| Accumulated other comprehensive income | 7,463 | | | 5,070 | |

| Retained deficit | (2,078,178) | | | (2,064,982) | |

| Total stockholders’ equity | 377,054 | | | 378,979 | |

| Total liabilities and stockholders’ equity | $ | 917,006 | | | $ | 924,309 | |

GLOBALSTAR, INC.

RECONCILIATION OF GAAP NET INCOME (LOSS) TO NON-GAAP ADJUSTED EBITDA

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | |

| | | March 31, | | |

| | | 2024 | | 2023 | | | | |

| Net loss | | $ | (13,196) | | | $ | (3,480) | | | | | |

| | | | | | | | | |

| Interest income and expense, net | | 3,785 | | | 2,032 | | | | | |

| Derivative loss | | 953 | | | — | | | | | |

| Income tax expense | | 8 | | | 44 | | | | | |

| Depreciation, amortization, and accretion | | 22,097 | | | 21,933 | | | | | |

| EBITDA | | 13,647 | | | 20,529 | | | | | |

| | | | | | | | | |

| Non-cash compensation | | 9,227 | | | 3,760 | | | | | |

| Foreign exchange gain and other | | 3,738 | | | (2,118) | | | | | |

| Reduction in value of long-lived assets | | 305 | | | — | | | | | |

| Non-cash consideration under SSA (2) | | 1,392 | | | — | | | | | |

| Transaction costs | | 1,325 | | | — | | | | | |

| Loss on extinguishment of debt | | — | | | 10,403 | | | | | |

Adjusted EBITDA (1) | | $ | 29,634 | | | $ | 32,574 | | | | | |

| | | | | |

| (1) | EBITDA represents earnings before interest, income taxes, depreciation, amortization, accretion and derivative (gains)/losses. Adjusted EBITDA excludes non-cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, and certain other non-cash or non-recurring charges as applicable. Management uses Adjusted EBITDA to manage the Company's business and to compare its results more closely to the results of its peers. EBITDA and Adjusted EBITDA do not represent and should not be considered as alternatives to GAAP measurements, such as net income/(loss). These terms, as defined by us, may not be comparable to similarly titled measures used by other companies.

The Company uses Adjusted EBITDA as a supplemental measurement of its operating performance. The Company believes it best reflects changes across time in the Company's performance, including the effects of pricing, cost control and other operational decisions. The Company's management uses Adjusted EBITDA for planning purposes, including the preparation of its annual operating budget. The Company believes that Adjusted EBITDA also is useful to investors because it is frequently used by securities analysts, investors and other interested parties in their evaluation of companies in similar industries. As indicated, Adjusted EBITDA does not include interest expense on borrowed money or depreciation expense on our capital assets or the payment of income taxes, which are necessary elements of the Company's operations. Because Adjusted EBITDA does not account for these expenses, its utility as a measure of the Company's operating performance has material limitations. Because of these limitations, the Company's management does not view Adjusted EBITDA in isolation and also uses other measurements, such as revenues and operating profit, to measure operating performance.

|

| (2) | In connection with the License Agreement with XCOM, the Company entered into a Support Services Agreement (the “SSA”) with XCOM. Fees payable by Globalstar pursuant to the SSA were or are to be paid in shares of its common stock.

|

GLOBALSTAR, INC.

SCHEDULE OF SELECTED OPERATING METRICS

(In thousands, except subscriber and ARPU data)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 31, 2024 | | March 31, 2023 | | | | |

| Service revenue: | | | | | | | |

| Subscriber services | | | | | | | |

| Duplex | $ | 4,755 | | | $ | 5,751 | | | | | |

| SPOT | 10,243 | | | 11,314 | | | | | |

| Commercial IoT | 6,437 | | | 5,178 | | | | | |

| Wholesale capacity services | 31,629 | | | 30,411 | | | | | |

| Engineering and other services | 401 | | | 300 | | | | | |

| Total service revenue | 53,465 | | | 52,954 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Subscriber equipment sales | 3,015 | | | 5,690 | | | | | |

| | | | | | | |

| Total revenue | $ | 56,480 | | | $ | 58,644 | | | | | |

| | | | | | | | | | | | | | | |

| | | |

| | | | | | | |

| Average subscribers | | | | | | | |

| Duplex | 29,257 | | | 36,616 | | | | | |

| SPOT | 249,640 | | | 266,067 | | | | | |

| Commercial IoT | 502,915 | | | 462,077 | | | | | |

| Other | 314 | | | 400 | | | | | |

| Total | 782,126 | | | 765,160 | | | | | |

| | | | | | | |

ARPU (1) | | | | | | | |

| Duplex | $ | 54.18 | | | $ | 52.35 | | | | | |

| SPOT | 13.68 | | | 14.17 | | | | | |

| Commercial IoT | 4.27 | | | 3.74 | | | | | |

(1) Average monthly revenue per user (ARPU) measures service revenues per month divided by the average number of subscribers during that month. Average monthly revenue per user as so defined may not be similar to average monthly revenue per unit as defined by other companies in the Company's industry, is not a measurement under GAAP and should be considered in addition to, but not as a substitute for, the information contained in the Company's statement of operations. The Company believes that average monthly revenue per user provides useful information concerning the appeal of its rate plans and service offerings and its performance in attracting and retaining high value customers.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

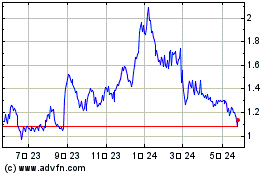

Globalstar (AMEX:GSAT)

過去 株価チャート

から 11 2024 まで 12 2024

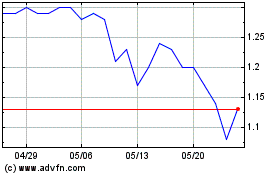

Globalstar (AMEX:GSAT)

過去 株価チャート

から 12 2023 まで 12 2024