false

0001279620

0001279620

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 23, 2024

| Zoned Properties, Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 000-51640 |

|

46-5198242 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

8360 E. Raintree Drive, #230

Scottsdale, AZ |

|

85260 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(Registrant’s telephone number, including

area code): (877) 360-8839

N/A

(Former name, former address and former fiscal

year, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2.)

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive

Agreement.

Purchase and Sale Agreement and Joint Escrow

On February 23, 2024, ZP RE Holdings, LLC (“ZP

Holdings”), a wholly owned subsidiary of Zoned Properties, Inc. (the “Company”), provided an approval notice to the

Seller (as hereinafter defined) of the Surprise Property (as hereinafter defined), related to the Company’s intent to consummate

the purchase of the Surprise Property, following notice from the City of Surprise that the Company had received final approvals of its

cannabis entitlements, after satisfaction of the appeal period (the “Cannabis Approvals”), related to a use-permit for a cannabis

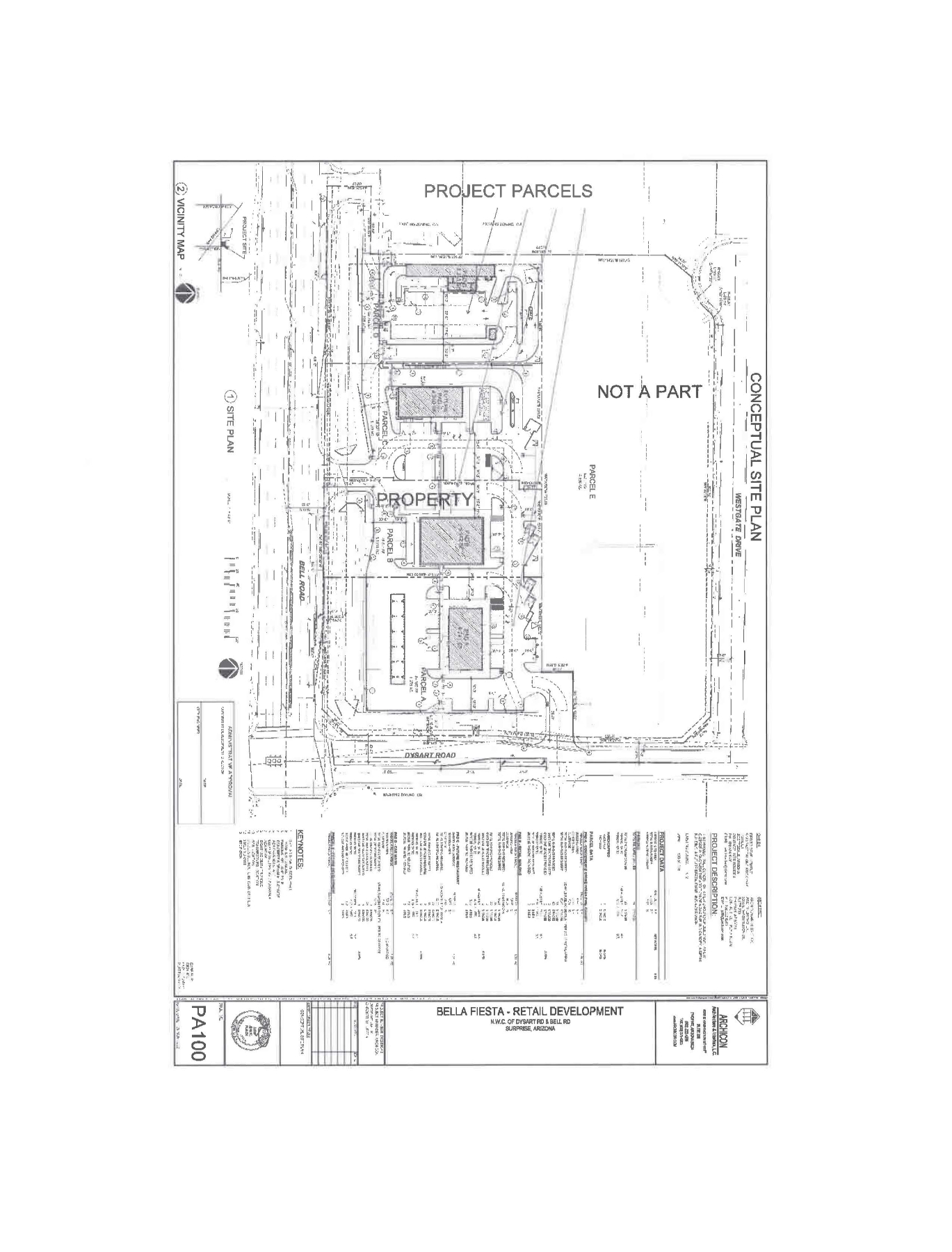

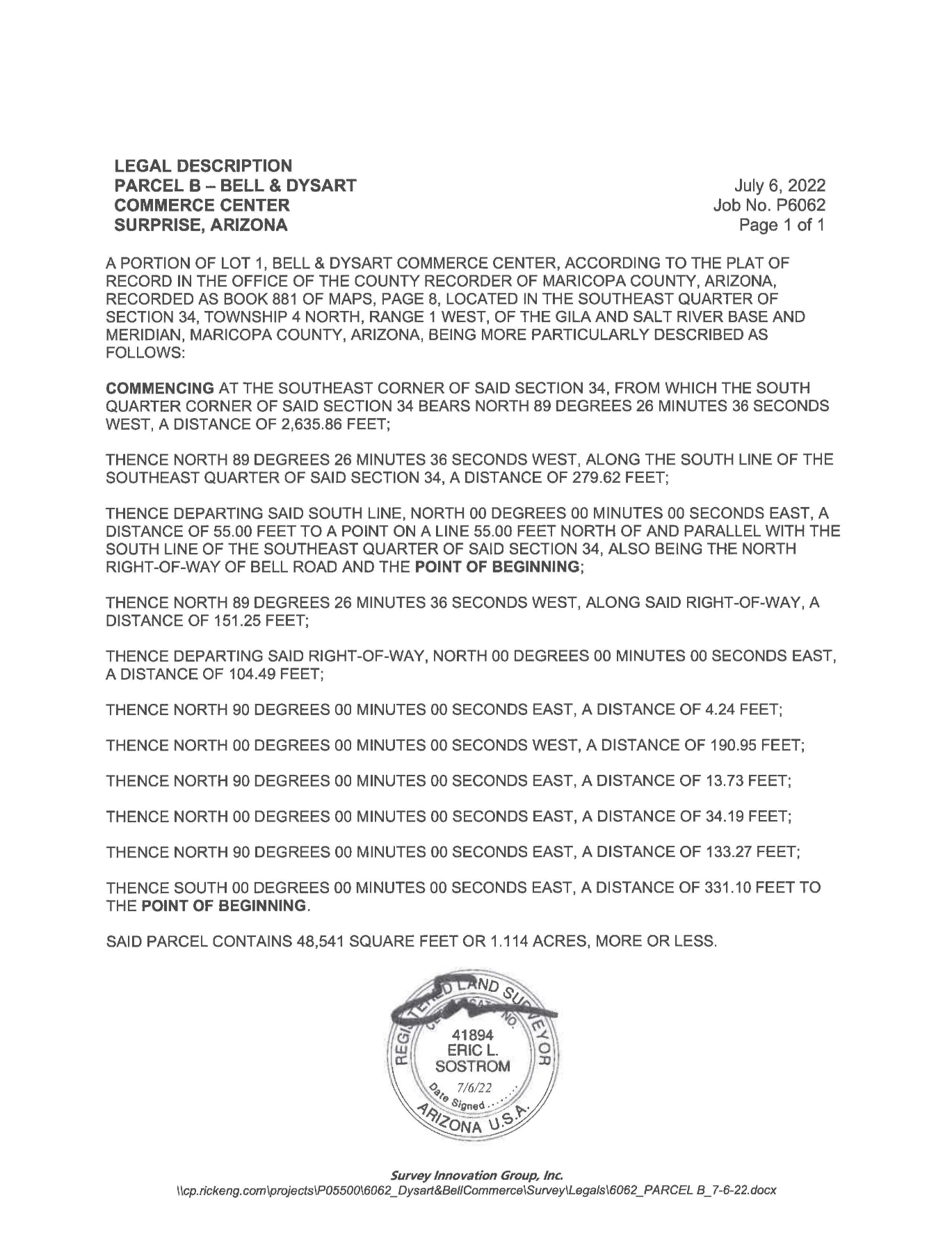

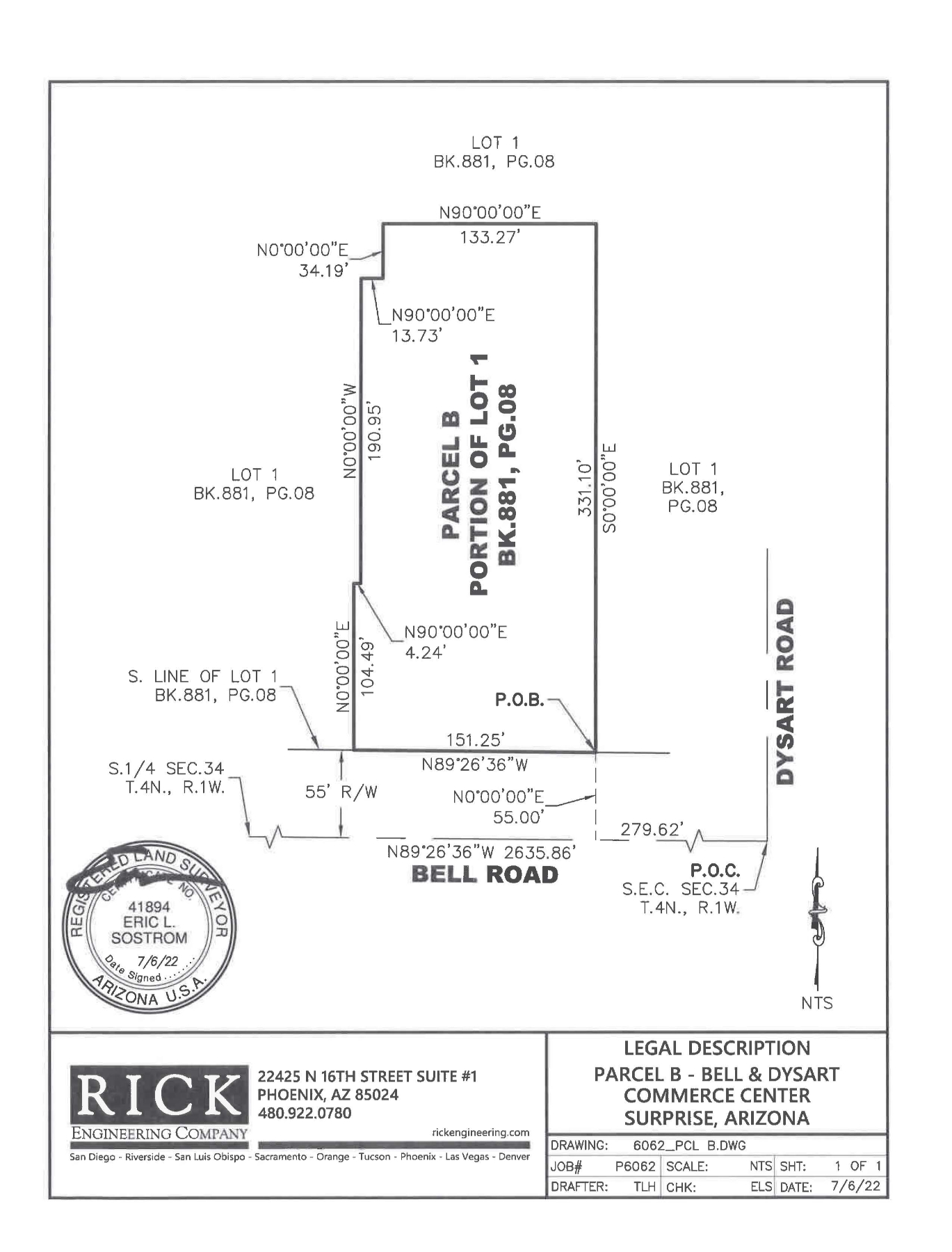

retail dispensary to be developed at the Surprise Property. As used herein, the “Surprise Property” refers to that certain

property commonly known as Bella Fiesta Pad B in Surprise, Arizona, which property is a certain tract or parcel of land containing approximately

1.114 acres, together with all improvements, buildings, leases, rights, easements, and appurtenances pertaining thereto.

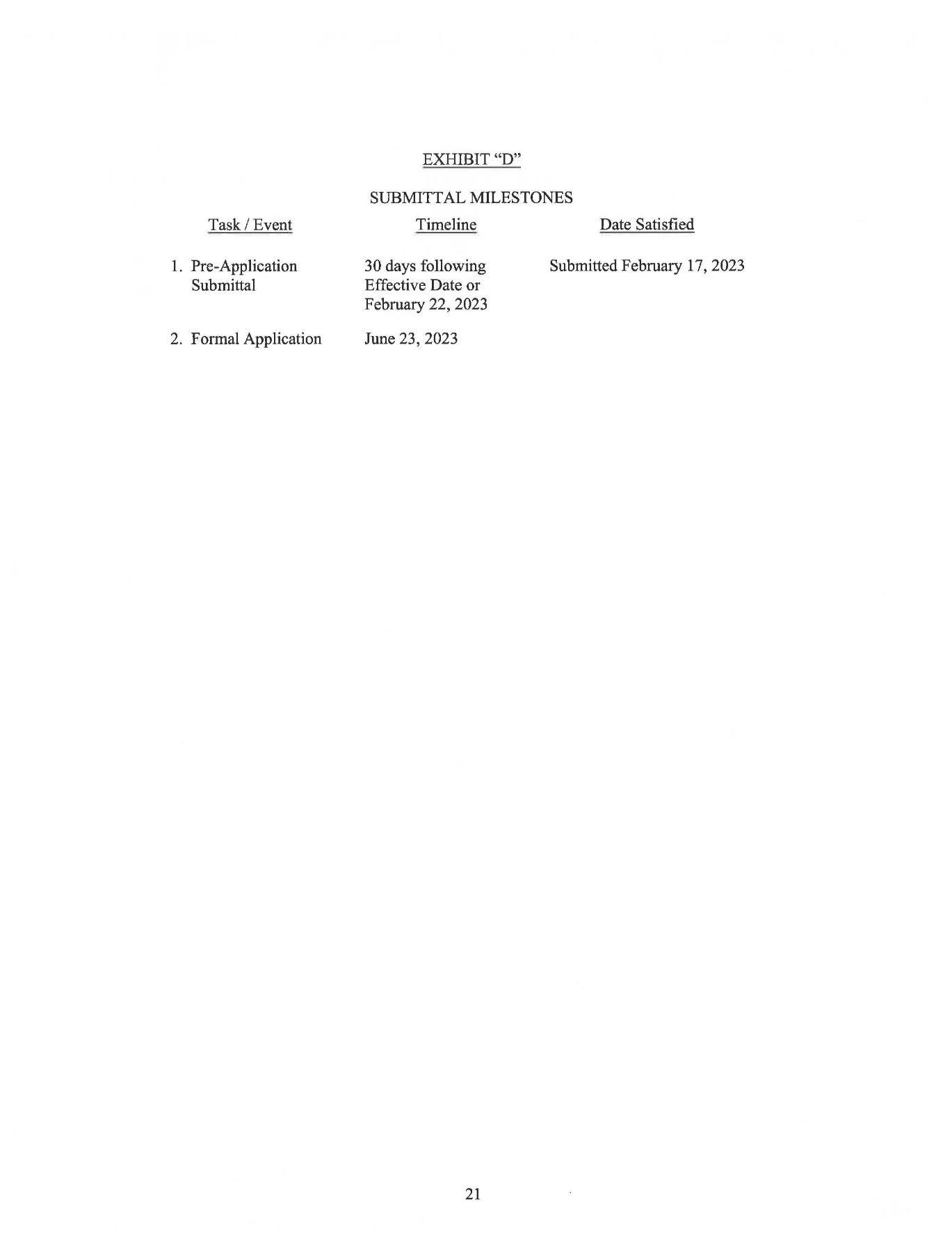

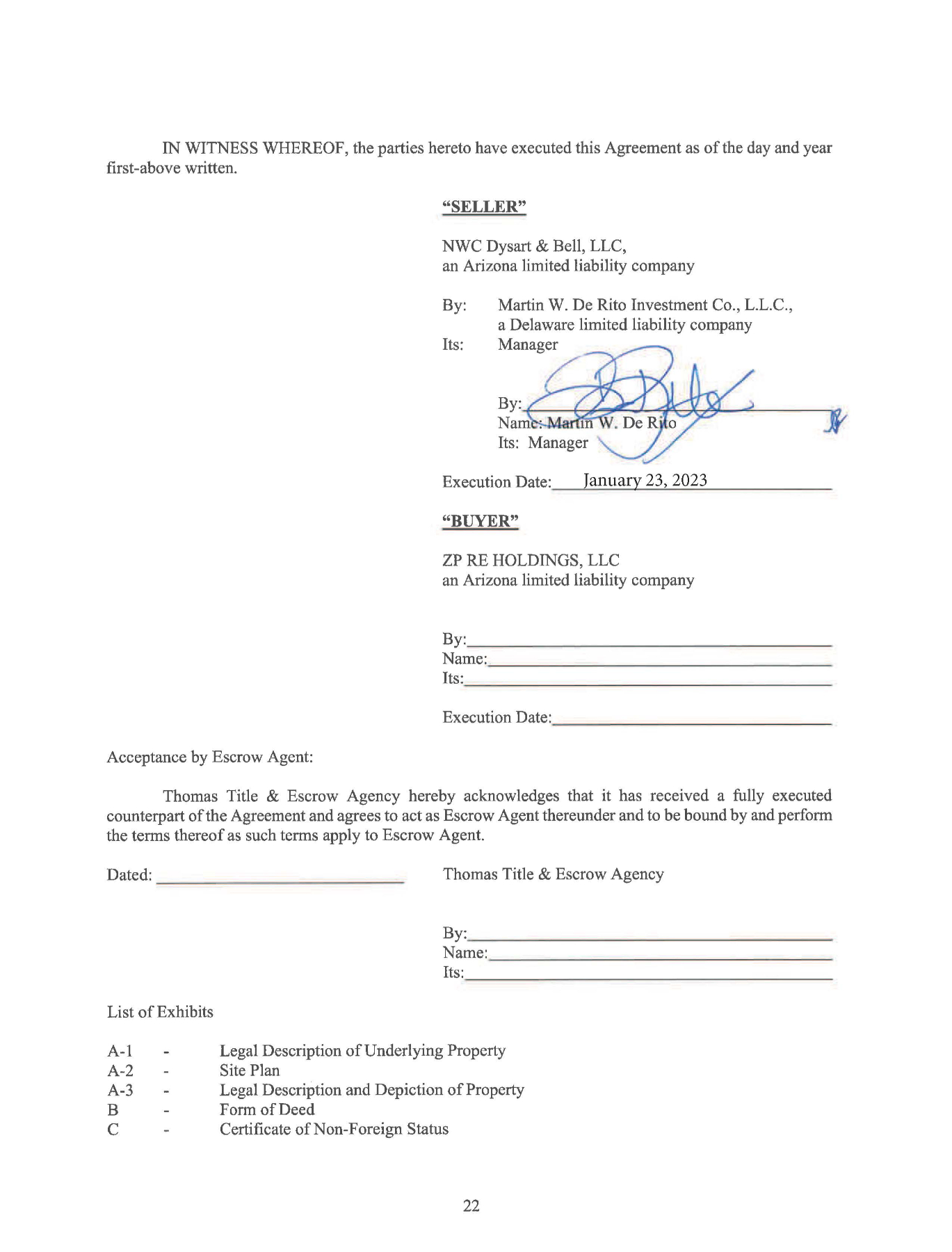

Previously, on January 23, 2023, ZP Holdings entered

into a Purchase and Sale Agreement and Joint Escrow Instructions, by and between NWC Dysart & Bell LLC (the “Seller”)

and ZP Holdings as the buyer. Such agreement was subsequently amended on May 12, 2023, October 25, 2023, and December 20, 2023 (as amended,

the “Agreement”). Pursuant to the terms of the Agreement, the Seller agreed to sell to ZP Holdings, and ZP Holdings agreed

to purchase, the Surprise Property in exchange for a purchase price of $1,100,000 (the “Purchase Price”). Pursuant to the

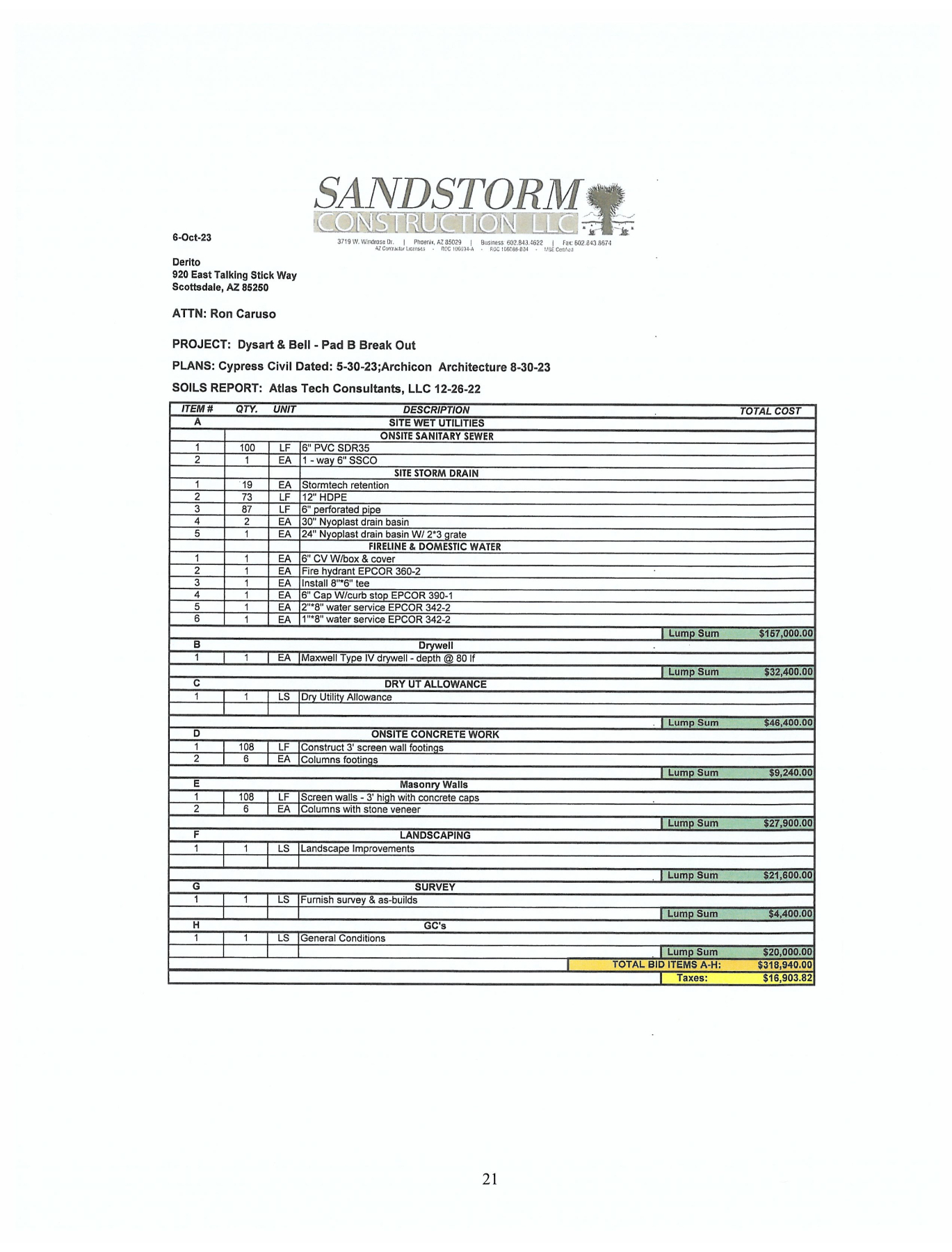

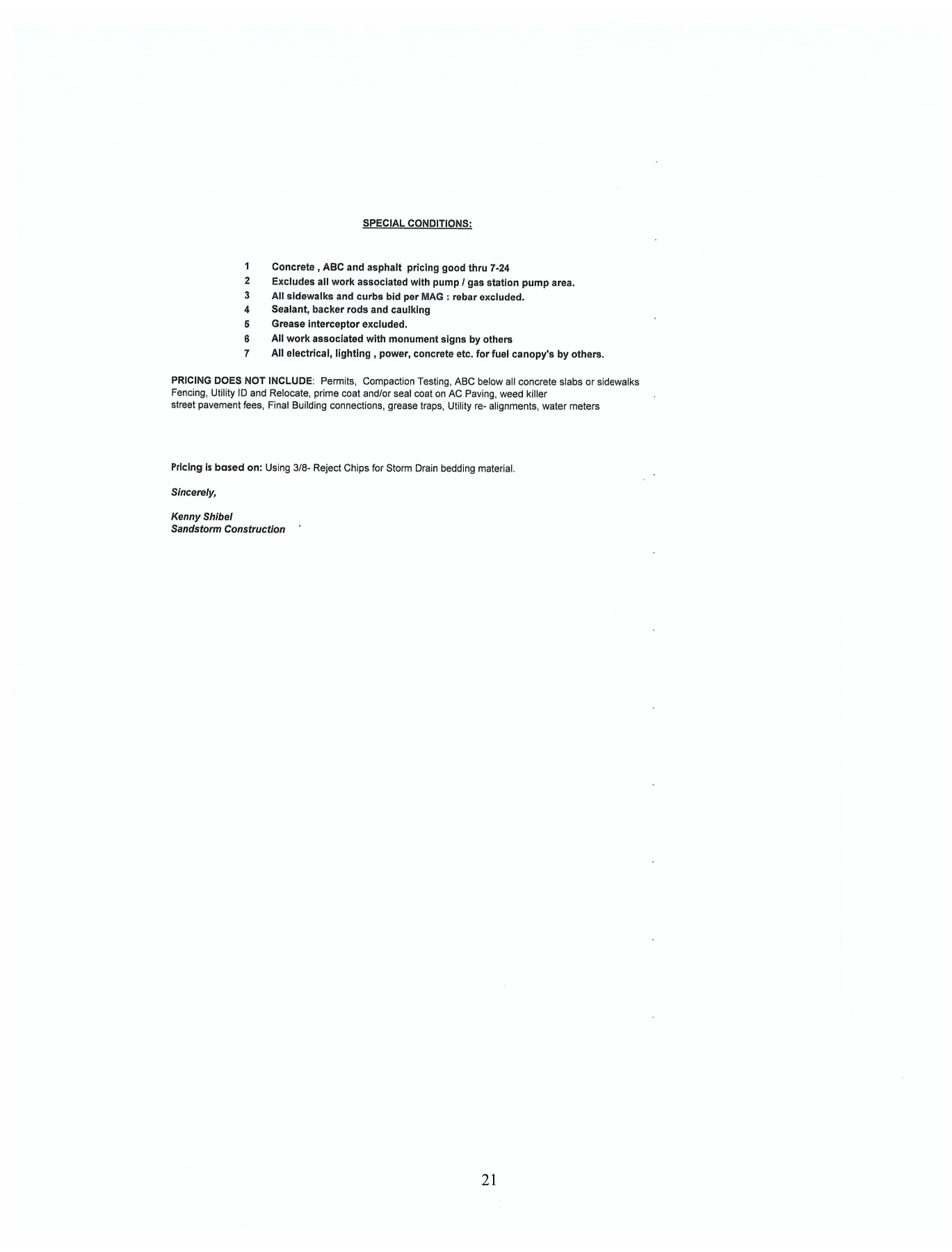

terms of the Agreement, the Seller also agreed to complete a number of on-site and off-site improvements to the Surprise Property (the

“Seller’s Work”) in exchange for ZP Holdings’ reimbursement of up to $250,000 for the off-site work and reimbursement

of up to $350,000 for the on-site work (collectively, the “Reimbursements”). The obligation to complete the Reimbursements

is conditioned upon the closing of the sale of the Surprise Property to ZP Holdings.

Pursuant to the terms of the Agreement, ZP Holdings

deposited the following amounts into escrow: (i) $50,000, for the initial earnest money deposit, and (ii) $47,500, for additional earnest

money deposited related to extensions to the Agreement (collectively, the “Earnest Money”). The Earnest Money will be applied

as a credit upon closing.

The closing of the transactions contemplated by

the Agreement is subject to several conditions, including the successful receipt of the Cannabis Approvals, and the successful completion

of the Seller’s Work. In addition, ZP Holdings has the right to conduct inspections on the Surprise Property. Pursuant to the terms

of the Agreement, if, during the inspection period, ZP Holdings determines, in its sole and absolute discretion, that the Surprise Property

is not suitable for ZP Holdings’ purchase and use for any reason or no reason, ZP Holdings may terminate the Agreement.

The foregoing description of the Agreement is

not a complete description of all of the parties’ rights and obligations under the Agreement, and is qualified in its entirety by

reference to the Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Licensed Cannabis Facility Absolute Net Lease

Agreement, Guaranty and Security Agreement

On January 2, 2024, ZP Holdings entered into a contingent Licensed

Cannabis Facility Absolute Net Lease Agreement (the “Sunday Goods Lease”), with a commencement date contingent upon the satisfaction

of various contingencies to the Sunday Goods Lease, by and between ZP Holdings, as landlord, and The Pharm, LLC (“Sunday Goods”),

as tenant. Pursuant to the terms of the Sunday Goods Lease, ZP Holdings agreed to lease the Surprise Property to Sunday Goods for use

as a licensed medical and adult use marijuana retail dispensary in accordance with the laws of Arizona. The Sunday Goods Lease has a term

of 15 years, with four five-year renewal terms. Pursuant to the Sunday Goods Lease, ZP Holdings has agreed to provide a tenant improvement

allowance for up to $1,000,000 to Sunday Goods to be reimbursed in tranches following completion of tenant’s work. The rental payment

terms pursuant to the Sunday Goods Lease are as follows:

| Year Period | |

Month Period | | |

Base Rent | |

| 1 | |

| 1 | | |

$ | 25,000.00 | |

| 2 | |

| 13 | | |

$ | 25,750.00 | |

| 3 | |

| 25 | | |

$ | 26,522.50 | |

| 4 | |

| 37 | | |

$ | 27,318.18 | |

| 5 | |

| 49 | | |

$ | 28,137.72 | |

| 6 | |

| 61 | | |

$ | 28,981.85 | |

| 7 | |

| 73 | | |

$ | 29,851.31 | |

| 8 | |

| 85 | | |

$ | 30,746.85 | |

| 9 | |

| 97 | | |

$ | 31,669.25 | |

| 10 | |

| 109 | | |

$ | 32,619.33 | |

| 11 | |

| 121 | | |

$ | 33,597.91 | |

| 12 | |

| 133 | | |

$ | 34,605.85 | |

| 13 | |

| 145 | | |

$ | 35,644.02 | |

| 14 | |

| 157 | | |

$ | 36,713.34 | |

| 15 | |

| 169 | | |

$ | 37,814.74 | |

Pursuant to the terms of the Sunday Goods Lease,

on February 27, 2024, Sunday Goods executed a guaranty (the “Guaranty”) in favor of ZP Holdings, guaranteeing the prompt and

complete payment and performance of all of Sunday Goods’ obligations to ZP Holdings arising under the Sunday Goods Lease.

The foregoing description of the Sunday Goods

Lease and the Guaranty is not a complete description of all of the parties’ rights and obligations under the Justice Grown Lease

and the Guaranty, and is qualified in its entirety by reference to the Sunday Goods Lease and the Guaranty, copies of which are filed

as Exhibits 10.2 and 10.3, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On

February 29, 2024, the Company issued a press release announcing its Agreement to acquire the Surprise Property and that it has received

the necessary Cannabis Approvals.

The information included in this Item 7.01, including

Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing. The information set forth under this Item 7.01 shall not be deemed an admission as to the materiality

of any information in this Current Report on Form 8-K that is required to be disclosed solely to satisfy the requirements of Regulation

FD.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| 10.1 |

|

Purchase and Sale Agreement and Joint Escrow Instructions, dated as of January 23, 2023, by and between NWC Dysart & Bell, LLC and ZP RE Holdings, LLC. |

| 10.2 |

|

Licensed Cannabis Facility Absolute Net Lease Agreement dated as of January 2, 2024, by and between ZP RE Holdings, LLC and The Pharm, LLC. |

| 10.3 |

|

Guaranty of Payment and Performance, dated as of February 27, 2024, by The Pharm, LLC in favor of ZP RE Holdings, LLC. |

| 99.1 |

|

Press release of the registrant dated February 29, 2024. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ZONED PROPERTIES, INC. |

| |

|

| Dated: February 29, 2024 |

/s/ Bryan McLaren |

| |

Bryan McLaren |

| |

Chief Executive Officer & Chief Financial Officer |

3

Exhibit 10.1

Exhibit 10.2

LICENSED CANNABIS FACILITY

ABSOLUTE NET GROUND LEASE AGREEMENT

ZP RE HOLDINGS, LLC

(Landlord or Lessor)

&

The Pharm, LLC

(Tenant or Lessee)

Dated December 20, 2023

(for reference purposes only)

TABLE OF CONTENTS

| 1. |

Basic Lease Provisions. |

1 |

| 2. |

Premises and Common Areas Leased. |

2 |

| 3. |

Compliance with Law; AS IS. |

2 |

| 4. |

Lease Term. |

3 |

| 5. |

Rent. |

4 |

| 6. |

Additional Rent. |

5 |

| 7. |

Insurance. |

7 |

| 8. |

Repairs and Maintenance; Utilities; Non-Liability of Landlord;

Inspection. |

9 |

| 9. |

Fixtures, Personal Property and Alterations. |

9 |

| 10. |

Use and Compliance with Applicable Laws. |

11 |

| 11. |

Damage and Destruction. |

14 |

| 12. |

Eminent Domain. |

14 |

| 13. |

Default; Remedies. |

15 |

| 14. |

Bankruptcy Provisions. |

17 |

| 15. |

Assignment and Subletting. |

18 |

| 16. |

Estoppel Certificate; Attornment and Subordination. |

19 |

| 17. |

Miscellaneous. |

19 |

LICENSED CANNABIS FACILITY

ABSOLUTE NET GROUND LEASE AGREEMENT

This LEASE (“Lease” or “Agreement”)

dated as of the Effective Date, is made by and between ZP RE HOLDINGS, LLC, an Arizona limited liability company (“Landlord”

or “Lessor”), and The Pharm, LLC (“Tenant” or “Lessee”) (collectively the “Parties”).

In consideration of the obligations of Tenant to

pay rent and other charges as provided in this Lease and in consideration of the other terms, covenants and conditions hereof, Landlord

leases to Tenant and Tenant leases from Landlord the Premises for the Term and subject to the terms and conditions set forth herein.

1. Basic Lease

Provisions. The following terms shall have the meanings specified in this Section 1, unless otherwise specifically provided.

Other terms may be defined in other parts of this Lease.

| |

(A) Landlord |

ZP RE Holdings, LLC

|

| |

(B) Landlord’s Address |

c/o Zoned Properties, Inc.

8360 E. Raintree Dr., Ste. 230

Scottsdale, Arizona 85260

legal@zonedproperties.com

|

| |

(C) Tenant |

The Pharm, LLC

|

| |

(D) Tenants Address |

PO Box 54730

Phoenix, AZ 85078

JHaugh@ThePharmAZ.com

|

| |

(E) Tenant Use |

Licensed medical and adult use marijuana retail

dispensary in accordance with the laws of the State of Arizona, including, without limitation, the Arizona Medical Marijuana Act and the

Smart and Safe Act, as amended from time to time, the rules and regulations promulgated by the Arizona Department of Health Services,

and other applicable laws, rules and regulations from any governmental authority, applicable licensure requirements and the regulations

and uses incidental thereto (collectively, “Cannabis Laws”), and no other use without Landlord’s prior written

consent.

|

| |

(F) Premises or Building |

A to-be-constructed approximately 3,500 to 5,000-rentable-square-foot

freestanding single-story, single-tenant building on the Property, together with the easements, rights of record, and parking spaces located

on the Property (on a non-exclusive basis), as well as the other parking spaces to which the Property is permitted to use on a non-exclusive

basis under any matters of record encumbering the Property.

|

| |

(G) Property |

Approximately 48,541 square feet (1.1141 acres)

of land located in Surprise, Arizona with the assessor parcel number 503-66-992, as legally described in Exhibit C

|

| |

(H) Initial Term |

Commencing as of the Commencement Date and expiring

on the fifteenth (15th) anniversary of the Rent Commencement Date.

|

| |

(I) Renewal Terms |

Four (4) five (5) year terms, subject to the provisions

of Article 4

|

| |

(J) Contingencies

|

Landlord acquiring title to the Premises, Landlord’s

receipt of a conditional use permit from the City of Surprise, Arizona for the Permitted Use at the Premises, and completion of certain

off-site improvements and certain on-site improvement to the Property, as described in more detail on Exhibit E & Exhibit F.

See Section 4.1.2.

|

| |

(K) Commencement Date |

Five (5) days after the Contingencies have been

satisfied as evidenced by written notice from Landlord to Tenant. Following such notice, Landlord shall update Exhibit A

to this Lease with the Commencement Date.

|

| |

(L) Base Rent |

Exhibit B

|

| |

(M) Security Deposit |

Last month’s Base Rent, $37,814.74, due

on the Effective Date

|

| |

(N) Base Rent Abatement |

The earlier of Twelve (12) months following the

Commencement Date and the date Tenant opens for business at the Premises. The “Rent Commencement Date” shall be the

first day following the expiration of the Base Rent Abatement.

|

| |

(O) Landlord Broker |

None

|

| |

(P) Tenant Broker |

None |

2.

Premises and Common Areas Leased.

2.1. Lease of Premises.

Subject to the provisions of this Lease, Landlord hereby leases to Tenant, without any representation or warranty, express or implied,

on the part of Landlord (except those expressly set forth in Section 17.29 in this Lease), and Tenant hereby leases from Landlord the

Premises, subject to the terms and conditions herein.

2.2. Measurement of Premises.

The terms “Rentable Area of the Premises,” “rentable square feet,” “actual square footage”

and words of similar importance (whether or not spelled with initial capitals) as used in this Lease will be defined as the total floor

area constituting the Premises as measured from the unfinished outside of the exterior Building walls to the opposite unfinished outside

of like exterior Building walls. “Rentable Area of the Premises” shall also include any mezzanine space as measured

from the outside of the exterior Building walls to like outside exterior Building walls and from outside exterior Building walls to the

termination of the mezzanine deck, and all equipment closets. Tenant acknowledges that, except as otherwise expressly set forth in this

Lease, neither Landlord nor any agent, property manager or broker of Landlord has made any representation or warranty with respect to

the Premises or the Building or their suitability for the conduct of Tenant’s business.

3. Compliance with Law;

AS IS. Tenant accepts the Premises strictly on an “AS IS” basis, without any representations or warranties from Landlord,

except those set forth in Section 17.29 of this Lease. Tenant, at its sole cost and expense, agrees to comply with all applicable federal

(to the extent not in conflict with the Cannabis Laws), state and local laws, statutes, rules, regulations, requirements, codes, and

ordinances in effect, or subsequently passed into effect, as of and after the Commencement Date, including without limitation Cannabis

Laws, Environmental Laws and the Americans With Disabilities Act (collectively, “Laws”). Tenant shall comply at its

own expense with all conditions, covenants and restrictions applicable to and/or encumbering the Premises. Without limiting the generality

of the foregoing, subject to Landlord’s prior written consent as required herein, Tenant shall make any structural changes or additions

to the Premises required in order to comply with all Laws, including any requirements of Tenant’s business operations. Tenant acknowledges

that upon the Commencement Date, Landlord will have recently acquired the Property and has ownership history or knowledge regarding the

Property. With the exception of Section 17.29 of this Lease, Landlord makes no representations or warranties to Tenant, and hereby disclaims

any and all representations or warranties to Tenant concerning the Premises, including without limitation, that as of the Commencement

Date, the Premises are (a) in compliance with Laws; or (b) free from hazardous materials, including without limitation asbestos, lead

paint and polychlorinated biphenyl. “Environmental Laws” shall include, but not be limited to, the Resource, Conservation and

Recovery Act of 1976, 42 U.S.C. Section 6901, et seq.; the Comprehensive Environmental Response, Compensation and Liability Act

of 1980, 42 U.S.C. Section 9601, et seq.; the Clean Water Act, 33 U.S.C. Section 1251, et seq.; the Toxic Substance Control

Act, 15 U.S.C. Section 2601, et seq.; the Safe Drinking Water Act, 42 U.S.C. Section 201,300f to j-9 and any and all environmental

laws of the state where the Property is located and any and all amendments to such Environmental Laws. Tenant agrees to hold harmless

Landlord, and hereby waives all rights and claims of contribution against Landlord, with respect to any violations or alleged violations

of any Laws concerning the Premises, including claims that relate to periods prior to the Commencement Date.

4. Lease Term.

4.1. Lease Commencement

and Contingencies.

4.1.1. Term. The duration

of the period of this Lease (as extended by Section 4.2 below, the “Term”) shall commence on the Commencement Date.

Landlord will input the Commencement Date in Exhibit A following satisfaction of the Contingencies.

4.1.2. Contingencies.

The Parties acknowledge that as of the Effective Date, Landlord does not own fee title to the Property; however, Landlord has an equitable

interest in the Property. The obligations of Landlord and Tenant to proceed under the terms of this Lease are subject to the following

contingencies, which must be satisfied or waived in writing on or before the time periods specified below:

(i) Conditional

Use Permit. Within 180 days following the Effective Date, Landlord shall receive a final conditional use permit approval from the

City of Surprise, Arizona, for the Permitted Use at the Premises (the “CUP Contingency”).

(ii) Landlord’s

Acquisition of Premises. Within 180 days following the Effective Date, Landlord must acquire title to the Premises (the “Acquisition

Contingency”).

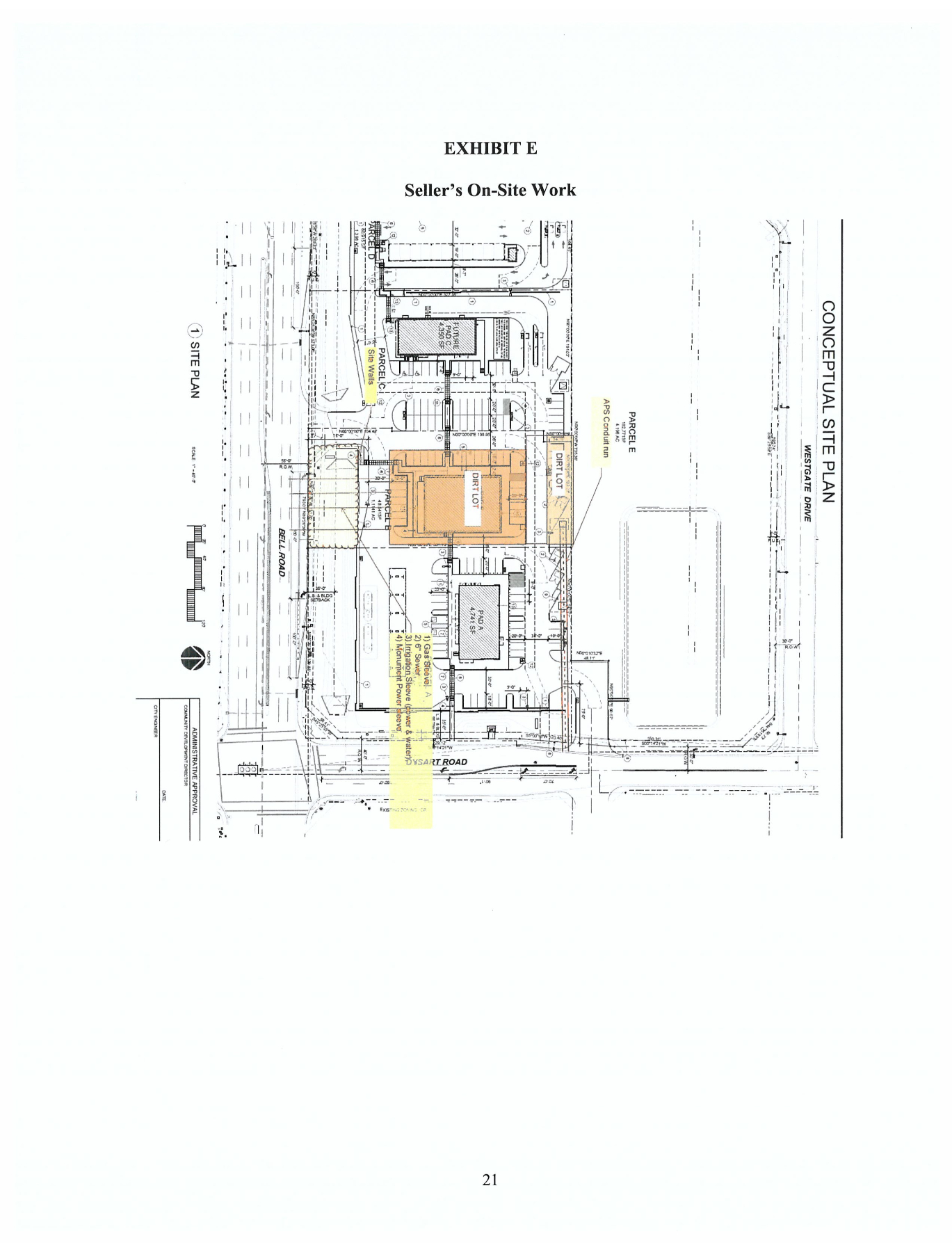

(iii) Off-Site

Improvements. Within 365 days of the Effective Date, certain off-site improvements to the Property shall be completed, as described

in more detail on Exhibit E (the “Off-Site Contingency”).

(iv) On-Site

Improvements. Within 365 days of the Effective Date, certain on-site improvements to the Property shall be completed, as described

in more detail on Exhibit F (the “On-Site Contingency”).

The foregoing contingencies in Section 4.1.2(i)-(iv)

shall be collectively referred to as the “Contingencies.” Landlord agrees to deliver written notice to the Tenant following

satisfaction of the CUP Contingency, the Acquisition Contingency, the Off-Site Contingency, and the On-Site Contingency. Once the Parties

have notice that all Contingencies have been satisfied, Landlord shall send written notice to the Tenant (such notice the “Commencement

Notice”) and the Commencement Date shall be the date that is five (5) days after the date of the Commencement Notice. Prior

to or following the Commencement Date, it is anticipated Landlord will assign all its rights, interests, and obligations in this Lease

to an affiliate of the Landlord, and the Parties acknowledge that Section 17.17 governs such assignment.

4.1.2.1. Landlord agrees to

pursue satisfaction of the Contingencies at its expense but does not make any representation or warranty as to whether the Contingencies

can be satisfied. If Landlord has not delivered a written notice to the Tenant confirming satisfaction of each of the Contingencies within

the time periods set forth in Sections 4.1.2(i)-(iv), respectively, then Tenant shall have the right to terminate this Lease by delivering

written notice to Landlord. In the event this Lease is terminated pursuant to this Section, Landlord shall promptly return to Tenant the

Security Deposit, and the Parties shall have no further obligations to each other except for those obligations that expressly survive

the termination of this Lease.

4.1.2.2. Tenant acknowledges

and agrees that Tenant is responsible, at its sole expense (subject to the Allowance), to construct the Building and all other improvements

to the Premises, with the sole exception of the off-site improvements described on Exhibit E and the on-site improvements

described on Exhibit F.

4.1.3. Tenant’s Approvals.

Starting on the Effective Date and through the Rent Commencement Date, Tenant and its agents shall use their best efforts to apply for

and obtain all the necessary approvals to operate and build a cannabis dispensary pursuant to the Permitted Use, which necessary approvals

shall include, but not be limited to, obtaining local approvals for the Permitted Use at the Premises, state approvals for the Permitted

Use at the Premises and construction permits to construct the Premises for the Permitted Use (collectively, the “Tenant Approvals”).

Tenant shall send all plans, documents, and other submittals Tenant desires to submit to the City of Surprise to obtain the Tenant Approvals

to Landlord for review and, prior to the receipt of the Landlord Approvals, Landlord shall have the right to approve or modify the plans,

documents, or other submittals Tenant has sent to Landlord for review. If Landlord does not give written notice to Tenant of its approval

or denial of any such plans, documents, or submittals within ten (10) days after Landlord’s receipt, Landlord shall be deemed to

have approved the same. To ensure clarity and for the avoidance of doubt, Tenant cannot begin any construction of the Premises until

the Commencement Date and receipt of construction permits. Within three (3) days of the date Tenant receives the Tenant Approvals, Tenant

shall give written notice to Landlord informing Landlord of Tenant receiving the Tenant Approvals.

4.1.4. Requirement to Open.

Tenant shall on or before the expiration of the Base Rent Abatement period open to the public fully fixturized, stocked and staffed and

thereafter, Tenant shall in good faith continuously throughout the Term of this Lease conduct and carry on in the entire Premises conducting

Tenant’s Use described on the Basic Lease Information and shall not conduct or carry on any other business.

4.2. Option to Extend.

Tenant shall have the option, exercisable by written notice to Landlord given not later than one hundred eighty (180) days prior to the

expiration of the then current Term, to extend the Term for four (4) further terms of five (5) years each on the same terms and conditions

as provided in this Lease, and: (a) Landlord shall have no obligation to make any improvements to the Premises; (b) For each Lease Year

during the extended Term, Base Rent for such extended Term shall be increased by three percent (3%) each Lease Year; and (c) there is

no option to further extend the Term. Notwithstanding the foregoing, any option to extend the Term shall be deemed null and void, without

the requirement of any notice and at Landlord’s discretion, if one or more of the following has occurred:

4.2.1.

Tenant has been late in the payment of Rent on three (3) or more occasions within any Lease Year;

4.2.2.

Tenant is in default in the performance of any of its obligations under this Lease at the time Tenant exercises the option to extend

or at the commencement of the extended Term;

4.2.3.

Tenant has failed to give written notice to Landlord one hundred twenty (120) days prior to the expiration of the then current

Term; or

4.2.4.

Tenant has assigned its interest in and to this Lease.

4.3. Lease Year Defined.

The “First Lease Year” means the period beginning on the Commencement Date and ending on the last day of the twelfth full calendar

month thereafter; provided, however, if the Commencement Date is not the first day of a month, then the First Lease Year shall commence

on the Commencement Date and shall continue for the balance of the month in which the Commencement Date occurs and for a period of twelve

(12) full calendar months thereafter. “Lease Year” means each successive twelve (12) month period after the First Lease Year

occurring during the Term. The First Lease Year shall also be considered a Lease Year.

5. Rent.

5.1. Base Rent. The

Base Rent shall be as set forth in Exhibit B and shall be adjusted annually as set forth in Exhibit B. Tenant

shall pay Landlord the Base Rent on the first day of each and every month, in advance, during the Term to Landlord at the address set

forth in Section 1 or at such other place as Landlord may direct in writing, without any prior notice or demand therefor

and without any abatement, deduction, offset or setoff. If the Term commences on any day other than the first day of a calendar month

and/or ends on any day other than the last day of a calendar month, Base Rent for the fraction(s) of a month at the commencement and/or

upon the expiration of the Term shall be prorated based upon the actual number of days in such fractional month(s). Notwithstanding the

foregoing, so long as there is no Event of Default by Tenant under this Lease, Landlord agrees to abate Base Rent for the time stated

in Section 1 (the “Abated Rent”). Abated Rent shall be due and payable in lump sum on Landlord’s

demand if Tenant commits or allows an Event of Default hereunder in the first twelve (12) months after the Commencement Date.

5.2. Additional Rent.

In addition to Base Rent, Tenant shall pay to Landlord all sums of money and other charges required to be paid by Tenant under this Lease

(all such sums being herein deemed “Additional Rent’’). Any Additional Rent provided for in this Lease shall become due with

the next monthly installment of Base Rent. The term “Rent” as used in this Lease, shall refer collectively to Base Rent

and Additional Rent. If, at any time, there are amounts due hereunder by Tenant, Landlord may (but shall not be obligated to) invoice

Tenant for such costs as Additional Rent, and Tenant shall pay such Additional Rent within the lesser of ten (10) days after the date

of the invoice, or the period specified for such cost in this Lease.

5.3. Late Payment and

Overdue Interest. Tenant acknowledges that late payment by Tenant of any Rent will cause Lessor to incur costs not contemplated

by this Lease, the exact amount of which will be extremely difficult to ascertain. Such costs include, but are not limited to,

processing and accounting charges, and late charges which may be imposed upon Landlord by its lender. Accordingly, if any Rent is

not received by Lessor within five (5) days after such amount is due, then, without any requirement for notice to Tenant, Tenant

shall pay to Landlord a late charge equal to 5% of such overdue amount. The Parties hereby agree that such late charge

represents a fair and reasonable estimate of the costs Landlord will incur by reason of such late payment. Acceptance of such late

charge by Landlord shall in no event constitute a waiver of any breach or default with respect to such overdue amount, nor prevent

the exercise of any of the other rights and remedies granted hereunder. In the event a late charge is payable hereunder, whether or

not collected, for two (2) installments of Base Rent during any Lease Year, then notwithstanding any provision of this Lease to the

contrary, Base Rent shall, at Landlord’s option, become due and payable quarterly in advance. Any monetary payment due to

Landlord hereunder, other than late charges, not received by Landlord when due shall bear interest from the 31st day after it was

due. The interest (“Interest” or “Overdue Rate”) charged shall be computed at the rate of 1.5% per month but

shall not exceed the maximum rate allowed by law.

5.4. Prepaid Rent. Tenant

shall pay the prepaid rent stated in Section 1, if any, within three (3) days following the Effective Date. Prepaid rent,

if any, will be held by Landlord and applied to the first month’s Base Rent following the period of Abated Rent.

5.5. Security Deposit.

On the Effective Date, Tenant shall deliver the Security Deposit in the amount stated in Section 1 to Landlord. Upon the

occurrence of any Event of Default, Landlord shall have the right to apply all or any portion of the Security Deposit toward amounts

owing under this Lease and to compensate Landlord for all damages and costs sustained by Landlord resulting from or in connection with

such Event of Default. In the event of any such application of the Security Deposit by Landlord, Tenant shall upon demand deliver to

Landlord the sum required to restore the Security Deposit to the amount set forth in Section 1. Provided that no Event

of Default exists at the expiration or termination of this Lease, Landlord shall return any remaining unapplied portion of the Security

Deposit to Tenant within thirty (30) days after the date of such expiration or termination. Landlord is not required to segregate the

Security Deposit from Landlord’s general funds and has no obligation to pay Tenant interest on the Security Deposit. In the event of

a transfer of Landlord’s interest in this Lease during the Term hereof, provided Landlord transfers the then unapplied Security Deposit

to the transferee, Landlord shall be discharged from any further liability with respect to the Security Deposit.

6. Additional Rent.

6.1. Operating

Costs. Tenant shall pay directly, or to Landlord, as applicable, all Operating Costs (defined below) of the Property in a timely

manner and prior to delinquency. In the event Tenant fails to pay any Operating Cost within ten (10) days after written notice by

Landlord to Tenant, and without being under any obligation to do so and without waiving any default by Tenant, Landlord may pay any

delinquent Operating Costs. Any Operating Cost paid by Landlord and any expenses reasonably incurred by Landlord in connection with

the payment of the delinquent Operating Cost, together with interest thereon at the Overdue Rate from the date paid by Landlord

until the date repaid by Tenant, may be billed immediately to Tenant, or at Landlord’s option and upon written notice to Tenant, may

be deducted from the Security Deposit. “Operating Costs” means all costs and expenses relating to the ownership,

maintenance and operation of the Property including, but not limited to: insurance, maintenance, repair and replacement of the

foundation, roof, walls, heating, ventilation, air conditioning, plumbing, electrical, mechanical, utility and safety systems,

paving and parking areas, roads and driveways; maintenance, repair and replacement of exterior areas such as gardening and

landscaping, snow removal and signage; maintenance, repair and replacement of roof membrane, flashings, gutters, downspouts, roof

drains, skylights and waterproofing; painting; lighting; cleaning; refuse removal; security; utilities for, or the maintenance of,

outside areas; building personnel costs; asset, property or administrative management fees incurred or attributable to the

management of the Property; the costs, expenses, charges and assessments related to or arising from any covenants, conditions and

restrictions affecting the Premises, or other matters of record; rentals or lease payments paid by Landlord for rented or leased

personal property used in the operation or maintenance of the Premises; and fees for required licenses and permits. The terms

“Operating Costs” and “Additional Rent” shall not include any costs and expenses relating to the off-site

improvements described on Exhibit E, the on-site improvements described on Exhibit F, or any off-site

improvements related to or arising from any covenants, conditions and restrictions affecting the Premises.

6.2. Real Property Taxes.

From and after the Commencement Date, subject to terms and conditions of this Section 6.1, Tenant shall be responsible for and shall

pay prior to delinquency, all Real Property Taxes. Landlord and Tenant agree to use commercially reasonable efforts to cause the tax

assessor having jurisdiction over the Property to issue duplicate (or, if duplicate is not feasible, then separate) property tax bills

to Landlord and Tenant, provided that if duplicate or separate tax bills are not issued by the tax assessor, the property tax bills shall

be sent to Tenant. Tenant shall not be obligated to pay for the following (referred to as the “Excluded Taxes”): any income

taxes imposed on Landlord (it being understood that any sales taxes or similar taxes on the Rent and other proceeds received by Landlord

under this Lease shall be the responsibility of Tenant).

6.3. Real Property Taxes

– Defined. “Real Property Taxes” means all real estate taxes, leasehold excise taxes and all other taxes relating

to the Building and the Premises, all other taxes which may be levied in lieu of real estate taxes, all assessments, local improvement

districts, assessment bonds, levies, fees and other governmental charges, including, but not limited to, charges for traffic facilities

and improvements, water service studies, and improvements or amounts necessary to be expended because of governmental orders, whether

general or special, ordinary or extraordinary, unforeseen as well as foreseen, of any kind and nature for public improvements, services,

benefits, or any other purpose, which are assessed, levied, confirmed, imposed or become a lien upon the Building or any portion of the

Premises, or become payable during the Term (or which become payable after the expiration or earlier termination hereof and are attributable

in whole or in part to any period during the Term hereof), together with all costs and expenses incurred by Landlord in contesting, resisting

or appealing any such taxes, rates, duties, levies or assessments. Real Property Taxes exclude any franchise, estate, inheritance or

succession transfer tax of Landlord, or any federal or state income, profits or revenue tax or charge upon the net income of Landlord

from all sources; provided, however, if at any time during the Term there is levied or assessed against Landlord a federal, state or

local tax or excise tax on rent, or any other tax however described on account of rent or gross receipts or any portion thereof, Tenant

shall pay those taxes to Landlord as Additional Rent.

6.4. Personal Property Taxes.

Tenant shall pay, prior to delinquency, all taxes and assessments levied upon all personal property of Tenant, including trade fixtures,

inventories and other real or personal property placed or installed in and upon the Premises by Tenant (collectively, “Personal

Property Taxes”). If any such taxes on Tenant’s personal property or trade fixtures are levied against Landlord or Landlord’s

property or if the assessed value of the Premises is increased by the inclusion therein of a value placed upon such real or personal

property or trade fixtures of Tenant, and if Landlord pays the taxes based upon such increased assessment, Tenant shall, upon demand,

repay to Landlord the taxes so levied or the portion of such taxes reusing from such increase in the assessment. Tenant shall deliver

to Landlord reasonable documentation evidencing Tenant’s compliance with the foregoing payment obligations.

6.5. Rental Taxes. In

addition to Base Rent, Tenant shall pay Landlord all transaction privilege, sales, rental, excise, use, and/or other taxes levied upon

or assessed against Landlord by any governmental authority having jurisdiction, which are measured by the Rent or other charges in any

form paid by Tenant to Landlord (collectively with the Real Property Taxes and Personal Property Taxes, the “Taxes”).

The amount required to be paid by Tenant to Landlord pursuant to the immediately preceding sentence shall be paid at the time the applicable

Rent is due or other charges are due.

6.6. Payment of Delinquent

Taxes. If Tenant is delinquent in the payment of any Taxes it is obligated to pay prior to delinquency, Landlord may, in its sole

discretion, pay such delinquent amounts, including any interest or penalties due thereon, on behalf of Tenant. To the extent that Landlord

has paid such amounts on behalf of Tenant, the aggregate amount thereof plus interest thereon at the Overdue Rate, from the date of Landlord’s

payment thereof to the date of Tenant’s payment to Landlord, shall be immediately due and payable to Landlord by Tenant and shall

constitute Additional Rent.

6.7. Estimated Payments.

At Landlord’s option, Tenant shall pay to Landlord each month together with payment of Base Rent one-twelfth (1/12) of Landlord’s

reasonable estimate of the annual total of Operating Costs, Taxes, and other charges payable by Tenant to Landlord or a third party under

this Lease.

7. Insurance.

7.1. Tenant’s Insurance.

Tenant shall, at its own cost and expense, keep and maintain in full force during the Term and any other period of occupancy of the Premises

by Tenant, the following types of insurance with insurance companies approved to engage in business in the State of Arizona, and reasonably

approved by Landlord, in the amounts specified and in the form provided below:

7.1.1.

Property, fire, casualty and extended coverage, all risk, insurance on and for the entire Premises and on Tenant’s fixtures, improvements

and other property for not less than the full replacement value, together with business interruption coverage, as Landlord may reasonably

require. Such policy shall contain an agreed amount endorsement in lieu of a coinsurance clause. Landlord, at its option, may, from time

to time, elect to maintain fire, casualty and extended coverage, all risk, insurance on the Premises for not less than the full replacement

value, in which event Tenant shall reimburse Landlord for the costs and expenses of such Landlord insurance no later than five (5) days

after Tenant’s receipt of Landlord’s invoice for such costs and expenses.

7.1.2.

Commercial liability insurance insuring Tenant against any liability arising out of the lease, use, occupancy or maintenance of

the Premises and all areas appurtenant thereto or business operated by Tenant pursuant to the Lease, including that from personal injury

or property damage in or about the Premises, insuring Landlord, and any designated mortgagee of Landlord, and Tenant, and naming Landlord

and any designated mortgagee of Landlord as an additional insured therein. Such insurance shall be in the minimum amounts of not less

than $1,000,000 per occurrence against liability for bodily injury including death and personal injury for any single (1) occurrence and

not less than $1,000,000 per occurrence for property damage, or combined single limit insurance insuring for bodily injury, death and

property damage in an amount of not less than $2,000,000.00. The policy shall insure the hazards of the Premises and Tenant’s operations

therein, shall include independent contractor and contractual liability coverage (covering the indemnity contained in Section 7.06 hereof)

and shall (a) name Landlord and Landlord’s mortgagee under a mortgage or beneficiary under a deed of trust either having a first lien

against the Premises (the “Lender”) as an additional insured; (b) contain a cross-liability provision; and (c) contain a provision

that the insurance provided hereunder shall be primary and non-contributing with any other insurance available to Landlord.

7.1.3.

Workers’ compensation insurance for the benefit of all employees entering upon the Premises as a result of or in connection with

the employment by Tenant.

7.1.4.

Such other forms of insurance as may be reasonably required by Landlord to cover future risks against which a reasonably prudent

Landlord or Tenant would protect itself.

7.2. Form of Insurance Certificates.

All policies shall be written in a form satisfactory to Landlord and shall be written by insurance companies licensed with a Best’s

rating and Financial Size Category Rating of “A-” and authorized to do business in the state in which the Property is situated.

Tenant shall furnish to Landlord, prior to Tenant’s entry into the Premises and thereafter within thirty (30) days prior to the expiration

of each such policy (or renewal thereof), a certificate of insurance issued by the insurance carrier of each policy of insurance carried

by Tenant pursuant hereto, together with a copy of the policy declaration page(s), certifying that such policy(ies) has been issued,

provides coverage required by this Section 7 (including name of additional insured entities as required by this Section 7 and a statement

that no deductible or self-insurance retention applies to such policy and upon request by Landlord, a copy of each such policy of insurance.

7.3. Tenant’s Failure.

If Tenant fails to maintain any insurance required in this Lease, Tenant shall be liable for any loss or cost resulting from said failure,

and Landlord shall have the right to obtain such insurance on Tenant’s behalf and at Tenant’s sole expense, the cost of which, plus a

ten percent (10%) administrative fee, shall be deemed Additional Rent and shall be payable upon Landlord’s demand. This Section

7.3 shall not be deemed to be a waiver of any of Landlord’s rights and remedies under any other Section of this Lease. If Landlord obtains

any insurance, which is the responsibility of Tenant to obtain under this Section 7, Landlord agrees to deliver to Tenant a written statement

setting forth the cost of any such insurance and any administrative fee charged as provided for under this Section of this Lease.

7.4. Waiver of Subrogation.

Each policy evidencing insurance required to be carried by Tenant pursuant to this Section 7 shall contain the following clauses and

provisions: (i) that such policy and the coverage evidenced thereby shall be primary and non-contributing with respect to any policies

carried by Landlord and that any coverage carried by Landlord be excess insurance; (ii) including Landlord and the parties set forth

in Section 7 of this Lease and any other parties designated by Landlord from time to time as additional insured entities; (iii) a waiver

by the insurer of any right to subrogation against Landlord and other additional insured entities, its or their agents, employees and

representatives which arises or might arise by reason of any payment under such policy(ies) or by reason of any act or omission of Landlord,

its agents, employees or representatives; (iv) a severability of interest clause or endorsement; and (v) that the insurer will not cancel

or change the coverage provided by such policy without giving Landlord thirty (30) days’ prior written notice. Any policy of insurance

required to be carried by Tenant that names the parties set forth in this Section 7 as additional insured entities shall not be subject

to a deductible or self-insured retention, it being the intent of the parties that such insurance shall fully and completely insure such

additional insured entitles for all loss or expense.

7.5. Tenant’s Properties

and Fixtures. Tenant assumes the risk of damage, destruction, theft and loss to any furniture, equipment, machinery, goods, supplies

or fixtures which are or remain the property of Tenant. Tenant shall not do or keep anything unreasonable or outside the usual course

of Tenant’s business in or about the Premises, which will in any way tend to increase insurance rates. In no event shall Tenant

carry on any activities, which would invalidate any insurance coverage maintained by Landlord or Tenant. If Tenant’s occupancy or business

in, or on, the Premises, whether or not Landlord has consented to the same, results in any increase in premiums for any insurance with

respect to the Premises, Tenant shall pay any such increase in premiums as Additional Rent within ten (10) days after being billed by

Landlord. Tenant shall promptly comply with all reasonable requirements of the insurance underwriters and/or any governmental authority

having jurisdiction there over, necessary for the maintenance of reasonable fire and extended insurance for the Premises.

7.6. Indemnification.

7.6.1. Tenant Indemnification

of Landlord. For purposes of this Lease, “Indemnified Parties” means Landlord, its owners, shareholders, partners,

members, directors, officers, employees, and agents. For purposes of this Lease, “Claims” means any claims, demands,

causes of action, suits, proceedings, debts, liens, obligations, liabilities, damages, losses, judgments, orders, penalties, fines, settlements,

costs, and expenses (including reasonable attorneys’ fees and related costs). Subject to the insurance provisions and waiver of

subrogation in Section 7 of this Lease, and except to the extent a Claim results from the negligence, willful misconduct, or bad faith

of Landlord, Tenant shall defend, indemnify, and hold Landlord and the Indemnified Parties harmless from and against all Claims arising

during the Term and directly arising from each of the following:

(i)

Any accident, injury, or damage to any person or to the property of any person occurring within the Premises.

(ii) Any accident, injury or

damage to any person or to the property of any person occurring outside of the Premises but within the Property, where the accident,

injury, or damage results from a negligent or willful act of Tenant.

(iii) A breach or violation

by Tenant of any laws relating to the Premises.

(iv) A breach or

nonperformance by Tenant of any covenant, condition, or agreement in this Lease.

7.6.2. Indemnity Procedures.

If any Claim is made or brought against an Indemnified Party under this Section 7.6, upon demand by the Indemnified Party, the Tenant

shall defend the Claim at its sole cost and expense. Tenant shall engage attorneys subject to the reasonable approval of the Indemnified

Party, provided that attorneys appointed by Tenant’s insurer are hereby deemed approved. Tenant may direct an Indemnified Party

to settle, compromise or dispose of any and all Claims related to the foregoing indemnity, subject to the prior written approval of Landlord,

which approval shall not be unreasonably withheld.

7.7. Damage to Tenant’s

Property. Notwithstanding the provisions of Section 7.6. to the contrary, except to the extent due to the gross negligence or willful

misconduct of Landlord, Landlord, its agents, employees and/or contractors shall not be liable for (i) any damage to property entrusted

to employees or security officers of the Premises, (ii) loss or damage to any property by theft or otherwise, or (iii) any injury or

damage to persons or property resulting from fire, explosion, falling substances or materials, steam, gas, electricity, water or rain

which may leak from any part of the Premises or from the pipes, appliances or plumbing work therein or from the roof, street, or subsurface

or from any other place or resulting from dampness or any other cause. Neither Landlord nor its agents, employees or contractors shall

be liable for interference with light. Tenant shall give prompt notice to Landlord and appropriate emergency response officials if Tenant

is or becomes aware of fire or accidents in the Premises or of defects therein in the fixtures or equipment.

8. Repairs and Maintenance;

Utilities; Non-Liability of Landlord; Inspection.

8.1. Repairs and Maintenance.

Tenant shall, at its own cost and expense, maintain the structural and non-structural portions of the Premises, including the parking

areas and vacant land areas, in good and tenantable condition consistent with a first class retail premises and otherwise in compliance

with all applicable federal, state and local laws, rules, regulations, orders and guidelines now or hereafter in force, and make all

repairs to the Premises and every part thereof as needed. Tenant’s obligations under this Section shall include, but not be limited to,

modifying, repairing, replacing, installing and maintaining, as applicable, the following: items as are required by any governmental

agency having jurisdiction thereof (whether the same is ordinary or extraordinary, foreseen or unforeseen); the roof, exterior walls,

structural columns and structural floor or floors of the Premises in good condition; interior walls and glass; the interior portions

of exterior walls; ceilings; utility meters exclusively serving the Premises (including those outside the Premises if they exclusively

serve the Premises); pipes and conduits within the Premises exclusively serving the Premises; all pipes and conduits outside the Premises

exclusively serving the Premises between the Premises and the service meter; all fixtures; heating, ventilating and air conditioning

(“HVAC”) system exclusively serving the Premises (including all components thereof whether located inside or outside

the Premises); sprinkler equipment and other equipment within the Premises exclusively serving the Premises; the storefront and all exterior

glass; all of Tenant’s signs (both interior and exterior); locks and closing devices; all window sashes, casements or frames, doors and

door frames; and any alterations, additions or changes performed by or on behalf of Tenant (whether structural or non-structural); provided

that Tenant shall make no adjustment, alteration or repair of any part of any sprinkler or sprinkler alarm system in or serving the Premises

without Landlord’s prior approval.

8.2. Utilities. Tenant

shall arrange for all on-site utilities to be furnished to the Premises, including lines for water, electricity, sewage and telephone.

Tenant shall pay before delinquency, at its sole cost and expense, all charges for on-site water, heat, electricity, power, telephone

service, sewer service and other utilities or services charged or attributable to the Premises; provided, however, that if any such services

or utilities shall be billed to Landlord, Tenant shall pay to Landlord as Additional Rent, an amount equal to such costs. Tenant shall

not be responsible for the construction or payment of any off-site infrastructure or utility costs or charges.

8.3. Non-Liability of Landlord.

Notwithstanding anything to the contrary contained in this Lease, Landlord shall not be in default hereunder or be liable for any damages

directly or indirectly resulting from, nor shall the Rent herein reserved be abated or rebated by reason of (a) the interruption or curtailment

of the use of the Premises; or (b) any failure to furnish or delay in furnishing any services required to be provided by Landlord, unless

and to the extent such failure or delay is caused by any condition created solely by Landlord’s gross negligence; or (c) the limitation,

curtailment, rationing or restriction of the use of water or electricity, gas or any other form of energy or any other service or utility

whatsoever serving the Premises.

8.4. Inspection of Premises.

Subject to the Cannabis Laws and twenty-four (24) hours’ notice provided by Landlord to Tenant, Landlord may enter the Premises

to inspect, clean, improve or repair the same, to inspect the performance by Tenant of the terms and conditions hereof, show the Premises

to prospective purchasers, tenants and lenders and for all other purposes as Landlord shall reasonably deem necessary or appropriate;

provided, that Landlord shall use reasonable efforts not to unreasonably interfere with Tenant’s business in exercise of Landlord’s rights

hereunder. Tenant hereby waives any claim for damages for any injury or inconvenience to or interference with Tenant’s business, any

loss of occupancy or quiet enjoyment of the Premises and any other loss in, upon or about the Premises, arising from exercise by Landlord

of its rights hereunder.

9. Tenant’s Work,

Allowance, Fixtures, Personal Property and Alterations.

9.1. Tenant’s Work.

Tenant shall cause its architect and/or engineer to prepare “Tenant’s Plans” for the initial improvements to

be constructed on the Premises by Tenant for Landlord’s review and commercially reasonable approval, which approval shall not be

unreasonably withheld, conditioned or delayed. If Tenant’s Plans are not approved or rejected within ten (10) business days of

delivery, Tenant’s Plans shall be deemed approved. Once the Tenant’s Plans are approved (“Tenant’s Approved

Plans”), the improvements to be constructed in accordance therewith are referred to herein as the “Initial Improvements”.

Following the preparation and approval of Tenant’s Approved Plans, Tenant, at its sole cost and expense, subject to the Allowance

(defined below), shall construct the Initial Improvements in a good and workmanlike manner substantially in accordance with Tenant’s

Approved Plans (“Tenant’s Work”), and obtain all necessary permits in connection with Tenant’s Work. Prior

to the commencement of the Initial Improvements, Tenant shall deliver to Landlord the contractor’s name, state license number, a certificate

of liability insurance naming Landlord and, at Landlord’s option, Landlord’s mortgagee as an additional insured. Landlord’s

consent or comments on any such plans shall not be deemed an express or implicit covenant or warranty that any plans or specifications

submitted by Tenant are accurate, safe or sufficient or that the same comply with any laws, ordinances, or building codes. Tenant will,

during the Term of this Lease, indemnify, protect, defend and hold Landlord and the Indemnified Parties (defined above), and the Premises

harmless for, from and against any loss, damage, liability, claims, cost or expense, including attorneys’ fees and costs, incurred as

a result of any defects in design, materials or workmanship resulting from Tenant’s Work or any other alterations, improvements, or modifications

to the Premises. Notwithstanding anything to the contrary herein, Tenant shall be responsible at Tenant’s sole cost and expense

for all work, construction and installation in the Premises (including but not limited to all Tenant’s Work and all fixtures, furniture,

equipment and other office installations), subject to the Allowance. For the avoidance of doubt, and to ensure clarity, this Lease is

a ground lease and Tenant shall be responsible for constructing the Building on the Property as part of the Initial Improvements. The

Building and all other affixed improvements and structures on the Property shall become the property of Landlord at the end of the Lease.

9.2. Allowance. Subject

to the terms and conditions of this Section, Landlord shall provide Tenant with an allowance of up to One Million Dollars ($1,000,000.00)

(the “Allowance”). The Allowance may be used for Tenant’s Work, which may include, but not be limited to, hard

and soft costs associated with Tenant’s Work to build the Building, and may include furniture, fixtures, equipment in the Premises.

Tenant shall be responsible for all costs of Tenant’s Work in excess of the Allowance. Subject to the terms and conditions of this

Section, and so long as there is no default ongoing beyond any notice and/or cure period, partial payments of the Allowance provided

by Landlord shall be made to Tenant within thirty (30) days of Tenant submitting to Landlord evidence of each payment made to Tenant’s

general contractor with: (i) a commercially reasonable breakdown of the Tenant’s Work included in the payment and (ii) a Form W-9,

Request for Taxpayer Identification Number and Certification, executed by Tenant. The first twenty seven percent (27%) of the Allowance

owed to Tenant shall be withheld by Landlord until completion of the building improvements on the Property, and Landlord’s obligation

to disburse the first twenty seven percent (27%) of the Allowance is expressly conditioned upon receipt of the following “Allowance

Deliverables”: (i) Tenant has furnished to Landlord a copy of a commercially reasonably detailed final cost breakdown for Tenant’s

Work and Landlord has inspected the Premises to confirm that Tenant’s Work has been completed in a good and workmanlike manner

according to the Tenant’s Approved Plans; (ii) Tenant has furnished to Landlord commercially reasonable final affidavits and final

lien releases from Tenant’s general contractor, if any, all subcontractors and all material suppliers for all labor and materials performed

or supplied as part of Tenant’s Work (whether or not the Allowance is applicable thereto); and (iii) a copy of the certificate of occupancy

from the governmental authority having jurisdiction has been delivered to Landlord.

9.3. Fixtures and Personal

Property. Tenant, at Tenant’s expense, may install any necessary trade fixtures, equipment and furniture in the Premises, provided

that such items are installed and are removable without damage to the structure of the Premises, including, but not limited to, damage

to drywall, doors, door frames and floors. Landlord reserves the right to approve or disapprove of any interior improvements over Fifty

Thousand Dollars ($50,000.00). Said trade fixtures, equipment, furniture, cabling and personal property shall remain Tenant’s property

and shall be maintained in good condition while on the Premises and removed by Tenant upon the expiration or earlier termination of the

Lease. As a covenant which shall survive the expiration or earlier termination of this Lease, Tenant shall repair, at Tenant’s sole expense,

or at Landlord’s election, reimburse Landlord for the cost to repair all damage caused by the installation, use, or removal of said trade

fixtures, equipment, cabling, furniture, personal property or temporary improvements. If Tenant fails to remove any items required by

Landlord prior to or upon the expiration or earlier termination of this Lease, Landlord, at its option and without liability to Tenant,

may keep and use them or remove any or all of them and cause them to be stored or sold in accordance with applicable Laws, and Tenant

shall, upon demand of Landlord, pay to Landlord as Additional Rent hereunder all costs and expenses incurred by Landlord in so storing

and/or selling said items. In the event any such fixtures, equipment, and/or furniture of Tenant are sold by Landlord, the proceeds of

such sale shall be applied, first, to all expenses of Landlord incurred in connection with storage and sale; second, to any amounts owed

by Tenant to Landlord under this Lease or otherwise, and, third, the remainder, if any, shall be paid to Tenant.

9.4. Alterations. After

the Initial Improvements are complete, except for non-structural improvements and alterations in the aggregate amount of $50,000.00 or

less per improvement, Tenant shall not make or allow to be made any alterations, additions or improvements (“Alterations”)

to the Premises without obtaining the prior written consent of Landlord, in Landlord’s sole discretion. Tenant shall deliver to

Landlord the contractor’s name, state license number, a certificate of liability insurance naming Landlord and, at Landlord’s

option, Landlord’s Lender(s) as an additional insured, as well as full and complete plans and specifications of all such Alterations

and any subsequent modifications or additions to such plans and specifications, and no proposed work shall be commenced or continued

by Tenant until Landlord has received and given its written approval of each of the foregoing. Landlord shall either approve or disapprove

any proposed Alteration within thirty (30) days following receipt of all of the foregoing items, and if Landlord fails to deliver notice

of disapproval within thirty (30) days following receipt of all the foregoing items, Landlord’s consent is deemed granted. Landlord’s

consent or comments on any such plans shall not be deemed an express or implicit covenant or warranty that any plans or specifications

submitted by Tenant are accurate, safe or sufficient or that the same comply with any Laws, ordinances, or building codes. Tenant will

indemnify, protect, defend and hold Landlord and the Indemnified Parties, and the Premises harmless for, from and against any loss, damage,

liability, claims, cost or expense, including attorneys’ fees and costs, incurred as a result of any defects in design, materials

or workmanship resulting from Tenant’s Alterations to the Premises. All Alterations which are not permanently affixed to the Premises

shall remain the property of Tenant, unless otherwise agreed in writing. At the expiration or termination of the Lease, Landlord may

require Tenant to remove any partitions, counters, railings, telephone and telecommunications lines, cables, conduits and equipment and/or

other improvements installed by Tenant, and Tenant shall repair all damage resulting from such removal or shall pay to Landlord all costs

arising from such removal if Landlord demands the removal of such improvements upon expiration or termination of this Lease and Tenant

fails to remove and repair the Premises prior to Tenant’s vacation thereof. All Alterations shall be done in a good and workmanlike

manner and in compliance with the plans and specifications approved by Landlord and in compliance with all applicable Laws and as-built

plans and specifications shall be provided to Landlord by Tenant upon completion of the work. If required by Landlord, Tenant shall secure

at Tenant’s own cost and expense a completion and lien indemnity bond or other adequate security, in form and substance reasonably

satisfactory to Landlord. Tenant shall reimburse Landlord for Landlord’s reasonable charges (including any professional fees incurred

by Landlord and a reasonable administrative fee as established by Landlord from time to time) for reviewing and approving or disapproving

plans and specifications for any proposed Alterations.

9.5. Liens. Tenant shall

promptly file and/or record, as applicable, all notices of completion provided for by law, and shall pay and discharge all claims for

work or labor done, supplies furnished or services rendered at the request of Tenant or at the request of Landlord on behalf of Tenant,

and shall keep the Premises free and clear of all contractor’s, mechanics’, materialmen’s and worker’s liens in connection

therewith. Landlord shall have the right, and shall be given ten (10) business days written notice by Tenant prior to commencement of

the work, to post or keep posted on the Premises, or in the immediate vicinity thereof, any notices of non-responsibility for any construction,

alteration, or repair of the Premises by Tenant. If any such lien or notice preceding the filing of any lien is filed, Tenant shall cause

same to be discharged of record within ten (10) days thereof. If said lien or potential encumbrance is not timely discharged by Tenant,

Landlord may, but shall not be required to, take such action or pay such amount as may be necessary to remove such lien and Tenant shall

pay to Landlord as Additional Rent any such amounts expended by Landlord, together with Interest thereon within ten (10) days after notice

is received from Landlord of the amount expended by Landlord.

10. Use and Compliance with

Applicable Laws.

10.1. Use of Premises and

Compliance. Tenant shall only use the Premises for the purposes described in Section 1 above, and uses customarily incidental thereto,

and for no other use without the prior written consent of Landlord. Tenant shall, at Tenant’s sole cost and expense, comply with applicable

Laws pertaining to Tenant’s business operations, alterations and/or specific use of the Premises. In connection with the immediately

preceding sentence, Tenant and Landlord acknowledge their belief that this Lease of the Premises for the intended use relates to activities

that they have been advised are lawful under the laws of the State ofArizona, yet not lawful under the laws of the United States.

10.2. Hazardous Materials.

“Hazardous Materials” means, among other things, any of the following, in any amount: (a) any petroleum or petroleum

derived or derivative product, asbestos in any form, urea formaldehyde and polychlorinated biphenyls and medical wastes; (b) any radioactive

substance; (c) any toxic, infectious, reactive, corrosive, ignitable or flammable chemical or chemical compound; and (d) any chemicals,

materials or substances, whether solid, liquid or gas, defined as or included in the definitions of “hazardous substances,”

“hazardous wastes,” “hazardous materials,” “extremely hazardous wastes,” “restricted hazardous wastes,”

“toxic substances,” “toxic pollutants,” “solid waste,” or words of similar import in any federal, state or

local statute, law, ordinance or regulation or court decisions now existing or hereafter existing as the same may be interpreted by government

offices and agencies. “Hazardous Materials Laws” means any federal, state or local statutes, laws, ordinances or regulations

or court decisions now existing or hereafter existing that control, classify, regulate, list or define Hazardous Materials or require

remediation of Hazardous Materials contamination.

10.2.1. Compliance. Tenant

will not cause any Hazardous Material to be brought upon, kept, generated or used on the Property or Premises in a manner or for a purpose

prohibited by or that could result in liability under any Hazardous Materials Law; provided, however, in no event shall Tenant allow

any Hazardous Material to be brought upon, kept, generated or used on the Property or Premises other than those Hazardous Materials for

which Tenant has received Landlord’s prior written consent to bring on (other than small quantities of cleaning or other/industrial supplies

as are customarily used by a Tenant in the ordinary course of business). Tenant, at its sole cost and expense, will comply with (and

obtain all permits required under) all Hazardous Materials Laws, groundwater wellhead protection laws, storm water management laws, fire

protection provisions, and prudent industry practice relating to the presence, storage, transportation, disposal, release or management

of Hazardous Materials in, on, under or about the Premises or Premises that Tenant brings upon, keeps, generates or uses in the Premises

or on the Property (including, without limitation, but subject to this Section 10.2, immediate remediation of any Hazardous Materials

in, on, under or about the Property or Premises that Tenant brings upon, keeps, generates or uses on the Property or Premises in compliance

with Hazardous Materials Laws) and in no event shall Tenant allow any liens or encumbrances pertaining to Tenant’s use of Hazardous Materials

to attach to any portion of the Property or Premises. On or before the expiration or earlier termination of this Lease, Tenant, at its

sole cost and expense, will completely remove from the Premises or, as applicable, the Property (regardless whether any Hazardous Materials

Law requires removal), in compliance with all Hazardous Materials Laws, all Hazardous Materials Tenant causes to be present in, on, under

or about the Premises or the Property. Tenant will not take any remedial action in response to the presence of any Hazardous Materials

in on, under or about the Premises or the Property, nor enter into (or commence negotiations with respect to) any settlement agreement,

consent decree or other compromise with respect to any claims relating to or in any way connected with Hazardous Materials in, on, under

or about the Premises or the Property, without first notifying Landlord of Tenant’s intention to do so and affording Landlord reasonable

opportunity to investigate, appear, intervene and otherwise assert and protect Landlord’s interest in the Premises or the Property. Landlord

shall have the right from time to time to inspect the Premises or Property to determine if Tenant is in compliance with this Section

10.2.

10.2.2. Notice of Actions.

Tenant will notify Landlord of any of the following actions affecting Landlord, Tenant or the Premises or the Property that result from

or in any way relate to Tenant’s use of the Premises or the Property immediately after receiving notice of the same: (i) any enforcement,

cleanup, removal or other governmental or regulatory action instituted, completed or threatened under any Hazardous Materials Law; (ii)

any claim made or threatened by any person relating to damage, contribution, liability, cost recovery, compensation, loss or injury resulting

from or claimed to result from any Hazardous Material; and (iii) any reports made by any person, including Tenant, to any environmental

agency relating to any Hazardous Material, including any complaints, notices, warnings or asserted violations. Tenant will also deliver

to Landlord, as promptly as possible and in any event within five (5) business days after Tenant first receives or sends the same, copies

of all claims, reports, complaints, notices, warnings or asserted violations relating in any way to the Premises or the Property or Tenant’s

use of the Premises or the Property. Upon Landlord’s written request, Tenant will promptly deliver to Landlord documentation acceptable

to Landlord reflecting the legal and proper disposal of all Hazardous Materials removed or to be removed from the Premises or Property.

All such documentation will list Tenant or its agent as a responsible party and the generator of such Hazardous Materials and will not

attribute responsibility for any such Hazardous Materials to Landlord or Landlord’s property manager.

10.2.3. Disclosure. Tenant

acknowledges and agrees that all reporting and warning obligations required under Hazardous Materials Laws resulting from or in any way

relating to Tenant’s use of the Premises or Project are Tenant’s sole responsibility, regardless whether the Hazardous Materials Laws

permit or require Landlord to report or warn.

10.2.4. Indemnification for

Environmental Liability. Tenant releases and will indemnify, defend , protect and hold harmless the Landlord and the Indemnified

Parties for, from and against any and all claims, liabilities, damages, losses, costs and expenses arising or resulting, in whole or

in part, directly from the presence, treatment, storage, transportation, disposal, release or management of Hazardous Materials in, on,

under, upon or from the Premises or the Property (including water tables and atmosphere). Tenant’s obligations under this Section include

(i) the costs of any required or necessary repair, cleanup, detoxification or decontamination of the Premises or the Property; (ii) the

costs of implementing any closure, remediation or other required action in connection therewith as stated above; (iii) the value of any

loss of use and any diminution in value of the Premises or the Property, and (iv) consultants’ fees, experts’ fees and response costs.

The Tenant’s obligations under this section survive the expiration or earlier termination of this Lease.

10.3. Signs.

Tenant shall not paint, display, inscribe, place or affix any sign, picture, advertisement, notice, lettering, or direction on any part

of the outside of the Building or visible from the outside of the Premises, except as first approved by Landlord in writing. All signage

shall comply with Landlord’s sign criteria as adopted and promulgated by Landlord from time to time, and with any declaration or

covenants, conditions and restrictions affecting the Premises, and with all Laws.

10.4. Sales

Reporting.

10.4.1. Gross

Sales – Defined. The term “Tenant’s Gross Sales” means the gross proceeds from business done in or from the

Premises, including but not limited to, the entire sales price of products sold (including gift and certificates), charges for services

or rentals, deposits not refunded to customers, the entire sales price of product sold as a result of orders taken at the Premises but

delivered elsewhere, and the entire sales price of products delivered from the Premises as a result of orders taken elsewhere. The gross

proceeds from business done by any vending machines or other devices located in the Premises (including proceeds from ATMs within the

Premises) and gross proceeds from business done in or from the Premises with employees shall also be a part of Tenant’s Gross Sales.

An installment sale or a sale on credit shall be treated as a sale at the full sales price in the month during which such sale is made.

No deduction from Tenant’s Gross Sales shall be allowed for uncollectible credit accounts. Tenant’s Gross Sales shall not

be deemed to include any sums collected from customers and paid out for a sales or excise tax imposed by any duly constituted governmental

authority if the amount of such tax is separately charged to the customer and paid by Tenant directly to or for the benefit of the governmental

authority.

10.4.2. Sales

Reports. On or before the fifteenth (15th) day of the month following each calendar quarter during the Term, Tenant shall prepare

and deliver to Landlord a statement of Tenant’s Gross Sales signed by Tenant for the preceding calendar quarter, which statement

shall be provided as an accommodation to Landlord. In addition, within thirty (30) days after the expiration of each calendar year, Tenant

shall prepare and deliver to Landlord a statement of Tenant’s Gross Sales during such calendar year certified to be correct by Tenant,

and if requested by Landlord, an independent Certified Public Accountant.

10.5. Financial