UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

1-A

(Amendment No. 2)

REGULATION

A OFFERING CIRCULAR

UNDER

THE SECURITIES ACT OF 1933

| Nevada |

|

7389 |

|

45-5192997 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

4700

Spring Street, Suite 304, La Mesa, California, 91942

(619)

722-5505

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Attn:

David R. Koos

Chief

Executive Officer

REGEN

BIOPHARMA, INC.

4700

Spring Street, Suite 304

La

Mesa, CA 91942

Tel:

619-702-1404

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

As

submitted to the Securities and Exchange Commission on October 28, 2024

An

offering statement pursuant to Regulation A+ relating to these securities has been filed with the United States Securities and Exchange

Commission (the “SEC”). Information contained in this Preliminary Offering Circular is subject to completion or amendment.

These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the SEC is qualified. This

Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales

of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under

the laws of any such state.

| OFFERING

CIRCULAR |

ACCREDITED

INVESTORS ONLY |

REGEN

BIOPHARMA, INC.

Up

to 10,000,000 Shares of Common Stock

Offering

under Tier I of Regulation A+ of the Securities and Exchange Commission

10,000,000

Shares of Common Stock, $0.0001 Par Value,

Offering

Amount: A Maximum of $400,000

Price:

$0.04 per share of Common Stock

Minimum

Purchase Amount: 0

Sales

will be made to Accredited Investors Only

You

may only rely on the information contained in this Offering Circular or that we have referred you to. We have not authorized anyone to

provide you with different information. This Offering Circular does not constitute an offer to sell or a solicitation of an offer to

buy any securities other than the common stock offered by this Offering Circular. This Offering Circular does not constitute an offer

to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither

the delivery of this Offering Circular nor any sale made in connection with this Offering Circular shall, under any circumstances, create

any implication that there has been no change in our affairs since the date of this Offering Circular is correct as of any time after

its date.

There is no minimum proceeds threshold for the

offering. The offering will commence within two days of qualification by the United States Securities and Exchange Commission and will

terminate 90 days after qualification.

The Company will retain all proceeds received from the shares sold in this offering. The Company has not made any arrangements to place

the proceeds in an escrow or trust account. Any proceeds received in this offering may be immediately used by the Company in its sole

discretion. There are no minimum purchase requirements for each investor. All proceeds retained by the Company may not be sufficient

to continue operations.

THIS

INVESTMENT INVOLVES A HIGH DEGREE OF RISK. BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY, THE RISK FACTORS

SECTION, BEGINNING ON PAGE 7.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS OFFERING CIRCULAR IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| | |

Price

to Public | | |

Underwriting

Discount and

Commissions | | |

Proceeds

to

Issuer | |

| Per

Share | |

$ | 0.04 | | |

| 0 | | |

$ | 0.04 | |

| Total

Minimum | |

$ | 0.00 | | |

| 0 | | |

$ | 0.00 | |

| Total

Maximum | |

$ | 400,000 | | |

| 0 | | |

$ | 400,000 | |

The

date of this Offering Circular is November 21, 2024.

THIS

OFFERING CIRCULAR FOLLOWS THE OFFERING CIRCULAR FORMAT DESCRIBED IN PART II OF SEC FORM 1-A.

Contents

In

this Offering Circular, the terms “Regen Biopharma, Inc.. “, “Regen”, “Company”, “we”,

or “our”, unless the context otherwise requires, mean Regen Biopharma, Inc., a Nevada corporation and its wholly owned subsidiary

KCL, Therapeutics, Inc., a Nevada corporation.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

Offering Circular contains statements that are considered forward-looking statements. Forward-looking statements give the Company’s

current expectations, plans, objectives, assumptions or forecasts of future events. All statements other than statements of current or

historical fact contained in this Offering Circular, including statements regarding the Company’s future financial position, business

strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. In some

cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plans,”

“potential,” “projects,” “ongoing,” “expects,” “management believes,” “we

believe,” “we intend,” and similar expressions. These statements are based on the Company’s current plans and

are subject to risks and uncertainties, and as such the Company’s actual future activities and results of operations may be materially

different from those set forth in the forward looking statements. Any or all of the forward-looking statements in this Offering Circular

may turn out to be inaccurate and as such, you should not place undue reliance on these forward-looking statements. The Company has based

these forward-looking statements largely on its current expectations and projections about future events and financial trends that it

believes may affect its financial condition, results of operations, business strategy and financial needs. The forward-looking statements

can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and assumptions due to a number of factors, including:

| |

● |

dependence

on key personnel; |

| |

● |

degree

of success of research and development programs |

| |

● |

the

operation of our business; and |

| |

● |

general

economic conditions |

These

forward-looking statements speak only as of the date on which they are made, and except to the extent required by federal securities

laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which

the statement is made or to reflect the occurrence of unanticipated events. In addition, we cannot assess the impact of each factor on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements. All subsequent written and oral forward-looking statements attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by the cautionary statements contained in this Offering Circular.

SUMMARY

ABOUT

US

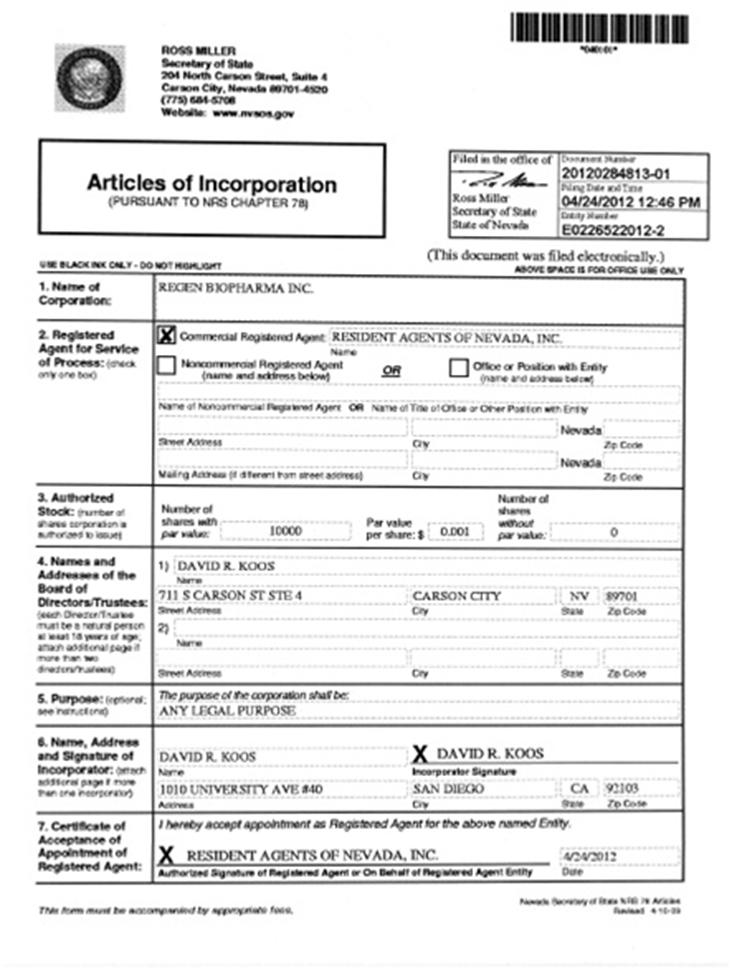

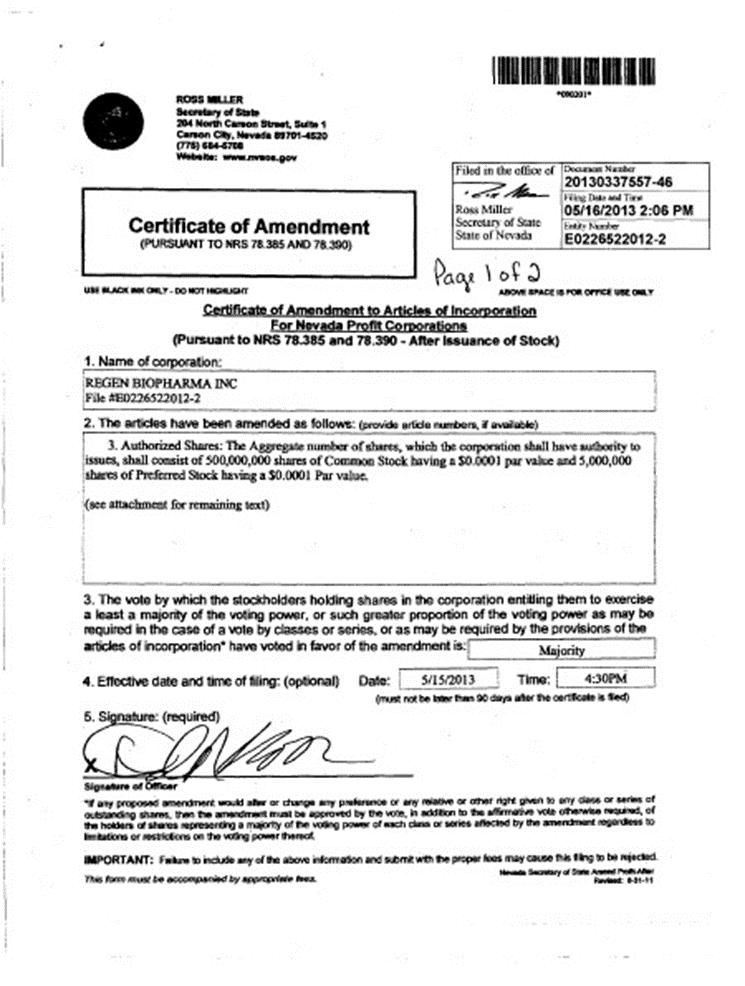

We

were incorporated April 24, 2012 under the laws of the State of Nevada. We intend to engage primarily in the development of regenerative

medical applications which we intend to license, develop internally or acquire outright from other entities up to the point of successful

completion of Phase I and or Phase II clinical trials after which we would either attempt to sell or license those developed applications

or, alternatively, advance the application further to Phase III clinical trials. The primary factor to be considered by us in arriving

at a decision to advance an application further to Phase III clinical trials would be a greater than anticipated indication of efficacy

seen in Phase I trials.

The

Company has the following therapies in development:

HemaXellarate

: HemaXellarate is a cellular composition of autologous stromal vascular fraction derived from adipose tissue. HemaXellarate contains

endothelial progenitor cells as well as mesenchymal stem cells. It is believed by the Company that once re-infused into the patient,

the patient’s bone marrow will regenerate and begin to function normally.

dCellVax:

dCellVax is comprised of autologous dendritic cells which have been treated with an siRNA inhibitor of indoleamine-2,3-dioxygenase (IDO),

an immunosuppressive enzyme. The Company believes that by inhibiting this enzyme in these dendritic cells, the patient’s cells

can now attack cancers, particularly breast cancer.

tCellVax:

Immune cells are removed from the patient, treated with siRNA to inhibit NR2F6 and the cells re-infused to the patient. The Company believes

that once the inhibitor protein is blocked, the immune system will be very activated and kill tumors. siRNA is a double-stranded RNA

molecule that is non-coding and is a powerful tool in drug targeting and therapeutics development as it is used to modulate gene expression

through transcriptional or translational repression. The NR2F6 nuclear receptor has been identified as a potentially very important immune

cell inhibitor (an immune checkpoint) and cancer stem cell differentiator.

DiffronC:

This drug is intended to use our proprietary siRNA in vivo to inhibit cancer growth and activate T cells. The siRNA targets NR2F6. T

cells are part of the immune system and develop from stem cells in the bone marrow.

DuraCar:

DuraCar is comprised of CAR-T cells which have been treated with an shRNA targeting the gene NR2F6. By inhibiting NR2F6, we expect our

DuraCar cells to have greater efficacy and persistence than conventional CAR-T cells and create a new, optimal way to manufacture CAR-T

cells. We are currently in pre-clinical testing of this drug. Chimeric antigen receptor T cells ( CAR-T cells) are T cells that have

been genetically engineered to produce an artificial T cell receptor for use in immunotherapy. Chimeric antigen receptors are receptor

proteins that have been engineered to give T cells the new ability to target a specific antigen.

Small

molecule: We have identified and patented a series of small molecules which can both activate and inhibit NR2F6. We are currently in

pre-clinical testing of these drugs.

None

of the abovementioned statements regarding any of our products in development are intended to be a prediction or conclusion of efficacy.

No clinical trials on our product candidates have commenced so no conclusions of efficacy can be made.

As

of November 5, 2024 we have not licensed any existing therapies which may be marketed.

The

Company has entered into license agreements with Zander Therapeutics, Inc. ( an entity under common control) and Oncology Pharma Inc.

( an unrelated entity).

Both

Zander and Oncology Pharma, Inc. will be required to obtain approval from the United States Food and Drug Administration (“FDA”)

in order to market any Licensed Product which may be developed within the United States and no assurance may be given that such approval

would be granted.

As

a Tier I issuer under Regulation A+ of the Securities and Exchange Commission (the “SEC”), the Company will be required to

file with the SEC a Form 1-Z (Exit Report Under Regulation A+) upon termination of this Offering. The Company is also required to file

periodic reports with the SEC pursuant to the Securities Act of 1934.

Selected

Financial Data

The

stockholders’ equity section of the Company contains the following classes of capital stock :

As

of November 20, 2024

Common

stock, $ 0.0001 par value; 5, 800,000,000 shares authorized: 21,554,705 shares issued and outstanding.

Preferred

Stock, $0.0001 par value, 800,000,000 shares authorized of which 600,000 is designated as Series AA Preferred Stock: 34 shares issued

and outstanding as of November 20, 2024, 540,000,000 is designated Series A Preferred Stock of which 10,123,771 shares are outstanding

as of November 20, 2024, 60,000,000 is designated Series M Preferred Stock of which 29,338 shares are outstanding as of November

20, 2024 and 20,000 is designated Series NC Preferred Stock of which 15,007 shares are outstanding as of November 20, 2024.

Our

common stock is traded on the OTC Pink Market under the symbol “RGBP” and our Series A Preferred stock is traded on the OTC

Pink Market under the symbol “RGBPP”. No public market currently exists for any other equity securities of the Company.

| | |

At September 30, 2024 (unaudited) | |

| Selected Balance Sheet Information: | |

| | |

| Cash | |

$ | 716 | |

| Current assets | |

| 159,878 | |

| Total assets | |

$ | 177,611 | |

| Current liabilities | |

$ | 5,371,640 | |

| Total liabilities | |

| 5,371,640 | |

| Total stockholders’ equity (deficit) | |

$ | (5,194,029 | ) |

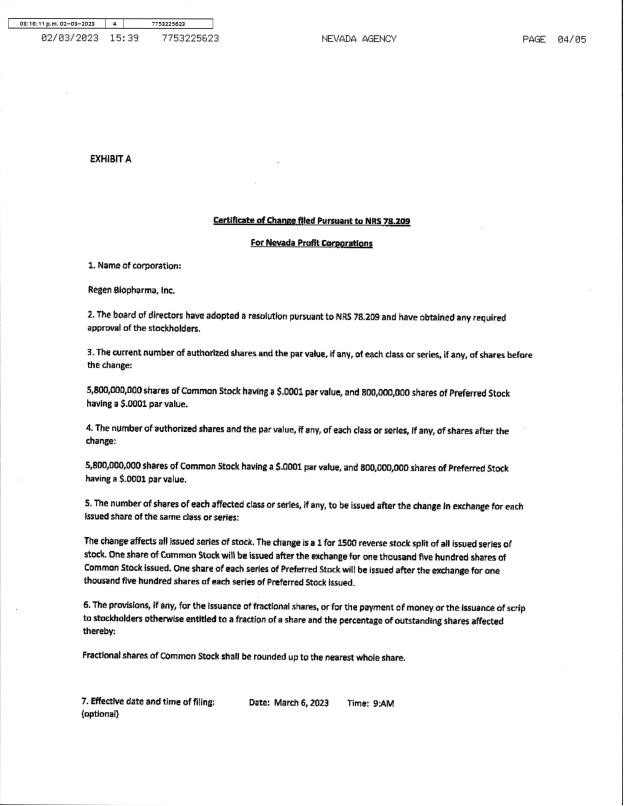

Retroactively

adjusted to reflect a 1 for 1500 reverse stock split of all issued series of stock effective as of March 6, 2023

| | |

For

the year ended September 30, 2023 | | |

For

the year ended September 30, 2024 | |

| | |

| | |

(unaudited) | |

| | |

| | |

| |

| Selected Statement of Operations Information: | |

| | | |

| | |

| | |

| | | |

| | |

| Revenues | |

$ | 236,560 | | |

$ | 236,560 | |

| Total operating expenses | |

| 923,509 | | |

| 654,749 | |

| Operating income (loss) | |

| (686,950 | ) | |

| (418,189 | ) |

| Net income (loss) to common shareholders | |

$ | 1,023,508 | | |

$ | (867,252 | ) |

| Basis and diluted earnings (loss) per common share | |

$ | 0.29 | | |

$ | (0.21 | ) |

| Weighted average common shares outstanding basic and diluted | |

| 3,536,963 | | |

| 4,110,265 | |

All

stock amounts have been retroactively adjusted to reflect a 1 for 1500 reverse stock split of all issued series of stock effective as

of March 6, 2023.

DILUTION

The

following unaudited table illustrates the dilution on a per share of common stock basis under the scenarios of the Company achieving

the sale of 10%, 25%, 50%, 75% and 100% of this offering*:

| | |

If 10% of | | |

If 25% of | | |

If 50% of | | |

If 75% of | | |

If 100% of | |

| | |

shares sold | | |

shares sold | | |

shares sold | | |

shares sold | | |

shares sold | |

| Book value per share before offering | |

$ | (0.16 | ) | |

$ | (0.16 | ) | |

$ | (0.16 | ) | |

$ | (0.16 | ) | |

$ | (0.16 | ) |

| Book value per share after offering | |

$ | (0.16 | ) | |

$ | (0.15 | ) | |

$ | (0.14 | ) | |

$ | (0.12 | ) | |

$ | (0.12 | ) |

| Net increase to original shareholders | |

$ | 0.00 | | |

$ | 0.01 | | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.04 | |

| Decrease in investment to new shareholders | |

$ | 0.20 | | |

$ | 0.19 | | |

$ | 0.18 | | |

$ | 0.16 | | |

$ | 0.16 | |

| Dilution percentage to new shareholders | |

| 500 | % | |

| 475 | % | |

| 450 | % | |

| 400 | % | |

| 400 | % |

*

Based on book value as of 9/30/2024, based upon $0.04 offering price, includes

15,426,385 common distributed as a dividend to all shareholders of record as of October 17, 2024 (“Record Date”) paid to shareholders

on or about November 1, 2024

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should carefully consider the risks described below as well as other

information provided to you in this Offering Circular, including information in the section of this document entitled “CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS”. If any of the following risks actually occur, our business, financial condition

or results of operations could be materially adversely affected, the value of our common stock could decline, and you may lose all or

part of your investment. The following discussion and analysis should be read in conjunction with the other financial information and

consolidated financial statements and related notes appearing in this Offering Circular.

Risks

Related to our Business:

THERE

IS SUBSTANTIAL DOUBT ABOUT THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN.

The

Company generated net losses of $20,616,114 during the period from April 24, 2012 (inception) through September 30, 2024.

This condition raises substantial doubt about the Company’s ability to continue as a going concern. The Company’s continuation

as a going concern is dependent on its ability to meet its obligations, to obtain additional financing as may be required and ultimately

to attain profitability. Because obtaining investment capital is not certain, we may not have the funds necessary to continue our operations.

Our ability to meet our operating needs depends in large part on our ability to secure third party financing. We cannot provide any assurances

that we will be able to obtain sufficient financing.

THE

COMPANY DOES NOT CURRENTLY OWN OR OPERATE ANY LABORATORY OR MANUFACTURING FACILITIES, THE COMPANY CAN PROVIDE NO ASSURANCE THAT THE USAGE

OF SUCH FACILITIES CAN BE OBTAINED ON TERMS FAVORABLE TO THE COMPANY

The

Company does not currently own or operate any laboratory or manufacturing facilities. As a result, we plan to outsource certain functions,

tests and services to Contract Research Organizations (“CROs”) and collaborators as well as outsourcing manufacturing to

collaborators and/or contract manufacturers. We also plan to engage CROs to run all aspects of preclinical studies and clinical trials

on our behalf. There is no assurance that such individuals or organizations will be able to provide the functions, tests, or services

as agreed upon or in a quality fashion or on terms favorable to the Company. Any failure to do so could cause us to suffer significant

delays in the development of our products.

WE

ARE IN THE EARLY STAGES OF DEVELOPING OUR PRODUCTS, THE EFFECTIVENESS OF WHICH ARE UNPROVEN.

The

Company is currently in the early stage of developing its products. No assurance can be given that the Company’s products will

prove effective for their intended purpose or otherwise that any of our work will result in any commercially viable product.

COMPETITORS

WITH MORE RESOURCES MAY FORCE US OUT OF BUSINESS.

In

the event that we have sufficient financial resources, we anticipate that we will compete with many large and well-established companies.

Aggressive pricing by our competitors or the entrance of new competitors into our markets could reduce our revenue and profit margins

and otherwise result in significant financial losses that could result in insolvency or bankruptcy.

WE

MAY NOT BE ABLE TO ATTAIN PROFITABILITY WITHOUT SIGNIFICANT ADDITIONAL FINANCING WHICH MAY BE UNAVAILABLE.

To

date we have funded our operations with minimal financial resources, and we have not generated sufficient cash from operations to be

profitable. Unless we are successful in generating sufficient revenues to finance operations as a going concern while also achieving

profitability and positive cash flow, we may experience liquidity and solvency problems. Such liquidity and solvency problems may force

us to cease operations if additional financing is not available.

WE

MAY NOT BE ABLE TO RAISE ADDITIONAL CAPITAL ON ACCEPTABLE TERMS.

We

are aware that our business may require significant capital in the future each year and for many years even if we can implement our business

plans. Even if we are successful in implementing our business plan, any person who acquires our Common Stock or our Preferred Stock will

likely suffer significant and immediate dilution or otherwise become subordinate to the rights and claims of creditors. In addition,

any financing that we obtain may not be available on terms favorable to us, or at all. Our ability to obtain additional funding will

be subject to various factors, including market conditions, our operating performance, lender and investor sentiment and our ability

to incur additional debt or equity financing in compliance with other contractual restrictions which may arise. These factors may make

the timing, amount, terms and conditions of additional financings unattractive. Our inability to raise capital could impede our growth.

Any person who acquires our securities should be prepared to lose all of their investment.

WE

RELY ON HIGHLY SKILLED PERSONNEL AND, IF WE ARE UNABLE TO RETAIN OR MOTIVATE KEY PERSONNEL OR HIRE QUALIFIED PERSONNEL, WE MAY NOT BE

ABLE TO GROW EFFECTIVELY.

Our

performance largely depends on the talents and efforts of highly skilled individuals. Competition in our industry for qualified employees

is intense. In addition, our compensation arrangements may not always be successful in attracting new employees and retaining and motivating

our existing employees. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and

motivate our existing employees.

THE

COMPANY DOES NOT MAINTAIN CERTAIN INSURANCE, INCLUDING ERRORS AND OMISSIONS INSURANCE.

The

Company has limited capital and, therefore, does not currently have a policy of insurance against liabilities arising out of the negligence

of its officers and directors and/or deficiencies in any of its business operations. Even assuming that the Company obtained insurance,

there is no assurance that such insurance coverage would be adequate to satisfy any potential claims made against the Company, its officers

and directors, or its business operations or products. Any such liability which might arise could be substantial and may exceed the assets

of the Company.

WE

MAY HAVE DIFFICULTY IN ATTRACTING AND RETAINING MANAGEMENT AND OUTSIDE INDEPENDENT MEMBERS TO OUR BOARD OF DIRECTORS AS A RESULT OF THEIR

CONCERNS RELATING TO THEIR INCREASED PERSONAL EXPOSURE TO LAWSUITS AND STOCKHOLDER CLAIMS BY VIRTUE OF HOLDING THESE POSITIONS IN A PUBLICLY-HELD

COMPANY.

We

are aware that directors and management of publicly-traded corporations are increasingly concerned with the extent of their personal

exposure to lawsuits and stockholder claims, as well as governmental and creditor claims which may be made against them, particularly

in view of recent changes in securities laws imposing additional duties, obligations and liabilities on management and directors. Due

to these perceived risks, directors and management are also becoming increasingly concerned with the availability of directors’

and officers’ liability insurance to pay on a timely basis the costs incurred in defending such claims. We currently do not carry

directors’ and officers’ liability insurance. Directors’ and officers’ liability insurance has recently become

much more expensive and difficult to obtain. If we are unable to provide directors’ and officers’ liability insurance at

affordable rates or at all, it may become increasingly more difficult to attract and retain qualified outside directors to serve on our

board of directors. We may lose potential independent board members and management candidates to other companies that have greater directors’

and officers’ liability insurance to insure them from liability or to companies that have revenues or have received greater funding

to date which can offer more lucrative compensation packages. The fees of directors are also rising in response to their increased duties,

obligations and liabilities as well as increased exposure to such risks. As a company that is in the early stages of development and

which has limited resources, we will have a more difficult time attracting and retaining management and outside independent directors

than a more established company due to these enhanced duties, obligations and liabilities.

IN

THE FUTURE WE MAY BE SUBJECT TO INTELLECTUAL PROPERTY RIGHTS CLAIMS, WHICH ARE COSTLY TO DEFEND, COULD REQUIRE US TO PAY DAMAGES AND

COULD LIMIT OUR ABILITY TO SELL SOME OF OUR PRODUCTS.

Although

we have not been subject to any intellectual property litigation or infringement claims, we may be in the future, which could cause us

to incur significant expenses to defend such claims, divert management’s attention or prevent us from manufacturing, selling or

using some aspect of our products. If we chose or are forced to settle such claims, we may be required to pay for a license to certain

rights, paying royalties on both a retrospective and prospective basis, and/or cease our manufacturing and sale of certain products that

are alleged to be infringing. Future infringement claims against us by third parties may adversely impact our business, financial condition

and results of operations.

WE

MAY BE SUBJECT TO VARIOUS FORMS OF LITIGATION INCLUDING, BUT NOT LIMITED TO, CLASS ACTION LAWSUITS, WHICH ARE COSTLY TO DEFEND, COULD

REQUIRE US TO PAY DAMAGES AND COULD LIMIT OUR ABILITY TO SELL SOME OF OUR PRODUCTS.

Companies

have been the target of class action lawsuits and other proceedings alleging, among other things, violations of federal and state workplace

and employment laws. Proceedings of this nature, if successful, could result in our payment of substantial damages.

Our

results of operations may be adversely affected by legal or governmental proceedings brought by or on behalf of employees or consumers.

In recent years, a number of companies, have been subject to lawsuits, including class action lawsuits, alleging violations of federal

and state law. A number of these lawsuits have resulted in the payment of substantial awards by the defendants. Although we are not currently

a party to any class action lawsuits, we could incur substantial damages and expenses resulting from lawsuits, which would increase the

cost of operating the business and decrease the cash available for other uses.

WE

ARE SUBJECT TO NUMEROUS LAWS AND REGULATIONS, FAILURE TO COMPLY WITH THOSE LAWS AND REGULATIONS MAY ADVERSELY IMPACT OUR BUSINESS.

Products

we are currently developing and which may be developed by us would be highly regulated. We currently have no products approved for sale

and we cannot guarantee that we will ever have marketable products. The development of a product candidate and issues relating to its

approval and marketing are subject to extensive regulation by the Food and Drug Administration (FDA) in the United States and regulatory

authorities in other countries, with regulations differing from country to country. We are not permitted to market our product candidates

in the United States until we receive approval of a New Drug Application (NDA) or a Biologic License Application (BLA), as applicable,

from the FDA.

In

the United States, NDAs and BLAs must include extensive preclinical and clinical data and supporting information to establish the product

candidate’s safety and effectiveness for each desired indication. NDAs and BLAs must also include significant information regarding

the chemistry, manufacturing and controls for the product. Obtaining approval of a NDA or BLA is a lengthy, expensive and uncertain process,

and we may not be successful in obtaining approval. Regulators of other jurisdictions, such as the European Medicines Agency (EMA),

a European Union agency for the evaluation of medicinal products, have their own procedures for approval of product candidates. Even

in the event that a product is approved, the FDA or the EMA, as the case may be, may limit the indications for which the product may

be marketed, require extensive warnings on the product labeling or require expensive and time-consuming clinical trials or reporting

as conditions of approval. Regulatory authorities in countries outside of the United States and Europe also have requirements for approval

of drug candidates with which we must comply prior to marketing in those countries. Obtaining regulatory approval for marketing of a

product candidate in one country does not ensure that we will be able to obtain regulatory approval in any other country.

NO

ASSURANCE CAN BE GIVEN THAT ANY PRODUCT IN DEVELOPMENT OR WHICH MAY BE PUT INTO DEVELOPMENT WILL SUCCESSFULLY COMPLETE ANY CLINICAL TRIALS.

Clinical

trials involving new drugs and biologics are commonly classified into three phases. Each phase of the drug approval process is treated

as a separate clinical trial and the drug-development process usually advances through all four phases over many years. Each phase exposes

greater number of subjects to the drug and each phase builds on existing safety and efficacy information. Phase 1 trials are designed

to assess the safety and tolerability of a drug or biologic. Phase II trials are designed to assess how well the drug or biologic works,

as well as to continue Phase I safety assessments in a larger group of volunteers and patients. Phase III trials are aimed at being the

definitive assessment of how effective the drug or biologic is, in comparison with current treatment and to provide an adequate basis

for physician labeling. If the drug or biologic successfully passes through Phases I, II, and III, it will usually be approved by the

national regulatory authority for use in the general population.

The

Company’s plan is to engage primarily in the development of regenerative medical applications up to the point of successful completion

of Phase I and or Phase II clinical trials after which we would either attempt to sell or license those developed applications or, alternatively,

advance the application further to Phase III clinical trials.

We

have yet to complete a successful clinical trial of any product under development and no assurance can be made that any product under

development will successfully complete a clinical trial.

THE

COMPANY CAN PROVIDE NO ASSURANCE THAT IT WILL BE ABLE TO SELL OR LICENSE ANY PRODUCT UNDER DEVELOPMENT OR WHICH WE MAY DEVELOPIN THE

FUTURE.

The

Company’s current plans include the development of regenerative medical applications up to the point of successful completion of

Phase I and/ or Phase II clinical trials after which we would either attempt to sell or license those developed applications or, alternatively,

advance the application further to Phase III clinical trials. We can provide no assurance that the Company will be able to sell or license

any product or that, if such product is sold or licensed, such sale or license will be on terms favorable to the Company.

WE

HAVE NOT OBTAINED PATENT PROTECTION FOR MUCH OF OUR INTELLECTUAL PROPERTY.

The

Company has not obtained patent protection on much of its intellectual property. Although the Company plans on attempting to obtain patents

on its products and services, there can be no assurance that the Company can obtain effective protection against unauthorized duplication

or the introduction of substantially similar products.

LIABILITY

OF DIRECTORS FOR BREACH OF DUTY OF CARE IS LIMITED. OUR BYLAWS INDEMNIFY MEMBERS OF OUR BOARD OF DIRECTORS, OUR OFFICERS, EMPLOYEES,

AND AGENTS AND PERSONS WHO FORMERLY HELD SUCH POSITIONS, AND THE LEGAL REPRESENTATIVES OF ANY OF THEM, TO THE FULLEST EXTENT LEGALLY

PERMISSIBLE UNDER THE GENERAL CORPORATION LAW OF THE STATE OF NEVADA AGAINST ANY OR ALL EXPENSE, LIABILITY AND LOSS REASONABLY INCURRED

IN DEFENDING A CIVIL OR CRIMINAL ACTION, SUIT OR PROCEEDING TO WHICH ANY SUCH PERSON SHALL HAVE BECOME SUBJECT BY REASON OF HIS HAVING

HELD SUCH A POSITION OR HAVING ALLEGEDLY TAKEN OR OMITTED TO TAKE ANY ACTION IN CONNECTION WITH SUCH POSITION.

According

to Nevada law (NRS 78.138(7)), all Nevada corporations limit the liability of directors and officers, including acts not in good faith.

Our stockholders’ ability to recover damages for fiduciary breaches may be reduced by this statute. In addition our Bylaws indemnify

members of the board of directors, our officers, employees, and agents and persons who formerly held such positions, and the legal representatives

of any of them, to the fullest extent legally permissible under the general corporation law of the state of Nevada against any or all

expense, liability and loss reasonably incurred in defending a civil or criminal action, suit or proceeding to which any such person

shall have become subject by reason of his having held such a position or having allegedly taken or omitted to take any action in connection

with such position.

DEPENDENCE

ON DAVID R. KOOS, WITHOUT WHOSE SERVICES COMPANY BUSINESS OPERATIONS COULD CEASE.

At

this time, the sole officer and director of the Company is David R. Koos, who is wholly responsible for the development and execution

of our business. Mr. Koos is not party to an employment agreement with us. If Mr. Koos should choose to leave us for any reason before

we have hired additional personnel our operations may fail. Even if we are able to find additional personnel, it is uncertain whether

we could find qualified management who could develop our business along the lines described herein or would be willing to work for compensation

the Company could afford. Without such management, the Company could be forced to cease operations and investors in our common stock

or other securities could lose their entire investment. David Koos is not party to an employment agreement with the Company.

LIABILITY

OF DIRECTORS FOR BREACH OF DUTY OF CARE IS LIMITED.

According

to Nevada law (NRS 78.138(7)), all Nevada corporations limit the liability of directors and officers, including acts not in good faith.

Our stockholders’ ability to recover damages for fiduciary breaches may be reduced by this statute.

EVENTS

OUTSIDE OF OUR CONTROL, INCLUDING PUBLIC HEALTH CRISES SUCH AS THE COVID-19 PANDEMIC, COULD NEGATIVELY AFFECT OUR BUSINESS AND OUR OPERATING

RESULTS.

A

public health crisis such as the COVID-19 pandemic may cause us to experience disruptions that could severely impact our business including

interruptions in preclinical studies due to restricted or limited operations at laboratory facilities, interruption or delays in the

operations of the FDA or other regulatory authorities, which may impact review and approval timelines and interruption of, or delays

in receiving, supplies for productions of our product candidates from our third party suppliers due to staffing shortages, production

slowdowns or stoppages and disruptions in delivery system.

While

we are not currently conducting any clinical trials in the event of a public health crisis during a time when we are in the process of

conducting one or more clinical trials such trials may be adversely impacted due to:

| ● |

delays or difficulties in enrolling patients in our clinical

trials; |

| ● |

delays or difficulties in clinical trial site activities, including

difficulties in recruiting clinical trial staff; |

| ● |

diversion of healthcare resources away from the conduct of

clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of

our clinical trials; |

| ● |

interruption of key clinical trial activities, such as clinical

trial site data monitoring, due to limitations on travel imposed or recommended by federal or state governments, employers and others

or interruption of clinical trial subject visits and study procedures (i.e., those that are deemed non-essential), which may impact the

integrity of subject data and clinical study endpoints. |

Risks

Related to an Investment in Our Common Stock

WE

DO NOT PLANT TO PAY CASH DIVIDENDS IN THE FORESEEABLE FUTURE.

We

currently intend to retain all future earnings for use in the operation and expansion of our business. We do not intend to pay any cash

dividends in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless

they sell them. There is no assurance that stockholders will be able to sell shares when desired or that any continuous and liquid trading

market will develop or, if it does develop, that it will be sustained for any period of time and at a level that will allow a stockholder

an opportunity to sell any shares of our common stock in any amount at any time.

OUR

COMMON STOCK IS QUOTED ON THE OTC PINK MARKET WHICH MAY HAVE AN UNFAVORABLE IMPACT ON OUR STOCK PRICE AND LIQUIDITY.

Our

common stock is quoted on the OTC Pink Market. The OTC Pink Market is a significantly more limited market than the New York Stock Exchange

or NASDAQ system. The quotation of our shares on the OTC Pink Market may result in a less liquid market available for existing and potential

stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse

impact on our ability to raise capital in the future.

PENNY

STOCK” RULES MAY MAKE BUYING OR SELLING OUR COMMON STOCK DIFFICULT.

Trading

in our securities is subject to the “penny stock” rules. The SEC has adopted regulations that generally define a penny stock

to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. These rules require that

any broker-dealer who recommends our securities to persons other than prior customers and accredited investors, must, prior to the sale,

make a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the

transaction. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock,

of a disclosure schedule explaining the penny stock market and the risks associated with trading in the penny stock market. In addition,

broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for

the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from

effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. Broker-dealers

who sell penny stocks to certain types of investors are required to comply with the Commission’s regulations concerning the transfer

of penny stocks. These regulations require broker- dealers to:

| |

● |

Make

a suitability determination prior to selling a penny stock to the purchaser; |

| |

● |

Receive

the purchaser’s written consent to the transaction; and |

| |

● |

Provide

certain written disclosures to the purchaser. |

These

requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

CONCENTRATED

CONTROL RISKS; SHAREHOLDERS COULD BE UNABLE TO CONTROL OR INFLUENCE KEY CORPORATE ACTIONS OR EFFECT CHANGES IN THE COMPANY’S BOARD

OF DIRECTORS OR MANAGEMENT

Our

sole officer and director, David R. Koos, has voting power over 436,997 shares of our common stock, 413,281 of our Series A Preferred

stock, 34 shares of our Series AA Preferred Stock, 7,667 shares of our Series M Preferred Stock and 15,007 shares of our Series NC Preferred

stock representing approximately 14% of the voting control of the Company as of November 5, 2024 Mr. Koos therefore has

significant influence with regard to many major decisions regarding our affairs. In addition, due to Mr. Koos voting power, investors

in this offering will have limited control over matters requiring approval by our security holders, including the election of directors,

whether or not to sell all or substantially all of our assets and for what consideration and whether or not to authorize more stock for

issuance or otherwise amend our charter or bylaws.

BECAUSE

WE HAVE ELECTED TO DEFER COMPLIANCE WITH NEW OR REVISED ACCOUNTING STANDARDS PURSUANT TO SECTION 102(b)(1) OF THE JOBS ACT OUR FINANCIAL

STATEMENT DISCLOSURE MAY NOT BE COMPARABLE TO SIMILAR COMPANIES.

We

have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of

the JOBS Act. This allows us to delay the adoption of new or revised accounting standards that have different effective dates for public

and private companies until those standards apply to private companies. As a result of our election, our financial statements may not

be comparable to companies that comply with public company effective dates.

LIKELIHOOD

OF IMMEDIATE AND SUBSTANTIAL DILUTION.

We

anticipate that we may need to raise additional capital to implement our business plan. At present we have not had any definitive discussions

with any venture capital, angel investors, FINRA-registered broker dealers, or other persons regarding the extent of their interest in

investing into the Company. Since we are an early-stage company with no track record of generating revenues, positive cash flow, or profitability,

there can be no guarantee that we will raise the additional capital that we anticipate that we will need to raise or, if we are successful

in raising any such additional capital that we can do so on a reasonable and timely basis, in sufficient amounts and on terms that are

reasonable in light of our present circumstances. For these and other reasons, any person who acquires our Common Stock is likely to

incur immediate and substantial dilution with respect to the book value of the Company’s common stock offered hereby.

FUTURE

ISSUANCE OF COMMON STOCK RELATED TO CONVERTIBLE NOTES PAYABLE AND ACCRUED INTEREST ON CONVERTIBLE NOTES PAYABLE MAY HAVE A DILUTING FACTOR

ON EXISTING AND FUTURE SHAREHOLDERS.

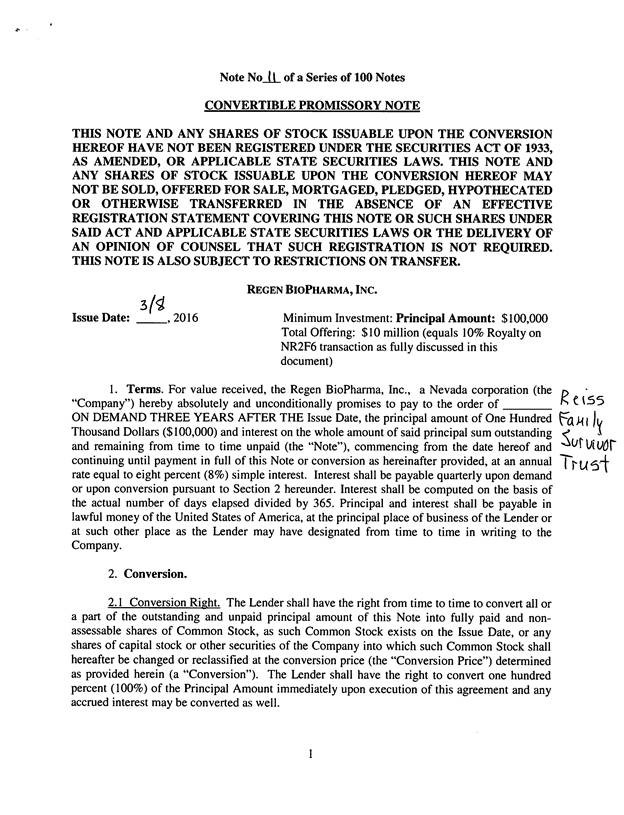

As

of November 4, 2024 the Company has outstanding an aggregate of $800,217 of convertible debt and accrued interest on

convertible debt. Of that aggregate amount approximately $581,799 is convertible into common or Series A preferred shares of the

Company at various discounts from the market price of the Company’s publicly traded shares. It is the Company’s belief that

shares issuable to the holders of $800,217 of combined convertible debt and accrued interest on convertible debt may be resold

pursuant to the safe harbor provisions of Rule 144.

WE

DO NOT CURRENTLY INTEND TO REGISTER OUR COMMON SHARES UNDER THE SECURITIES AND EXCHANGE ACT OF 1934 (“EXCHANGE ACT”). OUR

REPORTING OBLIGATIONS UNDER SECTION 15(D) OF THE EXCHANGE ACT MAY BE SUSPENDED AUTOMATICALLY IF WE HAVE FEWER THAN 300 HOLDERS OF RECORD

ON THE FIRST DAY OF OUR FISCAL YEAR AFTER THE YEAR OF EFFECTIVENESS OF THE REGISTRATION STATEMENT FILED PURSUANT TO THE SECURITIES ACT

OF 1933 OF WHICH THIS PROSPECTUS CONSTITUTES PART.

We

became subject to the Exchange Act reporting requirements under Section 15(d) on September 20,2023 upon effectiveness of

a registration statement and will be for at least one year after effectiveness. Our obligation to file reports under Section

15(d) of the Exchange Act will be automatically suspended if, on the first day of any fiscal year, other than a fiscal year in which

a registration statement under the Securities Act has gone effective, we have fewer than 300 holders of record. In such an event, we

may cease providing periodic reports and current or periodic information, including operational and financial information

WE

DO NOT CURRENTLY INTEND TO REGISTER OUR COMMON SHARES UNDER THE SECURITIES AND EXCHANGE ACT OF 1934 (“EXCHANGE ACT”). UNLESS

WE REGISTER A CLASS OF OUR SECURITIES PURSUANT TO SECTION 12 OF THE EXCHANGE ACT, WE WILL ONLY BE SUBJECT TO THE PERIODIC REPORTING OBLIGATIONS

IMPOSED BY SECTION 15(D) OF THE EXCHANGE ACT WHICH MAY LIMIT THE INFORMATION ON THE COMPANY AVAILABLE TO SHAREHOLDERS.

We

do not currently intend to register our common shares under the Securities and Exchange act of 1934 (“Exchange Act”). Unless

we register a class of our securities pursuant to Section 12 of the Exchange Act, we will only be subject to the periodic reporting obligations

imposed by Section 15(d) of the Exchange Act. Accordingly, we will not be subject to the proxy rules, short-swing profit provisions,

going-private regulation, beneficial ownership reporting, and the majority of the tender offer rules and the reporting requirements of

the Exchange Act. Accordingly, shareholders may have access to less information regarding the activities of the Company and its officers

and directors than they otherwise may have if a class of the Company’s securities was registered under the Exchange Act.

ABOUT

THE OFFERING

WHO

MAY INVEST IN THE OFFERING

The

Company is offering for sale in this Regulation A+ offering (the “Offering”) up to 10,000,000 shares of its common stock,

$0.0001 par value, for a maximum purchase price of $0.04 per share, for a total offering amount of $400,000. The shares

are being offered for sale by this Offering Circular only to accredited investors, as such term is defined in Regulation D of the Securities

and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Act”).

Accredited

Investor

To

be an “accredited investor,” an investor must come within any of the following categories, or be a person who the issuer

reasonably believes comes within any of the following categories at the time of the sale of the shares to that investor:

| |

● |

Any

bank as defined in Section 3(a)(2) of the Act, or any savings and loan association or other institution as defined in Section 3(a)(5)(A)

of the act whether acting in its individual or fiduciary capacity; any broker or dealer registered pursuant to Section 15 of the

Securities Exchange Act of 1934; any insurance company registered under the Investment Company Act of 1940 or a business development

company as defined in Section 2(a)(48) of that Act; any Small Business Investment Company licensed by the U.S. Small Business Administration

under Section 301(c) or (d) of the Small Business Investment Act of 1958; any plan established and maintained by a state, its political

subdivisions, or any agency or instrumentality of a state or political subdivisions, for the benefit of its employees, if such plan

has total assets in excess of $5,000,000; any employee benefit plan within the meaning of the Employee Retirement Income Security

Act of 1974, if the investment decision is made by a plan fiduciary, as defined in Section 3(21) of such Act, which is either a bank,

savings and loan association, insurance company, or registered investment advisor, or if the employee benefit plan has total assets

in excess of $5,000,000, or, if a self-directed plan, with investment decisions made solely by persons that are accredited investors; |

| |

● |

Any

private business development company as defined in Section 202(a)(22) of the Investment Advisers Act of 1940; |

| |

● |

Any

organization described in Section 501(c)(3) of the Internal Revenue Code, or corporation, Massachusetts or similar business trust,

or partnership, not formed for the specific purpose of acquiring the shares offered, with total assets in excess of $5,000,000; |

| |

● |

Any

director, executive officer, or general partner of the issuer of the securities being offered or sold, or any director, executive

officer, or general partner of a general partner of that issuer; |

| |

● |

Any

natural person whose individual net worth, or joint net worth with that person’s spouse or spousal equivalent, at the time

of his purchase (excluding the value of the person’s primary residence) exceeds $1,000,000; |

| |

● |

Any

natural person who had an individual income in excess of $200,000 in each of the two most recent years, or joint income with that

person’s spouse or spousal equivalent in excess of $300,000 in each of those years and has a reasonable expectation of reaching

the same income level in the current year; |

| |

● |

Any

trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the shares offered, whose purchase

is directed by a sophisticated person as described in Rule 506(b)(2)(ii) of Regulation D; |

| |

● |

Any

entity in which all of the equity owners are accredited investors (as defined above). |

| |

● |

Any

entity, of a type not listed above, not formed for the specific purpose of acquiring the securities offered, owning investments in

excess of $5,000,000: |

| |

● |

Any

natural person holding in good standing one or more professional certifications or designations or credentials from an accredited

educational institution that the SEC has designated as qualifying an individual for accredited investor status; |

| |

● |

Any

natural person who is a “knowledgeable employee,” as defined in Rule 3c-5(a)(4) under the Investment Company Act of 1940,

of the issuer of the securities being offered or sold where the issuer would be an investment company, as defined in Section 3 of

such Act, but for the exclusion provided by either section 3(c)(1) or section 3(c)(7) of such Act; |

| |

● |

Any

“family office” as defined in Rule 202(a)(11)(G)-1 under the Investment Advisers Act of 1940 with assets under management

in excess of $5,000,000, that is not formed for the specific purpose of acquiring the securities offered, and whose prospective investment

is directed by a person who has such knowledge and experience in financial and business matters that such family office is capable

of evaluating the merits and risks of the prospective investment; and |

| |

● |

Any

“family client” as defined in Rule 202(a)(G)-1 under the Investment Advisers Act of 1940, of a family office meeting

the requirements of a family office and whose prospective investment in the issuer is directed by such family office. |

Each

subscriber will represent and warrant to the Company in such subscriber’s subscription agreement that such subscriber is an accredited

investor and shall designate in the subscription agreement the specific section or sections of the above description of the definition

of accredited investor which applies to the subscriber.

USE

OF PROCEEDS

If

the Offering is consummated and all 10,000,000 Shares offered hereby are sold, the gross proceeds from the sale of those Shares at the price of $0.04 per share would be $400,000 and the net proceeds would be approximately $392,000

after giving effect to estimated expenses in connection with the Offering of approximately $8,000, including, but not limited

to, expenses of filing on the SEC’s EDGAR system, printing and copying costs, legal fees, accounting fees, filing fees, postage,

and other miscellaneous costs and expenses, including meeting expenses. Notwithstanding the foregoing, the Company can provide no assurances

as to the total number of Shares that may be sold or the amount of expenses to be paid. The abovementioned offering expenses are estimates

only and the actual offering expenses may be higher or lower than anticipated.

The

net proceeds from the Offering of $392,000 will be used by the Company as working capital to support the operational and research

and development expenses of the Company. The Company has significant discretion over the net proceeds of the Offering. As is the case

with any business, it should be expected that certain expenses unforeseeable to management at this juncture will arise in the future.

There can be no assurance that management’s use of proceeds generated through this Offering will prove optimal or translate into

revenue or profitability for the Company.

ABOUT

THIS OFFERING

| Offering

Entity |

|

Regan

Biopharma, Inc. |

| |

|

|

| Address

and Telephone Number |

|

4700

Spring Street, Suite 304, La Mesa, California, 91942 (619) 722-5505 |

| |

|

|

| OTC

Pink Trading Symbol |

|

RGBP |

| |

|

|

| Securities

Offered |

|

Up

to 10,000,000 shares of the common stock of the Company (the “Shares”) |

| |

|

|

| Offering

Price Per Share |

|

$0.04

per share |

| |

|

|

| Minimum

Subscription Total |

|

There

is no minimum number of Shares that must be sold. |

| |

|

|

| Minimum

Subscription Per Subscriber |

|

No

Minimum |

| |

|

|

| Maximum

Offering Amount |

|

$400,000

assuming all 10,000,000 Shares are purchased

in the Offering. at $0.04 per share |

| |

|

|

| Shares

of Common Stock Outstanding after the Offering |

|

As

of the date of this Offering Circular, the Company has 21,554,705 shares of common stock outstanding. If all Shares

are sold in the Offering, the Company will have an aggregate of 31,554,745 shares of common stock issued and outstanding,

assuming no conversion of any outstanding convertible instruments. |

| |

|

|

| How

to Subscribe |

|

To

subscribe for Shares in the Offering, complete a subscription agreement (the form is included with this Offering Circular), and deliver

it, together with the total subscription price for all the Shares you wish to purchase, on or before the Closing Date, as defined

below, to the Company |

The offering will commence within two days of qualification by the

United States Securities and Exchange Commission and will terminate 90 days after qualification. The Company will retain all proceeds

received from the shares sold in this offering. The Company has not made any arrangements to place the proceeds in an escrow or trust

account. Any proceeds received in this offering may be immediately used by the Company in its sole discretion. There are no minimum purchase

requirements for each investor. All proceeds retained by the Company may not be sufficient to continue operations. Subscription proceeds

will not be escrowed and will be immediately available to the Company.

*

includes 15,426,386 common shares to be distributed as a dividend to all shareholders of record as of October 17, 2024 (“Record

Date”) to be paid to shareholders on or about November 1, 2024

DISQUALIFYING

EVENTS AND BAD ACTOR DISCLOSURE

Regulation

A+ promulgated under the Securities Act prohibit an issuer from claiming an exemption from registration of its securities under such

rule if the issuer, or any of its predecessors, any affiliated issuer, any director, executive officer, other officer participating in

the offering of the interests, general partner or managing member of the issuer, any beneficial owner of 20% or more of the voting power

of the issuer’s outstanding voting securities, any promoter connected with the issuer in any capacity as of the date hereof, an

investment manager of the issuer any person that has been or will be paid (directly or indirectly) remuneration for solicitation of purchasers

in connection with such sale of the issuer’s interests, any general partner or managing member of any such investment manager or

solicitor, or any director, executive officer or other officer participating in the offering of any such investment manager or solicitor

or general partner or managing member of such investment manager or solicitor has been subject to certain “Disqualifying Events”

described in 17 CFR 230.262(a), subject to certain limited exceptions. The Company is required to exercise reasonable care in conducting

an inquiry to determine whether any such persons have been subject to such Disqualifying Events and is required to disclose any Disqualifying

Events that occurred prior to November 2014 to investors in the Company.

The

Company believes that it has exercised reasonable care in conducting an inquiry into Disqualifying Events by the foregoing persons and

is aware of no such Disqualifying Events. Under 17 CFR 230.262(d), the Company is also required to include in this Offering Circular

a description of any matters that would have triggered disqualification that occurred before June 19, 2015.

On

June 26 - 28 of 2001 the NYSE held an administrative hearing panel regarding Mr. David Koos’ ( the Company’s sole officer

and director) handling of a client’s account while he was a Registered Representative at Everen Securities. The panel found Mr.

Koos had engaged in excessive, unsuitable and discretionary trading in a client’s account. The NYSE found Mr. Koos guilty of the

aforementioned and suspended him from association with the NYSE and its affiliates for a period of 9 months. On appeal, the Enforcement

Division requested the suspension be 18 months, which was upheld by the Appeal Board. The final disposition by the Appeal Board was not

further appealed due to legal costs., Mr. Koos agreed to accept the suspension even though he maintained his innocence in any wrongdoing.

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

The

Company’s common stock is a “penny stock,” as defined in Rule 3a51-1 under the Exchange Act. The penny stock rules

require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk

disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer

also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its

sales person in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s

account. In addition, the penny stock rules require that the broker-dealer, not otherwise exempt from such rules, must make a special

written determination that the penny stock is suitable for the purchaser and receive the purchaser’s written agreement to the transaction.

These disclosure rules have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject

to the penny stock rules. So long as the common stock of the Company is subject to the penny stock rules, it may be more difficult to

sell common stock of the Company.

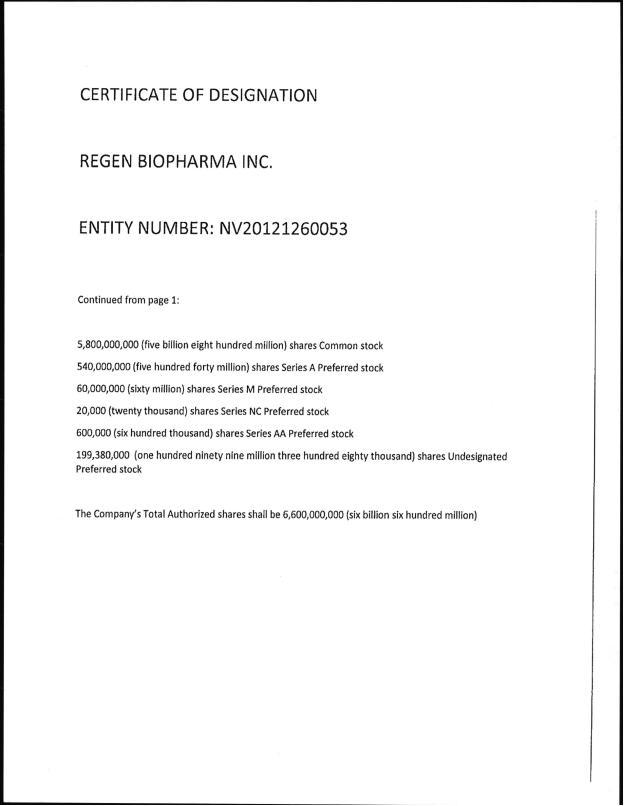

The

stockholders’ equity section of the Company contains the following classes of capital stock as of November 20, 2024:

Common

stock, $ 0.0001 par value; 5,800,000,000 shares authorized: 21,554,705 shares issued and outstanding.

With

respect to each matter submitted to a vote of stockholders of the Corporation, each holder of Common Stock shall be entitled to cast

that number of votes which is equivalent to the number of shares of Common Stock owned by such holder times one (1).

On

any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the holders of the Common Stock shall receive,

out of assets legally available for distribution to the Company’s stockholders, a ratable share in the assets of the Corporation.

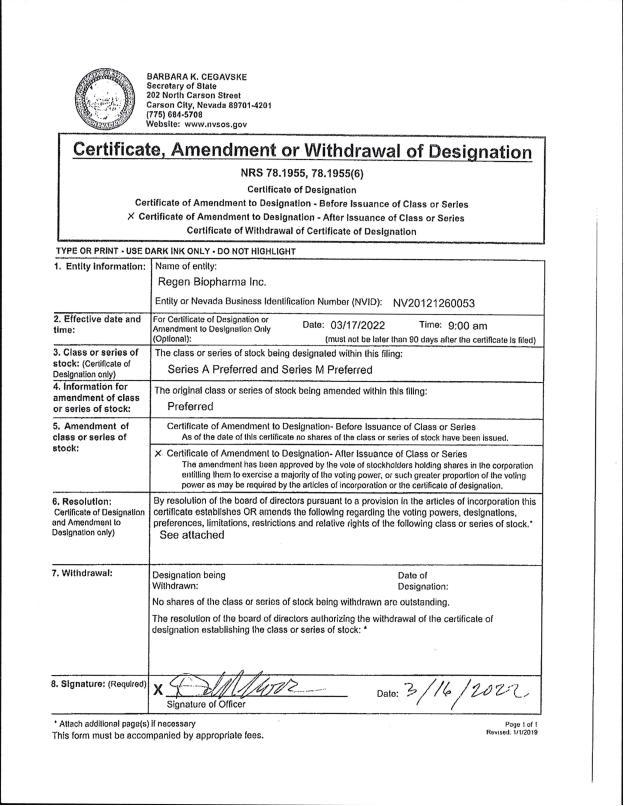

Preferred

Stock, $0.0001 par value, 800,000,000 shares authorized of which 600,000 is designated as Series AA Preferred Stock: 34 shares issued

and outstanding as of November 20, 2024, 739,000,000 is designated Series A Preferred Stock of which 10,123,771 shares are outstanding

as of November 20, 2024, 60,000,000 is designated Series M Preferred Stock of which 29,338 shares are outstanding as of November

20, 2024, and 20,000 is designated Series NC stock of which 15,007 shares are outstanding as of November 20, 2024.

The

abovementioned shares authorized pursuant to the Company’s certificate of incorporation may be issued from time to time without

prior approval of the shareholders. The Board of Directors of the Company shall have the full authority permitted by law to establish

one or more series and the number of shares constituting each such series and to fix by resolution full or limited, multiple or fractional,

or no voting rights, and such designations, preferences, qualifications, restrictions, options, conversion rights and other special or

relative rights of any series of the Stock that may be desired.

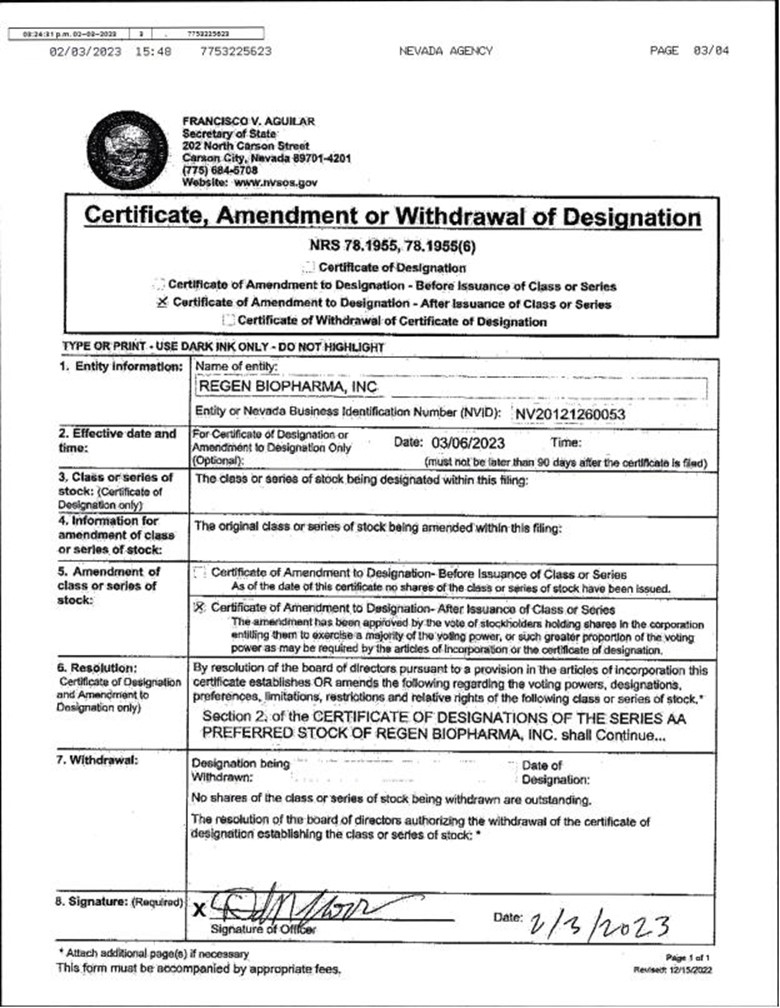

Series

AA Preferred Stock

On

September 15, 2014 the Company filed a CERTIFICATE OF DESIGNATION (“Certificate of Designations”) with the Nevada Secretary

of State setting forth the preferences rights and limitations of a newly authorized series of preferred stock designated and known as

“Series AA Preferred Stock” (hereinafter referred to as “Series AA Preferred Stock”).

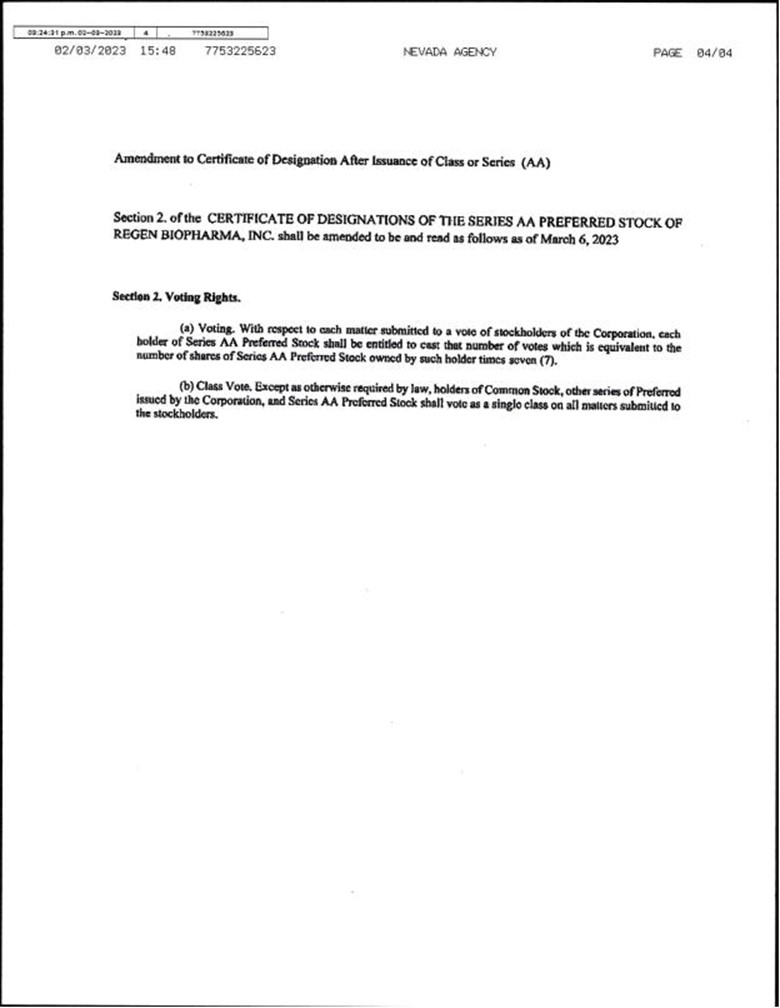

The

Board of Directors of the Company have authorized 600,000 shares of the Series AA Preferred Stock, par value $0.0001. With respect to

each matter submitted to a vote of stockholders of the Corporation, each holder of Series AA Preferred Stock shall be entitled to cast

that number of votes which is equivalent to the number of shares of Series AA Preferred Stock owned by such holder times seven (7). Except

as otherwise required by law holders of Common Stock, other series of Preferred issued by the Corporation, and Series AA Preferred Stock

shall vote as a single class on all matters submitted to the stockholders.

Series

A Preferred Stock

On

January 15, 2015 the Company filed a CERTIFICATE OF DESIGNATION (“Certificate of Designations”) with the Nevada Secretary

of State setting forth the preferences rights and limitations of a newly authorized series of preferred stock designated and known as

“Series A Preferred Stock” (hereinafter referred to as “Series A Preferred Stock”).

The

Board of Directors of the Company have authorized 739,000,000 shares of the Series A Preferred Stock, par value $0.0001. With respect

to each matter submitted to a vote of stockholders of the Corporation, each holder of Series A Preferred Stock shall be entitled to cast

that number of votes which is equivalent to the number of shares of Series A Preferred Stock owned by such holder times one . Except

as otherwise required by law holders of Common Stock, other series of Preferred issued by the Corporation, and Series A Preferred Stock

shall vote as a single class on all matters submitted to the stockholders.

Holders

of the Series A Preferred Stock will be entitled to receive, when, as and if declared by the board of directors of the Company (the “Board”)

out of funds legally available therefore, non-cumulative cash dividends of $0.01 per quarter. In the event any dividends are declared

or paid or any other distribution is made on or with respect to the Common Stock, the holders of Series A Preferred Stock as of the

record date established by the Board for such dividend or distribution on the Common Stock shall be entitled to receive, as additional

dividends (the “Additional Dividends”) an amount (whether in the form of cash, securities or other property) equal to the

amount (and in the form) of the dividends or distribution that such holder would have received had each share of the Series A Preferred

Stock been one share of the Common Stock, such Additional Dividends to be payable on the same payment date as the payment date for the

Common Stock.

Upon

any liquidation, dissolution, or winding up of the Company, whether voluntary or involuntary (collectively, a “Liquidation”),

before any distribution or payment shall be made to any of the holders of Common Stock or any other series of preferred stock, the holders

of Series A Preferred Stock shall be entitled to receive out of the assets of the Company, whether such assets are capital, surplus or

earnings, an amount equal to $0.01 per share of Series A Preferred (the “Liquidation Amount”) plus all declared and unpaid

dividends thereon, for each share of Series A Preferred held by them.

If,

upon any Liquidation, the assets of the Company shall be insufficient to pay the Liquidation Amount, together with declared and unpaid

dividends thereon, in full to all holders of Series A Preferred, then the entire net assets of the Company shall be distributed among

the holders of the Series A Preferred, ratably in proportion to the full amounts to which they would otherwise be respectively entitled

and such distributions may be made in cash or in property taken at its fair value (as determined in good faith by the Board), or both,

at the election of the Board.

On

January 10, 2017 Regen Biopharma, Inc. (“Regen”) filed a CERTIFICATE OF DESIGNATION (“Certificate of Designations”)

with the Nevada Secretary of State setting forth the preferences rights and limitations of a newly authorized series of preferred stock

designated and known as “Series M Preferred Stock” (hereinafter referred to as “Series M Preferred Stock”).

The

Board of Directors of Regen have authorized 60,000,000 shares of the Series M Preferred Stock, par value $0.0001. With respect to each

matter submitted to a vote of stockholders of Regen, each holder of Series M Preferred Stock shall be entitled to cast that number of

votes which is equivalent to the number of shares of Series M Preferred Stock owned by such holder times one. Except as otherwise required

by law holders of Common Stock, other series of Preferred issued by Regen, and Series M Preferred Stock shall vote as a single class

on all matters submitted to the stockholders.

The

holders of Series M Preferred Stock shall be entitled receive dividends, when, as and if declared by the Board of Directors in accordance

with Nevada Law, in its discretion, from funds legally available therefore

On

any voluntary or involuntary liquidation, dissolution or winding up of Regen, the holders of the Series M Preferred Stock shall receive,

out of assets legally available for distribution to Regen’s stockholders, a ratable share in the assets of Regen.

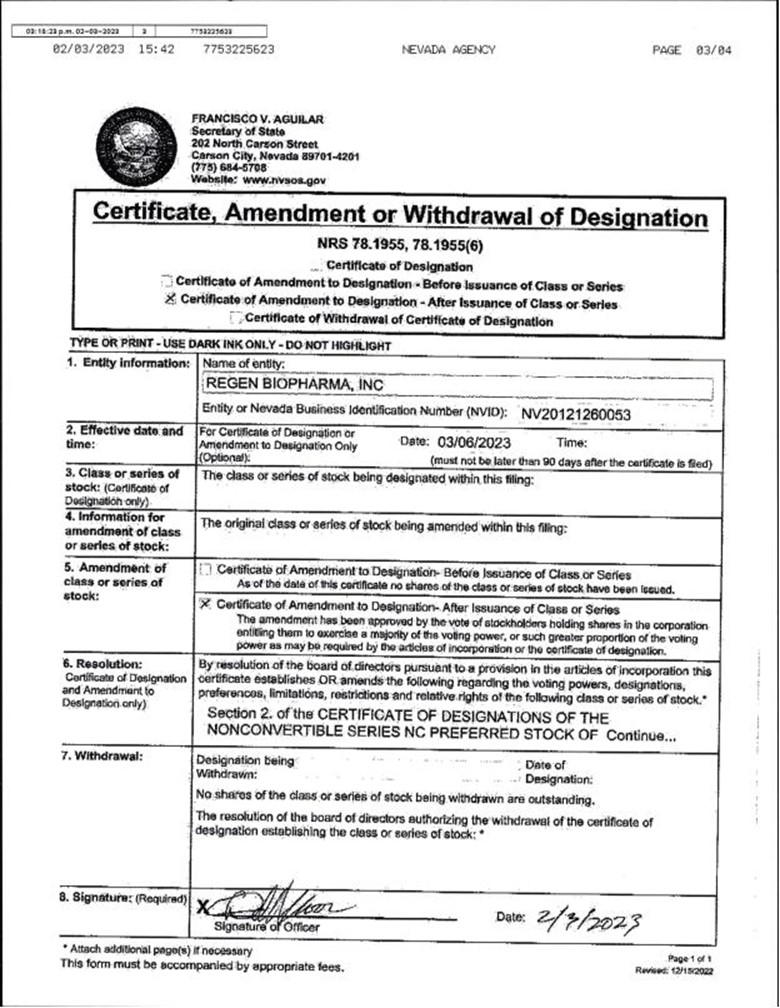

On

March 26, 2021 Regen Biopharma, Inc. ( “Regen”) filed a CERTIFICATE OF DESIGNATION (“Certificate of Designations”)

with the Nevada Secretary of State setting forth the preferences rights and limitations of a newly authorized series of preferred stock

designated and known as Nonconvertible Series NC Preferred Stock (hereinafter referred to as “Series NC Preferred Stock”).

The

Board of Directors of Regen have authorized 20,000 shares of the Series NC Preferred Stock, par value $0.0001. With respect to each matter

submitted to a vote of stockholders of Regen, each holder of Series NC Preferred Stock shall be entitled to cast that number of votes

which is equivalent to the number of shares of Series NC Preferred Stock owned by such holder times 334. Except as otherwise required

by law holders of Common Stock, other series of Preferred issued by Regen, and Series NC Preferred Stock shall vote as a single class

on all matters submitted to the stockholders.

The

holders of Series NC Preferred Stock shall be entitled receive dividends, when, as and if declared by the Board of Directors in accordance

with Nevada Law, in its discretion, from funds legally available therefore

On

any voluntary or involuntary liquidation, dissolution or winding up of Regen, the holders of the Series NC Preferred Stock shall receive,

out of assets legally available for distribution to Regen’s stockholders, a ratable share in the assets of Regen.

On

May 20, 2024 Regen Biopharma, Inc. amended its Certificate of Incorporation adding the following Article 8 which is and reads as follows:

Shares

of one class or series of stock may be issued as a share dividend in respect of another class or series.

On

May 21, 2024 the Board of Directors of Regen Biopharma, Inc declared a dividend to all shareholders of record as of June 20, 2024 (“Record

Date”) to be paid to shareholders on or about July 1, 2024 such dividend to be payable in shares of the Regen’s authorized

but unissued Series A Preferred Stock and to consist of two share of Series A Preferred Stock for every one share of Regen Biopharma,

Inc. Common Stock owned as of the Record Date, every one share of Regen Biopharma, Inc. Series A Preferred Stock owned as of the Record

Date, every one share of Series AA Preferred Stock owned as of the Record Date, every one share of Series M Preferred Stock owned as

of the Record Date and every one share of Series NC Preferred Stock owned as of the Record Date

We

have never paid any cash dividends on our common stock. We currently anticipate that we will retain all future earnings for use in our

business. Consequently, we do not anticipate paying any cash dividends in the foreseeable future. The payment of dividends in the future

will depend upon our results of operations, as well as our short term and long-term cash availability, working capital, working capital

needs, and other factors as determined by our Board of Directors. Currently, except as may be provided by applicable laws, there are

no contractual or other restrictions on our ability to pay dividends if we were to decide to declare and pay them.

Below

is the range of high and low bid information for our common equity for each quarter within the last two fiscal years. These quotations

reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

All

stock prices have been retroactively adjusted to reflect a 1 for 1500 reverse stock split of all issued series of stock effective as

of March 6, 2023.

| October 1, 2023 to September 30, 2024 | |

HIGH | | |

LOW | |

| First Quarter | |

$ | 1.6279 | | |

$ | 0.4337 | |

| Second Quarter | |

$ | 0.9302 | | |

$ | 0.4983 | |

| Third Quarter | |

$ | 0.9966 | | |

$ | 0.333 | |

| Fourth Quarter | |

$ | 0.6645 | | |

$ | -.1152 | |

| October 1, 2022 to December 31, 2022 | |

HIGH | | |

LOW | |

| First Quarter | |

$ | 10.89 | | |

$ | 5.89 | |

| January 1, 2023 to March 31, 2023 | |

HIGH | | |

LOW | |

| Second Quarter | |

$ | 7.16 | | |

$ | 1.25 | |

| April 1, 2023 to June 30, 2023 | |

HIGH | | |

LOW | |

| Third Quarter | |

$ | 2.28 | | |

$ | 1.50 | |

| July 1, 2023 to September 30, 2023 | |

HIGH | | |

LOW | |

| Fourth Quarter | |

$ | 2.00 | | |

$ | 1.46 | |

As

of November 5, 2024 there were approximately 482 holders of our Common Stock.

As of November 5, 2024 there were approximately

479 holders of our Series A Preferred Stock.

As of November 5, 2024 there was 1 holder

of our Series AA Preferred Stock.

As of November 5, 2024 there were approximately

7 holders of our Series M Preferred Stock

As of November 5, 2024 there was one holder

of our Series NC Preferred Stock.

Dividends

No

cash dividends were paid during the fiscal year ending September 30, 2024. We do not expect to declare cash dividends in the immediate

future.

Director

Independence

Audit

Committee and Audit Committee Financial Expert

The

members of the Company’s board of Directors may not be considered independent. The Company is not a “listed company”

under Securities and Exchange Commission (“SEC”) rules and is therefore not required to have an audit committee comprised

of independent directors. The Company does not currently have an audit committee, however, for certain purposes of the rules and regulations

of the SEC and in accordance with the Sarbanes-Oxley Act of 2002, the Company’s Board of Directors is deemed to be its audit committee

and as such functions as an audit committee and performs some of the same functions as an audit committee including: (1) selection and

oversight of our independent accountant; (2) establishing procedures for the receipt, retention and treatment of complaints regarding

accounting, internal controls and auditing matters; and (3) engaging outside advisors. The Board of Directors has determined that its

member is able to read and understand fundamental financial statements and has substantial business experience that results in that member’s

financial sophistication. Accordingly, the Board of Directors believes that its member has the sufficient knowledge and experience necessary

to fulfill the duties and obligations that an audit committee would have.

Nominating

and Compensation Committees

The

Company does not have standing nominating or compensation committees, or committees performing similar functions. The board of directors

believes that it is not necessary to have a compensation committee at this time because the functions of such committee are adequately

performed by the board of directors. The board of directors also is of the view that it is appropriate for the Company not to have a

standing nominating committee because the board of directors has performed and will perform adequately the functions of a nominating

committee. The Company is not a “listed company” under SEC rules and is therefore not required to have a compensation committee

or a nominating committee.

Shareholder

Communications

There

has not been any defined policy or procedure requirements for stockholders to submit recommendations or nomination for directors. There

are no specific, minimum qualifications that the board of directors believes must be met by a candidate recommended by the board of directors.

Currently, the entire board of directors decides on nominees, on the recommendation of any member of the board of directors followed

by the board’s review of the candidates’ resumes and interview of candidates. Based on the information gathered, the board

of directors then makes a decision on whether to recommend the candidates as nominees for director. The Company does not pay any fee

to any third party or parties to identify or evaluate or assist in identifying or evaluating potential nominee.

Because

the Chief Executive Officer of the Company is also the Chairman of the Board of Directors of the Company, the Board of Directors has

determined not to adopt a formal methodology for communications from shareholders on the belief that any communication would be brought

to the Board of Directors’ attention by virtue of the co-extensive capacities of the Chairman of the Board of Directors.

MANAGEMENT

AND DIRECTORS

David

R. Koos:

David

R. Koos has served as Chairman of the Board of Directors, Chief Executive Officer, Secretary, and Treasurer since April 24, 2012 until

his resignation in January 22, 2020.

David

R. Koos has served as Acting Chief Financial Officer of the Company for the period beginning April 24, 2012 and ending February 11, 2015.

On

March 23, 2021 David R. Koos was appointed Chairman and Sole Director of Regen Biopharma, Inc. On March 23, 2021 David R. Koos was appointed