|

Altamira commences copper exploration

program in Juruena Belt, Mato Grosso, Brazil

Vancouver, BC -- February 21, 2018 -- InvestorsHub

NewsWire -- Altamira Gold Corp. (TSXV: ALTA) (FSE: T6UP) (USA: EQTRF), (“Altamira” or the

“Company”) is pleased to report that it commenced an

exploration program for concealed porphyry copper mineralization

throughout the Juruena Belt of Mato Grosso state in eastern Brazil.

The rationale behind the program is as follows: -

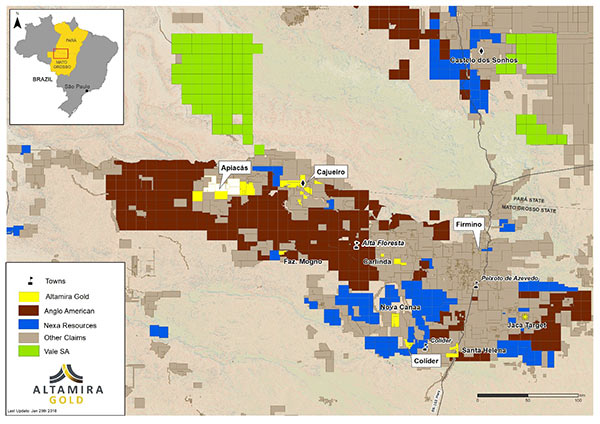

- The description of copper-gold mineralization at the Jaca

target (see attached map) consistent with porphyry mineralization

based on an examination of open file reports

- The recent staking of approximately 3.5M ha of new claims by

Anglo American Corp., Nexa Resources S.A. and Vale S.A. over the

Juruena Belt

- The identification of significant copper values from the

re-analysis of drill core at Colíder and Firmino, including 4.1m @

1.05% Cu and 18.59g/t Au

- A re-interpretation of detailed aeromagnetic data over

Altamira’s Cajuiero project has revealed 14 separate targets for

concealed porphyry style mineralization

During the last four months, several major mining companies,

including Anglo American Corp., Nexa Resources S.A. and Vale S.A.,

have all staked large areas of the Juruena gold belt amounting to

approximately 3.5M hectares. This staking rush is unprecedented in

Brazil. As a result, Altamira’s concession areas within the belt,

which include Cajueiro, Apiacás, Santa Helena and Carlinda are now

completely surrounded by third party claims (see attached map or

click https://altamiragold.com/altamira_juruena_pr_feb_21_18).

The catalyst for this staking rush appears to be a significant

copper discovery at Jaca located in the eastern part of the belt

(see map). Jaca was the subject of a University of Campinas

research study completed in December 2015 which describes

mineralization and alteration consistent with a porphyry Cu-Au

deposit. Based on Google Live satellite imagery, it appears that

Anglo American currently has 6 drill rigs drilling on the

project.

Altamira Gold’s Holds Over

200,000 Hectares in the Juruena Belt, Brazil

Several of Altamira’s projects are characterized by elevated

copper values including values exceeding 1% Cu from grab samples at

the Paulinho Troca Tiro prospect at Apiacás, 1m @

+1% Cu from a historic drill hole, Hole #FI-3 at

Firmino, and multiple elevated copper values in

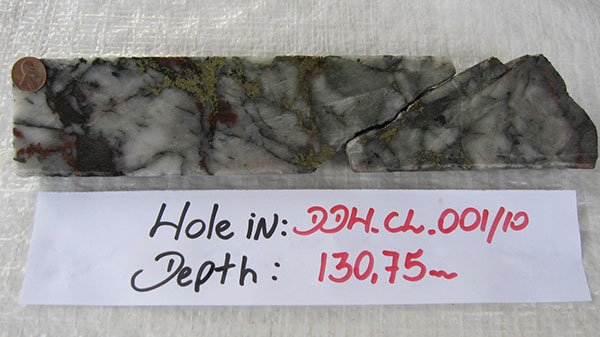

previous drill holes at the Colíder project

including 4.1m @ 1.05% Cu and 18.59g/t Au in Hole #CL-1 and 2.9m @

0.61% Cu and 6.1g/t Au in Hole #CL-8.

Altamira Gold’s Colíder

project 4.1m @ 1.05% Cu and 18.59g/t Au in Hole #CL-1

Furthermore, a recent re-interpretation of the detailed

aeromagnetic data for the Cajueiro project has revealed the

presence of 14 discrete targets with magnetic and/or radiometric

responses that may be consistent with concealed porphyry-style

mineralization at depth, which could be the driver for the

extensive gold mineralization observed on surface at Cajueiro.

Ground follow-up work is planned in advance of drilling on these

targets.

Michael Bennett, President & CEO stated “the apparent

discovery of porphyry copper mineralization at Jaca and the recent

staking rush in the Juruena belt by major companies, provides a new

and exciting dimension to the overall potential of the Juruena

belt. The apparent association of copper with known gold

occurrences bodes well for the potential of Altamira’s projects in

the region which all produced placer gold. With copper identified

at Colíder, Nova Canaa, Apiacás and Firmino, we believe that

Altamira is well positioned to play a leading role in ongoing

copper exploration in the belt”.

About Altamira Gold Corp.

The Company is focused on the exploration and development of gold

deposits within western central Brazil. The Company holds 12

projects comprising approximately 200,000 hectares, within the

prolific Juruena gold belt which historically produced an estimated

7 to 10Moz of placer gold. The Company’s advanced Cajueiro project

has an NI 43-101 resources of 8.64Mt @ 0.78 g/t Au (for 214,000oz)

in the Indicated Resource category and 9.53Mt @ 0.66 g/t Au (for

204,000oz) in the Inferred Resource category and an additional

1.37Mt @ 1.61 g/t Au in oxides (for 79,000oz in saprolite) in the

Inferred Resource category (Gustavson Associates, 2016).

On Behalf of the Board of Directors,

ALTAMIRA GOLD CORP.

“Michael Bennett”

Michael Bennett

President & CEO

Tel: 604.676.5660

info@altamiragold.com

Guillermo Hughes, P. Geo., a consultant to the Company as

well as a Qualified Person as defined by National Instrument

43-101, supervised the preparation of the technical information in

this news release.

Neither TSX Venture Exchange nor it Regulation Services Provider

(as that term is defined in the policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Forward-Looking Statements

Statements in this document which are not purely historical are

forward-looking statements, including any statements regarding

beliefs, plans, expectations or intentions regarding the future. It

is important to note that actual outcomes and the Company’s actual

results could differ materially from those in such forward-looking

statements. Except as required by law, we do not undertake to

update these forward-looking statements.

|