Aurora Spine Corporation (“Aurora Spine” or the “Company”) (TSXV:

ASG) (OTCQB: ASAPF), a leader in spine and interventional spine

technology that improves spinal surgery outcomes, today announced

its financial results for first quarter ended March 31, 2024.

All figures are in U.S. dollars.

Financial and Business Highlights

- Positive

EBITDAC – Q1 2024 EBITDAC was $117,171 as compared to

($377,871) in Q1 2023, an improvement of $495,042. This represents

the third consecutive quarter of positive EBITDAC, and the second

consecutive quarter of $4 million plus in revenue.

- Sales

growth – Q1 2024 sales of $4,013,801, represents an

Increase of $1,055,713 or 35.7% compared to sales of $2,958,088 in

the same period the previous year.

- Higher Margins –

Gross margin of 61.9% in the current period is a 10.2% increase

over the 51.7% gross margin in the comparable period of the

previous year. Margin growth is driven by sales of higher margin

implants and decreased distributor commissions as a percentage of

sales offset by higher royalty and shipping costs.

- SiLO

sales – Sales of the SiLO-TFX SI joint implant and SiLO

allograft implant made up 35.2% or $1.41 million in sales in the

quarter as compared to 20.3% or $601K in the same period the

previous year and 32.8% or $1.33 million of sales in Q4 2023. Sales

of the higher margin SiLO-TFX implants are related to expansion in

the pain market.

- Zip 51

– Sales of the Zip 51 implant increased to $544,190 as

compared to $185,490 in the same period the previous year, an

increase of 193%. Increased marketing of the product among surgeons

led to increased use and an overall increase in Zip sales.

- Sales

force – The Company continued to expand its sales force in

the first quarter. This has contributed to our increased sales, and

as the new sales staff bring new surgeons to Aurora, we expect

their success to continue. The Company also plans to add additional

new sales staff in 2024.

- Training – The

Company continued to conduct more advanced training sessions and

cadaver labs that introduced leading orthopedic, neurosurgical, and

pain management physicians to the ZIP™ and SiLO™ implants.

Management Commentary

“Aurora Spine's commitment to innovation is exemplified by our

state-of-the-art technology platforms, renowned for their superior

performance and clinical efficacy,” said Trent Northcutt, CEO and

President of Aurora Spine. "The ZIP, SiLO-TFX, and DEXA

technologies are leading the way to increased revenues and

margins."

Northcutt emphasized the importance of strategic alliances in

Aurora Spine's growth strategy. "Aurora continues to cultivate

strategic alliances with healthcare providers, surgery centers and

distributors to extend our reach and to set new standards of

accessibility and care, especially within the growing sacroiliac

fusion market."

Mr. Chad Clouse, Chief Financial Officer of

Aurora Spine, added, “The Company shows continued progress with a

third consecutive EBITDAC positive quarter and the second

consecutive quarter with $4 million plus in sales. The Company has

continued to invest in cost control through the asset purchase of a

local supplier. This investment will allow the company to produce

its own implants, instruments, and allow for quick prototyping of

future products at a lower cost.”

Financial Results

Total revenues for the first quarter of 2024

were $4.01 million, an increase of 35.7% when compared to $2.96

million in the same quarter one year ago. The quarter saw increased

activity in the pain market with increased SI joint implant sales

due to SiLO TFX and continued growth in Zip implants. We have also

been targeting the pain market with increased marketing, training,

new product releases, and an increase in the sales force. This has

resulted in a changing product mix with large increases in our ZIP

51 and SiLO TFX sales.

Gross margin on total revenues were 61.9% for

the first quarter of 2024, compared to 51.7% in Q1 of 2023. The

improvements in gross margins are attributable to the company’s

strategy of selling more proprietary, Aurora Spine products into

markets with improved pricing, like ambulatory surgery centers. As

the company continues to focus on growing sales of proprietary

products, gross margin has the capabilities for additional

improvements, dependent upon sales mix and shipping costs.

Total operating expenses were $2.75 million for

the first quarter of 2024, compared to $2.19 million in the first

quarter of 2023. Operating expenses are higher during the current

quarter primarily due to an increase in salary expense offset by a

decrease in research and development and professional fees. Salary

expense and travel costs increased as the Company hired more

salespeople.

EBITDAC (a non-GAAP figure non IFRS measure

defined as Earnings before Interest, Tax, Depreciation,

Amortization and Stock based compensation) was $0.12 million for

the first quarter of 2024, compared to $(0.38) million in the first

quarter of 2023. EBITDAC improvements were due to higher gross

margin levels from selling more proprietary products.

Net loss was $(0.267) million for the first

quarter of 2024, compared to the first quarter of 2023 with a loss

of $(0.663) million. Basic and diluted net loss per share was

$(0.00) per share in the first quarter of 2024 and $(0.01) per

share for the first quarter of 2023.

Full financial statements can be found on SEDAR at

(www.sedarplus.ca).

SELECTED STATEMENT OF FINANCIAL POSITION

INFORMATION

The following table summarizes selected key

financial data.

|

As at |

March 31, 2024 |

December 31, 2023 |

December 31, 2022 |

|

|

$USD |

$USD |

$USD |

|

Cash |

366,756 |

766,829 |

423,401 |

|

Receivables |

4,324,354 |

3,968,439 |

3,666,310 |

|

Prepaid and other current assets |

258,864 |

204,173 |

186,800 |

|

Inventory |

3,631,876 |

3,562,349 |

3,054,173 |

|

Current Assets |

8,581,850 |

8,501,790 |

7,330,684 |

|

Notes Receivable |

460,193 |

454,628 |

- |

|

Intangible Assets |

903,514 |

753,180 |

881,354 |

|

Property and Equipment |

2,087,288 |

2,275,478 |

1,910,940 |

|

Total Assets |

12,032,845 |

11,985,076 |

10,122,978 |

|

Current Liabilities |

3,566,977 |

3,273,058 |

3,029,599 |

|

Non-Current Liabilities |

3,394,706 |

3,414,695 |

2,773,919 |

|

Share Capital |

27,657,591 |

27,657,591 |

25,218,093 |

SELECTED QUARTERLY

INFORMATION

The Company’s functional currency is the US

dollar (USD). The functional currency of the Company’s US

subsidiary Aurora is USD.

Operating results for each quarter for the last

two fiscal years are presented in the table below.

|

Quarters End |

March 31,2024 |

|

December 31,2023 |

|

September 30,2023 |

|

June 30,2023 |

|

March 31,2023 |

|

December 31, 2022 |

|

September 30, 2022 |

|

June 30,2022 |

|

|

|

$USD |

|

$USD |

|

$USD |

|

$USD |

|

$USD |

|

$USD |

|

$USD |

|

$USD |

|

|

Revenue |

4,013,801 |

|

4,044,234 |

|

3,949,530 |

|

3,568,583 |

|

2,958,088 |

|

3,609,514 |

|

3,648,680 |

|

4,067,166 |

|

|

Cost of goods sold |

(1,529,538 |

) |

(1,749,216 |

) |

(1,592,530 |

) |

(1,537,410 |

) |

(1,429,987 |

) |

(1,783,881 |

) |

(1,706,677 |

) |

(1,926,683 |

) |

|

Gross profit |

2,484,263 |

|

2,295,018 |

|

2,357,000 |

|

2,031,173 |

|

1,528,101 |

|

1,825,632 |

|

1,942,003 |

|

2,140,483 |

|

|

Operating expenses |

2,751,188 |

|

2,580,613 |

|

2,606,618 |

|

2,513,587 |

|

2,191,039 |

|

2,665,203 |

|

2,057,655 |

|

2,367,985 |

|

|

EBITDAC* |

117,171 |

|

109,734 |

|

120,796 |

|

(163,660 |

) |

(377,871 |

) |

(358,311 |

) |

150,687 |

|

96,285 |

|

|

Net loss |

(266,925 |

) |

(285,595 |

) |

(249,618 |

) |

(482,414 |

) |

(662,938 |

) |

(839,570 |

) |

(115,652 |

) |

(159,667 |

) |

|

Basic and diluted loss per share** |

(0.00 |

) |

(0.00 |

) |

(0.00 |

) |

(0.01 |

) |

(0.01 |

) |

(0.01 |

) |

(0.00 |

) |

(0.00 |

) |

* EBITDAC is a non-GAAP, non IFRS measure

defined as Earnings before Interest, Tax, Depreciation,

Amortization and Stock based compensation. This amount includes

Gains (losses) on sale of property and equipment and Other income

(expense). ** Outstanding options and warrants

have not been included in the calculation of the diluted loss per

share as they would have the effect of being anti-dilutive.

First Quarter 2024 and Fiscal Year 2023 Conference Call

Details

Date and Time: Tuesday May 14, 2024, at 11:00

a.m. ET / 8:00 a.m. PT

Call-in Information: Interested parties can

access the conference call by dialing (844) 861-5497 or (412)

317-5794.

Webcast: Interested parties can access the

conference call via a live webcast, which is available via the

following link: https://app.webinar.net/JbqanyRDeyx.

Replay: A teleconference replay of the call

will be available until May 21, 2024, at (877) 344-7529 or (412)

317-0088, replay access code 9427446. Additionally, a replay of the

webcast will be available at https://app.webinar.net/JbqanyRDeyx

for 90 days.

About Aurora Spine

Aurora Spine is focused on bringing new solutions to the spinal

implant market through a series of innovative, minimally invasive,

regenerative spinal implant technologies. Additional information

can be accessed at www.aurora-spine.com or www.aurorapaincare.com.

Neither TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Forward-Looking Statements This news release

contains forward-looking information that involves substantial

known and unknown risks and uncertainties, most of which are beyond

the control of Aurora Spine, including, without limitation, those

listed under "Risk Factors" and "Cautionary Statement Regarding

Forward-Looking Information" in Aurora Spine's final prospectus

(collectively, "forward-looking information"). Forward-looking

information in this news release includes information concerning

the proposed use and success of the company’s products in surgical

procedures. Aurora Spine cautions investors of Aurora Spine's

securities about important factors that could cause Aurora Spine's

actual results to differ materially from those projected in any

forward-looking statements included in this news release. Any

statements that express, or involve discussions as to,

expectations, beliefs, plans, objectives, assumptions or future

events or performance are not historical facts and may be

forward-looking and may involve estimates, assumptions and

uncertainties which could cause actual results or outcomes to

differ unilaterally from those expressed in such forward-looking

statements. No assurance can be given that the expectations set out

herein will prove to be correct and, accordingly, prospective

investors should not place undue reliance on these forward-looking

statements. These statements speak only as of the date of this

press release and Aurora Spine does not assume any obligation to

update or revise them to reflect new events or circumstances.

Contact:

Aurora Spine Corporation

Trent Northcutt President and Chief Executive Officer (760)

424-2004

Chad Clouse Chief Financial Officer (760) 424-2004

www.aurora-spine.com

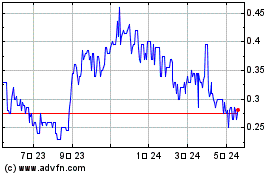

Aurora Spine (TSXV:ASG)

過去 株価チャート

から 12 2024 まで 1 2025

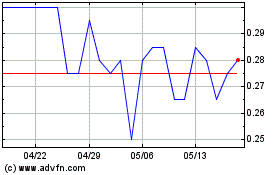

Aurora Spine (TSXV:ASG)

過去 株価チャート

から 1 2024 まで 1 2025