News Release – TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or

the Company) will host its Investor Day today. The event will

outline TC Energy’s strategic vision and growth outlook,

highlighting the Company's position as a leading North American

energy infrastructure company. François Poirier, TC Energy’s

President and Chief Executive Officer commented, "With natural gas

and electricity projected to drive 75 per cent of the growth in

final energy consumption through 2035, TC Energy’s portfolio of

natural gas and power assets strategically align with the vast

opportunity we are seeing across our North American footprint." He

continued, "by focusing on safety, operational excellence,

disciplined capital allocation, and maximizing the value of our

assets, TC Energy will continue to deliver solid growth, low risk

and repeatable performance.”

We have now aligned our portfolio across complementary

businesses, natural gas and power, where wide-scale electrification

is a significant common driver of future demand growth. Led by a

three-fold increase in LNG exports, strong growth in power

generation driven by coal retirements and data centre demand, our

forecast shows North American natural gas demand increasing by

nearly 40 Bcf/d by 2035. Our assets have a pivotal role in the

delivery of reliable, affordable, and sustainable energy, as

evidenced by approximately 13 Bcf/d of projects currently in

development.

Reflecting this opportunity, today we are announcing four new

growth projects across our portfolio with a weighted average

build multiple(2) expected to range near the midpoint of 5 to 7

times.

- We have sanctioned two projects on our Columbia Gulf System:

the US$0.4 billion Pulaski Project and the US$0.4 billion Maysville

Project. These mainline extension projects off Columbia Gulf will

facilitate full coal-to-gas conversion at two existing power plants

and provide supply for incremental gas-fired generation.

Underpinned by 20 year take-or-pay contracts, each project will

provide 0.2 Bcf/d of capacity, with estimated in-service dates in

2029. The opportunity for coal-to-gas conversion is significant,

with nine gigawatts of coal-fired power generation slated to retire

by 2031 within 15 miles of our assets.

- In response to growing peak day requirements and reliability

needs from LDC customers, we have sanctioned the US$0.3 billion

Southeast Virginia Energy Storage Project. This is an LNG peaking

facility in southeast Virginia that will serve an existing LDC's

growing winter peak day load and mitigate its peak day pricing

exposure, as well as increase operational flexibility on a critical

part of the Columbia Gas system. The 0.1 Bcf/d deliverability

project has a targeted in-service date of 2030. This project

furthers our position as one of the largest natural gas storage

operators in North America.

- With electricity demand in the province of Ontario expected to

increase 75 per cent by 2050, we are pleased to announce that Bruce

Power is progressing with Stage 3a of Project 2030 which will

provide incremental capacity of approximately 90 MW at the site. TC

Energy’s share of the capital required is approximately $175

million. Bruce Power will not be requesting an incremental capital

call for this stage. By optimizing its existing Units through this

program, when complete, Project 2030 is expected to increase the

Bruce Power site peak output to 7,000 MW. All of this output will

be sold under Bruce Power’s long-term contract with the IESO.

Coastal GasLink LP (CGL) has also executed a commercial

agreement with LNG Canada and CGL customers that declares pipeline

commercial in-service for the pipeline, allowing for the collection

of tolls from customers retroactive to Oct. 1, 2024.

- As part of the agreement, TC Energy

will receive a one-time payment of $199 million, in recognition of

the completion of certain work and settlement of final costs. In

line with the terms of the agreement, this payment is expected to

be received three months after LNGC declares in-service, but no

later than Dec. 15, 2025. The final project costs remain within the

approximately $14.5 billion cost estimate. Coastal GasLink LP

continues to pursue cost recoveries from contractors through

various proceedings, and while we are unable to quantify with any

certainty, expect these efforts are likely to result in net

recoveries. This is another important milestone in support of LNG

Canada’s commissioning and safe start-up activities. As LNG Canada

has indicated, it remains on track to deliver first cargoes by the

middle of 2025.

By focusing on a clear set of strategic priorities that

emphasize safety, operational excellence and project execution, TC

Energy is poised to deliver significant value. Our $32 billion

sanctioned capital program, utility-like asset base and disciplined

strategy provide visibility to organically deliver an expected

above-average comparable EBITDA growth rate of approximately five

to seven per cent through 2027. Approximately 97 per cent of our

comparable EBITDA outlook continues to be underpinned by

rate-regulation and/or long-term take-or-pay contracts. We will

continue to look for ways to high-grade projects, optimize capital

expenditures and deliver strong project execution to further

enhance this solid, low-risk growth profile.

TC Energy’s Investor Day event is scheduled to begin at 8 a.m.

EST (6 a.m. MST) on Nov. 19, 2024. Connect to the live event

webcast by registering through the TC Energy website Investors

section, Investor Day 2024 (tcenergy.com) or at the webcast link,

TC Energy Investor Day webcast 2024. Presentation materials will be

available at Investor Day 2024 (tcenergy.com) at 6 a.m. EST (4 a.m.

MST), Nov. 19, 2024, and a recording will be posted following the

event.

|

1) |

Comparable

EBITDA is a non-GAAP measure used throughout this news release.

This measure does not have any standardized meaning under GAAP and

therefore is unlikely to be comparable to similar measures

presented by other companies. The most directly comparable GAAP

measure is Segmented earnings. For more information on non-GAAP

measures, refer to the “Non-GAAP Measures” section of this news

release. |

| 2) |

Build multiple is a metric calculated by dividing capital

expenditures by comparable EBITDA. Please note our method for

calculating build multiple may differ from methods used by other

entities. Therefore, it may not be comparable to similar measures

presented by other entities. |

| 3) |

Adjusted funds from operations (AFFO) is a non-GAAP measure.

For more information on non-GAAP measures, refer to the “Non-GAAP

Measures” section of this news release. |

| |

|

About TC EnergyWe’re a team of 7,000+ energy

problem solvers working to safely move, generate and store the

energy North America relies on. Today, we’re delivering solutions

to the world’s toughest energy challenges – from innovating to

deliver the natural gas that feeds LNG to global markets, to

working to reduce emissions from our assets, to partnering with our

neighbours, customers and governments to build the energy system of

the future. It’s all part of how we continue to deliver sustainable

returns for our investors and create value for communities.

TC Energy’s common shares trade on the Toronto (TSX) and New

York (NYSE) stock exchanges under the symbol TRP. To learn more,

visit us at TCEnergy.com.

NON-GAAP MEASURESThis release refers to

comparable EBITDA, build multiple, and Adjusted funds generated

from operations, each of which are non-GAAP measures or non-GAAP

ratios. Each these measures do not have any standardized meaning as

prescribed by U.S. GAAP and therefore may not be comparable to

similar measures presented by other entities.

For comparable EBITDA, the most directly comparable measure

presented in the financial statements is segmented earnings. For

reconciliations of comparable EBITDA to segmented earnings for the

years ended Dec. 31, 2023 and 2022, refer to the applicable

business segment in our management’s discussion and analysis

(MD&A) for such periods, which sections are incorporated by

reference herein. Refer to the non-GAAP measures section of the

MD&A in our most recent quarterly report for more information

about the non-GAAP measures we use, which section of the MD&A

is incorporated by reference herein. The MD&A can be found on

SEDAR+ at www.sedarplus.ca under TC Energy’s profile.

Build multiple is a non-GAAP ratio which is calculated using

capital expenditures and comparable EBITDA. We believe build

multiple provides investors with a useful measure to evaluate

capital projects. Please note our method for calculating build

multiple may differ from methods used by other entities. Therefore,

it may not be comparable to similar measures presented by other

entities.

Adjusted funds generated from operations represents comparable

FGFO, adjusted to reflect non-controlling interest distributions

before capex contributions and debt recapitalization. The most

directly comparable measure presented in the financial statements

is net cash from operations. We believe funds generated from

operations is a useful measure of our consolidated operating cash

flows because it excludes fluctuations from working capital

balances, which do not necessarily reflect underlying operations in

the same period, and is used to provide a consistent measure of the

cash-generating ability of our businesses. Comparable funds

generated from operations is adjusted for the cash impact of

specific items described in the reconciliation. For reconciliations

of comparable funds generated from operations to net cash from

operations for the years ended Dec. 31, 2023 and 2022, refer to the

applicable business segment in our management’s discussion and

analysis (MD&A) for such periods, which sections are

incorporated by reference herein. Refer to the non-GAAP measures

section of the MD&A in our most recent quarterly report for

more information about the non-GAAP measures we use, which section

of the MD&A is incorporated by reference herein. The MD&A

can be found on SEDAR+ at www.sedarplus.ca under TC Energy’s

profile.

See “Reconciliation” for the reconciliation of Adjusted funds

generated from operations for the years ended Dec. 31, 2022 and

2023.

FORWARD-LOOKING INFORMATIONThis release

contains certain information that is forward-looking and is subject

to important risks and uncertainties (such statements are usually

accompanied by words such as "anticipate", "expect", "believe",

"may", "will", "should", "estimate", "intend" or other similar

words). Forward-looking statements in this document may include,

but are not limited to, expectations about strategies and goals for

growth and expansion, statements on our projected comparable

EBITDA, expected energy demand levels, our expected capital

expenditures, including Build multiple, expected outcomes with

respect to legal proceedings, and expected costs and schedules for

planned projects, including projects under construction and in

development. Forward-looking statements in this document are

intended to provide TC Energy security holders and potential

investors with information regarding TC Energy and its

subsidiaries, including management's assessment of TC Energy's and

its subsidiaries' future plans and financial outlook. All

forward-looking statements reflect TC Energy's beliefs and

assumptions based on information available at the time the

statements were made and as such are not guarantees of future

performance. As actual results could vary significantly from the

forward-looking information, you should not put undue reliance on

forward-looking information and should not use future-oriented

information or financial outlooks for anything other than their

intended purpose. We do not update our forward-looking information

due to new information or future events, unless we are required to

by law. For additional information on the assumptions made, and the

risks and uncertainties which could cause actual results to differ

from the anticipated results, refer to the most recent Quarterly

Report to Shareholders and Annual Report filed under TC Energy’s

profile on SEDAR+ at www.sedarplus.ca and with the U.S. Securities

and Exchange Commission at www.sec.gov.

Reconciliation:

|

|

year ended December 31 |

|

(millions of Canadian $) |

2023 |

|

2022 |

|

|

|

|

|

| Net cash

provided by operations |

7,268 |

|

6,375 |

|

Increase (decrease) in operating working capital |

(207) |

|

639 |

|

Funds generated from

operationsi |

7,061 |

|

7,014 |

| Specific

items |

|

|

|

|

Current income tax expense on disposition of equity interestii |

736 |

|

- |

|

Focus Project costs, net of current income tax |

54 |

|

- |

|

Keystone regulatory decisions, net of current income tax |

53 |

|

27 |

|

Liquids Pipelines business separation costs |

40 |

|

- |

|

Milepost 14 insurance expense |

36 |

|

- |

|

Settlement of Mexico prior years' income tax assessments |

- |

|

196 |

|

Keystone XL preservation and other, net of current income tax |

14 |

|

20 |

|

Current income tax expense on Keystone XL asset impairment charge

and other |

(14) |

|

96 |

|

Comparable funds generated from

operationsi |

7,980 |

|

7,353 |

| NCI

distributions (pre-capex and debt recap) |

(246) |

|

(44) |

|

Adjusted FGFO (AFFO) |

7,734 |

7,309 |

|

|

| i Funds generated from operations, comparable

funds generated from operations and adjusted funds from operations

are non-GAAP measures. See the non-GAAP measures slide at the front

of this presentation for more information. |

| ii Current income tax expense related to

applying an approximate 24 per cent tax rate to the tax gain on

sale of a 40 per cent non-controlling equity interest in Columbia

Gas and Columbia Gulf. This is offset by a corresponding deferred

tax recovery resulting in no net impact to tax expense. |

| |

-30-

Media Inquiries:Media

Relationsmedia@tcenergy.com 403-920-7859 or 800-608-7859

Investor & Analyst Inquiries:Gavin Wylie /

Hunter Mauinvestor_relations@tcenergy.com403-920-7911 or

800-361-6522

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d88aeb97-194c-4757-bb22-1b15d736a375

PDF

available: http://ml.globenewswire.com/Resource/Download/f4f8547b-80db-4675-8e47-68462d86c1e5

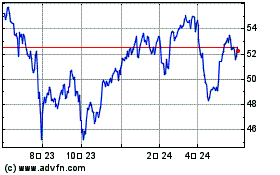

TC Energy (TSX:TRP)

過去 株価チャート

から 11 2024 まで 12 2024

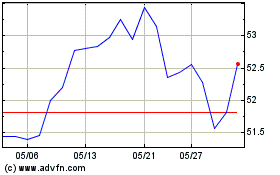

TC Energy (TSX:TRP)

過去 株価チャート

から 12 2023 まで 12 2024