(TSX: NWC): The North

West Company Inc. (the "Company" or "North West") today reported

its unaudited financial results for the second quarter ended

July 31, 2024. It also announced that the Board of Directors

has declared a quarterly dividend of $0.40, an increase of $0.01 or

2.6% per share, to shareholders of record on September 30,

2024, to be paid on October 15, 2024.

“Overall, we are very pleased with the results

this quarter where we delivered increases in adjusted EBITDA and

adjusted net earnings in comparison to a strong second quarter last

year," commented President & CEO, Dan McConnell. “Looking

ahead, we are optimistic about the foundation we are building

across our company through our focus on operational excellence

initiatives and the momentum in our Canadian business which

collectively, are expected to offset near-term uncertainty related

to economic and inflationary pressures in our International

Operations.”

Financial

Highlights

Sales Second

quarter consolidated sales increased 4.6% to $646.5 million

compared to $618.1 million last year driven by same store sales

gains, the impact of foreign exchange on the translation of

International Operations sales and new stores. Excluding the

foreign exchange impact, consolidated sales increased 3.8%, with

food sales increasing 3.9% and general merchandise and other sales

increasing 3.4% compared to last year. On a same store basis, sales

increased 4.3%1 compared to the second quarter last year led by a

6.8%1 increase in same store sales in Canadian Operations. A 0.9%1

increase in same store sales in International Operations was also a

factor.

Gross Profit

Gross profit increased 7.5% to $219.8 million compared to $204.4

million last year due to sales gains and a 91 basis point increase

in gross profit rate compared to last year. The increase in gross

profit rate was largely due to changes in sales blend, including a

lower blend of wholesale food sales, and a decrease in

markdowns.

Selling, Operating and

Administrative Expenses Selling, operating and

administrative expenses ("Expenses") increased $15.1 million or

10.1% compared to last year and were up 127 basis points as a

percentage to sales. The increase in Expenses is mainly due to cost

inflation impacts, including higher wage costs, an increase in

depreciation, the impact of foreign exchange on the translation of

International Operations Expenses and higher vessel repairs

incurred through our investment in Transport Nanuk Inc. ("TNI") in

Canadian Operations. The impact of a $5.5 million increase in

share-based compensation costs primarily due to adjustments from

changes in the Company's share price partially offset by a $3.7

million loss on our Fox Lake, Alberta store that was destroyed by

wild fire in the second quarter last year (collectively

"Non-Comparable Expenses2") were also factors.

Earnings From

Operations Earnings from operations ("EBIT")

increased 0.4% to $54.9 million compared to $54.7 million last year

and earnings before interest, income taxes, depreciation and

amortization ("EBITDA2") increased 4.1% to $83.4 million compared

to $80.1 million last year due to the sales, gross profit and

Expense factors previously noted. A $1.8 million decrease in

earnings from our investment in TNI compared to last year resulting

from an increase in vessel repairs, that also temporarily delayed

the start of the sealift shipping season, combined with lower

International shipping rates, was also a factor. Adjusted EBITDA2,

which excludes the Non-Comparable Expenses, increased 6.1% to $88.4

million compared to $83.3 million last year and as a percentage to

sales was 13.7% compared to 13.5% last year.

Income Tax

Expense Income tax expense increased to $13.6

million compared to $12.0 million last year due to higher earnings

and an increase in the effective tax rate to 27.0% compared to

24.0% last year. The increase in the effective tax rate is largely

due to the impact of The Global Minimum Tax Act ("GMTA") – Pillar

Two legislation enacted in Canada on June 20, 2024, but is

effective as of the beginning of the Company's fiscal year. This

legislation applies a minimum effective tax rate of 15% on income

earned in each jurisdiction in which the Company operates resulting

in a $1.0 million increase in income tax expense and a 198 basis

point increase in the effective tax rate in the quarter.

Net Earnings

Net earnings decreased 3.0% to $36.9 million compared to very

strong net earnings of $38.0 million last year. Net earnings

attributable to shareholders were $35.3 million and diluted

earnings per share were $0.73 per share compared to $0.76 per share

last year. Adjusted net earnings2, which excludes the after-tax

impact of the Non-Comparable Expenses, increased $0.6 million or

1.6% to $40.7 million compared to $40.0 million last year due to

the gross profit, Expense and GMTA - Pillar Two income tax expense

factors.

Non-GAAP Financial

Measures

The Company uses the following non-GAAP

financial measures: earnings before interest, income taxes,

depreciation and amortization ("EBITDA"), adjusted EBITDA and

adjusted net earnings. The Company believes these non-GAAP

financial measures provide useful information to both management

and investors in measuring the financial performance and financial

condition of the Company for the reasons outlined below.

Earnings Before Interest, Income

Taxes, Depreciation and Amortization (EBITDA) is

not a recognized measure under IFRS. Management believes that in

addition to net earnings, EBITDA is a useful supplemental measure

as it provides investors with an indication of the Company's

operational performance before allocating the cost of interest,

income taxes and capital investments. Investors should be cautioned

however, that EBITDA should not be construed as an alternative to

net earnings determined in accordance with IFRS as an indicator of

the Company's performance. The Company's method of calculating

EBITDA may differ from other companies and may not be comparable to

measures used by other companies.

Adjusted EBITDA and Adjusted Net

Earnings are not recognized measures under IFRS.

Management uses these non-GAAP financial measures to exclude the

impact of certain income and expenses that must be recognized under

IFRS. The excluded amounts are either subject to volatility in the

Company's share price or may not necessarily be reflective of the

Company's underlying operating performance. These factors can make

comparisons of the Company's financial performance between periods

more difficult. The Company may exclude additional items if it

believes that doing so will result in a more effective analysis and

explanation of the underlying financial performance. The exclusion

of these items does not imply that they are non-recurring.

These measures do not have a standardized

meaning prescribed by GAAP and therefore they may not be comparable

to similarly titled measures presented by other publicly traded

companies and should not be construed as an alternative to the

other financial measures determined in accordance with IFRS.

Reconciliation of consolidated

earnings from operations (EBIT) to EBITDA and adjusted

EBITDA:

|

|

|

| |

Second Quarter |

| ($ in

thousands) |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

| Earnings from operations

(EBIT) |

$ |

54,881 |

|

$ |

54,686 |

|

| Add:

Amortization |

|

28,532 |

|

|

25,422 |

|

|

EBITDA |

$ |

83,413 |

|

$ |

80,108 |

|

| Adjusted for: |

|

|

|

|

Fox Lake wild fire asset write-off(3) |

|

— |

|

|

3,694 |

|

|

Share-based compensation expense |

|

5,014 |

|

|

(471 |

) |

|

Adjusted EBITDA |

$ |

88,427 |

|

$ |

83,331 |

|

(3) On May 5, 2023, the Company's store in Fox

Lake, Alberta was destroyed by wild fire which resulted in a

write-off of assets.

1 Excluding the impact of foreign

exchange2 See Non-GAAP Measures Section of the news

release

Reconciliation of consolidated net

earnings to adjusted net earnings:

|

|

|

| |

Second Quarter |

|

($ in thousands) |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

| Net earnings |

$ |

36,897 |

|

$ |

38,045 |

|

| Adjusted for: |

|

|

|

|

Fox Lake wild fire asset write-off, net of tax(3) |

|

— |

|

|

2,551 |

|

|

Share-based compensation expense, net of tax |

|

3,776 |

|

|

(559 |

) |

|

Adjusted net earnings |

$ |

40,673 |

|

$ |

40,037 |

|

(3) On May 5, 2023, the Company's store in Fox

Lake, Alberta was destroyed by wild fire which resulted in a

write-off of assets.

Certain share-based compensation costs are

presented as liabilities on the Company's consolidated balance

sheets. The Company is exposed to market price fluctuations in its

share price through these share-based compensation costs. These

liabilities are recorded at fair value at each reporting date based

on the market price of the Company's shares at the end of each

reporting period with the changes in fair value recorded in

selling, operating and administrative expenses.

Further information on the financial results is

available in the Company's 2024 second quarter Report to

Shareholders, Management's Discussion and Analysis and unaudited

interim period condensed consolidated financial statements which

can be found in the investor section of the Company's website at

www.northwest.ca.

Second Quarter Conference

Call

North West will host a conference call for its

second quarter results on September 5, 2024 at 8:30 a.m. (Central

Time). To access the call, please dial 416-406-0743 or

1-800-952-5114 with a pass code of 1022928#. The conference call

will be archived and can be accessed by dialing 905-694-9451 or

1-800-408-3053 with a pass code of 7013862# on or before October 3,

2024.

Notice to

Readers

Certain forward-looking statements are made in

this news release, within the meaning of applicable securities

laws. These statements reflect North West's current expectations

and are based on information currently available to management.

Forward-looking statements about the Company, including its

business operations, strategy and expected financial performance

and condition. Forward-looking statements include statements that

are predictive in nature, depend upon or refer to future events or

conditions, or include words such as “expects”, “anticipates”,

“plans”, “believes”, “estimates”, “intends”, “targets”, “projects”,

“forecasts” or negative versions thereof and other similar

expressions, or future or conditional future financial performance

(including sales, earnings, growth rates, capital expenditures,

dividends, debt levels, financial capacity, access to capital, and

liquidity), ongoing business strategies or prospects, the Company's

intentions regarding a normal course issuer bid, the potential

impact of a pandemic on the Company's operations, supply chain and

the Company's related business continuity plans, the realization of

cost savings from cost reduction plans, the anticipated impact of

The Next 100 strategic priorities and possible future action by the

Company.

Forward-looking statements are based on current

expectations and projections about future events and are inherently

subject to, among other things, risks, uncertainties and

assumptions about the Company, economic factors and the retail

industry in general. They are not guarantees of future performance,

and actual events and results could differ materially from those

expressed or implied by forward-looking statements made by the

Company due to changes in economic conditions, political and market

factors in North America and internationally. These factors

include, but are not limited to, changes in inflation, interest and

foreign exchange rates, the Company's ability to maintain an

effective supply chain, changes in accounting policies and methods

used to report financial condition, including uncertainties

associated with critical accounting assumptions and estimates, the

effect of applying future accounting changes, business competition,

technological change, changes in government regulations and

legislation, changes in tax laws, unexpected judicial or regulatory

proceedings, catastrophic events, the Company's ability to complete

and realize benefits from capital projects, E-Commerce investments,

strategic transactions and the integration of acquisitions, the

Company's ability to realize benefits from investments in

information technology ("IT") and systems, including IT system

implementations, or unanticipated results from these initiatives

and the Company's success in anticipating and managing the

foregoing risks.

The reader is cautioned that the foregoing list

of important factors is not exhaustive. Other risks are outlined in

the Risk Management section of the 2023 Annual Report and in the

Risk Factors sections of the Annual Information Form and Management

Information Circular, material change reports and news releases.

The reader is also cautioned to consider these and other factors

carefully and not place undue reliance on forward-looking

statements. Other than as specifically required by applicable law,

the Company does not intend to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

Additional information on the Company, including

our Annual Information Form, can be found on SEDAR+ at

www.sedarplus.com or on the Company's website at

www.northwest.ca.

Company

Profile

The North West Company Inc., through its

subsidiaries, is a leading retailer of food and everyday products

and services to rural communities and urban neighbourhoods in

Canada, Alaska, the South Pacific and the Caribbean. North West

operates 229 stores under the trading names Northern, NorthMart,

Giant Tiger, Alaska Commercial Company, Cost-U-Less and RiteWay

Food Markets and has annualized sales of approximately CDN$2.5

billion.

The common shares of North West

trade on the Toronto Stock Exchange under the symbol

NWC.

For more information

contact:

Dan McConnell, President and Chief Executive

Officer, The North West Company Inc. Phone 204-934-1482; fax

204-934-1317; email dmcconnell@northwest.ca

John King, Executive Vice-President and Chief

Financial Officer, The North West Company Inc. Phone 204-934-1397;

fax 204-934-1317; email jking@northwest.ca

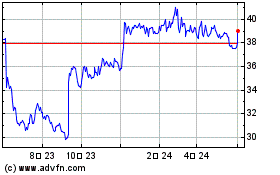

The North West (TSX:NWC)

過去 株価チャート

から 12 2024 まで 1 2025

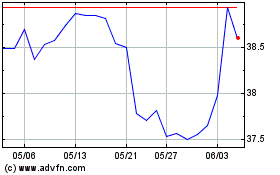

The North West (TSX:NWC)

過去 株価チャート

から 1 2024 まで 1 2025