SL Green Announces Sale Closings Totaling $691 Million

2024年7月18日 - 5:20AM

SL Green Realty Corp. (NYSE: SLG), Manhattan’s largest office

landlord, today announced that it has closed on the sale of three

properties totaling $691.4 million, including 625 Madison Avenue,

719 Seventh Avenue and the Palisades Premier Conference Center,

which generated net proceeds to the Company of $222.7 million that

was used for corporate debt repayment.

“As we enter the second half of the year with an improving

market backdrop, we have made meaningful progress in achieving our

ambitious business goals for 2024, as evidenced by the execution of

these strategic transactions,” said Brett Herschenfeld,

Executive Vice President, Retail & Opportunistic

Investments.

- 625 Madison Avenue: Together with its joint

venture partner, the Company closed on the sale of the fee

ownership interest in 625 Madison Avenue for a gross sales price of

$634.6 million plus certain fees payable to the Company. In

connection with the sale, the Company, together with its joint

venture partner, originated a $235.5 million preferred equity

investment in the property. The transaction generated net proceeds

to the Company of $199.3 million.

- 719 Seventh Avenue: The Company closed on the

sale of 719 Seventh Avenue in Times Square for $30.5 million plus

certain fees payable to the Company. In connection with the closing

of the sale, the Company repaid the existing $50.0 million mortgage

for $32.0 million. The transaction generated net proceeds to the

Company of $3.6 million after repayment of the mortgage loan.

- Palisades Training Center: The Company closed

on the sale of the Palisades Premier Conference Center for $26.3

million plus certain fees payable to the Company. The transaction

generated net proceeds to the Company of $19.8 million.

About SL Green Realty Corp.SL Green Realty

Corp., Manhattan's largest office landlord, is a fully integrated

real estate investment trust, or REIT, that is focused primarily on

acquiring, managing and maximizing the value of Manhattan

commercial properties. As of June 30, 2024, SL Green held interests

in 55 buildings totaling 31.8 million square feet. This included

ownership interests in 28.1 million square feet of Manhattan

buildings and 2.8 million square feet securing debt and preferred

equity investments.

Forward Looking StatementThis

press release includes certain statements that may be deemed to be

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and are intended to be

covered by the safe harbor provisions thereof. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that we

expect, believe or anticipate will or may occur in the future,

including such matters as future capital expenditures, dividends

and acquisitions (including the amount and nature thereof),

development trends of the real estate industry and the New York

metropolitan area markets, business strategies, expansion and

growth of our operations and other similar matters, are

forward-looking statements. These forward-looking statements are

based on certain assumptions and analyses made by us in light of

our experience and our perception of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate. Forward-looking statements are not

guarantees of future performance and actual results or developments

may differ materially, and we caution you not to place undue

reliance on such statements. Forward-looking statements are

generally identifiable by the use of the words "may," "will,"

"should," "expect," "anticipate," "estimate," "believe," "intend,"

"project," "continue," or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this

press release are subject to a number of risks and uncertainties,

many of which are beyond our control, that may cause our actual

results, performance or achievements to be materially different

from future results, performance or achievements expressed or

implied by forward-looking statements made by us. Factors and risks

to our business that could cause actual results to differ from

those contained in the forward-looking statements include risks and

uncertainties described in our filings with the Securities and

Exchange Commission. Except to the extent required by law, we

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of future events,

new information or otherwise.

PRESS CONTACTslgreen@berlinrosen.com

SLG-A&D

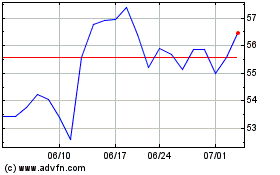

SL Green Realty (NYSE:SLG)

過去 株価チャート

から 6 2024 まで 7 2024

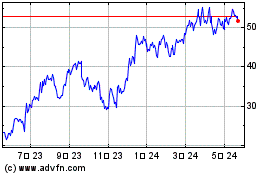

SL Green Realty (NYSE:SLG)

過去 株価チャート

から 7 2023 まで 7 2024