- Subscription revenue of $67.1 million, up 12%

year-over-year.

- Subscription gross margin of 78% and non-GAAP subscription

gross margin of 80%, an improvement of more than 190 basis points

year-over-year.

- Continued improvement in areas of profitability, including a

185% improvement in operating cash flow year-to-date.

PROS Holdings, Inc. (NYSE: PRO), a leading provider of

AI-powered SaaS pricing, CPQ, revenue management, and digital offer

marketing solutions, today announced financial results for the

third quarter ended September 30, 2024.

“I’m proud of our team for delivering a strong third quarter

where we exceeded the high-end of our guidance ranges across all

metrics,” stated CEO Andres Reiner. “Our strong performance

reflects the trust and confidence businesses have in our platform,

which is why we’re winning prominent new customers and expanding

our existing base, further demonstrating the value and innovation

we bring to the market.”

Third Quarter 2024 Financial Highlights

Key financial results for the third quarter 2024 are shown

below. Throughout this press release all dollar figures are in

millions, except net earnings (loss) per share. Unless otherwise

noted, all results are on a reported basis and are compared with

the prior-year period.

GAAP

Non-GAAP

Q3 2024

Q3 2023

Change

Q3 2024

Q3 2023

Change

Revenue:

Total Revenue

$

82.7

$

77.3

7

%

n/a

n/a

n/a

Subscription Revenue

$

67.1

$

60.0

12

%

n/a

n/a

n/a

Subscription and Maintenance Revenue

$

70.4

$

64.7

9

%

n/a

n/a

n/a

Profitability:

Gross Profit

$

54.4

$

48.8

12

%

$

56.3

$

50.9

11

%

Operating Income (Loss)

$

—

$

(7.8

)

$

7.9

$

8.4

$

4.5

$

3.8

Net Income (Loss)

$

0.2

$

(13.9

)

$

14.1

$

6.6

$

4.0

$

2.5

Net Earnings (Loss) Per Share

$

—

$

(0.30

)

$

0.30

$

0.14

$

0.09

$

0.05

Adjusted EBITDA

n/a

n/a

n/a

$

9.3

$

5.6

$

3.6

Cash:

Net Cash Provided by Operating

Activities

$

1.6

$

8.7

$

(7.1

)

n/a

n/a

n/a

Free Cash Flow

n/a

n/a

n/a

$

1.4

$

8.5

$

(7.1

)

The attached table provides a summary of PROS results for the

period, including a reconciliation of GAAP to non-GAAP metrics.

Recent Business Highlights

- Welcomed many new customers who are adopting the PROS Platform

such as a global top 5 telecommunications provider, Dan Air, Fox

Rent-A-Car, Noweda, South African Airways, Twist Bioscience, and

Vallen, among others.

- Expanded adoption of the PROS Platform within existing

customers including Asiana Air, BASF, Fonterra, Etihad. Kenworth de

Monterrey, Lufthansa, and TE Connectivity, among others.

- Added an AI agent to PROS Search Engine Marketing (SEM)

solution that leverages advanced models to optimize bidding

strategies for paid search; one AI model analyzes trends in clicks

and average cost-per-click, while another estimates the probability

of conversion—these insights inform the AI agent's optimized bid

proposals, helping marketing teams improve search engine

performance and maximize ROI.

- Launched Smart Rebate Management, enabling sellers to deliver

optimized, fully digital offers by integrating pricing, discounts,

promotions and rebates, while providing a holistic view of economic

levers for more tailored and optimal offers across all

channels.

- Certified as a Great Place to Work® for the third time and

across all eligible countries, recognizing our inclusive,

people-first culture.

Financial Outlook

PROS currently anticipates the following based on an estimated

47.5 million diluted weighted average shares outstanding for the

fourth quarter of 2024 and a 22% non-GAAP estimated tax rate for

the fourth quarter and full year 2024.

Q4 2024 Guidance

v. Q4 2023 at

Mid-Point

Full Year 2024

Guidance

v. Prior Year at

Mid-Point

Total Revenue

$84.1 to $85.1

9%

$329.5 to $330.5

9%

Subscription Revenue

$68.5 to $69.0

13%

$265.5 to $266.0

14%

Subscription ARR

n/a

n/a

$280.0 to $284.0

9%

Non-GAAP Earnings Per Share

$0.12 to $0.14

$0.11

n/a

n/a

Adjusted EBITDA

$8.4 to $9.4

$6.4

$27.5 to $28.5

$22.0

Free Cash Flow

n/a

n/a

$21.0 to $24.0

$11.1

Conference Call

In conjunction with this announcement, PROS Holdings, Inc. will

host a conference call on Tuesday, October 29, 2024, at 4:45 p.m.

ET to discuss the Company’s financial results and business outlook.

To access this call, dial 1-877-407-9039 (toll-free) or

1-201-689-8470. The live and archived webcasts of this call can be

accessed under the “Investor Relations” section of the Company’s

website at www.pros.com.

A telephone replay will be available until Tuesday, November 5,

2024, 11:59 PM ET at 1-844-512-2921 (toll-free) or 1-412-317-6671

using the pass code 13748298.

About PROS

PROS Holdings, Inc. (NYSE: PRO) is a leading provider of

AI-powered SaaS pricing, CPQ, revenue management, and digital offer

marketing solutions. Our vision is to optimize every shopping and

selling experience. With nearly 40 years of industry expertise and

a proven track record of success, PROS helps B2B and B2C companies

across the globe, in a variety of industries, including airlines,

manufacturing, distribution, and services, drive profitable growth.

The PROS Platform leverages AI to provide real-time predictive

insights that enable businesses to drive revenue and margin

improvements. To learn more about PROS and our innovative SaaS

solutions, please visit our website at www.pros.com.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements about our financial outlook;

expectations; ability to achieve future growth and profitability

goals; management's confidence and optimism; positioning; customer

successes; demand for our software solutions; pipeline; business

expansion; revenue; subscription revenue; subscription ARR;

non-GAAP earnings (loss) per share; adjusted EBITDA; free cash

flow; shares outstanding and effective tax rate. The

forward-looking statements contained in this press release are

based upon our historical performance and our current plans,

estimates and expectations and are not a representation that such

plans, estimates or expectations will be achieved. Factors that

could cause actual results to differ materially from those

described herein include, among others, risks related to: (a)

cyberattacks, data breaches and breaches of security measures

within our products, systems and infrastructure or products,

systems and infrastructure of third parties upon whom we rely, (b)

the macroeconomic environment and geopolitical uncertainty and

events, (c) increasing business from customers, maintaining

subscription renewal rates and capturing customer IT spend, (d)

managing our growth and profit objectives effectively, (e)

disruptions from our third party data center, software, data, and

other unrelated service providers, (f) implementing our solutions,

(g) cloud operations, (h) intellectual property and third-party

software, (i) acquiring and integrating businesses and/or

technologies, (j) catastrophic events, (k) operating globally,

including economic and commercial disruptions, (l) potential

downturns in sales and lengthy sales cycles, (m) software

innovation, (n) competition, (o) market acceptance of our software

innovations, (p) maintaining our corporate culture, (q) personnel

risks including loss of any key employees and competition for

talent, (r) expanding and training our direct and indirect sales

force, (s) evolving data privacy, cyber security, data localization

and AI laws, (t) our debt repayment obligations, (u) the timing of

revenue recognition and cash flow from operations, and (v)

returning to profitability. Additional information relating to the

risks and uncertainties affecting our business is contained in our

filings with the SEC. These forward-looking statements represent

our expectations as of the date hereof. Subsequent events may cause

these expectations to change, and PROS disclaims any obligations to

update or alter these forward-looking statements in the future,

whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Measures

PROS has provided in this release certain non-GAAP financial

measures, including non-GAAP gross profit and margin, non-GAAP

subscription margin, non-GAAP income (loss) from operations or

non-GAAP operating income (loss), subscription annual recurring

revenue, adjusted EBITDA, free cash flow, non-GAAP tax rate,

non-GAAP net income (loss), and non-GAAP earnings (loss) per share.

PROS uses these non-GAAP financial measures internally in analyzing

its financial results and believes they are useful to investors, as

a supplement to GAAP measures, in evaluating PROS ongoing

operational performance and cloud transition. Non-GAAP gross margin

can be compared to gross margin which can be calculated from the

condensed consolidated statements of income (loss) by dividing

gross profit by total revenue. Non-GAAP gross margin is similarly

calculated but first adds back to gross profit the portion of

certain of the non-GAAP adjustments described below attributable to

cost of revenue. Non-GAAP subscription margin can be compared to

subscription margin which can be calculated from the condensed

consolidated statements of income (loss) by dividing subscription

gross profit (subscription revenue minus subscription cost) by

subscription revenue. Non-GAAP subscription margin is similarly

calculated but first subtracts out from subscription cost the

portion of certain of the non-GAAP adjustments described below

attributable to cost of subscription. These items and amounts are

presented in the Supplemental Schedule of Non-GAAP Financial

Measures.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. Investors are encouraged to

review the reconciliation of these non-GAAP measures to their most

directly comparable GAAP financial measure as detailed above. A

reconciliation of GAAP financial measures to the non-GAAP financial

measures has been provided in the tables included as part of this

press release, and can be found, along with other financial

information, in the investor relations portion of our website. PROS

use of non-GAAP financial measures may not be consistent with the

presentations by similar companies in PROS industry. PROS has also

provided in this release certain forward-looking non-GAAP financial

measures, including non-GAAP income (loss) from operations,

subscription annual recurring revenue, non-GAAP earnings (loss) per

share, adjusted EBITDA, free cash flow, non-GAAP tax rates, and

calculated billings (collectively the "non-GAAP financial

measures") as follows:

Non-GAAP income (loss) from operations: Non-GAAP income

(loss) from operations excludes the impact of share-based

compensation, amortization of acquisition-related intangibles and

severance. Non-GAAP income (loss) from operations excludes the

following items from non-GAAP estimates:

- Share-Based Compensation: Although share-based

compensation is an important aspect of compensation for our

employees and executives, our share-based compensation expense can

vary because of changes in our stock price and market conditions at

the time of grant, varying valuation methodologies, and the variety

of award types. Since share-based compensation expense can vary for

reasons that are generally unrelated to our performance during any

particular period, we believe this could make it difficult for

investors to compare our current financial results to previous and

future periods. Therefore, we believe it is useful to exclude

share-based compensation in order to better understand our business

performance and allow investors to compare our operating results

with peer companies.

- Amortization of Acquisition-Related Intangibles: We view

amortization of acquisition-related intangible assets, such as the

amortization of the cost associated with an acquired company's

research and development efforts, trade names, customer lists and

customer relationships, as items arising from pre-acquisition

activities determined at the time of an acquisition. While these

intangible assets are continually evaluated for impairment,

amortization of the cost of purchased intangibles is a static

expense, one that is not typically affected by operations during

any particular period.

- Severance: Severance related to costs incurred as the

Company reprioritized its investments to focus on supporting key

growth areas of its business. As a result of this reprioritization,

the Company incurred severance, employee benefits, outplacement and

related costs. These amounts are unrelated to our core performance

during any particular period, and therefore, we believe it is

useful to exclude these amounts in order to better understand our

business performance and allow investors to compare our results

with peer companies.

Non-GAAP earnings (loss) per share: Non-GAAP net income

(loss) excludes the items listed above as excluded from non-GAAP

income (loss) from operations and also excludes amortization of

debt premium and issuance costs, loss on derivatives, loss on debt

extinguishment and the taxes related to these items and the items

excluded from non-GAAP income (loss) from operations. Estimates of

non-GAAP earnings (loss) per share are calculated by dividing

estimates for non-GAAP net income (loss) by our estimate of

weighted average shares outstanding for the future period. In

addition to the items listed above as excluded from non-GAAP income

(loss) from operations, non-GAAP net income (loss) excludes the

following items from non-GAAP estimates:

- Amortization of Debt Premium and Issuance Costs:

Amortization of debt premium and issuance costs are related to our

convertible notes. These amounts are unrelated to our core

performance during any particular period, and therefore, we believe

it is useful to exclude these amounts in order to better understand

our business performance and allow investors to compare our results

with peer companies.

- Loss on Derivatives: Loss on derivatives relates to mark

to market features identified as part of the exchange of certain of

our convertible notes (the "Exchange") and related capped call,

non-recurring transactions, during the quarter ended September 30,

2023. These amounts are unrelated to our core performance during

any particular period, and therefore, we believe it is useful to

exclude these amounts in order to better understand our business

performance and allow investors to compare our results with peer

companies.

- Loss on Debt Extinguishment: Loss on debt extinguishment

relates to the Exchange, a non-recurring transaction, during the

quarter ended September 30, 2023. These amounts are unrelated to

our core performance during any particular period, and therefore,

we believe it is useful to exclude these amounts in order to better

understand our business performance and allow investors to compare

our results with peer companies.

- Taxes: We exclude the tax consequences associated with

non-GAAP items to provide investors with a useful comparison of our

operating results to prior periods and to our peer companies

because such amounts can vary significantly. In the fourth quarter

of 2014, we concluded that it is more likely than not that we will

be unable to fully realize our deferred tax assets and accordingly,

established a valuation allowance against those assets. The ongoing

impact of the valuation allowance on our non-GAAP effective tax

rate has been eliminated to allow investors to better understand

our business performance and compare our operating results with

peer companies.

Subscription Annual Recurring Revenue: Subscription

Annual Recurring Revenue ("subscription ARR") is used to assess the

trajectory of our cloud business. Subscription ARR means, as of a

specified date, the contracted subscription revenue, including

contracts with a future start date, together with annualized

overage fees incurred above contracted minimum transactions.

Subscription ARR should be viewed independently of revenue and any

other GAAP measure.

Non-GAAP Tax Rate: The estimated non-GAAP effective tax

rate adjusts the tax effect to quantify the impact of the excluded

non-GAAP items.

Adjusted EBITDA: Adjusted EBITDA is defined as GAAP net

income (loss) before interest expense, provision for income taxes,

depreciation and amortization, as adjusted to eliminate the effect

of stock-based compensation cost, severance, amortization of

acquisition-related intangibles, depreciation and amortization, and

capitalized internal-use software development costs. Adjusted

EBITDA should not be considered as an alternative to net income

(loss) as an indicator of our operating performance.

Free Cash Flow: Free cash flow is a non-GAAP financial

measure which is defined as net cash provided by (used in)

operating activities, excluding severance payments, less capital

expenditures and capitalized internal-use software development

costs.

Calculated Billings: Calculated billings is defined as

total subscription, maintenance and support revenue plus the change

in recurring deferred revenue in a given period.

These non-GAAP estimates are not measurements of financial

performance prepared in accordance with GAAP, and we are unable to

reconcile these forward-looking non-GAAP financial measures to

their directly comparable GAAP financial measures because the

information described above which is needed to complete a

reconciliation is unavailable at this time without unreasonable

effort.

PROS Holdings, Inc.

Condensed Consolidated Balance

Sheets

(In thousands, except share and

per share amounts)

(Unaudited)

September 30, 2024

December 31, 2023

Assets:

Current assets:

Cash and cash equivalents

$

140,564

$

168,747

Trade and other receivables, net of

allowance of $690 and $574, respectively

48,225

49,058

Deferred costs, current

4,448

4,856

Prepaid and other current assets

10,782

12,013

Total current assets

204,019

234,674

Restricted cash

10,000

10,000

Property and equipment, net

20,391

23,051

Operating lease right-of-use assets

13,770

14,801

Deferred costs, noncurrent

10,690

10,292

Intangibles, net

7,997

11,678

Goodwill

107,970

107,860

Other assets, noncurrent

9,332

9,477

Total assets

$

384,169

$

421,833

Liabilities and Stockholders’ (Deficit)

Equity:

Current liabilities:

Accounts payable and other liabilities

$

5,270

$

3,034

Accrued liabilities

13,603

13,257

Accrued payroll and other employee

benefits

22,831

32,762

Operating lease liabilities, current

3,590

5,655

Deferred revenue, current

114,538

120,955

Current portion of convertible debt,

net

—

21,668

Total current liabilities

159,832

197,331

Deferred revenue, noncurrent

2,675

3,669

Convertible debt, net, noncurrent

271,173

272,324

Operating lease liabilities,

noncurrent

24,482

25,118

Other liabilities, noncurrent

1,231

1,264

Total liabilities

459,393

499,706

Stockholders' (deficit) equity:

Preferred stock, $0.001 par value,

5,000,000 shares authorized; none issued

—

—

Common stock, $0.001 par value, 75,000,000

shares authorized; 51,953,232 and 51,184,584 shares issued,

respectively; 47,272,509 and 46,503,861 shares outstanding,

respectively

52

51

Additional paid-in capital

625,085

604,084

Treasury stock, 4,680,723 common shares,

at cost

(29,847

)

(29,847

)

Accumulated deficit

(665,760

)

(647,252

)

Accumulated other comprehensive loss

(4,754

)

(4,909

)

Total stockholders’ (deficit) equity

(75,224

)

(77,873

)

Total liabilities and stockholders’

(deficit) equity

$

384,169

$

421,833

PROS Holdings, Inc.

Condensed Consolidated

Statements of Income (Loss)

(In thousands, except per share

data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue:

Subscription

$

67,068

$

59,987

$

197,017

$

173,260

Maintenance and support

3,361

4,693

10,341

15,498

Total subscription, maintenance and

support

70,429

64,680

207,358

188,758

Services

12,273

12,570

38,045

37,466

Total revenue

82,702

77,250

245,403

226,224

Cost of revenue:

Subscription

14,470

14,510

43,653

42,662

Maintenance and support

1,698

1,769

5,311

5,927

Total cost of subscription, maintenance

and support

16,168

16,279

48,964

48,589

Services

12,130

12,185

36,986

37,988

Total cost of revenue

28,298

28,464

85,950

86,577

Gross profit

54,404

48,786

159,453

139,647

Operating expenses:

Selling and marketing

20,074

20,324

66,293

71,214

Research and development

21,081

22,205

67,280

66,343

General and administrative

13,218

14,099

43,335

42,083

Income (loss) from operations

31

(7,842

)

(17,455

)

(39,993

)

Convertible debt interest and

amortization

(1,121

)

(1,497

)

(3,471

)

(4,649

)

Other income (expense), net

1,531

(4,288

)

3,312

(1,046

)

Income (loss) before income tax

provision

441

(13,627

)

(17,614

)

(45,688

)

Income tax provision

206

241

894

471

Net income (loss)

$

235

$

(13,868

)

$

(18,508

)

$

(46,159

)

Net income (loss) per share:

Basic and diluted

$

—

$

(0.30

)

$

(0.39

)

$

(1.00

)

Weighted average number of shares:

Basic

47,231

46,225

47,038

46,084

Diluted

47,338

46,225

47,038

46,084

PROS Holdings, Inc.

Condensed Consolidated

Statements of Cash Flows

(In thousands)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Operating activities:

Net income (loss)

$

235

$

(13,868

)

$

(18,508

)

$

(46,159

)

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities:

Depreciation and amortization

1,976

2,549

6,371

8,301

Amortization of debt premium and issuance

costs

(310

)

348

(896

)

1,094

Share-based compensation

7,271

10,933

30,219

31,589

Provision for credit losses

(108

)

—

52

88

Gain on lease modification

—

—

(697

)

—

Loss on disposal of assets

—

16

774

51

Loss on derivatives

—

4,343

—

4,343

Loss on debt extinguishment

—

1,779

—

1,779

Changes in operating assets and

liabilities:

Accounts and unbilled receivables

(385

)

4,497

788

(1,573

)

Deferred costs

(562

)

363

10

704

Prepaid expenses and other assets

984

1,480

1,158

31

Operating lease right-of-use assets and

liabilities

(322

)

(449

)

(1,838

)

(1,686

)

Accounts payable and other liabilities

(1,694

)

(2,123

)

2,191

(3,375

)

Accrued liabilities

(1,331

)

412

1,087

1,489

Accrued payroll and other employee

benefits

3,605

3,446

(9,906

)

(242

)

Deferred revenue

(7,765

)

(5,008

)

(7,435

)

(401

)

Net cash provided by (used in) operating

activities

1,594

8,718

3,370

(3,967

)

Investing activities:

Purchases of property and equipment

(231

)

(345

)

(669

)

(2,168

)

Capitalized internal-use software

development costs

—

—

(58

)

—

Investment in equity securities

—

(113

)

(113

)

(113

)

Net cash used in investing activities

(231

)

(458

)

(840

)

(2,281

)

Financing activities:

Proceeds from employee stock plans

1,055

1,033

2,079

2,170

Tax withholding related to net share

settlement of stock awards

(1,135

)

(1,163

)

(11,296

)

(6,831

)

Debt issuance costs related to Credit

Agreement

—

(837

)

—

(837

)

Purchase of capped call

—

(22,771

)

—

(22,771

)

Repayment of convertible debt

—

—

(21,713

)

—

Net cash used in financing activities

(80

)

(23,738

)

(30,930

)

(28,269

)

Effect of foreign currency rates on

cash

195

(9

)

217

(30

)

Net change in cash, cash equivalents and

restricted cash

1,478

(15,487

)

(28,183

)

(34,547

)

Cash, cash equivalents and restricted

cash:

Beginning of period

149,086

184,567

178,747

203,627

End of period

$

150,564

$

169,080

$

150,564

$

169,080

Reconciliation of cash, cash

equivalents and restricted cash to the condensed consolidated

balance sheets

Cash and cash equivalents

$

140,564

$

159,080

$

140,564

$

159,080

Restricted cash

10,000

10,000

10,000

10,000

Total cash, cash equivalents and

restricted cash

$

150,564

$

169,080

$

150,564

$

169,080

PROS Holdings, Inc.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(In thousands, except per share

data)

(Unaudited)

We use these non-GAAP financial

measures to assist in the management of the Company because we

believe that this information provides a more consistent and

complete understanding of the underlying results and trends of the

ongoing business due to the uniqueness of these charges.

See breakdown of the reconciling

line items on page 10.

Three Months Ended September

30,

Quarter over Quarter

Nine Months Ended September

30,

Year over Year

2024

2023

% change

2024

2023

% change

GAAP gross profit

$

54,404

$

48,786

12

%

$

159,453

$

139,647

14

%

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles

738

1,099

2,644

3,679

Severance

—

—

—

749

Share-based compensation

1,177

1,033

3,396

2,850

Non-GAAP gross profit

$

56,319

$

50,918

11

%

$

165,493

$

146,925

13

%

Non-GAAP gross margin

68.1

%

65.9

%

67.4

%

64.9

%

GAAP income (loss) from operations

$

31

$

(7,842

)

(100

)%

$

(17,455

)

$

(39,993

)

(56

)%

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles

1,074

1,446

3,675

4,872

Severance

—

—

—

3,586

Share-based compensation

7,271

10,933

30,219

31,589

Total non-GAAP adjustments

8,345

12,379

33,894

40,047

Non-GAAP income from operations

$

8,376

$

4,537

85

%

$

16,439

$

54

30,343

%

Non-GAAP income from operations % of total

revenue

10.1

%

5.9

%

6.7

%

—

%

GAAP net income (loss)

$

235

$

(13,868

)

(102

)%

$

(18,508

)

$

(46,159

)

(60

)%

Non-GAAP adjustments:

Total non-GAAP adjustments affecting

income (loss) from operations

8,345

12,379

33,894

40,047

Amortization of debt premium and issuance

costs

(380

)

294

(1,105

)

1,040

Loss on derivatives

—

4,343

—

4,343

Loss on debt extinguishment

—

1,779

—

1,779

Tax impact related to non-GAAP

adjustments

(1,643

)

(895

)

(2,444

)

137

Non-GAAP net income

$

6,557

$

4,032

63

%

$

11,837

$

1,187

897

%

Non-GAAP earnings per share

$

0.14

$

0.09

$

0.25

$

0.03

Shares used in computing non-GAAP earnings

per share

47,338

47,397

47,554

46,823

PROS Holdings, Inc.

Supplemental Schedule of

Non-GAAP Financial Measures

Increase (Decrease) in GAAP

Amounts Reported

(In thousands)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cost of Subscription Items

Amortization of acquisition-related

intangibles

738

1,099

2,644

3,679

Severance

—

—

—

125

Share-based compensation

244

201

681

495

Total cost of subscription items

$

982

$

1,300

$

3,325

$

4,299

Cost of Maintenance Items

Severance

—

—

—

307

Share-based compensation

98

93

331

271

Total cost of maintenance items

$

98

$

93

$

331

$

578

Cost of Services Items

Severance

—

—

—

317

Share-based compensation

835

739

2,384

2,084

Total cost of services items

$

835

$

739

$

2,384

$

2,401

Sales and Marketing Items

Amortization of acquisition-related

intangibles

336

347

1,031

1,193

Severance

—

—

—

1,595

Share-based compensation

675

2,992

6,740

9,023

Total sales and marketing items

$

1,011

$

3,339

$

7,771

$

11,811

Research and Development Items

Severance

—

—

—

1,008

Share-based compensation

898

2,817

6,543

7,840

Total research and development items

$

898

$

2,817

$

6,543

$

8,848

General and Administrative

Items

Severance

—

—

—

234

Share-based compensation

4,521

4,091

13,540

11,876

Total general and administrative items

$

4,521

$

4,091

$

13,540

$

12,110

PROS Holdings, Inc.

Supplemental Reconciliation of

GAAP to Non-GAAP Financial Measures

(In thousands)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Adjusted EBITDA

GAAP Income (Loss) from

Operations

$

31

$

(7,842

)

$

(17,455

)

$

(39,993

)

Amortization of acquisition-related

intangibles

1,074

1,446

3,675

4,872

Severance

—

—

—

3,586

Share-based compensation

7,271

10,933

30,219

31,589

Depreciation and other amortization

902

1,103

2,696

3,429

Capitalized internal-use software

development costs

—

—

(58

)

—

Adjusted EBITDA

$

9,278

$

5,640

$

19,077

$

3,483

Net Cash Provided by (Used in)

Operating Activities

$

1,594

$

8,718

$

3,370

$

(3,967

)

Severance

—

121

—

3,870

Purchase of property and equipment

(231

)

(345

)

(669

)

(2,168

)

Capitalized internal-use software

development costs

—

—

(58

)

—

Free Cash Flow

$

1,363

$

8,494

$

2,643

$

(2,265

)

Guidance

Q4 2024 Guidance

Full Year 2024

Guidance

Low

High

Low

High

Adjusted EBITDA

GAAP Loss from Operations

$

(3,600

)

$

(2,600

)

$

(21,000

)

$

(20,000

)

Amortization of acquisition-related

intangibles

800

800

4,400

4,400

Share-based compensation

10,300

10,300

40,500

40,500

Depreciation and other amortization

900

900

3,600

3,600

Adjusted EBITDA

$

8,400

$

9,400

$

27,500

$

28,500

PROS Holdings, Inc.

Supplemental Reconciliation of

GAAP to Non-GAAP Financial Measures (Continued)

(In thousands)

(Unaudited)

Three Months Ended September

30,

Quarter over Quarter

Nine Months Ended September

30,

Year over Year

2024

2023

% change

2024

2023

% change

GAAP subscription gross profit

$

52,598

$

45,477

16

%

$

153,364

$

130,598

17

%

Non-GAAP adjustments:

Amortization of acquisition-related

intangibles

738

1,099

2,644

3,679

Severance

—

—

—

125

Share-based compensation

244

201

681

495

Non-GAAP subscription gross profit

$

53,580

$

46,777

15

%

$

156,689

$

134,897

16

%

Non-GAAP subscription gross margin

79.9

%

78.0

%

79.5

%

77.9

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029370725/en/

Investor Contact: PROS Investor Relations Belinda

Overdeput 713-335-5879 ir@pros.com

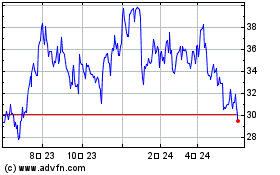

Pros (NYSE:PRO)

過去 株価チャート

から 10 2024 まで 11 2024

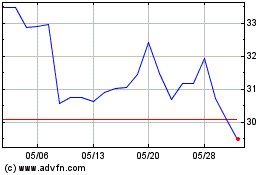

Pros (NYSE:PRO)

過去 株価チャート

から 11 2023 まで 11 2024