UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☐ |

Soliciting Material Pursuant to §240.14a-12

|

VOLATO GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

April 29, 2024

Dear Stockholder:

At Volato, we aspire to elevate the private aviation experience. We pride ourselves on delivering the best customer experience, innovative solutions, the utmost transparency, and

most of all, safety without compromise, and we appreciate your support and confidence as we take this journey together.

You are cordially invited to attend the 2024 annual meeting of stockholders (the “Annual Meeting”) of Volato Group, Inc. (“we,” the “Company” or “Volato Group”). The virtual-only

meeting will be held on Thursday, June 20, 2024 at 8:00 a.m., Eastern Time via live webcast, providing stockholders with the ability to participate in the Annual Meeting, vote their shares and ask questions.

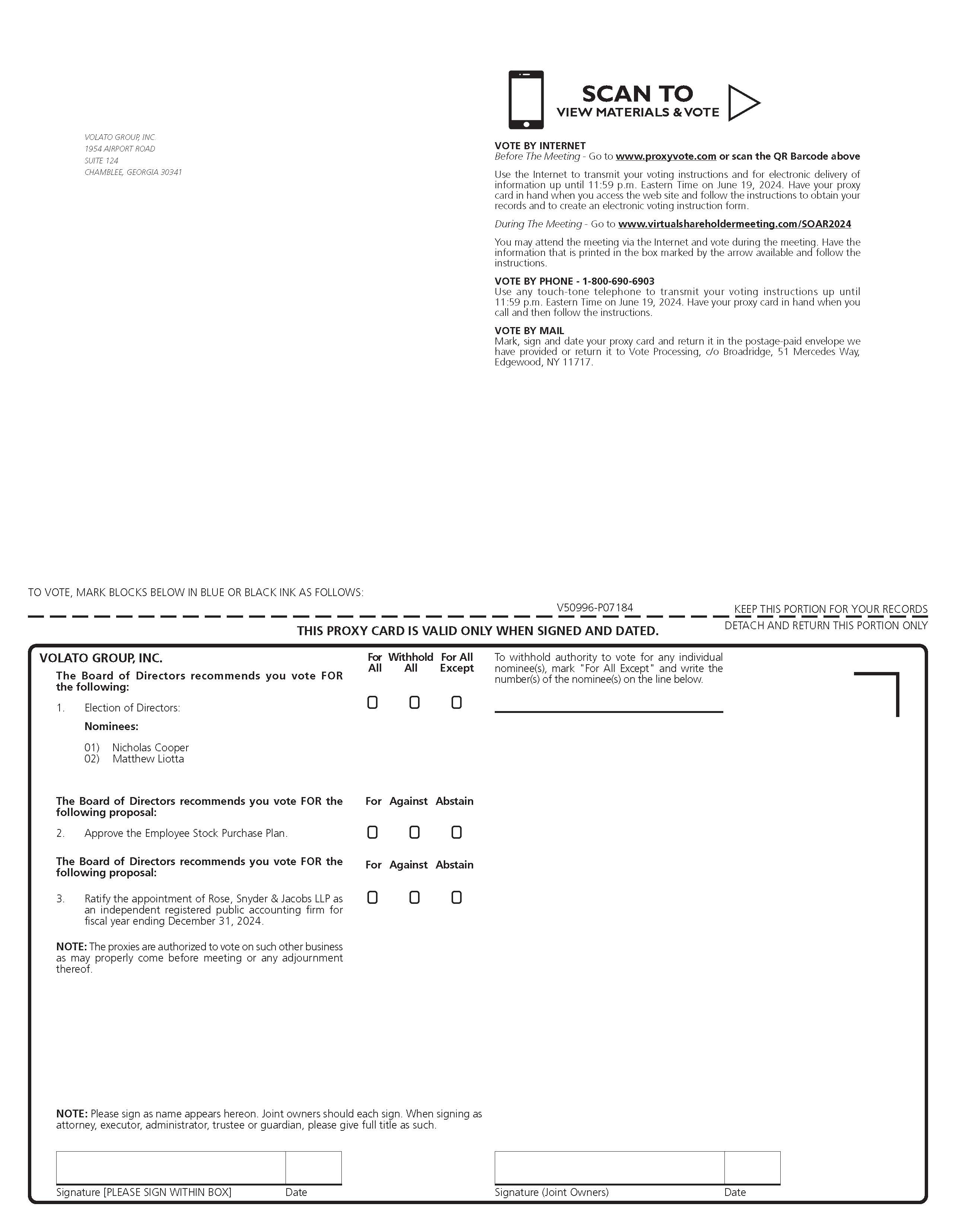

Under Securities and Exchange Commission rules, we are providing access to the proxy materials for the Annual Meeting to stockholders via the internet. You can access our proxy

materials, register for the Annual Meeting (registration opens 15 minutes before the meeting start time) and vote online at www.proxyvote.com. Our proxy materials and our Annual Report on Form 10-K for the year ended December 31, 2023 (our "2023

Annual Report") are also available on our website at https://ir.flyvolato.com/ under the “Investor Relations” section. Instructions for accessing our proxy materials and voting are described below and in the accompanying Notice of Annual Meeting.

The agenda for the Annual Meeting includes the election of two Class I directors for a three-year term, the approval of the Employee Stock Purchase Plan and the ratification of the appointment of Rose, Snyder & Jacobs LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2024. To attend the Annual Meeting or vote your shares, you will need the control number, which can be found on the Notice of Internet Availability, on your proxy

card, or in the instructions accompanying your proxy materials. More details can be found in the accompanying Notice of Annual Meeting and proxy statement.

Your vote is very important. Whether or not you plan to join the virtual Annual Meeting, it is important that your shares be represented. To ensure that your vote is counted,

please carefully review the enclosed proxy statement and cast your vote as soon as possible, even if you plan to attend the Annual Meeting. If you are a stockholder of record, you may vote over the internet, by telephone, or, if you request to

receive a printed set of the proxy materials, by completing, signing, dating and mailing the accompanying proxy card in the return envelope. If your shares are held in street name (held for your account by a broker or other nominee), you will

receive instructions from your broker or other nominee explaining how to vote your shares. Please cast your vote by one of the available means at your earliest convenience to ensure that your vote will be received in time and counted at the Annual

Meeting. Only Volato stockholders of record as the close of business on April 17, 2024 will be entitled to receive notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

At Volato, we seek to provide modern ways to enjoy luxury private jets through efficient and sustainable solutions, and your investment and continuing interest in our efforts are

very much appreciated. We hope that you will join us virtually on June 20, 2024.

| |

Sincerely

|

| |

|

| |

/s/ Matthew Liotta

|

| |

Matthew Liotta

|

| |

Chair and Chief Executive Officer

|

VOLATO GROUP, INC.

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

|

Time

|

8:00 a.m., Eastern Time

|

| |

|

|

Date

|

Thursday, June 20, 2024

|

| |

|

|

Place

|

The 2024 Annual Meeting of Stockholders of Volato Group, Inc. (the "Annual Meeting") will be conducted virtually via live webcast. You will be able to attend the Annual Meeting

virtually by visiting www.virtualshareholdermeeting.com/SOAR2024, where you will be able to submit questions and vote online during the meeting.

|

| |

|

|

Purpose

|

(1) To elect each of Nicholas Cooper and Matthew Liotta to serve as a Class I director, until

the Company’s 2027 Annual Meeting of Stockholders and until his successor is duly elected and qualified, or until such director's earlier death, resignation or removal;

(2) To approve the Employee Stock Purchase Plan (the “ESPP”);

(3) To ratify the selection of Rose, Snyder & Jacobs LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and

(4) To transact any other business that may properly come before the meeting or any adjournment thereof.

|

| |

|

|

Record Date

|

The board of directors has fixed the close of business on April 17, 2024 as the record date for determining stockholders entitled to notice of and to vote at the meeting.

|

| |

|

|

Meeting Admission

|

All stockholders as of the record date, or their duly appointed proxies, may attend the virtual meeting. In order to attend the Annual Meeting, you must register in advance at

www.proxyvote.com and provide the control number located on the Notice of Internet Availability or proxy card. Upon completing your registration, you will receive further instructions via email.

|

| |

|

|

Voting by Proxy

|

If you are a stockholder of record, you may vote via the internet, by telephone or by submitting a proxy card by mail. If your shares are held in street name, you will receive

instructions from your broker or other nominee explaining how to vote your shares, and you may also have the choice of instructing the record holder as to the voting of your shares over the internet or by telephone. Follow the instructions

on the voting instruction form you received from your broker or nominee.

|

The Notice of Internet Availability (the “Notice”) is being mailed on or about May 6, 2024 to all shareholders entitled to vote at the Annual Meeting. The Notice contains instructions on how to cast your vote via the

internet and how to request a paper copy of our proxy materials and our 2023 Annual Report. This proxy statement and our 2023 Annual Report are also available on our website at https://ir.flyvolato.com/ under the “Investor Relations” section and on

the SEC’s website at www.sec.gov.

| |

By order of the Board of Directors,

|

| |

|

| |

|

| |

Matthew Liotta

|

| |

Chair and Chief Executive Officer

|

Chamblee, Georgia

April 29, 2024

Important Notice Regarding the Internet Availability of Proxy Materials for the Company’s 2024 Annual Meeting of Stockholders to Be Held on June 20, 2024: The Notice of 2024 Annual

Meeting of Stockholders, proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are each available at www.proxyvote.com.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC, except for exhibits, will be furnished without charge to any stockholder

upon written request to Volato Group, Inc., 1954 Airport Road, Suite 124, Chamblee, Georgia 30341, Attention: Secretary. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are also available on the

SEC’s website at www.sec.gov.

| |

|

| |

Page

|

|

|

1

|

| |

|

|

|

6

|

| |

|

|

|

7

|

|

|

|

|

|

8

|

| |

|

|

|

13

|

| |

|

|

|

14

|

| |

|

|

|

18

|

| |

|

|

|

19

|

| |

|

|

|

20

|

| |

|

|

|

27

|

| |

|

|

|

31

|

| |

|

|

|

34

|

| |

|

|

|

35

|

| |

|

|

|

35

|

| |

|

|

|

35

|

| |

|

|

|

36

|

| |

|

|

|

A-1

|

VOLATO GROUP, INC.

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 20, 2024

AT 8:00 AM EASTERN TIME

When are this proxy statement and the accompanying materials scheduled to be sent to stockholders?

We have elected to provide access to our proxy materials to our stockholders via the internet. Accordingly, on or about May 6, 2024, we will begin mailing to our stockholders a Notice of Internet

Availability containing instructions on how to access our proxy materials, including our proxy statement and our 2023 Annual Report. The Notice of Internet Availability also instructs you on how to submit your proxy or voting instructions through

the internet or to request a paper copy of our proxy materials, including a proxy card or voting instruction form that includes instructions on how to submit your proxy or voting instructions by mail or telephone. For shares held in street name

(held for your account by a broker or other nominee), you will receive a voting instruction form from your broker or nominee. Our 2023 Annual Report is available at www.proxyvote.com.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we are providing access to our proxy materials over the internet rather than printing and mailing the proxy materials.

We believe electronic delivery will expedite the receipt of materials, will help lower our costs and reduce the environmental impact of our annual meeting materials. Therefore, a Notice of Internet Availability will be mailed to holders of record

and beneficial owners of our common stock starting on or around May 6, 2024. The Notice of Internet Availability will provide instructions as to how stockholders may access and review the proxy materials, including the Notice of Annual Meeting,

proxy statement, proxy card and Annual Report, on the website referred to in the Notice of Internet Availability or, alternatively, how to request that a copy of the proxy materials, including a proxy card, be sent to stockholders by mail. The

Notice of Internet Availability will also provide voting instructions. In addition, stockholders of record may request to receive the proxy materials in printed form by mail, or electronically by email, on an ongoing basis for future stockholder

meetings. Please note that while our proxy materials are available at the website referenced in the Notice of Internet Availability, and our Notice of Annual Meeting, proxy statement and 2023 Annual Report are available on our website, no other

information contained on either website is incorporated by reference in or considered to be a part of this document.

Who is soliciting my vote?

The board of directors of Volato Group, Inc. is soliciting your vote for the 2024 Annual Meeting of Stockholders.

When is the record date for the Annual Meeting?

The board of directors has fixed the record date for the Annual Meeting as of the close of business on April 17, 2024.

How many votes can be cast by all stockholders?

A total of 29,258,087 shares of common stock of the Company were outstanding on April 17, 2024 and entitled to be voted at the meeting. Each share of common stock is entitled to one vote on each

matter.

How do I vote?

If you are a stockholder of record and your shares are registered directly in your name, you may vote:

|

• |

By Internet. If you received the Notice of Internet Availability or a printed copy of the proxy materials, follow the instructions in

the Notice of Internet Availability or on the proxy card. Votes submitted by internet must be received by 11:59 p.m. Eastern Time on June 19, 2024.

|

|

• |

By Telephone. If you received a printed copy of the proxy materials, follow the instructions on the proxy card. Votes submitted by

telephone must be received by 11:59 p.m. Eastern Time on June 19, 2024.

|

|

• |

By Mail. If you received a printed copy of the proxy materials, complete, sign, date, and mail your proxy card in the enclosed,

postage-prepaid envelope. If you sign and return the enclosed proxy card but do not specify how you want your shares voted, they will be voted FOR the director nominees to the Company’s board of

directors named herein and FOR the ratification of Rose, Snyder & Jacobs LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024, and will

be voted according to the discretion of the proxy holder upon such other matters that may properly come before the meeting or any adjournment or postponement thereof. If you are mailed or otherwise receive or obtain a proxy card or voting

instruction form, and you choose to vote by internet or by telephone, you do not have to return your proxy card or voting instruction form. Votes submitted by mail must be received by June 19, 2024.

|

|

• |

In Person at the Annual Meeting. You may also vote in person by attending the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/SOAR2024.

To attend the virtual Annual Meeting and vote your shares, you must register in advance at www.proxyvote.com and provide the control number located on your Notice of Internet Availability or proxy card.

|

If your shares of common stock are held in street name (held for your account by a broker or other nominee):

|

• |

By Internet or By Telephone.

You will receive instructions from your broker or other nominee if you are permitted to vote by internet or telephone.

|

|

• |

By Mail. You will receive instructions from your broker or other nominee explaining how to vote your shares by mail.

|

How do I attend the Annual Meeting?

We will be hosting our Annual Meeting online via live webcast at www.virtualshareholdermeeting.com/SOAR2024. Any stockholder can attend the

Annual Meeting by registering at www.proxyvote.com. In order to attend the Annual Meeting, you must register in advance at www.proxyvote.com and provide the control number located on your Notice of Internet Availability or proxy card. Upon

completing your registration, you will receive further instructions via email. The Annual Meeting will start at 8:00 a.m. Eastern Time on June 20, 2024.

Why are you holding a virtual Annual Meeting?

We are utilizing a virtual-only meeting format in order to leverage technology to enhance stockholder access to the Annual Meeting by enabling attendance and participation from any location. We

believe that the virtual-only meeting format will give stockholders the opportunity to participate fully and equally, and without cost, and to exercise the same rights as if they had attended an in-person meeting. We have designed our virtual

format to enhance, rather than constrain, stockholder access, participation and communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the Annual Meeting so that they can ask questions

of our board of directors or management.

What are the Board of Directors’ recommendations on how to vote my shares?

The board of directors recommends a vote:

Proposal 1: FOR the election of two Class I director nominees

Proposal 2: FOR the approval of the ESPP

Proposal 3: FOR the ratification of the selection of Rose, Snyder & Jacobs LLP as the Company’s independent registered public

accounting firm

Who pays the cost for soliciting proxies?

The Company will pay the cost for the solicitation of proxies by the board of directors. The solicitation of proxies will be made primarily by mail and through internet access to materials. Proxies

may also be solicited personally, by telephone, fax or email by employees of the Company without any remuneration to such individuals other than their regular compensation. The Company will also reimburse brokers, banks, custodians, other nominees

and fiduciaries for forwarding these materials to their principals to obtain the authorization for the execution of proxies.

Will my shares be voted if I do not return my proxy?

If your shares are registered directly in your name, you are a “stockholder of record” who may vote at the Annual Meeting. As the stockholder of record, you have the right to direct the voting of your

shares by voting over the internet, by telephone, by returning your proxy or by voting online during the Annual Meeting.

If your shares are held in an account at a bank or at a brokerage firm or other nominee holder, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are

being forwarded to you by your bank, broker or other nominee who is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how

to vote your shares and to participate in the Annual Meeting. You will receive instructions from your bank, broker or other nominee explaining how you can vote your shares and whether they permit internet or telephone voting. Follow the

instructions from your bank, broker or other nominee included with these proxy materials, or contact your bank, broker or other nominee to request a proxy form. We encourage you to provide voting instructions to your bank, broker or other nominee

by giving your proxy to them. This ensures that your shares will be voted at the Annual Meeting according to your instructions. If you want to vote in person virtually at the Annual Meeting, you must register in advance at www.proxyvote.com. You

may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

If your shares are held in “street name” by a brokerage firm, your brokerage firm is required to vote your shares according to your instructions. If you do not give instructions to your brokerage

firm, the brokerage firm will still be able to vote your shares with respect to certain “routine” items, but will not be allowed to vote your shares with respect to “non-routine” items. A “broker non-vote” refers to a share represented at the

meeting held by a broker, as to which instructions have not been received from the beneficial owner or person entitled to vote such shares and with respect to which, on one or more but not all matters, the broker does not have discretionary voting

power to vote such share.

What vote is required to approve each item and how are votes counted?

Votes cast by proxy or online at the Annual Meeting will be counted by the persons appointed by the Company to act as tabulators for the meeting. The tabulators will count all votes FOR and AGAINST,

votes withheld, abstentions and broker non-votes, as applicable, for each matter to be voted on at the Annual Meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the

nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Proposal 1—Election of two Class I director nominees

Proposal 1 is considered to be a “non-routine” item. If you do not instruct your broker how to vote with respect to this proposal, your broker may not vote for this proposal, and those votes will be

counted as broker “non-votes.” To be elected, the directors nominated in Proposal 1 must receive a plurality of the votes cast and entitled to vote on the election of directors, meaning that the two director nominees receiving the most votes will

be elected as directors. Shares voting WITHHELD and broker non-votes will have no effect on the election of directors.

Proposal 2—Approval of the ESPP

Proposal 2 is considered to be a “non-routine” item. If you do not instruct your broker how to vote with respect to this proposal, your broker may not vote for this proposal, and those votes will be

counted as broker “non-votes.” To approve the ESPP, holders of a majority of the votes cast on the matter must vote FOR the proposal. Only FOR and AGAINST votes will affect the outcome. Abstentions and broker non-votes, if any, will have no effect

on the outcome of the vote on Proposal 2.

Proposal 3—Ratification of selection of Rose, Snyder & Jacobs LLP as our independent registered public accounting firm

Proposal 3 is considered to be a “routine” item, and your brokerage firm will be able to vote on this proposal even if it does not receive instructions from you. To ratify Rose, Snyder & Jacobs

LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024, holders of a majority of the votes cast on the matter must vote FOR the proposal. Only FOR and AGAINST votes will affect the outcome. Abstentions

and broker non-votes, if any, will have no effect on the outcome of the vote on Proposal 3.

Could other matters be decided at the Annual Meeting?

The Company does not know of any other matters that may be presented for action at the Annual Meeting. Should any other business come before the meeting, the persons named on the enclosed proxy will

have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any

other business that comes before the Annual Meeting unless they receive instructions from you with respect to such matter.

Can I change my vote?

You may revoke your proxy at any time before it is voted by notifying the Company’s Secretary in writing, by returning a signed proxy with a later date, by transmitting a subsequent vote over the

internet or by telephone prior to the close of the internet voting facility or the telephone voting facility. You may also attend the virtual meeting and vote during the meeting. If your stock is held in street name, you must contact your broker or

nominee for instructions as to how to change your vote.

How is a quorum reached?

The presence, by virtual attendance or by proxy, of holders of at least a majority of the outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the

Annual Meeting. Voted withheld, abstentions and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the meeting.

What happens if the meeting is postponed or adjourned?

Your proxy may be voted at the postponed or adjourned meeting. You will still be able to change your proxy until it is voted.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K (“Form 8-K”) that we expect to file with the SEC within four

business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four

business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What does it mean if I receive more than one proxy card or voting instruction form?

It means that you have multiple accounts at the transfer agent or with brokers. Please complete and return all proxy cards or voting instruction forms to ensure that all of your shares are voted.

What if I have technical difficulties or trouble accessing the Annual Meeting?

If you encounter difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Proposals to include in our proxy statement

Stockholders may present proper proposals to be included in our proxy statement and considered at the next annual meeting of stockholders by submitting their proposals in writing to our Secretary. For

a stockholder proposal to be considered for inclusion in our proxy statement for our 2025 annual meeting of stockholders (the “2025 Annual Meeting”), our Secretary must receive the written proposal at our principal executive offices no later than

December 31, 2024, unless the date of the 2025 Annual Meeting is held more than 30 days before or after June 20, 2025, in which case the proposal must be received a reasonable time before we begin to print and send proxy materials for the 2025

Annual Meeting. In addition, stockholder proposals must comply with the applicable requirements of Rule 14a-8 under the Exchange Act.

Proposals that will not be included in our proxy statement

Our Second Amended and Restated Bylaws (our “Bylaws”) contain an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for

the proposal to be included in our proxy statement. These matters may only be brought before the annual meeting by a stockholder of record entitled to vote at the annual meeting who has delivered timely written notice, containing the information

specified in our Bylaws, to our Secretary. To be timely for the 2025 Annual Meeting, our Secretary must receive the written notice at our principal executive offices no earlier than February 21, 2025, and no later than March 22, 2025. However, if

we hold the 2025 Annual Meeting more than 30 days before or more than 60 days after June 20, 2025, then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no later than the close of business

on the later of (a) the 90th day before the 2025 Annual Meeting and (b) the 10th day following the day on which public announcement of the date of the 2025 Annual Meeting is first made.

Director nominations

To comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice no later than April 21, 2025.

Such notice must comply with the additional requirements of Rule 14a-19(b).

Who should I call if I have any additional questions?

If you hold your shares directly, please call the Secretary of the Company at 844-399-8998. If your shares are held in street name, please contact the telephone number provided on your voting

instruction form or contact your broker or nominee holder directly.

PROPOSAL 1: ELECTION OF DIRECTORS

Our board of directors (the “Board”) is divided into three classes, with one class of our directors standing for election each year. The members of each class are elected to serve a

three-year term with the term of office of each class ending in successive years. Nicholas Cooper and Matthew Liotta are the directors whose terms will expire at

this Annual Meeting and, based on the recommendation of our Nominating and Corporate Governance Committee, each of Directors Cooper and Liotta has been nominated for and has agreed to stand for re-election to the board of directors to serve as a

Class I director of the Company until the 2027 Annual Meeting of Stockholders and until his successor is duly elected and qualified.

It is intended that, unless you give contrary instructions, shares represented by proxies solicited by the board of directors will be voted for the election of the director nominees listed below. We

have no reason to believe that the director nominees will be unavailable for election at the Annual Meeting. In the event that a director nominee is unexpectedly not available to serve, proxies may be voted for another person nominated as a

substitute by the board of directors, or the board of directors may reduce the number of directors to be elected at the Annual Meeting. Pursuant to our Second Amended and Restated Certificate of Incorporation, the board of directors has fixed the

number of directors at five as of the date of the Annual Meeting. Vacancies on the board of directors are filled exclusively by the affirmative vote of a majority of the remaining directors, even if less than a quorum is present, and not by the

stockholders. Your proxy cannot be voted for a greater number of persons than the number of director nominees named in this proxy statement.

Information relating to the director nominee and each continuing director, including his or her period of service as a director of the Company, principal occupation and other biographical material is

shown below.

Voting Requirement to Approve Proposal

For Proposal 1, the two nominees receiving the plurality of votes properly cast will be elected as directors. Votes withheld and broker non-votes will have no impact on the outcome of this vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE

"FOR"

EACH DIRECTOR NOMINEE FOR CLASS I DIRECTOR:

NICHOLAS COOPER AND MATTHEW LIOTTA

AS CLASS I DIRECTORS, EACH TO SERVE FOR A THREE-YEAR TERM ENDING AT THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD IN 2027

(PROPOSAL 1 ON YOUR PROXY CARD)

The biographical description of each director below includes the specific experience, qualifications, attributes and skills that the board of directors would expect to consider if it were making a

conclusion currently as to whether such person should serve as a director.

Nominees for Election as Class I Directors

The following table sets forth information concerning our nominees for Class I directors as of April 29, 2024.

|

Name

|

Age

|

Position(s)

|

Director Since

|

|

Matthew Liotta

|

45

|

Chair, Chief Executive Officer and Class I Director

|

December 2023

|

|

Nicholas Cooper

|

38

|

Chief Commercial Officer and Class I Director

|

December 2023

|

Matthew Liotta. Mr. Liotta co-founded Volato, Inc. (“Volato”) and served as a director and Chief Executive Officer of

Volato since its inception as well as serving as our Chief Executive Officer and as director since December 1, 2023 and as our Chair since March 28, 2024. Prior to co-founding Volato, in 2016, Mr. Liotta founded Agrify (NASDAQ: AGFY), an

agricultural technology company where he served as President until 2019 and Chief Technology Officer from to 2019 to 2020. Prior to that, Mr. Liotta worked for several Silicon Valley venture capital- backed portfolio companies, including gMoney

Corporation, Yipes, TeamToolz, and DevX. Mr. Liotta has also held positions at Hudson Global, Pharmasset, and One Ring Networks. In 2019, Mr. Liotta also co-founded CEADS, a non-profit organization for the advancement of Controlled Environment

Agriculture and served as its President until 2022. He currently serves as a Director for Fintainium, a cloud-based financial technology company that provides secure remote and mobile access for financial services. The Board believes Mr. Liotta is

qualified to serve on the Board because of his significant operational and senior management experience.

Nicholas Cooper, CFA. Mr. Cooper co-founded Volato and served as a director and in various executive officer roles at

Volato since its inception as well as serving as our Chief Commercial Officer since December 1, 2023. Prior to co-founding Volato, in 2016, Mr. Cooper founded TriGrow Systems, a venture capital-backed technology services company where he served as

Chief Executive Officer until the company was acquired by Agrify (NASDAQ: AGFY) in 2020. Prior to that, in 2015, Mr. Cooper founded Apptuto, a 500 Startups accelerator portfolio company focused on mobile-first consumer edtech, where he served as

Chief Executive Officer until 2017. Before starting his entrepreneurial career, Mr. Cooper worked in the investment banking sector serving as Investment Manager at Al Nahdha Investment and Abu Dhabi Capital Group, a prominent family office in Abu

Dhabi, UAE, where he was responsible for managing the Private Equity and Venture Capital portfolios from 2010 to 2015. From 2003 to 2009, Mr. Cooper was a Senior Associate at Macquarie Bank, operating out of the London and Sydney offices. Mr.

Cooper holds a Bachelor of Commerce Degree from the University of Sydney Australia, where he was a resident of St. Johns College and Ellwood Scholarship recipient. Mr. Cooper is a CFA® charterholder, CFA Institute, and is a former Chartered

Accountant and lapsed member of the Institute of Chartered Accountants England and Wales. The Board believes Mr. Cooper is qualified to serve on the Board because of his significant investor relations and executive officer experience.

Directors Continuing in Office

The following table sets forth information concerning our continuing directors as of April 29, 2024.

|

Name

|

Age

|

Position(s)

|

Director Since

|

|

Christopher Burger

|

48

|

Class III Director

|

2024

|

|

Fred Colen

|

71

|

Class II Director

|

2024

|

|

Michael Nichols

|

53

|

Class III Director

|

2023

|

Fred Colen. Mr. Colen has served as a Director of Volato Group since April 23, 2024, and has served as Chairman of the Board of Xeltis AG,

an international medical device company, since 2023. Since 2017, Mr. Colen has served on the Board of Directors of Onward Medical (Euronext: ONWD). From January 2018 to April 2023, he served as the President and Chief Executive Officer of Neovasc

Inc. (NASDAQ: NVCN). Prior to joining Neovasc Inc., Mr. Colen served as the President and Chief Executive Officer at BeneChill, Inc., a medical device company in San Diego, California, from 2011 to 2016. Before joining BeneChill, Inc., Mr. Colen

served in various capacities at Boston Scientific (NYSE: BSX) from 1999 to 2010. Mr. Colen holds a Master of Electrical Engineering with a specialization in Biomedical Engineering from the University of Aachen in Germany. Mr. Colen is qualified to

serve on the Board because of his significant public company board and managerial experience.

Christopher Burger. Mr. Burger has served as a Director of Volato Group since April 23, 2024, and served as a Senior Advisor from 2022 to

2024. Since 2020, Mr. Burger has served as Founder & Managing Director of Transform, a business consulting firm. From July 2018 to April 2020, he served as the Vice President of Global Technology and Global Chief Information Officer Chief of

Staff at IHG Hotels & Resorts (NYSE: IHG), and as a strategic advisor to the company’s Chief Information Officer. Prior to joining IHG Hotels & Resorts, Mr. Burger served as the Group Head of Technology & Innovation and Group Chief

Information Technology Officer Chief of Staff at Etihad Aviation Group in Abu Dhabi, United Arab Emirates from 2015 to 2018. Prior to joining Etihad Aviation Group, Mr. Burger built a career serving in a number of operations and consulting roles in

the aviation and technology services industries. Mr. Burger holds a Bachelor of Business Administration with a distinction in Marketing from Emory University’s Goizueta Business School. Mr. Burger is qualified to serve on the Board because of his

organizational experience and expertise in technology, innovation, and business consulting across aviation and hospitality industries.

Michael Nichols. Mr. Nichols has served as a Director of Volato since August 19, 2021 and as the Chief Executive

Officer of the Piper M-Class Owners & Pilots Association (PMOPA) since September 2022. In September 2021, Mr. Nichols founded Flieger Strategies, LLC, an aviation and business strategy consultancy, where he continues to serve as President.

Previously, Mr. Nichols was a senior executive with the National Business Aviation Association (NBAA), where he served in several executive roles over the course of an 18-year tenure from 2003 to 2021, most recently as its Senior Vice President of

Strategy & Innovation. He continues to serve as a director on the NBAA’s Certified Aviation Manager Governing Board. In addition to a Bachelor of Science in Business Administration from Kutztown University of Pennsylvania, Mr. Nichols has

earned Certified Aviation Manager (CAM), Certified Association Executive (CAE) and Institute for Organizational Management (IOM) credentials. Mr. Nichols is qualified to serve on the Board because of his extensive experience as an aviation

association executive.

On December 1, 2023, Volato, Inc., a Georgia corporation (“Volato”), PROOF Acquisition Corp I, a Delaware corporation (“PACI”) and PACI Merger Sub, Inc., a Delaware corporation and a direct,

wholly-owned subsidiary of PACI (“Merger Sub”), consummated a business combination transaction pursuant to a Business Combination Agreement, dated August 1, 2023 (the “Business Combination Agreement”). Pursuant to the terms of the Business

Combination Agreement, a business combination between PACI and Volato was effected through the merger of Merger Sub with and into Volato, with Volato surviving the merger as a wholly-owned subsidiary of PACI (the “Business Combination”). In

connection with the consummation of the Business Combination (the “Closing”), PACI changed its name to “Volato Group, Inc.”

Board Composition

The board of directors has fixed the size of the board at five as of the date of this Annual Meeting and the terms of office of the directors are divided into three classes:

|

• |

Class I, whose term will expire at the Annual Meeting;

|

|

• |

Class II, whose term will expire at the annual meeting of stockholders to be held in 2025; and

|

|

• |

Class III, whose term will expire at the annual meeting of stockholders to be held in 2026.

|

Currently, Class I consists of Directors Cooper and Liotta, Class II consists of Director Colen, and Class III consists of Directors Burger and Nichols. At each annual meeting of stockholders, the

successors to directors whose terms will then expire shall serve from the time of election and qualification until the third annual meeting following election and until their successors are duly elected and qualified. A resolution of the board of

directors may change the authorized number of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of

one-third of the directors. This classification of the board of directors may have the effect of delaying or preventing changes in control or management of our company.

Director Independence

The NYSE American listing rules require that a majority of our board of directors be independent. An “independent director” is defined generally as a person other than an executive officer or employee

of us or any other individual having a relationship which, in the opinion of our board of directors, would interfere with the exercise of independent judgement in carrying out the responsibilities of a director. Our board of directors has

determined that each of Mr. Burger, Mr. Colen and Mr. Nichols qualifies as independent as defined under the applicable NYSE American and Securities and Exchange Commission (the “SEC”) rules.

Board Meetings and Attendance

Following the Business Combination and through the end of our fiscal year ended December 31, 2023, our board of directors held four meetings. Each of the incumbent directors attended at least 75% of

the meetings of the board of directors and the committees of the board of directors on which he or she served during the fiscal year ended December 31, 2023 (in each case, which were held during the period for which he or she was a director and/or

a member of the applicable committee).

Director Attendance at Annual Meeting of Stockholders

Directors are expected to attend all meetings, including the annual meeting of stockholders; last year, the Company did not hold an annual meeting of stockholders.

Committees of the Board of Directors

Our board of directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each committee operates pursuant to a written

charter. In addition, each committee reviews and assesses the adequacy of its charter and submits its charter to the board of directors for approval. Copies of each committee’s charter are posted on our website at

https://ir.flyvolato.com/corporate-governance/board-committees under the “Investor Relations” section. The information contained on or that can be accessed through our website is not incorporated by reference into this proxy statement, and you

should not consider such information to be part of this proxy statement.

Audit Committee

The Audit Committee of our Board is composed of Directors Burger and Colen, each of whom is an independent director under the NYSE American listing standards and applicable SEC rules. Director Colen

serves as the chairman of the Audit Committee. Each member of the Audit Committee is financially literate, and our Board has determined that Director Colen qualifies as an “audit committee financial expert” as defined in applicable SEC rules. None

of the Audit Committee members serves on the audit committee of more than three public companies.

The Audit Committee will, among other things:

|

• |

appoint and oversee the independent registered public accounting firm which audits our financial statements;

|

|

• |

approves audit and non-audit services performed by independent registered public accounting firms;

|

|

• |

evaluate the independence and qualifications of the independent registered public accounting firm;

|

|

• |

review of our internal controls and the integrity of our financial statements;

|

|

• |

review the presentation of our financial information, including earnings press releases and guidance;

|

|

• |

set hiring policies regarding the hiring of employees or former employees of the independent registered public accounting firm;

|

|

• |

review, approve and monitor related party transactions;

|

|

• |

adopt and oversee procedures to address complaints received by us regarding accounting, internal accounting controls or auditing matters;

|

|

• |

review and discuss with senior management and the independent registered public accounting firm matters related to our compliance with laws and regulations; and

|

|

• |

review and discuss with senior management and the independent registered public accounting firm guidelines and policies that identify, monitor and address enterprise risks.

|

Compensation Committee

The Compensation Committee of our Board is composed Directors Burger and Nichols, each of whom is an independent director, and Director Nichols serves as the chairman of the Compensation Committee. We

have adopted a Compensation Committee charter, which details the principal functions of the Compensation Committee, including:

|

• |

oversee our overall compensation philosophy and compensation policies, plans and benefit programs;

|

|

• |

review and recommend for approval to the Board compensation for our executive officers and directors;

|

|

• |

prepare the Compensation Committee report that the SEC requires to be included in our annual proxy statement, if any; and

|

|

• |

administer the Company’s incentive compensation plans, equity compensation plans and such other plans as designated from time to time by the Board.

|

The Compensation Committee charter also provides that the Compensation Committee may, in its discretion, retain or obtain the advice of a compensation consultant, legal counsel, or other adviser and

will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel, or any other adviser, the

Compensation Committee will consider the independence of each such adviser, including the factors required by the NYSE American and the SEC.

Compensation Committee Interlocks and Insider Participation

No person who has served as a member of the Compensation Committee during the last completed fiscal year (i) was, during that fiscal year, an officer or employee of Volato Group, (ii) was formerly an

officer of Volato Group or (iii) had any relationship requiring disclosure by Volato Group under any paragraph of Item 404 of Regulation S-K.

No executive officer of Volato Group served as a member of the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire

board of directors) of another entity, one of whose executive officers served on the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of Volato

Group.

No executive officer of Volato Group served as a director of another entity, one of whose executive officers served on the Compensation Committee (or other board committee performing equivalent

functions or, in the absence of any such committee, the entire board of directors) of Volato Group.

No executive officer of Volato Group served as a member of the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire

board of directors) of another entity, one of whose executive officers served as a director of Volato Group.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of our Board is composed of Directors Burger and Nichols, each of whom is an independent director, and Director Burger serves as the chairperson of

the corporate governance and nominating committee.

The primary functions of the Nominating and Corporate Governance Committee include:

|

• |

reviewing the qualifications of, and recommending to the Board, proposed nominees for election to the Board and its committees, consistent with criteria approved by the Board;

|

|

• |

developing, evaluating and recommending to the Board corporate governance practices applicable to the Company; and

|

|

• |

facilitating the annual performance review of the Board and its committees.

|

Criteria for Selecting Director Nominees

The criteria for selecting nominees, which are specified in the committee charter, provide that persons to be nominated:

|

• |

character, professional ethics and integrity;

|

|

• |

judgment, business acumen, proven achievement and competence in one’s field;

|

|

• |

the ability to exercise sound business judgment;

|

|

• |

tenure on the Board and skills that are complementary to the Board;

|

|

• |

an understanding of the Company’s business;

|

|

• |

an understanding of the responsibilities required of a Board member;

|

|

• |

other time commitments, diversity with respect to professional background; and

|

|

• |

the current composition, organization and governance of the Board and its committees.

|

Communication with the Board of Directors

Any interested party with concerns about the Company may report such concerns to the board of directors or the Chairperson of our board of directors or nominating and corporate governance committee,

by submitting a written communication to the attention of such director at the following address:

|

c/o Volato Group, Inc. |

|

|

1954 Airport Road, Suite 124

|

|

|

Chamblee, Georgia 30341

|

|

|

United States

|

|

You may submit your concern anonymously or confidentially by postal mail. You may also indicate whether you are a stockholder or other interested party.

A copy of any such written communication may also be forwarded to the Company’s legal counsel and a copy of such communication may be retained for a reasonable period of time. The director may discuss

the matter with the Company’s legal counsel, with independent advisors, with non-employee directors or with the Company’s management, or may take other action or no action as the director determines in good faith, using reasonable judgment and

applying his or her own discretion.

Communications may be forwarded to other directors if they relate to important substantive matters and include suggestions or comments that may be important for other directors to know. In general,

communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we receive repetitive or

duplicative communications.

The audit committee oversees the procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or audit matters and the

confidential, anonymous submission by employees of concerns regarding questionable accounting, internal accounting controls or auditing matters.

Corporate Governance Guidelines

The Corporate Governance Guidelines adopted by the Board, which include guidelines for determining director independence, are published on the Volato Group’s website at http://ir.flyvolato.com, in the

“Governance-Governance Documents” section, and are available in print to any stockholder upon request. That section of the website makes available the Volato Group’s corporate governance materials, including Board committee charters. Those

materials are also available in print to any stockholder upon request.

Code of Ethics

All directors, officers and employees of the Volato Group are expected to act ethically at all times and in accordance with the policies comprising our Code of Ethics and Business Conduct (the “Code”)

which is available on our website at http://ir.flyvolato.com, in the “Governance-Governance Documents” section, and is available in print to any stockholder upon request. Any waiver or any implicit waiver from a provision of the Code applicable to

our chief executive officer, chief financial officer, chief accounting officer, or any amendment to the Code must be approved by the Board. We will disclose on our website amendments to, and, if any are granted, any such waiver of, the Code. Our

Audit Committee is responsible for applying the Code to specific situations in which questions are presented to it and has the authority to interpret the Code in any particular situation. If, after investigating any potential breach of the Code

reported to it, the Audit Committee determines (by majority decision) that a breach has occurred, it will inform the Board of Directors. Upon being notified that a breach has occurred, the Board (by majority decision) will take or authorize such

disciplinary or preventive action as it deems appropriate, after consultation with the Audit Committee and/or the Volato Group’s General Counsel, up to and including dismissal or, in the event of criminal or other serious violations of law,

notification of the SEC or other appropriate law enforcement authorities.

Clawback Policy

During 2023, we adopted the Volato Group, Inc. Clawback Policy that is intended to comply with new rules promulgated by the NYSE American and the SEC (the “Clawback Policy”). The Clawback Policy

generally applies to current and former executive officers, and it provides for the recovery of certain incentive-based compensation received during a three-year recovery period if we are required to prepare an accounting restatement due to

material noncompliance with any financial reporting requirement under the securities laws. The incentive-based compensation recoverable under the Clawback Policy generally includes the amount of incentive-based compensation received (on or after

October 2, 2023) that exceeds the amount that would have been received had it been determined based on the restated amounts (without regard to any taxes paid). The Clawback Policy does not condition clawback on the fault of the executive officer,

but the required clawback under the Clawback Policy is subject to certain limited exceptions in accordance with the SEC and NYSE American rules.

Delinquent Section 16(a) Reports

Under U.S. securities laws, directors, certain officers and persons holding more than 10% of our common stock must report their initial ownership of our common stock and any changes in their ownership

to the SEC. The SEC has designated specific due dates for these reports and we must identify in this proxy statement those persons who did not file these reports when due. Based solely on our review of copies of the reports filed with the SEC and

the written representations of our directors and executive officers, we believe that all reporting requirements for the year ended December 31, 2023 were complied with by each person who at any time during the period was a director or an executive

officer or held more than 10% of our common stock, except for the following: due to a delay in receiving EDGAR codes, each of Steve Drucker, Mark Heinen, Michael Prachar and former director Dana Born did not initially file their Form 3s which were

due to be reported by December 11, 2023; the required Form 3s were filed on April 19, 2024, December 19, 2023, December 29, 2023 and December 29, 2023, respectively.

Involvement in Certain Legal Proceedings

During the past ten years, we are not aware of any events that have occurred that are material to an evaluation of the ability or integrity of any executive officer, key employee or director of the

Company, other than as follows:

Mr. Liotta was the Chief Executive Officer and a member of the board of directors of PodPonics, Inc. in May 2016 when that company made a voluntary filing for bankruptcy under Chapter 7.

The following table sets forth information regarding our executive officers as of April 29, 2024:

|

Name

|

Age

|

Position

|

Officer Since

|

|

Matthew Liotta (1)

|

45

|

Chief Executive Officer and Director

|

2021

|

|

Nicholas Cooper (1)

|

38

|

Chief Commercial Officer and Director

|

2021

|

|

Michael Prachar

|

54

|

Chief Operating Officer

|

2022

|

|

Keith Rabin

|

52

|

President

|

2023

|

|

Steven Drucker

|

53

|

Chief Technology Officer

|

2022

|

|

Mark Heinen

|

54

|

Chief Financial Officer

|

2023

|

| (1) |

Matthew Liotta and Nicholas Cooper are also directors of the Company and their biographical information appears on page 7.

|

Biographies of Non-Director Executive Officers

Michael Prachar. Mr. Prachar has served as Volato’s Chief Operating Officer since February 1, 2022. Prior to joining Volato, Mr. Prachar

served as Chief Operating Officer of Big Green IT, an information technology and Microsoft cloud consulting business from 2015 to 2022. Prior to joining Big Green IT, Mr. Prachar had over 20 years of experience in the operations career, serving in

a number of operations executive roles in the telecommunications and technology services industries, including Chief Operating Officer of LinkSource Technologies® from 2010 to 2015, President and Chief Operating Officer of Rapid Link, Inc. from

2006 to 2010, Vice President and Chief Operating Officer of Telenational Communications from 2001 to 2006 and Director of Operations for Intercontinental Exchange from 1995 to 1998. Mr. Prachar holds an Engineering Degree from the College for

Recording Arts in San Francisco.

Keith Rabin, M.B.A. Mr. Rabin has served as Volato’s President since May 1, 2023 and previously served as the Company’s Chief Financial

Officer. Prior to joining Volato, Mr. Rabin co-founded JetSuite in 2008 and JetSuiteX (now JSX) in 2015, an innovative light jet Part 135 operator and per-seat public charter operator respectively, where he served as President and Chief Financial

Officer for ten years. Prior to co-founding JetSuite/JSX, Mr. Rabin was a Partner at New York based hedge fund Verity Capital, where he was responsible for portfolio management and the development of Verity’s value-based sector shorting strategy.

Previously, Mr. Rabin worked as a management consultant for The Boston Consulting Group from 2003 to 2007 and Deloitte Consulting from 1997 to 2000, with a focus on corporate strategy in diverse industries including transportation, financial

services, and industrial and consumer goods. Mr. Rabin holds a Bachelor of Science in Industrial Engineering from the Georgia Institute of Technology, where the Office of the President named him a Fleet Scholar. He graduated Beta Gamma Sigma with a

Master of Business Administration focused on Finance and Strategy from Columbia Business School.

Steven Drucker. Mr. Drucker has served as Volato’s Chief Technology Officer since September 5, 2022. Prior to joining Volato, Mr. Drucker

held several software executive roles for TriGrow Systems and, following an acquisition, Agrify (NASDAQ: AGFY), starting in July 2018 and rising to the position of Chief Information Officer in early 2022. Prior to that, Mr. Drucker founded Fig Leaf

Software in 1995 and served as its President until 2018, from web development consulting and training for Fortune 100 companies. Steve has a Bachelor of Science in Computer Science from the University of Maryland, College Park.

Mark Heinen. Mr. Heinen has served as Volato’s Chief Financial Officer since November 28, 2023. Bringing over 30 years of finance and

accounting experience, Mr. Heinen previously served as Chief Financial Officer of Better Therapeutics, Inc (NASDAQ: BTTX). Prior to that, from 2017 until 2020, he served as the SVP, Global Corporate Controller and interim Chief Financial Officer at

Trintech, Inc. He has served in leadership positions in both publicly traded and private technology companies. Mr. Heinen's also previously worked in public accounting at PricewaterhouseCoopers. He holds a B.B.A. in accounting and an M.B.A from the

University of Oklahoma and is a certified public accountant.

Executive Compensation Overview

Volato’s executive compensation philosophy is rooted in our Company values, which emphasize transparency. Therefore, we seek to establish a compensation structure that is easily understood and

applied. Our compensation structure rewards performance for demonstrating Volato’s values, achieving challenging objectives that propel the Company forward, and driving shareholder value, while ensuring the sustainability and long-term viability

and value of the Company. Our compensation program is designed to both reward performance and attract and retain top talent that will deliver results for shareholders.

Our Board and/or Compensation Committee will review and adjust our compensation program at regular intervals consistent with the market, business achievements, pay equity, experience and individual

negotiations. Volato engaged an independent compensation consultant to help advise on the executive compensation program. Base pay adjustments reflect job duties, responsibilities and macroeconomic drivers. Short-term and long-term incentive

compensation (i.e., bonus and equity awards) are designed to reward the attainment of performance objectives and enhance shareholder value.

Our Compensation Committee is primarily responsible for the compensation programs for our executive officers. Our Compensation Committee is also authorized to retain the services of one or more

executive compensation advisors, as it sees fit, in connection with the establishment of our executive compensation programs and related policies. For additional information, see “Corporate Governance – Committees

of the Board of Directors – Compensation Committee”

Under the Company’s Corporate Governance Guidelines, our non-employee directors and committee chairs receive reasonable compensation for their services to be determined by the Board upon recommendation of the

Compensation Committee. Other than the pre-approved retainers for non-employee directors and committee chairs, the Company does not normally provide additional compensation, such as compensation for consulting services, to a non-employee director.

The amount of compensation for non-employee directors and committee chairs is generally intended to be consistent with market practices of comparable companies. Directors who are employees receive no additional pay for serving as directors. For additional information, see “Corporate Governance – Corporate Governance Guidelines,” and “Director Compensation” below.

Summary Compensation Table

Consistent with the scaled disclosure available under SEC rules to emerging growth companies, the following table sets forth information about the compensation paid to Volato’s principal executive

officer, and its two other most highly compensated executive officers, for services rendered for the years ended December 31, 2023 and 2022, respectively. These executives are referred to as the “named executive officers.”

|

Name and

principal position

|

Year

|

|

Salary

($)

|

|

Bonus

($)

|

|

Option

Awards

($)(1)

|

|

|

|

Other(2)

|

|

Total

($)

|

|

|

Matthew Liotta

Chair and Chief Executive Officer

|

2023

|

|

215,208

|

|

-

|

|

-

|

|

|

|

5,041

|

|

220,249

|

|

|

2022

|

|

148,333(3)

|

|

-

|

|

7,381

|

|

|

|

4,098

|

|

159,812

|

|

|

Keith Rabin

President(4)

|

2023

|

|

252,604

|

|

-

|

|

104,448

|

|

|

|

13,720

|

|

370,772

|

|

|

2022

|

|

154,688(5)

|

|

-

|

|

12,192

|

|

|

|

6,272

|

|

173,152

|

|

|

Nicholas Cooper

Chief Commercial Officer(6)

|

2023

|

|

207,847

|

|

-

|

|

-

|

|

|

|

10,392

|

|

218,239

|

|

|

2022

|

|

153,333

|

-

|

-

|

|

|

|

4,292

|

|

157,625

|

|

| (1) |

Represents the aggregate grant date fair value of option awards granted under the Volato 2021 Equity Incentive Stock Plan, calculated in accordance with Financial Accounting Standards Board ASC Topic

718-Stock Compensation and using the assumptions contained in Note 17 to the financial statements included in the Company’s Form 10-K, filed with the SEC on March 26, 2024.

|

| (2) |

Represents amounts received through the Company’s 401(k) matching policy and life insurance premiums.

|

| (3) |

Mr. Liotta’s annualized salary increased from $120,000 to $160,000 on April 16, 2022, and increased to $310,000 on August 18, 2023.

|

| (4) |

Mr. Rabin was promoted to President of Volato as of May 1, 2023 and previously served as Chief Financial Officer until November 28, 2023.

|

| (5) |

Mr. Rabin commenced employment with Volato on April 25, 2022. His annualized salary amount was $225,000 at the time he commenced employment and increased to $300,000 on August 18, 2023.

|

| (6) |

Mr. Cooper’s annualized salary was $120,000 from January 11, 2022 (hire date) to April 15, 2022, $160,000 starting on April 16, 2022 and increased to $290,000 as of August 18, 2023. Mr. Cooper did not serve

as a named executive officer in 2022.

|

Employment Agreements and Offer Letters

Volato Group has entered into employment agreements with each of the named executive officers, in order to promote retention and service following the Closing, to incentivize the executives to

continue to grow the Company and its market position, and to better reflect each executive’s value to Volato Group and its stakeholders. These agreements became effective on December 1, 2023.

Positions and Base Salary

Matthew Liotta. Mr. Liotta’s employment agreement provides for him to serve as Chief Executive Officer of Volato Group at an annual base salary of $310,000.

Keith Rabin. Mr. Rabin’s employment agreement provides for him to serve as President of Volato Group at an annual base salary of $300,000.

Nicholas Cooper. Mr. Cooper’s employment agreement provides for him to serve as Chief Commercial Officer of Volato Group at an annual base salary of $290,000.

Annual Incentive Bonuses

Pursuant to the employment agreements, for each calendar year of the term, each named executive officer will be eligible to receive an annual target bonus in an amount equal to one hundred percent

(100%) of the executive’s base salary (each, an “annual bonus”), with an opportunity to receive a maximum bonus of 200% of the executive’s base salary, based on the achievement of such performance factors and such other terms and conditions as may

be established by the Board and/or the Compensation Committee, The employment agreements also provide that, depending on results, the executive’s actual bonus may be higher or lower than the target bonus amount. The decision to award any annual

bonus and the amount and terms of any annual bonus will be in the sole discretion of the Board or the Compensation Committee. Due to their respective employment agreements becoming effective on December 1, 2023, the named executive officers were

not eligible to receive an annual bonus related to the calendar year ended December 31, 2023.

Long-Term Equity Incentives

The employment agreements provide that each executive would be granted an equity award (the “initial award”) for such number of shares of the common stock as may be determined by the Board and/or the

Committee. The initial award includes a performance-based vesting condition, pursuant to which (i) thirty percent (30%) of the number of shares of common stock subject to the initial award shall vest and, if applicable, become exercisable upon the

market price of the common stock (as determined based on trading on an applicable stock exchange) being equal to or exceeding $12.50 per share for thirty (30) consecutive trading days, and the remaining seventy percent (70%) of the number of shares

of common stock subject to the initial award shall vest and, if applicable, become exercisable upon the market price of the common stock being equal to or exceeding $15.00 per share for thirty (30) consecutive trading days. As of the date hereof,

the Board has not yet granted the initial award to the named executive officers. When granted, each initial award will be subject to the Company’s 2023 Stock Incentive Plan (such plan, as it may be amended and/or restated, the “2023 Plan”) and an

applicable award agreement which shall contain such terms and conditions as may be determined by the Board and/or the Committee. Following the grant of the initial award, during the employment agreement term, each executive will be eligible to

participate in the 2023 Plan on such terms and conditions as may be determined by the Board and/or the Committee in its or their discretion.

Other Benefits

The named executive officers are entitled to participate in employee benefit plans for which they are eligible of Volato and Volato Group provided for all employees of the two companies, such as a

401(k) plan, life insurance, group health insurance and disability insurance. All benefit plans are subject to change at the Company’s discretion.

Term, Termination and Severance; Restrictive Covenants

Each employment agreement has a one-year term commencing upon the Closing of the Business Combination, with automatic renewal for an additional six-month period, unless either party provides 30 days’

notice not to renew. In the event employment is terminated by Volato or Volato Group without “Cause” or by the named executive officer for “Good Reason,” Volato or Volato Group, as applicable, will pay the following severance payments and benefits:

(i) for each named executive officer, an amount equal to one (1) times the sum of such officer’s then-current base salary, payable on the regular payroll dates of Volato or Volato Group, as applicable, over a period of 12 months following

termination, and (ii) reimbursement for the cost of COBRA premiums or other health insurance that the named executive officer may elect for such officer and eligible dependents for up to 12 months or until such officer is no longer eligible to

receive COBRA continuation coverage or otherwise covered by other sources. If the named executive officer is not a participant in a health insurance plan offered by the Volato or Volato Group, as applicable, the companies will reimburse for a

portion of the reasonable and documented monthly premium paid by the named executive officer to maintain different health insurance, in an amount no greater than the reimbursement under COBRA continuation coverage.

For purposes of the employment agreements, the term “Cause” means the occurrence of any of the following by the named executive officer, which is not cured (if capable of cure) within 20 days after

receipt of written notice from Volato or Volato Group, as applicable: (i) willful or material failure to perform duties (other than a failure resulting from incapacity due to physical or mental illness); (ii) willful failure to comply with any

valid and legal directive of the Board or CEO; (iii) dishonesty, illegal conduct or other misconduct, which is, in each case, materially injurious to Volato or Volato Group, as applicable, or their affiliates; (iv) embezzlement, misappropriation or

fraud, whether or not related to employment; (v) conviction of or plea of guilty or nolo contendere to a crime that constitutes a felony (or state law equivalent) or a crime that constitutes a misdemeanor involving moral turpitude; (vi) material

violation of the written policies or codes of conduct of Volato or Volato Group; (vii) material breach of any written agreement with Volato or Volato Group; (viii) conduct that brings or is reasonably likely to bring the Companies negative

publicity or into public disgrace, embarrassment or disrepute; or (ix) the knowing misstatement of the financial records of Volato or Volato Group or complicit actions in respect thereof, or knowing failure to disclose material financial or other

information to the Board.

In addition, the term “Good Reason” means, without the named executive officer’s consent, the occurrence of any of the following, which is not cured by Volato or Volato Group, as applicable, within 30

days after its receipt of written notice provided within 15 days of the existence of any such event: (i) a material reduction in base salary (other than a reduction that affects all similarly situated executives in substantially the same

proportions); (ii) a material and adverse breach by Volato or Volato Group, as applicable, of any material provision of the employment agreement; (iii) a material and adverse change in title, authority, duties, reporting relationships or

responsibilities (other than temporarily while the named executive officer is physically or mentally incapacitated). If employment is not terminated for Good Reason within sixty (60) days after the first occurrence of the applicable grounds, then

the named executive officer will be deemed to have waived the right to terminate for Good Reason with respect to such grounds.

If the named executive officer’s employment is terminated due to “Disability,” Volato or Volato Group, as applicable, will pay, in addition to any other accrued or vested payments or benefits, (i) a

severance payment equal to 1 times the sum of such officer’s then-current base salary, payable on the regular payroll dates of Volato or Volato Group, as applicable, over a period of 12 months beginning with the first regular payroll payment date

that occurs on or after sixty (60) days following termination. Under the employment agreements, the term “Disability” means the inability to perform the essential duties of the position, with or without any reasonable accommodations, because of

mental or physical illness, injury, impairment or incapacity for a period in excess of ninety (90) consecutive days in any calendar year.

Each employment agreement provides that Volato Group’s and Volato’s obligation to pay any severance benefits (other than certain accrued amounts) is contingent upon the executive’s compliance with a

covenants agreement entered into between the Company and the executive containing certain restrictive covenants, employee invention assignment and confidentiality agreements (each such agreement, as it may be amended and/or restated, the “Covenants

Agreement”), and any other restrictive covenants that are applicable to the executive. All such payments and benefits are also conditioned upon the execution and non-revocation of a release of claims in the favor of Volato or Volato Group, as

applicable, within 60 days following termination of employment.

Outstanding Equity Awards at 2023 Fiscal Year-End

The following table summarizes the outstanding equity awards held by our Name Executive Officer (the “NEO”) as of December 31, 2023.

|

|

|

|

Option Awards

|

|

Name

|

|

|

Number of

securities

underlying

unexercised

options

(#)

Exercisable

|

|

|

Number of

securities

underlying

unexercised

options

(#)

unexercisable

|

|

|

Option

exercise

price

($)

|

|

|

Option

expiration

date

|

|

Matthew Liotta

|

|

|

146,901

|

|

|

|

|

|

$0.16

|

|

|

03/10/2027

|

|

Keith Rabin

|

|

|

-

|

|

|

31,442

|

|

|

$8.40

|

|

|

11/26/2033

|

| |

|

|

242,657

|

|

|

-

|

|

|

$0.14

|

|

|

11/15/2032

|

| |

|

|

239,053(1)

|

|

|

-

|

|

|

$0.14

|

|

|