NewMarket Corporation Announces Proposed Private Offering of Senior Notes

2006年12月5日 - 6:48AM

ビジネスワイヤ(英語)

NewMarket Corporation (NYSE:NEU) announced today that it proposes

to make a private offering of $150 million in aggregate principal

amount of senior notes due 2016. NewMarket intends to use the net

proceeds from the proposed offering, together with cash on hand, to

fund the purchase of any and all of its 8?% senior notes due 2010

in an outstanding aggregate principal amount of $150 million that

are validly tendered and accepted for purchase in the company�s

previously announced tender offer and consent solicitation

commenced on November 21, 2006, and to pay related fees and

expenses. To the extent that all existing notes are not tendered in

the tender offer and consent solicitation, NewMarket intends to use

any remaining net proceeds from the proposed offering of the new

notes, together with cash on hand, to repay the existing notes at

maturity or, at NewMarket�s discretion, to repurchase the existing

notes, including through open market purchases, or to redeem or

defease the existing notes under the terms of the indenture

governing the existing notes or for general corporate purposes. The

new notes proposed to be offered have not been and will not be

registered under the Securities Act of 1933, as amended, and may

not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements of the

Securities Act and applicable state securities laws. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy any of the new notes nor an offer to purchase, a

solicitation of an offer to sell, or a solicitation of consents

with respect to the existing notes. Offers for the new notes will

be made only by means of the Preliminary Confidential Offering

Circular, to be dated December 6, 2006. The tender offer and

consent solicitation are made solely by means of the Offer to

Purchase and Consent Solicitation Statement, dated November 21,

2006, and the related Letter of Transmittal and Consent. NewMarket

Corporation through its subsidiaries, Afton Chemical Corporation

and Ethyl Corporation, develops, manufactures, blends, and delivers

chemical additives that enhance the performance of petroleum

products. From custom-formulated chemical blends to market-general

additive components, the NewMarket family of companies provides the

world with the technology to make fuels burn cleaner, engines run

smoother and machines last longer. Safe Harbor Statement Some of

the information contained in this press release constitutes

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Although NewMarket�s

management believes its expectations are based on reasonable

assumptions within the bounds of its knowledge of its business and

operations, there can be no assurance that actual results will not

differ materially from expectations. Factors that could cause

actual results to differ materially from expectations include, but

are not limited to: timing of sales orders; gain or loss of

significant customers; competition from other manufacturers;

resolution of environmental liabilities; changes in the demand for

our products; significant changes in new product introduction;

increases in product cost; the impact of fluctuations in foreign

exchange rates on reported results of operations; changes in

various markets; geopolitical risks in certain of the countries in

which we conduct business; the impact of consolidation of the

petroleum additives industry; and other factors detailed from time

to time in the reports that NewMarket files with the Securities and

Exchange Commission, including the risk factors in Item 1A, �Risk

Factors� of our 2005 Annual Report on Form 10-K and in Item 1A,

�Risk Factors� of our Quarterly Report on Form 10-Q for the

quarterly period ended September 30, 2006, which are available to

shareholders upon request. You should keep in mind that any

forward-looking statement made by NewMarket in the foregoing

discussion speaks only as of the date on which such forward-looking

statement is made. New risks and uncertainties come up from time to

time, and it is impossible for us to predict these events or how

they may affect the company. We have no duty to, and do not intend

to, update or revise the forward-looking statements in this

discussion after the date hereof, except as may be required by law.

In light of these risks and uncertainties, you should keep in mind

that the events described in any forward-looking statement made in

this discussion, or elsewhere, might not occur. NewMarket

Corporation (NYSE:NEU) announced today that it proposes to make a

private offering of $150 million in aggregate principal amount of

senior notes due 2016. NewMarket intends to use the net proceeds

from the proposed offering, together with cash on hand, to fund the

purchase of any and all of its 8 7/8% senior notes due 2010 in an

outstanding aggregate principal amount of $150 million that are

validly tendered and accepted for purchase in the company's

previously announced tender offer and consent solicitation

commenced on November 21, 2006, and to pay related fees and

expenses. To the extent that all existing notes are not tendered in

the tender offer and consent solicitation, NewMarket intends to use

any remaining net proceeds from the proposed offering of the new

notes, together with cash on hand, to repay the existing notes at

maturity or, at NewMarket's discretion, to repurchase the existing

notes, including through open market purchases, or to redeem or

defease the existing notes under the terms of the indenture

governing the existing notes or for general corporate purposes. The

new notes proposed to be offered have not been and will not be

registered under the Securities Act of 1933, as amended, and may

not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements of the

Securities Act and applicable state securities laws. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy any of the new notes nor an offer to purchase, a

solicitation of an offer to sell, or a solicitation of consents

with respect to the existing notes. Offers for the new notes will

be made only by means of the Preliminary Confidential Offering

Circular, to be dated December 6, 2006. The tender offer and

consent solicitation are made solely by means of the Offer to

Purchase and Consent Solicitation Statement, dated November 21,

2006, and the related Letter of Transmittal and Consent. NewMarket

Corporation through its subsidiaries, Afton Chemical Corporation

and Ethyl Corporation, develops, manufactures, blends, and delivers

chemical additives that enhance the performance of petroleum

products. From custom-formulated chemical blends to market-general

additive components, the NewMarket family of companies provides the

world with the technology to make fuels burn cleaner, engines run

smoother and machines last longer. Safe Harbor Statement Some of

the information contained in this press release constitutes

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Although NewMarket's

management believes its expectations are based on reasonable

assumptions within the bounds of its knowledge of its business and

operations, there can be no assurance that actual results will not

differ materially from expectations. Factors that could cause

actual results to differ materially from expectations include, but

are not limited to: timing of sales orders; gain or loss of

significant customers; competition from other manufacturers;

resolution of environmental liabilities; changes in the demand for

our products; significant changes in new product introduction;

increases in product cost; the impact of fluctuations in foreign

exchange rates on reported results of operations; changes in

various markets; geopolitical risks in certain of the countries in

which we conduct business; the impact of consolidation of the

petroleum additives industry; and other factors detailed from time

to time in the reports that NewMarket files with the Securities and

Exchange Commission, including the risk factors in Item 1A, "Risk

Factors" of our 2005 Annual Report on Form 10-K and in Item 1A,

"Risk Factors" of our Quarterly Report on Form 10-Q for the

quarterly period ended September 30, 2006, which are available to

shareholders upon request. You should keep in mind that any

forward-looking statement made by NewMarket in the foregoing

discussion speaks only as of the date on which such forward-looking

statement is made. New risks and uncertainties come up from time to

time, and it is impossible for us to predict these events or how

they may affect the company. We have no duty to, and do not intend

to, update or revise the forward-looking statements in this

discussion after the date hereof, except as may be required by law.

In light of these risks and uncertainties, you should keep in mind

that the events described in any forward-looking statement made in

this discussion, or elsewhere, might not occur.

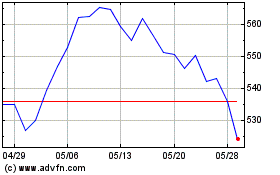

NewMarket (NYSE:NEU)

過去 株価チャート

から 6 2024 まで 7 2024

NewMarket (NYSE:NEU)

過去 株価チャート

から 7 2023 まで 7 2024