Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-258270

PRICING SUPPLEMENT NO. 7 Dated

May 14, 2024

(To Prospectus Dated July 29, 2021 and

Prospectus Supplement Dated July 29,

2021)

McDONALD’S

CORPORATION

Medium-Term

Notes

(Fixed

Rate Notes)

Due

From One Year to 60 Years From Date of Issue

The following description

of the terms of the Notes offered hereby supplements, and, to the extent inconsistent therewith, replaces, the descriptions included

in the Prospectus and Prospectus Supplement referred to above, to which descriptions reference is hereby made.

| Principal Amount: |

USD 500,000,000 |

| |

|

| Issue Price: |

99.669% of the principal

amount of the Notes |

| |

|

| Original Issue Date: |

May 17, 2024 (T+3)1 |

| |

|

| Stated Maturity: |

May 17, 2034 |

| |

|

| Interest Rate: |

5.200% per annum |

| |

|

| Interest Payment Dates: |

May 17 and November 17 of each year, beginning November 17, 2024 |

| [Applicable only if other than February 15

and August 15 of each year] |

| |

|

| Regular Record Dates: |

May 1 and November 1 of each year, as the case may be |

| [Applicable only if other than February

1 and August 1 of each year] |

| Form: |

x Book-Entry

¨ Certificated |

Specified Currency:

[Applicable only

if other than U.S. dollars]

Option to Receive Payments

in Specified Currency: ¨

Yes ¨ No

[Applicable

only if Specified Currency is other than U.S. dollars and if Note is not in Book Entry form]

Authorized

Denominations:

[Applicable

only if other than U.S. $1,000 and increments of U.S. $1,000, or if Specified Currency is other than U.S. dollars]

| 1 | It

is expected that delivery of the Notes will be made against payment therefor on or about

May 17, 2024, which will be the third business day following the date of pricing of the Notes,

or “T+3.” Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended,

trades in the United States secondary market generally are required to settle in two business

days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers

who wish to trade the Notes on the date of pricing will be required, by virtue of the fact

the Notes initially will settle in T+3, to specify an alternate settlement cycle at the time

of any such trade to prevent a failed settlement. Each purchaser should consult their own

advisor. |

Method of Payment of Principal:

[Applicable only

if other than immediately available funds]

| Optional Redemption: | ¨ | The

Notes cannot be redeemed prior to Stated Maturity. |

| | | |

| x | The

Notes can be redeemed in whole or in part at any time prior to Stated Maturity at the option

of McDonald’s Corporation (the “Company”) as set forth below. |

| | | |

| Optional Redemption Dates: | | At

any time prior to Stated Maturity at the option of the Company as set forth below. |

Redemption Prices:

| ¨ | The

Redemption Price shall initially be %

of the principal amount of the Note to be redeemed and shall decline at each anniversary

of the initial Optional Redemption Date by % of the principal amount to be redeemed until

the Redemption Price is 100% of such principal amount; provided, however, that if

this Note is an Original Issue Discount Note, the Redemption Price shall be the Amortized

Face Amount of the principal amount to be redeemed. |

| | | |

| x | Other:

Prior to February 17, 2034 (the “Par Call Date”), the Company may redeem the

Notes at its option, in whole or in part, at any time and from time to time, at a redemption

price (expressed as a percentage of principal amount and rounded to three decimal places)

equal to the greater of: |

| (1) | (a)

the sum of the present values of the remaining scheduled payments of principal and interest

on the Notes to be redeemed discounted to the redemption date (assuming the Notes matured

on the Par Call Date) on a semi-annual basis (assuming a 360-day year consisting of twelve

30-day months) at the Treasury Rate plus 15 basis points, less (b) interest accrued to the

redemption date, and |

| (2) | 100%

of the principal amount of the Notes to be redeemed, |

plus,

in either case, accrued and unpaid interest thereon to the redemption date.

On or after the Par Call Date,

the Company may redeem the Notes at its option, in whole or in part, at any time and from time to time, at a redemption price equal to

100% of the principal amount of the Notes to be redeemed plus accrued and unpaid interest thereon to the redemption date.

“Treasury

Rate” means, with respect to any redemption date, the yield determined by the Company in accordance with the following two paragraphs.

The Treasury

Rate shall be determined by the Company as of 4:15 p.m., New York City time (or as of such time as yields on U.S. government securities

are posted daily by the Board of Governors of the Federal Reserve System), on the third business day preceding the redemption date based

upon the yield or yields for the most recent day that appear as of such time on such day in the most recent statistical release published

by the Board of Governors of the Federal Reserve System designated as “Selected Interest Rates (Daily) - H.15” (or any successor

designation or publication) (“H.15”) under the caption “U.S. government securities–Treasury constant maturities–Nominal”

(or any successor caption or heading) (“H.15 TCM”). In determining the Treasury Rate, the Company shall select, as applicable:

(1) the yield for the Treasury constant maturity on H.15 exactly equal to the period from the

redemption

date to the Par Call Date (the “Remaining Life”); (2) if there is no such Treasury constant maturity on H.15 exactly equal

to the Remaining Life, the two yields – one yield corresponding to the Treasury constant maturity on H.15 immediately shorter than

the Remaining Life and one yield corresponding to the Treasury constant maturity on H.15 immediately longer than the Remaining Life –

and shall interpolate to the Par Call Date on a straight-line basis (using the actual number of days) using such yields and rounding

the result to three decimal places; or (3) if there is no such Treasury constant maturity on H.15 shorter than or longer than the Remaining

Life, the yield for the single Treasury constant maturity on H.15 closest to the Remaining Life. For purposes of this paragraph, the

applicable Treasury constant maturity or maturities on H.15 shall be deemed to have a maturity date equal to the relevant number of months

or years, as applicable, of such Treasury constant maturity from the redemption date.

If on

the third business day preceding the redemption date H.15 TCM is no longer published, the Company shall calculate the Treasury Rate based

on the rate per annum equal to the semi-annual equivalent yield to maturity at 11:00 a.m., New York City time, on the second business

day preceding the redemption date of the United States Treasury security maturing on, or with a maturity that is closest to, the Par

Call Date. If there is no United States Treasury security maturing on the Par Call Date but there are two or more United States Treasury

securities with a maturity date equally distant from the Par Call Date – one with a maturity date preceding the Par Call Date and

one with a maturity date following the Par Call Date – the Company shall select the United States Treasury security with a maturity

date preceding the Par Call Date. If there are two or more United States Treasury securities maturing on the Par Call Date or two or

more United States Treasury securities meeting the criteria of the preceding sentence, the Company shall select from among these two

or more United States Treasury securities the United States Treasury security that is trading closest to par based upon the average of

the bid and asked prices for such United States Treasury securities at 11:00 a.m., New York City time on the second business day preceding

the redemption date. For purposes of this paragraph, the semi-annual yield to maturity of the applicable United States Treasury security

shall be based upon the average of the bid and asked prices for such United States Treasury security (expressed as a percentage of principal

amount and rounded to three decimal places) at 11:00 a.m., New York City time, on the second business day preceding the redemption date.

The Company’s

actions and determinations in determining the redemption price shall be conclusive and binding for all purposes, absent manifest error,

and the trustee shall have no duty to confirm or verify any such determination.

Unless

the Company defaults in payment of the redemption price, on and after the redemption date interest will cease to accrue on the Notes

or portions thereof called for redemption.

| Sinking

Fund: | x |

The

Notes are not subject to a Sinking Fund. |

| ¨ | The

Notes are subject to a Sinking Fund. |

Sinking

Fund Dates:

Sinking

Fund Amounts:

| Amortizing

Note: |

¨ Yes

x No |

Amortizing

Schedule:

| |

|

Outstanding Balance |

| Repayment

Date |

Repayment Amount |

Following Repayment Amount |

| Optional

Repayment: |

¨ Yes

x No |

Optional

Repayment Dates:

Optional

Repayment Prices:

| Original

Issue Discount Note: |

¨ Yes

x No |

Total

Amount of OID:

Yield

to Stated Maturity:

Initial

Accrual Period OID:

Calculation

Agent (if other than Principal Paying Agent):

| Agents’

Discount: | 0.450%

of the principal amount of the Notes |

| Net

proceeds to Company: | 99.219%

of the principal amount of the Notes |

| Agents’

Capacity: | ¨ Agent

x Principal |

Agents:

| Joint Bookrunners: |

BofA Securities, Inc. |

| |

MUFG Securities Americas Inc. |

| |

RBC Capital Markets, LLC |

| |

U.S. Bancorp Investments, Inc. |

Passive Bookrunners: |

Standard Chartered Bank

Westpac Capital Markets LLC

ANZ Securities, Inc. |

Co-Managers: |

BNP Paribas Securities Corp.

Commerz Markets LLC

HSBC Securities (USA) Inc.

ING Financial Markets LLC

PNC Capital Markets LLC

Credit Agricole Securities (USA)

Inc.

Truist Securities, Inc.

UniCredit Capital Markets LLC

J.P. Morgan Securities LLC

Wells Fargo Securities, LLC

Citigroup Global Markets Inc.

SG Americas Securities, LLC

Academy Securities, Inc.

Siebert Williams Shank & Co.,

LLC

Loop Capital Markets LLC

Samuel A. Ramirez & Company,

Inc. |

| |

|

| CUSIP: |

58013MFY5 |

Plan of Distribution to Agents:

| Agent |

Principal Amount |

| BofA Securities, Inc. |

$100,000,000 |

| MUFG Securities Americas Inc. |

100,000,000 |

| RBC Capital Markets, LLC |

100,000,000 |

| U.S. Bancorp Investments, Inc. |

100,000,000 |

| Standard Chartered Bank |

17,500,000 |

| Westpac Capital Markets LLC |

17,500,000 |

| ANZ Securities, Inc. |

17,500,000 |

| BNP Paribas Securities Corp. |

2,500,000 |

| Commerz Markets LLC |

2,500,000 |

| HSBC Securities (USA) Inc. |

2,500,000 |

| ING Financial Markets LLC |

2,500,000 |

| PNC Capital Markets LLC |

2,500,000 |

| Credit Agricole Securities (USA) Inc. |

2,500,000 |

| Truist Securities, Inc. |

2,500,000 |

| UniCredit Capital Markets LLC |

2,500,000 |

| J.P. Morgan Securities LLC |

2,500,000 |

| Wells Fargo Securities, LLC |

2,500,000 |

| Citigroup Global Markets Inc. |

2,500,000 |

| SG Americas Securities, LLC |

2,500,000 |

| Academy Securities, Inc. |

5,000,000 |

| Siebert Williams Shank & Co., LLC |

5,000,000 |

| Loop Capital Markets LLC |

5,000,000 |

| Samuel A. Ramirez & Company, Inc. |

2,500,000 |

| Total |

$500,000,000 |

Additional Information Regarding

Agents:

Standard Chartered Bank will not effect

any offers or sales of any notes in the U.S. unless it is through one or more U.S. registered broker-dealers as permitted by the regulations

of FINRA.

Modification of Prospectus Supplement,

dated July 29, 2021

The Prospectus Supplement, dated July 29,

2021, is modified as follows:

| (1) | Marketing

Legends: The text appearing on pages S-ii and S-iii shall be replaced in its entirety

with the following six paragraphs: |

None

of this prospectus supplement, the accompanying prospectus and any related pricing supplement is a prospectus for the purposes of the

Prospectus Regulation (as defined below). This prospectus supplement, the accompanying prospectus and any related pricing supplement

have been prepared on the basis that any offer of notes in any Member State of the European Economic Area (the “EEA”)

will only be made to a legal entity which is a qualified investor under the Prospectus Regulation (“EEA Qualified Investors”).

Accordingly any person making or intending to make an offer in any Member State of notes that are the subject of the offering contemplated

in this prospectus supplement, the accompanying prospectus and

any

related pricing supplement may only do so with respect to EEA Qualified Investors. Neither we nor the agents have authorized, nor do

we or they authorize, the making of any offer of notes in the EEA other than to EEA Qualified Investors. The expression “Prospectus

Regulation” means Regulation (EU) 2017/1129, as amended.

PROHIBITION

OF SALES TO EEA RETAIL INVESTORS — The notes are not intended to be offered, sold or otherwise made available, and should not

be offered, sold or otherwise made available, to any retail investor in the EEA. For these purposes, a “retail investor”

means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU, as amended

(“MiFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97, as amended (the “Insurance Distribution

Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID

II; or (iii) not a qualified investor as defined in the Prospectus Regulation. Consequently no key information document required by Regulation

(EU) No 1286/2014, as amended (the “PRIIPs Regulation”), for offering or selling the notes or otherwise making them

available to retail investors in the EEA has been prepared and therefore offering or selling the notes or otherwise making them available

to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

None

of this prospectus supplement, the accompanying prospectus and any related pricing supplement is a prospectus for the purposes of the

UK Prospectus Regulation (as defined below). This prospectus supplement, the accompanying prospectus and any related pricing supplement

have been prepared on the basis that any offer of notes in the United Kingdom will only be made to a legal entity which is a qualified

investor under the UK Prospectus Regulation (“UK Qualified Investors”). Accordingly any person making or intending

to make an offer in the United Kingdom of notes that are the subject of the offering contemplated in this prospectus supplement, the

accompanying prospectus and any related pricing supplement may only do so with respect to UK Qualified Investors. Neither we nor the

agents have authorized, nor do we or they authorize, the making of any offer of notes in the UK other than to UK Qualified Investors.

The expression “UK Prospectus Regulation” means Regulation (EU) 2017/1129 as it forms part of domestic law of the

United Kingdom by virtue of the European Union (Withdrawal) Act 2018, as amended by the European Union (Withdrawal Agreement) Act 2020

(the “EUWA”).

The

communication of this prospectus supplement, the accompanying prospectus, any related pricing supplement and any other document or materials

relating to the notes is not being made, and such documents and/or materials have not been approved, by an authorized person for the

purposes of section 21 of the United Kingdom’s Financial Services and Markets Act 2000, as amended (the “FSMA”).

Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United

Kingdom. This prospectus supplement, the accompanying prospectus, any related pricing supplement and such other documents and/or materials

are for distribution only to persons who (i) have professional experience in matters relating to investments and who fall within the

definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion)

Order 2005, as amended (the "Financial Promotion Order")), (ii) fall within Article 49(2)(a) to (d) of the Financial

Promotion Order, (iii) are outside the United Kingdom, or (iv) are other persons to whom it may otherwise lawfully be made under the

Financial Promotion Order (all such persons together being referred to as "relevant persons"). This prospectus supplement,

the accompanying prospectus, any related pricing supplement and

any

other document or materials relating to the notes are directed only at relevant persons and must not be acted on or relied on by persons

who are not relevant persons. Any investment or investment activity to which prospectus supplement, the accompanying prospectus, any

related pricing supplement and any other document or materials relates will be engaged in only with relevant persons. Any person in the

United Kingdom that is not a relevant person should not act or rely on this prospectus supplement, the accompanying prospectus, any related

pricing supplement and any other document or materials relating to the notes or any of their contents.

PROHIBITION

OF SALES TO UK RETAIL INVESTORS — The notes are not intended to be offered, sold or otherwise made available, and should not

be offered, sold or otherwise made available, to any retail investor in the United Kingdom. For these purposes, a retail investor means

a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms

part of domestic law of the United Kingdom by virtue of the EUWA; (ii) a customer within the meaning of the provisions of the FSMA, and

any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify

as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law of

the United Kingdom by virtue of the EUWA (“UK MiFIR”); or (iii) not a qualified investor as defined in Article 2 of

Regulation (EU) 2017/1129 as it forms part of domestic law of the United Kingdom by virtue of the EUWA. Consequently no key information

document required by Regulation (EU) No 1286/2014 as it forms part of domestic law of the United Kingdom by virtue of the EUWA (the “UK

PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the United

Kingdom has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the

United Kingdom may be unlawful under the UK PRIIPs Regulation.

MIFID

II/ UK MIFIR PRODUCT GOVERNANCE / TARGET MARKET — The pricing supplement in respect of any notes may include a legend entitled

“MiFID II Product Governance” and/or “UK MiFIR Product Governance”, as applicable, which will outline the target

market assessment in respect of the notes and which channels for distribution of the notes are appropriate. Any person subsequently offering,

selling or recommending the notes (a “distributor”) should take into consideration the target market assessment. However,

a distributor subject to MiFID II and/or the FCA Handbook Product Intervention and Product Governance Sourcebook (the “UK MiFIR

Product Governance Rules”), as applicable, is responsible for undertaking its own target market assessment in respect of the

notes (by either adopting or refining the target market assessment) and determining appropriate distribution channels. A determination

will be made in relation to each issue about whether, for the purpose of the MiFID Product Governance rules under EU Delegated Directive

2017/593, as amended (the “MiFID Product Governance Rules”), and/or the UK MiFIR Product Governance Rules, as applicable,

any agent subscribing for any notes is a manufacturer in respect of such notes, but otherwise neither the agents nor any of their respective

affiliates will be a manufacturer for the purpose of the MiFID Product Governance Rules and/or the UK MiFIR Product Governance Rules,

as applicable. We make no representation or warranty as to any manufacturer’s or distributor’s compliance with the MiFID

Product Governance Rules and/or the UK MiFIR Product Governance Rules, as applicable. We make no representation or warranty as to any

manufacturer’s or distributor’s compliance with the MiFID Product Governance Rules or the UK MiFIR Product Governance Rules,

as applicable.

| (2) | Plan

of Distribution: The text under “Plan of Distribution” is amended as follows: |

| (a) | The

text appearing under the subheading “Prohibition of Sales to EEA Retail Investors”

on page S-49 shall be replaced in its entirety with the following: |

Prohibition of Sales to

EEA Retail Investors

Each

agent has represented and agreed, and each further agent appointed under the Distribution Agreement will be required to represent and

agree, that it has not offered, sold or otherwise made available and will not offer, sell or otherwise make available, any notes which

are the subject of the offering contemplated by this prospectus supplement as completed by the pricing supplement in relation thereto

to any retail investor in the EEA. For the purposes of this provision:

| (a) | the

expression “retail investor” means a person who is one (or more) of the

following: |

| (i) | a

retail client as defined in point (11) of Article 4(1) of MiFID II; |

| (ii) | a

customer within the meaning of the Insurance Distribution Directive, where that customer

would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID

II; or |

| (iii) | not

a qualified investor as defined in the Prospectus Regulation; and |

| (b) | the

expression “offer” includes the communication in any form and by any means

of sufficient information on the terms of the offer and the notes to be offered so as to

enable an investor to decide to purchase or subscribe for the notes. |

| (b) | The

text appearing under the subheading “Prohibition of Sales to United Kingdom Retail

Investors” on page S-50 shall be replaced in its entirety with the following: |

Prohibition of Sales to

United Kingdom Retail Investors

Each

agent has represented and agreed, and each further agent appointed under the Distribution Agreement will be required to represent and

agree, that it has not offered, sold or otherwise made available and will not offer, sell or otherwise make available any notes to any

retail investor in the United Kingdom. For the purposes of this provision:

(a) the expression “retail investor” means a person who is one (or more) of the following:

(i)

a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law of the United Kingdom

by virtue of the EUWA;

(ii)

a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement the Insurance

Distribution Directive, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of UK

MiFIR; or

(iii)

not a qualified investor as defined in Article 2 of the UK Prospectus Regulation; and

(b) the expression “offer” includes the communication in any form and by any means of sufficient information on the terms

of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe for the notes.

EX-FILING FEES

Calculation of Filing Fee Tables

424(b)(2)

(Form Type)

McDonald’s

Corporation

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s

Name into English)

Table 1: Newly Registered and Carry Forward

Securities

| |

Security Type |

Security

Class

Title |

Fee

Calculation

or Carry

Forward Rule |

Amount

Registered |

Proposed

Maximum

Offering Price

Per Unit |

Maximum

Aggregate

Offering Price |

Fee Rate |

Amount of

Registration Fee |

Carry

Forward

Form Type |

Carry

Forward

File Number |

Carry

Forward

Initial

effective date |

Filing Fee

Previously Paid

In Connection

with Unsold

Securities

to be Carried

Forward |

| Newly

Registered Securities |

| Fees to Be Paid |

Debt |

5.200% Medium-Term Notes due 2034 |

457(o) |

|

|

498,345,000 |

0.00014760 |

73,555.72 |

|

|

|

|

| Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

| Carry

Forward Securities |

| Carry Forward Securities |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Offering Amounts |

|

498,345,000 |

|

73,555.72 |

|

|

|

|

| |

Total Fees Previously Paid |

|

|

|

|

|

|

|

|

| |

Total Fee Offsets |

|

|

|

|

|

|

|

|

| |

Net Fee Due |

|

|

|

73,555.72 |

|

|

|

|

Table 2: Fee Offset Claims and Sources

| |

Registrant or

Filer Name |

Form

or

Filing Type |

File

Number |

Initial

Filing Date |

Filing

Date |

Fee Offset

Claimed |

Security

Type

Associated with

Fee Offset Claimed |

Security

Title

Associated with

Fee Offset Claimed |

Unsold

Securities

Associated with

Fee Offset Claimed |

Unsold

Aggregate

Offering Amount

Associated with

Fee Offset Claimed |

Fee Paid with

Fee Offset Source |

| Rules

457(b) and 0-11(a)(2) |

| Fee Offset Claims |

|

|

|

|

|

|

|

|

|

|

|

| Fee Offset Sources |

|

|

|

|

|

|

|

|

|

|

|

| Rule

457(p) |

| Fee Offset Claims |

|

|

|

|

|

|

|

|

|

|

|

| Fee Offset Sources |

|

|

|

|

|

|

|

|

|

|

|

Table 3: Combined Prospectuses

| Security Type |

Security

Class Title |

Amount

of Securities

Previously Registered |

Maximum

Aggregate

Offering Price

of Securities

Previously Registered |

Form

Type |

File

Number |

Initial

Effective Date |

| |

|

|

|

|

|

|

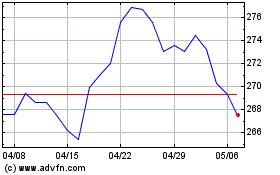

McDonalds (NYSE:MCD)

過去 株価チャート

から 4 2024 まで 5 2024

McDonalds (NYSE:MCD)

過去 株価チャート

から 5 2023 まで 5 2024