COHEN & STEERS LIMITED DURATION PREFERRED AND INCOME FUND, INC.

SCHEDULE OF INVESTMENTS

March 28,

2024 (Unaudited)*

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| PREFERRED SECURITIES—EXCHANGE-TRADED |

|

|

10.1 |

% |

|

|

|

|

|

|

|

|

| BANKING |

|

|

2.5 |

% |

|

|

|

|

|

|

|

|

| Morgan Stanley, 6.276% (3 Month USD Term SOFR + 0.962%, Floor 4.00%), Series

A(a)(b)(c) |

|

|

|

101,802 |

|

|

$ |

2,310,905 |

|

| Regions Financial Corp., 5.70% to 5/15/29, Series C(a)(b)(d) |

|

|

|

87,831 |

|

|

|

2,072,812 |

|

| Regions Financial Corp., 6.375% to 9/15/24, Series B(a)(b)(d) |

|

|

|

59,551 |

|

|

|

1,461,381 |

|

| U.S. Bancorp, 6.176% (3 Month USD Term SOFR + 0.862%, Floor 3.50%), Series

B(a)(b)(c) |

|

|

|

350,657 |

|

|

|

7,374,317 |

|

| U.S. Bancorp, 6.58% (3 Month USD Term SOFR + 1.282%, Floor 3.50%), Series

A(a)(b)(c) |

|

|

|

2,511 |

|

|

|

2,120,414 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,339,829 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL SERVICES |

|

|

1.7 |

% |

|

|

|

|

|

|

|

|

| Affiliated Managers Group, Inc., 6.75%, due 3/30/64(a) |

|

|

|

135,600 |

|

|

|

3,460,512 |

|

| Brookfield Oaktree Holdings LLC, 6.55%, Series B(a)(b) |

|

|

|

99,985 |

|

|

|

2,317,652 |

|

| Brookfield Oaktree Holdings LLC, 6.625%, Series A(a)(b) |

|

|

|

39,252 |

|

|

|

938,123 |

|

| TPG Operating Group II LP, 6.95%, due 3/15/64(a) |

|

|

|

142,392 |

|

|

|

3,742,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,458,349 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INDUSTRIAL SERVICES |

|

|

1.5 |

% |

|

|

|

|

|

|

|

|

| WESCO International, Inc., 10.625% to 6/22/25, Series A(b)(d) |

|

|

|

351,462 |

|

|

|

9,246,965 |

|

|

|

|

|

|

|

|

|

|

|

| INSURANCE |

|

|

2.1 |

% |

|

|

|

|

|

|

|

|

| Allstate Corp., 8.741% (3 Month USD Term SOFR + 3.427%),

due 1/15/53(a)(c) |

|

|

|

44,509 |

|

|

|

1,138,540 |

|

| Athene Holding Ltd., 6.35% to 6/30/29, Series A(a)(b)(d) |

|

|

|

68,967 |

|

|

|

1,643,484 |

|

| Athene Holding Ltd., 7.25% to 3/30/29, due 3/30/64(a)(d) |

|

|

|

132,145 |

|

|

|

3,367,055 |

|

| Athene Holding Ltd., 7.75% to 12/30/27, Series E(a)(b)(d) |

|

|

|

83,098 |

|

|

|

2,169,689 |

|

| F&G Annuities & Life, Inc., Senior Debt, 7.95%, due 12/15/53(a) |

|

|

|

95,041 |

|

|

|

2,486,272 |

|

| Lincoln National Corp., 9.00%, Series D(a)(b) |

|

|

|

83,821 |

|

|

|

2,310,945 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,115,985 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PIPELINES |

|

|

0.5 |

% |

|

|

|

|

|

|

|

|

| TC Energy Corp., 3.903% to 4/30/24, Series 7 (Canada)(a)(b)(d) |

|

|

|

241,622 |

|

|

|

3,360,643 |

|

|

|

|

|

|

|

|

|

|

|

| TELECOMMUNICATIONS |

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

| U.S. Cellular Corp., Senior Debt, 5.50%, due 3/1/70(a) |

|

|

|

53,603 |

|

|

|

965,926 |

|

| U.S. Cellular Corp., Senior Debt, 5.50%, due 6/1/70(a) |

|

|

|

50,965 |

|

|

|

922,466 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,888,392 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UTILITIES |

|

|

1.5 |

% |

|

|

|

|

|

|

|

|

| Algonquin Power & Utilities Corp., 6.20% to 7/1/24, due 7/1/79, Series 19-A (Canada)(a)(d) |

|

|

|

40,000 |

|

|

|

1,000,000 |

|

| SCE Trust V, 5.45% to 3/15/26, Series K (TruPS)(a)(b)(d) |

|

|

|

94,286 |

|

|

|

2,267,578 |

|

| SCE Trust VII, 7.50%, Series M (TruPS)(a)(b) |

|

|

|

219,622 |

|

|

|

5,848,534 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,116,112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL PREFERRED SECURITIES—EXCHANGE-TRADED

(Identified

cost—$61,865,917) |

|

|

|

|

|

|

|

62,526,275 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount** |

|

|

|

|

| PREFERRED

SECURITIES—OVER-THE-COUNTER |

|

|

136.9 |

% |

|

|

|

|

|

|

|

|

| BANKING |

|

|

87.8 |

% |

|

|

|

|

|

|

|

|

| Abanca Corp. Bancaria SA, 6.00% to 1/20/26 (Spain)(b)(d)(e)(f) |

|

|

EUR |

2,200,000 |

|

|

|

2,292,062 |

|

| ABN AMRO Bank NV, 6.875% to 9/22/31 (Netherlands)(b)(d)(e)(f) |

|

|

EUR |

2,400,000 |

|

|

|

2,678,281 |

|

| AIB Group PLC, 5.25% to 10/9/24 (Ireland)(b)(d)(e)(f) |

|

|

EUR |

1,000,000 |

|

|

|

1,073,173 |

|

| AIB Group PLC, 6.25% to 6/23/25 (Ireland)(b)(d)(e)(f) |

|

|

EUR |

3,800,000 |

|

|

|

4,086,818 |

|

| Banco Bilbao Vizcaya Argentaria SA, 6.50% to 3/5/25, Series

9

(Spain)(b)(d)(e) |

|

|

|

3,400,000 |

|

|

|

3,379,514 |

|

| Banco Bilbao Vizcaya Argentaria SA, 9.375% to 3/19/29 (Spain)(b)(d)(e) |

|

|

|

3,841,000 |

|

|

|

4,140,444 |

|

1

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount** |

|

|

Value |

|

| Banco de Credito e Inversiones SA, 8.75% to 2/8/29 (Chile)(b)(d)(e)(g) |

|

|

1,000,000 |

|

|

$ |

1,031,875 |

|

| Banco de Sabadell SA, 5.75% to 3/15/26 (Spain)(b)(d)(e)(f) |

|

EUR |

1,600,000 |

|

|

|

1,672,152 |

|

| Banco de Sabadell SA, 9.375% to 7/18/28 (Spain)(b)(d)(e)(f) |

|

EUR |

2,200,000 |

|

|

|

2,579,259 |

|

| Banco Santander SA, 9.625% to 11/21/28 (Spain)(b)(d)(e) |

|

|

3,200,000 |

|

|

|

3,423,776 |

|

| Banco Santander SA, 9.625% to 5/21/33 (Spain)(b)(d)(e) |

|

|

8,200,000 |

|

|

|

9,052,456 |

|

| Bank of America Corp., 4.375% to 1/27/27, Series RR(a)(b)(d) |

|

|

5,063,000 |

|

|

|

4,758,929 |

|

| Bank of America Corp., 5.875% to 3/15/28, Series FF(a)(b)(d) |

|

|

3,177,000 |

|

|

|

3,132,371 |

|

| Bank of America Corp., 6.10% to 3/17/25, Series AA(a)(b)(d) |

|

|

3,808,000 |

|

|

|

3,828,042 |

|

| Bank of America Corp., 6.125% to 4/27/27, Series TT(a)(b)(d) |

|

|

2,972,000 |

|

|

|

2,987,547 |

|

| Bank of America Corp., 6.25% to 9/5/24, Series X(a)(b)(d) |

|

|

2,202,000 |

|

|

|

2,210,011 |

|

| Bank of America Corp., 6.50% to 10/23/24, Series Z(a)(b)(d) |

|

|

1,295,000 |

|

|

|

1,299,336 |

|

| Bank of America Corp., 8.738% (3 Month USD Term SOFR + 3.397%),

Series

U(a)(b)(c) |

|

|

6,709,000 |

|

|

|

6,734,541 |

|

| Bank of Ireland Group PLC, 6.00% to 9/1/25 (Ireland)(b)(d)(e)(f) |

|

EUR |

1,800,000 |

|

|

|

1,922,821 |

|

| Bank of Ireland Group PLC, 7.50% to 5/19/25 (Ireland)(b)(d)(e)(f) |

|

EUR |

3,800,000 |

|

|

|

4,173,624 |

|

| Bank of New York Mellon Corp., 3.75% to 12/20/26, Series I(a)(b)(d) |

|

|

1,032,000 |

|

|

|

948,511 |

|

| Bank of New York Mellon Corp., 4.625% to 9/20/26, Series F(a)(b)(d) |

|

|

1,464,000 |

|

|

|

1,386,341 |

|

| Bank of Nova Scotia, 4.90% to 6/4/25 (Canada)(a)(b)(d) |

|

|

2,455,000 |

|

|

|

2,421,914 |

|

| Bank of Nova Scotia, 8.00% to 1/27/29, due 1/27/84 (Canada)(a)(d) |

|

|

2,200,000 |

|

|

|

2,244,172 |

|

| Bank of Nova Scotia, 8.625% to 10/27/27, due 10/27/82 (Canada)(a)(d) |

|

|

5,200,000 |

|

|

|

5,427,245 |

|

| Barclays Bank PLC, 6.278% to 12/15/34, Series 1 (United Kingdom)(b)(d) |

|

|

1,820,000 |

|

|

|

1,822,044 |

|

| Barclays PLC, 6.125% to 12/15/25 (United Kingdom)(b)(d)(e) |

|

|

4,000,000 |

|

|

|

3,865,522 |

|

| Barclays PLC, 7.125% to 6/15/25 (United Kingdom)(b)(d)(e) |

|

GBP |

1,200,000 |

|

|

|

1,493,002 |

|

| Barclays PLC, 8.00% to 3/15/29 (United Kingdom)(b)(d)(e) |

|

|

2,200,000 |

|

|

|

2,200,966 |

|

| Barclays PLC, 8.875% to 9/15/27 (United Kingdom)(b)(d)(e)(f) |

|

GBP |

3,400,000 |

|

|

|

4,377,693 |

|

| Barclays PLC, 9.25% to 9/15/28 (United Kingdom)(b)(d)(e) |

|

GBP |

1,600,000 |

|

|

|

2,088,609 |

|

| Barclays PLC, 9.625% to 12/15/29 (United Kingdom)(b)(d)(e) |

|

|

6,800,000 |

|

|

|

7,227,734 |

|

| BNP Paribas SA, 4.625% to 1/12/27 (France)(b)(d)(e)(g) |

|

|

5,000,000 |

|

|

|

4,546,326 |

|

| BNP Paribas SA, 4.625% to 2/25/31 (France)(b)(d)(e)(g) |

|

|

4,600,000 |

|

|

|

3,806,163 |

|

| BNP Paribas SA, 7.00% to 8/16/28 (France)(b)(d)(e)(g) |

|

|

3,400,000 |

|

|

|

3,376,885 |

|

| BNP Paribas SA, 7.375% to 8/19/25 (France)(b)(d)(e)(g) |

|

|

4,000,000 |

|

|

|

4,019,488 |

|

| BNP Paribas SA, 7.75% to 8/16/29 (France)(b)(d)(e)(g) |

|

|

10,600,000 |

|

|

|

10,877,540 |

|

| BNP Paribas SA, 8.00% to 8/22/31 (France)(b)(d)(e)(g) |

|

|

2,000,000 |

|

|

|

2,046,260 |

|

| BNP Paribas SA, 8.50% to 8/14/28 (France)(b)(d)(e)(g) |

|

|

5,800,000 |

|

|

|

6,076,962 |

|

| BNP Paribas SA, 9.25% to 11/17/27 (France)(b)(d)(e)(g) |

|

|

4,200,000 |

|

|

|

4,517,184 |

|

| CaixaBank SA, 7.50% to 1/16/30 (Spain)(b)(d)(e)(f) |

|

EUR |

1,800,000 |

|

|

|

2,017,486 |

|

| CaixaBank SA, 8.25% to 3/13/29 (Spain)(b)(d)(e)(f) |

|

EUR |

3,400,000 |

|

|

|

3,908,038 |

|

| Charles Schwab Corp., 4.00% to 6/1/26, Series I(a)(b)(d) |

|

|

11,889,000 |

|

|

|

11,137,896 |

|

| Charles Schwab Corp., 4.00% to 12/1/30, Series H(a)(b)(d) |

|

|

9,684,000 |

|

|

|

8,183,026 |

|

| Charles Schwab Corp., 5.00% to 6/1/27, Series K(a)(b)(d) |

|

|

2,849,000 |

|

|

|

2,730,937 |

|

| Charles Schwab Corp., 5.375% to 6/1/25, Series G(a)(b)(d) |

|

|

3,730,000 |

|

|

|

3,713,510 |

|

| Citigroup, Inc., 3.875% to 2/18/26, Series X(b)(d) |

|

|

7,382,000 |

|

|

|

6,985,387 |

|

| Citigroup, Inc., 5.95% to 5/15/25, Series P(b)(d) |

|

|

5,680,000 |

|

|

|

5,678,568 |

|

| Citigroup, Inc., 6.25% to 8/15/26, Series T(b)(d) |

|

|

1,153,000 |

|

|

|

1,158,843 |

|

| Citigroup, Inc., 7.625% to 11/15/28, Series AA(b)(d) |

|

|

12,019,000 |

|

|

|

12,648,399 |

|

| Citizens Financial Group, Inc., 5.65% to 10/6/25, Series F(b)(d) |

|

|

970,000 |

|

|

|

950,203 |

|

| CoBank ACB, 6.25% to 10/1/26, Series I(a)(b)(d) |

|

|

5,755,000 |

|

|

|

5,651,620 |

|

| CoBank ACB, 6.45% to 10/1/27, Series K(a)(b)(d) |

|

|

2,300,000 |

|

|

|

2,273,650 |

|

| Commerzbank AG, 7.00% to 4/9/25 (Germany)(b)(d)(e)(f) |

|

|

2,800,000 |

|

|

|

2,761,349 |

|

| Credit Agricole SA, 4.75% to 3/23/29 (France)(a)(b)(d)(e)(g) |

|

|

3,800,000 |

|

|

|

3,347,015 |

|

| Credit Agricole SA, 6.50% to 9/23/29, Series EMTN (France)(b)(d)(e)(f) |

|

EUR |

5,600,000 |

|

|

|

6,143,046 |

|

| Credit Agricole SA, 7.25% to 9/23/28, Series EMTN (France)(b)(d)(e)(f) |

|

EUR |

2,300,000 |

|

|

|

2,621,626 |

|

2

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Principal

Amount** |

|

|

Value |

|

| Credit Agricole SA, 8.125% to 12/23/25 (France)(a)(b)(d)(e)(g) |

|

|

2,950,000 |

|

|

$ |

3,014,723 |

|

| Credit Suisse Group AG, 5.25%, Claim (Switzerland)(b)(e)(g)(h)(i) |

|

|

1,400,000 |

|

|

|

161,000 |

|

| Credit Suisse Group AG, 6.375%, Claim (Switzerland)(b)(e)(g)(h)(i) |

|

|

4,300,000 |

|

|

|

494,500 |

|

| Credit Suisse Group AG, 7.50%, Claim (Switzerland)(b)(e)(g)(h)(i) |

|

|

2,400,000 |

|

|

|

276,000 |

|

| Danske Bank AS, 7.00% to 6/26/25 (Denmark)(b)(d)(e)(f) |

|

|

1,847,000 |

|

|

|

1,835,711 |

|

| Deutsche Bank AG, 6.00% to 10/30/25, Series 2020 (Germany)(b)(d)(e) |

|

|

2,000,000 |

|

|

|

1,856,456 |

|

| Deutsche Bank AG, 7.50% to 4/30/25 (Germany)(b)(d)(e) |

|

|

1,600,000 |

|

|

|

1,576,918 |

|

| Deutsche Bank AG, 10.00% to 12/1/27 (Germany)(b)(d)(e)(f) |

|

EUR |

4,000,000 |

|

|

|

4,690,300 |

|

| Farm Credit Bank of Texas, 5.70% to 9/15/25, Series 4(b)(d)(g) |

|

|

4,275,000 |

|

|

|

4,236,899 |

|

| Farm Credit Bank of Texas, 9.601% (3 Month USD Term SOFR +

4.01%)(b)(c)(g) |

|

|

14,168 |

† |

|

|

1,416,800 |

|

| First Citizens BancShares, Inc., 9.563% (3 Month USD Term SOFR + 4.234%), Series

B(b)(c) |

|

|

5,674,000 |

|

|

|

5,778,782 |

|

| First Horizon Bank, 6.437% (3 Month USD Term SOFR + 1.112%, Floor

3.75%)(a)(b)(c)(g) |

|

|

14,750 |

† |

|

|

9,366,250 |

|

| Goldman Sachs Capital I, 6.345%, due 2/15/34 (TruPS) |

|

|

2,540,000 |

|

|

|

2,649,112 |

|

| Goldman Sachs Group, Inc., 3.65% to 8/10/26, Series U(b)(d) |

|

|

1,954,000 |

|

|

|

1,789,595 |

|

| Goldman Sachs Group, Inc., 7.50% to 2/10/29, Series W(b)(d) |

|

|

2,555,000 |

|

|

|

2,719,391 |

|

| HSBC Capital Funding Dollar 1 LP, 10.176% to 6/30/30, Series 2 (United

Kingdom)(b)(d)(g) |

|

|

4,285,000 |

|

|

|

5,399,550 |

|

| HSBC Holdings PLC, 4.00% to 3/9/26 (United Kingdom)(a)(b)(d)(e) |

|

|

3,000,000 |

|

|

|

2,794,500 |

|

| HSBC Holdings PLC, 4.60% to 12/17/30 (United Kingdom)(a)(b)(d)(e) |

|

|

5,300,000 |

|

|

|

4,496,942 |

|

| HSBC Holdings PLC, 6.00% to 5/22/27 (United Kingdom)(a)(b)(d)(e) |

|

|

6,000,000 |

|

|

|

5,790,413 |

|

| HSBC Holdings PLC, 6.375% to 3/30/25 (United Kingdom)(a)(b)(d)(e) |

|

|

900,000 |

|

|

|

894,867 |

|

| HSBC Holdings PLC, 6.50% to 3/23/28 (United Kingdom)(a)(b)(d)(e) |

|

|

2,800,000 |

|

|

|

2,747,222 |

|

| HSBC Holdings PLC, 6.50%, due 9/15/37 (United Kingdom)(a) |

|

|

1,200,000 |

|

|

|

1,279,725 |

|

| HSBC Holdings PLC, 8.00% to 3/7/28 (United Kingdom)(a)(b)(d)(e) |

|

|

4,800,000 |

|

|

|

4,994,165 |

|

| Huntington Bancshares, Inc., 4.45% to 10/15/27, Series G(b)(d) |

|

|

1,085,000 |

|

|

|

985,936 |

|

| Huntington Bancshares, Inc., 5.625% to 7/15/30, Series F(b)(d) |

|

|

2,553,000 |

|

|

|

2,334,915 |

|

| Huntington Bancshares, Inc., 8.456% (3 Month USD Term SOFR + 3.142%), Series

E(b)(c) |

|

|

5,500,000 |

|

|

|

5,411,352 |

|

| ING Groep NV, 4.25% to 5/16/31, Series NC10 (Netherlands)(b)(d)(e) |

|

|

600,000 |

|

|

|

456,713 |

|

| ING Groep NV, 4.875% to 5/16/29 (Netherlands)(b)(d)(e)(f) |

|

|

3,800,000 |

|

|

|

3,273,385 |

|

| ING Groep NV, 5.75% to 11/16/26 (Netherlands)(b)(d)(e) |

|

|

7,200,000 |

|

|

|

6,860,748 |

|

| ING Groep NV, 6.50% to 4/16/25 (Netherlands)(b)(d)(e) |

|

|

3,600,000 |

|

|

|

3,558,524 |

|

| ING Groep NV, 7.50% to 5/16/28 (Netherlands)(b)(d)(e)(f) |

|

|

2,100,000 |

|

|

|

2,089,162 |

|

| ING Groep NV, 8.00% to 5/16/30 (Netherlands)(b)(d)(e)(f) |

|

|

2,600,000 |

|

|

|

2,641,340 |

|

| Intesa Sanpaolo SpA, 7.70% to 9/17/25 (Italy)(b)(d)(e)(g) |

|

|

5,400,000 |

|

|

|

5,391,783 |

|

| Intesa Sanpaolo SpA, 9.125% to 9/7/29 (Italy)(b)(d)(e)(f) |

|

EUR |

2,400,000 |

|

|

|

2,897,908 |

|

| JPMorgan Chase & Co., 6.10% to 10/1/24, Series X(a)(b)(d) |

|

|

1,344,000 |

|

|

|

1,345,380 |

|

| JPMorgan Chase & Co., 6.125% to 4/30/24, Series U(a)(b)(d) |

|

|

1,301,000 |

|

|

|

1,300,363 |

|

| JPMorgan Chase & Co., 6.875% to 6/1/29, Series NN(a)(b)(d) |

|

|

15,083,000 |

|

|

|

15,645,177 |

|

| JPMorgan Chase & Co., 8.818% (3 Month USD Term SOFR + 3.512%), Series

Q(a)(b)(c) |

|

|

1,807,000 |

|

|

|

1,808,405 |

|

| JPMorgan Chase & Co., 8.868% (3 Month USD Term SOFR + 3.562%), Series

R(a)(b)(c) |

|

|

9,500,000 |

|

|

|

9,507,412 |

|

| JPMorgan Chase & Co., 9.348% (3 Month USD Term SOFR + 4.042%), Series

S(a)(b)(c) |

|

|

2,175,000 |

|

|

|

2,178,832 |

|

| KeyCorp Capital III, 7.75%, due 7/15/29 (TruPS) |

|

|

2,000,000 |

|

|

|

2,007,479 |

|

| Lloyds Banking Group PLC, 6.75% to 6/27/26 (United Kingdom)(b)(d)(e) |

|

|

1,000,000 |

|

|

|

988,838 |

|

| Lloyds Banking Group PLC, 7.50% to 9/27/25 (United Kingdom)(b)(d)(e) |

|

|

4,600,000 |

|

|

|

4,593,111 |

|

| Lloyds Banking Group PLC, 8.00% to 9/27/29 (United Kingdom)(b)(d)(e) |

|

|

1,500,000 |

|

|

|

1,514,049 |

|

| Lloyds Banking Group PLC, 8.50% to 9/27/27 (United Kingdom)(b)(d)(e) |

|

GBP |

1,200,000 |

|

|

|

1,547,522 |

|

| M&T Bank Corp., 3.50% to 9/1/26, Series I(b)(d) |

|

|

626,000 |

|

|

|

481,714 |

|

| Mellon Capital IV, 6.159% (3 Month USD Term SOFR + 0.827%, Floor 4.00%), Series 1

(TruPS)(a)(b)(c) |

|

|

2,967,000 |

|

|

|

2,522,601 |

|

| NatWest Group PLC, 6.00% to 12/29/25 (United Kingdom)(b)(d)(e) |

|

|

4,600,000 |

|

|

|

4,503,357 |

|

| NatWest Group PLC, 8.00% to 8/10/25 (United Kingdom)(b)(d)(e) |

|

|

6,400,000 |

|

|

|

6,439,539 |

|

| Nordea Bank Abp, 6.625% to 3/26/26 (Finland)(a)(b)(d)(e)(g) |

|

|

2,600,000 |

|

|

|

2,580,273 |

|

| PNC Financial Services Group, Inc., 3.40% to 9/15/26, Series T(a)(b)(d) |

|

|

3,735,000 |

|

|

|

3,273,876 |

|

3

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount** |

|

|

Value |

|

| PNC Financial Services Group, Inc., 6.00% to 5/15/27, Series U(a)(b)(d) |

|

|

|

3,809,000 |

|

|

$ |

3,733,003 |

|

| PNC Financial Services Group, Inc., 6.20% to 9/15/27, Series V(a)(b)(d) |

|

|

|

4,850,000 |

|

|

|

4,849,497 |

|

| PNC Financial Services Group, Inc., 6.25% to 3/15/30, Series W(a)(b)(d) |

|

|

|

6,857,000 |

|

|

|

6,662,758 |

|

| Regions Financial Corp., 5.75% to 6/15/25, Series D(b)(d) |

|

|

|

1,814,000 |

|

|

|

1,791,548 |

|

| Skandinaviska Enskilda Banken AB, 6.875% to

6/30/27

(Sweden)(a)(b)(d)(e)(f) |

|

|

|

800,000 |

|

|

|

792,000 |

|

| Societe Generale SA, 5.375% to 11/18/30 (France)(b)(d)(e)(g) |

|

|

|

6,200,000 |

|

|

|

5,239,698 |

|

| Societe Generale SA, 6.75% to 4/6/28 (France)(b)(d)(e)(g) |

|

|

|

5,800,000 |

|

|

|

5,298,072 |

|

| Societe Generale SA, 7.875% to 1/18/29, Series EMTN (France)(b)(d)(e)(f) |

|

|

EUR |

1,200,000 |

|

|

|

1,357,792 |

|

| Societe Generale SA, 8.00% to 9/29/25 (France)(b)(d)(e)(g) |

|

|

|

1,400,000 |

|

|

|

1,407,361 |

|

| Societe Generale SA, 9.375% to 11/22/27 (France)(b)(d)(e)(g) |

|

|

|

6,000,000 |

|

|

|

6,228,378 |

|

| Societe Generale SA, 10.00% to 11/14/28 (France)(b)(d)(e)(g) |

|

|

|

5,200,000 |

|

|

|

5,529,488 |

|

| Standard Chartered PLC, 4.30% to 8/19/28 (United Kingdom)(b)(d)(e)(g) |

|

|

|

400,000 |

|

|

|

330,171 |

|

| Standard Chartered PLC, 4.75% to 1/14/31 (United Kingdom)(b)(d)(e)(g) |

|

|

|

2,200,000 |

|

|

|

1,834,090 |

|

| Standard Chartered PLC, 7.875% to 3/8/30 (United Kingdom)(b)(d)(e)(g) |

|

|

|

4,400,000 |

|

|

|

4,385,859 |

|

| State Street Corp., 6.70% to 3/15/29, Series I(b)(d) |

|

|

|

5,955,000 |

|

|

|

6,057,557 |

|

| Swedbank AB, 7.625% to 3/17/28 (Sweden)(b)(d)(e)(f) |

|

|

|

1,000,000 |

|

|

|

997,407 |

|

| Swedbank AB, 7.75% to 3/17/30 (Sweden)(b)(d)(e)(f) |

|

|

|

3,200,000 |

|

|

|

3,179,974 |

|

| Toronto-Dominion Bank, 8.125% to 10/31/27, due 10/31/82 (Canada)(a)(d) |

|

|

|

7,800,000 |

|

|

|

8,200,553 |

|

| Truist Financial Corp., 4.95% to 9/1/25, Series P(a)(b)(d) |

|

|

|

1,881,000 |

|

|

|

1,850,121 |

|

| Truist Financial Corp., 5.10% to 3/1/30, Series Q(a)(b)(d) |

|

|

|

5,432,000 |

|

|

|

5,080,219 |

|

| Truist Financial Corp., 5.125% to 12/15/27, Series M(a)(b)(d) |

|

|

|

4,900,000 |

|

|

|

4,437,835 |

|

| UBS Group AG, 4.375% to 2/10/31 (Switzerland)(b)(d)(e)(g) |

|

|

|

2,200,000 |

|

|

|

1,814,607 |

|

| UBS Group AG, 4.875% to 2/12/27 (Switzerland)(b)(d)(e)(g) |

|

|

|

5,700,000 |

|

|

|

5,248,088 |

|

| UBS Group AG, 6.875% to 8/7/25 (Switzerland)(b)(d)(e)(f) |

|

|

|

5,800,000 |

|

|

|

5,748,751 |

|

| UBS Group AG, 9.25% to 11/13/28 (Switzerland)(b)(d)(e)(g) |

|

|

|

7,400,000 |

|

|

|

8,036,215 |

|

| UBS Group AG, 9.25% to 11/13/33 (Switzerland)(b)(d)(e)(g) |

|

|

|

9,400,000 |

|

|

|

10,631,748 |

|

| USB Capital IX, 6.596% (3 Month USD Term SOFR + 1.282%, Floor 3.50%)

(TruPS)(a)(b)(c) |

|

|

|

7,443,000 |

|

|

|

6,095,345 |

|

| U.S. Bancorp, 3.70% to 1/15/27, Series N(a)(b)(d) |

|

|

|

904,000 |

|

|

|

786,308 |

|

| U.S. Bancorp, 5.30% to 4/15/27, Series J(a)(b)(d) |

|

|

|

3,410,000 |

|

|

|

3,273,279 |

|

| Wells Fargo & Co., 3.90% to 3/15/26, Series BB(b)(d) |

|

|

|

17,650,000 |

|

|

|

16,803,705 |

|

| Wells Fargo & Co., 5.875% to 6/15/25, Series U(b)(d) |

|

|

|

1,713,000 |

|

|

|

1,713,514 |

|

| Wells Fargo & Co., 5.95%, due 12/15/36 |

|

|

|

1,832,000 |

|

|

|

1,847,931 |

|

| Wells Fargo & Co., 7.625% to 9/15/28(b)(d) |

|

|

|

9,810,000 |

|

|

|

10,508,551 |

|

| Wells Fargo & Co., 7.95%, due 11/15/29, Series B |

|

|

|

445,000 |

|

|

|

497,451 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

543,786,581 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ENERGY |

|

|

1.6 |

% |

|

|

|

|

|

|

|

|

| BP Capital Markets PLC, 4.875% to 3/22/30(a)(b)(d) |

|

|

|

6,154,000 |

|

|

|

5,890,273 |

|

| BP Capital Markets PLC, 6.45% to 12/1/33(b)(d) |

|

|

|

3,910,000 |

|

|

|

4,058,928 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,949,201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL SERVICES |

|

|

2.2 |

% |

|

|

|

|

|

|

|

|

| American Express Co., 3.55% to 9/15/26, Series D(b)(d) |

|

|

|

4,145,000 |

|

|

|

3,847,002 |

|

| Apollo Management Holdings LP, 4.95% to 12/17/24, due 1/14/50(a)(d)(g) |

|

|

|

2,336,000 |

|

|

|

2,221,989 |

|

| ARES Finance Co. III LLC, 4.125% to 6/30/26, due 6/30/51(a)(d)(g) |

|

|

|

3,290,000 |

|

|

|

3,068,724 |

|

| Discover Financial Services, 6.125% to 6/23/25, Series D(b)(d) |

|

|

|

1,156,000 |

|

|

|

1,161,276 |

|

| ILFC E-Capital Trust II, 7.395% (3 Month USD

Term SOFR + 2.062%), due 12/21/65 (TruPS)(c)(g) |

|

|

|

4,250,000 |

|

|

|

3,412,911 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,711,902 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INSURANCE |

|

|

17.7 |

% |

|

|

|

|

|

|

|

|

| Aegon Ltd., 5.50% to 4/11/28, due 4/11/48 (Netherlands)(a)(d) |

|

|

|

1,589,000 |

|

|

|

1,542,567 |

|

| Aegon Ltd., 5.625% to 4/15/29 (Netherlands)(b)(d)(e)(f) |

|

|

EUR |

3,800,000 |

|

|

|

3,995,737 |

|

| Allianz SE, 3.50% to 11/17/25 (Germany)(a)(b)(d)(e)(g) |

|

|

|

3,000,000 |

|

|

|

2,790,009 |

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount** |

|

|

Value |

|

| Allianz SE, 6.35% to 3/6/33, due 9/6/53 (Germany)(a)(d)(g) |

|

|

|

3,200,000 |

|

|

$ |

3,366,979 |

|

| Athora Netherlands NV, 7.00% to 6/19/25 (Netherlands)(b)(d)(e)(f) |

|

|

EUR |

2,600,000 |

|

|

|

2,815,444 |

|

| AXA SA, 6.375% to 7/16/33, Series EMTN (France)(b)(d)(e)(f) |

|

|

EUR |

1,600,000 |

|

|

|

1,796,216 |

|

| AXA SA, 8.60%, due 12/15/30 (France)(a) |

|

|

|

1,290,000 |

|

|

|

1,524,637 |

|

| CNP Assurances SACA, 4.875% to 10/7/30 (France)(a)(b)(d)(e)(f) |

|

|

|

600,000 |

|

|

|

508,371 |

|

| Corebridge Financial, Inc., 6.875% to 9/15/27, due 12/15/52(a)(d) |

|

|

|

4,030,000 |

|

|

|

4,038,859 |

|

| Dai-ichi Life Insurance Co. Ltd., 5.10% to

10/28/24 (Japan)(b)(d)(g) |

|

|

|

1,000,000 |

|

|

|

993,418 |

|

| Enstar Finance LLC, 5.50% to 1/15/27, due 1/15/42(a)(d) |

|

|

|

3,635,000 |

|

|

|

3,392,576 |

|

| Enstar Finance LLC, 5.75% to 9/1/25, due 9/1/40(a)(d) |

|

|

|

4,389,000 |

|

|

|

4,263,494 |

|

| Equitable Holdings, Inc., 4.95% to 9/15/25, Series B(a)(b)(d) |

|

|

|

2,405,000 |

|

|

|

2,356,393 |

|

| Fukoku Mutual Life Insurance Co., 5.00% to 7/28/25 (Japan)(a)(b)(d)(f) |

|

|

|

2,400,000 |

|

|

|

2,365,367 |

|

| Global Atlantic Fin Co., 4.70% to 7/15/26, due 10/15/51(d)(g) |

|

|

|

3,230,000 |

|

|

|

2,912,892 |

|

| Hartford Financial Services Group, Inc., 7.694% (3 Month USD Term SOFR + 2.387%), due

2/12/47, Series ICON(a)(c)(g) |

|

|

|

9,885,000 |

|

|

|

8,806,971 |

|

| Lancashire Holdings Ltd., 5.625% to 3/18/31, due 9/18/41

(United

Kingdom)(d)(f) |

|

|

|

2,179,000 |

|

|

|

1,961,464 |

|

| Liberty Mutual Group, Inc., 4.125% to 9/15/26, due 12/15/51(d)(g) |

|

|

|

1,954,000 |

|

|

|

1,768,696 |

|

| Lincoln National Corp., 7.619% (3 Month USD Term SOFR + 2.302%), due

4/20/67(c) |

|

|

|

1,000,000 |

|

|

|

769,500 |

|

| Lincoln National Corp., 7.938% (3 Month USD Term SOFR + 2.619%), due

5/17/66(c) |

|

|

|

334,000 |

|

|

|

267,936 |

|

| Lincoln National Corp., 9.25% to 12/1/27, Series C(b)(d) |

|

|

|

2,134,000 |

|

|

|

2,304,236 |

|

| Markel Group, Inc., 6.00% to 6/1/25(b)(d) |

|

|

|

990,000 |

|

|

|

983,128 |

|

| MetLife Capital Trust IV, 7.875%, due 12/15/37 (TruPS)(a)(g) |

|

|

|

7,080,000 |

|

|

|

7,608,359 |

|

| MetLife, Inc., 9.25%, due 4/8/38(a)(g) |

|

|

|

6,150,000 |

|

|

|

7,216,625 |

|

| NN Group NV, 6.375% to 9/12/30 (Netherlands)(b)(d)(e)(f) |

|

|

EUR |

800,000 |

|

|

|

867,836 |

|

| Phoenix Group Holdings PLC, 5.625% to

1/29/25

(United Kingdom)(b)(d)(e)(f) |

|

|

|

2,150,000 |

|

|

|

2,104,091 |

|

| Prudential Financial, Inc., 6.00% to 6/1/32, due 9/1/52(a)(d) |

|

|

|

3,357,000 |

|

|

|

3,343,973 |

|

| Prudential Financial, Inc., 6.50% to 12/15/33, due 3/15/54(a)(d) |

|

|

|

6,410,000 |

|

|

|

6,514,643 |

|

| Prudential Financial, Inc., 6.75% to 12/1/32, due 3/1/53(a)(d) |

|

|

|

2,640,000 |

|

|

|

2,751,390 |

|

| QBE Insurance Group Ltd., 5.875% to 6/17/26, due 6/17/46, Series EMTN

(Australia)(a)(d)(f) |

|

|

|

4,800,000 |

|

|

|

4,730,672 |

|

| QBE Insurance Group Ltd., 5.875% to 5/12/25 (Australia)(a)(b)(d)(g) |

|

|

|

5,200,000 |

|

|

|

5,160,332 |

|

| Rothesay Life PLC, 4.875% to 4/13/27, Series NC6

(United

Kingdom)(b)(d)(e)(f) |

|

|

|

2,400,000 |

|

|

|

2,094,600 |

|

| SBL Holdings, Inc., 6.50% to 11/13/26(b)(d)(g) |

|

|

|

2,450,000 |

|

|

|

1,918,105 |

|

| SBL Holdings, Inc., 7.00% to 5/13/25(b)(d)(g) |

|

|

|

3,605,000 |

|

|

|

3,082,275 |

|

| Sumitomo Life Insurance Co., 5.875% to 1/18/34 (Japan)(a)(b)(d)(g) |

|

|

|

6,000,000 |

|

|

|

5,991,437 |

|

| Swiss Re Finance Luxembourg SA, 5.00% to 4/2/29, due

4/2/49

(Switzerland)(a)(d)(g) |

|

|

|

800,000 |

|

|

|

779,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

109,688,630 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PIPELINES |

|

|

11.4 |

% |

|

|

|

|

|

|

|

|

| Enbridge, Inc., 5.75% to 4/15/30, due 7/15/80, Series

20-A (Canada)(a)(d) |

|

|

|

5,609,000 |

|

|

|

5,315,106 |

|

| Enbridge, Inc., 6.00% to 1/15/27, due 1/15/77, Series

16-A (Canada)(a)(d) |

|

|

|

4,534,000 |

|

|

|

4,439,599 |

|

| Enbridge, Inc., 6.25% to 3/1/28, due 3/1/78 (Canada)(a)(d) |

|

|

|

7,464,000 |

|

|

|

7,277,595 |

|

| Enbridge, Inc., 7.375% to 10/15/27, due 1/15/83 (Canada)(a)(d) |

|

|

|

2,022,000 |

|

|

|

2,036,528 |

|

| Enbridge, Inc., 7.625% to 10/15/32, due 1/15/83 (Canada)(a)(d) |

|

|

|

2,148,000 |

|

|

|

2,209,761 |

|

| Enbridge, Inc., 8.25% to 10/15/28, due 1/15/84, Series NC5 (Canada)(a)(d) |

|

|

|

5,480,000 |

|

|

|

5,716,172 |

|

| Enbridge, Inc., 8.50% to 10/15/33, due 1/15/84 (Canada)(a)(d) |

|

|

|

8,370,000 |

|

|

|

9,115,223 |

|

| Energy Transfer LP, 6.50% to 11/15/26, Series H(b)(d) |

|

|

|

4,320,000 |

|

|

|

4,245,013 |

|

| Energy Transfer LP, 7.125% to 5/15/30, Series G(b)(d) |

|

|

|

3,971,000 |

|

|

|

3,886,760 |

|

| Energy Transfer LP, 8.00% to 2/15/29, due 5/15/54(d) |

|

|

|

2,720,000 |

|

|

|

2,854,996 |

|

| Enterprise Products Operating LLC, 8.573% (3 Month USD Term SOFR + 3.248%), due

8/16/77, Series D(a)(c) |

|

|

|

4,592,000 |

|

|

|

4,591,240 |

|

| Transcanada Trust, 5.50% to 9/15/29, due 9/15/79 (Canada)(d) |

|

|

|

7,891,000 |

|

|

|

7,285,036 |

|

| Transcanada Trust, 5.60% to 12/7/31, due 3/7/82 (Canada)(d) |

|

|

|

4,404,000 |

|

|

|

4,025,927 |

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Principal

Amount** |

|

|

Value |

|

| Transcanada Trust, 5.875% to 8/15/26, due 8/15/76, Series 16-A (Canada)(d) |

|

|

|

8,098,000 |

|

|

$ |

7,888,531 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70,887,487 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REAL ESTATE |

|

|

1.8 |

% |

|

|

|

|

|

|

|

|

| Scentre Group Trust 2, 4.75% to 6/24/26, due 9/24/80 (Australia)(a)(d)(g) |

|

|

|

5,378,000 |

|

|

|

5,169,929 |

|

| Scentre Group Trust 2, 5.125% to 6/24/30, due 9/24/80 (Australia)(a)(d)(g) |

|

|

|

3,100,000 |

|

|

|

2,873,774 |

|

| Unibail-Rodamco-Westfield SE, 7.25% to 7/3/28 (France)(b)(d)(f) |

|

|

EUR |

2,800,000 |

|

|

|

3,211,231 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,254,934 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TELECOMMUNICATIONS |

|

|

0.7 |

% |

|

|

|

|

|

|

|

|

| Telefonica Europe BV, 6.135% to 2/3/30 (Spain)(b)(d)(f) |

|

|

EUR |

1,600,000 |

|

|

|

1,792,919 |

|

| Vodafone Group PLC, 4.125% to 3/4/31, due 6/4/81 (United Kingdom)(d) |

|

|

|

3,000,000 |

|

|

|

2,588,847 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,381,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UTILITIES |

|

|

13.7 |

% |

|

|

|

|

|

|

|

|

| Algonquin Power & Utilities Corp., 4.75% to 1/18/27, due

1/18/82

(Canada)(d) |

|

|

|

5,322,000 |

|

|

|

4,696,430 |

|

| CMS Energy Corp., 3.75% to 9/1/30, due 12/1/50(d) |

|

|

|

3,000,000 |

|

|

|

2,461,761 |

|

| CMS Energy Corp., 4.75% to 3/1/30, due 6/1/50(d) |

|

|

|

2,004,000 |

|

|

|

1,848,077 |

|

| Dominion Energy, Inc., 4.35% to 1/15/27, Series C(b)(d) |

|

|

|

3,631,000 |

|

|

|

3,417,375 |

|

| Dominion Energy, Inc., 4.65% to 12/15/24, Series B(b)(d) |

|

|

|

2,361,000 |

|

|

|

2,322,809 |

|

| Edison International, 5.00% to 12/15/26, Series B(b)(d) |

|

|

|

702,000 |

|

|

|

666,832 |

|

| Edison International, 5.375% to 3/15/26, Series A(b)(d) |

|

|

|

3,153,000 |

|

|

|

3,059,003 |

|

| Edison International, 7.875% to 3/15/29, due 6/15/54(d) |

|

|

|

6,930,000 |

|

|

|

7,136,694 |

|

| Electricite de France SA, 7.50% to 9/6/28, Series EMTN (France)(b)(d)(f) |

|

|

EUR |

2,400,000 |

|

|

|

2,811,407 |

|

| Electricite de France SA, 9.125% to 3/15/33 (France)(b)(d)(g) |

|

|

|

5,400,000 |

|

|

|

5,962,599 |

|

| Emera, Inc., 6.75% to 6/15/26, due 6/15/76, Series

16-A (Canada)(d) |

|

|

|

9,601,000 |

|

|

|

9,518,183 |

|

| Enel SpA, 6.625% to 4/16/31, Series EMTN (Italy)(b)(d)(f) |

|

|

EUR |

1,300,000 |

|

|

|

1,529,653 |

|

| NextEra Energy Capital Holdings, Inc., 5.65% to 5/1/29, due 5/1/79(a)(d) |

|

|

|

4,698,000 |

|

|

|

4,516,788 |

|

| NextEra Energy Capital Holdings, Inc., 6.70% to 6/1/29, due 9/1/54(a)(d) |

|

|

|

6,780,000 |

|

|

|

6,819,092 |

|

| Sempra, 4.125% to 1/1/27, due 4/1/52(a)(d) |

|

|

|

4,750,000 |

|

|

|

4,405,844 |

|

| Sempra, 4.875% to 10/15/25(b)(d) |

|

|

|

4,200,000 |

|

|

|

4,119,964 |

|

| Sempra, 6.875% to 7/1/29, due 10/1/54(a)(d) |

|

|

|

6,150,000 |

|

|

|

6,219,455 |

|

| Southern California Edison Co., 9.767% (3 Month USD Term SOFR + 4.461%), Series

E(b)(c) |

|

|

|

9,158,000 |

|

|

|

9,202,654 |

|

| Southern Co., 3.75% to 6/15/26, due 9/15/51, Series

21-A(a)(d) |

|

|

|

4,252,000 |

|

|

|

3,980,429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

84,695,049 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL PREFERRED

SECURITIES—OVER-THE-COUNTER

(Identified cost—$847,185,475) |

|

|

|

848,355,550 |

|

|

|

|

|

|

|

|

|

|

|

| CORPORATE BONDS |

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

| UTILITIES |

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

| Enel Finance America LLC, 7.10%, due 10/14/27 (Italy)(a)(g) |

|

|

|

800,000 |

|

|

|

846,795 |

|

| Enel Finance International NV, 7.50%, due 10/14/32 (Italy)(a)(g) |

|

|

|

800,000 |

|

|

|

902,186 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL CORPORATE BONDS

(Identified cost—$1,576,120) |

|

|

|

|

|

|

|

1,748,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

|

|

| SHORT-TERM INVESTMENTS |

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

| MONEY MARKET FUNDS |

|

|

|

|

|

|

|

|

|

|

|

|

| State Street Institutional Treasury Plus Money Market Fund, Premier Class,

5.25%(j) |

|

|

|

113,098 |

|

|

|

113,098 |

|

6

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| State Street Institutional U.S. Government Money Market Fund, Premier

Class,

5.26%(j) |

|

|

|

1,439,636 |

|

|

$ |

1,439,636 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$1,552,734) |

|

|

|

|

|

|

|

1,552,734 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL INVESTMENTS IN SECURITIES

(Identified cost—$912,180,246) |

|

|

147.6 |

% |

|

|

|

|

|

|

914,183,540 |

|

| LIABILITIES IN EXCESS OF OTHER ASSETS |

|

|

(47.6 |

) |

|

|

|

|

|

|

(294,697,921 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

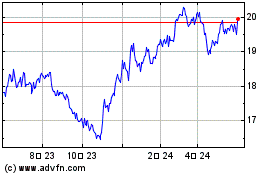

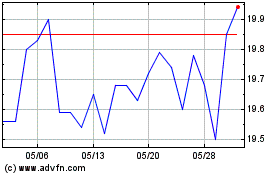

| NET ASSETS (Equivalent to $21.30 per share based on 29,079,221 shares of common stock

outstanding) |

|

|

100.0 |

% |

|

|

|

|

|

$ |

619,485,619 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Centrally Cleared Interest Rate Swap Contracts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notional

Amount |

|

|

Fixed

Rate

Payable |

|

|

Fixed

Payment

Frequency |

|

Floating

Rate

Receivable

(resets

monthly) |

|

Floating

Payment

Frequency |

|

Maturity Date |

|

Value |

|

|

Upfront

Receipts

(Payments) |

|

|

Unrealized

Appreciation

(Depreciation) |

|

| |

$85,000,000 |

|

|

|

0.548% |

|

|

Monthly |

|

5.424%(k) |

|

Monthly |

|

9/15/25 |

|

$ |

5,365,262 |

|

|

$ |

11,669 |

|

|

$ |

5,376,931 |

|

| |

94,000,000 |

|

|

|

1.181% |

|

|

Monthly |

|

5.424%(k) |

|

Monthly |

|

9/15/26 |

|

|

7,347,797 |

|

|

|

16,296 |

|

|

|

7,364,093 |

|

| |

90,000,000 |

|

|

|

0.930% |

|

|

Monthly |

|

5.424%(k) |

|

Monthly |

|

9/15/27 |

|

|

9,730,341 |

|

|

|

16,931 |

|

|

|

9,747,272 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

22,443,400 |

|

|

$ |

44,896 |

|

|

$ |

22,488,296 |

|

| |

|

|

The total amount of all interest rate swap contracts as presented in the table above are representative of the

volume of activity for this derivative type during the period ended March 28, 2024.

Over-the-Counter Total Return Swap Contracts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Counterparty |

|

Notional

Amount |

|

|

Fixed

Payable

Rate |

|

|

Fixed

Payment

Frequency |

|

Underlying

Reference Entity |

|

|

Position |

|

Maturity

Date |

|

|

Value |

|

|

Premiums

Paid |

|

|

Unrealized

Appreciation

(Depreciation) |

|

| BNP Paribas |

|

$ |

7,948,415 |

|

|

|

0.25% |

|

|

Monthly |

|

|

BNPXCHY5 Index(l) |

|

|

Short |

|

|

5/15/24 |

|

|

$ |

(77,068 |

) |

|

$ |

— |

|

|

$ |

(77,068 |

) |

| BNP Paribas |

|

EUR |

7,359,355 |

|

|

|

0.30% |

|

|

Monthly |

|

|

BNPXCEX5 Index(m) |

|

|

Short |

|

|

5/15/24 |

|

|

|

14,318 |

|

|

|

— |

|

|

|

14,318 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(62,750 |

) |

|

$ |

— |

|

|

$ |

(62,750 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

Forward Foreign Currency Exchange Contracts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Counterparty |

|

Contracts

to Deliver |

|

|

In Exchange

For |

|

|

Settlement

Date |

|

Unrealized

Appreciation

(Depreciation) |

|

| Brown Brothers Harriman |

|

CAD |

|

|

4,332,282 |

|

|

USD |

|

|

3,194,922 |

|

|

4/3/24 |

|

$ |

(3,490 |

) |

| Brown Brothers Harriman |

|

EUR |

|

|

2,141,616 |

|

|

USD |

|

|

2,326,371 |

|

|

4/3/24 |

|

|

15,889 |

|

| Brown Brothers Harriman |

|

EUR |

|

|

55,910,044 |

|

|

USD |

|

|

60,566,233 |

|

|

4/3/24 |

|

|

247,687 |

|

| Brown Brothers Harriman |

|

GBP |

|

|

634,813 |

|

|

USD |

|

|

803,910 |

|

|

4/3/24 |

|

|

2,681 |

|

| Brown Brothers Harriman |

|

GBP |

|

|

608,023 |

|

|

USD |

|

|

774,341 |

|

|

4/3/24 |

|

|

6,925 |

|

| Brown Brothers Harriman |

|

GBP |

|

|

5,497,700 |

|

|

USD |

|

|

6,954,354 |

|

|

4/3/24 |

|

|

15,433 |

|

| Brown Brothers Harriman |

|

USD |

|

|

3,201,060 |

|

|

CAD |

|

|

4,332,282 |

|

|

4/3/24 |

|

|

(2,648 |

) |

| Brown Brothers Harriman |

|

USD |

|

|

62,702,178 |

|

|

EUR |

|

|

58,051,660 |

|

|

4/3/24 |

|

|

(73,151 |

) |

| Brown Brothers Harriman |

|

USD |

|

|

8,515,858 |

|

|

GBP |

|

|

6,740,536 |

|

|

4/3/24 |

|

|

(8,292 |

) |

| Brown Brothers Harriman |

|

CAD |

|

|

4,552,158 |

|

|

USD |

|

|

3,364,691 |

|

|

5/2/24 |

|

|

2,529 |

|

| Brown Brothers Harriman |

|

EUR |

|

|

59,558,054 |

|

|

USD |

|

|

64,399,528 |

|

|

5/2/24 |

|

|

70,680 |

|

| Brown Brothers Harriman |

|

GBP |

|

|

840,733 |

|

|

USD |

|

|

1,061,770 |

|

|

5/2/24 |

|

|

471 |

|

| Brown Brothers Harriman |

|

GBP |

|

|

6,709,871 |

|

|

USD |

|

|

8,477,888 |

|

|

5/2/24 |

|

|

7,684 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

282,398 |

|

| |

|

Glossary of Portfolio Abbreviations

|

|

|

|

|

|

|

CAD |

|

Canada Dollar |

|

|

EMTN |

|

Euro Medium Term Note |

|

|

EUR |

|

Euro Currency |

|

|

GBP |

|

British Pound |

|

|

ICON |

|

Income Capital Obligation Note |

|

|

OIS |

|

Overnight Indexed Swap |

|

|

SOFR |

|

Secured Overnight Financing Rate |

|

|

TruPS |

|

Trust Preferred Securities |

|

|

USD |

|

United States Dollar |

Note: Percentages indicated are based on the net assets of the Fund.

| * |

March 28, 2024 represents the last business day of the Fund’s quarterly period. See Note 1 of the

accompanying Notes to Schedule of Investments. |

| ** |

Amount denominated in U.S. dollars unless otherwise indicated. |

| (a) |

All or a portion of the security is pledged as collateral in connection with the Fund’s revolving

credit agreement. $412,845,149 in aggregate has been pledged as collateral. |

| (b) |

Perpetual security. Perpetual securities have no stated maturity date, but they may be called/redeemed by

the issuer. |

| (c) |

Variable rate. Rate shown is in effect at March 28, 2024. |

| (d) |

Security converts to floating rate after the indicated fixed-rate coupon period. |

| (e) |

Contingent Capital security (CoCo). CoCos are debt or preferred securities with loss absorption

characteristics built into the terms of the security for the benefit of the issuer. Aggregate holdings amounted to $292,817,121 which represents 47.3% of the net assets of the Fund (31.3% of the managed assets of the Fund). |

| (f) |

Securities exempt from registration under Regulation S of the Securities Act of 1933. These securities are

subject to resale restrictions. Aggregate holdings amounted to $104,396,166 which represents 16.9% of the net assets of the Fund, of which 0.0% are illiquid. |

| (g) |

Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may

only be resold to qualified institutional buyers. Aggregate holdings amounted to $208,821,658 which represents 33.7% of the net assets of the Fund, of which 1.7% are illiquid. |

| (h) |

Non-income producing security. |

| (i) |

Security is in default. |

| (j) |

Rate quoted represents the annualized seven–day yield. |

| (k) |

Based on USD-SOFR-OIS.

Represents rates in effect at March 28, 2024. |

| (l) |

The index intends to track the performance of the CDX.NA HY. The two constituent investments held within the

index at March 28, 2024 were as follows: |

8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment |

|

Receive |

|

Frequency |

|

Payment |

|

Frequency |

|

Maturity

Date |

|

Total

Weight |

|

|

3/28/24

Price |

|

|

3/28/24

Value |

|

| Credit Default Swaps (CDS)—MARKIT CDX.NA.HY.42 Index |

|

5.00% per

anum |

|

Quarterly |

|

Performance

of CDS |

|

Semiannually |

|

6/20/29 |

|

|

99.69 |

% |

|

|

107.16 |

|

|

$ |

7,923,824 |

|

| Cash |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

0.31 |

% |

|

|

— |

|

|

|

24,591 |

|

| (m) |

The index intends to track the performance of the iTraxx Crossover CDS. The two constituent investments held

within the index at March 28, 2024 were as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment |

|

Receive |

|

Frequency |

|

Payment |

|

Frequency |

|

Maturity

Date |

|

Total

Weight |

|

|

3/28/24

Price |

|

|

3/28/24

Value |

|

| Credit Default Swaps (CDS)—MARKIT ITRX EUR XOVER Index |

|

5.00% per

anum |

|

Quarterly |

|

Performance

of CDS |

|

Semiannually |

|

6/20/29 |

|

|

100.15 |

% |

|

|

EUR 297.03 |

|

|

$ |

7,936,410 |

|

| Cash |

|

|

|

— |

|

— |

|

— |

|

— |

|

|

(0.15 |

)% |

|

|

— |

|

|

|

(11,953 |

) |

|

|

|

|

|

| Country Summary |

|

% of

Managed

Assets |

|

| United States |

|

|

49.4 |

|

| France |

|

|

10.2 |

|

| Canada |

|

|

9.9 |

|

| United Kingdom |

|

|

9.2 |

|

| Spain |

|

|

3.7 |

|

| Switzerland |

|

|

3.6 |

|

| Netherlands |

|

|

3.3 |

|

| Australia |

|

|

1.9 |

|

| Germany |

|

|

1.8 |

|

| Italy |

|

|

1.2 |

|

| Ireland |

|

|

1.2 |

|

| Japan |

|

|

1.0 |

|

| Sweden |

|

|

0.5 |

|

| Other (includes short-term investments) |

|

|

3.1 |

|

|

|

|

|

|

|

|

|

100.0 |

|

|

|

|

|

|

9

COHEN & STEERS LIMITED DURATION PREFERRED AND INCOME FUND, INC.

NOTES TO SCHEDULE OF INVESTMENTS (Unaudited)

Note 1. Quarterly Period

Since March 28, 2024 represents the last day during the Fund’s quarterly period on which the New York Stock Exchange was

open for trading, the Fund’s schedule of investments have been presented through that date.

Note 2. Portfolio Valuation

Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the

last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no

ask price is available, at the bid price. Exchange-traded options are valued at their last sale price as of the close of options trading on applicable exchanges on the valuation date. In the absence of a last sale price on such day, options are

valued based upon prices provided by a third-party pricing service. Over-the-counter (OTC) options and total return swaps are valued based upon prices provided by a

third- party pricing service or counterparty. Forward foreign currency exchange contracts are valued daily at the prevailing forward exchange rate. Centrally cleared interest rate swaps are valued at the price determined by the relevant exchange or

clearinghouse.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges (including

NASDAQ) are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of

which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain

non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the OTC market, including listed securities whose primary market is believed by

Cohen & Steers Capital Management, Inc. (the investment advisor) to be OTC, are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment advisor,

pursuant to delegation by the Board of Directors, to reflect the fair value of such securities.

Fixed-income securities

are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment advisor, pursuant to delegation by the Board of Directors, to reflect the fair value of such

securities. The pricing services or broker-dealers use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services or broker-dealers may utilize a market-based approach through

which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services or broker-dealers also utilize proprietary valuation models which may consider market

transactions in comparable securities and the various relationships between securities in determining fair value and/or characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates,

anticipated timing of principal repayments, underlying collateral, and other unique security features which are then used to calculate the fair values.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair

value. Investments in open-end mutual funds are valued at net asset value (NAV).

The Board of Directors has designated the investment advisor as the Fund’s “Valuation Designee” under Rule 2a-5 under the 1940 Act. As Valuation Designee, the investment advisor is authorized to make fair valuation determinations, subject to the oversight of the Board of Directors. The investment advisor has established

a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to

utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable, or securities for which the investment advisor determines that the bid

and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund’s Board of Directors. Circumstances in

which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close

of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or

factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

The Fund’s use of fair value pricing may cause the NAV of Fund shares to differ from the NAV that would be calculated

using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to

transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in

determining the fair value of the Fund’s investments is summarized below.

COHEN & STEERS LIMITED DURATION PREFERRED AND INCOME FUND, INC.

NOTES TO SCHEDULE OF INVESTMENTS (Unaudited) (Continued)

| |

• |

|

Level 1—quoted prices in active markets for identical investments |

| |

• |

|

Level 2—other significant observable inputs (including quoted prices for similar investments, interest

rates, credit risk, etc.) |

| |

• |

|

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the

fair value of investments) |

The inputs or methodology used for valuing investments may or may not be an

indication of the risk associated with those investments. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the inputs used as of March 28, 2024 in valuing the Fund’s investments carried at value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quoted Prices in

Active Markets

for Identical

Investments

(Level 1) |

|

|

Other

Significant

Observable

Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Preferred Securities—Exchange-Traded |

|

$ |

62,526,275 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

62,526,275 |

|

| Preferred

Securities—Over-the-Counter |

|

|

— |

|

|

|

848,355,550 |

|

|

|

— |

|

|

|

848,355,550 |

|

| Corporate Bonds |

|

|

— |

|

|

|

1,748,981 |

|

|

|

— |

|

|

|

1,748,981 |

|

| Short-Term Investments |

|

|

— |

|

|

|

1,552,734 |

|

|

|

— |

|

|

|

1,552,734 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments in Securities(a) |

|

$ |

62,526,275 |

|

|

$ |

851,657,265 |

|

|

$ |

— |

|

|

$ |

914,183,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Forward Foreign Currency Exchange Contracts |

|

$ |

— |

|

|

$ |

369,979 |

|

|

$ |

— |

|

|

$ |

369,979 |

|

| Interest Rate Swap Contracts |

|

|

— |

|

|

|

22,488,296 |

|

|

|

— |

|

|

|

22,488,296 |

|

| Total Return Swap Contracts |

|

|

— |

|

|

|

14,318 |

|

|

|

— |

|

|

|

14,318 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Derivative Assets(a) |

|

$ |

— |

|

|

$ |

22,872,593 |

|

|

$ |

— |

|

|

$ |

22,872,593 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Forward Foreign Currency Exchange Contracts |

|

$ |

— |

|

|

$ |

(87,581 |

) |

|

$ |

— |

|

|

$ |

(87,581 |

) |

| Total Return Swap Contracts |

|

|

— |

|

|

|

(77,068 |

) |

|

|

— |

|

|

|

(77,068 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Derivative Liabilities(a) |

|

$ |

— |

|