UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 6)1

Gildan Activewear Inc.

(Name

of Issuer)

Common Shares

(Title of Class of Securities)

375916103

(CUSIP Number)

Usman Nabi

Browning West LP

1999 Avenue of the Stars

Suite 1150

Los Angeles, California 90067

(310) 984-7600

Andrew M. Freedman

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

May 23, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Browning West, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

9,617,135 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

9,617,135 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

9,617,135 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.7% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN, IA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Usman Nabi |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

9,617,135 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

9,617,135 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

9,617,135 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.7% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN, HC |

|

The following constitutes

Amendment No. 6 to the Schedule 13D filed by the undersigned (“Amendment No. 6”). This Amendment No. 6 amends the Schedule

13D as specifically set forth herein.

| Item 2. | Identity and Background. |

Items 2(a) and (c) are hereby

amended and restated as follows:

(a) This

statement is filed by:

| (i) | Browning West, LP, a Delaware limited partnership (“Browning West”), with respect to the Shares

held by certain funds (the “Browning West Funds”) to which it serves as investment manager; and |

| (ii) | Usman Nabi, as the managing member of Browning West UPG ManCo LLC (“Browning West UPG”), the

general partner of Browning West, and the Chief Investment Officer of Browning West. |

Each of the foregoing

is referred to as a “Reporting Person” and collectively as the “Reporting Persons.” Each of the Reporting Persons

is party to that certain Joint Filing Agreement, as further described in Item 6 of the Schedule 13D. Accordingly, the Reporting Persons

are hereby filing a joint Schedule 13D.

(c) The

principal business of Browning West is serving as the investment manager of the Browning West Funds. Mr. Nabi serves as the managing member

of Browning West UPG and the Chief Investment Officer of Browning West.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby amended

and restated as follows:

The Shares beneficially owned

by the Reporting Persons were purchased with the working capital of the Browning West Funds for which Browning West serves as investment

manager (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business) in open market

purchases. The aggregate purchase price of the 9,617,135 Shares beneficially owned by the Reporting Persons is approximately $267,245,278,

including brokerage commissions.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On May 23, 2024, the Issuer

announced that its entire Board of Directors (the “Board”) had resigned en masse, accompanied by the resignation of CEO and

President Vince Tyra, paving the way for (i) Browning West's entire eight-member slate of nominees to be appointed as the full Board and

(ii) the reinstatement of co-founder Glenn Chamandy as the Issuer's Chief Executive Officer and as a director. This sweeping leadership

change at the Issuer follows shareholders’ overwhelming votes in favor of Browning West’s director candidates, concluding

a six-month proxy contest marked by persistent public calls from many shareholders for change that went unheeded by the previous Board.

The Reporting Persons announced

in a press release (the “May 23 Press Release”) that all of Browning West’s nominees – Michael Kneeland, Glenn

J. Chamandy, Michener Chandlee, Ghislain Houle, Mélanie Kau, Peter Lee, Karen Stuckey, and J.P. Towner – will be the sole

slate at the Issuer’s Annual Meeting, held on May 28, 2024, and constitute the full Board moving forward. Michael Kneeland has

been appointed as Chair, and Glenn Chamandy has been reinstated as CEO, ushering the Issuer into a new era of stability and growth.

Usman S. Nabi and Peter M.

Lee expressed their gratitude on behalf of Browning West in the May 23 Press Release:

“We are deeply grateful

for the outpouring of support that Browning West’s slate and plan have received from our fellow shareholders, Gildan employees,

and leading proxy advisory firms. While we are disappointed that the Board ignored the clear will of its shareholders for so many months

and spent tens of millions of shareholder capital in an effort to defend its mistakes, we are nevertheless gratified that the current

Board has decided to cease its campaign activities and pave the way for an orderly and conclusive leadership transition.

Our directors are eager to

begin working toward their common goal of delivering enhanced shareholder value, which begins with reinstating Glenn Chamandy as CEO.

Glenn is a visionary leader with a track record of value creation, an unparalleled knowledge of Gildan’s manufacturing business,

a deep connection with the Company’s employees and shareholders, and an impressive ability to foresee key industry shifts to keep

Gildan one step ahead of competitors. He knows exactly what it will take to expand the Company’s already strong position alongside

the newly reconstituted Board, including proven value creator Michael Kneeland, who the new Board intends to appoint as Chair.

Browning West and our entire

director slate appreciate the thoughtful engagement we have had with Company stakeholders over the last several months. We also recognize

that this is the first time in more than a decade that an overwhelming majority of shareholders and all leading proxy advisory firms –

ISS, Glass Lewis, and Egan Jones – supported a full reconstitution of a board of directors. As a long-term, significant investor

in Gildan, we take the responsibility of having a Browning West representative on the Board seriously and look forward to the opportunity

to deliver enduring value for all Gildan stakeholders.”

Mr. Chamandy, the Issuer’s

now reinstated CEO, expressed his excitement about returning to the role, emphasizing the Issuer's resilience and future potential under

new leadership:

“I’m extremely

excited to return as Gildan’s CEO and am gratified for the incredible support I have received from both shareholders and employees

over the past six months. I’m proud of our dedicated employees for their hard work and focus through a tumultuous period. The resilience

of the team and the high quality of our newly seated Board give me great confidence that Gildan’s best days are yet to come.”

Furthermore, Michael Kneeland,

the Issuer’s newly appointed Chair of the Board, commented:

“Gildan has an impressive

40-year history anchored by strong long-term operating results, an outstanding employee base, and a founder who has demonstrated a clear

ability to oversee an increasingly global business and has an unrivaled track record of value creation. It is an honor to be joining Gildan

as Chair alongside Glenn and the entire slate of directors. We look forward to putting this contest behind us so that we can focus our

energy on implementing our operating plan and positioning Gildan for long-term success. As independent directors, we will help usher in

accountability and alignment at Gildan. The interests of the Company and its stakeholders will remain relentlessly in focus under the

new Board.”

A copy of the May 23 Press

Release is attached hereto as Exhibit 99.1, which is incorporated herein by reference.

| Item 5. | Interest in Securities of the Issuer. |

Items 5(a)-(c) are hereby

amended and restated as follows:

The aggregate percentage

of Shares reported owned by each person named herein is based upon 168,589,957 Shares outstanding as of April 29, 2024, which is the total

number of Shares outstanding as reported in Exhibit 99.1 to the Issuer’s Form 6-K filed with the Securities and Exchange Commission

on May 1, 2024.

A. Browning West

| (a) | Browning West, as the investment manager to the Browning West Funds, may be deemed to beneficially own

the 9,617,135 Shares held by the Browning West Funds. |

Percentage: Approximately

5.7%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 9,617,135

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 9,617,135 |

| (c) | The transactions in the Shares by Browning West on behalf of the Browning West Funds since the filing

of Amendment No. 5 to the Schedule 13D are set forth on Schedule A and are incorporated herein by reference. |

B. Mr. Nabi

| (a) | As the managing member of Browning West UPG and Chief Investment Officer of Browning West, Mr. Nabi may

be deemed to beneficially own the 9,617,135 Shares beneficially owned by Browning West. |

Percentage: Approximately

5.7%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 9,617,135

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 9,617,135 |

| (c) | Mr. Nabi has not entered into any transactions in the Shares since the filing of Amendment No. 5 to the

Schedule 13D. The transactions in the Shares by Browning West on behalf of the Browning West Funds since the filing of Amendment No. 5

to the Schedule 13D are set forth on Schedule A and are incorporated herein by reference. |

The filing of this Schedule

13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities Exchange Act of 1934,

as amended, the beneficial owners of any securities of the Issuer that he or it does not directly own. Each of the Reporting Persons specifically

disclaims beneficial ownership of the securities reported herein that he or it does not directly own.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby

amended to add the following exhibit:

| 99.1 | May 23 Press Release. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: May 28, 2024

| |

Browning West, LP |

| |

|

|

| |

By: |

/s/ Samuel Green |

| |

|

Name: |

Samuel Green |

| |

|

Title: |

Chief Compliance Officer and Chief Financial Officer |

| |

/s/ Usman Nabi |

| |

Usman Nabi |

SCHEDULE A

Transactions in Securities of the Issuer

Since the Filing of Amendment No. 5 to the Schedule 13D

| Nature of the Transaction |

Securities

Purchased/(Sold) |

Price Per

Security($) |

Date of

Purchase/Sale |

Browning West, LP

(On Behalf of the Browning West Funds)

| Purchase of Common Shares |

181,075 |

33.4798 |

05/10/2024 |

| Purchase of Common Shares |

87,331 |

33.9026 |

05/13/2024 |

| Purchase of Common Shares |

192,391 |

34.5426 |

05/14/2024 |

| Purchase of Common Shares |

215,890 |

35.1330 |

05/15/2024 |

| Purchase of Common Shares |

200,000 |

35.6356 |

05/16/2024 |

| Purchase of Common Shares |

100,000 |

35.2563 |

05/17/2024 |

Exhibit 99.1

Browning West Announces Successful Replacement of Gildan Activewear’s

Entire Board of Directors with Full Eight-Member Slate

Thanks Shareholders for Their Overwhelming Vote in Favor of

Browning West’s Slate, Which Provides a Rare Mandate for the Replacement of Gildan’s Entire Board of Directors

Pleased That the Transition of Power at Gildan Has Commenced

to Ensure Glenn Chamandy is Reinstated as CEO and Michael Kneeland is Appointed as Chair of the Board of Directors

Browning West, Glenn Chamandy, and Michael Kneeland Reiterate

the Slate’s Commitment to Restore Stability to Gildan and Create Long-Term Value for All Company Stakeholders

May 23, 2024 05:58 PM Eastern Daylight Time

LOS ANGELES--(BUSINESS WIRE)--Browning

West, LP (together with its affiliates, “Browning West” or “we”), which is a long-term shareholder of Gildan Activewear

Inc. (NYSE: GIL) (TSX: GIL) (“Gildan” or the “Company”) and beneficially owns approximately 5.7% of the Company’s

outstanding shares, today announced that its eight-member slate of directors – Michael Kneeland, Glenn J. Chamandy, Michener Chandlee,

Ghislain Houle, Mélanie Kau, Peter Lee, Karen Stuckey, and J.P. Towner – will constitute the entirety of the Company’s

Board of Directors (the “Board”) and will be the only director candidates to stand for election at Gildan’s 2024 Annual

Meeting of Shareholders (the “Annual Meeting”). This follows the resignations of the entire incumbent Board and the termination

of executives, including CEO Vince Tyra. Notably, preliminary results indicate that an overwhelming majority of shares have been voted

in support of Browning West’s full eight-member slate prior to the Board’s resignation.

Usman S. Nabi and Peter M. Lee of Browning West commented:

“We are deeply grateful for the outpouring of support that

Browning West’s slate and plan have received from our fellow shareholders, Gildan employees, and leading proxy advisory firms. While

we are disappointed that the Board ignored the clear will of its shareholders for so many months and spent tens of millions of shareholder

capital in an effort to defend its mistakes, we are nevertheless gratified that the current Board has decided to cease its campaign activities

and pave the way for an orderly and conclusive leadership transition.

Our directors are eager to begin working toward their common goal

of delivering enhanced shareholder value, which begins with reinstating Glenn Chamandy as CEO. Glenn is a visionary leader with a track

record of value creation, an unparalleled knowledge of Gildan’s manufacturing business, a deep connection with the Company’s

employees and shareholders, and an impressive ability to foresee key industry shifts to keep Gildan one step ahead of competitors. He

knows exactly what it will take to expand the Company’s already strong position alongside the newly reconstituted Board, including

proven value creator Michael Kneeland, who the new Board intends to appoint as Chair.

Browning West and our entire director slate appreciate the thoughtful

engagement we have had with Company stakeholders over the last several months. We also recognize that this is the first time in more than

a decade that an overwhelming majority of shareholders and all leading proxy advisory firms – ISS, Glass Lewis, and Egan Jones –

supported a full reconstitution of a board of directors. As a long-term, significant investor in Gildan, we take the responsibility of

having a Browning West representative on the Board seriously and look forward to the opportunity to deliver enduring value for all Gildan

stakeholders.”

Glenn Chamandy, Gildan’s co-founder and soon-to-be reinstated

CEO, commented:

“I’m extremely excited to return as Gildan’s CEO

and am gratified for the incredible support I have received from both shareholders and employees over the past six months. I’m proud

of our dedicated employees for their hard work and focus through a tumultuous period. The resilience of the team and the high quality

of our newly seated Board give me great confidence that Gildan’s best days are yet to come.”

Michael Kneeland, Gildan’s soon-to-be appointed Chair of the

Board, commented:

“Gildan has an impressive 40-year history anchored by strong

long-term operating results, an outstanding employee base, and a founder who has demonstrated a clear ability to oversee an increasingly

global business and has an unrivaled track record of value creation. It is an honor to be joining Gildan as Chair alongside Glenn and

the entire slate of directors. We look forward to putting this contest behind us so that we can focus our energy on implementing our operating

plan and positioning Gildan for long-term success. As independent directors, we will help usher in accountability and alignment at Gildan.

The interests of the Company and its stakeholders will remain relentlessly in focus under the new Board.”

***

Disclaimer for Forward-Looking Information

Certain information in this news release may constitute “forward-looking

information” within the meaning of applicable securities legislation. Forward-looking statements and information generally can be

identified by the use of forward-looking terminology such as “outlook,” “objective,” “may,” “will,”

“expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,”

“plans,” “continue,” or similar expressions suggesting future outcomes or events. Forward-looking information

in this news release may include, but is not limited to, statements of Browning West regarding (i) how Browning West intends to exercise

its legal rights as a shareholder of the Company, and (ii) its plans to make changes at the Board and management of the Company.

Although Browning West believes that the expectations reflected

in any such forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. Such

forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ

materially from those contained in the statements including, without limitation, the risks that (i) the Company may use tactics to thwart

the rights of Browning West as a shareholder and (ii) the actions being proposed and the changes being demanded by Browning West, may

not take place for any reason whatsoever. Except as required by law, Browning West does not intend to update these forward-looking statements.

Advisors

Olshan Frome Wolosky LLP is serving as legal counsel, Goodmans LLP

is serving as Canadian legal counsel, and IMK is serving as Quebec legal counsel. Longacre Square Partners is serving as strategic advisor

and Pelican PR is serving as public relations advisor. Carson Proxy is serving as proxy advisor.

About Browning West, LP

Browning West is an independent investment partnership based in

Los Angeles, California. The partnership employs a concentrated, long-term, and fundamental approach to investing and focuses primarily

on investments in North America and Western Europe.

Browning West seeks to identify and invest in a limited number of

high-quality businesses and to hold these investments for multiple years. Backed by a select group of leading foundations, family offices,

and university endowments, Browning West’s unique capital base allows it to focus on long-term value creation at its portfolio companies.

Contacts

Browning West

info@browningwest.com

310-984-7600

Longacre Square Partners

Charlotte Kiaie / Scott Deveau, 646-386-0091

browningwest@longacresquare.com

Pelican PR

Lyla Radmanovich / Mélanie Tardif, 514-845-8763

media@rppelican.ca

Carson Proxy

Christine Carson, 416-804-0825

christine@carsonproxy.com

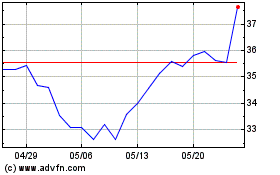

Gildan Activewear (NYSE:GIL)

過去 株価チャート

から 5 2024 まで 6 2024

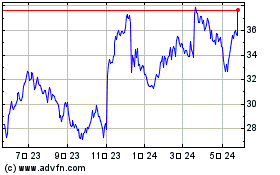

Gildan Activewear (NYSE:GIL)

過去 株価チャート

から 6 2023 まで 6 2024