Form 8-K - Current report

2024年9月12日 - 8:09PM

Edgar (US Regulatory)

AMERICAN TOWER CORP /MA/0001053507false00010535072024-09-122024-09-120001053507exch:XNYSus-gaap:CommonStockMember2024-09-122024-09-120001053507exch:XNYSamt:A1375SeniorNotesDue2025Member2024-09-122024-09-120001053507exch:XNYSamt:A1950SeniorNotesDue2026Member2024-09-122024-09-120001053507exch:XNYSamt:A0450SeniorNotesDue2027Member2024-09-122024-09-120001053507exch:XNYSamt:A0400SeniorNotesDue2027Member2024-09-122024-09-120001053507exch:XNYSamt:A4125SeniorNotesDue2027Member2024-09-122024-09-120001053507exch:XNYSamt:A0500SeniorNotesDue2028Member2024-09-122024-09-120001053507exch:XNYSamt:A0875SeniorNotesDue2029Member2024-09-122024-09-120001053507exch:XNYSamt:A0950SeniorNotesDue2030Member2024-09-122024-09-120001053507exch:XNYSamt:A3.900SeniorNotesDue2030Member2024-09-122024-09-120001053507exch:XNYSamt:A4625SeniorNotesDue2031Member2024-09-122024-09-120001053507exch:XNYSamt:A1000SeniorNotesDue2032Member2024-09-122024-09-120001053507exch:XNYSamt:A1250SeniorNotesDue2033Member2024-09-122024-09-120001053507exch:XNYSamt:A4.100SeniorNotesDue2034Member2024-09-122024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): September 12, 2024 AMERICAN TOWER CORPORATION

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | | | | |

Delaware | | 001-14195 | | 65-0723837 | |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

116 Huntington Avenue

Boston, Massachusetts 02116

(Address of Principal Executive Offices) (Zip Code)

(617) 375-7500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | AMT | New York Stock Exchange |

| 1.375% Senior Notes due 2025 | AMT 25A | New York Stock Exchange |

| 1.950% Senior Notes due 2026 | AMT 26B | New York Stock Exchange |

| 0.450% Senior Notes due 2027 | AMT 27C | New York Stock Exchange |

| 0.400% Senior Notes due 2027 | AMT 27D | New York Stock Exchange |

| 4.125% Senior Notes due 2027 | AMT 27F | New York Stock Exchange |

| 0.500% Senior Notes due 2028 | AMT 28A | New York Stock Exchange |

| 0.875% Senior Notes due 2029 | AMT 29B | New York Stock Exchange |

| 0.950% Senior Notes due 2030 | AMT 30C | New York Stock Exchange |

| 3.900% Senior Notes due 2030 | AMT 30D | New York Stock Exchange |

| 4.625% Senior Notes due 2031 | AMT 31B | New York Stock Exchange |

| 1.000% Senior Notes due 2032 | AMT 32 | New York Stock Exchange |

| 1.250% Senior Notes due 2033 | AMT 33 | New York Stock Exchange |

| 4.100% Senior Notes due 2034 | AMT 34A | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 7.01 Regulation FD Disclosure.

On September 12, 2024, American Tower Corporation (the “Company”) issued a press release (the “Press Release”) announcing that the Company, through its subsidiaries, ATC Asia Pacific Pte. Ltd. and ATC Telecom Infrastructure Private Limited (“ATC TIPL”), which holds the Company’s operations in India, completed the sale of 100% of the equity interests in ATC TIPL to Data Infrastructure Trust, an infrastructure investment trust sponsored by an affiliate of Brookfield Asset Management. A copy of the Press Release is furnished herewith as Exhibit 99.1.

Exhibit 99.1 is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such exhibit be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| AMERICAN TOWER CORPORATION |

| (Registrant) |

| |

| Date: | September 12, 2024 | By: | /s/ Rodney M. Smith |

| | Rodney M. Smith |

| | Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

ATC Contact: Adam Smith

Senior Vice President, Investor Relations and FP&A

Telephone: (617) 375-7500

AMERICAN TOWER CLOSES THE SALE OF OPERATIONS IN INDIA TO BROOKFIELD

Boston, Massachusetts – September 12, 2024 – American Tower Corporation (NYSE: AMT) (“American Tower”) today announced that it has closed the previously announced sale of 100% of the equity interests in its operations in India (“ATC India”) to Data Infrastructure Trust (“DIT”), an Infrastructure Investment Trust sponsored by an affiliate of Brookfield Asset Management (NYSE: BAM, TSX: BAM) (“Brookfield”).

Total cash proceeds to American Tower associated with the transaction represents approximately INR 210 billion, or $2.5 billion at today’s exchange rates. Total cash proceeds include approximately $320 million associated with the monetization of optionally converted debentures issued by Vodafone Idea and payments on ATC India receivables, net of withholding tax, and approximately $2.2 billion of final proceeds at closing. Such proceeds are expected to be used to repay American Tower’s existing indebtedness, including the repayment of the existing India term loan at closing. No further proceeds associated with this transaction are anticipated.

American Tower’s current 2024 outlook midpoints, as reported in the Company’s Form 8-K dated July 30, 2024, included full year contributions from the India business. As a result of the transaction, results associated with ATC India will now be reported as discontinued operations. The Company estimates that the current outlook midpoints for property revenue and Adjusted EBITDA, including the contributions from discontinued operations and adjusted to reflect the closing of the transaction, are $10,830 million and $7,185 million, respectively, and AFFO Attributable to AMT Shareholders per diluted Share, which will be reported inclusive of contributions from discontinued operations, is $10.48 per Share. The Company estimates that property revenue and Adjusted EBITDA from continuing operations and AFFO attributable to AMT common stockholders per Share from continuing operations proforma for interest expense savings associated with the use of ATC India sale proceeds, with proceeds and associated interest expense savings impacts considered on an annualized basis, would have been $9,920 million, $6,805 million and $9.95, respectively.

Supplementary slides with additional details have been provided on the “Investor Relations” section of the Company’s website under “Investor Presentations.”

Citi is serving as lead financial advisor and CDX Advisors is serving as financial advisor to American Tower. Talwar Thakore & Associates (TT&A) is serving as principal legal advisor to American Tower.

About American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of nearly 148,000 communications sites (excludes India assets sold) and a highly interconnected footprint of U.S. data center facilities. For more information about American Tower, please visit the “Investor Relations” section of the Company’s website, www.americantower.com.

Cautionary Language Regarding Forward-Looking Statements

This press release contains “forward-looking statements” concerning the Company’s goals, beliefs, expectations, strategies, objectives, plans, future operating results and underlying assumptions and other statements that are not necessarily based on historical facts. Examples of these statements include, but are not limited to, statements regarding the expected use of the proceeds to repay existing indebtedness and the expected impacts of the transaction on the Company’s outlook. Actual results may differ materially from those indicated in the Company’s forward-looking statements as a result of various factors, including those factors set forth under the caption “Risk Factors” in Item 1A of its most recent annual report on Form 10-K, and other risks described in documents the Company subsequently files from time to time with the Securities and Exchange Commission. The Company undertakes no obligation to update the information contained in this press release to reflect subsequently occurring events or circumstances.

###

v3.24.2.u1

Cover Cover

|

Sep. 12, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 12, 2024

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-14195

|

| Entity Tax Identification Number |

65-0723837

|

| Entity Address, Address Line One |

116 Huntington Avenue

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02116

|

| City Area Code |

617

|

| Local Phone Number |

375-7500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Registrant Name |

AMERICAN TOWER CORP /MA/

|

| Entity Central Index Key |

0001053507

|

| Amendment Flag |

false

|

| NEW YORK STOCK EXCHANGE, INC. | Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

AMT

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.375% Senior Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.375% Senior Notes due 2025

|

| Trading Symbol |

AMT 25A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.950% Senior Notes due 2026 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.950% Senior Notes due 2026

|

| Trading Symbol |

AMT 26B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | Zero Point Four Five Zero Percent Senior Notes, Due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.450% Senior Notes due 2027

|

| Trading Symbol |

AMT 27C

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | Zero Point Five Zero Percent Senior Notes Due 2028 [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.500% Senior Notes due 2028

|

| Trading Symbol |

AMT 28A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | One Point Zero Percent Senior Notes Due 2032 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.000% Senior Notes due 2032

|

| Trading Symbol |

AMT 32

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | Zero Point Eight Seven Five Percent Senior Notes, Due |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Senior Notes due 2029

|

| Trading Symbol |

AMT 29B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | One Point Two Five Zero Percent Senior Notes, Due 2033 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Senior Notes due 2033

|

| Trading Symbol |

AMT 33

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.400% Senior Notes Due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.400% Senior Notes due 2027

|

| Trading Symbol |

AMT 27D

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.950% Senior Notes Due 2030 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.950% Senior Notes due 2030

|

| Trading Symbol |

AMT 30C

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 4.125% Senior Notes due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.125% Senior Notes due 2027

|

| Trading Symbol |

AMT 27F

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 4.625% Senior Notes Due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.625% Senior Notes due 2031

|

| Trading Symbol |

AMT 31B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.900% Senior Notes Due 2030 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.900% Senior Notes due 2030

|

| Trading Symbol |

AMT 30D

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 4.100% Senior Notes due 2034 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.100% Senior Notes due 2034

|

| Trading Symbol |

AMT 34A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A1375SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A1950SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0450SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0500SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A1000SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0875SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A1250SeniorNotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0400SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0950SeniorNotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A4125SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A4625SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A3.900SeniorNotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A4.100SeniorNotesDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

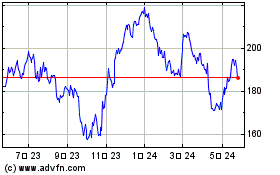

American Tower (NYSE:AMT)

過去 株価チャート

から 9 2024 まで 10 2024

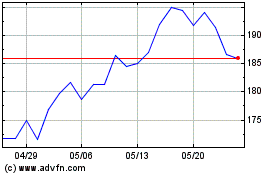

American Tower (NYSE:AMT)

過去 株価チャート

から 10 2023 まで 10 2024