0001273813false00012738132024-08-072024-08-070001273813us-gaap:CommonStockMemberexch:XNYS2024-08-072024-08-070001273813ago:AssuredGuarantyUSHoldingsInc6125SeniorNotesDue2028Memberexch:XNYS2024-08-072024-08-070001273813ago:AssuredGuarantyUSHoldingsInc3150SeniorNotesDue2031Memberexch:XNYS2024-08-072024-08-070001273813ago:AssuredGuarantyUSHoldingsInc3600SeniorNotesDue2051Memberexch:XNYS2024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)—August 7, 2024

ASSURED GUARANTY LTD.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Bermuda | 001-32141 | 98-0429991 |

(State or other jurisdiction

of incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

30 Woodbourne Avenue

Hamilton HM 08 Bermuda

(Address of principal executive offices)

Registrant’s telephone number, including area code: (441) 279-5700

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class: | Trading Symbol(s) | Name of exchange on which registered |

| Common Shares | $0.01 par value per share | AGO | New York Stock Exchange |

| Assured Guaranty US Holdings Inc. 6.125% Senior Notes due 2028 (and the related guarantee of Registrant) | AGO/28 | New York Stock Exchange |

| Assured Guaranty US Holdings Inc. 3.150% Senior Notes due 2031 (and the related guarantee of Registrant) | AGO/31 | New York Stock Exchange |

| Assured Guaranty US Holdings Inc. 3.600% Senior Notes due 2051 (and the related guarantee of Registrant) | AGO/51 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition.

On August 7, 2024 Assured Guaranty Ltd. issued a press release reporting its second quarter 2024 results and the availability of its June 30, 2024 financial supplement. The press release and the financial supplement are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated by reference herein. |

| |

| Item 9.01 | Financial Statements and Exhibits.

(d) Exhibits |

| |

Exhibit

Number | Description |

| 99.1 | |

| 99.2 | |

| 104.1 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Assured Guaranty Ltd. |

| |

| |

| By: | /s/ BENJAMIN G. ROSENBLUM |

| | Name: Benjamin G. Rosenblum

Title: Chief Financial Officer |

DATE: August 7, 2024

Assured Guaranty Ltd. Reports Results for Second Quarter 2024

•GAAP Highlights:

•Net income attributable to Assured Guaranty Ltd. was $78 million, or $1.41 per share(1), for second quarter 2024.

•Shareholders’ equity attributable to Assured Guaranty Ltd. per share was $104.15 as of June 30, 2024.

•Gross written premiums (GWP) were $132 million for second quarter 2024.

•Non-GAAP Highlights:

•Adjusted operating income(2) was $80 million, or $1.44 per share, for second quarter 2024.

•Adjusted operating shareholders’ equity(2) per share and adjusted book value (ABV)(2) per share were $109.88 and $161.65, respectively, as of June 30, 2024.

•Present value of new business production (PVP)(2) was $155 million for second quarter 2024.

•Return of Capital to Shareholders:

•Second quarter 2024 capital returned to shareholders was $169 million including share repurchases of $152 million and dividends of $17 million.

•Stock redemptions by U.S. Insurance Subsidiaries

•$100 million stock redemption by Assured Guaranty Municipal Corp. (AGM) on May 13, 2024.

•$300 million stock redemption by Assured Guaranty Inc. (AG, formerly Assured Guaranty Corp.) on August 5, 2024.

Hamilton, Bermuda, August 7, 2024 -- Assured Guaranty Ltd. (NYSE: AGO) (AGL and, together with its subsidiaries, Assured Guaranty or the Company) announced today its financial results for the three-month period ended June 30, 2024 (second quarter 2024).

“We have laid the foundation for an exceptional year in new business production. In the second quarter alone, our U.S. and international public finance and structured finance GWP totaled $132 million, and PVP totaled $155 million. These results were driven by the second best direct GWP and the best direct PVP produced in a second quarter since 2009. Our success in second quarter 2024 was a result of insuring several large infrastructure transactions, high U.S. municipal bond market issuance and bond insurance penetration, along with our 58% share of primary-market insured par sold, while still being selective on credit quality and maintaining our pricing discipline,” said Dominic Frederico, President and CEO.

“Once again, we reached new highs on a per-share basis for all three of our key shareholder value measures: shareholders’ equity, adjusted operating shareholders’ equity and adjusted book value.

“Additionally, we completed the merger of AGM into AG, formerly known as Assured Guaranty Corp., on August 1. This will result in a more efficient utilization of capital and simplify our organizational structure. In connection with the merger, the Maryland Insurance Administration approved, and on August 5 we completed, a $300 million stock redemption (sometimes described as a “special dividend”) from the combined company to the holding company level. This followed a $100 million stock redemption by AGM in the second quarter.”

(1) All per share information for net income and adjusted operating income is based on diluted shares.

(2) Please see “Explanation of Non-GAAP Financial Measures.”

1

U.S. Insurance Subsidiaries - Stock Redemptions

AGM’s entire $100 million stock redemption, and $172 million of AG’s $300 million stock redemption, was in exchange for cash. The remainder of AG’s stock redemption was in exchange for alternative investments.

Summary Financial Results

(in millions, except per share amounts)

| | | | | | | | | | | |

| Quarter Ended |

| | June 30, |

| | 2024 | | 2023 |

| | | |

GAAP (1) | | | |

| Net income (loss) attributable to AGL | $ | 78 | | | $ | 125 | |

| Net income (loss) attributable to AGL per diluted share | $ | 1.41 | | | $ | 2.06 | |

| Weighted average diluted shares | 55.0 | | | 60.1 | |

| Non-GAAP | | | |

Adjusted operating income (loss) (2) | $ | 80 | | | $ | 36 | |

Adjusted operating income per diluted share (2) | $ | 1.44 | | | $ | 0.60 | |

| Weighted average diluted shares | 55.0 | | | 60.1 | |

Gain (loss) related to FG VIE and CIV consolidation (3) included in adjusted operating income | $ | (1) | | | $ | (18) | |

| Gain (loss) related to FG VIE and CIV consolidation included in adjusted operating income per share | $ | (0.03) | | | $ | (0.30) | |

| | | |

| Components of total adjusted operating income (loss) | | | |

| Insurance segment | $ | 116 | | | $ | 106 | |

| Asset Management segment | — | | | (2) | |

| Corporate division | (35) | | | (50) | |

| Other | (1) | | | (18) | |

| Adjusted operating income (loss) | $ | 80 | | | $ | 36 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| June 30, 2024 | | December 31, 2023 |

| Amount | | Per Share | | Amount | | Per Share |

| | | | | | | |

| Shareholders’ equity attributable to AGL | $ | 5,539 | | | $ | 104.15 | | | $ | 5,713 | | | $ | 101.63 | |

Adjusted operating shareholders’ equity (2) | 5,844 | | | 109.88 | | | 5,990 | | | 106.54 | |

ABV (2) | 8,598 | | | 161.65 | | | 8,765 | | | 155.92 | |

| | | | | | | |

| Common Shares Outstanding | 53.2 | | | | | 56.2 | | | |

________________________________________________

(1) Generally accepted accounting principles in the United States of America.

(2) Please see “Explanation of Non-GAAP Financial Measures” at the end of this press release.

(3) The effect of consolidating financial guaranty (FG) variable interest entities (VIEs) and consolidated investment vehicles (CIVs).

On a per share basis, shareholders’ equity attributable to AGL increased to $104.15 as of June 30, 2024 from $101.63 as of December 31, 2023, primarily due to net income and share repurchases, partially offset by dividends and unrealized losses in the investment portfolio. On a per share basis, ABV increased to $161.65 primarily due to adjusted operating income, new business production and share repurchases, partially offset by dividends.

Insurance Segment

The Insurance segment primarily consists of (i) the Company’s insurance subsidiaries that provide credit protection products to the United States (U.S.) and non-U.S. public finance (including infrastructure) and structured finance markets, excluding the effect of VIE consolidations, and (ii) AG’s investment subsidiary.

Insurance Segment New Business Production

Insurance Segment

New Business Production

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, |

| 2024 | | 2023 |

| GWP | | PVP (1) | | Gross Par Written (2) | | GWP | | PVP (1) | | Gross Par Written (2) |

| | | | | | | | | | | |

| Public finance - U.S. | $ | 103 | | | $ | 116 | | | $ | 7,043 | | | $ | 78 | | | $ | 77 | | | $ | 7,747 | |

| Public finance - non-U.S. | 25 | | | 33 | | | 1,572 | | | 9 | | | 6 | | | 249 | |

| Structured finance - U.S. | 2 | | | 4 | | | 214 | | | 5 | | | 3 | | | 252 | |

| Structured finance - non-U.S. | 2 | | | 2 | | | 594 | | | 3 | | | 5 | | | 726 | |

| Total | $ | 132 | | | $ | 155 | | | $ | 9,423 | | | $ | 95 | | | $ | 91 | | | $ | 8,974 | |

________________________________________________

(1) PVP, a non-GAAP financial measure, measures the value of the Insurance segment’s new business production for all contracts regardless of form or GAAP accounting model. See “Explanation of Non-GAAP Financial Measures” at the end of this press release. PVP is based on “close date,” when the transaction settles. PVP was discounted at 5.0% in second quarter 2024 and 4.0% in the three-month period ended June 30, 2023 (second quarter 2023).

(2) Gross Par Written is based on “close date,” when the transaction settles.

U.S. public finance GWP and PVP in second quarter 2024 were higher than the comparable GWP and PVP in second quarter 2023, primarily due to two large transportation revenue transactions that were closed in second quarter 2024. The Company’s direct par written represented 58% of the total U.S. municipal market insured issuance in second quarter 2024, compared with 64% in second quarter 2023, and the Company’s penetration of all municipal issuance was 5.2% in second quarter 2024 compared with 6.5% in second quarter 2023.

In second quarter 2024, non-U.S. public finance GWP and PVP were higher than GWP and PVP in second quarter 2023, primarily due to secondary market guaranties of several U.K. regulated utility and airport transactions in second quarter 2024.

Insurance Segment Adjusted Operating Income

Insurance segment adjusted operating income increased to $116 million in second quarter 2024 from $106 million in second quarter 2023, primarily due to lower loss expense in second quarter 2024, compared with second quarter 2023, and higher earnings from alternative investments, partially offset by lower fair value gains on trading securities in second quarter 2024.

Insurance Segment Results

(in millions)

| | | | | | | | | | | |

| Quarter Ended |

| June 30, |

| 2024 | | 2023 |

| Segment revenues | | | |

| Net earned premiums and credit derivative revenues | $ | 87 | | | $ | 88 | |

| Net investment income | 81 | | | 90 | |

| Fair value gains (losses) on trading securities | 17 | | | 40 | |

| Foreign exchange gains (losses) on remeasurement | — | | | 2 | |

| Other income (loss) | 4 | | | 4 | |

| Total segment revenues | 189 | | | 224 | |

| | | |

| Segment expenses | | | |

| Loss expense (benefit) | — | | | 44 | |

| | | |

| Amortization of deferred acquisition costs (DAC) | 3 | | | 3 | |

| Employee compensation and benefit expenses | 40 | | | 36 | |

| Other operating expenses | 27 | | | 27 | |

| Total segment expenses | 70 | | | 110 | |

| Equity in earnings (losses) of investees | 15 | | | 5 | |

| Segment adjusted operating income (loss) before income taxes | 134 | | | 119 | |

| Less: Provision (benefit) for income taxes | 18 | | | 13 | |

| Segment adjusted operating income (loss) | $ | 116 | | | $ | 106 | |

The components of the Insurance segment’s premiums, losses and income from the investment portfolio are presented below.

Insurance Segment Net Earned Premiums and Credit Derivative Revenues

Insurance Segment

Net Earned Premiums and Credit Derivative Revenues

(in millions)

| | | | | | | | | | | |

| Quarter Ended |

| June 30, |

| 2024 | | 2023 |

| Scheduled net earned premiums and credit derivative revenues | $ | 84 | | | $ | 80 | |

| Accelerations | 3 | | | 8 | |

| Total | $ | 87 | | | $ | 88 | |

Insurance Segment Loss Expense (Benefit) and the Roll Forward of Expected Losses

Loss expense is a function of net economic loss development (benefit) and deferred premium revenue. The difference between loss expense and economic development in a given period represents the amount of deferred premium revenue absorbing expected losses to be paid.

Insurance Segment

Loss Expense (Benefit)

(in millions)

| | | | | | | | | | | |

| Quarter Ended |

| June 30, |

| 2024 | | 2023 |

| Public finance | $ | 3 | | | $ | 45 | |

| U.S. residential mortgage-backed securities (RMBS) | (6) | | | (3) | |

| Other structured finance | 3 | | | 2 | |

| Total | $ | — | | | $ | 44 | |

The table below presents the roll forward of net expected losses for second quarter 2024.

Roll Forward of Net Expected Loss to be Paid (Recovered) (1)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Net Expected Loss to be Paid (Recovered) as of March 31, 2024 | | Net

Economic Loss Development (Benefit) | | Net (Paid) Recovered

Losses | | Net Expected Loss to be Paid (Recovered) as of June 30, 2024 |

| | | | | | | |

| Public finance | $ | 398 | | | $ | 29 | | | $ | (16) | | | $ | 411 | |

| U.S. RMBS | (2) | | | (10) | | | 12 | | | — | |

| Other structured finance | 37 | | | 2 | | | (3) | | | 36 | |

| Total | $ | 433 | | | $ | 21 | | | $ | (7) | | | $ | 447 | |

________________________________________________

(1) Net economic loss development (benefit) represents the change in net expected loss to be paid (recovered) attributable to the effects of changes in the economic performance of insured transactions, changes in assumptions based on observed market trends, changes in discount rates, accretion of discount and the economic effects of loss mitigation efforts, each net of reinsurance. Net economic loss development (benefit) is the principal measure that the Company uses to evaluate the loss experience in its insured portfolio. Expected loss to be paid (recovered) includes all transactions insured by the Company, regardless of the accounting model prescribed under GAAP and without consideration of deferred premium revenue.

The net economic loss development was $21 million in second quarter 2024, and was primarily attributable to certain public finance healthcare exposures, partially offset by a benefit from improved transaction performance and higher recoveries in second-lien RMBS. The effect of changes in risk-free rates used to discount expected losses was a loss of $1 million.

Insurance Segment Income from Investment Portfolio

Insurance Segment

Income from Investment Portfolio

(in millions)

| | | | | | | | | | | |

| Quarter Ended |

| June 30, |

| 2024 | | 2023 |

| Net investment income | $ | 81 | | | $ | 90 | |

Fair value gains (losses) on trading securities (1) | 17 | | | 40 | |

Equity in earnings (losses) of investees (2) | 15 | | | 5 | |

| Total | $ | 113 | | | $ | 135 | |

________________________________________________

(1) Represents contingent value instruments issued by Puerto Rico that are classified as trading securities with changes in fair value reported in the condensed consolidated statements of operations.

(2) Equity in earnings (losses) of investees primarily relates to funds managed by Sound Point Capital Management, LP and certain of its investment management subsidiaries (Sound Point) and Assured Healthcare Partners, LLC (AHP), as well as, prior to July 1, 2023, Assured Investment Management LLC and its investment management affiliates (AssuredIM). Investments in funds are reported on a one-quarter lag.

Net investment income, which represents interest income on available-for-sale fixed-maturity debt and short-term investments, decreased to $81 million in second quarter 2024 from $90 million in second quarter 2023 primarily due to lower income on loss mitigation securities and lower average balances in the externally managed portfolio, which were partially offset by higher short-term interest rates and higher average balances in the short-term investment portfolio.

As of June 30, 2024, the Insurance segment had $803 million in alternative investments, which had an inception-to-date annualized internal rate of return of approximately 14.0%. In the Insurance segment, alternative investments consist primarily of funds managed by Sound Point and AHP, and are generally recorded at net asset value (NAV), with changes in NAV reported in “equity in earnings (losses) of investees.” Equity in earnings of investees is more volatile than net investment income on available-for-sale fixed-maturity securities and short-term investments. To the extent that the amounts invested in alternative fund investments increase and available-for-sale fixed-maturity securities decrease, net investment income may decline and mark-to-market volatility related to equity in earnings of investees may increase.

Asset Management Segment

Since July 2023, the Company participates in the asset management business through its ownership interest in Sound Point and in second quarter 2024, asset management adjusted operating income primarily consists of the Company’s ownership interest in Sound Point, including the amortization of intangible assets, as well as certain ongoing performance fees. Sound Point’s results are reported on a one quarter lag and are included in “equity in earnings (losses) of investees.” Prior to July 1, 2023, the Company participated in the asset management business through AssuredIM.

Corporate Division

The Corporate division primarily consists of interest expense on the debt of Assured Guaranty US Holdings Inc. and AGMH, as well as other operating expenses attributed to holding company activities. Adjusted operating loss for the Corporate division was $35 million in second quarter 2024 compared with $50 million in second quarter 2023. The decrease in the net loss attributable to the Corporate division is primarily due to expenses incurred in second quarter 2023 associated with the Sound Point and AHP transactions, offset in part by increases in premises-related expenses.

Reconciliation to GAAP

The following table presents a reconciliation of net income (loss) attributable to AGL to adjusted operating income (loss).

Reconciliation of Net Income (Loss) Attributable to AGL to

Adjusted Operating Income (Loss)

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended |

| June 30, |

| 2024 | | 2023 |

| Total | | Per Diluted Share | | Total | | Per Diluted Share |

| Net income (loss) attributable to AGL | $ | 78 | | | $ | 1.41 | | | $ | 125 | | | $ | 2.06 | |

| Less pre-tax adjustments: | | | | | | | |

| Realized gains (losses) on investments | (6) | | | (0.11) | | | (9) | | | (0.14) | |

| Non-credit impairment-related unrealized fair value gains (losses) on credit derivatives | 3 | | | 0.06 | | | 90 | | | 1.48 | |

| Fair value gains (losses) on committed capital securities (CCS) | 1 | | | 0.02 | | | 1 | | | 0.00 | |

| Foreign exchange gains (losses) on remeasurement of premiums receivable and loss and loss adjustment expense (LAE) reserves | — | | | — | | | 26 | | | 0.43 | |

| Total pre-tax adjustments | (2) | | | (0.03) | | | 108 | | | 1.77 | |

| Less tax effect on pre-tax adjustments | — | | | — | | | (19) | | | (0.31) | |

| Adjusted operating income (loss) | $ | 80 | | | $ | 1.44 | | | $ | 36 | | | $ | 0.60 | |

| | | | | | | |

| Gain (loss) related to FG VIE and CIV consolidation included in adjusted operating income | $ | (1) | | | $ | (0.03) | | | $ | (18) | | | $ | (0.30) | |

Non-credit impairment-related unrealized fair value gains on credit derivatives in second quarter 2024 were generated primarily due to the termination of certain structured finance policies. Non-credit impairment-related unrealized fair value gains on credit derivatives in second quarter 2023 were primarily generated by lower collateral asset spreads. Except for credit impairment, the fair value adjustments on credit derivatives in the insured portfolio are non-economic adjustments that reverse to zero over the remaining term of that portfolio.

Fair value of CCS is heavily affected by, and in part fluctuates with, changes in market interest rates, credit spreads and other market factors and is not expected to result in an economic gain or loss.

Foreign exchange gains (losses) primarily relate to the remeasurement of premiums receivable and are mainly due to changes in the exchange rate relative to the U.S. dollar of the pound sterling and, to a lesser extent, the euro.

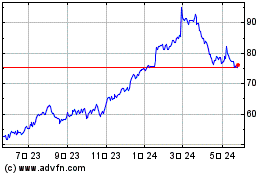

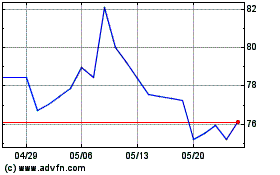

Common Share Repurchases

On May 2, 2024, AGL’s Board of Directors (the Board) authorized the repurchase of an additional $300 million of the Company’s common shares. From the beginning of the repurchase program in 2013 through August 6, 2024, the Company repurchased a total of 148 million common shares for $5.2 billion, representing approximately 76% of the total shares outstanding as of January 1, 2013. As of August 6, 2024, the Company was authorized to purchase $275 million of its common shares. These repurchases can be made from time to time in the open market or in privately negotiated transactions.

Summary of Share Repurchases

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | |

| Amount (1) | | Number of Shares | | Average Price Per Share |

| | | | | |

| 2024 (January 1 - March 31) | $ | 129 | | | 1.54 | | | $ | 84.07 | |

| 2024 (April 1 - June 30) | 152 | | | 1.93 | | | 78.50 | |

2024 (July 1 - August 6) | 48 | | | 0.60 | | | 79.96 | |

| Total 2024 | $ | 329 | | | 4.07 | | | 80.82 | |

________________________________________________

(1) Excludes commissions and excise taxes.

The timing, form and amount of the share repurchases under the program are at the discretion of management and will depend on a variety of factors, including funds available at the parent company, other potential uses for such funds, market conditions, the Company’s capital position, legal requirements and other factors. The repurchase program may be modified, extended or terminated by the Board at any time. It does not have an expiration date.

Financial Statements

Condensed Consolidated Statements of Operations (unaudited)

(in millions)

| | | | | | | | | | | |

| Quarter Ended |

| June 30, |

| 2024 | | 2023 |

| Revenues | | | |

| Net earned premiums | $ | 84 | | | $ | 85 | |

| Net investment income | 81 | | | 89 | |

| Asset management fees | — | | | 27 | |

| Net realized investment gains (losses) | (6) | | | (9) | |

| Fair value gains (losses) on credit derivatives | 6 | | | 91 | |

| Fair value gains (losses) on CCS | 1 | | | 1 | |

| Fair value gains (losses) on FG VIEs | (1) | | | (3) | |

| Fair value gains (losses) on CIVs | 11 | | | 6 | |

| Foreign exchange gain (loss) on remeasurement | — | | | 28 | |

| Fair value gains (losses) on trading securities | 17 | | | 40 | |

| Other income (loss) | 9 | | | 5 | |

| Total revenues | 202 | | | 360 | |

| Expenses | | | |

| Loss and LAE (benefit) | (2) | | | 55 | |

| Interest expense | 23 | | | 22 | |

| Amortization of DAC | 3 | | | 3 | |

| Employee compensation and benefit expenses | 48 | | | 70 | |

| Other operating expenses | 41 | | | 71 | |

| Total expenses | 113 | | | 221 | |

| Income (loss) before income taxes and equity in earnings (losses) of investees | 89 | | | 139 | |

| Equity in earnings (losses) of investees | 5 | | | 5 | |

| Income (loss) before income taxes | 94 | | | 144 | |

| Less: Provision (benefit) for income taxes | 13 | | | 18 | |

| Net income (loss) | 81 | | | 126 | |

| Less: Noncontrolling interests | 3 | | | 1 | |

| Net income (loss) attributable to AGL | $ | 78 | | | $ | 125 | |

Condensed Consolidated Balance Sheets (unaudited)

(in millions)

| | | | | | | | | | | |

| As of |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Investments: | | | |

| Fixed-maturity securities available-for-sale, at fair value | $ | 6,006 | | | $ | 6,307 | |

| Fixed-maturity securities, trading, at fair value | 221 | | | 318 | |

| Short-term investments, at fair value | 1,717 | | | 1,661 | |

| Other invested assets | 882 | | | 829 | |

| Total investments | 8,826 | | | 9,115 | |

| Cash | 92 | | | 97 | |

| Premiums receivable, net of commissions payable | 1,472 | | | 1,468 | |

| DAC | 169 | | | 161 | |

| Salvage and subrogation recoverable | 293 | | | 298 | |

| FG VIEs’ assets | 160 | | | 328 | |

| Assets of CIVs | 378 | | | 366 | |

| Other assets | 698 | | | 706 | |

| Total assets | $ | 12,088 | | | $ | 12,539 | |

| | | |

| Liabilities | | | |

| Unearned premium reserve | $ | 3,662 | | | $ | 3,658 | |

| Loss and LAE reserve | 294 | | | 376 | |

| Long-term debt | 1,696 | | | 1,694 | |

| Credit derivative liabilities, at fair value | 38 | | | 53 | |

| FG VIEs’ liabilities, at fair value | 393 | | | 554 | |

| Other liabilities | 410 | | | 439 | |

| Total liabilities | 6,493 | | | 6,774 | |

| | | |

| Shareholders’ equity | | | |

| Common shares | 1 | | | 1 | |

| Retained earnings | 5,929 | | | 6,070 | |

| Accumulated other comprehensive income (loss) | (392) | | | (359) | |

| Deferred equity compensation | 1 | | | 1 | |

| Total shareholders’ equity attributable to AGL | 5,539 | | | 5,713 | |

| Nonredeemable noncontrolling interests | 56 | | | 52 | |

| Total shareholders’ equity | 5,595 | | | 5,765 | |

| Total liabilities and shareholders’ equity | $ | 12,088 | | | $ | 12,539 | |

Explanation of Non-GAAP Financial Measures

The Company discloses both: (i) financial measures determined in accordance with GAAP; and (ii) financial measures not determined in accordance with GAAP (non-GAAP financial measures). Financial measures identified as non-GAAP should not be considered substitutes for GAAP financial measures. The primary limitation of non-GAAP financial measures is the potential lack of comparability to financial measures of other companies, whose definitions of non-GAAP financial measures may differ from those of the Company.

The Company believes its presentation of non-GAAP financial measures provides information that is necessary for analysts to calculate their estimates of Assured Guaranty’s financial results in their research reports on Assured Guaranty and for investors, analysts and the financial news media to evaluate Assured Guaranty’s financial results.

GAAP requires the Company to consolidate entities where it is deemed to be the primary beneficiary which include:

•FG VIEs, which the Company does not own and where its exposure is limited to its obligation under the financial guaranty insurance contract, and

•CIVs in which certain subsidiaries invest.

The Company discloses the effect of FG VIE and CIV consolidation that is embedded in each non-GAAP financial measure, as applicable. The Company believes this information may also be useful to analysts and investors evaluating Assured Guaranty’s financial results. In the case of both the consolidated FG VIEs and the CIVs, the economic effect on the Company of each of the consolidated FG VIEs and CIVs is reflected primarily in the results of the Insurance segment.

Management of the Company and AGL’s Board of Directors use non-GAAP financial measures further adjusted to remove the effect of FG VIE and CIV consolidation (which the Company refers to as its core financial measures), as well as GAAP financial measures and other factors, to evaluate the Company’s results of operations, financial condition and progress towards long-term goals. The Company uses core financial measures in its decision-making process for and in its calculation of certain components of management compensation. The financial measures that the Company uses to help determine compensation are: (1) adjusted operating income, further adjusted to remove the effect of FG VIE and CIV consolidation; (2) adjusted operating shareholders’ equity, further adjusted to remove the effect of FG VIE and CIV consolidation; (3) adjusted book value per share, further adjusted to remove the effect of FG VIE and CIV consolidation; and (4) PVP.

Management believes that many investors, analysts and financial news reporters use adjusted operating shareholders’ equity and/or adjusted book value, each further adjusted to remove the effect of FG VIE and CIV consolidation, as the principal financial measures for valuing AGL’s current share price or projected share price and also as the basis of their decision to recommend, buy or sell AGL’s common shares. Management also believes that many of the Company’s fixed income investors also use adjusted operating shareholders’ equity, further adjusted to remove the effect of FG VIE and CIV consolidation, to evaluate the Company’s capital adequacy.

Adjusted operating income, further adjusted for the effect of FG VIE and CIV consolidation, enables investors and analysts to evaluate the Company’s financial results in comparison with the consensus analyst estimates distributed publicly by financial databases.

The following paragraphs define each non-GAAP financial measure disclosed by the Company and describe why it is useful. To the extent there is a directly comparable GAAP financial measure, a reconciliation of the non-GAAP financial measure and the most directly comparable GAAP financial measure is presented below.

Adjusted Operating Income

Management believes that adjusted operating income is a useful measure because it clarifies the understanding of the operating results of the Company. Adjusted operating income is defined as net income (loss) attributable to AGL, as reported under GAAP, adjusted for the following:

1) Elimination of realized gains (losses) on the Company’s investments, except for gains and losses on securities classified as trading. The timing of realized gains and losses, which depends largely on market credit cycles, can vary considerably across periods. The timing of sales is largely subject to the Company’s discretion and influenced by market opportunities, as well as the Company’s tax and capital profile.

2) Elimination of non-credit impairment-related unrealized fair value gains (losses) on credit derivatives that are recognized in net income, which is the amount of unrealized fair value gains (losses) in excess of the present value of the expected estimated economic credit losses, and non-economic payments. Such fair value adjustments are heavily affected by, and in part fluctuate with, changes in market interest rates, the Company’s credit spreads, and other market factors and are not expected to result in an economic gain or loss.

3) Elimination of fair value gains (losses) on the Company’s CCS that are recognized in net income. Such amounts are affected by changes in market interest rates, the Company’s credit spreads, price indications on the Company’s publicly traded debt and other market factors and are not expected to result in an economic gain or loss.

4) Elimination of foreign exchange gains (losses) on remeasurement of net premium receivables and loss and LAE reserves that are recognized in net income. Long-dated receivables and loss and LAE reserves represent the present value of future contractual or expected cash flows. Therefore, the current period’s foreign exchange remeasurement gains (losses) are not necessarily indicative of the total foreign exchange gains (losses) that the Company will ultimately recognize.

5) The tax effects related to the above adjustments, which are determined by applying the statutory tax rate in each of the jurisdictions that generate these adjustments.

See “Reconciliation to GAAP” above for a reconciliation of net income (loss) attributable to AGL to adjusted operating income (loss).

Adjusted Operating Shareholders’ Equity and Adjusted Book Value

Management believes that adjusted operating shareholders’ equity is a useful measure because it excludes the fair value adjustments on investments, credit derivatives and CCS that are not expected to result in economic gain or loss.

Adjusted operating shareholders’ equity is defined as shareholders’ equity attributable to AGL, as reported under GAAP, adjusted for the following:

1) Elimination of non-credit impairment-related unrealized fair value gains (losses) on credit derivatives, which is the amount of unrealized fair value gains (losses) in excess of the present value of the expected estimated economic credit losses, and non-economic payments. Such fair value adjustments are heavily affected by, and in part fluctuate with, changes in market interest rates, credit spreads and other market factors and are not expected to result in an economic gain or loss.

2) Elimination of fair value gains (losses) on the Company’s CCS. Such amounts are affected by changes in market interest rates, the Company’s credit spreads, price indications on the Company’s publicly traded debt, and other market factors and are not expected to result in an economic gain or loss.

3) Elimination of unrealized gains (losses) on the Company’s investments that are recorded as a component of accumulated other comprehensive income (AOCI). The AOCI component of the fair value adjustment on the investment portfolio is not deemed economic because the Company generally holds these investments to maturity and therefore would not recognize an economic gain or loss.

4) The tax effects related to the above adjustments, which are determined by applying the statutory tax rate in each of the jurisdictions that generate these adjustments.

Management uses adjusted book value, further adjusted to remove the effect of FG VIE and CIV consolidation, to measure the intrinsic value of the Company, excluding franchise value. Adjusted book value per share, further adjusted for FG VIE and CIV consolidation (core adjusted book value), is one of the key financial measures used in determining the amount of certain long-term compensation elements to management and employees and used by rating agencies and investors. Management believes that adjusted book value is a useful measure because it enables an evaluation of the Company’s in-force premiums and revenues net of expected losses. Adjusted book value is adjusted operating shareholders’ equity, as defined above, further adjusted for the following:

1) Elimination of deferred acquisition costs, net. These amounts represent net deferred expenses that have already been paid or accrued and will be expensed in future accounting periods.

2) Addition of the net present value of estimated net future revenue. See below.

3) Addition of the deferred premium revenue on financial guaranty contracts in excess of expected loss to be expensed, net of reinsurance. This amount represents the present value of the expected future net earned premiums, net of the present value of expected losses to be expensed, which are not reflected in GAAP equity.

4) The tax effects related to the above adjustments, which are determined by applying the statutory tax rate in each of the jurisdictions that generate these adjustments.

The unearned premiums and revenues included in adjusted book value will be earned in future periods, but actual earnings may differ materially from the estimated amounts used in determining current adjusted book value due to changes in foreign exchange rates, prepayment speeds, terminations, credit defaults and other factors.

Reconciliation of Shareholders’ Equity Attributable to AGL to

Adjusted Operating Shareholders’ Equity and ABV

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| June 30, 2024 | | December 31, 2023 |

| Total | | Per Share | | Total | | Per Share |

| | | | | | | |

| Shareholders’ equity attributable to AGL | $ | 5,539 | | | $ | 104.15 | | | $ | 5,713 | | | $ | 101.63 | |

| Less pre-tax adjustments: | | | | | | | |

| Non-credit impairment-related unrealized fair value gains (losses) on credit derivatives | 47 | | | 0.89 | | | 34 | | | 0.61 | |

| Fair value gains (losses) on CCS | 4 | | | 0.08 | | | 13 | | | 0.22 | |

| Unrealized gain (loss) on investment portfolio | (400) | | | (7.53) | | | (361) | | | (6.40) | |

| Less taxes | 44 | | | 0.83 | | | 37 | | | 0.66 | |

| Adjusted operating shareholders’ equity | 5,844 | | | 109.88 | | | 5,990 | | | 106.54 | |

| Pre-tax adjustments: | | | | | | | |

| Less: DAC | 169 | | | 3.19 | | | 161 | | | 2.87 | |

| Plus: Net present value of estimated net future revenue | 190 | | | 3.58 | | | 199 | | | 3.54 | |

| Plus: Net deferred premium revenue on financial guaranty contracts in excess of expected loss to be expensed | 3,424 | | | 64.37 | | | 3,436 | | | 61.12 | |

| Plus taxes | (691) | | | (12.99) | | | (699) | | | (12.41) | |

| ABV | $ | 8,598 | | | $ | 161.65 | | | $ | 8,765 | | | $ | 155.92 | |

| | | | | | | |

| Gain (loss) related to FG VIE and CIV consolidation included in: | | | | | | | |

| Adjusted operating shareholders’ equity | $ | 3 | | | $ | 0.06 | | | $ | 5 | | | $ | 0.07 | |

| ABV | (2) | | | (0.04) | | | — | | | — | |

| | | | | | | |

| Shares outstanding at the end of the period | 53.2 | | | | | 56.2 | | | |

Net Present Value of Estimated Net Future Revenue

Management believes that this amount is a useful measure because it enables an evaluation of the present value of estimated net future revenue for non-financial guaranty insurance contracts. This amount represents the net present value of estimated future revenue from these contracts (other than credit derivatives with net expected losses), net of reinsurance, ceding commissions and premium taxes.

Future installment premiums are discounted at the approximate average pre-tax book yield of fixed-maturity securities purchased during the prior calendar year, other than Loss Mitigation Securities. The discount rate is recalculated annually and updated as necessary. Net present value of estimated future revenue for an obligation may change from period to period due to a change in the discount rate or due to a change in estimated net future revenue for the obligation, which may change due to changes in foreign exchange rates, prepayment speeds, terminations, credit defaults or other factors that affect par outstanding or the ultimate maturity of an obligation. There is no corresponding GAAP financial measure.

PVP or Present Value of New Business Production

Management believes that PVP is a useful measure because it enables the evaluation of the value of new business production in the Insurance segment by taking into account the value of estimated future installment premiums on all new contracts underwritten in a reporting period as well as additional installment premiums and fees on existing contracts (which may result from supplements or fees or from the issuer not calling an insured obligation the Company projected would be called), regardless of form, which management believes GAAP gross written

premiums and changes in fair value of credit derivatives do not adequately measure. PVP in respect of contracts written in a specified period is defined as gross upfront and installment premiums received and the present value of gross estimated future installment premiums.

Future installment premiums are discounted at the approximate average pre-tax book yield of fixed-maturity securities purchased during the prior calendar year, other than certain fixed-maturity securities such as Loss Mitigation Securities. The discount rate is recalculated annually and updated as necessary. Under GAAP, financial guaranty installment premiums are discounted at a risk-free rate. Additionally, under GAAP, management records future installment premiums on financial guaranty insurance contracts covering non-homogeneous pools of assets based on the contractual term of the transaction, whereas for PVP purposes, management records an estimate of the future installment premiums the Company expects to receive, which may be based upon a shorter period of time than the contractual term of the transaction.

Actual installment premiums may differ from those estimated in the Company’s PVP calculation due to factors including, but not limited to, changes in foreign exchange rates, prepayment speeds, terminations, credit defaults or other factors that affect par outstanding or the ultimate maturity of an obligation.

Reconciliation of GWP to PVP

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | June 30, 2024 |

| | Public Finance | | Structured Finance | | |

| | U.S. | | Non - U.S. | | U.S. | | Non - U.S. | | Total |

| GWP | | $ | 103 | | | $ | 25 | | | $ | 2 | | | $ | 2 | | | $ | 132 | |

Less: Installment GWP and other GAAP adjustments (1) | | 85 | | | 13 | | | 2 | | | 2 | | | 102 | |

| Upfront GWP | | 18 | | | 12 | | | — | | | — | | | 30 | |

Plus: Installment premiums and other (2) | | 98 | | | 21 | | | 4 | | | 2 | | | 125 | |

| PVP | | $ | 116 | | | $ | 33 | | | $ | 4 | | | $ | 2 | | | $ | 155 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | June 30, 2023 |

| | Public Finance | | Structured Finance | | |

| | U.S. | | Non - U.S. | | U.S. | | Non - U.S. | | Total |

| GWP | | $ | 78 | | | $ | 9 | | | $ | 5 | | | $ | 3 | | | $ | 95 | |

Less: Installment GWP and other GAAP adjustments (1) | | 41 | | | 9 | | | 5 | | | 3 | | | 58 | |

| Upfront GWP | | 37 | | | — | | | — | | | — | | | 37 | |

Plus: Installment premiums and other (2) | | 40 | | | 6 | | | 3 | | | 5 | | | 54 | |

| PVP | | $ | 77 | | | $ | 6 | | | $ | 3 | | | $ | 5 | | | $ | 91 | |

________________________________________________

(1) Includes the present value of new business on installment policies discounted at the prescribed GAAP discount rates, GWP adjustments on existing installment policies due to changes in assumptions and other GAAP adjustments.

(2) Includes the present value of future premiums and fees on new business paid in installments, discounted at the approximate average pre-tax book yield of fixed-maturity securities purchased during the prior calendar year, other than certain fixed-maturity securities such as Loss Mitigation Securities. Six months 2023 also includes the present value of future premiums and fees associated with other guaranties written by the Company that, under GAAP, are accounted for under ASC 460, Guarantees.

Conference Call and Webcast Information

The Company will host a conference call for investors at 8:00 a.m. Eastern Time (9:00 a.m. Atlantic Time) on Thursday, August 8, 2024. The conference call will be available via live webcast in the Investor Information section of the Company’s website at AssuredGuaranty.com or by dialing 1-833-470-1428 (in the U.S.) or 1-404-975-4839 (International); the access code is 854591.

A replay of the conference call will be available approximately three hours after the call ends. The webcast replay will be available for 90 days in the Investor Information section of the Company’s website at AssuredGuaranty.com and the telephone replay will be available for 30 days by dialing 1-866-813-9403 (in the U.S.) or 1-929-458-6194 (International); the access code is 297872.

Please refer to Assured Guaranty’s June 30, 2024 Financial Supplement, which is posted on the Company's website at assuredguaranty.com/agldata, for more information on the Company’s financial guaranty portfolio, investment portfolio and other items. In addition, the Company is posting at assuredguaranty.com/presentations its “June 30, 2024 Equity Investor Presentation.”

The Company plans to post by early next week on its website at assuredguaranty.com/agldata the following:

•“Public Finance Transactions in 2Q 2024,” which lists the U.S. public finance new issues insured by the Company in second quarter 2024, and

•“Structured Finance Transactions at June 30, 2024,” which lists the Company’s structured finance exposure as of that date.

In addition, the Company will post on its website, when available, the Company’s separate-company subsidiary financial supplements and its “Fixed Income Presentation” for the current quarter. Those documents will be furnished to the Securities and Exchange Commission in a Current Report on Form 8-K.

# # #

Assured Guaranty Ltd. is a publicly traded (NYSE: AGO), Bermuda-based holding company. Through its subsidiaries, Assured Guaranty provides credit enhancement products to the U.S. and non-U.S. public finance, infrastructure and structured finance markets. Assured Guaranty also participates in the asset management business through its ownership interest in Sound Point Capital Management, LP and certain of its investment management affiliates. More information on Assured Guaranty Ltd. and its subsidiaries can be found at AssuredGuaranty.com.

Cautionary Statement Regarding Forward-Looking Statements

Any forward-looking statements made in this press release reflect the Company’s current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties that may cause actual results to differ materially from those set forth in these statements. Among factors that could cause actual results to differ adversely are:

(i) significant changes in inflation, interest rates, the world’s credit markets or segments thereof, credit spreads, foreign exchange rates or general economic conditions, including the possibility of a recession or stagflation; (ii) geopolitical risk, terrorism and political violence risk, including those arising out of Russia’s invasion of Ukraine and intentional or accidental escalation between The North Atlantic Treaty Organization (NATO) and Russia, conflict in the Middle East and confrontation over Iran’s nuclear program, the polarized political environment of the 2024 United States (U.S.) presidential election and U.S. – China strategic competition; (iii) cybersecurity risk and the impacts of artificial intelligence, machine learning and other technological advances, including potentially increasing the risks of malicious cyber attacks, dissemination of misinformation, and disruption of markets; (iv) the possibility of a U.S. government shutdown, payment defaults on the debt of the U.S. government or instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, and downgrades to their credit ratings; (v) developments in the world’s financial and capital markets, including stresses in the financial condition of banking institutions in the U.S. and the possibility that increasing participation of unregulated financial institutions in these markets results in losses or lower valuations of assets, reduced liquidity and credit and/or contraction of these markets, that adversely affect repayment rates of insured obligors, Assured Guaranty’s insurance loss or recovery experience, or investments of Assured Guaranty; (vi) reduction in the amount of available insurance opportunities and/or in the demand for Assured Guaranty’s insurance; (vii) the possibility that budget or pension shortfalls or other factors will result in credit losses or liquidity claims on obligations of state, territorial and local governments and their related authorities and public corporations that Assured Guaranty insures or reinsures; (viii) insured losses, including losses with respect to related legal proceedings, in excess of those expected by Assured Guaranty or the failure of Assured Guaranty to realize loss recoveries that are assumed in its expected loss estimates for insurance exposures, including as a result of the final resolution of Assured Guaranty’s Puerto Rico Electric Power Authority (PREPA) exposure or the amounts recovered on securities received in connection with the resolution of Puerto Rico exposures already resolved; (ix) the impact of Assured Guaranty satisfying its obligations under insurance policies with respect to legacy insured Puerto Rico bonds; (x) increased competition, including from new entrants into the financial guaranty industry, nonpayment insurance and other forms of capital saving or risk syndication available to banks and insurers; (xi) the possibility that investments made by Assured Guaranty for its investment portfolio, including alternative investments, do not result in the benefits anticipated or subject Assured Guaranty to reduced liquidity at a time it requires liquidity, or to other negative or unanticipated consequences; (xii) the impacts of Assured Guaranty’s transactions with Sound Point Capital Management, LP (Sound Point, LP) and certain of its investment management affiliates (together with Sound Point, LP, Sound Point) and/or Assured Healthcare Partners LLC (AHP) on Assured Guaranty and its relationships with its shareholders, regulators, rating agencies, employees and the obligors it insures and on the asset management business contributed to Sound Point, LP and on the business of AHP and their relationships with their respective clients and employees; (xiii) the possibility that strategic transactions made by Assured Guaranty, including the transactions with Sound Point and/or AHP and/or merger of Assured Guaranty Municipal Corp. (AGM) with and into Assured Guaranty Inc. (AG, formerly Assured Guaranty Corp.), do not result in the benefits anticipated or subject Assured Guaranty to negative consequences; (xiv) the inability to control the business, management or policies of entities in which Assured Guaranty holds a minority interest; (xv) the impact of market volatility on the fair value of Assured Guaranty’s assets and liabilities subject to mark-to-market, including certain of its investments, contracts accounted for as derivatives, its committed capital securities, its consolidated investment vehicles and certain consolidated variable interest entities (VIEs); (xvi) rating agency action, including a ratings downgrade, a change in outlook, the placement of ratings on watch for downgrade, or a change in rating criteria, at any time, of AGL or any of its insurance subsidiaries, and/or of any securities AGL or any of its subsidiaries have issued, and/or of transactions that AGL’s insurance subsidiaries have insured; (xvii) the inability of Assured

Guaranty to access external sources of capital on acceptable terms; (xviii) changes in applicable accounting policies or practices; (xix) changes in applicable laws or regulations, including insurance, bankruptcy and tax laws, or other governmental actions; (xx) difficulties with the execution of Assured Guaranty’s business strategy; (xxi) loss of key personnel; (xxii) the effects of mergers, acquisitions and divestitures; (xxiii) public health crises, including pandemics and endemics, and the governmental and private actions taken in response to such events; (xxiv) natural or man-made catastrophes; (xxv) the impact of climate change on Assured Guaranty’s business and regulatory actions taken related to such risk; (xxvi) other risk factors identified in AGL’s filings with the U.S. Securities and Exchange Commission (SEC); (xxvii) other risks and uncertainties that have not been identified at this time; and (xxviii) management’s response to these factors.

Readers are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are made as of August 7, 2024, and Assured Guaranty undertakes no obligation to update publicly or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Contact Information

Robert Tucker

Senior Managing Director, Investor Relations and Corporate Communications

212-339-0861

rtucker@agltd.com

Ashweeta Durani

Director, Media Relations

212-408-6042

adurani@agltd.com

Assured Guaranty Ltd.

June 30, 2024

Financial Supplement

| | | | | | | | | | | | | | | | | |

| Table of Contents | | | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Income from Investment Portfolio and CIVs | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

This financial supplement should be read in conjunction with documents filed by Assured Guaranty Ltd. (AGL and, together with its subsidiaries, Assured Guaranty or the Company) with the United States (U.S.) Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the year ended December 31, 2023 and its Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2024 and June 30, 2024.

Cautionary Statement Regarding Forward Looking Statements

Any forward looking statements made in this supplement reflect the current views of Assured Guaranty with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties that may cause actual results to differ materially from those set forth in these statements. Assured Guaranty's forward looking statements could be affected by many events. These events include:

(i) significant changes in inflation, interest rates, the world’s credit markets or segments thereof, credit spreads, foreign exchange rates or general economic conditions, including the possibility of a recession or stagflation; (ii) geopolitical risk, terrorism and political violence risk, including those arising out of Russia’s invasion of Ukraine and intentional or accidental escalation between The North Atlantic Treaty Organization (NATO) and Russia, conflict in the Middle East and confrontation over Iran’s nuclear program, the polarized political environment of the 2024 United States (U.S.) presidential election and U.S. – China strategic competition; (iii) cybersecurity risk and the impacts of artificial intelligence, machine learning and other technological advances, including potentially increasing the risks of malicious cyber attacks, dissemination of misinformation, and disruption of markets; (iv) the possibility of a U.S. government shutdown, payment defaults on the debt of the U.S. government or instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, and downgrades to their credit ratings; (v) developments in the world’s financial and capital markets, including stresses in the financial condition of banking institutions in the U.S. and the possibility that increasing participation of unregulated financial institutions in these markets results in losses or lower valuations of assets, reduced liquidity and credit and/or contraction of these markets, that adversely affect repayment rates of insured obligors, Assured Guaranty’s insurance loss or recovery experience, or investments of Assured Guaranty; (vi) reduction in the amount of available insurance opportunities and/or in the demand for Assured Guaranty’s insurance; (vii) the possibility that budget or pension shortfalls or other factors will result in credit losses or liquidity claims on obligations of state, territorial and local governments and their related authorities and public corporations that Assured Guaranty insures or reinsures; (viii) insured losses, including losses with respect to related legal proceedings, in excess of those expected by Assured Guaranty or the failure of Assured Guaranty to realize loss recoveries that are assumed in its expected loss estimates for insurance exposures, including as a result of the final resolution of Assured Guaranty’s Puerto Rico Electric Power Authority (PREPA) exposure or the amounts recovered on securities received in connection with the resolution of Puerto Rico exposures already resolved; (ix) the impact of Assured Guaranty satisfying its obligations under insurance policies with respect to legacy insured Puerto Rico bonds; (x) increased competition, including from new entrants into the financial guaranty industry, nonpayment insurance and other forms of capital saving or risk syndication available to banks and insurers; (xi) the possibility that investments made by Assured Guaranty for its investment portfolio, including alternative investments, do not result in the benefits anticipated or subject Assured Guaranty to reduced liquidity at a time it requires liquidity, or to other negative or unanticipated consequences; (xii) the impacts of Assured Guaranty’s transactions with Sound Point Capital Management, LP (Sound Point, LP) and certain of its investment management affiliates (together with Sound Point, LP, Sound Point) and/or Assured Healthcare Partners LLC (AHP) on Assured Guaranty and its relationships with its shareholders, regulators, rating agencies, employees and the obligors it insures and on the asset management business contributed to Sound Point, LP and on the business of AHP and their relationships with their respective clients and employees; (xiii) the possibility that strategic transactions made by Assured Guaranty, including the transactions with Sound Point and/or AHP and/or merger of Assured Guaranty Municipal Corp. (AGM) with and into Assured Guaranty Inc. (AG, formerly Assured Guaranty Corp.), do not result in the benefits anticipated or subject Assured Guaranty to negative consequences; (xiv) the inability to control the business, management or policies of entities in which Assured Guaranty holds a minority interest; (xv) the impact of market volatility on the fair value of Assured Guaranty’s assets and liabilities subject to mark-to-market, including certain of its investments, contracts accounted for as derivatives, its committed capital securities, its consolidated investment vehicles and certain consolidated variable interest entities (VIEs); (xvi) rating agency action, including a ratings downgrade, a change in outlook, the placement of ratings on watch for downgrade, or a change in rating criteria, at any time, of AGL or any of its insurance subsidiaries, and/or of any securities AGL or any of its subsidiaries have issued, and/or of transactions that AGL’s insurance subsidiaries have insured; (xvii) the inability of Assured Guaranty to access external sources of capital on acceptable terms; (xviii) changes in applicable accounting policies or practices; (xix) changes in applicable laws or regulations, including insurance, bankruptcy and tax laws, or other governmental actions; (xx) difficulties with the execution of Assured Guaranty’s business strategy; (xxi) loss of key personnel; (xxii) the effects of mergers, acquisitions and divestitures; (xxiii) public health crises, including pandemics and endemics, and the governmental and private actions taken in response to such events; (xxiv) natural or man-made catastrophes; (xxv) the impact of climate change on Assured Guaranty’s business and regulatory actions taken related to such risk; (xxvi) other risk factors identified in AGL’s filings with the U.S. Securities and Exchange Commission (SEC); (xxvii) other risks and uncertainties that have not been identified at this time; and (xxviii) management’s response to these factors.

Assured Guaranty undertakes no obligation to update publicly or review any forward looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Assured Guaranty Ltd.

Selected Financial Highlights (1 of 2)

(dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

GAAP (1) Highlights | | | | | | | |

| Net income (loss) attributable to AGL | $ | 78 | | | $ | 125 | | | $ | 187 | | | $ | 206 | |

| Net income (loss) attributable to AGL per diluted share | $ | 1.41 | | | $ | 2.06 | | | $ | 3.31 | | | $ | 3.40 | |

| Weighted average shares outstanding | | | | | | | |

| Basic shares outstanding | 54.1 | | | 59.2 | | | 54.9 | | | 59.1 | |

Diluted shares outstanding | 55.0 | | | 60.1 | | | 56.1 | | | 60.3 | |

| Effective tax rate on net income | 14.5 | % | | 12.6 | % | | 18.6 | % | | 15.6 | % |

GAAP return on equity (ROE) (4) | 5.6 | % | | 9.5 | % | | 6.6 | % | | 8.0 | % |

| | | | | | | |

Non-GAAP Highlights (2) | | | | | | | |

| Adjusted operating income (loss) | $ | 80 | | | $ | 36 | | | $ | 193 | | | $ | 104 | |

| Adjusted operating income (loss) per diluted share | $ | 1.44 | | | $ | 0.60 | | | $ | 3.41 | | | $ | 1.72 | |

| Weighted average diluted shares outstanding | 55.0 | | | 60.1 | | | 56.1 | | | 60.3 | |

Effective tax rate on adjusted operating income (3) | 13.8 | % | | (0.9) | % | | 18.1 | % | | 14.8 | % |

Adjusted operating ROE (4) | 5.4 | % | | 2.6 | % | | 6.5 | % | | 3.7 | % |

| | | | | | | |

Components of adjusted operating income (loss) (2) | | | | | | | |

| Insurance segment | $ | 116 | | | $ | 106 | | | $ | 265 | | | $ | 223 | |

| Asset Management segment | — | | | (2) | | | 1 | | | (3) | |

| Corporate division | (35) | | | (50) | | | (72) | | | (94) | |

Other (6) | (1) | | | (18) | | | (1) | | | (22) | |

| Adjusted operating income (loss) | $ | 80 | | | $ | 36 | | | $ | 193 | | | $ | 104 | |

| | | | | | | |

| Insurance Segment | | | | | | | |

| Gross written premiums (GWP) | $ | 132 | | | $ | 95 | | | $ | 193 | | | $ | 181 | |

Present value of new business production (PVP) (2) | 155 | | | 91 | | | 218 | | | 203 | |

| Gross par written | 9,423 | | | 8,974 | | | 13,166 | | | 14,337 | |

| | | | | | | |

| Effect of refundings and terminations on GAAP measures: | | | | | | | |

| Net earned premiums, pre-tax | $ | 3 | | | $ | 8 | | | $ | 42 | | | $ | 12 | |

| Net income effect | 2 | | | 7 | | | 32 | | | 10 | |

| Net income per diluted share | 0.04 | | | 0.11 | | | 0.57 | | | 0.16 | |

| | | | | | | |

| Effect of refundings and terminations on non-GAAP measures: | | | | | | | |

Operating net earned premiums and credit derivative revenues(5), pre-tax | $ | 3 | | | $ | 8 | | | $ | 42 | | | $ | 12 | |

Adjusted operating income(5) effect | 2 | | | 7 | | | 32 | | | 10 | |

Adjusted operating income per diluted share (5) | 0.04 | | | 0.11 | | | 0.57 | | | 0.16 | |

1) Accounting principles generally accepted in the United States of America (GAAP).

2) Please refer to the explanation of Non-GAAP Financial Measures set forth at the end of this Financial Supplement.

3) Represents the ratio of adjusted operating provision for income taxes to adjusted operating income before income taxes.

4) Quarterly ROE calculations represent annualized returns. See page 6 for additional information on calculation.

5) Condensed consolidated statement of operations items mentioned in this Financial Supplement that are described as operating (i.e. operating net earned premiums and credit derivative revenues) are non-GAAP measures and represent components of adjusted operating income. Please refer to the explanation of Non-GAAP Financial Measures set forth at the end of this Financial Supplement.

6) Represents the effect of consolidating financial guaranty variable interest entities (FG VIEs) and consolidated investment vehicles (CIVs) (FG VIE and CIV consolidation).

Assured Guaranty Ltd.

Selected Financial Highlights (2 of 2)

(dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| June 30, 2024 | | December 31, 2023 |

| Amount | | Per Share | | Amount | | Per Share |

| Shareholders’ equity attributable to AGL | $ | 5,539 | | | $ | 104.15 | | | $ | 5,713 | | | $ | 101.63 | |

Adjusted operating shareholders’ equity (1) | 5,844 | | | 109.88 | | | 5,990 | | | 106.54 | |

Adjusted book value (1) | 8,598 | | | 161.65 | | | 8,765 | | | 155.92 | |

| Gain (loss) related to FG VIE and CIV consolidation included in: | | | | | | | |

| Adjusted operating shareholders’ equity | 3 | | | 0.06 | | | 5 | | | 0.07 | |

| Adjusted book value | (2) | | | (0.04) | | | — | | | — | |

| | | | | | | |

| Shares outstanding at the end of period | 53.2 | | | | | 56.2 | | | |

| | | | | | | |

| Exposure | | | | | | | |

| Financial guaranty net debt service outstanding | $ | 404,685 | | | | | $ | 397,636 | | | |

| Financial guaranty net par outstanding: | | | | | | | |

| Investment grade | $ | 248,894 | | | | | $ | 243,716 | | | |

| Below-investment-grade (BIG) | 5,502 | | | | | 5,437 | | | |

| Total | $ | 254,396 | | | | | $ | 249,153 | | | |

| | | | | | | |

Claims-paying resources (2) | $ | 10,633 | | | | | $ | 10,665 | | | |

1) Please refer to the explanation of Non-GAAP Financial Measures set forth at the end of this Financial Supplement.

2) See page 19 for additional detail on claims-paying resources.

Assured Guaranty Ltd.

Condensed Consolidated Statements of Operations (unaudited)

(dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| Net earned premiums | $ | 84 | | | $ | 85 | | | $ | 203 | | | $ | 166 | |

| Net investment income | 81 | | | 89 | | | 165 | | | 170 | |

| Asset management fees | — | | | 27 | | | — | | | 53 | |

| Net realized investment gains (losses) | (6) | | | (9) | | | 2 | | | (11) | |

| Fair value gains (losses) on credit derivatives | 6 | | | 91 | | | 16 | | | 106 | |

| Fair value gains (losses) on committed capital securities (CCS) | 1 | | | 1 | | | (9) | | | (15) | |

| Fair value gains (losses) on FG VIEs | (1) | | | (3) | | | (4) | | | (8) | |

| Fair value gains (losses) on CIVs | 11 | | | 6 | | | 33 | | | 64 | |

| Foreign exchange gains (losses) on remeasurement | — | | | 28 | | | (12) | | | 48 | |

| Fair value gains (losses) on trading securities | 17 | | | 40 | | | 43 | | | 38 | |

| Other income (loss) | 9 | | | 5 | | | 10 | | | 32 | |

| Total revenues | 202 | | | 360 | | | 447 | | | 643 | |

| Expenses | | | | | | | |

| Loss and loss adjustment expense (LAE) (benefit) | (2) | | | 55 | | | (3) | | | 59 | |

| Interest expense | 23 | | | 22 | | | 46 | | | 43 | |

| Amortization of deferred acquisition costs (DAC) | 3 | | | 3 | | | 9 | | | 6 | |

| Employee compensation and benefit expenses | 48 | | | 70 | | | 106 | | | 152 | |

| Other operating expenses | 41 | | | 71 | | | 80 | | | 126 | |

| Total expenses | 113 | | | 221 | | | 238 | | | 386 | |

| Income (loss) before income taxes and equity in earnings (losses) of investees | 89 | | | 139 | | | 209 | | | 257 | |

| Equity in earnings (losses) of investees | 5 | | | 5 | | | 29 | | | 7 | |

| Income (loss) before income taxes | 94 | | | 144 | | | 238 | | | 264 | |

| Less: Provision (benefit) for income taxes | 13 | | | 18 | | | 44 | | | 41 | |

| Net income (loss) | 81 | | | 126 | | | 194 | | | 223 | |

| Less: Noncontrolling interests | 3 | | | 1 | | | $ | 7 | | | $ | 17 | |

| Net income (loss) attributable to AGL | $ | 78 | | | $ | 125 | | | $ | 187 | | | $ | 206 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 1.43 | | | $ | 2.09 | | | $ | 3.38 | | | $ | 3.46 | |

| Diluted | $ | 1.41 | | | $ | 2.06 | | | $ | 3.31 | | | $ | 3.40 | |

Assured Guaranty Ltd.

Condensed Consolidated Balance Sheets (unaudited)

(dollars in millions)

| | | | | | | | | | | | | | |

| | As of |

| | June 30, | | December 31, |

| | 2024 | | 2023 |

| Assets | | | | |

| Investments: | | | | |

| Fixed-maturity securities available-for-sale, at fair value | | $ | 6,006 | | | $ | 6,307 | |

| Fixed-maturity securities, trading, at fair value | | 221 | | | 318 | |

| Short-term investments, at fair value | | 1,717 | | | 1,661 | |

| Other invested assets | | 882 | | | 829 | |

| Total investments | | 8,826 | | | 9,115 | |

| Cash | | 92 | | | 97 | |

| Premiums receivable, net of commissions payable | | 1,472 | | | 1,468 | |

| DAC | | 169 | | | 161 | |

| Salvage and subrogation recoverable | | 293 | | | 298 | |

| FG VIEs’ assets | | 160 | | | 328 | |

| Assets of CIVs | | 378 | | | 366 | |

| Other assets | | 698 | | | 706 | |

| Total assets | | $ | 12,088 | | | $ | 12,539 | |

| | | | |

| Liabilities | | | | |

| Unearned premium reserve | | $ | 3,662 | | | $ | 3,658 | |

| Loss and LAE reserve | | 294 | | | 376 | |

| Long-term debt | | 1,696 | | | 1,694 | |

| Credit derivative liabilities, at fair value | | 38 | | | 53 | |

| FG VIEs’ liabilities, at fair value | | 393 | | | 554 | |

| Other liabilities | | 410 | | | 439 | |

| Total liabilities | | 6,493 | | | 6,774 | |

| | | | |

| Shareholders’ equity | | | | |

| Common shares | | 1 | | | 1 | |

| Retained earnings | | 5,929 | | | 6,070 | |

| Accumulated other comprehensive income (loss) | | (392) | | | (359) | |

| Deferred equity compensation | | 1 | | | 1 | |

| Total shareholders’ equity attributable to AGL | | 5,539 | | | 5,713 | |

| Nonredeemable noncontrolling interests | | 56 | | | 52 | |

| Total shareholders’ equity | | 5,595 | | | 5,765 | |

| Total liabilities and shareholders’ equity | | $ | 12,088 | | | $ | 12,539 | |

Assured Guaranty Ltd.

Selected Financial Highlights

GAAP to Non-GAAP Reconciliations (1 of 3)

(dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Operating Income Reconciliation | Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Net income (loss) attributable to AGL | $ | 78 | | | $ | 125 | | | $ | 187 | | | $ | 206 | |

| Less pre-tax adjustments: | | | | | | | |

| Realized gains (losses) on investments | (6) | | | (9) | | | 2 | | | (11) | |

| Non-credit impairment-related unrealized fair value gains (losses) on credit derivatives | 3 | | | 90 | | | 13 | | | 103 | |

Fair value gains (losses) on CCS | 1 | | | 1 | | | (9) | | | (15) | |

| Foreign exchange gains (losses) on remeasurement of premiums receivable and loss and LAE reserves | — | | | 26 | | | (12) | | | 46 | |

| Total pre-tax adjustments | (2) | | | 108 | | | (6) | | | 123 | |

| Less tax effect on pre-tax adjustments | — | | | (19) | | | — | | | (21) | |

| Adjusted operating income (loss) | $ | 80 | | | $ | 36 | | | $ | 193 | | | $ | 104 | |

| | | | | | | |

| Gain (loss) related to FG VIE and CIV consolidation included in adjusted operating income | $ | (1) | | | $ | (18) | | | $ | (1) | | | $ | (22) | |

| | | | | | | |

| Components of adjusted operating income: | | | | | | | |

| Segments: | | | | | | | |

| Insurance | $ | 116 | | | 106 | | | $ | 265 | | | $ | 223 | |

| Asset Management | — | | | (2) | | | 1 | | | (3) | |

| Total segments | 116 | | | 104 | | | 266 | | | 220 | |

| Corporate division | (35) | | | (50) | | | (72) | | | (94) | |

| Other | (1) | | | (18) | | | (1) | | | (22) | |

| Adjusted operating income (loss) | $ | 80 | | | $ | 36 | | | $ | 193 | | | $ | 104 | |

| | | | | | | |

| | | | | | | |

| Per diluted share: | | | | | | | |

| Net income (loss) attributable to AGL | $ | 1.41 | | | $ | 2.06 | | | $ | 3.31 | | | $ | 3.40 | |

| Less pre-tax adjustments: | | | | | | | |

| Realized gains (losses) on investments | (0.11) | | | (0.14) | | | 0.04 | | | (0.17) | |

| Non-credit impairment-related unrealized fair value gains (losses) on credit derivatives | 0.06 | | | 1.48 | | | 0.23 | | | 1.68 | |

| Fair value gains (losses) on CCS | 0.02 | | | — | | | (0.16) | | | (0.25) | |

Foreign exchange gains (losses) on remeasurement of premiums receivable and loss and LAE reserves | — | | | 0.43 | | | (0.21) | | | 0.75 | |

| Total pre-tax adjustments | (0.03) | | | 1.77 | | | (0.10) | | | 2.01 | |

| Less tax effect on pre-tax adjustments | — | | | (0.31) | | | — | | | (0.33) | |

| Adjusted operating income (loss) | $ | 1.44 | | | $ | 0.60 | | | $ | 3.41 | | | $ | 1.72 | |

| | | | | | | |

| Gain (loss) related to FG VIE and CIV consolidation included in adjusted operating income | $ | (0.03) | | | $ | (0.30) | | | $ | (0.02) | | | $ | (0.35) | |

Please refer to the explanation of Non-GAAP Financial Measures set forth at the end of this Financial Supplement.

Assured Guaranty Ltd.

Selected Financial Highlights

GAAP to Non-GAAP Reconciliations (2 of 3)

(dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ROE Reconciliation and Calculation | As of |

| | June 30, | | March 31, | | December 31, | | June 30, | | March 31, | | December 31, |

| | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2022 |

| Shareholders’ equity attributable to AGL | | $ | 5,539 | | | $ | 5,629 | | | $ | 5,713 | | | $ | 5,276 | | | $ | 5,220 | | | $ | 5,064 | |

| Adjusted operating shareholders’ equity | | 5,844 | | | 5,932 | | | 5,990 | | | 5,628 | | | 5,606 | | | 5,543 | |

| Gain (loss) related to FG VIE and CIV consolidation included in adjusted operating shareholders' equity | | 3 | | | 3 | | | 5 | | | (3) | | | 13 | | | 17 | |

| | | | | | | | | | | | |

| | | | | | Three Months Ended | | Six Months Ended |

| | | | | | June 30, | | June 30, |

| | | | | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) attributable to AGL | | | | | | $ | 78 | | | $ | 125 | | | $ | 187 | | | $ | 206 | |

| Adjusted operating income (loss) | | | | | | 80 | | | 36 | | | 193 | | | 104 | |

| | | | | | | | | | | | |

| Average shareholders’ equity attributable to AGL | | | | | | $ | 5,584 | | | $ | 5,248 | | | $ | 5,626 | | | $ | 5,170 | |

| Average adjusted operating shareholders’ equity | | | | | | 5,888 | | | 5,617 | | | 5,917 | | | 5,586 | |

| Gain (loss) related to FG VIE and CIV consolidation included in average adjusted operating shareholders’ equity | | | | | | 3 | | | 5 | | | 4 | | | 7 | |

| | | | | | | | | | | | |

GAAP ROE (1) | | | | | | 5.6 | % | | 9.5 | % | | 6.6 | % | | 8.0 | % |

Adjusted operating ROE (1) | | | | | | 5.4 | % | | 2.6 | % | | 6.5 | % | | 3.7 | % |

1) Quarterly ROE calculations represent annualized returns.