Arcosa, Inc. Announces Completion of Stavola Acquisition and Sale of Steel Components Business

2024年10月2日 - 5:16AM

ビジネスワイヤ(英語)

- Transactions Advance Long-Term Strategy to Grow in Attractive

Markets and Reduce Complexity and Cyclicality

Arcosa, Inc. (NYSE: ACA) (“Arcosa” or the “Company”), a provider

of infrastructure-related products and solutions, today announced

it has completed the previously announced acquisition of the

construction materials business of Stavola Holding Corporation and

its affiliated entities (“Stavola”) for $1.2 billion.

Founded in 1948, Stavola is an aggregates-led and vertically

integrated construction materials company primarily serving the New

York-New Jersey Metropolitan Statistical Area (“MSA”) through its

network of five hard rock natural aggregates quarries, twelve

asphalt plants, and three recycled aggregates sites. For the last

twelve months ended June 30, 2024 (“LTM”), Stavola generated

revenues of $283 million and Adjusted EBITDA of $100 million,

representing a 35% Adjusted EBITDA Margin. The aggregates business

contributed 56% to Stavola’s LTM Adjusted EBITDA. The structure of

the transaction is expected to create tax benefits attributable to

Arcosa with a net present value of approximately $125 million.

The acquisition was funded with a $600 million 6.875% Senior

Note issuance due 2032, which closed on August 26, 2024, and a

pre-payable $700 million variable-rate senior secured Term Loan B

Facility due 2031, which funded concurrently with the closing of

the transaction. Excess cash proceeds will be used to pay down

borrowings on our revolving credit facility.

Additionally, the Company completed the previously announced

sale of its steel components business on August 16, 2024. For the

quarter ended September 30, 2024, we estimate Adjusted EBITDA for

the business will be a $1.0 million to $1.5 million loss,

reflecting a partial period of ownership that was impacted by the

deferral of certain product shipments and business interruption

from actions necessary to complete the divestiture process.

Antonio Carrillo, President and Chief Executive Officer,

commented, “We are pleased to announce the successful completion of

the Stavola acquisition and the divestiture of our steel components

business. These transactions significantly advance our strategy of

growing in attractive markets while reducing the cyclicality and

complexity of our overall portfolio. Stavola underscores our

aggregates-led acquisition strategy, expanding our platform into

the nation’s largest MSA with industry-leading financial

attributes. Proforma for these transactions, our Construction

Products segment represents nearly two-thirds of our Adjusted

EBITDA, up from one-third at our spin-off, and our Adjusted EBITDA

Margin increases more than 200 basis points.

“In August, we arranged attractive permanent financing for the

acquisition, providing ample prepayment flexibility to reduce debt,

consistent with our deleveraging strategy. As a near-term capital

allocation priority, we anticipate deploying our strong free cash

flow to return to our net leverage target of 2.0-2.5x within 18

months.”

Carrillo concluded, “We are excited to welcome Stavola and its

experienced management team and look forward to the long-term

strategic benefit and value creation this transaction will achieve

for Arcosa’s shareholders.”

The Company plans to update its full year 2024 revenue and

Adjusted EBITDA guidance for the completion of these transactions

in connection with the release of its third quarter earnings.

About Arcosa

Arcosa, Inc., headquartered in Dallas, Texas, is a provider of

infrastructure-related products and solutions with leading

positions in construction, engineered structures, and

transportation markets. Arcosa reports its financial results in

three principal business segments: Construction Products,

Engineered Structures, and Transportation Products. For more

information, visit www.arcosa.com.

Cautionary Statements About Forward-Looking

Information

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Arcosa’s estimates,

expectations, beliefs, intentions or strategies for the future.

Arcosa uses the words “anticipates,” “assumes,” “believes,”

“estimates,” “expects,” “intends,” “forecasts,” “may,” “will,”

“should,” “guidance,” “outlook,” “strategy,” “plans,” “goal” and

similar expressions to identify these forward-looking statements.

Forward-looking statements speak only as of the date of this

release, and Arcosa expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, except as required by

federal securities laws. Forward-looking statements are based on

management’s current views and assumptions and involve risks and

uncertainties that could cause actual results to differ materially

from historical experience or present expectations, including but

not limited to, the intended use of offering proceeds, the

contingencies related to the special mandatory redemption, the

failure to successfully complete and integrate acquisitions,

including the Transaction, or divest any business, or failure to

achieve the expected benefits of acquisitions or divestitures;

market conditions and customer demand for Arcosa’s business

products and services; the cyclical nature of, and seasonal or

weather impact on, the industries in which Arcosa competes;

competition and other competitive factors; governmental and

regulatory factors; changing technologies; availability of growth

opportunities; market recovery; ability to improve margins; the

impact of inflation and costs of materials; assumptions regarding

achievements of the expected benefits from the Inflation Reduction

Act; the delivery or satisfaction of any backlog or firm orders;

the impact of pandemics on Arcosa’s business; and Arcosa’s ability

to execute its long-term strategy, and such forward-looking

statements are not guarantees of future performance. For further

discussion of such risks and uncertainties, see “Risk Factors” and

the “Forward-Looking Statements” section of “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” in Arcosa's Form 10-K for the year ended December 31,

2023 and as may be revised and updated by Arcosa's Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001760409/en/

MEDIA CONTACT: media@arcosa.com

INVESTOR CONTACTS Erin Drabek VP of Investor Relations T

972.942.6500 InvestorResources@arcosa.com

David Gold ADVISIRY Partners T 212.661.2220

David.Gold@advisiry.com

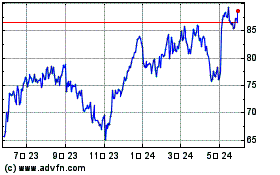

Arcosa (NYSE:ACA)

過去 株価チャート

から 12 2024 まで 1 2025

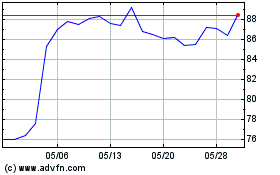

Arcosa (NYSE:ACA)

過去 株価チャート

から 1 2024 まで 1 2025