Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-279223

2,240,000

Ordinary Shares

ZOOZ

Power Ltd.

NASDAQ

trading symbol: ZOOZ

This

prospectus relates to the offering of an aggregate of 2,240,000 ZOOZ ordinary shares which may be sold from time to time by the Selling

Shareholders named in this prospectus.

The

Selling Shareholders may offer, sell or distribute all or a portion of the ZOOZ ordinary shares registered hereby publicly or through

private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of

the ZOOZ ordinary shares. We will bear all costs, expenses and fees in connection with the registration of these securities. The Selling

Shareholders will bear all commissions and discounts, if any, attributable to their sale of ZOOZ ordinary shares See “Plan of Distribution.”

The ZOOZ ordinary

shares that are being registered for resale under this prospectus consist of a total of 1,120,000 ZOOZ ordinary shares (the

“Sponsor Earnout Shares”) that are currently being held in escrow for the benefit of Keyarch Global Sponsor

Limited, a Cayman Islands exempted company (the “Sponsor”), subject to being released under certain circumstances

described below and in more detail in this prospectus. In connection with the initial public offering of Keyarch Acquisition

Corporation, a Cayman Islands exempted company (“Keyarch”) in January 2022 (the “IPO”), the

Sponsor in July 2021 purchased from Keyarch as founders’ consideration shares 1,120,000 Keyarch Class B ordinary shares par

value $0.0001 per share of Keyarch (the “Founder Subject Shares”), for approximately $0.009 per share, for a

total of $10,080, among other purchases by the Sponsor of securities of Keyarch in connection with its IPO in 2022. At the closing

of the Business Combination (as defined in this prospectus), on April 4, 2024, such Founder Subject Shares were exchanged for ZOOZ

ordinary shares, in accordance with the business combination agreement relating to the Business Combination, and which we refer to

as the Sponsor Earnout Shares.

Pursuant to the promissory

note dated April 4, 2024 (the “EBC Note”), for the principal amount of $840,000, made by ZOOZ and Keyarch in favor

of EarlyBirdCapital, Inc. (“EBC”), at any time, EBC may elect to have any amount of outstanding principal and/or accrued

interest of the EBC Note prepaid by the Sponsor by the transfer of Sponsor Earnout Shares then remaining in the Escrow Account (as defined

below) to EBC, with the price per Sponsor Earnout Share for purposes of determining the amount of the obligations satisfied under the

EBC Note for such prepayment being equal to ninety percent (90%) of the volume weighted average price of an ordinary share of ZOOZ on

the principal U.S. securities exchange on which ZOOZ’s ordinary shares then trade for the five trading day period ending on the

trading day immediately prior to the Sponsor’s and ZOOZ’s receipt of the applicable prepayment notice from EBC. In addition,

on the maturity date of the EBC Note (April 4, 2026), all outstanding obligations will be paid by the Sponsor by the transfer of Sponsor

Earnout Shares from the Escrow Account using the same pricing terms as in the previous sentence, with the five trading day period ending

on the trading day immediately prior to such maturity date. Accordingly, the purchase price per share paid by the Sponsor for the ZOOZ

ordinary shares being registered under this prospectus for resale by the Sponsor is $0.009, subject to the fact that such shares must

be used to pay obligations owed to EBC until such obligations are paid in full; and the effective purchase price per share to be paid

by EBC for the ZOOZ ordinary shares being registered under this prospectus for resale by EBC is ninety percent (90%) of the volume weighted

average price of an ordinary share of ZOOZ on the principal U.S. securities exchange on which ZOOZ’s ordinary shares then trade

for the five trading day period ending on the trading day immediately prior to (a) the receipt of the applicable prepayment notice from

EBC or (b) the maturity date of the EBC Note, as applicable. Given that the prices at which the Selling Shareholders acquired (or may

acquire) the ZOOZ ordinary shares being registered for resale under this prospectus are considerably below the current market price of

the ZOOZ ordinary shares, and that such shares represent approximately 11.9% of the outstanding ZOOZ ordinary shares held by parties

other than the Sponsor (but including the Sponsor Earnout Shares in the denominator), sales of shares under this prospectus (or the expectation

thereof) could have a significant negative impact on the public trading price of the ZOOZ ordinary shares.

The

ZOOZ ordinary shares and public warrants are traded on Nasdaq under the symbols “ZOOZ” and “ZOOZW,” respectively.

The exercise price of the

public warrants is $11.50 per ZOOZ ordinary share, and the last quoted sale price for the ZOOZ ordinary shares as reported on the Nasdaq

Capital Market on May 21, 2024 was $2.23 per share. Given that the warrants are currently out of the money, it is not likely that warrant

holders will exercise their warrants. Cash proceeds to ZOOZ associated with the exercise of the warrants are dependent on the stock price,

and as such, ZOOZ does not expect to receive cash proceeds from warrant exercises until the trading price of the ZOOZ ordinary shares

on the Nasdaq Capital Market exceeds the warrant exercise price of $11.50. ZOOZ’s ability to successfully carry out its business

plan is primarily dependent upon its ability to obtain sufficient additional capital and increase its revenue and reduce its costs. There

are no assurances that ZOOZ will be successful in obtaining an adequate level of financing needed for the long-term business plan or

that any financing will result in and increasing its profitability. ZOOZ expects that it will need to obtain substantial additional funding

in connection with its continuing operations. If ZOOZ is unable to raise capital when needed or on attractive terms, it could be forced

to delay, reduce or eliminate its research and development programs or future commercialization efforts. In order to continue ZOOZ’s

operations, including research and development and sales and marketing, ZOOZ is looking to secure financing from various sources, including

additional investment funding.

We

are a “foreign private issuer,” and an “emerging growth company” each as defined under the federal securities

laws, and, as such, we are subject to reduced public company reporting requirements. See the section entitled “Prospectus Summary

— Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Investing

in our ZOOZ ordinary shares and/or public warrants involves a high degree of risk. You should purchase our ZOOZ ordinary shares and/or

public warrants only you can afford to lose your entire investment. See “Risk Factors,” which begins on page 6.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus is June 12, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus forms part of a registration statement on Form F-1 filed by ZOOZ with the U.S. Securities and Exchange Commission (the “SEC”).

Unless

otherwise indicated or the context otherwise requires, all references in this prospectus to the terms “ZOOZ,” the Company,”

“us,” “we” and words of like import refer to ZOOZ Power Ltd., together with its subsidiaries. All references

in this prospectus to “Keyarch” refer to Keyarch Acquisition Corporation.

Keyarch

was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar

business combination with one or more businesses. Keyarch’s efforts to identify a prospective target business were not limited

to any particular industry or geographic region. Prior to executing the Business Combination Agreement with ZOOZ, Keyarch’s efforts

were limited to organizational activities, completion of its initial public offering and the evaluation of possible business combinations.

Recapitalization

In

March 2024, ZOOZ’s shareholders approved, and ZOOZ shortly thereafter effected, a recapitalization of the ZOOZ ordinary shares,

which resulted in a 11.4372-for-one reverse stock split and a change in the par value of the ZOOZ ordinary shares from NIS 0.00025 per

share to NIS 0.00286 per share, effective on March 25, 2024 (the “Recapitalization”). All share and per share information

in this prospectus retroactively reflects the Recapitalization.

FUNCTIONAL

AND REPORTING CURRENCY

The

terms “dollar,” “USD” or “$” refer to U.S. dollars and the term “New Israeli Shekel”

and “NIS” refer to the legal currency of the State of Israel.

The

currency of the primary economic environment in which the operations of ZOOZ are conducted is the NIS. Thus, the functional currency

of ZOOZ is the NIS. ZOOZ’s presentation and reporting currency is U.S dollar.

INDUSTRY

AND MARKET DATA

In

this prospectus, we present industry data, information and statistics regarding the markets in which ZOOZ competes as well as publicly

available information, industry and general publications and research and studies conducted by third parties. This information is supplemented

where necessary with ZOOZ’s own internal estimates, taking into account publicly available information about other industry participants

and ZOOZ’s management’s judgment where information is not publicly available.

Industry

publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed

to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information

obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this

prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including

those described under “Risk Factors.” These and other factors could cause results to differ materially from those

expressed in any forecasts or estimates.

TRADEMARKS,

TRADE NAMES AND SERVICE MARKS

ZOOZ

owns or has rights to trademarks, trade names and service marks that it uses in connection with the operation of its business. In addition,

ZOOZ’s names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and service

marks appearing in this prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks,

trade names and service marks referred to in this prospectus are listed without the applicable “©,” “SM”

and “TM” symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks,

trade names and service marks.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary may not contain all the information that may be important

to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Information on the

Company” and “Operating and Financial Review and Prospects” sections and our consolidated financial statements, including

the notes thereto, included elsewhere in this prospectus, before deciding to invest in our ordinary

shares.

Overview

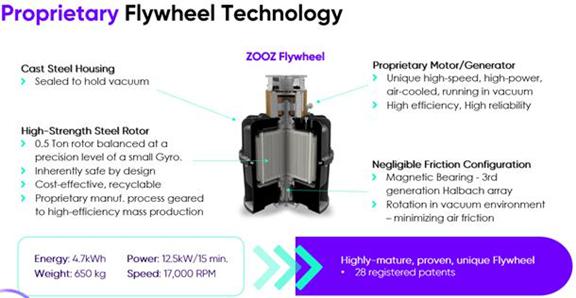

ZOOZ develops, produces, markets and sells energy storage systems based on storing kinetic energy in flywheels

for ultra-fast charging of electric vehicles, or EVs. ZOOZ has developed proprietary flywheel technology for storing kinetic energy and

as of the date of this proxy statement/prospectus, has introduced two generations of Kinetic Storage Systems – the KPB50, which

was ZOOZ’s first-generation product and was introduced in 2018 as proof-of-concept and for market introduction, which was announced

as successful and is still operating as of the date of this proxy statement/prospectus, and which is a discontinued product, and the

ZOOZTER™-100, ZOOZ’s second-generation product, which was introduced in 2022 and is geared towards high-volume production

and deployment.

The

Business Combination Agreement and Transaction Financing

On

April 4, 2024 (the “Closing Date”), Keyarch Acquisition Corporation, a Cayman Islands exempted company (“Keyarch”),

and ZOOZ Power Ltd. (TASE: ZOOZ), a limited liability company organized under the laws of the State of Israel (the “Company”

or “ZOOZ”), consummated (the “Closing”) their previously announced business combination (the “Business

Combination”), pursuant to that certain Business Combination Agreement, dated as of July 30, 2023 (as amended on February 9,

2024, March 8, 2024 and March 15, 2024, the “Business Combination Agreement”), by and among Keyarch, ZOOZ, ZOOZ Power

Cayman, a Cayman Islands exempted company and a direct, wholly owned subsidiary of ZOOZ (“Merger Sub”), Keyarch Global

Sponsor Limited, a Cayman Islands exempted company (the “Sponsor”), in the capacity as representative of specified

shareholders of Keyarch after the effective time of the Business Combination, and, by a joinder agreement, Dan Weintraub in the capacity

as representative of the pre-Closing shareholders of ZOOZ after the effective time of the Business Combination. Pursuant to the Closing,

Keyarch became a direct, wholly-owned subsidiary of the Company. Pursuant to the Business Combination Agreement, at the effective time

of the Business Combination (the “Effective Time”):

●

each outstanding Keyarch class A ordinary share, par value $0.0001 per share (“Keyarch Class A ordinary shares”),

comprising 4,949,391 of such Keyarch Class A ordinary shares (the number of the Keyarch Class A ordinary shares included the Subscription

Shares and the Sponsor Earnout Shares, as such terms are defined below), and each Keyarch Class B ordinary share, par value $0.0001

per share (“Keyarch Class B ordinary shares”) comprising one such Keyarch Class B ordinary share (collectively, with

such Keyarch Class A ordinary shares, “Keyarch ordinary shares”), in each case were exchanged for one ZOOZ ordinary

share, comprising the amount of 4,949,392 ZOOZ ordinary shares, including the Sponsor Earnout Shares (as defined below);

● each

outstanding public and private warrant of Keyarch entitling the holder to purchase one Keyarch Class A ordinary share per warrant at

a price of $11.50 per whole share (each, a “Keyarch Warrant”) outstanding immediately prior to the Effective Time

was converted into one equivalent warrant of ZOOZ entitling the holder to purchase one ZOOZ ordinary share per warrant at a price of

$11.50 per whole share, and preserving the existing public or private nature of such Keyarch Warrant, exercisable for up to an aggregate

of 6,022,500 ZOOZ ordinary shares (“ZOOZ Closing Warrants”); and

● the

registered holder of each outstanding right to receive one tenth (1/10) of one Keyarch Class A ordinary share (collectively, the “Keyarch

Rights”) was issued the number of full shares of Keyarch Class A ordinary shares to which such holder of Keyarch Rights was

eligible, and which were exchanged for the equivalent number of ZOOZ ordinary shares, comprising the amount of 1,204,500 ZOOZ ordinary

shares.

Up

to an additional 4,000,000 ZOOZ ordinary shares are contingently issuable, following the Closing, in the form of an earnout (the “Earnout”)

to existing ZOOZ holders before the Business Combination (“Existing ZOOZ Holders”) (any such shares, the “Earnout

Shares”). Issuance of the Earnout Shares during the five years commencing at the end of the full fiscal quarter following the

Closing (the “Earnout Period”) is subject to occurrence of the following price related events relating to ZOOZ ordinary

shares. In the event the volume-weighted average price of ZOOZ ordinary shares (“VWAP”) exceeds $12, for any twenty

(20) trading days within any thirty (30) consecutive trading day period during such period (the “Trading Period”),

then 1 million Earnout Shares will be issuable (constituting 25% of the Earnout Shares). In addition, in the event the VWAP exceeds $16

for the Trading Period, then 1,400,000 Earnout Shares are issuable (constituting 35% of the Earnout Shares), and additionally, in the

event VWAP exceeds $23 for the Trading Period, then 1,600,000 Earnout Shares are issuable (constituting 40% of the Earnout Shares). The

reference prices are subject to adjustment for share splits, share dividends, recapitalizations and similar events, and the shares issuable

under each of any of these events will be issued as soon as practicable following the settlement of such event. In addition, the Sponsor

has agreed in the Sponsor Letter Agreement to subject forty percent of all of its original holdings of Keyarch Class B ordinary shares

(which the Sponsor converted to Class A ordinary shares on August 14, 2023) to the same Earnout, other than to the extent used, in whole

or in part, in connection with payment of expenses of the Business Combination, as described further below, which comprise in aggregate

1,120,000 Keyarch Class A ordinary shares that were exchanged for 1,120,000 ZOOZ ordinary shares (the “Sponsor Earnout Shares”).

On

February 9, 2024, Keyarch and ZOOZ entered into subscription agreements (the “Subscription Agreements”) with certain

investors (the “PIPE Investors”). Pursuant to the Subscription Agreements, the PIPE Investors agreed to subscribe

for and purchase, and Keyarch agreed to issue and sell to these Investors, prior to the closing of the Business Combination, an aggregate

of 1,300,000 Keyarch Class A ordinary shares (the “Subscription Shares”) for a purchase price of $10.00 per share,

for gross proceeds of $13,000,000, on the terms and subject to the conditions set forth in the Subscription Agreements (the “Transaction

Financing”), which Transaction Financing closed on April 4, 2024, and which Subscription Shares were exchanged for 1,300,000

ZOOZ ordinary shares in the Business Combination on April 4, 2024.

Sponsor

Letter Agreement and Business Combination Marketing Agreement

On

July 30, 2023, Keyarch, the Sponsor and ZOOZ entered into an agreement, as subsequently amended (the “Sponsor Letter Agreement”)

pursuant to which the Sponsor agreed to make commercially reasonable efforts to utilize up to 40% (or 1,120,000 shares) of its ownership

of Keyarch shares (the “Subject Founder Shares”) to pay any portion of unpaid Keyarch transaction expenses or incentivize

investors or otherwise provider support in connection with transaction financing. Any remaining Subject Founder Shares which were not

transferred to such payees were placed in escrow at the Closing and, as converted to ZOOZ ordinary shares, being the Sponsor Earnout

Shares, will be released to the Sponsor if, during the Earnout Period, ZOOZ achieves the milestones as described above (including with

respect to the percentage of such remaining Sponsor Earnout Shares to be released upon the achievement of any targets). Any Sponsor Earnout

Shares that are not released will be transferred to ZOOZ for no consideration at the end of the Earnout Period, provided, however that

at least 50% of the Sponsor Earnout Shares placed in escrow will be released to the Sponsor at the end of the Earnout Period notwithstanding

the failure of ZOOZ to achieve any earnout milestones; and provided further that no Sponsor Earnout Shares will be released to the Sponsor

under the Earnout until the EBC Note (as defined below) is paid in full and, additionally, the Sponsor Note (as defined below) is paid

in full (in that order).

In

addition, during 2023, Keyarch issued certain promissory notes in favor of the Sponsor (the “Pre-Closing Sponsor Notes”),

which Pre-Closing Sponsor Notes were not repaid as of the Closing. On April 4, 2024, ZOOZ and Keyarch issued a promissory note in favor

of the Sponsor for the principal amount of $2,030,000 (the “Sponsor Note”), in satisfaction of the Pre-Closing Sponsor

Notes. The Sponsor Note matures on April 4, 2026 and accrues interest at an annual rate of 8%, which interest increases to 15% if the

Sponsor Note is not paid when due. In addition, ZOOZ is required to make mandatory cash prepayments on the Sponsor Note from time to

time in amounts equal to 25% of the gross proceeds less sales commissions received by ZOOZ from equity or equity-linked financings following

the issuance date and prior to maturity, provided that ZOOZ will not make any such prepayments until the EBC Note has been paid in full.

Further, at any time after the EBC Note has been paid in full, the Sponsor may elect to have any amount of outstanding principal and/or

accrued interest of the Sponsor Note satisfied by the transfer of Sponsor Earnout Shares then remaining in the Escrow Account (as defined

below) to the Sponsor, with the price per Sponsor Earnout Share for purposes of determining the amount of the obligations satisfied under

the Sponsor Note for such prepayment being equal to ninety percent (90%) of the volume weighted average price of an ordinary share of

ZOOZ on the principal U.S. securities exchange on which ZOOZ’s ordinary shares then trade for the five trading day period ending

on the trading day immediately prior to ZOOZ’s receipt of the applicable prepayment notice from the Sponsor. In addition, on the

maturity date of the Sponsor Note, provided that the EBC Note has been paid in full, all outstanding obligations will be satisfied by

the transfer of Sponsor Earnout Shares from the Escrow Account to the Sponsor using the same pricing terms as in the previous sentence,

with the five trading day period ending on the trading day immediately prior to such maturity date. Under the Sponsor Note, ZOOZ agreed

to file, within 30 days after the issuance date, a registration statement registering the resale by the Sponsor of the Sponsor Earnout

Shares, which obligation the registration statement on Form F-1 of which this prospectus forms a part is intended to satisfy.

Pursuant

to the “Business Combination Marketing Agreement,” dated January 24, 2022, as subsequently amended on April 4, 2024, between

EarlyBirdCapital, Inc. (“EBC”), who, among other things, served as the representative of the underwriters in Keyarch’s

initial public offering, Keyarch and (effective April 4, 2024) ZOOZ, Keyarch engaged EBC as an advisor in connection with a business

combination. Under the Business Combination Marketing Agreement, as compensation for EBC’s services, EBC is entitled to a total

fee of $1,500,000, of which a total of $660,000 was paid in cash to EBC at the Closing, and the remainder of which is reflected in a

promissory note dated April 4, 2024, for the principal amount of $840,000, made by ZOOZ and Keyarch in favor of EBC (the “EBC

Note”).

The

EBC Note matures on April 4, 2026 and accrues interest at an annual rate of 8%, which interest increases to 15% if the EBC Note is not

paid when due. In addition, ZOOZ is required to make mandatory cash prepayments on the EBC Note from time to time in amounts equal to

25% of the gross proceeds less sales commissions received by ZOOZ from equity or equity-linked financings following the issuance date

and prior to maturity. Further, at any time, EBC may elect to have any amount of outstanding principal and/or accrued interest of the

EBC Note prepaid by the Sponsor by the transfer of Sponsor Earnout Shares then remaining in the Escrow Account (as defined below) to

EBC, with the price per Sponsor Earnout Share for purposes of determining the amount of the obligations satisfied under the EBC Note

for such prepayment being equal to ninety percent (90%) of the volume weighted average price of an ordinary share of ZOOZ on the principal

U.S. securities exchange on which ZOOZ’s ordinary shares then trade for the five trading day period ending on the trading day immediately

prior to the Sponsor’s and ZOOZ’s receipt of the applicable prepayment notice from EBC. In addition, on the maturity date

of the EBC Note, all outstanding obligations will be paid by the Sponsor by the transfer of Sponsor Earnout Shares from the Escrow Account

using the same pricing terms as in the previous sentence, with the five trading day period ending on the trading day immediately prior

to such maturity date. Under the EBC Note, ZOOZ agreed to file, within 30 days after the issuance date, a registration statement registering

the resale by EBC of the Sponsor Earnout Shares, which obligation the registration statement on Form F-1 of which this prospectus forms

a part is intended to satisfy.

The

Sponsor Earnout Shares were deposited in an escrow account (the “Escrow Account”) at the Closing pursuant to an escrow

agreement, dated April 4, 2024 (the “Escrow Agreement”), which Escrow Agreement governs the release of such Sponsor

Earnout Shares in accordance with the Sponsor Letter Agreement, Sponsor Note and EBC Note.

Funding Requirements

The exercise price of our

public warrants is $11.50 per ZOOZ ordinary share, and the last quoted sale price for the ZOOZ ordinary shares as reported on the Nasdaq

Capital Market on May 21, 2024 was $2.23 per share. Given that the warrants are currently out of the money, it is not likely that warrant

holders will exercise their warrants. Cash proceeds to ZOOZ associated with the exercise of the warrants are dependent on the stock price,

and as such, ZOOZ does not expect to receive cash proceeds from warrant exercises until the trading price of the ZOOZ ordinary shares

on the Nasdaq Capital Market exceeds the warrant exercise price of $11.50. ZOOZ’s ability to successfully carry out its business

plan is primarily dependent upon its ability to obtain sufficient additional capital and increase its revenue and reduce its costs. There

are no assurances that ZOOZ will be successful in obtaining an adequate level of financing needed for the long-term business plan or

that any financing will result in and increasing its profitability. ZOOZ expects that it will need to obtain substantial additional funding

in connection with its continuing operations. If ZOOZ is unable to raise capital when needed or on attractive terms, it could be forced

to delay, reduce or eliminate its research and development programs or future commercialization efforts. In order to continue ZOOZ’s

operations, including research and development and sales and marketing, ZOOZ is looking to secure financing from various sources, including

additional investment funding.

Foreign

Private Issuer Status

ZOOZ

is a company organized under the laws of the State of Israel. ZOOZ reports under the Exchange Act as a non-U.S. company with foreign

private issuer status. Under Rule 405 of the Securities Act, the determination of foreign private issuer status is made annually on the

last business day of an issuer’s most recently completed second fiscal quarter, and accordingly, the next determination will be

made with respect to ZOOZ on June 30, 2024. Even after ZOOZ no longer qualifies as an emerging growth company, for so long as ZOOZ qualifies

as a foreign private issuer, it will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public

companies.

ZOOZ

is required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, ZOOZ intends to publish

its results on a quarterly basis through press releases, distributed pursuant to the rules and regulations of Nasdaq. However, no

assurance can be provided that ZOOZ will at all times publish its results on a quarterly basis, or that if it does, it will do so in

a timely or consistent manner. Rather, ZOOZ may from time to time elect not to publish quarterly results due to commercial considerations.

Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information

ZOOZ is required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with

the SEC by U.S. domestic issuers. Accordingly, ZOOZ shareholders receive less or different information about ZOOZ than a shareholder

of a U.S. domestic public company would receive.

ZOOZ

is listed on Nasdaq. Nasdaq rules permit a foreign private issuer such as ZOOZ to follow the corporate governance practices of its home

country. Certain corporate governance practices in Israel, which is ZOOZ’s home country, may differ significantly from Nasdaq listing

standards.

Foreign

private issuers, similar to emerging growth companies, are also exempt from certain more stringent executive compensation disclosure

rules. For example, for so long as ZOOZ retains its foreign private issuer status, officers, directors and principal shareholders of

ZOOZ will not be subject to the short-swing profit disclosure and recovery provisions of Section 16 of the Exchange Act. Thus, even at

such time as ZOOZ no longer qualifies as an emerging growth company but remains a foreign private issuer, it will continue to be exempt

from the more stringent compensation disclosures required of public companies that are neither an emerging growth company nor a foreign

private issuer.

Implications

of Being an Emerging Growth Company

As

a company with less than US$1.235 billion in revenue for the last fiscal year, we qualify as an “emerging growth company”

pursuant to the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). An emerging growth company

may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies.

These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002, or Section

404, in the assessment of the emerging growth company’s internal control over financial reporting. The JOBS Act also provides that

an emerging growth company does not need to comply with any new or revised financial accounting standards until such date that a private

company is otherwise required to comply with such new or revised accounting standards. We intend to take advantage of certain of these

exemptions.

We

will remain an emerging growth company until the earliest of (i) the last day of our fiscal year during which we have total annual gross

revenues of at least US$1.235 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion

of the Business Combination; (iii) the date on which we have, during the previous three year period, issued more than $1.0 billion in

non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which

would occur if the market value of our ordinary shares that are held by non-affiliates exceeds $700 million as of the last business day

of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months. Once we cease to be

an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

The

Offering

| Ordinary

Shares Offered: |

|

The

Selling Shareholders are offering 2,240,000 ordinary shares(1) |

| Outstanding

Ordinary Shares: |

|

12,066,115

ordinary shares(2) |

| Use

of Proceeds: |

|

ZOOZ

will not receive any proceeds from this offering |

Recapitalization

(reverse share split)

All

share and per share information concerning the ZOOZ ordinary shares reflects the 11.4372-for-one reverse share split as part of the Recapitalization.

| (1) |

Represents up to 1,120,000 Sponsor Earnout Shares which are

currently held in the Escrow Account that may be transferred (i) to EBC (and resold by EBC hereunder) to satisfy all or portions of the

EBC Note and/or (ii) to the Sponsor (and resold by the Sponsor hereunder) to satisfy all or portions of the Sponsor Note. |

| (2) |

Does not include 6,022,500 ordinary shares issuable upon exercise

of the ZOOZ Closing Warrants, 2,451,660 ordinary shares issuable upon exercise of other ZOOZ warrants, 4,000,000 ordinary shares which

are contingently issuable to Existing ZOOZ Holders pursuant to the Earnout and 831,985 ordinary shares issuable pursuant to exercise

of outstanding options of ZOOZ. |

RISK

FACTORS

Any

investment in our ordinary shares and/or public warrants involves a high degree of risk. You should carefully consider the risks set

forth below before deciding whether to purchase our common shares. The risks and uncertainties described herein are not the only

risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may

also impair our business operations. If any of the events or circumstances described herein actually occur, our business, financial condition

and results of operations would suffer. In that event, the price of our ordinary shares could decline, and you may lose all or part of

your investment. The risks discussed herein also include forward-looking statements and our actual results may differ substantially from

those discussed in these forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements.”

Risks

Related to this Offering

Due

to the significant number of Keyarch Class A ordinary shares that were redeemed in connection with the Business Combination, the number

of ZOOZ ordinary shares that the selling shareholders can sell into the public markets pursuant to this prospectus may represent a large

amount compared to our public float. As a result, the resale of ZOOZ ordinary shares pursuant to this prospectus could have a significant

negative impact on the trading price of our ordinary shares.

Due

to the significant number of Keyarch Class A ordinary shares that were redeemed in connection with the Business Combination, the number

of ZOOZ ordinary shares that the selling shareholders can sell into the public markets pursuant to this prospectus may represent a large

amount compared to our public float. As a result, the resale of ZOOZ ordinary shares pursuant to this prospectus could have a significant

negative impact on the trading price of our ordinary shares. This impact may be heightened by the fact that, as described below, certain

of the selling shareholders acquired, or are able to acquire, ZOOZ ordinary shares at prices that are well below the current trading

price of our ordinary shares.

The

selling securityholders will determine the timing, pricing and rate at which they sell such ZOOZ ordinary shares into the public market.

Although the current trading price of our ordinary share is below $10.00 per share, which was the sales price for units in the Keyarch

IPO, certain of the selling shareholders have an incentive to sell because they purchased shares (or may acquire shares) at prices below

the initial public offering price and/or below the recent trading prices of our securities. For example, the last quoted sale price for

the ZOOZ ordinary shares as reported on the Nasdaq Capital Market on May 21, 2024 was $2.23 per share. Additionally, while sales by such

investors may experience a positive rate of return based on the trading price at the time they sell their shares, the public securityholders

may not experience a similar rate of return on the securities they purchased due to differences in the prices at which such public securityholders

purchased their shares and the trading price. Given the substantial number of ZOOZ ordinary shares being registered for potential resale

by the selling shareholders pursuant to this prospectus, the sale of ordinary shares by the selling shareholders, or the perception in

the market that the selling shareholders of a large number of ordinary shares intend to sell ordinary shares, may increase the volatility

of the market price of our ordinary shares, may prevent the trading price of our securities from exceeding the Keyarch IPO offering price

and may cause the trading prices of our securities to experience a further decline.

The

ZOOZ ordinary shares that are being registered for resale under this prospectus consist of the 1,120,000 Sponsor Earnout Shares. In

connection with the initial public offering of Keyarch (the “IPO”) in January 2022, the Sponsor in July 2021

purchased from Keyarch as founders’ consideration shares 1,120,000 Keyarch Class B ordinary shares par value $0.0001 per share

of Keyarch (the “Founder Subject Shares”) as founders’ consideration shares for $0.009 per share, for a

total of $10,080, among other purchases by the Sponsor of securities of Keyarch in connection with its IPO in 2022. At the closing

of the Business Combination, on April 4, 2024, such Founder Subject Shares were exchanged for ZOOZ ordinary shares, in accordance

with the business combination agreement relating to the Business Combination, in this case, the Sponsor Earnout Shares.

Pursuant

to the EBC Note, at any time, EBC may elect to have any amount of outstanding principal and/or accrued interest of the EBC Note prepaid

by the Sponsor by the transfer of Sponsor Earnout Shares then remaining in the Escrow Account to EBC, with the price per Sponsor Earnout

Share for purposes of determining the amount of the obligations satisfied under the EBC Note for such prepayment being equal to ninety

percent (90%) of the volume weighted average price of an ordinary share of ZOOZ on the principal U.S. securities exchange on which ZOOZ’s

ordinary shares then trade for the five trading day period ending on the trading day immediately prior to the Sponsor’s and ZOOZ’s

receipt of the applicable prepayment notice from EBC. In addition, on the maturity date of the EBC Note (April 4, 2026), all outstanding

obligations will be paid by the Sponsor by the transfer of Sponsor Earnout Shares from the Escrow Account using the same pricing terms

as in the previous sentence, with the five trading day period ending on the trading day immediately prior to such maturity date. Accordingly,

the purchase price per share paid by the Sponsor for the ZOOZ ordinary shares being registered under this prospectus for resale by the

Sponsor is $0.009, subject to the fact that such shares must be used to pay obligations owed to EBC until such obligations are paid in

full; and the effective purchase price per share to be paid by EBC for the ZOOZ ordinary shares being registered under this prospectus

for resale by EBC is ninety percent (90%) of the volume weighted average price of an ordinary share of ZOOZ on the principal U.S. securities

exchange on which ZOOZ’s ordinary shares then trade for the five trading day period ending on the trading day immediately prior

to (a) the receipt of the applicable prepayment notice from EBC or (b) the maturity date of the EBC Note, as applicable. Therefore, EBC

has the potential to earn about a 10% profit from selling ordinary shares that it may acquire in settlement of the EBC Note, based on

the formula at which the outstanding amount under the EBC Note may be exchanged compared to the prevailing trading price at the time

of exchange, represented by the volume weighted average price used in the formula. In addition, the Sponsor will have the opportunity

to earn a profit (i) equal to the difference between 90% of the prevailing volume weighted average price of the ordinary shares and $0.009,

from settling the obligation to repay the EBC Note using the Sponsor Earnout Shares, with each share paying off the amount of the EBC

Note represented by the formula stated above, and (ii) in the event that the EBC Note has been paid off in full and there are remaining

Sponsor Earnout Shares in the Escrow Account, equal to about 10% from selling ordinary shares that it may be released from escrow in

settlement of the Sponsor Note, based on the formula at which the outstanding amount under the Sponsor Note may be exchanged compared

to the prevailing trading price at the time of exchange, represented by the volume weighted average price used in the formula.

Given

that the prices at which the Selling Shareholders acquired (or may acquire) the ZOOZ ordinary shares being registered for resale under

this prospectus are considerably below the current market price of the ZOOZ ordinary shares, and that such shares represent approximately

11.9% of the outstanding ZOOZ ordinary shares held by parties other than the Sponsor (such percentage calculated by including the Sponsor

Earnout Shares once in the numerator and once in the denominator), and 9.3% of the total outstanding ZOOZ ordinary shares, sales of shares

under this prospectus (or the expectation thereof) could have a significant negative impact on the public trading price of the ZOOZ ordinary

shares.

The

sale or availability for sale of substantial amounts of our Ordinary Shares could adversely affect their market price.

Sales

of substantial amounts of our shares in the public market after the completion of this offering, or the perception that these sales could

occur, could adversely affect the market price of our shares and could materially impair our ability to raise capital through equity

offerings in the future. As of the date of this prospectus, we have 12,066,115 Ordinary Shares issued and outstanding, of which 1,120,000

are held by the selling shareholders. The Ordinary Shares held by the selling shareholders will be freely tradable without restriction

or further registration under the Securities Act after this registration statement becomes effective, and Ordinary Shares held by our

existing shareholders may also be sold in the public market in the future subject to the restrictions in Rule 144 and Rule 701 under

the Securities Act and applicable lock-up agreements.

The

ZOOZ public warrants are currently out of the money, and ZOOZ does not expect to receive cash proceeds from warrant exercises until the

trading price of the ZOOZ ordinary shares on the Nasdaq Capital Market exceeds the warrant exercise price of $11.50.

The exercise price

of our public warrants is $11.50 per ZOOZ ordinary share, and the last quoted sale price for the ZOOZ ordinary shares as reported on

the Nasdaq Capital Market on May 21, 2024 was $2.23 per share. Given that the warrants are currently out of the money, it is not likely

that warrant holders will exercise their warrants. Cash proceeds to ZOOZ associated with the exercise of the warrants are dependent on

the stock price, and as such, ZOOZ does not expect to receive cash proceeds from warrant exercises until the trading price of the ZOOZ

ordinary shares on the Nasdaq Capital Market exceeds the warrant exercise price of $11.50. ZOOZ’s ability to successfully carry

out its business plan is primarily dependent upon its ability to obtain sufficient additional capital and increase its revenue and reduce

its costs. There are no assurances that ZOOZ will be successful in obtaining an adequate level of financing needed for the long-term

business plan or that any financing will result in and increasing its profitability. ZOOZ expects that it will need to obtain substantial

additional funding in connection with its continuing operations. If ZOOZ is unable to raise capital when needed or on attractive terms,

it could be forced to delay, reduce or eliminate its research and development programs or future commercialization efforts. In order

to continue ZOOZ’s operations, including research and development and sales and marketing, ZOOZ is looking to secure financing

from various sources, including additional investment funding.

Risks

Related to ZOOZ’s Business and Industry

ZOOZ

is an early-stage company with a history of losses. ZOOZ’s ability to continue as a going concern will depend on its ability to

generate sufficient revenue and/or depend on ZOOZ’s ability to raise capital that will allow it to continue operating until it

generates sufficient revenue.

ZOOZ

incurred a net loss of $7.8 million and $11.7 million for the year ended December 31, 2022, and for the year ended December 31, 2023,

respectively.

ZOOZ

had an accumulated deficit of approximately $35.4 million and $47.2 million as of December 31, 2022 and December 31, 2023, respectively.

ZOOZ believes it will continue to incur operating and comprehensive losses for the near-term. ZOOZ does not expect that it will improve

its cash flow generation and operating result significantly through 2024 and 2025 as ZOOZ is in the early stage of market penetration

and product introduction. ZOOZ’s ability to continue as a going concern will depend on its ability to generate sufficient revenue

and/or its ability to raise capital.

ZOOZ’s

potential profitability of the revenue stream from its product ZOOZTER™-100 is particularly dependent upon customer’s awareness

of product value, its proven readiness reliability and business justification, ZOOZ’s ability to build substantial backlog of orders

which will allow cost reduction over increased volume of production, and ZOOZ’s ability to reduce product manufacturing costs on

a timely basis, which may not occur.

The

report of ZOOZ’s independent registered public accounting firm contains an explanatory paragraph that expresses substantial doubt

about ZOOZ’s ability to continue as a going concern.

ZOOZ

management has determined, and the report of ZOOZ’s independent registered public accounting firm with respect to ZOOZ’s

audited consolidated financial statements as of December 31, 2023 indicates, that there is substantial doubt about ZOOZ’s ability

to continue as a going concern. The report states that, ZOOZ has accumulated net losses in the amount of approximately $47.2 million

as well as a negative cash flow from operating activities in the amount of approximately $12.2 million, for a period of 12 months that

ended on that date. These factors raise substantial doubt about the continued existence of ZOOZ as a “going concern.” Based

on the plans of ZOOZ’s management, ZOOZ’s cash balance as of December 31, 2023, and as of the date of approval of the audited

consolidated financial statements, may be insufficient to continue ZOOZ’s operations for more than 12 months following the date

of approval of the audited consolidated financial statements. In order to continue ZOOZ’s operations, ZOOZ is looking to secure

financing from various sources, such as additional investment funding. According to the report of ZOOZ’s independent registered

public accounting firm with respect to ZOOZ’s audited consolidated financial statements for the year ended December 31, 2023, the

dependency on these planned objectives raises substantial doubt of ZOOZ’s ability to continue as a going concern and that ZOOZ

may be unable to realize its assets and discharge its liabilities in the normal course of business. These audited consolidated financial

statements did not include any adjustments regarding the values of the assets and liabilities and their classification that might be

needed if ZOOZ could not continue to operate as a “going concern.”

ZOOZ

has identified material weaknesses in its internal control over financial reporting. If ZOOZ is unable to remediate these material weaknesses,

or if ZOOZ identifies additional material weaknesses in the future or otherwise fails to maintain an effective system of internal control

over financial reporting, this may impair ZOOZ’s ability to produce timely and accurate financial statements or comply with applicable

laws and regulations.

In

connection with the preparation and audit of ZOOZ’s audited consolidated financial statements for the years ended December 31,

2023 and 2022, material weaknesses were identified in ZOOZ’s internal control over financial reporting. A material weakness is

a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility

that a material misstatement of ZOOZ’s audited consolidated annual financial statements will not be prevented or detected on a

timely basis.

The

material weaknesses referenced above are described below:

| ● | Segregation

of duties has not been sufficiently established across the key business and financial processes.

Given the size, nature of the organization, and the current structure of the finance function,

a lack of segregation of duties applied to the key business and financial processes across

the organization has been identified. A consequence of the lack of segregation of duties

is the heightened risk of fraud or material misstatement when no appropriate mitigating controls

are in place. |

| ● | Lack

of personnel with appropriate knowledge and experience relating to U.S. GAAP and SEC reporting

requirements to enable the entity to design and maintain an effective financial reporting

process. A lack of knowledge and experience in these areas may lead to ZOOZ being in breach

of SEC financial reporting and other related requirements, especially given that the current

finance function has not been designed to include sufficient accounting and financial reporting

personnel with (i) the requisite knowledge and experience in the application of SEC financial

reporting rules and regulations; and (ii) the appropriate expertise in the relevant U.S.

accounting standards. |

Remediation

activities and Plans

| ● | ZOOZ

has begun implementation of a plan to remediate these material weaknesses, including implementation

of an ERP system, for, among other things, improving its appropriately designed, implemented

and documented controls in inventory process, in respect of separation of operation costs

from research and development costs. |

These

remediation measures are ongoing and may include hiring additional accounting and financial reporting personnel and implementing additional

policies, procedures and controls.

In

order to maintain and improve the effectiveness of ZOOZ’s internal control over financial reporting, ZOOZ has expended, and anticipate

that it will continue to expend, significant resources, including accounting-related costs and significant management oversight.

ZOOZ

cannot assure you the measures it is taking to remediate the material weaknesses will be sufficient or that they will prevent future

material weaknesses. Additional material weaknesses or failure to maintain effective internal control over financial reporting could

cause the combined company to fail to meet its reporting obligations as a public company listed for trading on the Nasdaq.

ZOOZ’s

management is not required to report on the effectiveness of its internal control over financial reporting until after ZOOZ is no longer

a “newly public company” listed for trading on the Nasdaq (i.e. in connection with the filing of its second annual report

following consummation of the business combination between Keyarch and ZOOZ Power Cayman, a Cayman Islands exempted company and a direct,

wholly owned subsidiary of ZOOZ (the “Merger Sub”) (the “Business Combination”)). At such time,

to the extent that the above-described material weaknesses continue to exist or new material weaknesses are identified, ZOOZ’s

management may be unable to conclude that its internal control over financial reporting is operating effectively. In addition, ZOOZ’s

independent registered public accounting firm is not required to attest to the effectiveness of its internal control over financial reporting

until after ZOOZ is no longer an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012

(the “JOBS Act”). At such time, ZOOZ’s independent registered public accounting firm may issue a report that

is adverse in the event its internal controls over financial reporting do not operate effectively. If ZOOZ is not able to complete its

initial assessment of its internal controls and otherwise implement the requirements of Section 404 of the Sarbanes-Oxley Act of 2002

(the “Sarbanes-Oxley Act”) in a timely manner or with adequate compliance, its independent registered public accounting

firm may not be able to attest to the effectiveness of its internal controls over financial reporting. Any failure to implement and maintain

effective internal control over financial reporting also could adversely affect the results of periodic management evaluations and annual

independent registered public accounting firm attestation reports regarding the effectiveness of our internal control over financial

reporting that ZOOZ will eventually be required to include in its periodic reports that are filed with the SEC. If ZOOZ is unable to

remediate its existing material weaknesses or identifies additional material weaknesses and is unable to comply with the requirements

of Section 404 in a timely manner or assert that its internal control over financial reporting is effective, or if the ZOOZ’s independent

registered public accounting firm is unable to express an opinion as to the effectiveness of ZOOZ’s internal control over financial

reporting once it is no longer an emerging growth company, investors may lose confidence in the accuracy and completeness of the audited

consolidated financial reports and the market price of the ZOOZ ordinary shares could be negatively affected, and it could become subject

to investigations by Nasdaq, the SEC or other regulatory authorities, which could require additional financial and management resources.

In

addition, any failure to maintain effective disclosure controls and procedures and internal control over financial reporting could adversely

affect ZOOZ’s business and operating results and could cause a decline in the price of the ZOOZ ordinary shares. These material

weaknesses will not be considered remediated until the mitigating controls have operated for the required period of time and until the

operating effectiveness of the controls has been validated, through testing, by ZOOZ’s management.

Failure

to expand ZOOZ’s geographic footprint and to build scalable and robust processes could harm ZOOZ’s prospects for growth and

profitability, and it may never successfully do so or achieve or sustain profitability.

ZOOZ’s

ability to achieve significant revenue growth and profitability in the future will depend, in large part, on ZOOZ’s success in

expanding its product portfolio and business both within its existing markets and to additional markets and geographies and building

scalable and robust processes to manage its business and operations. As of the date of this prospectus, ZOOZ has gained limited experience

in a small number of territories, which include Israel, Germany, the U.K., and the U.S. and ZOOZ has several deployments in Israel, Germany,

the U.K. and the U.S., and expects to complete several additional deployments in these territories in the coming months. If prospective

customers and business partners in such existing and new markets and geographies do not perceive ZOOZ’s product offerings to be

of value to them, or the ZOOZ products are not favorably received by them in such markets, ZOOZ may not be able to attract and retain

such customer or business partners and will not be successful in expanding its business and operations in its existing markets and to

new markets and geographies.

ZOOZ’s

supply chain is in early stage of development, and ZOOZ is in the process of outsourcing the manufacturing of the product – failure

in this process will not allow ZOOZ to scale-up its manufacturing capacity, which in turn could have an adverse effect on ZOOZ’s

ability to meet market demand.

In

addition, if ZOOZ is not able to build scalable and robust processes and resources to manage its existing business operations and prospective

growth and expansion, ZOOZ may fail to satisfy and retain its existing customers and business partners and may not be able to attract

new customers and business partners in additional markets and, as a result, ZOOZ’s ability to maintain and/or grow the business

and achieve or sustain profitability will be adversely affected.

ZOOZ

may enter into agreements to operate projects at a financial loss in order to penetrate certain markets.

In

order to penetrate certain markets or demonstrate our technological capabilities, and as part of its business strategy, ZOOZ may enter

into agreements to operate projects at a financial loss to it. Such agreements may materially affect its business, financial condition,

and results of operations.

ZOOZ

currently faces competition from a number of companies and expects to face significant competition in the future as the market for the

EV high power charger develops.

The

EV charging market is relatively new and competition is still developing. There are numerous factors that may affect the competition

in the market of power boosters for EV charging, which include product costs, footprint and electrical energy capacity. In the market

of power boosters for EV charging, ZOOZ primarily competes with providers of battery-based power boosters and energy storage systems

and ZOOZ expects competition by other equipment providers who will offer flywheel-based power boosters, once such products reaching maturity

and available to the market.

Competition

may include various technologies for energy storage, such as hydrogen-based energy storage, supercapacitors-based energy storage etc.

Further

for EV charging and commercial battery storage system market, ZOOZ’s current or potential competitors may be acquired by third

parties with greater available resources. As a result, competitors may be able to respond more quickly and effectively than ZOOZ to new

or changing opportunities, technologies, standards or customer requirements and may have the ability to initiate or withstand substantial

price competition. In addition, competitors may in the future establish cooperative relationships with vendors of complementary products,

technologies or services to increase the availability of their solutions in the marketplace. This competition may also materialize in

the form of costly intellectual property disputes or litigation.

New

competitors or alliances may emerge in the future that have greater market share, more widely adopted proprietary technologies, greater

marketing expertise and greater financial resources, which could put ZOOZ at a competitive disadvantage. Future competitors could also

be better positioned to serve certain segments of ZOOZ’s current or future target markets, which could create price pressure. In

light of these factors, even if ZOOZ’s offerings are more effective and higher quality than those of its competitors, current or

potential customers may accept ZOOZ’s competitors’ solutions instead of ZOOZ’s solutions. If ZOOZ fails to adapt to

changing market conditions or continue to compete successfully with current charging platform providers or new competitors, ZOOZ’s

growth will be limited which would adversely affect its business and results of operations.

The

market for EV high power charging may not develop to be as significant as anticipated.

There

are other means for charging EVs, which could affect the level of demand for ultra-fast charging capabilities. For example, wireless

charging capabilities as part of the road infrastructure and widespread availability of slow chargers, at home or in public sites, may

limit the needs for ultra-fast charging. If the future market trend will be to adopt these solutions widely, this may have an adverse

effect on ZOOZ’s business.

ZOOZ

faces risks related to natural disaster and health pandemics, including the coronavirus (“COVID-19”) pandemic, which could

have a material adverse effect on its business and results of operations.

Health

pandemics such as COVID-19 can impact changes in consumer and business behavior. Pandemic fears and market downturns, and restrictions

on business and individual activities, may create significant volatility in the global economy. The spread of COVID-19 has created a

disruption in the manufacturing, delivery and overall supply chain of vehicle and photovoltaic manufacturers and suppliers around the

world. Any sustained downturn in the demand for EVs or photovoltaic or battery storage system would harm ZOOZ’s business.

ZOOZ

relies on a limited number of suppliers and manufacturers for its products. Some of ZOOZ’s suppliers and manufacturers provide

ZOOZ with custom-designed components and sub-systems. A loss of any of these key suppliers and manufacturers could negatively affect

ZOOZ’s business.

ZOOZ

relies on a limited number of suppliers to manufacture its products, including in some cases, only a single supplier for some products

and components. Some of ZOOZ’s suppliers and manufacturers provide it with custom-designed components and sub-systems. While any

of such key suppliers and manufacturers could be replaced, this reliance on a limited number of manufacturers increases its risks, since

any change in its key suppliers or manufacturers will lead ZOOZ to incur material additional costs and substantial delays. If ZOOZ experiences

a significant increase in demand for its products, or if ZOOZ needs to replace an existing supplier, it may not be possible to supplement

or replace them on acceptable terms or expected time, which may undermine ZOOZ’s ability to deliver products to customers in a

timely manner. For example, it may take a significant amount of time to identify a manufacturer that has the capability and resources

to provide ZOOZ with certain custom-designed components or sub-systems. Identifying suitable suppliers and manufacturers could be an

extensive process that requires ZOOZ to become satisfied with their product performance, and their quality control, technical capabilities,

responsiveness and service, financial stability, regulatory compliance, and labor and other ethical practices. In addition, the process

of replacing suppliers of certain components and subsystems may require ZOOZ to invest additional resources and time in additional testing,

validation and certification processes. Accordingly, a loss of any of ZOOZ’s key suppliers or manufacturers could have an adverse

effect on its business, financial condition and operating results.

Increases

in costs, disruption of supply, or shortage of materials, have harmed and could harm ZOOZ’s business again in the future.

ZOOZ

has experienced and may in the future experience increases in the cost or a sustained interruption in the supply or shortage of materials

necessary for the production of its products. Any such increase in cost, supply interruption, or materials shortage in the future could

again adversely impact ZOOZ’s business, prospects, financial condition, and operating results. ZOOZ’s suppliers use various

materials. The prices and supply of these materials may fluctuate, depending on market conditions and global demand for these materials.

ZOOZ

is still in the process of product cost reduction. In case ZOOZ will not be successful to reach its cost reduction targets during the

next couple of years, this may prejudice ZOOZ’s profitability and market penetration.

Substantial

increases in the prices for ZOOZ’s materials could reduce its margins if ZOOZ cannot recoup the increased costs through increased

sale prices on its products. Furthermore, fluctuations in fuel costs, or other economic conditions, may cause ZOOZ to experience significant

increases in freight charges and material costs. Moreover, any attempts to increase prices in response to increased material costs could

increase the difficulty of selling at attractive prices to customers and lead to losing opportunities and cancellations of customer orders.

If ZOOZ is unable to effectively manage its supply chain and respond to disruptions to its supply chain in a cost-efficient manner, ZOOZ

may fail to achieve the financial results it expects or that financial analysts and investors expect, and ZOOZ’s business, prospects,

financial condition, and operating results may be adversely affected.

In

addition, ZOOZ supply chain, and especially materials and components which are sourced in the east (China, India and others) is subject

to delays and increased cost due to the geo-political situation and the conflict with the Houthis regime in Yemen, preventing sea transportation

of good to Israel through the red sea.

ZOOZ’s

business is subject to risks associated with construction, cost overruns and delays, and other contingencies that may arise in the course

of completing installations, and such risks may increase in the future.

The

installation of ZOOZ’s products at a particular site is generally subject to oversight and regulation in accordance with state

and local laws and ordinances relating to safety, environmental protection and related matters, and typically requires various local

and other governmental approvals and permits that may vary by jurisdiction. Meaningful delays or cost overruns may impact ZOOZ’s

recognition of revenue in certain cases and/or impact customer relationships, either of which could impact ZOOZ’s business and

profitability.

Furthermore,

ZOOZ may install its products at customer sites as part of offering a turnkey solution. Working with contractors may require ZOOZ to

obtain licenses or require it or its customers to comply with additional rules, working conditions and other union requirements, which

can add costs and complexity to an installation project. In addition, if these contractors are unable to provide timely, thorough and

quality installation-related services, customers could fall behind their construction schedules leading to liability to ZOOZ or cause

customers to become dissatisfied with the solutions it offers.

ZOOZ

has a limited operating history.

ZOOZ

began operations in 2013 and operates in the EV charging infrastructure market, which is rapidly evolving. As a result, there is limited

information about the market which puts at risk plans and/or projections of ZOOZ to achieve its goals. In addition, ZOOZ also does not

yet have enough information to validate the value of its solution to customers, and its ability to support them along the lifetime of

the charging infrastructure. If the assumptions ZOOZ uses to plan and operate its business are incorrect or change, ZOOZ’s results

of operations could differ materially from its expectations and its business, financial condition and results of operations could be

materially adversely affected.

The

EV charging infrastructure market is at an early stage, which requires additional development and market acceptance.

The

EV charging infrastructure market is at an early stage, which causes lack of evidence / history that market trends will progress as expected.

As a result, the market is still in learning phase, which results in a few numbers of players and customers to adequately comprehend

the problem that ZOOZ is intending to solve (and ZOOZ cannot guarantee that it will be comprehended as ZOOZ anticipates in the future).

In addition, in light of the early stage at which ZOOZ’s market is positioned, ZOOZ believes that the market players (potential

customers and partners) are not yet able to evaluate the technological solutions available (ZOOZ’s and those of its competitors)

and make a knowledgeable decision.

If

ZOOZ is unable to attract, retain, and motivate key employees and hire qualified management, technical, engineering and sales personnel,

ZOOZ’s ability to compete and successfully grow its business would be harmed and could diminish anticipated benefits.

ZOOZ’s

success depends, in part, on its continuing ability to identify, hire, attract, motivate, train, develop and retain highly qualified

personnel critical to the business and operations of ZOOZ. The inability to do so effectively would adversely affect ZOOZ’s business.

The success of ZOOZ will depend in part on the attraction, retention and motivation of executive personnel. Executives and key employees

may experience uncertainty about their future roles with ZOOZ. In addition, competitors may recruit its management and / or key personnel.

If ZOOZ is unable to attract, retain and motivate executive and key personnel that are critical to successful operations, it could face

disruptions in operations and strategic relationships, loss of key information, loss expertise or know-how and unanticipated recruitment

and onboarding costs and may harm ZOOZ’s ability to reach its business, technological and operational goals.

ZOOZ

is expanding operations internationally, which will expose us to additional risks of tax, compliance, market and other risks.

Currently,

ZOOZ’s primary operations are in Israel, Germany, the U.K. and the U.S. In addition, ZOOZ is continuing to invest to increase its

presence in its target markets. Managing this expansion requires additional resources and controls, and could subject ZOOZ to risks associated

with international operations, including:

| ● | difficulties

in staffing and managing foreign operations in an environment of diverse culture, laws, and

customers, and the increased travel, infrastructure, legal and compliance costs associated

with international operations; |

| ● | Products’

deliveries and installation challenges, including those associated with local licensing and

permitting requirements; |

| ● | compliance

with multiple, potentially conflicting and changing governmental laws, regulations, certifications,

and permitting processes including environmental, banking, employment and tax laws and regulations; |

| ● | compliance

with U.S. and foreign anti-bribery laws including the Foreign Corrupt Practices Act (“FCPA”); |

| ● | conforming

products to various international regulatory and safety requirements; |

| ● | difficulty

in establishing, staffing and managing foreign operations; |

| ● | difficulties

in collecting payments in foreign currencies and associated foreign currency exposure; |

| ● | restrictions

on repatriation of earnings; |

| ● | local

or regional economic and political conditions. |

In

addition, any continued expansion is likely to involve the incurrence of significant upfront capital expenditures. Furthermore, such

efforts to expand to new territories, which require significant resource allocation, may cause defocus of the penetration efforts into

territories where ZOOZ is already active and jeopardize the success of ZOOZ in those territories. As a result of these risks, ZOOZ’s

current expansion efforts and any potential future international expansion efforts may not be successful.

ZOOZ

may be adversely affected by inflationary or market fluctuations, including impact of tariffs, in the cost of products consumed in providing

its services.

The

prices ZOOZ pays for the principal items it consumes in performing its services are dependent primarily on current market prices.

Storage

solutions and charging systems for EVs are impacted by commodity pricing factors, including the impact of tariffs, which in many cases

are unpredictable and outside of ZOOZ’s control. ZOOZ will seek to pass on to customers such increased costs but sometimes it will

not be able to do so.

The

EV charging market and energy storage market currently benefit from the availability of rebates, tax credits and other financial incentives

from governments, utilities and others to offset the purchase or operating cost of EVs, EV charging stations and energy storage systems.

The reduction, modification, or elimination of such benefits, or any delay in payment could cause reduced demand for ZOOZ’s products

or delay their purchase or production, which would adversely affect its financial results.

State

and local governments provide rebates, tax credits, and other financial incentives to end users, purchasers and in some cases to manufacturers

of EVs, charging stations, and/or energy storage systems. The EV and energy storage markets rely on governmental rebates, tax credits

and other financial incentives to significantly reduce the effective price to customers and/or create incentives to manufacturers. Incentives

may, however, expire on a certain date, run out when funding is exhausted, or be reduced or terminated as a matter of regulatory or legislative

policy. In addition, there may be delays in the payment of rebates, or in the recognition of tax credits, which could affect the timing

of purchases by customers and also result in a delay or reduction in the production cycle. In addition, some of those incentives are

conditioned with manufacturing of related equipment (such as energy storage systems) locally and as long as ZOOZ is not manufacturing

locally its products, it may not be eligible to such financial incentives. All of these events could result in an adverse effect on ZOOZ’s

financial results.

Changes

to fuel economy standards or changes to governments’ regulations and policies in relation to environment or the success of alternative

fuels may negatively impact the EV market and thus the demand for ZOOZ’s products and services.

As

regulatory initiatives have required an increase in the mileage capabilities of cars, consumption of renewable transportation fuels,

such as ethanol and biodiesel, and consumer acceptance of EVs and other alternative vehicles has been increasing. If fuel efficiency

of non-electric vehicles continues to rise, whether as the result of regulations or otherwise, and affordability of vehicles using renewable

transportation fuels improves, or other factors (such as batteries prices) will increase the cost and /or reduce the attractiveness of

EVs, the demand for EVs could diminish. In addition, the EV fueling model is different than gas or other fuel models, requiring behavior

change and education of influencers, consumers and others such as regulatory bodies. Developments in alternative technologies, such as

advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine,

may materially and adversely affect demand for EVs and EV charging stations. Regulatory bodies may also adopt rules that substantially

favor certain alternatives to petroleum-based propulsion over others, which may not necessarily be EVs. This may impose additional obstacles

to the purchase of EVs or the development of a more ubiquitous EV market.

If

any of the above cause or contribute to consumers or businesses to no longer purchase EVs or purchase them at a lower rate or limit their

availability and presence in the market, it would materially and adversely affect ZOOZ’s business, operating results, financial

condition and prospects.

ZOOZ’s

future growth and success is partly correlated with and thus dependent upon the continuing rapid adoption of EVs for passenger and fleet

applications, and the need for widespread ultra-fast charging infrastructure to support the accelerated transition to electrical vehicles.

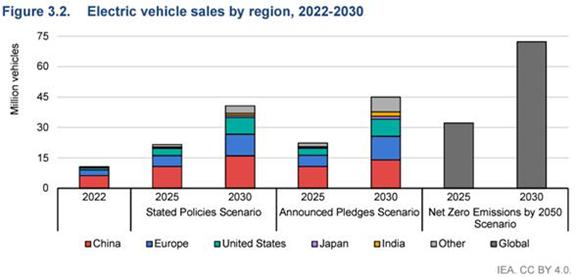

ZOOZ

is highly dependent on businesses and consumers adopting EVs in the upcoming years. With rapid changes in technology, competitive pricing,

and competitive factors, the market for electric vehicles is still rapidly evolving. Consumer demands and behaviors are changing, as