FALSE000156604400015660442024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________________________________________________

FORM 8-K

___________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 9, 2024

___________________________________________________________________________________________________________

VYNE Therapeutics Inc.

(Exact name of registrant as specified in its charter)

___________________________________________________________________________________________________________

| | | | | | | | |

| Delaware | 001-38356 | 45-3757789 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification Number) |

685 Route 202/206 N., Suite 301

Bridgewater, New Jersey 08807

(Address of principal executive offices, including Zip Code)

(800) 775-7936

(Registrant’s telephone number, including area code)

___________________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, $0.0001 par value | | VYNE | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, VYNE Therapeutics Inc. issued a press release announcing its financial results for the quarter ended March 31, 2024. The press release is being furnished as Exhibit 99.1 to this Current Report.

The information in Item 2.02 of this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are being furnished herewith.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| VYNE THERAPEUTICS INC. |

| | |

Date: May 9, 2024 | By: | /s/ Mutya Harsch |

| | Mutya Harsch

Chief Legal Officer and General Counsel |

Exhibit 99.1

VYNE Reports First Quarter 2024 Financial Results and Provides Business Update

•Design of Phase 2b trial for VYN201 in nonsegmental vitiligo finalized and on track to begin this quarter

•Phase 2b trial expected to enroll approximately 160 subjects with either active or stable nonsegmental vitiligo and will evaluate VYN201 gel in 1%, 2% and 3% concentrations compared to vehicle for 24 weeks, followed by a 28-week active treatment extension

•IND clearance received for oral BD2-selective BET inhibitor, VYN202; anticipate first healthy volunteers to be dosed in Phase 1a SAD/MAD trial this quarter

BRIDGEWATER, N.J., May 9, 2024 -- VYNE Therapeutics Inc. (Nasdaq: VYNE) (“VYNE” or the “Company”), a clinical-stage biopharmaceutical company focused on developing proprietary, innovative and differentiated therapies for the treatment of immuno-inflammatory conditions, today announced financial results as of and for the three months ended March 31, 2024 and provided a business update.

“During the first quarter, we made steady progress in advancing our VYN201 program toward a Phase 2b trial," said David Domzalski, President and CEO of VYNE. "We are rapidly activating clinical trial sites and expect to dose the first subject in the trial this quarter. In addition, we recently received IND clearance for our VYN202 program to proceed and expect to dose the first healthy volunteers in our Phase 1a trial this quarter. We look forward to updating our stakeholders on our progress in the coming months."

Recent Pipeline Updates

VYN201, a locally-administered pan-BD BET inhibitor:

•VYNE expects to enroll the first vitiligo subject in the Phase 2b trial for VYN201 this quarter. The Phase 2b trial will enroll subjects with either active or stable nonsegmental vitiligo and will be a randomized, double-blind, vehicle-controlled trial evaluating the efficacy, safety and pharmacokinetics of once-daily VYN201 gel in three dose cohorts (1%, 2% and 3% concentrations) compared to vehicle for 24 weeks. Subjects will be randomized at 1:1:1:1 ratio. Following the 24-week treatment period, subjects in the vehicle group will be equally re-randomized to receive VYN201 1%, 2% or 3% gel for an additional 28 weeks. VYNE expects to enroll approximately 40 subjects in each arm and to report top-line results from the 24-week double-blind portion of the trial in mid-2025.

VYN202, an oral small molecule BD2-selective BET inhibitor:

•VYNE's Investigational New Drug application for VYN202 was recently cleared by the U.S. Food & Drug Administration, and VYNE expects to dose the first healthy volunteers in the Phase 1a single ascending dose/multiple ascending dose ("SAD/MAD") trial this quarter. VYNE expects to report top-line results from the SAD/MAD trial in the second half of this year. If the Phase 1a trial is successfully completed, VYNE plans to initiate Phase 1b trials in subjects with moderate-to-severe plaque psoriasis and moderate-to-severe adult-onset rheumatoid arthritis, with top-line results anticipated in the second half of 2025.

Upcoming Conference Participation

•2024 Society for Investigative Dermatology Annual Meeting - Dr. Iain Stuart, Chief Scientific Officer of VYNE, will present preclinical and Phase 1b data for VYN201 in vitiligo. The conference is being held on May 15-18, 2024 in Dallas, Texas.

Financial Results as of and for the First Quarter Ended March 31, 2024

Cash position. As of March 31, 2024, VYNE had cash, cash equivalents, restricted cash and marketable securities of $86.0 million. VYNE believes its cash, cash equivalents, restricted cash and marketable securities as of March 31, 2024 will be sufficient to fund its operations through the end of 2025. See Note 1 to VYNE’s unaudited interim condensed consolidated financial statements included in VYNE’s Quarterly Report on Form 10-Q filed today for additional discussion on liquidity and capital resources.

Revenues. Revenues totaled $0.1 million for each of the three months ended March 31, 2024 and 2023, consisting of royalty revenue from the Company's royalty agreement with LEO Pharma, to whom VYNE previously licensed the rights to Finacea foam.

Research and development expenses. VYNE’s research and development expenses for the quarter ended March 31, 2024 were $3.7 million, representing an increase of $1.0 million, or 35.6%, compared to $2.7 million for the quarter ended March 31, 2023. The increase was primarily driven by preparatory activities for the Phase 1 trials for VYN202 and Phase 2b trial for VYN201 of $0.7 million and $0.3 million, respectively.

General and administrative expenses. VYNE’s general and administrative expenses for the quarter ended March 31, 2024 were $3.8 million, representing an increase of $0.5 million, or 16.4%, compared to $3.2 million for the quarter ended March 31, 2023. The increase was primarily driven by $0.3 million of consulting and professional fees and $0.2 million of employee-related expenses.

Net loss. Net loss and net loss per share for the quarter ended March 31, 2024 were $6.2 million and $0.15, respectively, compared to a net loss and net loss per share of $5.6 million and $1.74, respectively for the comparable period in 2023.

About VYNE Therapeutics Inc.

VYNE’s mission is to improve the lives of patients by developing proprietary, innovative and differentiated therapies for the treatment of immuno-inflammatory conditions. The Company’s unique and proprietary bromodomain & extra-terminal (BET) domain inhibitors, which comprise its InhiBET™ platform, include a locally administered pan-BD BET inhibitor (VYN201) and an orally available BD2-selective BET inhibitor (VYN202) that were licensed from Tay Therapeutics Limited.

For more information about VYNE Therapeutics Inc. or its product candidates, visit www.vynetherapeutics.com. VYNE may use its website to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor VYNE’s website in addition to following its press releases, filings with the U.S. Securities and Exchange Commission, public conference calls, and webcasts.

Investor Relations:

John Fraunces

LifeSci Advisors, LLC

917-355-2395

jfraunces@lifesciadvisors.com

Tyler Zeronda

VYNE Therapeutics Inc.

908-458-9106

Tyler.Zeronda@VYNEtx.com

Cautionary Statement Regarding Forward-Looking Statements

This release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding future clinical trials for VYN201 and VYN202, the expected timing for reporting top-line results from those trials, and VYNE’s projected cash runway, and other statements regarding the future expectations, plans and prospects of VYNE. All statements in this press release which are not historical facts are forward-looking statements. Any forward-looking statements are based on VYNE’s current knowledge and its present beliefs and expectations regarding possible future events and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially and adversely from those set forth or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: VYNE’s ability to successfully develop its product candidates; the timing of commencement of future preclinical studies and clinical trials; VYNE’s ability to complete and receive favorable results from clinical trials of its product candidates; VYNE’s ability to obtain additional funding, either through equity or debt financing transactions or collaboration arrangements; and VYNE’s ability to comply with various regulations applicable to its business. For a discussion of other risks and uncertainties, and other important factors, any of which could cause VYNE’s actual results to differ from those contained in the forward-looking statements, see the section titled “Risk Factors” in VYNE’s Annual Report on Form 10-K for the year ended December 31, 2023, and VYNE’s other filings from time to time with the U.S. Securities and Exchange Commission. Although VYNE believes these forward-looking statements are reasonable, they speak only as of the date of this announcement and VYNE undertakes no obligation to update publicly such forward-looking statements to reflect subsequent events or circumstances, except as otherwise required by law. Given these risks and uncertainties, you should not rely upon forward-looking statements as predictions of future events.

VYNE THERAPEUTICS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | |

| March 31 | | December 31 |

| 2024 | | 2023 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 19,065 | | | $ | 30,620 | |

| Restricted cash | 54 | | | 54 | |

| | | |

| Investment in marketable securities | 66,885 | | | 62,633 | |

| | | |

| | | |

| | | |

| | | |

| Prepaid and other expenses | 4,219 | | | 2,656 | |

| | | |

| | | |

| Total Current Assets | 90,223 | | | 95,963 | |

| Non-current Assets: | | | |

| | | |

| Operating lease right-of-use assets | 180 | | | 207 | |

| Non-current prepaid expenses and other assets | 1,273 | | | 1,515 | |

| | | |

| Total Non-current Assets | 1,453 | | | 1,722 | |

| Total Assets | $ | 91,676 | | | $ | 97,685 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current Liabilities: | | | |

| Trade payables | $ | 2,795 | | | $ | 1,659 | |

| Accrued expenses | 3,642 | | | 4,119 | |

| | | |

| Employee related obligations | 376 | | | 1,645 | |

| | | |

| Operating lease liabilities | 117 | | | 115 | |

| | | |

| | | |

| Total Current Liabilities | 6,930 | | | 7,538 | |

| | | |

| | | |

| | | |

| | | |

Long-term Liabilities: | | | |

| Non-current operating lease liabilities | 63 | | | 99 | |

| Other liabilities | 1,313 | | | 1,313 | |

| Total Long-term Liabilities | 1,376 | | | 1,412 | |

| Total Liabilities | 8,306 | | | 8,950 | |

| | | |

| Commitments and Contingencies | | | |

| | | |

| | | |

| | | |

| | | |

| Stockholders' Equity: | | | |

| Preferred stock: $0.0001 par value; 20,000,000 shares authorized at March 31, 2024 and December 31, 2023, respectively; no shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | — | | | — | |

| Common stock: $0.0001 par value; 150,000,000 shares authorized at March 31, 2024 and December 31, 2023; 14,301,688 and 14,098,888 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 1 | | | 1 | |

| Additional paid-in capital | 781,024 | | | 780,044 | |

| Accumulated other comprehensive (loss) income | (70) | | | 26 | |

| Accumulated deficit | (697,585) | | | (691,336) | |

| Total Stockholders' Equity | 83,370 | | | 88,735 | |

| Total Liabilities and Stockholders’ Equity | $ | 91,676 | | | $ | 97,685 | |

VYNE THERAPEUTICS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Revenues | | | | | | | |

| | | | | | | |

| | | | | | | |

| Royalty revenues | $ | 98 | | | $ | 99 | | | | | |

| Total Revenues | 98 | | | 99 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating Expenses: | | | | | | | |

| Research and development | 3,708 | | | 2,734 | | | | | |

| General and administrative | 3,770 | | | 3,240 | | | | | |

| | | | | | | |

| | | | | | | |

| Total Operating Expenses | 7,478 | | | 5,974 | | | | | |

| Operating Loss | (7,380) | | | (5,875) | | | | | |

| | | | | | | |

| Other income, net | 1,139 | | | 263 | | | | | |

| Loss from continuing operations before income taxes | (6,241) | | | (5,612) | | | | | |

| Income tax expense | — | | | — | | | | | |

| Loss from continuing operations | (6,241) | | | $ | (5,612) | | | | | |

| Loss from discontinued operations, net of income taxes | (8) | | | (10) | | | | | |

| Net Loss | $ | (6,249) | | | $ | (5,622) | | | | | |

| | | | | | | |

| Loss per share from continuing operations, basic and diluted | $ | (0.15) | | | $ | (1.74) | | | | | |

| Loss per share from discontinued operations, basic and diluted | $ | 0.00 | | | $ | 0.00 | | | | | |

| Loss per share, basic and diluted | $ | (0.15) | | | $ | (1.74) | | | | | |

| | | | | | | |

| Weighted average shares outstanding - basic and diluted | 42,581 | | | 3,255 | | | | | |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

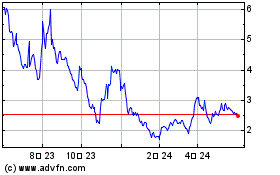

VYNE Therapeutics (NASDAQ:VYNE)

過去 株価チャート

から 4 2024 まで 5 2024

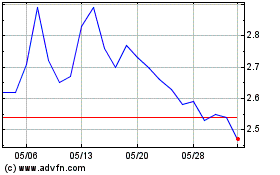

VYNE Therapeutics (NASDAQ:VYNE)

過去 株価チャート

から 5 2023 まで 5 2024