Instil Bio, Inc. (“Instil”) (Nasdaq: TIL), a clinical-stage

biopharmaceutical company focused on developing a pipeline of novel

therapies, today reported its second quarter 2024 financial results

and provided a corporate update.

“We have expanded our pipeline with a pair of

clinical-stage, potentially best-in-class therapeutics by

in-licensing SYN-2510 and SYN-27M,” said Bronson Crouch, CEO of

Instil. “By executing a 15-year lease of our Tarzana cell therapy

manufacturing facility, we have strengthened our financial

foundation to support Instil’s near-term clinical development of

these assets.”

Recent Highlights:

- In-licensed SYN-2510 and

SYN-27M: In August 2024, SynBioTx, Inc., a wholly owned

subsidiary of Instil, entered into a license and collaboration

agreement with ImmuneOnco (HKEX:1541) for the exclusive global

development and commercialization rights outside of Greater China

of SYN-2510, a potentially best-in-class PD-L1xVEGF bispecific

antibody, and SYN-27M, a next-generation ADCC-enhanced CTLA-4

antibody. SYN-2510 and SYN-27M have completed Phase 1a dose

escalation studies in multiple solid tumor types in China, and

ImmuneOnco is continuing patient enrollment in both programs to

support dose optimization and dose expansion.

- Executed lease of our cell

therapy manufacturing facility to AstraZeneca Pharmaceuticals

LP: In July 2024, Instil reported the execution of a lease

of its U.S. cell therapy manufacturing facility to AstraZeneca

Pharmaceuticals LP. Under the terms of the agreement, initial base

rent is greater than $7.5 million annually, and escalates at 3% per

annum, with the tenant also required to pay certain operating

expenses and tax expenses, subject to certain rent abatement in the

first year of the 15-year lease term.

- Exploring

further opportunities to in-license or acquire novel therapeutic

candidates: Instil continues to explore further

opportunities to in-license or otherwise acquire novel therapeutic

candidates with first-in-class or best-in-class potential.

- Cash runway expected beyond

2026.

Second Quarter 2024 Financial and Operating

Results:

As of June 30, 2024, Instil had cash, cash

equivalents, marketable securities and long-term investments of

$152.6 million, which consisted of $6.8 million in cash

and cash equivalents, $141.8 million in marketable securities,

and $4.0 million in long-term investments, compared to

$175.0 million in cash, cash equivalents, marketable

securities and long-term investments as of December 31, 2023,

consisting of $9.2 million in cash and cash equivalents,

$1.5 million in restricted cash, $141.2 million in

marketable securities, and $23.2 million in long-term investments.

Instil expects that its cash, cash equivalents, marketable

securities and long-term investments as of June 30, 2024 will

enable it to fund its operating plan beyond 2026.

Research and development expenses were $2.9 million

and $10.2 million for the three and six months ended June 30,

2024, respectively, compared to $8.5 million and $29.1 million for

the three and six months ended June 30, 2023,

respectively.

General and administrative expenses were $10.7

million and $23.1 million for the three and six months ended

June 30, 2024, respectively, compared to $11.5 million and

$24.7 million for the three and six months ended June 30,

2023, respectively.

Restructuring and impairment charges were $0.5

million and $4.8 million for the three and six months ended

June 30, 2024, respectively, compared to $1.0 million and

$25.6 million for three and six months ended June 30, 2023,

respectively.

Net loss per share, basic and diluted were $2.29

and $6.03 for the three and six months ended June 30, 2024,

respectively, compared to $2.87 and $11.64 for the three and six

months ended June 30, 2023, respectively. Non-GAAP net loss

per share, basic and diluted, were $1.57 and $3.95 for the three

and six months ended June 30, 2024, respectively, compared to

$2.03 and $6.33 for the three and six months ended June 30,

2023, respectively.

Note Regarding Use of Non-GAAP Financial

Measures

In this press release, Instil has presented certain

financial information that has not been prepared in accordance with

U.S. generally accepted accounting principles (“GAAP”). These

non-GAAP financial measures include non-GAAP net loss and non-GAAP

net loss per share, which are defined as net loss and net loss per

share, respectively, excluding non-cash stock-based compensation

expense and restructuring and impairment charges. Instil believes

that these non-GAAP financial measures, when considered together

with the GAAP figures, can enhance an overall understanding of

Instil’s financial performance. The non-GAAP financial measures are

included with the intent of providing investors with a more

complete understanding of Instil’s operating results. In addition,

these non-GAAP financial measures are among the indicators Instil’s

management uses for planning purposes and to measure Instil’s

performance. These non-GAAP financial measures should be considered

in addition to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. The non-GAAP

financial measures used by Instil may be calculated differently

from, and therefore may not be comparable to, non-GAAP financial

measures used by other companies. Please refer to the below

reconciliation of these non-GAAP financial measures to the

comparable GAAP financial measures.

About Instil Bio

Instil Bio is a clinical-stage biopharmaceutical

company focused on developing a pipeline of novel therapies.

Instil’s lead asset, SYN-2510, is a novel and differentiated

PD-L1xVEGF bispecific antibody in development for the treatment of

multiple solid tumor cancers. For more information visit

www.instilbio.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Words such as “anticipates,” “believes,”

“expects,” “expected,” “exploring,” “future,” “intends,” “may,”

“plans,” “potential,” “projects,” and “will” or similar expressions

are intended to identify forward-looking statements.

Forward-looking statements include express or implied statements

regarding our expectations with respect to the license and

collaboration agreement with ImmuneOnco, the therapeutic potential

of SYN-2510 and SYN-27M, clinical development of SYN-2510 and

SYN-27M and the generation of clinical data for SYN-2510 and

SYN-27M; concerning or implying our ability to acquire and develop

additional product candidates; our research, development and

regulatory plans for our product candidates; our expectations

regarding our capital position, resources, and balance sheet and

the expected impact of the lease of our U.S. manufacturing facility

with respect thereto, and the potential impact thereof on the

development of any product candidates; and other statements that

are not historical fact. Forward-looking statements are based on

management's current expectations and are subject to various risks

and uncertainties that could cause actual results to differ

materially and adversely from those expressed or implied by such

forward-looking statements, including risks and uncertainties

associated with acquiring additional product candidates, the costly

and time-consuming drug product development process and the

uncertainty of clinical success; the risks inherent in relying on

collaborators and other third parties, including for manufacturing

and generating clinical data, and the ability to rely on any such

data from clinical trials in China in regulatory filings submitted

to regulatory authorities outside of China; the risks and

uncertainties related to successfully initiating, enrolling,

completing and reporting data from clinical studies, particularly

collaborator-led clinical trials, as well as the risks that results

obtained in any clinical trials to date may not be indicative of

results obtained in ongoing or future trials and that our product

candidates may otherwise not be effective treatments in their

planned indications; risks related to macroeconomic conditions,

including as a result of international conflicts and U.S.-China

trade and political tensions, as well as interest rates, inflation,

and other factors, which could materially and adversely affect our

business and operations; the risks and uncertainties associated

with the time-consuming and uncertain regulatory approval process

and the sufficiency of our cash resources; and other risks and

uncertainties affecting us and our plans and development programs,

including those discussed in the section titled “Risk Factors” in

our Quarterly Report on Form 10-Q for the quarter ended

June 30, 2024 to be filed with the SEC, as well as our other

filings with the SEC. Additional information will be made available

in other filings that we make from time to time with the SEC.

Accordingly, these forward-looking statements do not constitute

guarantees of future performance, and you are cautioned not to

place undue reliance on these forward-looking statements. These

forward-looking statements speak only as the date hereof, and we

disclaim any obligation to update these statements except as may be

required by law.

Contacts:

Investor

Relations:1-972-499-3350

investorrelations@instilbio.comwww.instilbio.com

|

INSTIL BIO, INC.SELECTED FINANCIAL

DATA (Unaudited; in thousands, except share and per share

amounts)Selected Condensed Consolidated Balance Sheet

Data |

|

|

|

|

June 30, 2024 |

|

December 31, 2023 |

|

Cash, cash equivalents, restricted cash, marketable securities and

long-term investments |

$ |

152,578 |

|

$ |

175,018 |

|

Total assets |

$ |

294,316 |

|

$ |

325,630 |

|

Total liabilities |

$ |

99,297 |

|

$ |

99,801 |

|

Total stockholders’ equity |

$ |

195,019 |

|

$ |

225,829 |

|

Condensed Consolidated Statements of

Operations |

|

|

|

|

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

$ |

2,921 |

|

|

$ |

8,459 |

|

|

$ |

10,177 |

|

|

$ |

29,129 |

|

|

General and administrative |

|

10,706 |

|

|

|

11,518 |

|

|

|

23,130 |

|

|

|

24,740 |

|

|

Restructuring and impairment charges |

|

508 |

|

|

|

1,010 |

|

|

|

4,783 |

|

|

|

25,564 |

|

|

Total operating expenses |

|

14,135 |

|

|

|

20,987 |

|

|

|

38,090 |

|

|

|

79,433 |

|

|

Loss from operations |

|

(14,135 |

) |

|

|

(20,987 |

) |

|

|

(38,090 |

) |

|

|

(79,433 |

) |

|

Interest income |

|

1,919 |

|

|

|

2,287 |

|

|

|

3,981 |

|

|

|

4,358 |

|

|

Interest expense |

|

(1,999 |

) |

|

|

(590 |

) |

|

|

(3,980 |

) |

|

|

(1,226 |

) |

|

Other (expense) income, net |

|

(702 |

) |

|

|

628 |

|

|

|

(1,130 |

) |

|

|

571 |

|

|

Net loss |

$ |

(14,917 |

) |

|

$ |

(18,662 |

) |

|

$ |

(39,219 |

) |

|

$ |

(75,730 |

) |

|

Net loss per share, basic and diluted |

$ |

(2.29 |

) |

|

$ |

(2.87 |

) |

|

$ |

(6.03 |

) |

|

$ |

(11.64 |

) |

|

Weighted-average shares used in computing net loss per share, basic

and diluted |

|

6,503,913 |

|

|

|

6,503,913 |

|

|

|

6,503,913 |

|

|

|

6,503,913 |

|

|

INSTIL BIO, INC.Reconciliation of GAAP to

Non-GAAP Net Loss and Net Loss per Share (Unaudited; in

thousands, except share and per share amounts) |

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net loss |

$ |

(14,917 |

) |

|

$ |

(18,662 |

) |

|

$ |

(39,219 |

) |

|

$ |

(75,730 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expense |

|

4,173 |

|

|

|

4,413 |

|

|

|

8,688 |

|

|

|

8,943 |

|

|

Restructuring and impairment charges |

|

508 |

|

|

|

1,010 |

|

|

|

4,783 |

|

|

|

25,564 |

|

|

Non-GAAP net loss |

$ |

(10,236 |

) |

|

$ |

(13,239 |

) |

|

$ |

(25,748 |

) |

|

$ |

(41,223 |

) |

|

Net loss per share, basic and diluted |

$ |

(2.29 |

) |

|

$ |

(2.87 |

) |

|

$ |

(6.03 |

) |

|

$ |

(11.64 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expense per share |

|

0.64 |

|

|

|

0.68 |

|

|

|

1.34 |

|

|

|

1.38 |

|

|

Restructuring and impairment charges per share |

|

0.08 |

|

|

|

0.16 |

|

|

|

0.74 |

|

|

|

3.93 |

|

|

Non-GAAP net loss per share, basic and diluted* |

$ |

(1.57 |

) |

|

$ |

(2.03 |

) |

|

$ |

(3.95 |

) |

|

$ |

(6.33 |

) |

|

Weighted-average shares outstanding, basic and diluted |

|

6,503,913 |

|

|

|

6,503,913 |

|

|

|

6,503,913 |

|

|

|

6,503,913 |

|

* Non-GAAP net loss per share, basic and diluted

may not total due to rounding.

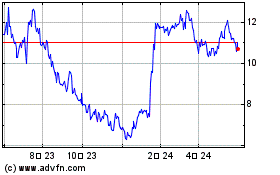

Instill Bio (NASDAQ:TIL)

過去 株価チャート

から 11 2024 まで 12 2024

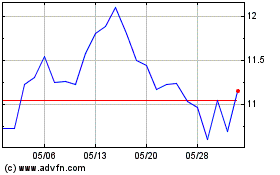

Instill Bio (NASDAQ:TIL)

過去 株価チャート

から 12 2023 まで 12 2024