UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION

12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to

_________.

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

Commission file number: 001-38773

China SXT Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in its Charter)

British Virgin Islands

(Jurisdiction of Incorporation or Organization)

178 Taidong Rd North, Taizhou

Jiangsu, China

(Address of Principal Executive Offices)

Feng Zhou

178 Taidong Rd North, Taizhou

Jiangsu, China

+86- 523-86298290

(Name, Telephone, E-mail and/or Facsimile Number

and Address of Company Contact Person)

Securities registered or to be registered pursuant

to Section 12(b) of the Act:

| Title of Each Class | | Name of Each Exchange On Which Registered |

| Ordinary shares, par value US$0.08 per share | | NASDAQ Capital Market |

Securities registered or to be registered pursuant

to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act:

None

(Title of Class)

The

number of outstanding shares of each of the issuer’s classes of capital or common stock as of March 31, 2023 was:

11,434,129 ordinary shares, par value $0.08 per

share.

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large

accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Emerging growth company ☒ |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange

Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting

the registrant has used to prepare the financial statements included in this filing:

| ☒ U.S. GAAP | ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ Other |

If “Other” has been checked in response

to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item

18 ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

CHINA SXT PHARMACEUTICALS, INC.

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

PART I

CERTAIN INFORMATION

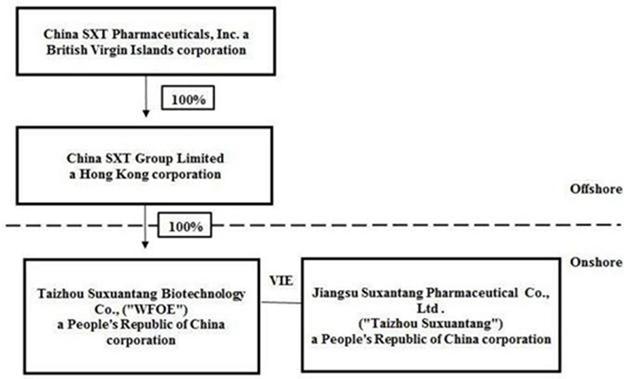

In this annual report on Form

20-F, unless otherwise indicated, “we,” “us,” “our company” and “our” refer to China SXT

Pharmaceuticals, Inc. and its consolidated subsidiaries and the VIE; we conduct operations in China through our subsidiaries and the VIE.

“China SXT” or “the Company” refers to China SXT Pharmaceuticals, Inc., a company organized in the British Virgin

Islands. “SXT HK” refers to China SXT Group Limited, a Hong Kong Corporation. “WFOE” refers to Taizhou Suxuantang

Biotechnology Co. Ltd., a limited liability company organized under the laws of the PRC. “Taizhou Suxuantang” or “the

VIE” refers to Jiangsu Suxuantang Pharmaceutical Co., Ltd., a limited liability company organized under the laws of the PRC.

We are a holding company incorporated

in the British Virgin Islands and not a Chinese operating company. As a holding company with no material operations of our own, we conduct

our operations through our subsidiaries in China and the VIE in China. For accounting purposes, we are deemed as the primary beneficiary

of the VIE pursuant to the certain contractual arrangements (the “VIE Agreements”), and can consolidate the financial results

of the VIE in our consolidated financial statements under generally accepted accounting principles in the U.S. (“U.S. GAAP”),

and the structure involves unique risks to investors. Our shareholders hold equity interest in China SXT, the offshore holding company

in the British Virgin Islands, instead of equity interest in our subsidiaries or the VIE in China, The VIE structure provides contractual

exposure to foreign investment in China-based companies. Chinese law, however, does not prohibit direct foreign investment in the VIE.

See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure” and “Item 3. Key

Information—D. Risk Factors—Risks Related to Doing Business in China.”

Because we do not directly

hold equity interests in the VIE, we are subject to risks and uncertainties of the interpretations and applications of PRC laws and regulations,

including but not limited to, regulatory review of overseas listing of PRC companies through special purpose vehicles and the validity

and enforcement of the VIE Agreements. We are also subject to the risks and uncertainties about any future actions of the PRC government

in this regard that could disallow the VIE structure, which would likely result in a material change in our operations, and the value

of our ordinary shares (“Ordinary Shares”) may depreciate significantly or become worthless. The VIE Agreements have not been

tested in a court of law in China as of the date of this annual report. See “Item 3. Key Information—D. Risk Factors—Risks

Related to Our Corporate Structure” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business

in China.”

Unless

the context indicates otherwise, all references to “China” and the “PRC” refer to the People’s Republic

of China, all references to “Renminbi” or “RMB” are to the legal currency of the People’s Republic of China,

all references to “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States.

This annual report contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader.

We make no representation that the Renminbi or U.S. dollar amounts referred to in this report could have been or could be converted into

U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On March 31, 2023, the cash buying rate announced by the

People’s Bank of China was RMB 6.8676 to $1.00.

On May 10, 2022, the Company’s

board of directors approved an amended and restated memorandum and articles of association to effectuate a one-for-twenty (1-for-20) reverse

split for its ordinary shares (the “2022 Reverse Split”). The market effective date of 2022 Reverse Split was May 19, 2022,

which was the first day when the Company’s ordinary shares begin trading on a split-adjusted basis. The 2022 Reverse Split did not

change the number of the Company’s authorized preferred and ordinary shares, which remain as unlimited. As a result of 2022 Reverse

Split, the shareholders received one new ordinary share of the Company, par value $0.08 each, for every twenty (20) shares they hold.

No fractional ordinary shares were issued to any shareholders in connection with the reverse stock split. Each shareholder was entitled

to receive one ordinary share in lieu of the fractional share that would have resulted from the reverse stock split. The share numbers

in this annual report are all presented on a post-split basis unless otherwise noted.

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking

statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that represent our

beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking

statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and

objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements

regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives,

and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”,

“could”, “would”, “predicts”, “potential”, “continue”, “expects”,

“anticipates”, “future”, “intends”, “plans”, “believes”, “estimates”

and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily

subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance

or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied

by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including

with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, and the

accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based

on the success of our business.

Forward-looking statements

should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the

times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time

those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties

that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements.

Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “D.

Risk Factors”, “Item 5. Operating and Financial Review and Prospects,” and elsewhere in this report.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT

AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

3.A. [Reserved]

3.B. Capitalization and Indebtedness

Not Applicable.

3.C. Reasons For The Offer And Use Of Proceeds

Not Applicable.

3.D. Risk Factors

An investment in our ordinary

shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all other

information contained in this annual report, including the matters discussed under the headings “Forward-Looking Statements”

and “Item 5. Operating and Financial Review and Prospects” before you decide to invest in our ordinary shares.

We are a holding company with substantial operations in China and are subject to a legal and regulatory environment that in many respects

differs from the United States. If any of the following risks, or any other risks and uncertainties that are not presently foreseeable

to us, actually occur, our business, financial condition, results of operations, liquidity and our future growth prospects could be materially

and adversely affected.

Summary of Risk Factors

Risks Related to Our Business

Risks and uncertainties related

to our business include, but are not limited to, the following:

| |

● |

We face risks related to

natural disasters (whether or not caused by climate change), unusually adverse weather conditions, pandemic outbreaks, in

particular, the current coronavirus pandemic, terrorist acts and global political events, all of which could result in adverse

effects to our business and financial performance. See more detailed discussion of this risk factor on page 5 of this annual

report. |

| |

● |

Our significant business

lines have a limited operating history, which makes it difficult to evaluate our future prospects and results of operations. See

more detailed discussion of this risk factor on page 7 of this annual report. |

| |

● |

Our dependence on a small

number of customers could adversely affect our business or results of operations. See more detailed discussion of this risk factor

on page 8 of this annual report. |

| |

● |

Our business requires a number of permits and licenses in order to carry on their business. See more detailed discussion of this risk factor on page 10 of this annual report. |

| |

● |

Any disruption in the

supply chain of raw materials and our products could adversely impact our ability to produce and deliver products. See more detailed

discussion of this risk factor on page 9 of this annual report. |

| |

● |

Price control regulations

in the PRC may decrease our profitability. See more detailed discussion of this risk factor on page 10 of this annual

report. |

Risks Related to Our Corporate Structure

We are also subject to risks

and uncertainties related to our corporate structure, including, but are not limited to, the following:

| |

● |

We do not have direct ownership of our operating entities in China and rely on VIE Agreements with the VIE for our business operations, which may not be as effective in providing operational control or enabling us to derive benefits as through ownership of controlling equity interests. See more detailed discussion of this risk factor on page 11 of this annual report. |

| |

● |

Contractual arrangements in relation to our variable interest entity may be subject to scrutiny by the PRC tax authorities and they may determine that we or our PRC variable interest entity owe additional taxes, which could negatively affect our results of operations and the value of your investment. See more detailed discussion of this risk factor on page 12 of this annual report. |

| |

● |

The approval of the China Securities Regulatory Commission and other compliance procedures may be required in connection with this offering, and, if required, we cannot predict whether we will be able to obtain such approval. As a result, both you and us face uncertainty about future actions by the PRC government that could significantly affect our financial performance and the enforceability of the VIE Agreements. See more detailed discussion of this risk factor on page 13 of this annual report. |

| |

● |

PRC laws and regulations governing our current business operations are sometimes vague and uncertain. See more detailed discussion of this risk factor on page 14 of this annual report. |

| |

|

|

| |

● |

Uncertainties exist with respect to the interpretation and implementation of the PRC Foreign Investment Law and how it may impact the viability of our current corporate structure and business operations. |

| |

● |

We have not received or been denied any permission from the PRC authorities to list on U.S. stock exchanges. However, we face uncertainty about future actions by the PRC government that could significantly affect the operating company’s financial performance and the enforceability of the VIE Agreements. See more detailed discussion of this risk factor on page 13 of this annual report. |

| |

● |

Uncertainties exist with respect to the interpretation and implementation of the Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. See more detailed discussion of this risk factor on page 15 of this annual report. |

Risks Related to Doing Business in China

We face risks and uncertainties

relating to doing business in the PRC in general, including, but not limited to, the following:

| |

● |

Although the audit report included in this annual report is prepared by an auditor who are currently inspected by the Public Company Accounting Oversight Board (the “PCAOB”), there is no guarantee that future audit reports will be prepared by auditors inspected by the PCAOB and, as such, in the future investors may be deprived of the benefits of such inspection. Furthermore, trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act (the “HFCA Act”) if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as Nasdaq, may determine to delist our securities. Furthermore, on December 29, 2022, the Consolidated Appropriations Act, was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to Accelerating HFCA Act, which reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. See more detailed discussion of this risk factor on page 19 of this annual report. |

| |

|

|

| |

● |

The PRC government has significant authority to intervene or influence the China operations of an offshore holding company, such as ours, at any time. The PRC government may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers. If the PRC government exerts more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers and we were to be subject to such oversight and control, it may result in a material adverse change to our business operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, and cause the ordinary shares to significantly decline in value or become worthless. See more detailed discussion of this risk factor on page 21 of this annual report. |

| |

● |

The uncertainties with respect to the Chinese legal system, including uncertainties regarding the enforcement of laws, and sudden or unexpected changes in laws and regulations in China with little advance notice could adversely affect us and limit the legal protections available to you and us. See more detailed discussion of this risk factor on page 23 of this annual report. |

| |

|

|

| |

● |

We may have difficulty in enforcing any rights we may have under the VIE Agreements in PRC. See more detailed discussion of this risk factor on page 24 of this annual report. |

| |

● |

It may be difficult for overseas shareholders and/or regulators to conduct investigation or collect evidence within China. See more detailed discussion of this risk factor on page 24 of this annual report. |

| |

● |

We face exposure to foreign currency exchange rate fluctuations. See more detailed discussion of this risk factor on page 26 of this annual report. |

Risks Related to Our Ordinary Shares

In addition to the risks described

above, we are subject to general risks and uncertainties relating to our ordinary shares, including, but not limited to, the following:

| |

● |

The market price for our ordinary shares may be volatile. See more detailed discussion of this risk factor on page 16 of this annual report. |

| |

● |

For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to accounting standards and disclosure about our executive compensation, that apply to other public companies. See more detailed discussion of this risk factor on page 17 of this annual report. |

| |

● |

If we fail to establish and maintain proper internal financial reporting controls, our ability to produce accurate financial statements or comply with applicable regulations could be impaired. See more detailed discussion of this risk factor on page 17 of this annual report. |

| |

● |

As a foreign private issuer, we are not subject to certain U.S. securities law disclosure requirements that apply to a domestic U.S. issuer, and are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the NASDAQ Stock Market corporate governance listing standards. See more detailed discussion of this risk factor on page 17 of this annual report. |

| |

● |

We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. See more detailed discussion of this risk factor on page 18 of this annual report. |

| |

● |

We do not intend to pay dividends for the foreseeable future. See more detailed discussion of this risk factor on page 19 of this annual report. |

Risks Related to Our Business

We face risks related to natural disasters

(whether or not caused by climate change), unusually adverse weather conditions, pandemic outbreaks, in particular, the current coronavirus

pandemic, terrorist acts and global political events, all of which could result in adverse effects to our business and financial performance.

Global pandemics, epidemics

in China or elsewhere in the world, or fear of spread of contagious diseases, such as Ebola virus disease (EVD), COVID-19, Middle East

respiratory syndrome (MERS), severe acute respiratory syndrome (SARS), H1N1 flu, H7N9 flu, and avian flu, as well as hurricanes, earthquakes,

tsunamis, or other natural disasters could disrupt our business operations, reduce or restrict our supply of products, incur significant

costs to protect our employees and facilities, or result in regional or global economic distress, which may materially and adversely affect

our business, financial condition, and results of operations. Actual or threatened war, terrorist activities, political unrest, civil

strife, and other geopolitical uncertainty could have a similar adverse effect on our business, financial condition, and results of operations.

Any one or more of these events may impede our production and delivery efforts and adversely affect our sales results, whether short-term

or for a prolonged period of time, which could materially and adversely affect our business, financial condition, and results of operations.

COVID-19 has spread to

many countries and was declared a pandemic by the WHO, resulting in actions from national and local governments that have

significantly affected virtually all facets of the PRC and global economies. Since early 2020, Jiangsu Province, where we conduct a

substantial part of our business, was materially impacted by the COVID-19. We have been following the recommendations of local

health authorities to minimize exposure risk for our employees, including the temporary closures of our offices and production, and

having employees work remotely. Due to the material impacts of COVID-19 on our logistics, our production was picking up slowly and

returned to the normal level in May 2020. Since January 1, 2022 to December 2022, there have been outbreaks of the Omicron

variant of the COVID-19 in China and the local governments have placed lockdown and mass testing policies in several provinces,

including Jiangsu, Liaoning, Heilongjiang, Henan, and Anhui, where some of our suppliers and clients operate, which had created

disruption in the delivery of our raw materials and finished products and negatively impacted our revenue for the year ended March

31, 2023. Since January 2023 and as of the date of this annual report, the lockdown and mass testing policies had been lifted, since

December 2022 and the operations of our suppliers and clients are gradually recovering.

If there is not a material

recovery in the COVID-19 situation, or the situation further deteriorates in China, our business, results of operations and financial

condition could be materially and adversely affected. While the potential downturn brought by and the duration of the COVID-19 outbreak

is difficult to assess or predict and the full impact of the virus on our operations will depend on many factors beyond our control. Our

business, results of operations, financial condition and prospects could be materially adversely affected to the extent that COVID-19

persists in China or harms the Chinese and global economy in general.

We are also vulnerable to

natural disasters and other calamities. We cannot assure you that we are adequately protected from the effects of fire, floods, typhoons,

earthquakes, power loss, telecommunications failures, break-ins, war, riots, terrorist attacks, or similar events. Any of the foregoing

events may give rise to interruptions, damage to our place of business, delays in product deliveries, breakdowns, system failures, or

internet failures, which could adversely affect our business, financial condition, and results of operations.

We have limited sources of working capital

and will need substantial additional financing

The working capital required

to implement our business plan will most likely be provided by funds obtained through offerings of our equity, debt, debt-linked securities,

and/or equity-linked securities, and revenues generated by us. No assurance can be given that we will have revenues sufficient to sustain

our operations or that we would be able to obtain equity/debt financing in the current economic environment. If we do not have sufficient

working capital and are unable to generate sufficient revenues or raise additional funds, we may delay the completion of or significantly

reduce the scope of our current business plan; delay some of our development and clinical or marketing efforts; postpone the hiring of

new personnel; or, under certain dire financial circumstances, substantially curtail or cease our operations.

To

date, we have relied almost exclusively on organically generated revenues and financing transactions to fund our operations. Our inability

to obtain sufficient additional financing would have a material adverse effect on our ability to implement our business plan and, as

a result, could require us to significantly curtail or potentially cease our operations. As of March 31, 2023, we had cash and cash equivalents

and restricted cash of $17,368,478, total current assets of $19,521,247 and total current liabilities of $14,496,938. As

of March 31, 2022, we had cash and cash equivalents of $15,524,322, total current assets of $22,451,855 and total current liabilities

of $17,121,565. We will need to engage in capital-raising transactions in the near future. Such financing transactions may well

cause substantial dilution to our shareholders and could involve the issuance of securities with rights senior to the outstanding shares.

Our ability to complete additional financings is dependent on, among other things, the state of the capital markets at the time of any

proposed offering, market reception of the Company and the likelihood of the success of its business model and offering terms. There

is no assurance that we will be able to obtain any such additional capital through asset sales, equity or debt financing, or any combination

thereof, on satisfactory terms or at all. Additionally, no assurance can be given that any such financing, if obtained, will be adequate

to meet our capital needs and to support our operations. If we do not obtain adequate capital on a timely basis and on satisfactory terms,

our revenues and operations and the value of our Ordinary Shares and Ordinary Share equivalents would be materially negatively impacted

and we may cease our operations.

Although we were incorporated 17 years ago,

our significant business lines have a limited operating history, which makes it difficult to evaluate our future prospects and results

of operations.

We only started to produce

Directly-Oral traditional Chinese medicine pieces products (the “Directly-Oral-TCMP”) and After-soaking-oral TCMP products

(the “After-Soaking-Oral-TCMP”) as our principal products four years ago. As a result, our past operating results are not

an accurate indication of the lines of business we are principally engaged in currently. Thus, you should consider our future prospects

in light of the risks and uncertainties experienced by early stage companies in evolving markets rather than typical companies of our

age. Some of these risks and uncertainties relate to our ability to:

| |

● |

attract additional customers and increased spending per customer; |

| |

● |

increase awareness of our brand and develop customer loyalty; |

| |

● |

respond to competitive market conditions; |

| |

● |

respond to changes in our regulatory environment; |

| |

● |

manage risks associated with intellectual property rights; |

| |

● |

maintain effective control of our costs and expenses; |

| |

● |

raise sufficient capital to sustain and expand our business; |

| |

● |

attract, retain and motivate qualified personnel; and |

| |

● |

upgrade our technology to support additional research and development of new products. |

If we are unsuccessful in

addressing any of these risks and uncertainties, our business may be materially and adversely affected.

Our failure to compete effectively may adversely

affect our ability to generate revenue.

We compete with other companies,

many of whom are developing or can be expected to develop products similar to ours. Many of our competitors are also more established

than we are, and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our

competitors, such as “Huichuntang” and “Tongrentang”, have greater name recognition and a larger customer base.

These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake

more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot

assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will

not harm our business.

Our dependence on a small number of customers

could adversely affect our business or results of operations.

We

derive a substantial portion of our revenue from a relatively small number of customers. Suxuantang had three significant customers which

accounted for 30.26%, 20.02%, and 13.87% of our total revenue during the year ended March 31, 2023, respectively. We expect that Suxuantang’s

largest customers will continue to account for a substantial portion of its total net revenue for the foreseeable future. Suxuantang

has long-standing relationships with many of its significant customers. However, because Suxuantang’s customers generally contract

with a finite duration, Suxuantang may lose these customers if the contracts are not renewed or replaced. The loss or reduction of, or

failure to renew or replace, any significant contracts with any of these customers could materially reduce Suxuantang’s revenue

and cash flows. If Suxuantang does not replace them with other customers, the loss of business from any one of such customers could have

a material adverse effect on our business or results of operations.

We are dependent on certain key personnel

and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain

extent, attributable to the management, sales and marketing, and research and development expertise of key personnel. We are dependent

upon the services of Mr. Zhou, our President, Chief Executive Officer and Chairman of the Board, for the continued growth and operation

of our Company, due to his industry experience, as well as his personal and business contacts in the PRC. We may not be able to retain

Mr. Zhou for any given period of time. Although we have no reason to believe that Mr. Zhou will discontinue his services with us or Taizhou

Suxuantang, the interruption or loss of his services would adversely affect our ability to effectively run our business and pursue our

business strategy as well as our results of operations. There can be no assurance that we will be able to retain these officers after

the terms of their employment expire. The loss of these officers could have a material adverse effect upon our business, financial condition,

and results of operations. We do not carry key man life insurance for any of our key personnel, nor do we foresee purchasing such insurance

to protect against the loss of key personnel.

We may not be able to hire and retain qualified

personnel to support our growth and if we are unable to retain or hire these personnel in the future, our ability to improve our products

and implement our business objectives could be adversely affected.

We must attract, recruit and

retain a sizeable workforce of technically competent employees. Competition for senior management and personnel in the PRC is intense

and the pool of qualified candidates in the PRC is very limited. We may not be able to retain the services of our senior executives or

personnel, or attract and retain high-quality senior executives or personnel in the future. This failure could materially and adversely

affect our future growth and financial condition.

If we fail to increase our brand recognition,

we may face difficulty in obtaining new customers.

Although our brand is well-respected

in traditional Chinese medicine pieces (the “TCMP”) industry, we still believe that maintaining and enhancing our brand recognition in a cost-effective manner outside of that market

is critical to achieving widespread acceptance of our current and future products and services and is an important element in our effort

to increase our customer base. Successful promotion of our other brands, or Suxuantang outside the TCMP industry, will depend largely

on our ability to maintain a sizeable and active customer base, our marketing efforts and ability to provide reliable and useful products

and services at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue

may not offset the expenses we will incur in building our brand. If we fail to successfully promote and maintain our brand, or if we incur

substantial expenses in an unsuccessful attempt to promote and maintain our brand, we may fail to attract enough new customers or retain

our existing customers to the extent necessary to realize a sufficient return on our brand-building efforts, in which case our business,

operating results and financial condition, would be materially adversely affected.

Any disruption in the supply chain of raw

materials and our products could adversely impact our ability to produce and deliver products.

As to the products we manufacture,

we must manage our supply chain for raw materials and delivery of our products. Supply chain fragmentation and local protectionism within

China further complicates supply chain disruption risks. Local administrative bodies and physical infrastructure built to protect local

interests pose transportation challenges for raw material transportation as well as product delivery throughout China. In addition, profitability

and volume could be negatively impacted by limitations inherent within the supply chain, including competitive, governmental, legal, natural

disasters, and other events that could impact both supply and price. Any of these occurrences could cause significant disruptions to our

supply chain, manufacturing capability and distribution system that could adversely impact our ability to produce and deliver some of

our products.

Additionally, some of the

raw materials we use are procured from farmers, who can be faced with environmental risks outside of their control. If these farmers are

unable to control any environmental issues, they may not have the ability to supply continuously and stably.

Our success depends on our ability to protect

our intellectual property.

Our success depends on our

ability to obtain and maintain patent protection for products developed utilizing our technologies, in the PRC and in other countries,

and to enforce these patents. There is no assurance that any of our existing and future patents will be held valid and enforceable against

third-party infringement or that our products will not infringe any third-party patent or intellectual property. Although we have filed

additional patent applications with the Patent Administration Department of the PRC, there is no assurance that they will be granted.

Any patents relating to our

technologies may not be sufficiently broad to protect our products. In addition, our patents may be challenged, potentially invalidated

or potentially circumvented. Our patents may not afford us protection against competitors with similar technology or permit the commercialization

of our products without infringing third-party patents or other intellectual property rights.

We also rely on or intend

to rely on our trademarks, trade names and brand names to distinguish our products from the products of our competitors, and have registered

or will apply to register a number of these trademarks. However, third parties may oppose our trademark applications or otherwise challenge

our use of the trademarks. In the event that our trademarks are successfully challenged, we could be forced to rebrand our products, which

could result in loss of brand recognition and could require us to devote resources to advertising and marketing these new brands. Further,

our competitors may infringe our trademarks, or we may not have adequate resources to enforce our trademarks.

In addition, we also have

trade secrets, non-patented proprietary expertise and continuing technological innovation that we shall seek to protect, in part, by entering

into confidentiality agreements with licensees, suppliers, employees and consultants. These agreements may be breached and there may not

be adequate remedies in the event of a breach. Disputes may arise concerning the ownership of intellectual property or the applicability

of confidentiality agreements. Moreover, our trade secrets and proprietary technology may otherwise become known or be independently developed

by our competitors. If patents are not issued with respect to products arising from research, we may not be able to maintain the confidentiality

of information relating to these products.

Our TCMP business is subject to inherent

risks relating to product liability and personal injury claims.

TCMP companies, similar to

pharmaceutical companies, are exposed to risks inherent in the manufacturing and distribution of TCMP products, such as with respect to

improper filling of prescriptions, labeling of prescriptions, adequacy of warnings, and unintentional distribution of counterfeit drugs.

In addition, product liability claims may be asserted against us with respect to any of the products we sell and as a distributor, we

are required to pay for damages for any successful product liability claim against us, although we may have the right under applicable

PRC laws, rules and regulations to recover from the relevant manufacturer for compensation we paid to our customers in connection with

a product liability claim. We may also be obligated to recall affected products. If we are found liable for product liability claims,

we could be required to pay substantial monetary damages. Furthermore, even if we successfully defend ourselves against this type of claim,

we could be required to spend significant management, financial and other resources, which could disrupt our business, and our reputation

as well as our brand name may also suffer. We, like many other similar companies in China, do not carry product liability insurance. As

a result, any imposition of product liability could materially harm our business, financial condition and results of operations. In addition,

we do not have any business interruption insurance due to the limited coverage of any available business interruption insurance in China,

and as a result, any business disruption or natural disaster could severely disrupt our business and operations and significantly decrease

our revenue and profitability.

We face risks related to research and the

ability to develop new TCMP products.

Our growth and survival depend

on our ability to consistently discover, develop and commercialize new products and find new and improved technology and platforms. As

such, if we fail to make sufficient investments in research, be attentive to consumer needs or focus on the most advanced technology,

our current and future products could be surpassed by more effective or advanced products of other companies.

Our business requires a number of permits

and licenses.

Pharmaceutical companies in

China are required to obtain certain permits and licenses from various PRC governmental authorities, including passing Good Manufacturing

Practice (“GMP”) compliance-inspection without notification. We are also required to obtain a Pharmaceutical Product Permit.

Also, we participate in the

manufacture of Chinese medicine, which is subject to various PRC laws and regulations pertaining to the pharmaceutical industry. We have

obtained certificates, permits, and licenses required for the operation of a pharmaceutical enterprise and the manufacturing of pharmaceutical

products in the PRC. We are required to meet GMP standards in order to continue manufacturing pharmaceutical products. There is no guarantee

we will always be able to pass the GMP compliance-inspection in the future.

We cannot assure you that

we can maintain all required licenses, permits and pass the GMP compliance-inspection to carry on our business at all times, and in the

past from time to time we may have not been in compliance with all such required licenses, permits and pass the GMP compliance-inspection.

Moreover, these licenses, permits and pass the GMP compliance-inspection are subject to periodic renewal and/or reassessment by the relevant

PRC governmental authorities and the standards of such renewal or reassessment may change from time to time. We intend to apply for the

renewal of these licenses, permits and to pass the GMP compliance-inspection when required by then applicable laws and regulations. Any

failure by us to obtain and maintain all licenses, permits and to pass the GMP compliance-inspection necessary to carry on our business

at any time could have a material adverse effect on our business, financial condition and results of operations. In addition, any inability

to renew these licenses, permits and to pass the GMP compliance-inspection could severely disrupt our business and prevent us from continuing

to carry on our business. Any changes in the standards used by governmental authorities in considering whether to renew or reassess our

business licenses, permits and to pass the GMP compliance-inspection, as well as any enactment of new regulations that may restrict the

conduct of our business, may also decrease our revenue and/or increase our costs and materially reduce our profitability and prospects.

Furthermore, if the interpretation or implementation of existing laws and regulations changes or if new regulations come into effect requiring

us to obtain any additional licenses, permits or pass any GMP compliance-inspection that were previously not required to operate our existing

businesses, we cannot assure you that we will successfully obtain such licenses, permits or pass the GMP compliance-inspection.

Our innovative Directly-Oral-TCMP

and After-Soaking-Oral-TCMP in China are subject to continuing regulation by the National Medical Products Administration (“NMPA”)

of China. If the labeling or manufacturing process of an approved medicine is significantly modified, the NMPA requires that we obtain

a new pre-market approval or pre-market approval supplement. Furthermore, there is no specific law or details of regulations that apply

to our innovative Directly-Oral-TCMP and After-Soaking-Oral-TCMP, but we will be required to comply with all existing and new rules related

to them.

Price control regulations in the PRC may

decrease our profitability.

The laws of the PRC provide

for the government to fix and adjust prices. The prices of certain TCMP products we distribute, including those listed in the Chinese

government’s catalogue of medications that are reimbursable under the PRC’s social insurance program, or the Insurance Catalogue,

are subject to control by the relevant state or provincial price administration authorities. The PRC establishes price levels for products

based on market conditions, average industry cost, supply and demand and social responsibility. In practice, price control with respect

to these medicines sets a ceiling on their retail price. The actual price of such medicines set by manufacturers, wholesalers and retailers

cannot historically exceed the price ceiling imposed by applicable government price control regulations. Although, as a general matter,

government price control regulations have resulted in lower drug prices over time, there has been no predictable pattern for such decreases.

It is possible that additional products may be subject to price control, or that price controls may be increased in the future. To the

extent that our products are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the

revenue we derive from our sales will be limited and we may face no limitation on our costs. Further, if price controls affect both our

revenue and costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the

applicable regulatory authorities in the PRC. Since May 1998, the relevant PRC governmental authorities have ordered price reductions

on thousands of pharmaceutical products. Such reductions, along with any future price controls or government mandated price reductions

may have a material adverse effect on our financial condition and results of operations, including significantly reducing our revenue

and profitability.

If the TCMP products we produce are replaced

by other medicines or are removed from the PRC’s insurance catalogue in the future, our revenue may suffer.

Under

Chinese regulations, patients purchasing medicine listed by the central and/or provincial governments in the insurance catalogue may be

reimbursed, in part or in whole, by a social medicine fund. Accordingly, pharmaceutical distributors prefer to engage in the distribution

of medicine listed in the insurance catalogue. Currently, 95% of our TCMP products, including 18 Advanced TCMP products are listed in

the insurance catalogue. The

content of the insurance catalogue is subject to change by the PRC Ministry of Labor and Social Security, and new medicine may be added

to the insurance catalogue by provincial level authorities as part of their limited ability to change certain medicines listed in the

insurance catalogue. If the TCMP products we produce are replaced by other medicines or removed from the insurance catalogue in the future,

our revenue may suffer.

Adverse publicity associated with our products,

ingredients or network marketing program, or those of similar companies, could harm our financial condition and operating results.

The results of our operations

may be significantly affected by the public’s perception of our product and similar companies. This perception is dependent upon

opinions concerning:

| |

● |

the safety and quality of our products and ingredients; |

| |

● |

the safety and quality of similar products and ingredients distributed by other companies; and |

Adverse publicity concerning

any actual or purported failure to comply with applicable laws and regulations regarding product claims and advertising, good manufacturing

practices, or other aspects of our business, whether or not resulting in enforcement actions or the imposition of penalties, could have

an adverse effect on our goodwill and could negatively affect our sales and ability to generate revenue. In addition, our consumers’

perception of the safety and quality of products and ingredients as well as similar products and ingredients distributed by other companies

can be significantly influenced by media attention, publicized scientific research or findings, widespread product liability claims and

other publicity concerning our products or ingredients or similar products and ingredients distributed by other companies. Adverse publicity,

whether or not accurate or resulting from consumers’ use or misuse of our products, that associates consumption of our products

or ingredients or any similar products or ingredients with illness or other adverse effects, questions the benefits of our or similar

products or claims that any such products are ineffective, inappropriately labeled or have inaccurate instructions as to their use, could

negatively impact our reputation or the market demand for our products.

Risks Related to Our Corporate Structure

We do not have direct ownership of our operating

entities in China and rely on VIE Agreements with the VIE for our business operations, which may not be as effective in providing operational

control or enabling us to derive benefits as through ownership of controlling equity interests.

We do not have direct ownership

of Taizhou Suxuantang, or the VIE, in China and rely on and expect to continue to rely on the VIE Agreements with the VIE in China and

its respective shareholders to operate business. Pursuant to the VIE Agreements, we are regarded as the primary beneficiary of the VIE

for accounting purpose, and, therefore, we are able to consolidate the financial results of the VIE in our consolidated financial statements

in accordance with U.S. GAAP. However, neither we nor our subsidiaries own any share in the VIE, and that the investors will not and may

never directly hold equity interests in the VIE either. VIE Agreements may not be as effective as an ownership of controlling equity interests

would be in providing us with control over the VIE, or in enabling us to derive economic benefits from the operations of the VIE. Under

the current VIE Agreements, as a legal matter, if any of the affiliated consolidated entities or any of their shareholders fails to perform

its, his or her respective obligations under the VIE Agreements, we may have to incur substantial costs and resources to enforce such

arrangements, and rely on legal remedies available under PRC laws, including seeking specific performance or injunctive relief, and claiming

damages, which we cannot assure you will be effective. For example, if shareholders of a variable interest entity were to refuse to transfer

their equity interests in such variable interest entity to us or our designated persons when we exercise the purchase option pursuant

to these contractual arrangements, we may have to take a legal action to compel them to fulfill their contractual obligations.

If (i) the applicable PRC

authorities invalidate these contractual arrangements for violation of PRC laws, rules and regulations, (ii) any variable interest entity

or its shareholders terminate the contractual arrangements or (iii) any variable interest entity or its shareholders fail to perform their

obligations under these contractual arrangements, our business operations in China would be materially and adversely affected, and the

value of your stock would substantially decrease. Further, if we fail to renew these contractual arrangements upon their expiration, we

would not be able to continue our business operations unless the then current PRC law allows us to directly operate businesses in China.

In addition, if any variable

interest entity or all or part of its assets become subject to liens or rights of third-party creditors, we may be unable to continue

some or all of our business activities, which could materially and adversely affect our business, financial condition and results of operations.

If any of the variable interest entity undergoes a voluntary or involuntary liquidation proceeding, its shareholders or unrelated third-party

creditors may claim rights to some or all of these assets, thereby hindering our ability to operate our business, which could materially

and adversely affect our business and our ability to generate revenues.

All of these contractual arrangements

are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. The legal environment in the PRC is

not as developed as in some other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could limit

our ability to enforce these contractual arrangements. In the event we are unable to enforce these contractual arrangements, we may not

be able to exert effective control over our operating entities and we may be precluded from operating our business, which would have a

material adverse effect on our financial condition and results of operations.

Taizhou Suxuantang’s shareholders

may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.

The equity interests of Taizhou

Suxuantang are held by Mr. Feng Zhou, who is our founder, director. His interests may differ from the interests of our Company as a whole.

He may breach, or cause Taizhou Suxuantang to breach, or refuse to renew the existing contractual arrangements we have with Taizhou Suxuantang,

which would have a material adverse effect on our ability to effectively control Taizhou Suxuantang and receive economic benefits from

them. For example, the shareholders may be able to cause our agreements with Taizhou Suxuantang to be performed in a manner adverse to

us by, among other things, failing to remit payments due under the contractual arrangements to us on a timely basis. We cannot assure

you that when conflicts of interest arise, any or all of these shareholders will act in the best interests of our Company or such conflicts

will be resolved in our favor.

Currently,

we do not have any arrangements to address potential conflicts of interest between these shareholders and our Company, except that we

could exercise our purchase option under the exclusive option agreement with these shareholders to request them to transfer all of their

equity interests in Taizhou Suxuantang to a PRC entity or individual designated by us, to the extent permitted by PRC laws. If we cannot

resolve any conflict of interest or dispute between us and the shareholders of Taizhou Suxuantang, we would have to rely on legal proceedings,

which could result in the disruption of our business and subject us to substantial uncertainty as to the outcome of any such legal proceedings.

Contractual arrangements in relation to

our variable interest entity may be subject to scrutiny by the PRC tax authorities and they may determine that we or our PRC variable

interest entity owe additional taxes, which could negatively affect our results of operations and the value of your investment.

Under applicable PRC laws

and regulations, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities within

ten years after the taxable year when the transactions are conducted. The PRC enterprise income tax law requires every enterprise in China

to submit its annual enterprise income tax return together with a report on transactions with its related parties to the relevant tax

authorities. The tax authorities may impose reasonable adjustments on taxation if they have identified any related party transactions

that are inconsistent with arm’s length principles. We may face material and adverse tax consequences if the PRC tax authorities

determine that the contractual arrangements between our WFOE, our variable interest entity Taizhou Suxuantang and the shareholders of

Taizhou Suxuantang were not entered into on an arm’s length basis in such a way as to result in an impermissible reduction in taxes

under applicable PRC laws, rules and regulations, and adjust Taizhou Suxuantang’s income in the form of a transfer pricing adjustment.

A transfer pricing adjustment could, among other things, result in a reduction of expense deductions recorded by Taizhou Suxuantang for

PRC tax purposes, which could in turn increase their tax liabilities without reducing WFOE’s tax expenses. In addition, if WFOE

requests the shareholders of Taizhou Suxuantang to transfer their equity interests in Taizhou Suxuantang at nominal or no value pursuant

to these contractual arrangements, such transfer could be viewed as a gift and subject WFOE to PRC income tax. Furthermore, the PRC tax

authorities may impose late payment fees and other penalties on Taizhou Suxuantang for the adjusted but unpaid taxes according to the

applicable regulations. Our results of operations could be materially and adversely affected if Taizhou Suxuantang’s tax liabilities

increase or if they are required to pay late payment fees and other penalties.

The approval of the China Securities

Regulatory Commission and other compliance procedures may be required in connection with an offering under PRC rules, regulations

or policies, and, if required, we cannot predict whether or how soon we will be able to obtain such approval. As a result, both you and

us face uncertainty about future actions by the PRC government that could significantly affect the operating company’s financial

performance and the enforceability of the VIE Agreements.

The Regulations on Mergers

and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”) requires an overseas special purpose vehicle

that are controlled by PRC companies or individuals formed for the purpose of seeking a public listing on an overseas stock exchange through

acquisitions of PRC domestic companies using shares of such special purpose vehicle or held by its shareholders as considerations to obtain

the approval of the China Securities Regulatory Commission, or the CSRC, prior to the listing and trading of such

special purpose vehicle’s securities on an overseas stock exchange. However, the application of the M&A Rules remains unclear.

If CSRC approval is required, it is uncertain whether it would be possible for us to obtain the approval. Any failure to obtain or delay

in obtaining CSRC approval for this offering would subject us to sanctions imposed by the CSRC and other PRC regulatory agencies.

Based on the current PRC laws,

regulations and rules that the CSRC’s approval may not be required for the listing and trading of our Ordinary Shares on the Nasdaq

Capital Market in the context of this offering, given that: (i) the CSRC currently has not issued any definitive rule or interpretation

concerning whether offerings like ours in this annual report are subject to this regulation, (ii) we establish our WFOE by means of direct

investment and acquiring equity interest or assets of an entity other than “PRC domestic company” as defined under the M&A

Rules, and (iii) no explicit provision in the M&A Rules clearly classifies VIE Agreements as a type of transaction subject to such

Rules.

However, there remains some

uncertainty as to how the M&A Rules will be interpreted or implemented in the context of an overseas offering and its opinions summarized

above are subject to any new laws, regulations and rules or detailed implementations and interpretations in any form relating to the M&A

Rules. We cannot assure you that relevant PRC regulatory agencies, including the CSRC, would reach the same conclusion as our PRC legal

counsel does. If it is determined that CSRC approval is required for this offering, we may face sanctions by the CSRC or other PRC regulatory

agencies for failure to obtain or delay in obtaining CSRC approval for this offering. These sanctions may include fines and penalties

on our operations in China, limitations on our operating privileges in China, delays in or restrictions on the repatriation of the proceeds

from this offering into the PRC, restrictions on or prohibition of the payments or remittance of dividends by our subsidiaries in China,

or other actions that could have a material and adverse effect on our business, reputation, financial condition, results of operations,

prospects, as well as the trading price of the Ordinary Shares. The CSRC or other PRC regulatory agencies may also take actions requiring

us, or making it advisable for us, to halt this offering before the settlement and delivery of the Ordinary Shares that we are offering.

Consequently, if you engage in market trading or other activities in anticipation of and prior to the settlement and delivery of the Ordinary

Shares we are offering, you would be doing so at the risk that the settlement and delivery may not occur. In addition, if the CSRC or

other regulatory agencies later promulgate new rules or explanations requiring that we obtain their approvals for this offering, we may

be unable to obtain a waiver of such approval requirements.

Recently, the General Office

of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severe

and Lawful Crackdown on Illegal Securities Activities, which was available to the public on July 6, 2021. These opinions emphasized

the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies.

These opinions proposed to take effective measures, such as promoting the construction of relevant regulatory systems, to deal with the

risks and incidents facing China-based overseas-listed companies and the demand for cybersecurity and data privacy protection. The aforementioned

policies and any related implementation rules to be enacted may subject us to additional compliance requirement in the future. As of the

date of this annual report, we have not received or been denied of any permission from the PRC authorities to list on U.S. stock exchanges.

As these opinions were recently issued, official guidance and interpretation of the opinions remain unclear in several respects at this

time. Therefore, we cannot assure you that we will remain fully compliant with all new regulatory requirements of these opinions or any

future implementation rules on a timely basis, or at all. We face uncertainty about future actions by the PRC government that could significantly

affect the operating company’s financial performance and the enforceability of the VIE Agreements.

Furthermore, on February 17,

2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial

Measures”), which took effect on March 31, 2023. The Trial Measures clarified and emphasized several aspects, which include but

are not limited to: (1) comprehensive determination of the “indirect overseas offering and listing by PRC domestic companies”

in compliance with the principle of “substance over form” and particularly, an issuer will be required to go through the filing

procedures under the Trial Measures if the following criteria are met at the same time: a) 50% or more of the issuer’s operating

revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting

year is accounted for by PRC domestic companies, and b) the main parts of the issuer’s business activities are conducted in mainland

China, or its main places of business are located in mainland China, or the senior managers in charge of its business operation and management

are mostly Chinese citizens or domiciled in mainland China; (2) exemptions from immediate filing requirements for issuers that a) have

already been listed or registered but not yet listed in foreign securities markets, including U.S. markets, prior to the effective date

of the Trial Measures, and b) are not required to re-perform the regulatory procedures with the relevant overseas regulatory authority

or the overseas stock exchange, c) whose such overseas securities offering or listing shall be completed before September 30, 2023, provided

however that such issuers shall carry out filing procedures as required if they conduct refinancing or are involved in other circumstances

that require filing with the CSRC; (3) a negative list of types of issuers banned from listing or offering overseas, such as (a) issuers

whose listing or offering overseas have been recognized by the State Council of the PRC as possible threats to national security, (b)

issuers whose affiliates have been recently convicted of bribery and corruption, (c) issuers under ongoing criminal investigations, and

(d) issuers under major disputes regarding equity ownership; (4) issuers’ compliance with web security, data security, and other

national security laws and regulations; (5) issuers’ filing and reporting obligations, such as obligation to file with the CSRC

after it submits an application for initial public offering to overseas regulators, and obligation after offering or listing overseas

to report to the CSRC material events including change of control or voluntary or forced delisting of the issuer; and (6) the CSRC’s

authority to fine both issuers and their shareholders between 1 and 10 million RMB for failure to comply with the Trial Measures, including

failure to comply with filing obligations or committing fraud and misrepresentation.

PRC laws and regulations governing our current

business operations are sometimes vague and uncertain.

We are an offshore holding

company conducting all of our business through our subsidiaries and variable interest entities in China. Our operations in China are governed

by PRC laws and regulations. Our PRC subsidiaries and the consolidated variable interest entities are generally subject to laws and regulations

applicable to foreign investments in China and, in particular, laws and regulations applicable to wholly foreign-owned enterprises.

The PRC legal system is based

on the PRC Constitution and is made up of written laws, regulations, circulars and directives. The PRC government is still in the process

of developing its legal system, so as to meet the needs of investors and to encourage foreign investment. As the PRC economy is generally

developing at a faster pace than its legal system, some degree of uncertainty exists in connection with whether and how existing laws

and regulations will apply to certain events or circumstances.

Some of the laws and regulations,

and the interpretation, implementation and enforcement thereof, are still subject to policy changes. There is no assurance that the introduction

of new laws, changes to existing laws and the interpretation or application thereof or the delays in obtaining approvals from the relevant

authorities will not have an adverse impact on our PRC subsidiaries’ business, financial performance and prospects.

Further, precedents on the

interpretation, implementation and enforcement of the PRC laws and regulations are limited, and unlike other common law countries such

as the United States, decisions on precedent cases are not binding on lower courts. As such, the outcome of dispute resolutions may not

be consistent or predictable as in the other more developed jurisdictions and it may be difficult to obtain swift or equitable enforcement

of the laws in the PRC, or obtain enforcement of judgment by a court of another jurisdiction.

As an offshore holding company,

we may make loans to our PRC subsidiaries and the consolidated VIE.

Any loans to our PRC subsidiaries

are subject to PRC regulations. For example, loans by us to our subsidiaries in China, which are foreign invested entities (“FIEs”),

to finance their activities cannot exceed statutory limits and must be registered with SAFE. On March 30, 2015, SAFE promulgated Hui Fa

[2015] No.19, a notice regulating the conversion by a foreign-invested company of foreign currency into RMB. The foreign exchange capital,

for which the monetary contribution has been confirmed by the foreign exchange authorities (or for which the monetary contribution has

been registered for account entry) in the capital account of a foreign-invested enterprise may be settled at a bank as required by the

enterprise’s actual management needs. Foreign-invested enterprises with investment as their main business (including foreign-oriented

companies, foreign-invested venture capital enterprises and foreign-invested equity investment enterprises) are allowed to, under the

premise of authenticity and compliance of their domestic investment projects, carry out based on their actual investment scales direct

settlement of foreign exchange capital or transfer the RMB funds in the foreign exchange settlement account for pending payment to the

invested enterprises’ accounts.

On May 10, 2013, SAFE released

Circular 21, which came into effect on May 13, 2013. According to Circular 21, SAFE has simplified the foreign exchange administration

procedures with respect to the registration, account openings and conversions, settlements of FDI-related foreign exchange, as well as

fund remittances. Circular 21 may significantly limit our ability to convert, transfer and use the net proceeds from our financing activities

and any offering of additional equity securities in China, which may adversely affect our liquidity and our ability to fund and expand

our business in the PRC.

We may also decide to finance

our subsidiaries by means of capital contributions. These capital contributions must be approved by the MOF or its local counterpart,

which usually takes no more than 30 working days to complete. We may not be able to obtain these government approvals on a timely basis,

if at all, with respect to future capital contributions by us to our PRC subsidiaries. If we fail to receive such approvals, we will not

be able to capitalize our PRC operations, which could adversely affect our liquidity and our ability to fund and expand our business.

In addition, on July 6, 2021,

the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued a document

to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among

other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation,

to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application

of the PRC securities laws. Since this document is relatively new, uncertainties still exist in relation to how soon legislative or administrative

regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will

be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on companies like us.

Uncertainties exist with respect to the

interpretation and implementation of the PRC Foreign Investment Law and how it may impact the viability of our current corporate structure

and business operations.

The National People’s

Congress promulgated the Foreign Investment Law on March 15, 2019 and the State Council adopted the Regulation on Implementing the Foreign

Investment Law (the “Implementation Regulations”) on December 12, 2019, effective from January 1, 2020, to replace the trio

of existing laws regulating foreign investment in China, namely, the Sino-foreign Equity Joint Venture Enterprise Law, the Sino-foreign

Cooperative Joint Venture Enterprise Law and the Wholly Foreign-invested Enterprise Law, together with their implementation rules and

ancillary regulations. The Foreign Investment Law embodies an expected PRC regulatory trend to rationalize its foreign investment regulatory

regime in line with prevailing international practice and the legislative efforts to unify the corporate legal requirements for both foreign

and domestic investments. However, since it is relatively new, uncertainties still exist in relation to its interpretation and implementation.

For instance, under the Foreign

Investment Law, “foreign investment” refers to the investment activities directly or indirectly conducted by foreign individuals,

enterprises or other entities in China. Though it does not explicitly classify contractual arrangements as a form of foreign investment,

there is no assurance that foreign investment via contractual arrangement would not be interpreted as a type of indirect foreign investment

activities under the definition in the future. In addition, the definition contains a catch-all provision which includes investments made

by foreign investors through means stipulated in laws or administrative regulations or other methods prescribed by the State Council.

Therefore, it still leaves leeway for future laws, administrative regulations or provisions promulgated by the State Council to provide

for contractual arrangements as a form of foreign investment. In any of these cases, it will be uncertain whether our contractual arrangements

will be deemed to be in violation of the market access requirements for foreign investment under the PRC laws and regulations. Furthermore,