UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

Amendment No. 2

Parke

Bancorp, Inc.

(Name

of Issuer)

Common

Stock, par value $0.10 per share

(Title

of Class of Securities)

700885106

(Cusip

Number)

Geoffrey

R. Morgan

Croke

Fairchild Duarte & Beres LLC

180

N. LaSalle Street, Suite 3400

Chicago,

IL 60601

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 14, 2024

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the act (however, see the Notes).

SCHEDULE

13D

CUSIP

No. 700885106

| 1 |

Name

of Reporting Person: I.R.S. Identification

Nos. of Above Person (entities only):

Jacob Shemer |

| 2 |

Check

the Appropriate Box if a Member of a Group (See Instructions):

(a) ☐

(b) ☐

|

| 3 |

SEC

Use Only:

|

| 4 |

Source

of Funds (See Instruction):

WC |

| 5 |

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): ☐

|

| 6 |

Citizenship

or Place of Organization:

Israel |

Number

of Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7 |

Sole

Voting Power:

0 |

| 8 |

Shared

Voting Power:

710,006 |

| 9 |

Sole

Dispositive Power:

0 |

| 10 |

Shared

Dispositive Power:

710,006 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person:

710,006 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11):

5.93%1 |

| 14 |

Type

of Reporting Person (See Instructions):

IN |

1

Based on 11,962,821 shares of Common Stock outstanding as of May 3,

2024, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 8, 2024.

SCHEDULE

13D

CUSIP

No. 700885106

| 1 |

Name

of Reporting Person: I.R.S. Identification

Nos. of Above Person (entities only):

Alphabeta

Ai Multi Strategy, LP |

| 2 |

Check

the Appropriate Box if a Member of a Group (See Instructions):

(a) ☐

(b) ☐

|

| 3 |

SEC

Use Only:

|

| 4 |

Source

of Funds (See Instruction):

WC |

| 5 |

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): ☐

|

| 6 |

Citizenship

or Place of Organization:

Cayman

Islands |

Number

of Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7 |

Sole

Voting Power:

8,253 |

| 8 |

Shared

Voting Power:

— |

| 9 |

Sole

Dispositive Power:

8,253 |

| 10 |

Shared

Dispositive Power:

— |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person:

8,253 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11):

Less

than 1%2 |

| 14 |

Type

of Reporting Person (See Instructions):

PN |

2

Based on 11,962,821 shares of Common Stock outstanding as of May 3, 2024, as reported in the Issuer’s Quarterly Report

on Form 10-Q filed with the Securities and Exchange Commission on May 8, 2024.

SCHEDULE

13D

CUSIP

No. 700885106

| 1 |

Name

of Reporting Person:

I.R.S. Identification Nos. of Above Person (entities only):

Ron Shemer |

| 2 |

Check

the Appropriate Box if a Member of a Group (See Instructions):

(a) ☐

(b) ☐

|

| 3 |

SEC

Use Only:

|

| 4 |

Source

of Funds (See Instruction):

PF |

| 5 |

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): ☐

|

| 6 |

Citizenship

or Place of Organization:

Israel and United States

|

Number

of Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7 |

Sole

Voting Power:

8,400 |

| 8 |

Shared

Voting Power:

710,006

|

| 9 |

Sole

Dispositive Power:

8,400 |

| 10 |

Shared

Dispositive Power:

710,006 |

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person:

718,406 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11):

6.00

%3

|

| 14 |

Type

of Reporting Person (See Instructions):

IN |

3

Based on 11,962,821 shares of Common Stock outstanding as of May 3,

2024, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 8, 2024.

SCHEDULE

13D

CUSIP

No. 700885106

| 1 |

Name

of Reporting Person:

I.R.S. Identification Nos. of Above Person (entities only):

RPS

Master – Investment Management RPS 2014

LP |

| 2 |

Check

the Appropriate Box if a Member of a Group (See Instructions):

(a) ☐

(b) ☐

|

| 3 |

SEC

Use Only:

|

| 4 |

Source

of Funds (See Instruction):

WC |

| 5 |

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): ☐

|

| 6 |

Citizenship

or Place of Organization:

Israel

|

Number

of Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7 |

Sole

Voting Power:

701,753 |

| 8 |

Shared

Voting Power:

|

| 9 |

Sole

Dispositive Power:

701,753 |

| 10 |

Shared

Dispositive Power:

|

| 11 |

Aggregate

Amount Beneficially Owned by Each Reporting Person:

701,753 |

| 12 |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

| 13 |

Percent

of Class Represented by Amount in Row (11):

5.87%4

|

| 14 |

Type

of Reporting Person (See Instructions):

PN |

4.

Based on 11,962,821 shares of Common Stock outstanding as of May 3,

2024, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 8, 2024.

SCHEDULE

13D

Item

1. Security and Issuer.

This

Amendment No.2 to Schedule 13D (this “Schedule 13D”) relates to the Class A Common Stock (the “Common

Stock”) of Parke Bancorp., a New Jersey corporation (the “Issuer” or “Registrant”). The address of the

principal executive offices of the Issuer is 601 Delsea Drive, Washington Township, New Jersey 08080, and its telephone number is

856-256-2500.

Item

2. Identity and Background.

| |

(a) |

This Schedule 13D is being

filed by the following persons (each, a “Reporting Person”): |

i.

Alphabeta Ai Multi Strategy, LP (“Alphabeta Ai”)

ii.

RPS Master Investment Management – RPS 2014 LP (“RPS Master”)

iii.

Ron Shemer (“R. Shemer”)

iv.

Jacob Shemer (“J. Shemer”)

| |

(b) |

The principal business

address each of the Reporting Persons is 5 Arie Disenchik St., Tel Aviv, Israel, Zip Code 6935640 |

| |

(c) |

Alphabeta

Ai is a Limited Partnership specializing in quantitative investment strategies. RPS Master is a Limited Partnership using quantitative

and fundamental investment strategies. R. Shemer is the Chairman of the General Partners of the Reporting Persons. |

Present

principal occupation or employment and the name, principal business and address of any corporation or other organization in which such

employment is conducted;

| |

(d) |

The Reporting Persons have

not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during the last five years. |

| |

|

|

| |

(e) |

During the last five years,

the Reporting Persons have not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

| |

|

|

| |

(f) |

R. Shemer is a citizen

of Israel and the United States. |

| |

|

|

| |

(g) |

J. Shemer is a citizen of Israel. |

Item

3. Source and Amount of Funds or Other Consideration.

Alphabeta

Ai and RPS Master used working capital and R. Shemer used personal funds to make the purchases

of Common Stock listed on Schedule I hereto.

Item

4. Purpose of Transaction.

The

Reporting Persons hold the Common Stock of the Issuer for investment purposes. Depending on the factors discussed herein, the Reporting

Persons may, from time to time, acquire additional shares of Common Stock and/or retain and/or sell all or a portion of the shares of

Common Stock held by the Reporting Persons in the open market or in privately negotiated transactions, and/or may distribute the Common

Stock held by the Reporting Person to other entities. Any actions the Reporting Persons might undertake will be dependent upon the Reporting

Persons’ review of numerous factors, including, among other things, the price levels of the Common Stock, general market and economic

conditions, ongoing evaluation of the Issuer’s business, financial condition, operations and prospects, the relative attractiveness

of alternative business and investment opportunities, investor’s need for liquidity, and other future developments. Any future

acquisitions of Common Stock will be subject to the Company’s policies, including its insider trading policy, as applicable.

Except

as set forth above, the Reporting Persons have no present plans or intentions which would result in or relate to any of the transactions

described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Item

5. Interests in Securities of the Issuer

(a,b)

For information regarding beneficial ownership, see the information presented on the cover page of this Schedule 13D.

(c)

Schedule I sets forth the transactions in the Common Stock effected by the Reporting Persons during the past 60 days.

(d)

Not applicable

(e)

Not applicable

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Not

applicable.

Item

7. Exhibits

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Date:

June 17, 2024

Alphabeta

Ai Multi Strategy, LP

| By:

|

Alpha

Beta Hedge Funds Ltd. |

|

| Its:

|

General

Partner |

|

| By: |

/s/

Ron Shemer |

|

| Name: |

Ron Shemer |

|

| Title: |

Chairman |

|

RPS

Master – Investment Management RPS 2014 LP

| By:

|

RPS Hedge Ltd. |

|

| Its:

|

General

Partner |

|

| By: |

/s/

Ron Shemer |

|

Name:

|

Ron Shemer |

|

| Title: |

Chairman |

|

Ron

Shemer

Jacob Shemer

SCHEDULE

I

The

following table lists all transactions completed by the Reporting Person in the Common Stock since April 8, 2024, which were all completed

through open market purchases.

RPS

Master – Investment Management RPS 2014 LP

| Date | |

Shares bought | | |

Price | |

| June 14, 2024 | |

| 4835 | | |

| 15.5082 | |

| June 14, 2024 | |

| 500 | | |

| 15.43 | |

| June 13, 2024 | |

| 500 | | |

| 15.60588 | |

| June 11, 2024 | |

| 2360 | | |

| 15.5405 | |

| June 10, 2024 | |

| 1002 | | |

| 15.65792 | |

| June 7, 2024 | |

| 2615 | | |

| 15.66104 | |

| June 6, 2024 | |

| 1700 | | |

| 15.6135 | |

| June 5, 2024 | |

| 1500 | | |

| 15.65891 | |

| June 4, 2024 | |

| 2100 | | |

| 15.67859 | |

| June 3, 2024 | |

| 1100 | | |

| 15.95552 | |

| May 31, 2024 | |

| 4072 | | |

| 16.1519 | |

| May 30, 2024 | |

| 1526 | | |

| 15.90163 | |

| May 29, 2024 | |

| 8900 | | |

| 15.96515 | |

| May 28, 2024 | |

| 3000 | | |

| 16.3753 | |

| May 24, 2024 | |

| 1410 | | |

| 16.4626 | |

| May 23, 2024 | |

| 1400 | | |

| 16.4958 | |

| May 22, 2024 | |

| 3103 | | |

| 16.8848 | |

| May 21, 2024 | |

| 700 | | |

| 16.8757 | |

| May 20, 2024 | |

| 1100 | | |

| 16.96545 | |

| May 17, 2024 | |

| 5973 | | |

| 16.9632 | |

| May 6, 2024 | |

| 100 | | |

| 16.83 | |

| April 30, 2024 | |

| 1800 | | |

| 16.4467 | |

| April 29, 2024 | |

| 2400 | | |

| 16.43342 | |

| April 26, 2024 | |

| 553 | | |

| 16.4822 | |

| April 25, 2024 | |

| 1753 | | |

| 16.4605 | |

| April 24, 2024 | |

| 1560 | | |

| 16.44169 | |

| April 22, 2024 | |

| 200 | | |

| 16.7504 | |

| April 17, 2024 | |

| 1500 | | |

| 16.0809 | |

| April 16, 2024 | |

| 906 | | |

| 16.06737 | |

| April 15, 2024 | |

| 96 | | |

| 16.09 | |

| April 12, 2024 | |

| 1837 | | |

| 16.1079 | |

| April 11, 2024 | |

| 3003 | | |

| 16.12385 | |

| April 10, 2024 | |

| 11200 | | |

| 16.185 | |

| April 9, 2024 | |

| 3600 | | |

| 16.5738 | |

| April 8, 2024 | |

| 900 | | |

| 16.62331 | |

| TOTAL | |

| | | |

| — | |

Alphabeta

AI Multi Strategy, LP

| Date | |

Shares

bought | | |

Price | |

| June

5, 2024 | |

| 300 | | |

| 15.6786 | |

| June

3, 2024 | |

| 200 | | |

| 15.99 | |

| April

17, 2024 | |

| 1500 | | |

| 16.09 | |

| April

15, 2024 | |

| 2500 | | |

| 16.08 | |

| Total | |

| | | |

| | |

Exhibit

1

Joint

Filing Agreement

In

accordance with Rule 13d-1(k)(1) promulgated under the Securities Exchange Act of 1934, as amended, the undersigned hereby agree that

they are jointly filing this statement on Schedule 13D. Each of them is responsible for the timely filing of such statement and any amendments

thereto, and for the completeness and accuracy of the information concerning such person contained therein; but none of them is responsible

for the completeness or accuracy of the information concerning the other persons making the filing, unless such person knows or has reason

to believe that such information is inaccurate.

IN

WITNESS WHEREOF, the undersigned hereby execute this Joint Filing Agreement as of March 25, 2024.

Alphabeta

Ai Multi Strategy, LP

| By: |

Alpha

Beta Hedge Funds Ltd. |

|

| Its: |

General

Partner |

|

| By: |

/s/

Ron Shemer |

|

| Name: |

Ron

Shemer |

|

| Title: |

Chairman |

|

RPS

Master – Investment Management RPS 2014 LP

| By: |

RPS

Hedge Ltd. |

|

| Its: |

General

Partner |

|

| By: |

/s/

Ron Shemer |

|

| Name: |

Ron

Shemer |

|

| Title: |

Chairman |

|

| Ron

Shemer |

|

| |

|

| /s/

Ron Shemer |

|

| Jacob

Shemer |

|

| |

|

| /s/

Jacob Shemer |

|

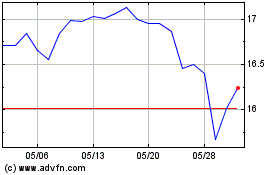

Parke Bancorp (NASDAQ:PKBK)

過去 株価チャート

から 5 2024 まで 6 2024

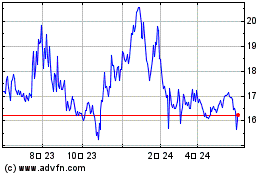

Parke Bancorp (NASDAQ:PKBK)

過去 株価チャート

から 6 2023 まで 6 2024