000074621012/312024Q1falsexbrli:sharesiso4217:USDiso4217:USDxbrli:sharesglow:segmentxbrli:pure00007462102024-01-012024-03-3100007462102024-05-0300007462102024-03-3100007462102023-12-3100007462102023-01-012023-03-310000746210us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2023-12-310000746210us-gaap:CommonStockMember2023-12-310000746210us-gaap:TreasuryStockCommonMember2023-12-310000746210us-gaap:AdditionalPaidInCapitalMember2023-12-310000746210us-gaap:RetainedEarningsMember2023-12-310000746210us-gaap:RetainedEarningsMember2024-01-012024-03-310000746210us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000746210us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2024-03-310000746210us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2024-01-012024-03-310000746210us-gaap:CommonStockMember2024-01-012024-03-310000746210us-gaap:CommonStockMember2024-03-310000746210us-gaap:TreasuryStockCommonMember2024-03-310000746210us-gaap:AdditionalPaidInCapitalMember2024-03-310000746210us-gaap:RetainedEarningsMember2024-03-310000746210us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2022-12-310000746210us-gaap:CommonStockMember2022-12-310000746210us-gaap:TreasuryStockCommonMember2022-12-310000746210us-gaap:AdditionalPaidInCapitalMember2022-12-310000746210us-gaap:RetainedEarningsMember2022-12-3100007462102022-12-310000746210us-gaap:RetainedEarningsMember2023-01-012023-03-310000746210us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000746210us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2023-01-012023-03-310000746210us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2023-03-310000746210us-gaap:CommonStockMember2023-03-310000746210us-gaap:TreasuryStockCommonMember2023-03-310000746210us-gaap:AdditionalPaidInCapitalMember2023-03-310000746210us-gaap:RetainedEarningsMember2023-03-3100007462102023-03-310000746210us-gaap:SeriesFPreferredStockMember2024-01-012024-03-310000746210us-gaap:CommonStockMember2023-01-012023-12-3100007462102021-06-2800007462102023-01-012023-12-310000746210srt:MaximumMember2024-03-310000746210us-gaap:SeriesFPreferredStockMemberus-gaap:PrivatePlacementMember2023-03-302023-03-300000746210us-gaap:SeriesFPreferredStockMemberus-gaap:PrivatePlacementMember2023-03-300000746210glow:PreferredWarrantsMemberus-gaap:PrivatePlacementMember2023-03-300000746210glow:InvestorWarrantsMemberus-gaap:PrivatePlacementMember2023-03-300000746210us-gaap:SeriesFPreferredStockMemberus-gaap:PrivatePlacementMember2023-03-312023-03-310000746210us-gaap:SeriesFPreferredStockMember2023-03-300000746210us-gaap:SeriesFPreferredStockMember2023-03-302023-03-3000007462102023-10-060000746210us-gaap:SeriesFPreferredStockMember2024-03-310000746210us-gaap:SeriesFPreferredStockMemberglow:Scenario1Member2024-01-012024-03-310000746210us-gaap:SeriesFPreferredStockMember2023-01-012023-12-310000746210us-gaap:SeriesFPreferredStockMember2023-03-312023-03-310000746210us-gaap:SeriesFPreferredStockMember2023-03-310000746210us-gaap:PreferredStockMemberus-gaap:SeriesFPreferredStockMember2023-01-012023-12-310000746210us-gaap:SeriesFPreferredStockMember2023-12-310000746210us-gaap:CommonStockMember2023-04-012024-03-310000746210glow:A2019EquityIncentivePlanMember2023-12-310000746210us-gaap:EmployeeStockOptionMember2023-01-012023-03-310000746210us-gaap:EmployeeStockOptionMember2024-01-012024-03-310000746210us-gaap:RestrictedStockMember2024-03-310000746210us-gaap:RestrictedStockMember2023-12-310000746210us-gaap:RestrictedStockMember2023-01-012023-03-310000746210us-gaap:RestrictedStockMember2024-01-012024-03-310000746210us-gaap:RestrictedStockMember2023-03-310000746210us-gaap:RestrictedStockMember2022-12-310000746210us-gaap:RestrictedStockUnitsRSUMember2022-12-310000746210us-gaap:RestrictedStockMember2023-01-012023-12-310000746210us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000746210us-gaap:RestrictedStockUnitsRSUMember2023-12-310000746210us-gaap:RestrictedStockUnitsRSUMember2024-03-310000746210us-gaap:RestrictedStockMember2024-01-012024-03-310000746210us-gaap:RestrictedStockMember2023-01-012023-03-310000746210us-gaap:EmployeeStockOptionMember2024-01-012024-03-310000746210us-gaap:EmployeeStockOptionMember2023-01-012023-03-310000746210us-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-03-310000746210us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-03-310000746210glow:PreferredWarrantMember2024-01-012024-03-310000746210glow:PreferredWarrantMember2023-01-012023-03-310000746210us-gaap:WarrantMember2024-01-012024-03-310000746210us-gaap:WarrantMember2023-01-012023-03-310000746210glow:ManagedServicesMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000746210glow:CollaborationProductsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000746210us-gaap:CorporateNonSegmentMember2024-01-012024-03-310000746210us-gaap:MaterialReconcilingItemsMemberglow:ManagedServicesMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000746210us-gaap:MaterialReconcilingItemsMemberglow:CollaborationProductsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000746210us-gaap:MaterialReconcilingItemsMemberus-gaap:CorporateNonSegmentMember2024-01-012024-03-310000746210us-gaap:MaterialReconcilingItemsMember2024-01-012024-03-310000746210glow:ManagedServicesMemberus-gaap:CorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000746210glow:CollaborationProductsMemberus-gaap:CorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000746210us-gaap:CorporateNonSegmentMemberus-gaap:CorporateNonSegmentMember2024-01-012024-03-310000746210us-gaap:CorporateNonSegmentMember2024-01-012024-03-310000746210glow:ManagedServicesMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000746210glow:CollaborationProductsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000746210us-gaap:CorporateNonSegmentMember2023-01-012023-03-310000746210us-gaap:MaterialReconcilingItemsMemberglow:ManagedServicesMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000746210us-gaap:MaterialReconcilingItemsMemberglow:CollaborationProductsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000746210us-gaap:MaterialReconcilingItemsMemberus-gaap:CorporateNonSegmentMember2023-01-012023-03-310000746210us-gaap:MaterialReconcilingItemsMember2023-01-012023-03-310000746210glow:ManagedServicesMemberus-gaap:CorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000746210glow:CollaborationProductsMemberus-gaap:CorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000746210us-gaap:CorporateNonSegmentMemberus-gaap:CorporateNonSegmentMember2023-01-012023-03-310000746210us-gaap:CorporateNonSegmentMember2023-01-012023-03-310000746210country:US2024-01-012024-03-310000746210country:US2023-01-012023-03-310000746210us-gaap:NonUsMember2024-01-012024-03-310000746210us-gaap:NonUsMember2023-01-012023-03-310000746210glow:VideoCollaborationServiceMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2024-01-012024-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:VideoCollaborationServiceMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2024-01-012024-03-310000746210glow:VideoCollaborationServiceMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2023-01-012023-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:VideoCollaborationServiceMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2023-01-012023-03-310000746210glow:NetworkServicesMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2024-01-012024-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:NetworkServicesMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2024-01-012024-03-310000746210glow:NetworkServicesMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2023-01-012023-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:NetworkServicesMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2023-01-012023-03-310000746210glow:ProfessionalAndOtherServicesMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2024-01-012024-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:ProfessionalAndOtherServicesMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2024-01-012024-03-310000746210glow:ProfessionalAndOtherServicesMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2023-01-012023-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:ProfessionalAndOtherServicesMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2023-01-012023-03-310000746210glow:ManagedServicesMemberus-gaap:ProductConcentrationRiskMember2024-01-012024-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2024-01-012024-03-310000746210glow:ManagedServicesMemberus-gaap:ProductConcentrationRiskMember2023-01-012023-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMemberglow:ManagedServicesMember2023-01-012023-03-310000746210glow:VideoCollaborationServiceMemberglow:CollaborationProductsMemberus-gaap:ProductConcentrationRiskMember2024-01-012024-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:VideoCollaborationServiceMemberglow:CollaborationProductsMemberus-gaap:ProductConcentrationRiskMember2024-01-012024-03-310000746210glow:VideoCollaborationServiceMemberglow:CollaborationProductsMemberus-gaap:ProductConcentrationRiskMember2023-01-012023-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:VideoCollaborationServiceMemberglow:CollaborationProductsMemberus-gaap:ProductConcentrationRiskMember2023-01-012023-03-310000746210us-gaap:ProductConcentrationRiskMember2024-01-012024-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMember2024-01-012024-03-310000746210us-gaap:ProductConcentrationRiskMember2023-01-012023-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberus-gaap:ProductConcentrationRiskMember2023-01-012023-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:ManagedServicesMemberus-gaap:CustomerConcentrationRiskMemberglow:CustomerNumberOneMember2024-01-012024-03-310000746210us-gaap:RevenueFromContractWithCustomerMemberglow:ManagedServicesMemberus-gaap:CustomerConcentrationRiskMemberglow:CustomerNumberOneMember2023-01-012023-03-310000746210us-gaap:AccountsReceivableMemberglow:ManagedServicesMemberus-gaap:CustomerConcentrationRiskMemberglow:CustomerNumberOneMember2024-01-012024-03-310000746210us-gaap:AccountsReceivableMemberglow:ManagedServicesMemberus-gaap:CustomerConcentrationRiskMemberglow:CustomerNumberOneMember2023-01-012023-03-310000746210us-gaap:AccountsReceivableMemberglow:CustomerNumberTwoMemberglow:ManagedServicesMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310000746210us-gaap:AccountsReceivableMemberglow:CustomerNumberTwoMemberglow:ManagedServicesMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310000746210glow:CustomerNumberThreeMemberus-gaap:AccountsReceivableMemberglow:CollaborationProductsMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310000746210glow:CustomerNumberThreeMemberus-gaap:AccountsReceivableMemberglow:CollaborationProductsMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310000746210us-gaap:AccountsReceivableMemberglow:CustomerNumberFourMemberglow:CollaborationProductsMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310000746210us-gaap:AccountsReceivableMemberglow:CustomerNumberFourMemberglow:CollaborationProductsMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310000746210us-gaap:AccountsReceivableMemberglow:CollaborationProductsMemberus-gaap:CustomerConcentrationRiskMemberglow:CustomerNumberFiveMember2024-01-012024-03-310000746210us-gaap:AccountsReceivableMemberglow:CollaborationProductsMemberus-gaap:CustomerConcentrationRiskMemberglow:CustomerNumberFiveMember2023-01-012023-03-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended March 31, 2024.

or

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission file number: 001-35376

OBLONG, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| Delaware | 77-0312442 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

110 16th Street, Suite 1400-1024, Denver, CO 80202

(Address of Principal Executive Offices, including Zip Code)

(213) 683-8863 ext. 5

(Registrant’s Telephone Number, including Area Code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

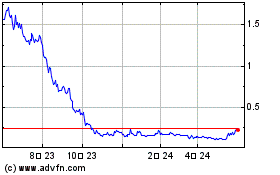

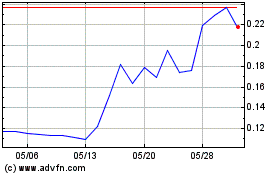

| Common Stock, par value $0.0001 per share | | OBLG | | Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ☐ | Accelerated filer ☐ |

Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.)

Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock as of May 3, 2024 was 20,286,675.

OBLONG, INC.

Index

| | | | | | | | |

| PART I - FINANCIAL INFORMATION | |

Item 1. Financial Statements | |

| Condensed Consolidated Balance Sheets at March 31, 2024 (unaudited) and December 31, 2023 | |

| Unaudited Condensed Consolidated Statements of Operations for the three months ended March 31, 2024 and 2023 | |

| Unaudited Condensed Consolidated Statements of Changes in Stockholders’ Equity for the three months ended March 31, 2024 and 2023 | |

| Unaudited Condensed Consolidated Statements of Cash Flows for the three months ended March 31, 2024 and 2023 | |

| Notes to unaudited Condensed Consolidated Financial Statements | |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. Quantitative and Qualitative Disclosures About Market Risk | |

Item 4. Controls and Procedures | |

| | |

PART II - OTHER INFORMATION | |

Item 1. Legal Proceedings | |

Item 1A. Risk Factors | |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

Item 3. Defaults Upon Senior Securities | |

Item 4. Mine Safety Disclosures | |

Item 5. Other Information | |

Item 6. Exhibits | |

Signatures | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q (this “Report”) contains statements that are considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and its rules and regulations (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, and its rules and regulations (the “Exchange Act”). These forward-looking statements include, but are not limited to, statements about the plans, objectives, expectations and intentions of Oblong, Inc. (“Oblong” or “we” or “us” or the “Company”). All statements other than statements of current or historical fact contained in this Report, including statements regarding Oblong’s future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” and similar expressions, as they relate to Oblong, are intended to identify forward-looking statements. These statements are based on Oblong’s current plans, and Oblong’s actual future activities and results of operations may be materially different from those set forth in the forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the statements made. Any or all of the forward-looking statements in this Report may turn out to be inaccurate. Oblong has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. The forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and assumptions. There are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including our plans, objectives, expectations and intentions and other factors that are discussed under the section entitled “Part I. Item 1A. Risk Factors” and in our consolidated financial statements and the footnotes thereto for the fiscal year ended December 31, 2023, each included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the Securities and Exchange Commission (the “SEC”) on March 19, 2024, as well as under “Part II. Item 1A. Risk Factors” in this report. Oblong undertakes no obligation to publicly revise these forward-looking statements to reflect events occurring after the date hereof. All subsequent written and oral forward-looking statements attributable to Oblong or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained in this Report. Forward-looking statements in this Report include, among other things: opportunities for and benefits of potential strategic alternatives; our expectations and estimates relating to customer attrition, demand for our product offerings, sales cycles, future revenues, expenses, capital expenditures and cash flows; evolution of our customer solutions and our service platforms; our ability to fund operations and continue as a going concern; expectations regarding adjustments to our cost of revenue and other operating expenses; our ability to finance investments in product development and sales and marketing; the future exercise of warrants; our ability to raise capital through sales of additional equity or debt securities and/or loans from financial institutions; our beliefs about the ongoing performance and success of our Managed Service business; statements relating to market need and evolution of the industry, our solutions and our service platforms; and the adequacy of our internal controls. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

•our ability to raise capital in one or more debt and/or equity offerings in order to fund operations or any growth initiatives and our ability to continue as a going concern;

•the impact of the issuance of our Series F Preferred Stock in the March 2023 private placements, conversions of our Series F Preferred Stock and sales of the underlying conversion shares.

•customer acceptance and demand for our video collaboration services and network applications;

•our ability to launch new products and offerings and to sell our solutions;

•our ability to compete effectively in the video collaboration services and network services businesses;

•the ongoing performance and success of our Managed Services business;

•our ability to maintain and protect our proprietary rights;

•our ability to withstand industry consolidation;

•our ability to adapt to changes in industry structure and market conditions;

•actions by our competitors, including price reductions for their competitive services;

•the quality and reliability of our products and services;

•the prices for our products and services and changes to our pricing model;

•the success of our sales and marketing approach and efforts, and our ability to grow revenue;

•customer renewal and retention rates;

•the continued impact from the aftermath of the coronavirus pandemic on our revenue and results of operations;

•risks related to the concentration of our customers and the degree to which our sales, now or in the future, depend on certain large client relationships;

•increases in material, labor or other manufacturing-related costs;

•changes in our go-to-market cost structure;

•inventory management and our reliance on our supply chain;

•our ability to attract and retain highly skilled personnel;

•our reliance on open-source software and technology;

•potential federal and state regulatory actions;

•our ability to innovate technologically, and, in particular, our ability to develop next generation Oblong technology;

•our ability to satisfy the standards for continued listing of our common stock on the Nasdaq Capital Market;

•changes in our capital structure and/or stockholder mix;

•the costs, disruption, and diversion of management’s attention associated with campaigns commenced by activist investors; and

•our management’s ability to execute its plans, strategies and objectives for future operations.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

OBLONG, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value, stated value, and shares)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 5,360 | | | $ | 5,990 | |

| | | |

| Accounts receivable, net | 15 | | | 424 | |

| Inventory, net | 127 | | | 239 | |

| Prepaid expenses and other current assets | 421 | | | 243 | |

| Total current assets | 5,923 | | | 6,896 | |

| | | |

| | | |

| | | |

Operating lease - right of use asset, net | — | | | 17 | |

| Other assets | 12 | | | 12 | |

| Total assets | $ | 5,935 | | | $ | 6,925 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 351 | | | $ | 211 | |

| Accrued expenses and other current liabilities | 1,031 | | | 1,038 | |

| Current portion of deferred revenue | 105 | | | 132 | |

| Operating lease liabilities | — | | | 17 | |

| Total current liabilities | 1,487 | | | 1,398 | |

| Long-term liabilities: | | | |

| | | |

| Deferred revenue, net of current portion | 14 | | | 26 | |

| | | |

| | | |

| Total liabilities | 1,501 | | | 1,424 | |

Commitments and contingencies (see Note 9) | | | |

| Stockholders’ equity: | | | |

Preferred stock Series F, convertible; $.0001 par value; $1,102,150 stated value; 42,000 shares authorized, 1,008 and 1,930 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | — | | | — | |

Common stock, $.0001 par value; 150,000,000 shares authorized; 20,294,228 shares issued and 20,285,675 outstanding at March 31, 2024 and 16,692,124 shares issued and 16,683,572 shares outstanding at December 31, 2023 | 2 | | | 2 | |

Treasury stock, 8,000 shares of common stock | (181) | | | (181) | |

| Additional paid-in capital | 233,980 | | | 233,911 | |

| Accumulated deficit | (229,367) | | | (228,231) | |

| Total stockholders' equity | 4,434 | | | 5,501 | |

| Total liabilities and stockholders’ equity | $ | 5,935 | | | $ | 6,925 | |

See accompanying notes to condensed consolidated financial statements.

-1-

OBLONG, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 31, | | |

| 2024 | | 2023 | | | | |

| Revenue | $ | 626 | | | $ | 1,038 | | | | | |

| Cost of revenue (exclusive of depreciation and amortization) | 629 | | | 762 | | | | | |

| Gross profit | (3) | | | 276 | | | | | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | 50 | | | 6 | | | | | |

| Sales and marketing | 54 | | | 218 | | | | | |

| General and administrative | 1,077 | | | 1,169 | | | | | |

| | | | | | | |

| | | | | | | |

| Depreciation and amortization | — | | | 86 | | | | | |

| Total operating expenses | 1,181 | | | 1,479 | | | | | |

| Loss from operations | (1,184) | | | (1,203) | | | | | |

| Interest and other expense, net | — | | | 5 | | | | | |

| Other income | (48) | | | (27) | | | | | |

| | | | | | | |

| Interest and other income, net | (48) | | | (22) | | | | | |

| Loss before income taxes | (1,136) | | | (1,181) | | | | | |

| Income tax expense | — | | | 38 | | | | | |

| Net loss | (1,136) | | | (1,219) | | | | | |

| Preferred stock dividends | 44 | | | — | | | | | |

| | | | | | | |

| | | | | | | |

| Warrant modification | — | | | 25 | | | | | |

| Net loss attributable to common stockholders | $ | (1,180) | | | $ | (1,244) | | | | | |

| | | | | | | |

| Net loss attributable to common stockholders per share: | | | | | | | |

| Basic and diluted net loss per share | $ | (0.07) | | | $ | (0.60) | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted-average number of shares of common stock: | | | | | | | |

| Basic and diluted | 17,123 | | | 2,065 | | | | | |

| | | | | | | |

| | | | | | | |

See accompanying notes to condensed consolidated financial statements.

-2-

OBLONG, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

Three Months Ended March 31, 2024

(In thousands, except shares of Series F Preferred Stock)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series F Preferred Stock | | Common Stock | | Treasury Stock | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Additional Paid-In Capital | | Accumulated Deficit | | Total |

| Balance at December 31, 2023 | 1,930 | | | $ | — | | | 16,692 | | | $ | 2 | | | 8 | | | $ | (181) | | | $ | 233,911 | | | $ | (228,231) | | | $ | 5,501 | |

Net loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,136) | | | (1,136) | |

Stock-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 31 | | | — | | | 31 | |

| | | | | | | | | | | | | | | | | |

Conversions of Series F Preferred Stock including accrued dividends of $82,000 | (922) | | | — | | | 3,602 | | | — | | | — | | | — | | | 82 | | | — | | | 82 | |

| Series F Preferred Stock dividends | — | | | — | | | — | | | — | | | — | | | — | | | (44) | | | — | | | (44) | |

| Balance at March 31, 2024 | 1,008 | | | $ | — | | | 20,294 | | | $ | 2 | | | 8 | | | $ | (181) | | | $ | 233,980 | | | $ | (229,367) | | | $ | 4,434 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

-3-

OBLONG, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

Three Months Ended March 31, 2023

(In thousands, except shares of Series F Preferred Stock)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series F Preferred Stock | | Common Stock | | Treasury Stock | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Additional Paid-In Capital | | Accumulated Deficit | | Total |

| Balance at December 31, 2022 | — | | | $ | — | | | 2,071 | | | $ | — | | | 8 | | | $ | (181) | | | $ | 227,645 | | | $ | (223,847) | | | $ | 3,617 | |

Net loss | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,219) | | | (1,219) | |

Stock-based compensation | — | | | — | | | — | | | — | | | — | | | — | | | 31 | | | — | | | 31 | |

| Proceeds from private placement, net of fees and amounts held in escrow | 6,550 | | | — | | | — | | | — | | | — | | | — | | | 1,473 | | | — | | | 1,473 | |

| Balance at March 31, 2023 | 6,550 | | | $ | — | | | 2,071 | | | $ | — | | | 8 | | | $ | (181) | | | $ | 229,149 | | | $ | (225,066) | | | $ | 3,902 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

-4-

OBLONG, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (1,136) | | | $ | (1,219) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | — | | | 86 | |

| Bad debt (recovery) expense | — | | | (24) | |

| Non-cash lease expense from right-of-use asset | 17 | | | 43 | |

| Stock-based compensation | 31 | | | 31 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 409 | | | 47 | |

| Inventory | 112 | | | 89 | |

| Prepaid expenses and other current assets | (178) | | | (298) | |

| Other assets | — | | | 9 | |

| Accounts payable | 140 | | | 23 | |

| Accrued expenses and other current liabilities | 31 | | | 591 | |

| Deferred revenue | (39) | | | (125) | |

| Lease liabilities | (17) | | | (97) | |

| Net cash used in operating activities | (630) | | | (844) | |

| | | |

| | | |

| | | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from private placement, net of issuance costs and amounts in escrow | — | | | 1,473 | |

| | | |

| | | |

| Net cash provided by financing activities | — | | | 1,473 | |

| Decrease (increase) in cash | (630) | | | 629 | |

| Cash and cash equivalents at beginning of period | 5,990 | | | 3,085 | |

| Cash and cash equivalents at end of period | $ | 5,360 | | | $ | 3,714 | |

| | | |

| Supplemental disclosures of cash flow information: | | | |

| | | |

| Reconciliation of cash and cash equivalents | | | |

| Cash | $ | 4,860 | | | $ | 3,714 | |

| Current certificates of deposit | 500 | | | — | |

| | | |

| Total cash and cash equivalents | $ | 5,360 | | | $ | 3,714 | |

| | | |

| Cash paid during the period for interest | $ | 5 | | | $ | 2 | |

| Cash paid for income taxes | $ | — | | | $ | 31 | |

| Non-cash investing and financing activities: | | | |

| Preferred stock dividends | $ | 44 | | | $ | — | |

| Warrant modification | $ | — | | | $ | 25 | |

| | | |

| | | |

| | | |

See accompanying notes to condensed consolidated financial statements.

-5-

OBLONG, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2024

(Unaudited)

Note 1 - Business Description and Significant Accounting Policies

Business Description

Oblong, Inc. (“Oblong” or “we” or “us” or the “Company”) was formed as a Delaware corporation in May 2000 and is a provider of patented multi-stream collaboration technologies and managed services for video collaboration and network applications.

Basis of Presentation

The Company's fiscal year ends on December 31 of each calendar year. The accompanying interim Condensed Consolidated Financial Statements are unaudited and have been prepared on substantially the same basis as our annual Consolidated Financial Statements for the fiscal year ended December 31, 2023. In the opinion of the Company's management, these interim Condensed Consolidated Financial Statements reflect all adjustments (consisting only of normal recurring adjustments) considered necessary for a fair statement of our financial position, results of operations and cash flows for the periods presented. The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Condensed Consolidated Financial Statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from these estimates.

The December 31, 2023 year-end Condensed Consolidated Balance Sheet data in this document was derived from audited consolidated financial statements. The Condensed Consolidated Financial Statements and notes included in this quarterly report on Form 10-Q do not include all disclosures required by U.S. generally accepted accounting principles and should be read in conjunction with the Company's audited consolidated financial statements as of and for the year ended December 31, 2023 and notes thereto included in the Company's fiscal 2023 Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on March 19, 2024 (the “2023 Annual Report”).

The results of operations and cash flows for the interim periods included in these Condensed Consolidated Financial Statements are not necessarily indicative of the results to be expected for any future period or the entire fiscal year.

Principles of Consolidation

The Condensed Consolidated Financial Statements include the accounts of Oblong and our 100%-owned subsidiaries (i) GP Communications, LLC (“GP Communications”), whose business function is to provide interstate telecommunications services for regulatory purposes, and (ii) Oblong Industries, Inc. All inter-company balances and transactions have been eliminated in consolidation. The U.S. Dollar is the functional currency for all subsidiaries.

Cash and Cash Equivalents

As of March 31, 2024, our total cash balance of $5,360,000 is available. Of this balance $500,000 was held in short-term certificates of deposit with MidFirst Bank. As of December 31, 2023, our total cash balance of $5,990,000 was available with $500,000 held in short-term certificates of deposit with MidFirst Bank. The Company considers highly liquid investments with original maturities of three months or less to be cash equivalents.

Segments

The Company currently operates in two segments: (1) “Collaboration Products” which represents the business surrounding our Mezzanine™ product offerings, and (2) “Managed Services” which represents the business surrounding managed services for video collaboration and network solutions. See Note 8 - Segment Reporting for further discussion.

Use of Estimates

Preparation of the Condensed Consolidated Financial Statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual amounts could differ from the estimates made. We continually evaluate estimates used in the preparation of our consolidated financial statements for reasonableness. Appropriate adjustments, if any, to the estimates used are made prospectively based upon such periodic evaluation. The significant areas of estimation include determining the allowances for inventory obsolescence and estimated credit losses and the inputs used in the fair value of equity-based awards.

Intangible Assets

As of March 31, 2024 and December 31, 2023, we had no intangible assets. During the three months ended March 31, 2023, we recorded $86,000 in amortization expense related to intangible assets.

Operating Lease Right-of-use-Assets and Liabilities

In February 2024, we exited our warehouse lease in City of Industry, California, and are no longer a party to any operating leases. Right-of-use assets, net totaled $17,000 as of December 31, 2023, consisting of the warehouse lease discussed above. As of March 31, 2024, the Company had no right-of-use assets remaining. The remaining operating lease liability as of December 31, 2023 was $17,000, consisting of the warehouse lease discussed above. As of March 31, 2024, the Company had no lease liability remaining. During the three months ended March 31, 2024, we recorded $17,000 in lease expenses. During the three months ended March 31, 2023, we recorded $46,000 in lease expenses, net of common charges, and sublease proceeds of $16,000.

Significant Accounting Policies

The significant accounting policies used in preparation of these Condensed Consolidated Financial Statements are disclosed in our 2023 Annual Report, and there have been no changes to the Company’s significant accounting policies during the three months ended March 31, 2024.

Recently Issued Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic280): Improvements to Reportable Segment Disclosures. The new guidance is intended to improve reportable segment disclosure requirements primarily through enhanced disclosures about significant segment expenses. The amendments are effective retrospectively for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024. The Company is in the process of evaluating the impact that the adoption of this ASU will have on the financial statements and related disclosures, which is not expected to be material.

In December 2023, the FASB issued ASU No. 2023-09, Improvements to Tax Disclosures (Topic 740), to enhance the transparency and decision usefulness of income tax disclosures through changes to the rate reconciliation and income taxes paid information. This guidance is effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is evaluating the impact of adopting this new accounting guidance on its Consolidated Financial Statements.

Note 2 - Liquidity

As of March 31, 2024, we had $5,360,000 in cash and working capital of $4,436,000. For the three months ended March 31, 2024, we incurred a net loss of $1,136,000 and used $630,000 of net cash in operating activities.

We believe that our existing cash will be sufficient to fund our operations and meet our working capital requirements for at least the next 12 months from the filing date of this Report with the SEC.

Note 3 - Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

| | | | | | | | | | | |

| March 31, | | December 31, |

| 2024 | | 2023 |

| | | |

| Compensation costs | $ | 526 | | | $ | 448 | |

| Customer deposits | 86 | | | 118 | |

| Professional fees | 129 | | | 104 | |

| Taxes and regulatory fees | 19 | | | 22 | |

| Accrued rent | 170 | | | 202 | |

| Accrued dividends on Series F Preferred Stock | 94 | | | 136 | |

| Other accrued expenses and liabilities | 7 | | | 8 | |

| Accrued expenses and other liabilities | $ | 1,031 | | | $ | 1,038 | |

| | | |

Note 4 - Capital Stock

Common Stock

The Company’s common stock, par value $0.0001 per share (the “Common Stock”), is listed on the Nasdaq Capital Market (“Nasdaq”), under the ticker symbol “OBLG”. As of March 31, 2024, we had 150,000,000 shares of our Common Stock authorized, with 20,294,000 and 20,286,000 shares issued and outstanding, respectively.

During the three months ended March 31, 2024, 922 shares of Series F Preferred Stock, plus $82,000 accrued dividends, were converted to 3,602,103 shares of the Company’s common stock. See Note 5 - Preferred Stock, for further detail.

Common Stock activity for the three months ended March 31, 2024 is presented below (in thousands).

| | | | | | | | |

| Issued Shares as of December 31, 2022 | | 2,071 | |

| | |

| Issuances from Preferred Stock conversions | | 14,102 | |

| Issuances related to warrant exercises | | 746 | |

| Issuances related to stock compensation | | 180 | |

| Common shares exchanged for prepaid warrants | | (407) | |

| | |

| Issued Shares as of December 31, 2023 | | 16,692 | |

| | |

| Issuances from Preferred Stock conversions | | 3,602 | |

| | |

| | |

| | |

| | |

| Issued Shares as of March 31, 2024 | | 20,294 | |

| Less Treasury Shares: | | (8) | |

| Outstanding Shares as of March 31, 2024 | | 20,286 | |

Common Stock Warrants

Warrants outstanding as of March 31, 2024 are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Issue Date | | Warrants Outstanding | | Exercise Price | | Expiration Date |

| | | | | | |

| | | | | | |

| June 28, 2021 | | 750 | | | $ | 66.00 | | | December 31, 2024 |

| March 31, 2023 | | 4,136,850 | | | $ | 1.71 | | | September 30, 2028 |

| | 4,137,600 | | | | | |

Warrant activity for the three months ended March 31, 2024 and the year ended December 31, 2023 is presented below.

| | | | | | | | | | | | | | | | | | |

| | Outstanding and Exercisable | | |

| | Number of Warrants | | Weighted Average Exercise Price | | | | |

| Warrants outstanding and exercisable, December 31, 2022 | | 343,099 | | | $ | 66.34 | | | | | |

| Granted | | 4,543,626 | | | 1.71 | | | | | |

| Exercised | | (746,027) | | | 0.78 | | | | | |

| Expired | | (2,601) | | | 76.93 | | | | | |

| Forfeited | | (247) | | | — | | | | |

| Warrants outstanding and exercisable, December 31, 2023 | | 4,137,850 | | | 1.72 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Expired | | (250) | | | 60.00 | | | | | |

| | | | | | | | |

| Warrants outstanding and exercisable, March 31, 2024 | | 4,137,600 | | | $ | 1.72 | | | | | |

Treasury Shares

The Company maintains treasury stock for the Common Stock shares bought back by the Company when withholding shares to cover taxes on transactions related to equity awards. There were no treasury stock transactions during the three months ended March 31, 2024 or the year ended December 31, 2023.

Note 5 - Preferred Stock

Our Certificate of Incorporation authorizes the issuance of up to 5,000,000 shares of preferred stock. As of March 31, 2024, we had 1,983,250 designated shares of preferred stock and 1,008 shares of preferred stock issued and outstanding. As of December 31, 2023, we had 1,930 shares of preferred stock issued and outstanding.

Series F Preferred Stock

On March 30, 2023, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain accredited investors (the “Investors”), pursuant to which we issued and sold, in a private placement (the “Private Placement”) (i) 6,550 shares of our newly designated Series F Preferred Stock, $0.0001 par value per share (the “Series F Preferred Stock”), (ii) preferred warrants (the “Preferred Warrants”) to acquire 32,750 shares of Series F Preferred Stock, and (iii) common warrants (“Common Warrants” and with the Preferred Warrants the “Investor Warrants”) to acquire up to 3,830,417 shares of Common Stock. Please refer to Note 4 - Capital Stock for additional detail regarding the Series F Preferred Stock and Preferred Warrants. The terms of the Series F Preferred Stock are as set forward in the Certificate of Designations of Series F Preferred Stock of Oblong, Inc. (the “Certificate of Designations”), which was filed and became effective with the Secretary of State of the State of Delaware on March 31, 2023. The Private Placement closed on March 31, 2023, in exchange for gross and net proceeds of $6,386,000 and $5,364,000, respectively. The financing fees associated with the Purchase Agreement were $1,022,000.

The Series F Preferred Shares are convertible into fully paid and non-assessable shares of the Company’s Common Stock at the election of the holder at any time at an initial conversion price of $1.71 (the “Conversion Price”). The holders of the Series F Preferred Shares may also elect to convert their shares at an alternative conversion price equal to the lower of (i) 80% of the applicable Conversion Price as in effect on the date of the conversion, (ii) 80% of the closing price on the trading day immediately preceding the delivery of the conversion notice, and (iii) the greater of (a) the Floor Price (as defined in the Certificate of Designations) and (b) the quotient of (x) the sum of the five lowest Closing Bid Prices (as defined in the Certificate of Designations) for trading days in the 30 consecutive trading day period ending and including the trading day immediately preceding the delivery of the applicable Conversion Notice, divided by (y) five. The Conversion Price is subject to customary adjustments for stock splits, stock dividends, stock combination recapitalization, or other similar transactions involving the Common Stock, and subject to price-based adjustment, on a full ratchet basis, in the event of any issuances of our common stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then-applicable Conversion Price (subject to certain exceptions).

On October 6, 2023, the Company and Investors holding a majority of the outstanding shares of the Preferred Stock agreed to waive any and all provisions, terms, covenants and obligations in the Certificate of Designations or Common Warrants to the

extent such provisions permit the conversion or exercise of the Preferred Stock and the Common Warrants, respectively, to occur at a price below $0.2792. Notwithstanding anything to the contrary in the Certificate of Designations, each of the “Alternate Conversion Price” and the “Floor Price” as set forth in the Certificate of Designations shall in no event be less than $0.2792 (as adjusted for stock splits, stock dividends, stock combinations, recapitalizations and similar events).

Under the Certificate of Designations, the Series F Preferred Shares have an initial stated value of $1,000 per share (the “Stated Value”). The holders of the Series F Preferred Shares are entitled to dividends of 9% per annum, which will be payable in arrears quarterly. Accrued dividends may be paid, at our option, in cash and if not paid, shall increase the stated value of the Series F Preferred Shares. Upon the occurrence and during the continuance of a Triggering Event (as defined in the Certificate of Designations), the Series F Preferred Shares will accrue dividends at the rate of 20% per annum (the “Default Rate”). The Series F Preferred Shares have no voting rights, other than with respect to certain matters affecting the rights of the Series F Preferred Shares. On matters with respect to which the holders of the Series F Preferred Shares have a right to vote, holders of the Preferred Shares will have voting rights on an as-converted basis.

Our ability to settle conversions is subject to certain limitations set forth in the Certificate of Designations. Further, the Certificate of Designations contains a certain beneficial ownership limitation after giving effect to the issuance of shares of common stock issuable upon conversion of the Series F Preferred Shares.

The Certificate of Designations includes certain Triggering Events (as defined in the Certificate of Designations), including, among other things, (i) the failure to file and maintain an effective registration statement covering the sale of the holder’s securities registrable pursuant to the Registration Rights Agreement, (ii) the failure to pay any amounts due to the holders of the Series F Preferred Shares when due, and (iii) if Peter Holst ceases to be the chief executive officer of the Company other than because of his death, and a qualified replacement, reasonably acceptable to a majority of the holders of the Series F Preferred Shares, is not appointed within thirty (30) business days. In connection with a Triggering Event, the Default Rate is triggered. We are subject to certain affirmative and negative covenants regarding the incurrence of indebtedness, acquisition transactions, the existence of liens, the repayment of indebtedness, the payment of cash in respect of dividends (other than dividends pursuant to the Certificate of Designations), maintenance of properties and the transfer of assets, among other matters.

During the year ended December 31, 2023 and the three months ended March 31, 2024, 4,620 and 922 shares of Series F Preferred Stock, plus accrued dividends, were converted to 14,102,477 and 3,602,103 shares of the Company’s common stock, respectively. There were 1,008 shares of Series F Preferred Stock outstanding and accrued dividends of $94,000 as of March 31, 2024. Series F Preferred Stock transactions are summarized in the table below (in thousands except for shares of Series F Preferred Stock:

| | | | | | | | | | | | | | |

| Series F Preferred Stock Shares | Preferred Stock Dividends | Weighted Average Conversion Price | Common Shares Issued from Conversions |

| March 31, 2023 Issuance | 6,550 | | $ | — | | | — | |

| 2023 Accrued Dividends | — | | $ | 343 | | | — | |

| 2023 Conversions | (4,620) | | $ | (211) | | $ | 0.34 | | 14,102 | |

| December 31, 2023 Balance | 1,930 | | $ | 132 | | | 14,102 | |

| 2024 Accrued Dividends | — | | $ | 44 | | | — | |

| 2024 Conversions | (922) | | $ | (82) | | 0.28 | | 3,602 | |

| March 31, 2024 Balance | 1,008 | | $ | 94 | | $ | 0.33 | | 17,704 | |

Series F Preferred Stock Warrants

The Preferred Warrants are exercisable for Series F Preferred Shares at an exercise price of $975. The exercise price is subject to customary adjustments for stock splits, stock dividends, stock combination recapitalizations or other similar transactions involving the Common Stock. The Preferred Warrants expire three years from the date of issuance and are exercisable for cash. For each Preferred Warrant exercised, the Investors shall receive Common Warrants to purchase a number of shares of Common Stock equal to 100% of the number of shares of Common Stock the Investors would receive if the Series F Preferred Shares issuable upon exercise of such Warrant were converted at the applicable Conversion Price. The fair value of the Preferred Warrants was recorded within additional paid-in capital upon issuance. As of March 31, 2024, no Preferred Warrants have been exercised.

Note 6 - Stock Based Compensation

2019 Equity Incentive Plan

On December 19, 2019, the Oblong, Inc. 2019 Equity Incentive Plan (the “2019 Plan”) was approved by the Company’s stockholders at the Company’s 2019 Annual Meeting of Stockholders. The 2019 Plan is an omnibus equity incentive plan pursuant to which the Company may grant equity and cash incentive awards to certain key service providers of the Company and its subsidiaries. As of December 31, 2023, the share pool available for new grants under the 2019 Plan was 3.

Stock Options

A summary of stock option activity under our plans, and options outstanding as of, and changes made during the three months ended March 31, 2024 and year ended December 31, 2023 is presented below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Outstanding | | Exercisable |

| Number of Options | | Weighted Average Exercise Price | | Number of Options | | Weighted Average Exercise Price |

| Options outstanding and exercisable, December 31, 2022 | 16,668 | | | $ | 143.63 | | | 10,000 | | | $ | 206.85 | |

| | | | | | | |

| | | | | | | |

| Vested | — | | | — | | 3,336 | | | 48.75 |

| Expired | (6,668) | | | 285.89 | | (6,668) | | | 285.89 |

| | | | | | | |

| Options outstanding and exercisable, December 31, 2023 | 10,000 | | | 48.75 | | | 6,668 | | | 48.75 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Options outstanding and exercisable, March 31, 2024 | 10,000 | | | $ | 48.75 | | | 6,668 | | | $ | 48.75 | |

| | | | | | | |

The intrinsic value of vested and unvested options was not significant for all periods presented. Stock compensation expense related to stock options for the three months ended March 31, 2024 and 2023 was $31,000 and was recorded as a general and administrative expense on our Condensed Consolidated Statements of Operations. The remaining unrecognized stock-based compensation expense for options as of March 31, 2024 is $30,000, which will be recognized over a weighted average period of 3 months.

Restricted Stock

As of March 31, 2024 and December 31, 2023, there were no outstanding restricted stock awards or restricted stock units (“Restricted Stock”). For the three months ended March 31, 2024 and 2023, there was no stock compensation expense recorded for Restricted Stock and there was no unamortized expense related to Restricted Stock. The following table shows a summary of Restricted Stock activity for the year ended December 31, 2023. There was no Restricted Stock activity during the three months ended March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Restricted Stock Awards | | Restricted Stock Units |

| | Shares | | Weighted Average Grant Price | | Shares | | Weighted Average Grant Price |

| Unvested shares, December 31, 2022 | | 42 | | | $ | 235.87 | | | — | | | $ | — | |

| Granted | | — | | | | | 177,564 | | | 2.14 | |

| Vested | | (42) | | | 235.87 | | | (177,564) | | | 2.14 | |

| Unvested Shares, December 31, 2023 | | — | | | — | | | — | | | — | |

| Unvested Shares, March 31, 2024 | | — | | | $ | — | | | — | | | $ | — | |

Note 7 - Net Loss Per Share

Basic net loss per share is computed by dividing net loss attributable to common stockholders by the weighted-average number of shares of common stock outstanding during the period. The weighted-average number of shares of common stock outstanding does not include any potentially dilutive securities or unvested Restricted Stock. Unvested Restricted Stock, although classified as issued and outstanding at March 31, 2023, was considered contingently returnable until the restrictions lapsed and was not included in the basic net loss per share calculation for the three months ended March 31, 2023. Unvested Restricted Stock does not contain non-forfeitable rights to dividends and dividend equivalents.

Diluted net loss per share is computed by giving effect to all potential shares of common stock, including stock options, preferred stock, warrants, and unvested Restricted Stock, to the extent they are dilutive. For the three months ended March 31, 2024 and 2023, all such common stock equivalents have been excluded from diluted net loss per share as the effect to net loss per share would be anti-dilutive (due to the net loss).

The following table sets forth the computation of the Company’s basic and diluted net loss per share (in thousands, except per share data):

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Numerator: | | | | | | | |

| Net loss | $ | (1,136) | | | $ | (1,219) | | | | | |

| Less: preferred stock dividends | (44) | | | — | | | | | |

| | | | | | | |

| | | | | | | |

| Less: warrant modification | — | | | (25) | | | | | |

| Net loss attributable to common stockholders | $ | (1,180) | | | $ | (1,244) | | | | | |

| Denominator: | | | | | | | |

| Weighted-average number of shares of common stock for basic and diluted net loss per share | 17,123 | | | 2,065 | | | | | |

| Basic and diluted net loss per share | $ | (0.07) | | | $ | (0.60) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The following table represents the potential shares that were excluded from the computation of weighted-average number of shares of common stock in computing the diluted net loss per share for the periods presented because including them would have had an anti-dilutive effect (due to the net loss):

| | | | | | | | | | | |

| As of March 31, |

| 2024 | | 2023 |

| Unvested restricted stock awards | — | | | 42 | |

| | | |

| Outstanding stock options | 10,000 | | | 10,167 | |

| Common stock issuable upon conversion of Series F Preferred Stock (1) | 3,947,529 | | | 3,830,409 | |

| Common stock issuable upon conversion of Series F Preferred Warrants (2) | 117,299,427 | | | — | |

| Common stock issuable upon conversion of Common Stock warrants | 4,137,600 | | | 4,479,947 | |

(1) Calculation assumes conversion of the stated value, and accrued dividends, of the Series F Preferred Stock into Common Stock at the Floor Price as of March 31, 2024, and at the initial conversion price of $1.71 as of March 31, 2023.

(2) Calculation assumes exercise of the Series F Preferred Warrants for cash into Series F Preferred Stock and subsequent conversion of the Series F Preferred Stock into Common Stock at the Floor Price as of March 31, 2024. The Series F Preferred Stock Warrants were not exercisable as of March 31, 2023.

Note 8 - Segment Reporting

The Company currently operates in two segments: (1) “Managed Services”, which represents the business surrounding managed services for video collaboration and network applications; and (2) “Collaboration Products” which represents the business surrounding our Mezzanine™ product offerings.

Certain information concerning the Company’s segments for the three months ended March 31, 2024 and 2023 is presented in the following tables (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Managed Services | | Collaboration Products | | Corporate | | Total |

| Revenue | $ | 522 | | | $ | 104 | | | $ | — | | | $ | 626 | |

| Cost of revenues | 369 | | | 260 | | | — | | | 629 | |

| Gross profit | $ | 153 | | | $ | (156) | | | $ | — | | | $ | (3) | |

| Gross profit % | 29 | % | | (150) | % | | | | — | % |

| | | | | | | |

| Allocated operating expenses | $ | — | | | $ | 121 | | | $ | — | | | $ | 121 | |

| Unallocated operating expenses | — | | | — | | | 1,060 | | | 1,060 | |

| Total operating expenses | $ | — | | | $ | 121 | | | $ | 1,060 | | | $ | 1,181 | |

| | | | | | | |

| Income (loss) from operations | $ | 153 | | | $ | (277) | | | $ | (1,060) | | | $ | (1,184) | |

| Interest and other income, net | (32) | | | (16) | | | — | | | (48) | |

| Net income (loss) before tax | 185 | | | (261) | | | (1,060) | | | (1,136) | |

| Income tax expense | — | | | — | | | — | | | — | |

| Net income (loss) | $ | 185 | | | $ | (261) | | | $ | (1,060) | | | $ | (1,136) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Managed Services | | Collaboration Products | | Corporate | | Total |

| Revenue | $ | 690 | | | $ | 348 | | | $ | — | | | $ | 1,038 | |

| Cost of revenues | 460 | | | 302 | | | — | | | 762 | |

| Gross profit | $ | 230 | | | $ | 46 | | | $ | — | | | $ | 276 | |

| Gross profit % | 33 | % | | 13 | % | | | | 27 | % |

| | | | | | | |

| Allocated operating expenses | $ | — | | | $ | 286 | | | $ | — | | | $ | 286 | |

| Unallocated operating expenses | — | | | — | | | 1,193 | | | 1,193 | |

| Total operating expenses | $ | — | | | $ | 286 | | | $ | 1,193 | | | $ | 1,479 | |

| | | | | | | |

| Income (loss) from operations | $ | 230 | | | $ | (240) | | | $ | (1,193) | | | $ | (1,203) | |

| Interest and other expense (income), net | 3 | | | (25) | | | — | | | (22) | |

| Income (loss) before income taxes | 227 | | | (215) | | | (1,193) | | | (1,181) | |

| Income tax expense | 7 | | | 31 | | | — | | | 38 | |

| Net income (loss) | $ | 220 | | | $ | (246) | | | $ | (1,193) | | | $ | (1,219) | |

Unallocated operating expenses in Corporate include costs for the three months ended March 31, 2024 and 2023 that are not specific to a particular segment but are general to the group; included are expenses incurred for administrative and accounting staff, general liability and other insurance, professional fees, and other similar corporate expenses.

For the three months ended March 31, 2024, and 2023, there was no material revenue attributable to any individual foreign country.

Revenue by geographic area is allocated as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Domestic | $ | 261 | | | $ | 563 | | | | | |

| Foreign | 365 | | | 475 | | | | | |

| $ | 626 | | | $ | 1,038 | | | | | |

| | | | | | | |

Disaggregated information for the Company’s revenue has been recognized in the accompanying Condensed Consolidated Statements of Operations and is presented below according to contract type (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | % of Revenue | | 2023 | | % of Revenue |

| Revenue: Managed Services | | | | | | | |

| Video collaboration services | $ | 14 | | | 2 | % | | $ | 64 | | | 6 | % |

| Network services | 503 | | | 80 | % | | 618 | | | 60 | % |

| Professional and other services | 5 | | | 1 | % | | 8 | | | 1 | % |

| Total Managed Services revenue | $ | 522 | | | 83 | % | | $ | 690 | | | 66 | % |

| | | | | | | |

| Revenue: Collaboration Products | | | | | | | |

| Visual collaboration product offerings | $ | 104 | | | 17 | % | | $ | 348 | | | 34 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total revenue | $ | 626 | | | 100 | % | | $ | 1,038 | | | 100 | % |

The Company considers a significant customer to be one that comprises more than 10% of the Company’s consolidated revenues or accounts receivable. The loss of or a reduction in sales or anticipated sales to our most significant or several of our smaller customers could have a material adverse effect on our business, financial condition, and results of operations.

Concentration of consolidated revenues was as follows:

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2024 | | 2023 |

| Segment | | % of Revenue | | % of Revenue |

| Customer A | Managed Services | | 82 | % | | 52 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Concentration of accounts receivable was as follows:

| | | | | | | | | | | | | | | | | |

| | | As of March 31, 2024 |

| | | 2024 | | 2023 |

| Segment | | % of Accounts Receivable | | % of Accounts Receivable |

| Customer A | Managed Services | | — | % | | 41 | % |

| Customer B | Managed Services | | — | % | | 11 | % |

| Customer C | Collaboration Products | | — | % | | 14 | % |

| Customer D | Collaboration Products | | — | % | | 15 | % |

| Customer E | Collaboration Products | | 73 | % | | — | % |

| | | | | |

Note 9 - Commitments and Contingencies

From time to time, we are subject to various legal proceedings arising in the ordinary course of business, including proceedings for which we have insurance coverage. As of the date hereof, we are not party to any legal proceedings that we currently believe will have a material adverse effect on our business, financial position, results of operations or liquidity.

COVID-19

On March 11, 2020, the World Health Organization (“WHO”) announced that infections of the novel Coronavirus (COVID-19) had become pandemic, and on March 13, 2020, the U.S. President announced a National Emergency relating to the disease. In May 2023, the WHO declared COVID-19 over as a global health emergency. Customers generally use our Mezzanine™ products in traditional office and operating center environments such as conference rooms or other presentation spaces. Revenue declines for our Collaboration Products business are primarily due to lower demand, largely a consequence of the commercial reactions to the COVID-19 pandemic and its prolonged effects. We believe the COVID-19 pandemic fundamentally altered the way businesses consider the use of physical office spaces and, consequently, the demand for technologies that enable in-person collaboration within these spaces. Our analysis indicates that the reduced demand for our Mezzanine™ products, particularly in the aftermath of COVID-19, reflects a broader reassessment among our customers regarding the necessity and investment in collaboration solutions tailored for traditional office environments. Continuation of this trend could cause further declines in our revenue for this business. Although the Company cannot presently quantify the future financial impacts of this trend, such impacts will likely continue to have a material adverse impact on the Company’s consolidated financial condition, results of operations, and cash flows.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are a provider of patented multi-stream collaboration products and managed services for video collaboration and network solutions. The Company currently operates in two segments: (1) “Collaboration Products,” which represents the business surrounding our Mezzanine™ product offerings, and (2) “Managed Services,” which represents the business surrounding managed services for video collaboration and network solutions.

Mezzanine™ Product Offerings

Our flagship product is called Mezzanine™, a family of turn-key products that enable dynamic and immersive visual collaboration across multi-users, multi-screens, multi-devices, and multi-locations (see further description of Mezzanine™ in Part I, Item 1). Mezzanine™ allows multiple people to share, control and arrange content simultaneously, from any location, enabling all participants to see the same content in its entirety at the same time in identical formats, resulting in dramatic enhancements to both in-room and virtual videoconference presentations. Applications include video telepresence, laptop and application sharing, whiteboard sharing and slides. Spatial input allows content to be spread across screens, spanning different walls, scalable to an arbitrary number of displays and interaction with our proprietary wand device. Mezzanine™ substantially enhances day-to-day virtual meetings with technology that accelerates decision making, improves communication, and increases productivity. Mezzanine™ scales up to support the most immersive and commanding innovation centers; across to link labs, conference spaces, and situation rooms; and down for the smallest work groups. Mezzanine’s digital collaboration platform can be sold as delivered systems in various configurations for small teams to total immersion experiences. The family includes the 200 Series (two display screen), 300 Series (three screen), and 600 Series (six screen). We also sell maintenance and support contracts related to Mezzanine™.

Historically, customers have used Mezzanine™ products in traditional office and operating center environments such as conference rooms or other presentation spaces. As discussed below, sales of our Mezzanine product have been adversely affected by the commercial response to the COVID-19 pandemic and its aftermath. Like many technology companies in recent months, we will continue to monitor and manage our costs relative to demand with the goal of growing the Company’s revenue in the future. To the extent we believe new investments in product development, marketing, or sales are warranted as a result of changes in market demand, we believe additional capital will be required to fund those efforts and our ongoing operations.

Managed Services for Video Collaboration

We provide a range of managed services for video collaboration, from automated to orchestrated, to simplify the user experience in an effort to drive adoption of video collaboration throughout our customers’ enterprise. We deliver our services through a hybrid service platform or as a service layer on top of our customers’ video infrastructure. We provide our customers with i) managed videoconferencing, where we set up and manage customer videoconferences and ii) remote service management, where we provide 24/7 support and management of customer video environments.

Managed Services for Network

We provide our customers with network solutions that ensure reliable, high-quality and secure traffic of video, data and internet. Network services are offered to our customers on a subscription basis. Our network services business carries variable costs associated with the purchasing and reselling of this connectivity.

Oblong’s Results of Operations

Three Months Ended March 31, 2024 (the “2024 First Quarter”) compared to the Three Months Ended March 31, 2023 (the “2023 First Quarter”)

Certain information concerning the Company’s segments for the three months ended March 31, 2024 and 2023 and is presented below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Managed Services | | Collaboration Products | | Corporate | | Total |

| Revenue | $ | 522 | | | $ | 104 | | | $ | — | | | $ | 626 | |

| Cost of revenues | 369 | | | 260 | | | — | | | 629 | |

| Gross profit | $ | 153 | | | $ | (156) | | | $ | — | | | $ | (3) | |

| Gross profit % | 29 | % | | (150) | % | | | | — | % |

| | | | | | | |

| Allocated operating expenses | $ | — | | | $ | 121 | | | $ | — | | | $ | 121 | |

| Unallocated operating expenses | — | | | — | | | 1,060 | | | 1,060 | |

| Total operating expenses | $ | — | | | $ | 121 | | | $ | 1,060 | | | $ | 1,181 | |

| | | | | | | |

| Income (loss) from operations | $ | 153 | | | $ | (277) | | | $ | (1,060) | | | $ | (1,184) | |

| Interest and other income, net | (32) | | | (16) | | | — | | | (48) | |

| Net income (loss) before tax | 185 | | | (261) | | | (1,060) | | | (1,136) | |

| Income tax expense | — | | | — | | | — | | | — | |

| Net income (loss) | $ | 185 | | | $ | (261) | | | $ | (1,060) | | | $ | (1,136) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Managed Services | | Collaboration Products | | Corporate | | Total |

| Revenue | $ | 690 | | | $ | 348 | | | $ | — | | | $ | 1,038 | |

| Cost of revenues | 460 | | | 302 | | | — | | | 762 | |

| Gross profit | $ | 230 | | | $ | 46 | | | $ | — | | | $ | 276 | |

| Gross profit % | 33 | % | | 13 | % | | | | 27 | % |

| | | | | | | |

| Allocated operating expenses | $ | — | | | $ | 286 | | | $ | — | | | $ | 286 | |

| Unallocated operating expenses | — | | | — | | | 1,193 | | | 1,193 | |

| Total operating expenses | $ | — | | | $ | 286 | | | $ | 1,193 | | | $ | 1,479 | |

| | | | | | | |

| Income (loss) from operations | $ | 230 | | | $ | (240) | | | $ | (1,193) | | | $ | (1,203) | |

| Interest and other expense (income), net | 3 | | | (25) | | | — | | | (22) | |

| Income (loss) before income taxes | 227 | | | (215) | | | (1,193) | | | (1,181) | |

| Income tax expense | 7 | | | 31 | | | — | | | 38 | |

| Net income (loss) | $ | 220 | | | $ | (246) | | | $ | (1,193) | | | $ | (1,219) | |

Unallocated operating expenses in Corporate include costs during the 2024 and 2023 First Quarters that are not specific to a particular segment but are general to the group; included are expenses incurred for administrative and accounting staff, general liability and other insurance, professional fees, and other similar corporate expenses.

Revenue. Total revenue decreased 40% in the 2024 First Quarter compared to the 2023 First Quarter. The following table summarizes the changes in components of our revenue (in thousands), and the significant changes in revenue are discussed in more detail below.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | % of Revenue | | 2023 | | % of Revenue |

| Revenue: Managed Services | | | | | | | |

| Video collaboration services | $ | 14 | | | 2 | % | | $ | 64 | | | 6 | % |

| Network services | 503 | | | 80 | % | | 618 | | | 60 | % |

| Professional and other services | 5 | | | 1 | % | | 8 | | 1 | % |

| Total Managed Services revenue | $ | 522 | | | 83 | % | | $ | 690 | | | 66 | % |

| | | | | | | |

| Revenue: Collaboration Products | | | | | | | |

| Visual collaboration product offerings | $ | 104 | | | 17 | % | | $ | 348 | | | 34 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total revenue | $ | 626 | | | 100 | % | | $ | 1,038 | | | 100 | % |

Managed Services

•The decrease in revenue for video collaboration services is mainly attributable to lower revenue from existing customers (either from reductions in price or level of services) and loss of customers to competition.

•The decrease in revenue for network services is mainly attributable to net attrition of customers and lower demand for our services given the competitive environment and pressure on pricing that exists in the network services business.

•For the three months ended March 31, 2024, one customer made up 98% of Managed Services revenue. For the three months ended March 31, 2023, this same customer made up 80% of Managed Services revenue.

•We expect revenue declines in our Managed Services segment will continue in the future.

Collaboration Products

•Customers generally use our Mezzanine™ products in traditional office and operating center environments such as conference rooms or other presentation spaces. The year-over-year decrease in revenue for our Collaboration Products business is due to lower demand, largely a consequence of the work-place reactions to the COVID-19 pandemic and its prolonged effects. We believe the COVID-19 pandemic fundamentally altered the way businesses consider the use of physical office spaces and, consequently, the demand for technologies that enable in-person collaboration within these spaces. Our analysis indicates that the reduced demand for our Mezzanine™ products, particularly in the aftermath of COVID-19, reflects a broader reassessment among our customers regarding the necessity and investment in collaboration solutions tailored for traditional office environments.

Cost of Revenue (exclusive of depreciation and amortization). Cost of revenue, exclusive of depreciation and amortization and casualty loss, includes all internal and external costs related to the delivery of revenue. Cost of revenue also includes taxes which have been billed to customers. Cost of revenue by segment is presented in the following table (in thousands):

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cost of Revenue | | | |

| Managed Services | $ | 369 | | | $ | 460 | |

| Collaboration Products | 260 | | | 302 | |

| Total cost of revenue | $ | 629 | | | $ | 762 | |

The decrease in our consolidated cost of revenue is mainly attributable to lower costs associated with the decrease in revenue during the same period, offset by an increase in the expense related to our reserve for obsolescence on our inventory asset for our Collaboration Products segment. Our consolidated gross profit as a percentage of revenue was 0% in the 2024 First Quarter compared to a consolidated gross profit as a percentage of revenue of 27% in the 2023 First Quarter.

Our Managed Services segment recorded a 29% gross profit as a percentage of sales for the 2024 First Quarter compared to 33% in the 2023 First Quarter. This decrease was mainly attributable to fixed overhead costs related to lower sales as addressed above.