Oblong Announces Compliance with Nasdaq Bid Price Requirement

2024年9月12日 - 9:00PM

ビジネスワイヤ(英語)

Oblong, Inc. (Nasdaq: OBLG) (“Oblong” or the “Company”), the

award-winning maker of multi-stream collaboration solutions, today

announced that the Company received formal notice from The Nasdaq

Stock Market LLC ("Nasdaq") that the Company has regained

compliance with Nasdaq's minimum bid price requirement set forth in

Nasdaq Listing Rule 5550(a)(2), after the Company’s stock traded

above $1.00 per share for 10 consecutive business days.

Accordingly, Nasdaq has advised that the matter is now closed.

"We are pleased to report that Oblong is now back in full

compliance with Nasdaq’s listing requirements," said Peter Holst,

CEO of Oblong. "As of June 30, 2024, we had $5.9 million of cash

and no debt. We believe our existing cash provides us liquidity

into the first half of 2026. We remained focused on actively

seeking inorganic growth opportunities through M&A. Our

exploration of strategic alternatives is diverse, encompassing the

possibility of a business combination; a reverse merger; or

outright sale of the company. Each option is being carefully

evaluated to ensure it aligns with our overarching goal of

sustainable growth and value creation.”

About Oblong, Inc.

Oblong (Nasdaq: OBLG) provides innovative and patented

technologies that change the way people work, create, and

communicate. Oblong’s flagship product Mezzanine™ is a meeting

technology platform that offers simultaneous content sharing to

optimize audience engagement and situational awareness. For more

information, visit www.oblong.com and Oblong’s Twitter and Facebook

pages.

Forward looking and cautionary statements

This press release and any oral statements made regarding the

subject of this release contain forward- looking statements as

defined under Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and are made under the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. All statements,

other than statements of historical facts, that address activities

that Oblong assumes, plans, expects, believes, intends, projects,

estimates or anticipates (and other similar expressions) will,

should or may occur in the future are forward-looking statements.

Oblong’s actual results may differ materially from its

expectations, estimates and projections, and consequently you

should not rely on these forward- looking statements as predictions

of future events. Without limiting the generality of the foregoing,

forward-looking statements contained in this press release include

statements relating to the Company’s exploration of strategic

alternatives and the Company’s liquidity projection. There can be

no assurance that the strategic review being undertaken will result

in a merger, sale or other business combination involving the

Company. The forward-looking statements are based on management’s

current belief, based on currently available information, as to the

outcome and timing of future events, and involve factors, risks,

and uncertainties, including the volatility of market price for our

securities, that may cause actual results in future periods to

differ materially from such statements. A list and description of

these and other risk factors can be found in the Company’s Annual

Report on Form 10-K for the year ending December 31, 2023 and in

other filings made by the Company with the SEC from time to time.

Any of these factors could cause Oblong’s actual results and plans

to differ materially from those in the forward-looking statements.

Therefore, the Company can give no assurance that its future

results will be as estimated. The Company does not intend to, and

disclaims any obligation to, correct, update, or revise any

information contained herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912460748/en/

Investor Relations Contact David Clark

investors@oblong.com (213) 683-8863 ext. 5

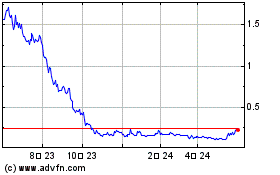

Oblong (NASDAQ:OBLG)

過去 株価チャート

から 11 2024 まで 12 2024

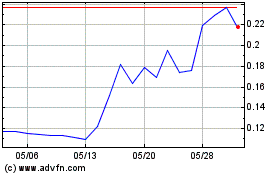

Oblong (NASDAQ:OBLG)

過去 株価チャート

から 12 2023 まで 12 2024