false

0000746210

0000746210

2024-08-22

2024-08-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 22, 2024

OBLONG, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

Incorporation or organization)

|

001-35376

(Commission File Number)

|

77-0312442

(IRS Employer

Identification No.)

|

110 16th Street, Suite 1400 - 1024

Denver, Colorado 80202

(Address of principal executive offices, zip code)

(213) 683-8863 ext. 5

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a‑12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

|

OBLG

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

8.01: Other Events

On August 22, 2024, the Company issued a press release (the "Press Release") announcing that it has filed an amendment to its certificate of incorporation that will effect a reverse stock split of the Company's issued and outstanding shares of Common Stock by a ratio of 1-for-40. The reverse stock split will become effective at 5:00 PM Eastern Time on August 23, 2024 (the "Effective Time"), and the Company's shares of common stock will begin trading on a split-adjusted basis on the Nasdaq Capital Market at the commencement of trading on August 26, 2024, under the Company's existing trading symbol "OBLG." At the Effective Time, every 40 issued and outstanding shares of Common Stock will be converted into one share of Common Stock. The number of authorized shares of Common Stock and the par value of each share of Common Stock will remain unchanged. No fractional shares were issued as a result of the reverse stock split, and any fractional shares that would otherwise have resulted from the reverse stock split were rounded up. The Company's Common Stock has been assigned a new CUSIP number of 674434 303 in connection with the reverse stock split.

The above description of the Press Release is qualified in its entirety by reference to the Press Release, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

OBLONG, INC.

|

|

| |

|

|

|

|

August 22, 2024

|

By:

|

/s/ Peter Holst

|

|

| |

|

Peter Holst

|

|

| |

|

President & CEO

|

|

Exhibit 99.1

Oblong Announces Reverse Stock Split

Shares Will Begin Trading on a Split-Adjusted Basis on August 26, 2024

August 22, 2024 -- (BUSINESS WIRE) Oblong, Inc. (Nasdaq: OBLG) (“Oblong” or the “Company”), the award-winning maker of multi-stream collaboration solutions, announced today that it has filed an amendment to its certificate of incorporation that will effect a reverse stock split of the Company's issued and outstanding shares of common stock by a ratio of 1-for-40, as approved by the Company’s stockholders at its 2023 annual meeting and the Company’s board of directors. The reverse stock split will become effective at 5:00 PM Eastern Time on August 23, 2024, and the Company's shares of common stock will begin trading on a split-adjusted basis on the Nasdaq Capital Market at the commencement of trading on August 26, 2024 under the Company's existing trading symbol “OBLG.”

The reverse stock split is intended to increase the per share trading value of the Company’s common stock to satisfy the Nasdaq Capital Market’s continued listing standards. The reverse stock split will be effected simultaneously for all outstanding shares of the Company’s common stock, and will affect all of the Company’s stockholders uniformly. At the effective time, every 40 issued and outstanding shares of common stock will be converted into one share of common stock. The Company’s common stock has been assigned a new CUSIP number of 674434303 in connection with the reverse stock split. The reverse stock split will not affect any stockholder’s percentage ownership interest in the Company, except to the extent that it results in any of the Company’s stockholders owning a fractional share, as any resulting fractional share will be rounded up to the nearest whole share. The reverse stock split will reduce the number of shares of the Company’s common stock from approximately 28,242,000 shares to approximately 710,000 shares. The reverse stock split will not affect the number of authorized shares of the Company’s common stock or the par value of a share of common stock. Proportionate adjustments will be made to the per share exercise price or conversion price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants and shares of preferred stock, as applicable.

Information for Stockholders

Stockholders holding their shares in book-entry form with the Company’s transfer agent, Equiniti Trust Company, or in brokerage accounts, do not need to take any action in connection with the reverse stock split. Stockholders holding shares of the Company’s common stock with a bank, broker or other nominee are encouraged to contact their bank, broker or other nominee with any questions regarding their holdings. The Company’s transfer agent is also acting as the exchange agent for the reverse stock split, and will provide instructions to any stockholders holding certificated shares regarding the process for exchanging their share certificates.

Any fractional shares of common stock resulting from the reverse stock split will be rounded up to the nearest whole post-split share and no stockholders will receive cash in lieu of fractional shares.

Additional information regarding the reverse stock split is available in the Company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission (“SEC”) on October 30, 2023.

Forward looking and cautionary statements

This press release contains forward-looking statements as defined under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, that address activities that the Company assumes, plans, expects, believes, intends, projects, estimates or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. The Company’s actual results may differ materially from its expectations, estimates and projections, and consequently you should not rely on these forward-looking statements as predictions of future events. Without limiting the generality of the foregoing, forward-looking statements contained in this press release include statements regarding the impact of the reverse stock split on the per share trading value of the Company’s common stock and the Company’s intention to regain compliance with the Nasdaq Capital Market’s continued listing standards. The forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events, and involve factors, risks, and uncertainties that may cause actual results in future periods to differ materially from such statements. A list and description of these and other risk factors can be found in the Company’s Annual Report on Form 10-K for the year ending December 31, 2023, the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2024, the Company’s Quarterly Report on Form 10-Q for the three months ended June 30, 2024 and in other filings made by the Company with the SEC from time to time. Any of these factors could cause the Company’s actual results and plans to differ materially from those in the forward-looking statements. Therefore, the Company can give no assurance that its future results will be as estimated. The Company does not intend to, and disclaims any obligation to, correct, update or revise any information contained herein.

About Oblong, Inc.

Oblong (Nasdaq: OBLG) provides innovative and patented technologies that change the way people work, create, and communicate. Oblong’s flagship product Mezzanine™ is a meeting technology platform that offers simultaneous content sharing to optimize audience engagement and situational awareness. For more information, visit www.oblong.com and Oblong’s Twitter and Facebook pages.

Investor Relations Contact:

David Clark

investors@oblong.com

(213) 683-8863 ext. 5

v3.24.2.u1

Document And Entity Information

|

Aug. 22, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

OBLONG, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 22, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35376

|

| Entity, Tax Identification Number |

77-0312442

|

| Entity, Address, Address Line One |

110 16th Street

|

| Entity, Address, Address Line Two |

Suite 1400 - 1024

|

| Entity, Address, City or Town |

Denver

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80202

|

| City Area Code |

213

|

| Local Phone Number |

683-8863

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

OBLG

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000746210

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

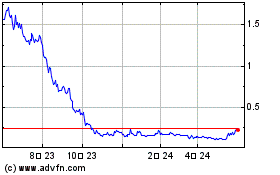

Oblong (NASDAQ:OBLG)

過去 株価チャート

から 11 2024 まで 12 2024

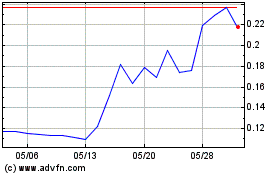

Oblong (NASDAQ:OBLG)

過去 株価チャート

から 12 2023 まで 12 2024