NextDecade Corporation (NextDecade or the Company) (NASDAQ:

NEXT) today provided an update on developmental and strategic

activities for the second quarter and early third quarter 2024.

CEO Commentary

“NextDecade has recently made excellent strides toward achieving

its dual goals of constructing Phase 1 at the Rio Grande LNG

Facility safely, on schedule, and on budget, and progressing Train

4 expansion capacity toward a positive Final Investment Decision

(FID),” said Matt Schatzman, NextDecade’s Chairman and Chief

Executive Officer. “We do not agree with the D.C. Circuit Court’s

recent decision to vacate the Federal Energy Regulatory

Commission’s (FERC) remand authorization of the Rio Grande LNG

Facility. We are committed to taking any and all available legal

and regulatory actions to ensure that Phase 1 will be delivered on

time and on budget and that FID of Trains 4 and 5 will not be

unduly delayed. The decision reached by the D.C. Circuit Court has

far-reaching implications. If the ruling stands, the precedent that

would be set by the Court’s action has the potential to impact

viability of all federally permitted infrastructure projects

because it will be difficult for these projects to attract capital

investments until they receive final unappealable permits.”

“During the second quarter, we made excellent commercial

progress for Train 4. We entered into a 20-year LNG sale and

purchase agreement (SPA) with ADNOC, under which they agreed to

purchase 1.9 MTPA of LNG from Train 4. We also entered into a

non-binding heads of agreement (HoA) with Aramco for 1.2 MTPA of

LNG, which we expect to convert into a binding SPA. These

developments, alongside our expectation that TotalEnergies will

exercise its LNG purchase option for 1.5 MTPA, lead us to believe

that we will soon reach the necessary contracted capacity to

commercially support Train 4. More recently, we finalized our

negotiations with Bechtel and executed the EPC contract for Train 4

and related infrastructure with a contract price of approximately

$4.3 billion, which concludes one of the final pieces of work

required before commencing the financing process for Train 4.”

“Construction of Phase 1 at the Rio Grande LNG Facility

continues to progress very positively. We are committed to working

with Bechtel to ensure a safe and timely delivery of Phase 1. As we

work through the impacts of the recent Court decision, we are

committed to continuing construction on Phase 1 and progressing the

development of Train 4 by securing financing and ultimately

reaching a positive FID, once necessary regulatory resolution is in

place.”

Significant Recent Developments

Construction

- Under the EPC contracts with Bechtel Energy Inc. (Bechtel),

Phase 1 progress is tracked for Train 1, Train 2, and the common

facilities on a combined basis and Train 3 on a separate basis. As

of June 2024:

- The overall project completion percentage for Trains 1 and 2

and the common facilities of the Rio Grande LNG Facility was 24.1%,

which is in line with the schedule under the EPC contract. Within

this project completion percentage, engineering was 66.4% complete,

procurement was 45.4% complete, and construction was 3.5%

complete.

- The overall project completion percentage for Train 3 of the

Rio Grande LNG Facility was 7.8%, which is also in line with the

schedule under the EPC contract. Within this project completion

percentage, engineering was 8.4% complete, procurement was 18.4%

complete, and construction was 0.1% complete.

Strategic and Commercial

- In May 2024, the Company entered into a 20-year LNG SPA with

ADNOC, pursuant to which ADNOC will purchase 1.9 MTPA of LNG from

Train 4 at the Rio Grande LNG Facility for 20 years, on a free on

board (FOB) basis at a price indexed to Henry Hub, subject to a

positive FID on Train 4.

- In June 2024, the Company entered into a non-binding HoA with

Aramco for a 20-year LNG SPA for offtake from Train 4 at the Rio

Grande LNG Facility. Under the terms of the HoA, Aramco expects to

purchase 1.2 MTPA of LNG for 20 years, on an FOB basis at a price

indexed to Henry Hub. Aramco and NextDecade are in the process of

negotiating a binding LNG SPA, and once executed, the SPA will be

subject to a positive FID on Train 4.

- In August 2024, the Company entered into an EPC contract with

Bechtel for Train 4 and related infrastructure with a contract

price of approximately $4.3 billion. Price validity under the EPC

contract for Train 4 and related infrastructure extends through

December 31, 2024.

- In July 2024, the Company appointed Tarik Skeik as Chief

Operating Officer. Mr. Skeik has over 20 years of experience

delivering complex global mega projects in LNG, oil, and

petrochemicals across North America, the Middle East, and Asia. He

led the completion and start-up of six greenfield assets, and his

experience includes the planning and execution through initial

operation of projects including the Huizhou Chemicals Complex in

China, Gulf Coast Growth Ventures in the U.S., Banyu Urip in

Indonesia, Kearl Expansion in Canada, and QatarGas 2 in Qatar.

Financial

- In June 2024, the Company’s subsidiary Rio Grande LNG, LLC (Rio

Grande) issued $1.115 billion of senior secured notes in a private

placement, and net proceeds were utilized to reduce outstanding

borrowings and commitments under existing Rio Grande term loan

facilities. These senior secured notes will be amortized over a

period of 18 years beginning in September 2029, with a final

maturity in September 2047. The senior secured notes bear interest

at a fixed rate of 6.58% and rank pari passu to Rio Grande’s

existing senior secured financings. Including this transaction, the

Company has now refinanced a total of over $1.85 billion of the

original $11.1 billion Rio Grande term loan facilities since a

positive FID was reached on Phase 1 at the Rio Grande LNG Facility

in July 2023.

Regulatory

- In August 2024, the U.S. Court of Appeals for the D.C. Circuit

(Court) issued an order vacating FERC’s remand authorization of the

Rio Grande LNG Facility on the grounds that the FERC should have

issued a supplemental Environmental Impact Statement (EIS) during

its remand process. The Court’s decision will not be effective

until the court has issued its mandate, which is not expected to

occur until the appeals process has been completed.

- At this time, construction continues on the first three

liquefaction trains and related infrastructure (Phase 1) at the Rio

Grande LNG Facility.

- The Company is disappointed in the Court’s unprecedented

decision and disagrees with its conclusions. The Company is

reviewing the Court’s decision and assessing all of its options,

together with the key project constituencies, including its equity

partners and lenders. The Company expects to take all available

legal and regulatory actions, including but not limited to,

appellate actions and other strategies, to ensure that construction

on Phase 1 will continue and that necessary regulatory approvals

will be maintained to enable the future construction of Trains 4

and 5 at the Rio Grande LNG Facility.

Rio Grande LNG Facility

NextDecade is constructing and developing the Rio Grande LNG

Facility on the north shore of the Brownsville Ship Channel in

south Texas. The site is located on 984 acres of land which has

been leased long-term and includes 15,000 feet of frontage on the

Brownsville Ship Channel.

Phase 1 (Trains 1-3)

Phase 1 at the Rio Grande LNG Facility is under construction.

Phase 1 includes three liquefaction trains with a total nameplate

capacity of 17.61 MTPA of LNG production, two 180,000 cubic meter

full containment LNG storage tanks, and two jetty berthing

structures designed to load LNG carriers up to 216,000 cubic meters

in capacity. Phase 1 also includes associated site infrastructure

and common facilities including feed gas pretreatment facilities,

electric and water utilities, two totally enclosed ground flares

for the LNG tanks and marine facilities, two ground flares for the

liquefaction trains, roads, levees surrounding the entire site, and

warehouses, administrative, operations control room, and

maintenance buildings.

As of June 2024, progress on Trains 1 through 3 is in line with

the schedule under the EPC contracts. Train 1 deep soil mixing has

been completed and foundation pours are underway, including

refrigeration compressor foundations. Additionally, steel erection

for Train 1 is in process, and the first pipework has been placed

in the Train 1 cryogenic rack. Train 2 deep soil mixing is in

process, and delivery of key materials such as large bore

above-ground pipe and structural steel has continued. LNG tank

progress has been strong, with excavation, pile leveling, and rebar

installation for Tank 1 underway and Tank 2 piling completed. The

permanent water supply for the site has been fully constructed and

is operational.

Bechtel has continued to make meaningful progress on procurement

for Phase 1, with a focus on completing purchase orders for

critical and high-value items early in the construction process. As

of June 2024, Bechtel has issued approximately 92% of the total

purchase orders for Trains 1 and 2 and approximately 88% of the

total purchase orders for Train 3.

NextDecade holds equity interests in the Phase 1 joint venture

that entitle it to receive up to 20.8% of the distributions of

available cash during operations.

Final Investment Decision on Train 4 and Train 5

Achieving a positive FID on Trains 4 and 5 at the Rio Grande LNG

Facility will be subject to, among other things, maintaining

requisite governmental approvals, finalizing and entering into EPC

contracts, entering into appropriate commercial arrangements, and

obtaining adequate financing to construct each train and related

infrastructure.

The Company has finalized an EPC contract with Bechtel for Train

4 and related infrastructure.

The Company continues to advance commercial discussions with

multiple potential counterparties and expects to finalize

commercial arrangements for Train 4 in the coming months to

commercially support an FID on Train 4. The Company entered into an

LNG SPA with ADNOC for the sale of 1.9 MTPA of LNG from Train 4, as

well as a non-binding HoA with Aramco for the sale of 1.2 MTPA of

LNG from Train 4. The Company is working with Aramco to finalize a

binding SPA. Additionally, the Company expects TotalEnergies to

exercise its LNG purchase option for 1.5 MTPA of LNG from Train

4.

The Company expects to finance construction of Train 4 utilizing

a combination of debt and equity funding. The Company expects to

enter into bank facilities for the debt portion of the funding. In

connection with consummating the Rio Grande Phase 1 equity joint

venture, the Company's equity partners each have options to invest

in Train 4 equity, which, if exercised, would provide approximately

60% of the equity funding required for Train 4. Inclusive of these

options, NextDecade currently expects to fund 40% of the equity

commitments for Train 4 and to have an initial economic interest of

40% in Train 4, increasing to 60% after its equity partners achieve

certain returns on their investments in Train 4. The Company

expects to take FID on Train 4 after commercial and financing

arrangements are finalized.

The Company expects to progress the development of Train 5 after

a positive FID on Train 4. TotalEnergies also holds an LNG purchase

option for 1.5 MTPA for Train 5, and the Rio Grande Phase 1 equity

partners have options to invest in Train 5 equity which are

materially equivalent to their options to participate in Train 4

equity.

Investor Presentation

NextDecade has posted an updated investor presentation to its

website concurrently with this release. A copy of this release and

the investor presentation can be found on its website at

www.next-decade.com.

About NextDecade Corporation

NextDecade Corporation is an energy company accelerating the

path to a net-zero future. Leading innovation in more sustainable

LNG and carbon capture solutions, NextDecade is committed to

providing the world access to cleaner energy. Through our

subsidiaries Rio Grande LNG and NEXT Carbon Solutions, we are

developing a 27 MTPA LNG export facility in South Texas along with

one of the largest carbon capture and storage projects in North

America. We are also working with third-party customers around the

world to deploy our proprietary processes to lower the cost of

carbon capture and storage and reduce CO2 emissions at their

industrial-scale facilities. NextDecade’s common stock is listed on

the Nasdaq Stock Market under the symbol “NEXT.” NextDecade is

headquartered in Houston, Texas. For more information, please visit

www.next-decade.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws. The words

“anticipate,” “contemplate,” “estimate,” “expect,” “project,”

“plan,” “intend,” “believe,” “may,” “might,” “will,” “would,”

“could,” “should,” “can have,” “likely,” “continue,” “design,”

“assume,” “budget,” “guidance,” “forecast,” and "target," and other

words and terms of similar expressions are intended to identify

forward-looking statements, and these statements may relate to the

business of NextDecade and its subsidiaries. These statements have

been based on assumptions and analysis made by NextDecade in light

of current expectations, perceptions of historical trends, current

conditions and projections about future events and trends and

involve a number of known and unknown risks, which may cause actual

results to differ materially from expectations expressed or implied

in the forward-looking statements. Although NextDecade believes

that the expectations reflected in these forward-looking statements

are reasonable, it can give no assurance that the expectations will

prove to be correct. NextDecade’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of a variety of factors, including those

discussed in NextDecade’s periodic reports that are filed with and

available from the Securities and Exchange Commission.

Additionally, any development of subsequent trains at the Rio

Grande LNG Facility or CCS projects remains contingent upon

maintaining requisite government approvals, execution of definitive

commercial and financing agreements, securing all financing

commitments and potential tax incentives, achieving other customary

conditions and making a final investment decision to proceed. The

forward-looking statements in this press release speak as of the

date of this release. NextDecade may from time to time voluntarily

update its prior forward-looking statements, however, it disclaims

any commitment to do so except as required by securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240814408202/en/

Investors Megan Light mlight@next-decade.com

832-981-6583

Media Susan Richardson srichardson@next-decade.com

832-413-6400

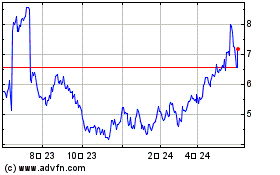

NextDecade (NASDAQ:NEXT)

過去 株価チャート

から 11 2024 まで 12 2024

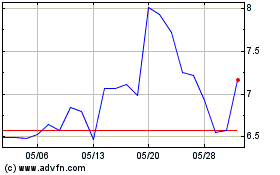

NextDecade (NASDAQ:NEXT)

過去 株価チャート

から 12 2023 まで 12 2024