0000355019

false

0000355019

2024-09-27

2024-09-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Act of 1934

Date

of Report (Date of earliest event reported): September

27, 2024

FONAR

CORPORATION

______________________________________________________

(Exact

name of registrant as specified in its charter)

| Delaware | |

0-10248 | |

11-2464137 |

| (State

or other jurisdiction of incorporation) | |

(Commission

File Number) | |

(I.R.S.

Employer Identification No.) |

| | |

| |

|

| | |

110

Marcus Drive,

Melville,

New

York 11747

(631)

694-2929 | |

|

| | |

(Address,

including zip code, and telephone number of registrant's principal executive office) | |

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

[

] Written

communications pursuant to Rule 425 under the Securities Act 17 CFR 230.425)

[

] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Securities

registered pursuant to Section 12(b) of the Act.

| Title

of each class | |

Trading

symbol(s) | |

Name

of each exchange on which registered |

| Common

Stock, $.0001 par value | |

FONR | |

Nasdaq

Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

2.02(a) Results of Operations and Financial Condition.

We

reported the results of operations and financial condition of the Company for Fiscal 2024 which ended June 30,

2024 in a press release dated September 27, 2024.

Exhibits:

99.1 Press Release dated September 27, 2024.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

FONAR

CORPORATION

(Registrant)

-------------------------------------------

By

/s/ Timothy R. Damadian

Timothy

R. Damadian

President

and CEO

Dated:

September 30, 2024

| NEWS |

|

|

| For

Immediate Release |

|

The

Inventor of MR Scanning™ |

| Contact:

Daniel Culver |

|

An

ISO 9001 Company |

| Director

of Communications |

|

Melville,

New York 11747 |

| E-mail:

investor@fonar.com |

|

Phone:

(631) 694-2929 |

| www.fonar.com |

|

Fax:

(631) 390-1772 |

FONAR

ANNOUNCES FISCAL 2024 FINANCIAL RESULTS

| · | Total

MRI scan volume at the HMCA-managed sites increased 11% to 209,327 scans for the fiscal year

ending June 30, 2024 as compared to the prior year. |

| · | Cash

and Cash Equivalents increased 10% to $56.3 million at June 30, 2024 versus the previous

fiscal year. |

| · | Total

Revenues - Net increased by 4% to $102.9 million for the fiscal year ended June 30, 2024

versus the previous fiscal year. |

| · | Income

from Operations increased 12% to $16.5 million for the fiscal year ended June 30, 2024 versus

the previous fiscal year. |

| · | Net

Income increased 16% to $14.1 million for the fiscal year ended June 30, 2024 versus the

previous fiscal year. |

| · | Diluted

Net Income per Common Share increased 16% to $1.53 for the fiscal year ended June 30, 2024

versus the previous fiscal year. |

| · | Working

Capital increased by 11% to $122.5 million during fiscal 2024. |

| · | Book

Value per Share for the fiscal year ended June 30, 2024 increased to $24.78 per share. |

| · | On

September 13, 2022, the Company adopted a stock repurchase plan of up to $9 million. |

| · | Two

HMCA-managed MRI scanners were added in fiscal 2024, bringing the total number to 42. |

MELVILLE,

NEW YORK, September 27, 2024 - FONAR Corporation (NASDAQ-FONR), The Inventor of MR Scanning™,

reported today its Fiscal 2024 results. FONAR’s primary source of income is attributable to its wholly-owned diagnostic imaging

management subsidiary, Health Management Company of America (HMCA). In 2009, HMCA managed 9 MRI scanners. Currently, HMCA manages 42

MRI scanners in New York and in Florida.

Financial

Results

Total

Revenues - Net increased by 4% to $102.9 million for the fiscal year ended June 30, 2024, as compared to $98.6 million for the fiscal

year ended June 30, 2023.

Total

Costs and Expenses for the fiscal year ended June 30, 2024 increased by 3% to $86.3 million, as compared to $83.9 million for the fiscal

year ended June 30, 2023.

Revenues

from the management of the diagnostic imaging center segment, consisting of Patient Fee Revenue Net of Contractual Allowances and Discounts,

and Management and Other Fees of Related and Non-related Medical Practices, increased 5% to $94.6 million for the fiscal year ended June

30, 2024, as compared to $90.4 million for the fiscal year ended June 30, 2023.

Revenues

from Product Sales and Upgrades and Service and Repair Fees for related and non-related medical parties, for the fiscal years ended June

30, 2024 and 2023 were $8.3 million.

Research

and Development expenses increased 11% to $1.7 million for the fiscal year ended June 30, 2024, as compared to $1.6 million for the fiscal

year ended June 30, 2023.

Selling,

General and Administrative (SG&A) expenses decreased 9% to $26.9 million for the fiscal year ended June 30, 2024, as compared to

$29.4 million for the fiscal year ended June 30, 2023.

Income

from Operations increased 12% to $16.5 million for the fiscal year ended June 30, 2024, as compared to $14.8 million for the fiscal year

ended June 30, 2023.

Net

Income increased 16% to $14.1 million for the fiscal year ended June 30, 2024, as compared to $12.1 million for the fiscal year ended

June 30, 2023.

Diluted

Net Income per Common Share Available to Common Shareholders increased 16% to $1.53, for the fiscal year ended June 30, 2024, as compared

to $1.32 for the fiscal year ended June 30, 2023.

The

weighted average diluted shares outstanding for the fiscal year ended June 30, 2024 was 6.5 million versus 6.7 million for the fiscal

year ended June 30, 2023.

Balance

Sheet Items

Total

Cash and Cash Equivalents and Short Term Investments at June 30, 2024 increased 10% to $56.5 million as compared to the $51.3 million

at June 30, 2023.

Total

Assets at June 30, 2024 were $214.2 million as compared to $200.6 million at June 30, 2023.

Total

Liabilities at June 30, 2024 increased 15% to $57.5 million as compared to $49.8 million at June 30, 2023. The main reason for the increase

was the increase in operating lease liabilities – net of current portion, which increased to $37.5 million for the year ended June

30, 2024 from $32.1 million for the year ended June 30, 2023 as lease agreements for the scanning centers were renegotiated. Another

reason for the increase was federal and state income taxes payable were $1.5 million for the year ended June 30, 2024 compared to $48

thousand for the year ended June 30, 2023, due to the utilization of the Federal net operating loss and certain State net operating losses.

Total

Current Assets at June 30, 2024 were $140.3 million as compared to $125.7 million at June 30, 2023.

Total

Current Liabilities at June 30, 2024 were $17.9 million as compared to $15.6 million at June 30, 2023.

The

Current Ratio was 7.9 at June 30, 2024.

Working

Capital increased 11% to $122.5 million at June 30, 2024, as compared to $110.0 million at June 30, 2023.

The

ratio of Total Assets/Total Liabilities was 3.7 at June 30, 2024 as compared to 4.0 at June 30, 2023.

Stockholders’

Equity

Total

Stockholders’ Equity was $156.8 million at June 30, 2024, as compared to $150.8 million at June 30, 2023.

Net

Book Value per Common Share (Total Assets minus Total Liabilities divided by Common Shares Outstanding) was $24.78 at June 30, 2024.

Cash

Flow Item

Operating

Cash Flow was $14.1 million for the fiscal year ended June 30, 2024 as compared to $14.5 million for the fiscal year ended June 30, 2023.

Management

Discussion

Timothy

Damadian, president and CEO of FONAR, said, “The total fourth-quarter scan volume at HMCA-managed MRI centers was 54,556, which

was 3.3% higher than that of the previous quarter (52,800), and the third of three consecutive quarterly scan-volume records. The total

scan volume for Fiscal 2024 was 209,346, 11.1% higher than the total scan volume in Fiscal 2023 (188,348), and the third of three consecutive

yearly scan-volume records.

“The

opening of a new Stand-Up MRI center in Casselberry, Florida and another in the Bronx, New York, accounted for 20% of the increase in

total scan volume in Fiscal 2024.”

“Another

major reason for the increase in scan volume at HMCA-managed sites in Fiscal 2024 was the employment of SwiftMR™, an Artificial

Intelligence (AI) product of AIRS Medical that enhances the quality of MRI images and enables shorter exam times. SwiftMR™ is a

software product that denoises and sharpens already-acquired MRI images. Both the radiologists who interpret these “Swifted”

MRI images and the physicians who refer their patients to HMCA-managed centers have been very pleased with the improvements in image

quality. And, of course, the owners of HMCA-managed centers are benefitting from the increase in the number of referrals as well as the

ability to scan more patients per hour.”

Mr.

Damadian continued, “One of the ways we grow the Company is to install second or even third MRI scanners in HMCA-managed facilities

where the demand is approaching capacity or where the addition of a high-field MRIs is expected to increase referrals from existing sources

and/or from new referral sources attracted by the diagnostic capabilities of high-field MRI technology. We have two such projects for

Fiscal 2025. In the first quarter of 2025, a high-field MRI was added to the HMCA-managed site in Naples, Florida. Later in the year,

a high-field MRI will be added to an HMCA-managed site in New York.”

“We

continue to seek to establish new locations or to acquire centers that will enhance our existing networks and increase their profitability.

Right now, we are managing 43 MRI scanners in total, 25 in New York and 18 in Florida, including the newly-installed high-field MRI in

Naples, Florida.”

“I

would also like to report that pursuant to our September 13, 2022 announcement of a FONAR stock repurchase plan of up to $9 million,

the Company has, as of June 30, 2024, repurchased 259,354 shares at a cost of $4.3

million. FONAR is limited by the manner, timing, price, and volume restrictions of its share repurchases as prescribed in the

safe harbor provisions of Rule 10b-18.”

Mr.

Damadian concluded, “I remain grateful to our HMCA management team and employees for their hard work, commitment and success. I

am also grateful to the FONAR R&D team for successfully implementing SwiftMR™ technology at our HMCA-managed facilities, as

well as introducing SwiftMR™ to unaffiliated MRI facilities equipped with FONAR and/or non-FONAR MRIs. FONAR’s R&D team

continues to provide valuable improvements, on a regular basis, to the imaging capabilities of FONAR STAND-UP® MRI (UPRIGHT Multi-Position™

MRI) scanners.

Significant

Event

The

Company’s filing status has changed to that of an accelerated filer as the Company’s Total Revenues – Net has surpassed

$100 million.

Company

Legacy

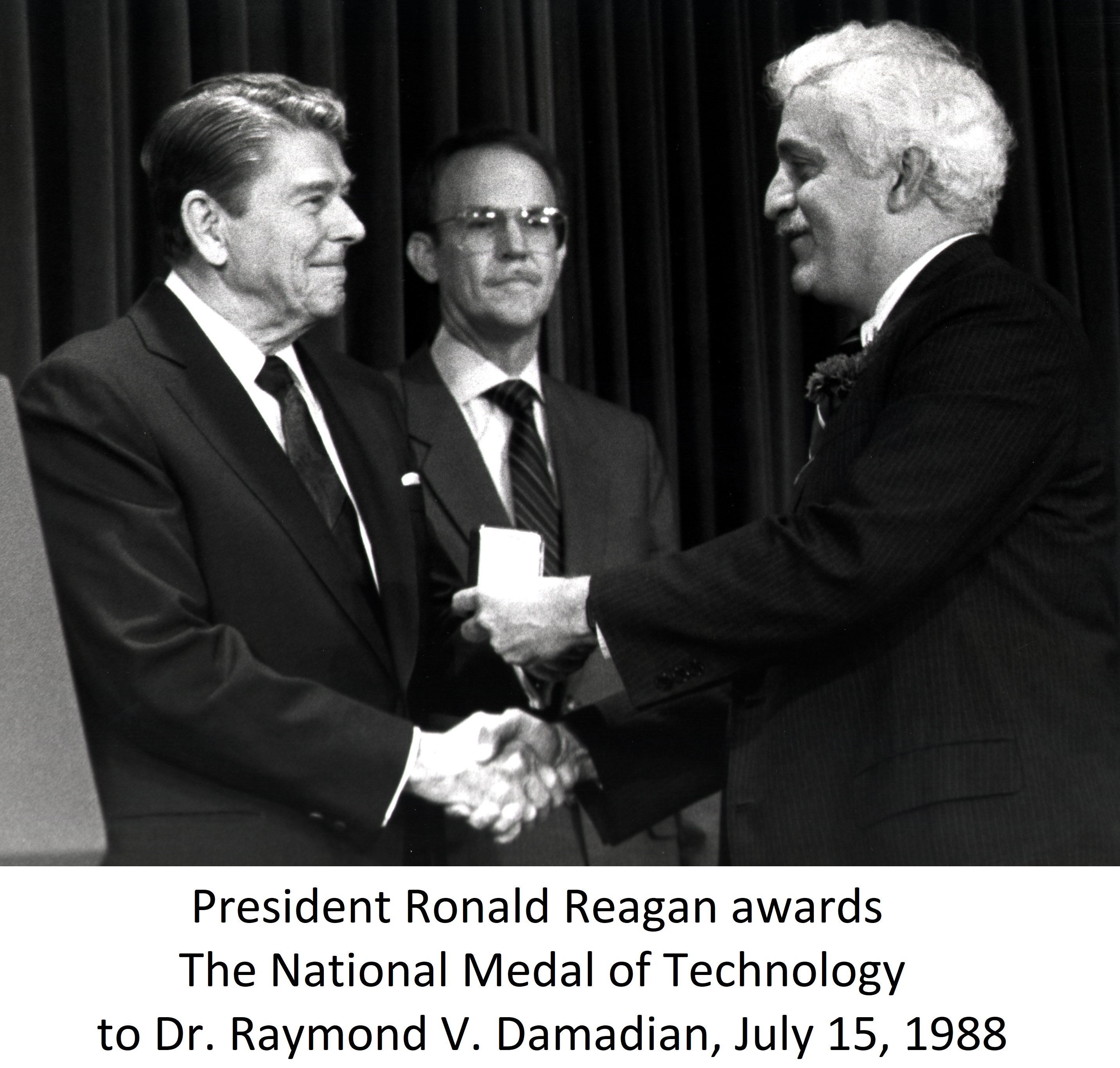

National

Medal of Technology Presented to Dr. Raymond Damadian by President Reagan

WASHINGTON,

DC – The White House – July 15, 1988 – President Ronald Reagan awarded the nation’s top scientists and engineers

the National Medal of Technology and the National Medal of Science at a ceremony at the White House. Among the honorees were the two

scientists responsible for the development of MR scanning, Paul C. Lauterbur and Raymond V. Damadian. Dr. Damadian and Dr. Lauterbur

shared the award “For their independent contributions in conceiving and developing the application of magnetic resonance technology

to medical uses, including whole-body scanning and diagnostic imaging.”

In

1969, Dr. Damadian was the first to conceive of using nuclear magnetic resonance (NMR) technology to scan the human body for diseased

tissue. He provided proof of the concept by acquiring an abnormal NMR signal from cancer tissue. His discovery, published in the Journal

Science in 1971 is the basis upon which every MRI ever built rests.

Dr.

Lauterbur devised a method for converting these signals into pictures, first demonstrating it on two

one-millimeter

capillary tubes of water.

Dr.

Damadian went on to form the world’s first commercial MR scanning company, later known as FONAR Corporation, which birthed a new

industry with its introduction of the world’s first MRI scanner in 1980.

At

the awards dinner held on the evening before in the Benjamin Franklin Room at the State Department, William Verity, Secretary of Commerce,

introduced all of the honorees. He explained that the Medals of Technology and Science were enabled by an act of Congress to recognize

the men and women who, through their innovations and inventions, founded major new industries for America.

The

medal can be seen at the Raymond V. Damadian Memorial Museum at FONAR Corporation, Melville, NY. The museum features a life-size display

of Dr. Damadian, his assistants, and Indomitable in the process of conducting the world’s first MRI scan which took place July

2-3, 1977. It includes other prestigious awards, an interactive display, some of Dr. Damadian’s personal items, and many historical

artifacts. The public is invited to visit the museum at FONAR in Melville. To make an appointment, contact Daniel Culver, Director of

Communications, at RVDmuseum@fonar.com.

About

FONAR

FONAR,

The Inventor of MR Scanning™, located in Melville, NY, was incorporated in 1978, and is the

first, oldest and most experienced MRI Company in the industry. FONAR went public in 1981 (Nasdaq:FONR). FONAR sold the world’s

first commercial MRI to Ronald J Ross, MD, Cleveland, Ohio. It was installed in 1980. Dr. Ross and his team began the world’s first

clinical MRI trials in January 1981. The results were reported in the June 1981 edition of Radiology/Nuclear Medicine Magazine and the

April 1982 peer-reviewed article in the Journal Radiology. The technique used for obtaining T1 and T2 values was the FONAR technique

(Field fOcusing Nuclear mAgnetic Resonance), not the back projection technique. www.fonar.com/innovations-timeline.html.

FONAR’s

signature product is the FONAR UPRIGHT® Multi-Position™ MRI (also known as the STAND-UP® MRI), the only whole-body MRI

that performs Position™ Imaging (pMRI™) and scans patients in numerous weight-bearing positions, i.e. standing, sitting,

in flexion and extension, as well as the conventional lie-down position. The FONAR UPRIGHT® MRI often detects patient problems that

other MRI scanners cannot because they are lie-down, “weightless-only” scanners. The patient-friendly UPRIGHT® MRI has

a near-zero patient claustrophobic rejection rate. As a FONAR customer states, “If the patient is claustrophobic in this scanner,

they’ll be claustrophobic in my parking lot.” Approximately 85% of patients are scanned sitting while watching TV.

FONAR

has new works-in-progress technology for visualizing and quantifying the cerebral hydraulics of the central nervous system, the flow

of cerebrospinal fluid (CSF), which circulates throughout the brain and vertebral column at the rate of 32 quarts per day. This imaging

and quantifying of the dynamics of this vital life-sustaining physiology of the body’s neurologic system has been made possible

first by FONAR’s introduction of the MRI and now by this latest works-in-progress method for quantifying CSF in all the normal

positions of the body, particularly in its upright flow against gravity. Patients with whiplash or other neck injuries are among those

who will benefit from this new understanding.

FONAR’s

primary source of income and growth is attributable to its wholly-owned diagnostic imaging management subsidiary, Health Management Company

of America (HMCA) www.hmca.com.

FONAR’s

substantial list of patents includes recent patents for its technology enabling full weight-bearing MRI imaging of all the gravity sensitive

regions of the human anatomy, especially the brain, extremities and spine. It includes its newest technology for measuring the Upright

cerebral hydraulics of the cerebrospinal fluid (CSF) of the central nervous system. FONAR’s UPRIGHT® Multi-Position™

MRI is the only scanner licensed under these patents.

UPRIGHT®,

and STAND-UP®

are

registered trademarks. The

Inventor of MR Scanning™,

CSP™,

MultiPosition™,

UPRIGHT

RADIOLOGY™,

pMRI™,

CFS

Videography™,

Dynamic™

and

The

Proof is in the Picture™,

are trademarks of Fonar Corporation.

This

release may include forward-looking statements from the company that may or may not materialize. Additional information on factors that

could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange Commission.

CONSOLIDATED

BALANCE SHEETS

ASSETS

| | |

June

30, |

| | |

2024 | |

2023 |

| Current

Assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 56,341,193 | | |

$ | 51,279,707 | |

| Short-term

investments | |

| 136,102 | | |

| 32,799 | |

| Accounts

receivable – net of allowances for credit losses of $166,049 and $198,593 at June 30, 2024 and 2023, respectively | |

| 4,035,336 | | |

| 3,861,512 | |

| Medical

receivables – net | |

| 23,991,533 | | |

| 21,259,262 | |

| Management

and other fees receivable – net of allowances for credit losses of $12,369,921 and $12,608,567 as of June 30, 2024 and 2023,

respectively | |

| 41,953,657 | | |

| 35,888,253 | |

| Management

and other fees receivable – related party medical practices – net of allowances for credit losses of $6,110,399 and $3,989,692

as of June 30, 2024 and 2023, respectively | |

| 9,865,061 | | |

| 9,161,870 | |

| Inventories | |

| 2,715,441 | | |

| 2,569,666 | |

| Prepaid

expenses and other current assets | |

| 1,285,962 | | |

| 1,607,768 | |

| Total

Current Assets | |

| 140,324,285 | | |

| 125,660,837 | |

| Accounts

receivable – long term | |

| 829,473 | | |

| 710,085 | |

| Note

receivable – related party | |

| 581,183 | | |

| — | |

| Deferred

income tax asset | |

| 7,223,255 | | |

| 10,041,960 | |

| Property

and equipment – net | |

| 18,708,920 | | |

| 22,146,373 | |

| Right-of-use-assets

– operating leases | |

| 38,427,757 | | |

| 33,068,755 | |

| Right-of-use-asset

– financing lease | |

| 530,348 | | |

| 729,229 | |

| Goodwill | |

| 4,269,277 | | |

| 4,269,277 | |

| Other

intangible assets – net | |

| 2,870,324 | | |

| 3,431,865 | |

| Other

assets | |

| 481,147 | | |

| 523,506 | |

| Total

Assets | |

$ | 214,245,969 | | |

$ | 200,581,887 | |

CONSOLIDATED

BALANCE SHEETS

LIABILITIES

| | |

June

30, |

| | |

2024 | |

2023 |

| Current

Liabilities: | |

| | | |

| | |

| Current

portion of long-term debt | |

$ | 47,002 | | |

$ | 43,767 | |

| Accounts

payable | |

| 1,855,879 | | |

| 1,579,240 | |

| Other

current liabilities | |

| 7,941,039 | | |

| 5,443,724 | |

| Operating

lease liabilities – current portion | |

| 3,473,674 | | |

| 3,905,484 | |

| Financing

lease liability – current portion | |

| 225,786 | | |

| 217,597 | |

| Unearned

revenue on service contracts | |

| 3,870,229 | | |

| 3,832,184 | |

| Customer

deposits | |

| 443,471 | | |

| 602,377 | |

| Total

Current Liabilities | |

| 17,857,080 | | |

| 15,624,373 | |

| Long-Term

Liabilities: | |

| | | |

| | |

| Unearned

revenue on service contracts | |

| 1,174,844 | | |

| 760,242 | |

| Deferred

income tax liability | |

| 371,560 | | |

| 394,758 | |

| Due

to related party medical practices | |

| 92,663 | | |

| 92,663 | |

| Operating

lease liabilities – net of current portion | |

| 37,467,746 | | |

| 32,105,405 | |

| Financing

lease liability – net of current portion | |

| 394,723 | | |

| 620,481 | |

| Long-term

debt and capital leases, less current portion | |

| 66,938 | | |

| 115,075 | |

| Other

liabilities | |

| 32,026 | | |

| 41,750 | |

| Total

Long-Term Liabilities | |

| 39,600,500 | | |

| 34,130,374 | |

| Total

Liabilities | |

| 57,457,580 | | |

| 49,754,747 | |

CONSOLIDATED

BALANCE SHEETS

STOCKHOLDERS’

EQUITY

| | |

June

30, |

| | |

2024 | |

2023 |

| Stockholders’

Equity: | |

| | | |

| | |

| Class

A non-voting preferred stock $.0001 par value; 453,000 shares authorized at June 30, 2024 and 2023, 313,438 issued and outstanding

at June 30, 2024 and 2023 | |

$ | 31 | | |

$ | 31 | |

| Preferred

stock $.001 par value; 567,000 shares authorized at June 30, 2024 and 2023, issued and outstanding – none | |

| — | | |

| — | |

| Common

stock $.0001 par value; 8,500,000 shares authorized at June 30, 2024 and 2023, 6,373,375 and 6,462,345 issued at June 30, 2024 and

2023, respectively 6,328,294 and 6,450,882 outstanding at June 30, 2024 and 2023, respectively | |

| 635 | | |

| 647 | |

| Class

B convertible common stock (10 votes per share) $.0001 par value; 227,000 shares authorized at June 30, 2024 and 2023, 146 issued

and outstanding at June 30, 2024 and 2023 | |

| — | | |

| — | |

| Class

C common stock (25 votes per share) $.0001 par value; 567,000 shares authorized at June 30, 2024 and 2023, 382,513 issued and outstanding

at June 30, 2024 and 2023 | |

| 38 | | |

| 38 | |

| Paid-in

capital in excess of par value | |

| 180,607,510 | | |

| 182,612,518 | |

| Accumulated

deficit | |

| (13,623,585 | ) | |

| (24,190,981 | ) |

| Treasury

stock, at cost – 45,081 and 11,463 shares of common stock at June 30, 2024 and 2023, respectively | |

| (1,016,632 | ) | |

| (515,820 | ) |

| Total

Fonar Corporation’s Stockholders’ Equity | |

| 165,967,997 | | |

| 157,906,433 | |

| Noncontrolling

interests | |

| (9,179,608 | ) | |

| (7,079,293 | ) |

| Total

Stockholders’ Equity | |

| 156,788,389 | | |

| 150,827,140 | |

| Total

Liabilities and Stockholders’ Equity | |

$ | 214,245,969 | | |

$ | 200,581,887 | |

CONSOLIDATED

STATEMENTS OF INCOME

| | |

For

the Years Ended June 30, |

| | |

2024 | |

2023 |

| Revenues | |

| |

|

| Patient

fee revenue, net of contractual allowances and discounts | |

$ | 33,815,796 | | |

$ | 29,793,993 | |

| Product

sales | |

| 737,727 | | |

| 731,607 | |

| Service

and repair fees | |

| 7,452,212 | | |

| 7,419,104 | |

| Service

and repair fees – related parties | |

| 139,167 | | |

| 110,000 | |

| Management

and other fees | |

| 48,789,287 | | |

| 48,640,497 | |

| Management

and other fees – related party medical practices | |

| 11,949,900 | | |

| 11,949,900 | |

| Total

Revenues – Net | |

| 102,884,089 | | |

| 98,645,101 | |

| Costs

and Expenses | |

| | | |

| | |

| Costs

related to product sales | |

| 1,052,159 | | |

| 852,025 | |

| Costs

related to service and repair fees | |

| 3,577,570 | | |

| 3,033,967 | |

| Costs

related to service and repair fees – related parties | |

| 144,413 | | |

| 44,983 | |

| Costs

related to patient fee revenue | |

| 18,199,579 | | |

| 16,183,166 | |

| Costs

related to management and other fees | |

| 28,626,595 | | |

| 26,975,563 | |

| Costs

related to management and other fees – related party medical practices | |

| 6,143,728 | | |

| 5,807,454 | |

| Research

and development | |

| 1,735,949 | | |

| 1,567,749 | |

| Selling,

general and administrative expenses | |

| 26,868,732 | | |

| 29,390,932 | |

| Total

Costs and Expenses | |

| 86,348,725 | | |

| 83,855,839 | |

| Income

from Operations | |

| 16,535,364 | | |

| 14,789,262 | |

| Other

Income and (Expenses): | |

| | | |

| | |

| | |

| | | |

| | |

| Interest

expense | |

| (76,997 | ) | |

| (50,131 | ) |

| Investment

income – related party | |

| 25,959 | | |

| — | |

| Investment

income | |

| 2,126,439 | | |

| 1,222,176 | |

| Other

income – related party | |

| 576,857 | | |

| — | |

| Other

income (expense) | |

| 78,763 | | |

| (202,720 | ) |

| Income

before provision for income taxes and noncontrolling interests | |

| 19,266,385 | | |

| 15,758,587 | |

| Provision

for Income Taxes | |

| (5,168,968 | ) | |

| (3,632,071 | ) |

| Net

Income | |

$ | 14,097,417 | | |

$ | 12,126,516 | |

| Net

Income – Noncontrolling Interests | |

| (3,530,021 | ) | |

| (2,750,740 | ) |

| Net

Income – Attributable to FONAR | |

$ | 10,567,396 | | |

$ | 9,375,776 | |

CONSOLIDATED

STATEMENTS OF INCOME (Continued)

| | |

For

the Years Ended June 30, |

| | |

2024 | |

2023 |

| Net

Income Available to Common Stockholders | |

$ | 9,908,920 | | |

$ | 8,801,974 | |

| Net

Income Available to Class A Non-Voting Preferred Stockholders | |

$ | 490,776 | | |

$ | 427,666 | |

| Net

Income Available to Class C Common Stockholders | |

$ | 167,700 | | |

$ | 146,136 | |

| Basic

Net Income Per Common Share Available to Common Stockholders | |

$ | 1.56 | | |

$ | 1.35 | |

| Diluted

Net Income Per Common Share Available to Common Stockholders | |

$ | 1.53 | | |

$ | 1.32 | |

| Basic

and Diluted Income Per Share – Class C Common | |

$ | 0.44 | | |

$ | 0.38 | |

| Weighted

Average Basic Shares Outstanding – Common Stockholders | |

| 6,350,862 | | |

| 6,539,376 | |

| Weighted

Average Diluted Shares Outstanding – Common Stockholders | |

| 6,478,366 | | |

| 6,666,880 | |

| Weighted

Average Basic and Diluted Shares Outstanding – Class C Common | |

| 382,513 | | |

| 382,513 | |

CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

For

the Years Ended June 30, |

| CASH

FLOWS FROM OPERATING ACTIVITIES | |

2024 | |

2023 |

| Net

Income | |

$ | 14,097,417 | | |

$ | 12,126,516 | |

| Adjustments

to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation

and amortization | |

| 4,596,421 | | |

| 4,540,135 | |

| Provision

for credit losses | |

| 1,882,061 | | |

| 5,513,476 | |

| Deferred

income tax - net | |

| 2,795,507 | | |

| 2,979,550 | |

| Amortization

on right-of-use assets | |

| 4,311,762 | | |

| 4,264,818 | |

| Gain

on sale of equipment – related party | |

| (581,183 | ) | |

| — | |

| (Gain)Loss

on disposition of fixed assets | |

| (75,411 | ) | |

| 213,244 | |

| Abandoned

patents | |

| 225,419 | | |

| — | |

| Changes

in assets and liabilities | |

| | | |

| | |

| Accounts,

medical and management fee receivables | |

| (11,676,139 | ) | |

| (8,055,843 | ) |

| Notes

receivable | |

| 55,200 | | |

| (64,532 | ) |

| Inventories | |

| (145,775 | ) | |

| (209,845 | ) |

| Prepaid

expenses and other current assets | |

| 266,606 | | |

| (438,911 | ) |

| Other

assets | |

| 42,359 | | |

| 2,763 | |

| Accounts

payable | |

| 276,639 | | |

| 19,685 | |

| Other

current liabilities | |

| 2,949,962 | | |

| (2,527,100 | ) |

| Customer

advances | |

| (158,906 | ) | |

| 241,132 | |

| Operating

lease liabilities | |

| (4,541,352 | ) | |

| (3,862,814 | ) |

| Financing

lease liabilities | |

| (217,569 | ) | |

| (210,353 | ) |

| Other

liabilities | |

| (9,724 | ) | |

| (64,791 | ) |

| NET

CASH PROVIDED BY OPERATING ACTIVITIES | |

| 14,093,294 | | |

| 14,467,130 | |

| CASH

FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchases

of property and equipment | |

| (789,961 | ) | |

| (4,218,084 | ) |

| Purchase

of Short-term investment | |

| (103,303 | ) | |

| (473 | ) |

| Proceeds

from sale of equipment | |

| 75,411 | | |

| — | |

| Cost

of patents | |

| (32,885 | ) | |

| (119,571 | ) |

| NET

CASH USED IN INVESTING ACTIVITIES | |

| (850,738 | ) | |

| (4,338,128 | ) |

| CASH

FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Repayment

of borrowings and capital lease obligations | |

| (44,902 | ) | |

| (36,615 | ) |

| Purchase

of treasury stock | |

| (2,505,832 | ) | |

| (1,759,457 | ) |

| Distributions

to noncontrolling interests | |

| (5,630,336 | ) | |

| (5,776,200 | ) |

| NET

CASH USED IN FINANCING ACTIVITIES | |

| (8,181,070 | ) | |

| (7,572,272 | ) |

| NET

INCREASE IN CASH AND CASH EQUIVALENTS | |

| 5,061,486 | | |

| 2,556,730 | |

| CASH

AND CASH EQUIVALENTS - BEGINNING OF YEAR | |

| 51,279,707 | | |

| 48,722,977 | |

| CASH

AND CASH EQUIVALENTS - END OF YEAR | |

$ | 56,341,193 | | |

$ | 51,279,707 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Fonar (NASDAQ:FONR)

過去 株価チャート

から 10 2024 まで 11 2024

Fonar (NASDAQ:FONR)

過去 株価チャート

から 11 2023 まで 11 2024