false

0000033488

0000033488

2024-10-11

2024-10-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported) |

October 11, 2024 |

| ESCALADE, INCORPORATED |

| (Exact Name of Registrant as Specified in Its Charter) |

| Indiana |

| (State or Other Jurisdiction of Incorporation) |

| 0-6966 |

13-2739290 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| 817 Maxwell Avenue, Evansville, Indiana |

47711 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| (812) 467-1358 |

| (Registrant’s Telephone Number, Including Area Code) |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of Exchange on which registered |

|

Common Stock, No Par Value

|

ESCA

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 – Entry into a Material Definitive Agreement

Item 2.03 - Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On October 11, 2024, Escalade, Incorporated (the “Company”) and its wholly owned subsidiary, Indian Industries, Inc. (“Indian”), entered into the Fifth Amendment (the “Fifth Amendment”) to the Amended and Restated Credit Agreement dated as of January 21, 2022 among the Company, Indian, their domestic subsidiaries, the lenders party thereto (the “Lenders”), and JPMorgan Chase Bank, N.A., as Administrative Agent and as a Lender (the “Credit Agreement”). This Form 8-K describes the primary changes made to the Credit Agreement upon entry into the Fifth Amendment.

The Fifth Amendment eliminated the fixed charge coverage ratio covenant and related provisions. The fixed charge ratio covenant was replaced by a new minimum interest coverage ratio covenant of 3.50 to 1:00 effective September 30, 2024. Under the terms of the Fifth Amendment, the Company and the Lenders also agreed to decrease the maximum availability under the senior revolving credit facility from $75.0 million to $60.0 million, but added an accordion feature that could increase the facility in an amount not to exceed $85.0 million.

In addition to the changes in covenants and availability, other significant changes reflected in the Fifth Amendment include: eliminating two categories in the definition of Applicable Rate which has the effect of improved pricing to Escalade in the event the Funded Debt to EBITDA Ratio would exceed 3:0 to 1.0; revising the restricted payments covenant to provide that if at any time Escalade’s Funded Debt to EBITDA Ratio would exceed 1.75 to 1.0, then the aggregate combined total of cash dividends and Escalade share repurchases may not exceed $12.0 million in any trailing twelve month period; and Escalade now will provide borrowing base certificates and supporting financial information on monthly basis instead of quarterly.

The maturity date of the revolving credit facility remains January 21, 2027. The Company may prepay the Revolving Facility, in whole or in part, and reborrow prior to the revolving loan maturity date. The Company’s indebtedness under the Credit Agreement continues to be collateralized by liens on all of the present and future equity of each of the Company’s and Indian’s domestic subsidiaries and substantially all of the assets of the Company (excluding real estate). Each direct and indirect domestic subsidiary of the Company and Indian has secured its guaranty of indebtedness incurred under the revolving facility with a first priority security interest and lien on all of such subsidiary’s assets. The obligations, guarantees, liens and other interests granted by the Company, Indian, and their domestic subsidiaries continues in full force and effect.

Item 9.01 Financial Statements and Exhibits

| |

Exhibit

|

Description

|

| |

|

|

| |

10.1

|

Fifth Amendment dated October 11, 2024 to Amended and Restated Credit Agreement dated as of January 21, 2022 among Escalade, Incorporated, Indian Industries, Inc., each of their domestic subsidiaries, the lenders party thereto, and JPMorgan Chase Bank, N.A., as Administrative Agent

|

| |

|

|

| |

104

|

Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Escalade, Incorporated has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 14, 2024 |

ESCALADE, INCORPORATED |

| |

|

| |

By: /s/ STEPHEN R. WAWRIN |

| |

|

| |

Stephen R. Wawrin, Vice President and Chief Financial Officer |

Exhibit 10.1

Fifth Amendment To Amended and Restated Credit Agreement

By And Among

Escalade, Incorporated

And

Indian Industries, Inc.

And

The Other Loan Parties Hereto

And

The Lenders Party Hereto

And

JPMorgan Chase Bank, N.A.,

As Administrative Agent

Effective As Of October 11, 2024

Fifth Amendment To Amended and Restated

Credit Agreement

This Fifth Amendment To Amended and Restated Credit Agreement (this “Fifth Amendment”) is effective as of October 11, 2024, by and among Escalade, Incorporated, and Indian Industries, Inc. (collectively, the “Borrowers”), the other Loan Parties party hereto, the Lenders party hereto, and JPMorgan Chase Bank, N.A., as administrative agent (in such capacity, the “Administrative Agent”). The parties hereto agree as follows:

W I T N E S S E T H:

Whereas, as of January 21, 2022, the parties hereto entered into a certain Amended and Restated Credit Agreement (as amended, the “Agreement”);

Whereas, the parties desire to amend the Agreement to, among other things, reduce the amount of the Revolving Commitment and to amend certain definitions, covenants and other provisions, all subject to and as provided in this Fifth Amendment;

Now, Therefore, in consideration of the premises, and the mutual promises herein contained, the parties agree that the Agreement shall be, and it hereby is, amended as provided herein and the parties further agree as follows:

Part I. Amendatory Provisions

Article I

Définitions

Section 1.01 Defined Terms. Section 1.01 of the Agreement is hereby amended by substituting the following definitions in lieu of the like existing definitions:

“Applicable Rate” means, for any day, with respect to any Loan, or with respect to the commitment fees payable hereunder, as the case may be, the applicable rate per annum set forth below under the caption “Revolving Commitment ABR Spread”, “Revolving Commitment Term Benchmark Spread”, “Letter of Credit Fee”, or “Commitment Fee Rate”, as the case may be, based upon the Company’s Funded Debt to EBITDA Ratio as of the most recent determination date:

|

Funded Debt to

EBITDA Ratio

|

Revolving

Commitment

ABR Spread

|

Revolving

Commitment

Term

Benchmark

Spread

|

Letter of

Credit Fee

|

Commitment

Fee Rate

|

|

Category 1

≥ 2.50 to 1.0

|

0.25%

|

2.00%

|

2.00%

|

0.30%

|

| |

|

|

|

|

|

Category 2

< 2.50 to 1.0 but

≥ 1.50 to 1.0

|

-0-

|

1.75%

|

1.75%

|

0.25%

|

| |

|

|

|

|

|

Category 3

<1.50 to 1.0

|

(0.25%)

|

1.50%

|

1.50%

|

0.20%

|

| Fifth Amendment to Amended and Restated Credit Agreement |

Page 1 |

For purposes of the foregoing, (a) the Applicable Rate shall be determined as of the end of each Fiscal Quarter of the Company, based upon the Company’s annual or quarterly consolidated financial statements delivered pursuant to Section 5.01 and (b) each change in the Applicable Rate resulting from a change in the Funded Debt to EBITDA Ratio shall be effective as of the third Business Day following the date of delivery to the Administrative Agent of such consolidated financial statements indicating such change and ending on the date immediately preceding the effective date of the next such change; provided, that at the option of the Administrative Agent or at the request of the Required Lenders, if the Borrowers fail to deliver the annual or quarterly consolidated financial statements required to be delivered by it pursuant to Section 5.01, the Funded Debt to EBITDA Ratio shall be deemed to be in Category 1 during the period from the expiration of the time for delivery thereof until such consolidated financial statements are delivered.

If at any time the Administrative Agent determines that the financial statements upon which the Applicable Rate was determined were incorrect (whether based on a restatement, fraud or otherwise), or any ratio or compliance information in a Compliance Certificate or other certification was incorrectly calculated, relied on incorrect information or was otherwise not accurate, true or correct, the Borrowers shall be required to retroactively pay any additional amount that the Borrowers would have been required to pay if such financial statements, Compliance Certificate or other information had been accurate and/or computed correctly at the time they were delivered.

“Availability” means an amount equal to (i) the lesser of (A) the aggregate Revolving Commitments and (B) the Borrowing Base minus (ii) the Aggregate Revolving Exposure (calculated, with respect to any Defaulting Lender, as if such Defaulting Lender had funded its Applicable Percentage of all outstanding Borrowings).

“Borrowing Base” means, at any date of determination, the sum of (a) eighty percent (80%) of the Eligible Accounts of the Loan Parties at such date, plus (b) fifty-five percent (55%) of the Eligible Inventory of the Loan Parties at such date, plus (c) the Maximum Eligible In-Transit Inventory at such date, less (d) the aggregate outstanding principal balance of all Term Loans, less (e) the sum of the Reserves at such date. The Borrowing Base at any time shall be determined by reference to the most recent Borrowing Base Certificate delivered to the Administrative Agent.

“Revolving Commitment” means, with respect to each Lender, the amount set forth on the Commitment Schedule opposite such Lender’s name, or in the Assignment and Assumption or other documentation or record (as such term is defined in Section 9-102(a)(70) of the New York Uniform Commercial Code) as provided in Section 9.04(b)(ii)(C), pursuant to which such Lender shall have assumed its Revolving Commitment, as applicable, as such Revolving Commitment may be reduced or increased from time to time pursuant to (a) Section 2.09 and (b) assignments by or to such Lender pursuant to Section 9.04; provided, that at no time shall the Revolving Exposure of any Lender exceed its Revolving Commitment. As of the Fifth Amendment Effective Date, the aggregate amount of the Lenders’ Revolving Commitments is $60,000,000.

| Fifth Amendment to Amended and Restated Credit Agreement |

Page 2 |

Section 1.01 of the Agreement is hereby further amended by deleting the following definitions and all references made thereto: “Fixed Charge Coverage Ratio” and “Fixed Charges.”

Section 1.01 of the Agreement is hereby further amended by adding the following new definitions thereto:

“Fifth Amendment Effective Date” means October 11, 2024.

“Interest Coverage Ratio” means, for any period, the ratio of (b) EBITDA to (b) cash Interest Expense for such period, all calculated for such period for the Company and its Subsidiaries on a consolidated basis in accordance with GAAP.

Article II

The Credits

Section 2.01 Commitments. Section 2.01 of the Agreement is hereby amended by substituting the following new clause (a) in lieu of the like existing clause (a):

(a) Subject to the terms and conditions set forth herein, each Lender severally (and not jointly) agrees to make Revolving Loans in dollars to the Borrowers from time to time during the Availability Period in an aggregate principal amount that will not result (after giving effect to any application of proceeds of such Borrowing pursuant to Section 2.10(a)) in (i) such Lender’s Revolving Exposure exceeding such Lender’s Revolving Commitment, and (ii) the Aggregate Revolving Exposure exceeding the lesser of (x) the aggregate Revolving Commitments and (y) the Borrowing Base. Within the foregoing limits and subject to the terms and conditions set forth herein, the Borrowers may borrow, prepay and reborrow Revolving Loans.

| Fifth Amendment to Amended and Restated Credit Agreement |

Page 3 |

Section 2.06 Letters of Credit. Section 2.06 of the Agreement is hereby amended by substituting the following new clause (b) in lieu of the like existing clause (b):

(b) Notice of Issuance, Amendment, Renewal, Extension; Certain Conditions. To request the issuance of a Letter of Credit (or the amendment or extension of an outstanding Letter of Credit), the Borrower Representative shall hand deliver or fax (or transmit through Electronic System, if arrangements for doing so have been approved by the respective Issuing Bank) to an Issuing Bank selected by it and to the Administrative Agent (reasonably in advance of the requested date of issuance, amendment, renewal or extension, but in any event no less than three (3) Business Days) a notice requesting the issuance of a Letter of Credit, or identifying the Letter of Credit to be amended or extended, and specifying the date of issuance, amendment or extension (which shall be a Business Day), the date on which such Letter of Credit is to expire (which shall comply with paragraph (c) of this Section), the amount of such Letter of Credit, the name and address of the beneficiary thereof, and such other information as shall be necessary to prepare, amend or extend such Letter of Credit. In addition, as a condition to any such Letter of Credit issuance, the applicable Borrower shall have entered into a continuing agreement (or other letter of credit agreement) for the issuance of letters of credit and/or shall submit a letter of credit application, in each case, as required by the respective Issuing Bank and using such Issuing Bank’s standard form (each, a “Letter of Credit Agreement”). In the event of any inconsistency between the terms and conditions of this Agreement and the terms and conditions of any Letter of Credit Agreement, the terms and conditions of this Agreement shall control. A Letter of Credit shall be issued, amended renewed or extended only if (and upon issuance, amendment or extension of each Letter of Credit the Borrowers shall be deemed to represent and warrant that), after giving effect to such issuance, amendment, renewal or extension (i) the aggregate LC Exposure shall not exceed $5,000,000, (ii) no Revolving Lender’s Revolving Exposure shall exceed its Revolving Commitment, and (iii) the Aggregate Revolving Exposure shall not exceed the lesser of the aggregate Revolving Commitments and the Borrowing Base. Notwithstanding the foregoing or anything to the contrary contained herein, no Issuing Bank shall be obligated to issue or modify any Letter of Credit if, immediately after giving effect thereto, the outstanding LC Exposure in respect of all Letters of Credit issued by such Person and its Affiliates would exceed such Issuing Bank’s Issuing Bank Sublimit. Without limiting the foregoing and without affecting the limitations contained herein, it is understood and agreed that the Borrower Representative may from time to time request that an Issuing Bank issue Letters of Credit in excess of its individual Issuing Bank Sublimit in effect at the time of such request, and each Issuing Bank agrees to consider any such request in good faith. Any Letter of Credit so issued by an Issuing Bank in excess of its individual Issuing Bank Sublimit then in effect shall nonetheless constitute a Letter of Credit for all purposes of the Credit Agreement, and shall not affect the Issuing Bank Sublimit of any other Issuing Bank, subject to the limitations on the aggregate LC Exposure set forth in clause (i) of this Section 2.06(b).

An Issuing Bank shall not be under any obligation to issue any Letter of Credit if:

(i) any order, judgment or decree of any Governmental Authority or arbitrator shall by its terms purport to enjoin or restrain such Issuing Bank from issuing such Letter of Credit, or any Requirement of Law relating to such Issuing Bank or any request or directive (whether or not having the force of law) from any Governmental Authority with jurisdiction over such Issuing Bank shall prohibit, or request that such Issuing Bank refrain from, the issuance of letters of credit generally or such Letter of Credit in particular or shall impose upon such Issuing Bank with respect to such Letter of Credit any restriction, reserve or capital requirement (for which such Issuing Bank is not otherwise compensated hereunder) not in effect on the Effective Date, or shall impose upon such Issuing Bank any unreimbursed loss, cost or expense which was not applicable on the Effective Date and which such Issuing Bank in good faith deems material to it; or

(ii) the issuance of such Letter of Credit would violate one (1) or more policies of such Issuing Bank applicable to letters of credit generally.

| Fifth Amendment to Amended and Restated Credit Agreement |

Page 4 |

Section 2.09 Termination of Commitments; Increase in Revolving Commitments. Section 2.09 of the Agreement is hereby amended by substituting the following new clause (e) in lieu of the like existing clause (e):

(e) Any amendment hereto for such an increase or addition shall be in form and substance satisfactory to the Administrative Agent and shall only require the written signatures of the Administrative Agent, the Borrowers and each Lender being added or increasing its Commitment, subject only to the approval of all Lenders if any such increase or addition would cause the Revolving Commitments to exceed $85,000,000. As a condition precedent to such an increase or addition, the Borrowers shall deliver to the Administrative Agent (i) a certificate of each Loan Party signed by an authorized officer of such Loan Party (A) certifying and attaching the resolutions adopted by such Loan Party approving or consenting to such increase, and (B) in the case of the Borrowers, certifying that, before and after giving effect to such increase or addition, (1) the representations and warranties contained in Article III and the other Loan Documents are true and correct, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they are true and correct as of such earlier date, (2) no Default exists and (3) the Borrowers are in compliance (on a pro forma basis) with the covenants contained in Section 6.12 and (ii) legal opinions and documents consistent with those delivered on the Effective Date, to the extent requested by the Administrative Agent.

Section 2.11 Prepayment of Loans. Section 2.11 of the Agreement is hereby amended by substituting the following new clause (b) in the lieu of the like existing clause (b):

(b) In the event and on such occasion that the Aggregate Revolving Exposure exceeds the lesser of (A) the aggregate Revolving Commitments and (B) the Borrowing Base, the Borrowers shall prepay, on demand, the Revolving Loans, LC Exposure and/or Swingline Loans (or, if no such Borrowings are outstanding, deposit cash collateral in the LC Collateral Account in an aggregate amount equal to such excess, in accordance with Section 2.06(j)).

Article V

Affirmative Covenants

Section 5.01 Financial Statements ; Borrowing Base and Other Information. Section 5.01 of the Agreement is hereby amended by substituting the following new clause (f) in lieu of the like existing clause (f):

(f) as soon as available but in any event within thirty (30) days of the end of each Fiscal Month, and at such other times as may be requested by the Administrative Agent when this clause (f) is applicable, as of the Fiscal Month then ended, a Borrowing Base Certificate and supporting information in connection therewith, together with any additional reports with respect to the Borrowing Base as the Administrative Agent may reasonably request;

| Fifth Amendment to Amended and Restated Credit Agreement |

Page 5 |

Article VI

Negative Covenants

Section 6.08 Restricted Payments; Certain Payments of Indebtedness. Section 6.08 of the Agreement is hereby amended by substituting the following new clause (a) in lieu of the like existing clause (a) :

(a) No Loan Party will, nor will it permit any Subsidiary to, declare or make, or agree to declare or make, directly or indirectly, any Restricted Payment, or enter into any transaction that has a substantially similar effect or incur any obligation (contingent or otherwise) to do so, except (i) the Borrowers may declare and pay dividends with respect to its common stock payable solely in additional shares of its common stock, and, with respect to its preferred stock, payable solely in additional shares of such preferred stock or in shares of its common stock, (ii) so long as there exists no Event of Default, the Borrowers may, to the extent required by law, repurchase fractional shares of Borrowers’ Equity Interests up to an aggregate repurchase total for all fractional shares repurchased of $500,000, (iii) the Borrowers may issue its common stock pursuant to the Borrowers’ equity incentive plan existing on the Effective Date, and (iv) the Borrowers may purchase shares of Borrowers’ Equity Interests and/or declare and pay cash dividends so long as (A) there exists no Event of Default, and (B) at the time of such purchase of shares and/or payment of cash dividends the Company’s Funded Debt to EBITDA Ratio calculated on a pro forma basis after giving effect to such purchase of shares and/or payment of cash dividends is less than or equal to 1.75 to 1.00; provided, however, if at any time of the Company’s Funded Debt to EBITDA Ratio determined on a pro form basis at such time after giving effect to such purchase of shares and/or payment of cash dividends is greater than 1.75 to 1.00, the aggregate combined total for the purchase of all shares and payment of cash dividends shall be permitted so long as it does not exceed $12,000,000 in any trailing twelve month period.

Section 6.12 Financial Covenants. Section 6.12 of the Agreement is hereby amended by substituting the following new clause (a) in lieu of the like existing clause (a):

(a) Interest Coverage Ratio. As of September 30, 2024 and as of the end of each Fiscal Quarter end thereafter, the Company and its Subsidiaries shall achieve an Interest Coverage Ratio for the four (4) successive Fiscal Quarters of the Company ending on the date of determination of not less than 3.50 to 1.00.

Article XI

The Borrower Representative

Section 11.07 Reporting. Section 11.07 of the Agreement is hereby amended and restated in its entirety as follows:

Section 11.07 Reporting. Each Borrower hereby agrees that such Borrower shall furnish promptly after each Fiscal Month to the Borrower Representative a copy of its Borrowing Base Certificate and any other certificate or report required hereunder or requested by the Borrower Representative on which the Borrower Representative shall rely to prepare the Borrowing Base Certificate and Compliance Certificate required pursuant to the provisions of this Agreement.

| Fifth Amendment to Amended and Restated Credit Agreement |

Page 6 |

Exhibits and Schedules

Subject to Part IV hereof, the Agreement is hereby amended by substituting each of the Exhibit E and the Commitment Schedule attached hereto in lieu of the Exhibit E and the Commitment Schedule, respectively, attached to the Agreement.

Part II. Continuing Effect

Except as expressly modified herein:

(a) All terms, conditions, representations, warranties and covenants contained in the Agreement shall remain the same and shall continue in full force and effect, interpreted, wherever possible, in a manner consistent with this Fifth Amendment; provided, however, in the event of any irreconcilable inconsistency, this Fifth Amendment shall control;

(b) The representations and warranties contained in the Agreement shall survive this Fifth Amendment in their original form as continuing representations and warranties of Borrowers; and

(c) Capitalized terms used in this Fifth Amendment, and not specifically herein defined, shall have the meanings ascribed to them in the Agreement.

In consideration hereof, each Borrower represents, warrants, covenants and agrees that:

(aa) Each representation and warranty set forth in the Agreement, as hereby amended, remains true and correct as of the date hereof in all material respects, except to the extent that such representation and warranty is expressly intended to apply solely to an earlier date and except changes reflecting transactions permitted by the Agreement;

(bb) There currently exist no offsets, counterclaims or defenses to the performance of the Obligations (such offsets, counterclaims or defenses, if any, being hereby expressly waived);

(cc) Except as expressly waived in this Fifth Amendment, there does not exist any Default or Event of Default; and

(dd) After giving effect to this Fifth Amendment and any transactions contemplated hereby, no Default or Event of Default is or will be occasioned hereby or thereby.

Part III. Independent Credit Decision

Each Lender acknowledges that it has, independently and without reliance upon the Administrative Agent or any other Lender, based on such documents and information as it has deemed appropriate, made its own credit analysis and decision to enter into this Fifth Amendment.

Part IV. Conditions Precedent

Notwithstanding anything contained in this Fifth Amendment to the contrary, this Fifth Amendment shall not become effective until each of the following conditions precedent have been fulfilled to the satisfaction of the Administrative Agent:

(a) The Administrative Agent shall have received counterparts of this Fifth Amendment, duly executed by the Administrative Agent, the Borrowers, and the Lenders;

| Fifth Amendment to Amended and Restated Credit Agreement |

Page 7 |

(b) The Administrative Agent shall have received a Replacement Revolving Note in favor of each Lender, duly executed by the Borrowers;

(c) The Administrative Agent shall have received a Consent and Reaffirmation, duly executed by the Guarantors;

(d) The Administrative Agent shall have received a duly executed certificate of the Secretary of each Borrower and Guarantor (A) certifying as to the authorizing resolutions of such Borrower and Guarantor, and (B) certifying as complete and correct as to attached copies of its Articles of Incorporation and By‑Laws or Articles of Organization and Operating Agreement, as applicable, or certifying that such Articles of Incorporation or By‑Laws or Articles of Organization or Operating Agreement, as applicable, have not been amended (except as shown) since the previous delivery thereof to the Administrative Agent;

(e) The Administrative Agent shall have received such documentation and other information requested in connection with applicable “know your customer” and anti-money laundering rules and regulations, including the USA Patriot Act; and

(f) All legal matters incident to this Fifth Amendment shall be reasonably satisfactory to the Administrative Agent and its counsel.

Part V. Expenses

The Borrowers agree to pay or reimburse the Administrative Agent for all reasonable expenses of the Administrative Agent (including, without limitation, reasonable attorneys’ fees) incurred in connection with this Fifth Amendment.

Part VI. Counterparts

This Fifth Amendment may be executed in any number of counterparts, each of which shall be an original, but all of which taken together shall constitute one and the same agreement. Delivery of an executed counterpart of this Fifth Amendment by telefacsimile or other electronic method of transmission shall have the same force and delivery of an original executed counterpart of this Fifth Amendment. Any party delivering an executed counterpart of this Fifth Amendment by telefacsimile or other electronic method of transmission shall also deliver an original executed counterpart of this Fifth Amendment, but the failure to do so shall not affect the validity, enforceability, and binding effect of this Fifth Amendment.

[This Space Intentionally Left Blank]

| Fifth Amendment to Amended and Restated Credit Agreement |

Page 8 |

In Witness Whereof, the parties hereto have caused this Fifth Amendment to be executed by their respective officers duly authorized as of the date first above written.

| |

“Borrowers” |

| |

|

| |

Escalade, Incorporated |

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN |

| |

Stephen R. Wawrin, Chief Financial Officer |

| |

|

| |

|

| |

Indian Industries, Inc. |

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN |

| |

Stephen R. Wawrin, Chief Financial Officer |

| |

|

| |

“Administrative Agent” |

| |

|

| |

JPMorgan Chase Bank, N.A., individually as a |

| |

Lender, and as Administrative Agent, Swingline |

| |

Lender and Issuing Bank |

| |

|

| |

|

| |

By: /s/HEATHER M. BOYLAN |

| |

|

| |

Name: Heather M. Boylan |

| |

|

| |

Title: Executive Director |

| |

|

| |

“Lenders” |

| |

|

| |

Old National Bank, as a Lender |

| |

|

| |

|

| |

By: /s/JEFF BONE |

| |

|

| |

Name: Jeff Bone |

| |

|

| |

Title: SVP; Corp Banking |

Signature Page to Fifth Amendment to Amended and Restated Credit Agreement

EXHIBIT E

COMPLIANCE CERTIFICATE

|

To:

|

The Lenders party to the

Credit Agreement described below

|

This Compliance Certificate (“Certificate”), for the period ended [_______ __], 20[__], is furnished pursuant to that certain Amended and Restated Credit Agreement dated as of January 21, 2022 (as amended, modified, renewed or extended from time to time, the “Agreement”) among Escalade, Incorporated and Indian Industries, Inc. (collectively, the “Borrowers”), the other Loan Parties, the Lenders party thereto and JPMorgan Chase Bank, N.A., as Administrative Agent for the Lenders and as the Issuing Bank and Swingline Lender. Unless otherwise defined herein, capitalized terms used in this Certificate have the meanings ascribed thereto in the Agreement.

THE UNDERSIGNED HEREBY CERTIFIES ON ITS BEHALF AND ON BEHALF OF THE BORROWERS THAT:

|

1.

|

I am the [_________________] of the Borrower Representative and I am authorized to deliver this Certificate on behalf of the Borrowers and their Subsidiaries;

|

|

2.

|

I have reviewed the terms of the Agreement and I have made, or have caused to be made under my supervision, a detailed review of the compliance of the Borrowers and their Subsidiaries with the Agreement during the accounting period covered by the attached financial statements (the “Relevant Period”);

|

|

3.

|

The attached financial statements of the Company and, as applicable, its Subsidiaries and/or Affiliates for the Relevant Period: (a) have been prepared on an accounting basis (the “Accounting Method”) consistent with the requirements of the Agreement and, except as may have been otherwise expressly agreed to in the Agreement, in accordance with GAAP consistently applied, and (b) to the extent that the attached are not the Company’s annual Fiscal Year end statements, are subject to normal year-end audit adjustments and the absence of footnotes;

|

|

4.

|

The examinations described in paragraph 2 did not disclose and I have no knowledge of, except as set forth below, (a) the existence of any condition or event which constitutes a Default or an Event of Default under the Agreement or any other Loan Document during or at the end of the Relevant Period or as of the date of this Certificate or (b) any change in the Accounting Method or in the application thereof that has occurred since the date of the annual financial statements delivered to the Administrative Agent in connection with the closing of the Agreement or subsequently delivered as required in the Agreement;

|

|

5.

|

I hereby certify that, except as set forth below, no Loan Party has changed (i) its name, (ii) its chief executive office, (iii) its principal place of business, (iv) the type of entity it is or (v) its state of incorporation or organization without having given the Administrative Agent the notice required by Section 4.12 of the Security Agreement;

|

|

6.

|

The representations and warranties of the Loan Parties set forth in the Loan Documents are true and correct as of the date hereof, except to the extent that any such representation or warranty specifically refers to an earlier date, in which case it is true and correct only as of such earlier date;

|

|

7.

|

Schedule I attached hereto sets forth financial data and computations evidencing the Borrowers’ compliance with certain covenants of the Agreement, all of which data and computations are true, complete and correct; and

|

|

8.

|

Schedule II hereto sets forth the computations necessary to determine the Applicable Rate commencing on the third Business Day following the date this Certificate is delivered.

|

Described below are the exceptions, if any, referred to in paragraph 4 hereof by listing, in detail, the (i) nature of the condition or event, the period during which it has existed and the action which the Borrowers have taken, are taking, or propose to take with respect to each such condition or event or (ii) change in the Accounting Method or the application thereof and the effect of such change on the attached financial statements:

The foregoing certifications, together with the computations set forth in Schedule I and Schedule II hereto and the financial statements delivered with this Certificate in support hereof, are made and delivered this [___] day of [__________, ____].

|

|

Escalade, Incorporated, |

|

| |

as the Borrower Representative |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

Name: |

|

|

|

|

Title:

|

|

|

Schedule I to Compliance Certificate

Compliance as of _________, ____ with

Provisions of and of the Agreement

[Schedule I must include detailed calculation tables for all components of the financial covenant calculations. Sample calculation tables are set forth below.]

| |

6.12

|

Financial Covenants.

|

(a) Interest Coverage Ratio. As of September 30, 2024 and as of the end of each Fiscal Quarter end thereafter, the Company and its Subsidiaries shall achieve an Interest Coverage Ratio for the four (4) successive Fiscal Quarters of the Company ending on the date of determination of not less than 3.50 to 1.00.

[INSERT CALCULATION TABLE]

As of the Compliance Test Date shown above, the Interest Coverage Ratio is ______.___ to 1.00

Compliance as of the Compliance Test Date shown above: [__] Yes [__] No

(b) Funded Debt to EBITDA Ratio. The Loan Parties shall achieve, at the end of each Fiscal Quarter which closes after the Effective Date, a Funded Debt to EBITDA Ratio of not more than 2.75 to 1.0 for the 12-month period then ended.

[INSERT CALCULATION TABLE]

As of the Compliance Test Date shown above, the Funded Debt to EBITDA Ratio is ______.___ to 1.00

Compliance as of the Compliance Test Date shown above: [__] Yes [__] No

Schedule II to Compliance Certificate

Borrowers’ Applicable Rate Calculation

COMMITMENT SCHEDULE

|

Lender

|

|

Revolving

Commitment

|

|

|

Term

Commitment

|

|

|

Swingline

Commitment

|

|

|

Total

Commitment

|

|

|

JPMorgan Chase Bank, N.A.

|

|

$ |

41,153,846.25 |

|

|

$ |

18,780,527.52 |

|

|

$ |

7,500,000.00* |

|

|

$ |

59,934,373.77 |

|

|

Old National Bank

|

|

$ |

18,846,153.75 |

|

|

$ |

8,600,428.48 |

|

|

$ |

0.00 |

|

|

$ |

27,446,582.23 |

|

|

Total

|

|

$ |

60,000,000.00 |

|

|

$ |

27,380,956.00 |

|

|

$ |

7,500,000.00 |

|

|

$ |

87,380,956.00 |

|

*The Swingline Commitment is part of JPMorgan Chase Bank, N.A.’s Revolving Commitment.

CONSENT AND REAFFIRMATION

Each of the undersigned Loan Guarantors hereby consents to the foregoing Fifth Amendment, and further agrees that the execution and delivery of such Fifth Amendment shall in no way affect, impair, discharge, relieve or release the obligations of the undersigned under its Loan Guaranty, which obligations are hereby ratified, confirmed and reaffirmed in all respects and shall continue in full force and effect, until all obligations of the Borrowers to the Lenders, the Issuing Bank and the Administrative Agent are fully, finally and irrevocably paid and performed. Each Loan Guarantor further acknowledges that the failure to consent to any subsequent amendment shall not affect the liability of such Loan Guarantor under its Loan Guaranty. Capitalized terms used herein and not defined have the meanings ascribed thereto in the Agreement.

| |

BEAR ARCHERY, INC.

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

| |

|

| |

|

| |

EIM COMPANY, INC.

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

| |

|

| |

|

| |

ESCALADE SPORTS PLAYGROUND, INC.

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

| |

|

| |

|

| |

SOP SERVICES, INC.

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

Consent and Reaffirmation to

Fifth Amendment to Amended and Restated Credit Agreement

| |

U.S. WEIGHT, INC.

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

| |

|

| |

|

| |

WEDCOR HOLDINGS, INC.

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

| |

|

| |

|

| |

GOALSETTER SYSTEMS, INC.

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

| |

|

| |

|

| |

LIFELINE PRODUCTS, LLC

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

| |

|

| |

|

| |

VICTORY MADE, LLC

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

| |

|

| |

|

| |

VICTORY TAILGATE, LLC

|

| |

|

| |

|

| |

By: /s/STEPHEN W. WAWRIN

|

| |

Stephen R. Wawrin, Chief Financial Officer

|

Consent and reaffirmation to

Fifth amendment to amended and restated credit agreement

v3.24.3

Document And Entity Information

|

Oct. 11, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ESCALADE, INCORPORATED

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 11, 2024

|

| Entity, Incorporation, State or Country Code |

IN

|

| Entity, File Number |

0-6966

|

| Entity, Tax Identification Number |

13-2739290

|

| Entity, Address, Address Line One |

817 Maxwell Avenue

|

| Entity, Address, City or Town |

Evansville

|

| Entity, Address, State or Province |

IN

|

| Entity, Address, Postal Zip Code |

47711

|

| City Area Code |

812

|

| Local Phone Number |

467-1358

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ESCA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000033488

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

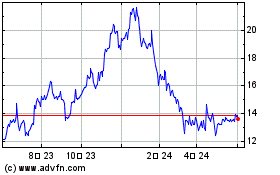

Escalade (NASDAQ:ESCA)

過去 株価チャート

から 1 2025 まで 2 2025

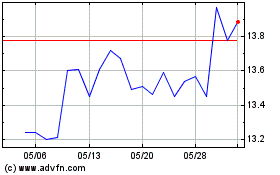

Escalade (NASDAQ:ESCA)

過去 株価チャート

から 2 2024 まで 2 2025