As

filed with the U.S. Securities and Exchange Commission on November 5, 2024.

Registration

Statement No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

| Eterna

Therapeutics Inc. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

2834 |

|

31-1103425 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

1035

Cambridge Street, Suite 18A

Cambridge,

MA 02141

(212)

582-1199

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Sanjeev

Luther

President

and Chief

Executive Officer

Eterna

Therapeutics Inc.

1035

Cambridge Street, Suite 18A

Cambridge,

MA 02141

(212)

582-1199

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant is filing a combined prospectus in this registration statement pursuant to Rule 429 under the Securities Act of 1933 (the

“Securities Act”) in order to satisfy the requirements of the Securities Act and the rules and regulations thereunder for

this offering and the offering registered under the registrant’s registration statement on Form S-3 (File No. 333-276493) (the

“January 2024 Registration Statement”), which was declared effective on January 22, 2024, and under the registrant’s

registration statement on Form S-3 (File No. 333-273977) (the “August 2023 Registration Statement” and together with the

January 2024 Registration Statement, the “Prior Registration Statements”)), which was declared effective on August 22, 2023.

The combined prospectus in this registration statement, upon effectiveness, shall act as Post-Effective Amendment No. 1 on Form S-1 to

each of the Prior Registration Statements and contains an updated prospectus relating to the resale of shares of the registrant’s

common stock issued or issuable upon exercise of warrants and/or conversion of convertible notes the registrant issued in private placements

consummated on December 2, 2022, July 14, 2023, December 15, 2023 and January 11, 2024 that were originally registered under the Prior

Registration Statements.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

prospectus forms a part of a registration statement on Form S-1, which registration statement also constitutes Post-Effective Amendment

No. 1 on Form S-1 to the registrant’s registration statement on Form S-3 (File No. 333-276493) (the “January 2024 Registration

Statement”), which was declared effective on January 22, 2024, and Post-Effective Amendment No. 1 on Form S-1 to the registrant’s

registration statement on Form S-3 (File No. 333-273977) (the “August 2023 Registration Statement” and together with the

January 2024 Registration Statement, the “Prior Registration Statements”)), which was declared effective on August 22, 2023,

and is being filed pursuant to the undertakings in Item 17 of the Prior Registration Statements to update and supplement the information

contained therein, as declared effective by the Securities and Exchange Commission on January 22, 2024 and August 22, 2023, respectively.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does

it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED

NOVEMBER 5, 2024 |

Eterna

Therapeutics, Inc.

Up

to 49,870,566 Shares of Common Stock

This

prospectus relates to the offering and resale from time to time by the selling stockholders identified in this prospectus of up to 49,870,566

shares of our common stock, $0.005 par value per share, composed of:

| ● | 1,901,664

shares of common stock issued in, and up to 141,642 shares of common stock issuable upon

the exercise of a warrant issued in, a private placement consummated in December 2022; |

| ● | 9,950,832

shares of common stock issued on October 29, 2024 in exchange for outstanding warrants issued

to certain selling stockholders in the December 2022 private placement and in private placements

consummated in each of July 2023, December 2023 and January 2024; |

| ● | 28,351,197

shares of common stock issued on October 29, 2024 in exchange for outstanding senior convertible

notes issued to certain selling stockholders in the July 2023, December 2023 and January

2024 private placements; |

| ● | 6,244,237

shares of common stock issued, and up to 1,764,000 shares of common stock issuable upon exercise

of pre-funded warrants issued, on October 29, 2024 upon conversion of senior convertible

notes issued to certain selling stockholders in a private placement consummated in September

2024; and |

| ● | 1,401,994

shares of common stock issued, and up to 115,000 shares of common stock issuable upon exercise

of pre-funded warrants issued, in a private placement consummated on October 29, 2024. |

For

additional information regarding the transactions in which the securities described above were issued to the selling stockholders, see

the sections of this prospectus titled “Prospectus Summary— Recent Events” and “Selling Stockholders.”

We

are not selling any shares of common stock under this prospectus and we will not receive any proceeds from the sale by the selling stockholders

of such shares. We will, however, receive the proceeds from the exercise of the warrant issued in the December 2022 private placement

to the extent the exercise price is paid in cash.

Sales

of the shares by the selling stockholders may occur at fixed prices, at market prices prevailing at the time of sale, at prices related

to prevailing market prices or at negotiated prices. The selling stockholders may sell shares to or through underwriters, broker-dealers

or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling stockholders, the purchasers

of the shares, or both. For more information about how the selling stockholders may sell their shares of common stock, see the section

of this prospectus titled “Plan of Distribution.”

We

are paying the cost of registering the shares of common stock covered by this prospectus as well as various related expenses. The selling

stockholders are responsible for all broker or similar commissions related to the offer and sale of their shares.

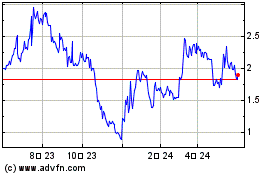

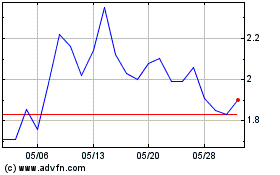

Our

common stock is listed on the Nasdaq Capital Market under the symbol “ERNA.” On October 31, 2024, the closing price

of our common stock as reported on The Nasdaq Capital Market was $1.09.

We

are a “smaller reporting company” as defined under federal securities law and we have elected to comply with certain reduced

public company reporting requirements available to smaller reporting companies. See the section titled “Prospectus Summary— Implications

of Being a Smaller Reporting Company.”

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading

“Risk Factors” on page 5 of this prospectus and any similar section contained in any amendment or supplement to this prospectus

and under similar headings in the documents that are incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”).

Under this registration statement, the selling stockholders may, from time to time, sell in one or more offerings the common stock described

in this prospectus.

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Incorporation of Documents by Reference.” You should carefully read this prospectus

as well as additional information described under “Incorporation of Documents by Reference,” before deciding to invest in

our securities.

Neither

we nor any selling stockholder has authorized anyone to provide you with additional information or information different from that contained

in, or incorporated by reference into, this prospectus. We take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. The information contained in this prospectus is accurate only as of the date on the

front cover page of this prospectus, or other earlier date stated in this prospectus, regardless of the time of delivery of this prospectus

or of any sale of our securities. Our business, financial condition, results of operations and future prospects may have changed since

that date.

For

investors outside the United States (“U.S.”): We have not done anything that would permit this offering or the possession

or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the U.S. Persons outside

the U.S. who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering

of the securities and the distribution of this prospectus outside of the U.S.

INFORMATION

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve risks, uncertainties and assumptions. You should not place undue reliance

on these forward-looking statements. All statements other than statements of historical fact in this prospectus are forward-looking statements.

The forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely on our

current expectations and projections about future events and financial trends that we believe may affect our business, our financial

condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. In some cases,

you can identify these forward-looking statements by terms such as “anticipate,” “believe,” “continue,”

“could,” “depends,” “estimate,” “expects,” “intend,” “may,” “ongoing,”

“plan,” “potential,” “predict,” “project,” “should,” “will,”

“would” or the negative of those terms or other similar expressions, although not all forward-looking statements contain

those words. These forward-looking statements include, but are not limited to, statements concerning the following: our ability to raise

capital to fund our operations; the sufficiency of our working capital to fund our operations in the near and long term, which raises

doubt about our ability to continue as a going concern; our dependence on in-licensed intellectual property; our ability to enter into

and sustain strategic partnerships with respect to the potential licensing of our intellectual property; our estimates regarding expenses,

future revenue, capital requirements and needs for additional financing; our intellectual property position and strategy; developments

relating to our competitors and our industry; the impact of government laws and regulations; the initiation, timing, progress, and results

of our research and development; and our ability to maintain the listing of our common stock on The Nasdaq Capital Market.

Factors

that may cause actual results to differ materially from those contemplated by such forward-looking statements include, without limitation:

we will need additional funding, and we cannot guarantee that we will find adequate sources of capital in the future; we have incurred

significant losses since our inception and may be unable to obtain additional funds before we achieve positive cash flows; we may not

be able to generate sufficient cash flow or raise adequate financing to grow or scale our business or to fund our operations; we may

be unable to protect our intellectual property rights and we may be liable for infringing the intellectual property rights of others;

our common stock may be delisted by Nasdaq; and the price of our common stock may be volatile. We discuss many of these risks in greater

detail under “Risk Factors” in this prospectus, in the “Business” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” sections incorporated by reference from our most recent Annual Report

on Form 10-K and in our Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent to our filing of such Annual Report

on Form 10-K, as well as any amendments thereto reflected in subsequent filings with the SEC. Moreover, new risks emerge from time to

time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statement. In light of these risks, uncertainties and assumptions, the forward-looking statements in this prospectus may not occur and

actual results could differ materially and adversely from those anticipated or implied by forward-looking statements. You should not

rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee that the future results, performance or events or circumstances reflected in forward-looking

statements will be achieved or occur.

Also,

forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future

events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed

or implied in such forward-looking statements. You should read this prospectus, any applicable prospectus supplement, together with the

documents that we have filed with the SEC that are incorporated by reference an, completely and with the understanding that our actual

future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents

by these cautionary statements.

You

should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration

statement of which this prospectus is a part with the understanding that our actual future results, performance and events and circumstances

may be materially different from what we expect.

PROSPECTUS

SUMMARY

The

following summary highlights selected information about us and this offering and does not contain all of the information that you should

consider before investing in this offering. You should carefully read this entire prospectus and the documents incorporated by reference

into this prospectus, especially the “Risk Factors,” as well as “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our financial statements, including the accompanying notes to those statements, incorporated

by reference from our most recent Annual Report on Form 10-K and our other filings with the SEC before making an investment decision.

In this prospectus, unless context requires otherwise, references to “we,” “us,” “our,” “Eterna”

or “the Company” refer to

Eterna Therapeutics, Inc. and its consolidated subsidiaries (Eterna Therapeutics LLC, Novellus, Inc. and Novellus Therapeutics Limited).

Company

Overview

We

are a publicly traded, preclinical-stage cell therapy company. Our vision is to improve the lives of patients with difficult-to-treat

diseases through innovative, effective, and safe, but accessible cellular therapies, and our mission is to develop allogenic off-the-shelf

cellular therapies, leveraging induced pluripotent stem cell (“iPSC”)-derived mesenchymal stem cells (“iMSCs”)

to target solid tumors.

Our

lead product ERNA-101 is allogenic IL-7 and IL-15-secreting iMSCs. ERNA-101 capitalizes on the intrinsic tumor-homing ability of MSCs

to slip through the tumor’s defenses and to deliver potent pro-inflammatory factors directly to the tumor microenvironment (“TME”),

limiting systemic exposure and potential toxicity while unleashing potent anti-cancer immune responses including enhancement of T-cell

anti-tumor activity. Our initial focus is to develop ERNA-101 in triple negative breast cancer and platinum-resistant, tp53-mutant ovarian

cancer. We collaborated with the University of Texas MD Anderson Cancer Center to investigate the ability of ERNA-101 to induce and modulate

antitumor immunity in ovarian cancer and breast cancer model. We are expecting to complete the Investigational New Drug (“IND”)

enabling studies and IND submission by 2026. We are also planning to investigate anti-inflammatory cytokine (e.g. IL-10)-secreting iMSCs

in inflammatory/auto-immune disorders like Rheumatoid arthritis. We are actively seeking strategic partnerships to co-develop or out-license

therapeutic assets and engage with potential collaborators to expand developmental opportunities.

Recent

Events

Private

Placement

On

October 29, 2024, we closed a private placement in which we sold an aggregate of 1,401,994 shares of our common stock and a pre-funded

warrant to purchase 115,000 shares of our common stock at a purchase price of $0.75 per share of common stock and $0.75 less $0.005 per

share of common stock subject to the pre-funded warrant. We received approximately $1.1 million in gross proceeds from the issuance of

such securities. For additional information regarding this private placement, see the section of this prospectus titled “Selling

Stockholders.”

Exchange

Transactions

Also

on October 29, 2024, in accordance with exchange agreements we entered into with the holders of certain of our warrants and convertible

notes, we issued an aggregate of 38,302,029 shares of our common stock in exchange for: (i) warrants to purchase an aggregate of approximately

4.4 million shares of our common stock that we issued in December 2022 with an exercise price of $1.43 per share; (ii) $8.7 million in

the aggregate principal amount of convertible notes that we issued in July 2023 and warrants to purchase an aggregate of approximately

6.1 million shares of our common stock that we issued in July 2023 with an exercise price of $1.43 per share; (iii) $9.2 million in the

aggregate principal amount of convertible notes that we issued in December 2023 and warrants to purchase an aggregate of approximately

9.6 million shares of our common stock that we issued in December 2023 with an exercise price of $1.43 per share.

The

holders of the warrants described in the paragraph above exchanged all their warrants for shares of our common stock at an exchange ratio

of 0.5 of a share of common stock for every one share of common stock issuable upon exercise of the applicable warrant (rounded up to

the nearest whole number), and the holders of the convertible notes described in the paragraph above exchanged all their convertible

notes for shares of our common stock at an exchange ratio equal to (A) the sum expressed in U.S. dollars of (1) the principal amount

of the applicable convertible note, plus (2) all accrued and unpaid interest thereon through the date the applicable convertible note

is exchanged plus (3) all interest that would have accrued through, but not including, the maturity date of applicable convertible note

if it was outstanding from the date such convertible note is exchanged through its maturity date, divided by (B) $1.00 (rounded up to

the nearest whole number).

For

additional information regarding the exchange transactions described above, see the section of this prospectus titled “Selling

Stockholders.”

Conversion

of Bridge Notes

On

September 24, 2024, we closed a private placement in which we sold an aggregate principal amount of approximately $3.9 million of 12.0%

senior convertible notes (the “bridge notes”).

On

October 29, 2024, in accordance with the terms of the bridge notes, approximately $3.0 million of the principal amount of the bridge

notes plus all accrued and unpaid interest thereon, plus such amount of interest that would have accrued on the principal amount through

December 24, 2024, was automatically converted at a conversion price of $0.50 into 6,244,237 shares of our common stock, and approximately

$0.9 million of the principal amount of the bridge notes plus all accrued and unpaid interest thereon, plus such amount of interest that

would have accrued on the principal amount through December 24, 2024, was automatically converted at a conversion price of $0.50 into

pre-funded warrants to purchase 1,764,000 shares of our common stock.

For

additional information regarding the private placement and conversion of the bridge notes, see the section of this prospectus titled

“Selling Stockholders.”

Agreements

with Factor Bioscience

License

Agreement

On

September 24, 2024, we entered into the Exclusive License and Collaboration Agreement (“the Factor L&C Agreement”) with

Factor Bioscience Limited (“Factor Limited”). The Factor L&C Agreement terminated the Amended and Restated Factor License

Agreement entered into on November 14, 2023 as well as an exclusive license agreement we acquired from Dilos Bio (formerly known as Exacis

Biotherapeutics Inc.) under an asset purchase agreement in April 2023.

Under

the Factor L&C Agreement, we have obtained an exclusive license in the fields of cancer, autoimmune disorders, and rare diseases

with respect to certain licensed technology and we have the right to develop the licensed technology directly or enter into co-development

agreements with partners who can help bring such technology to market. The Factor L&C Agreement also provides for certain services

and materials to be provided by Factor to facilitate our development of the licensed technology and to enable us to scale up production

at third party facilities.

The

initial term of the Factor L&C Agreement is one year after the effective date, and it automatically renews yearly thereafter. We

may terminate the Factor L&C Agreement for any reason upon 90 days’ written notice to Factor, and the parties otherwise have

customary termination rights, including in connection with certain uncured material breaches and specified bankruptcy events.

Pursuant

to the Factor L&C Agreement, we will pay Factor $0.2 million per month for the first twelve months, $0.1 million per month for the

first nine months toward patent costs, certain milestone payments, royalty payments on net sales of commercialized products and sublicensing

fee payments.

Lineage

Assignment Agreement

On

September 24, 2024, we entered into an agreement with Factor Bioscience Inc. (“Factor”) whereby we assigned the exclusive

option and license agreement (the “Lineage Agreement”) to Factor (the “Lineage Assignment Agreement”). Our rights

and obligations under the agreement are now Factor’s responsibility.

Payments

related to the Lineage Agreement will now be subject to the Lineage Assignment Agreement, which provides for Factor paying us thirty

percent (30%) of all amounts it actually receives from Lineage in the event that Lineage exercises its Option Right. Upon receipt of

payment for the customization activities set forth in the Lineage Agreement, Factor will pay the Company twenty percent (20%) of all

amounts Factor receives from Lineage.

Termination

of Sublease

In

October 2022, we entered into a sublease for office and laboratory space in Somerville, Massachusetts. In connection with entering into

the sublease, we delivered a security deposit in the form of a letter of credit in the amount of $4.1 million. The letter of credit was

collateralized with $4.1 million of cash deposited in a restricted account.

On

August 5, 2024, the sublessor drew down on the letter of credit for the full $4.1 million to cover the approximately $4.0 million of

past due rent payments for February 2024 through August 2024, plus interest and penalties.

On

August 9, 2024, we and the sublessor entered into a sublease termination agreement pursuant to which the parties agreed to terminate

the sublease effective August 31, 2024. Pursuant to the sublease termination agreement, we agreed to surrender and vacate the premises,

all of our right, title and interest in all furniture, fixtures and laboratory equipment at the premises will become the property of

the sublessor, and both parties will be released of their obligations under the sublease. As a result of the sublease termination, we

expect to save approximately $72 million in base rental payments, parking, operating expenses, taxes and utilities that we would have

paid over the remaining lease term.

Nasdaq

Matters

As

previously reported, on March 19, 2024, we received a notice from the Listing Qualifications Staff (“Staff”) of The

Nasdaq Stock Market LLC (“Nasdaq”) stating that we were not in compliance with the Nasdaq listing rule 5550(b)(1) (the

“Minimum Stockholders’ Equity Rule”) because we reported stockholders’ equity of less than $2.5 million as

of December 31, 2023. The notice had no immediate effect on our Nasdaq listing. Also as previously reported, in May 2024, we

submitted a plan to Nasdaq advising of actions we have taken or will take to regain compliance with the Minimum Stockholders’

Equity Rule. Nasdaq accepted our plan and granted us a 180-day extension, or through September 16, 2024, to regain compliance with

the Minimum Stockholders’ Equity Rule. On September 17, 2024, also as previously reported, we received a notice from the Staff

stating that the Staff has determined that we did not meet the terms of the extension to confirm or demonstrate compliance with the

Minimum Stockholders’ Equity Rule by September 16, 2024, and, as a result, unless we request an appeal of such determination

by September 24, 2024, trading of our common stock will be suspended at the opening of business on September 26, 2024, and a Form

25-NSE will be filed with the SEC, which will remove our securities from listing and registration on Nasdaq. On September 24,

2024, we submitted a timely request for a hearing with the Nasdaq’s Hearings Panel to appeal the Staff’s

determination. The request stayed the suspension of trading of our common stock and the filing of the Form 25-NSE pending the

Hearing Panel’s decision. The hearing is scheduled for November 12, 2024. The Hearings Panel typically issues its decision

within 30 days of the hearing.

After

giving effect to (i) the reclassification of the debt represented by the convertible notes to equity as a result of the exchange of

the convertible notes that occurred on October 29, 2024, (ii) the receipt of net proceeds we received in the October 2024 private

placement of our common stock and pre-funded warrants to purchase shares of our common stock, and (iii) the reclassification of the

debt represented by the bridge notes to equity as a result of the conversion of the bridge notes into shares of our common stock or

pre-funded warrants to purchase shares of our common stock, and after taking into account the savings resulting from the termination

of our former sublease, our stockholders’ equity exceeds $2.5 million, which we communicated in our pre-hearing submission

of materials to the Hearing Panel on October 23, 2024. At the hearing with the Hearings Panel scheduled for November 12, 2024, we

will present our plan to demonstrate long-term compliance with the Minimum Stockholders’ Equity Rule. For additional

information regarding the risks relating to the listing of our common stock on Nasdaq, see the risk factor titled “Our failure

to meet the continued listing requirements of Nasdaq could result in a delisting of our common stock,” in Risk Factors,

below.

Corporate

Information

Eterna

Therapeutics Inc. was incorporated under the laws of Delaware in 1984. We changed our name from our initial name Alroy Industries, Inc.

to NTN Communications, Inc. in 1985, to NTN Buzztime, Inc. in 2005, to Brooklyn ImmunoTherapeutics, Inc. in 2021 and to Eterna Therapeutics

Inc. on December 20, 2022. Our principal executive office is located at 1035 Cambridge Street, Suite 18A, Cambridge, Massachusetts 02141,

and our telephone number is (212) 582-1199. We maintain a website at www.eternatx.com. Information contained on or accessible through

our website is not incorporated by reference and does not form a part of this prospectus or the registration statement of which this

prospectus forms a part.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

To the extent that we continue to qualify as a smaller reporting company, we may take advantage of accommodations afforded to smaller

reporting companies including: (i) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes

Oxley Act of 2002, so long as we also qualify as a “non-accelerated filer” as defined in the Exchange Act; (ii) scaled executive

compensation disclosure requirements; and (iii) providing only two years of audited financial statements, instead of three years. We

will qualify as a smaller reporting company: (i) until the fiscal year following the determination that the market value of our voting

and non-voting common stock held by non-affiliates is more than $250 million measured on the last business day of our second fiscal quarter,

or (ii) if our annual revenues are less than $100 million during the most recently completed fiscal year, until the fiscal year following

the determination that the market value of our voting and non-voting common stock held by non-affiliates is more than $700 million measured

on the last business day of our second fiscal quarter.

THE

OFFERING

| Common

stock offered by the selling stockholders |

|

Up

to 49,870,566 shares. For additional information about how the selling stockholders acquired the shares offered by this prospectus,

see the section of this prospectus titled “Selling Stockholders.” |

| |

|

|

| Terms

of the offering |

|

Each

selling stockholder will determine when and how it will sell the common stock offered by this prospectus. For additional information,

see the section of this prospectus titled “Plan of Distribution.” |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of the shares of common stock offered by this prospectus. We will, however, receive the

proceeds from the exercise of the warrant issued in the December 2022 private placement to the extent the exercise price is paid

in cash. |

| |

|

|

| Risk

factors |

|

See

“Risk Factors” on page 5 and other information incorporated by reference into this prospectus for a discussion of factors

to consider carefully before deciding to invest in our securities. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

“ERNA” |

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. You should carefully consider the risk factors discussed below and under the heading

“Risk Factors” in our most recent Annual Report on Form 10-K, as updated by our subsequent quarterly reports on Form 10-Q

and other reports and documents that are incorporated by reference into this prospectus, before deciding whether to purchase any of our

common stock in this offering. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also adversely affect our business, prospects, financial condition,

and/or operating results. The occurrence of any known or unknown risks might cause you to lose all or part of your investment in our

securities.

Our

failure to meet the continued listing requirements of Nasdaq could result in a delisting of our common stock.

As

previously reported, on March 19, 2024, we received a notice from Nasdaq Staff stating that we are not in compliance with Nasdaq Listing

Rule 5550(b)(1) (the “Minimum Stockholders’ Equity Rule”) because we reported stockholders’ equity of less than

$2.5 million as of December 31, 2023. Our stockholders’ equity was $2.2 million as of December 31, 2023. The notice had no immediate

effect on our Nasdaq listing.

Also

as previously reported, in May 2024, we submitted a plan to the Staff advising of actions we have taken or will take to regain compliance

with the Minimum Stockholders’ Equity Rule. The Staff accepted the plan and granted us a 180-day extension, or through September

16, 2024, to regain compliance with the Minimum Stockholders’ Equity Rule. On September 17, 2024, also as previously reported,

we received a notice from the Staff stating that the Staff has determined that we did not meet the terms of the extension to confirm

or demonstrate compliance with the Minimum Stockholders’ Equity Rule by September 16, 2024, and, as a result, unless we request

an appeal of such determination by September 24, 2024, trading of our common stock will be suspended at the opening of business on September

26, 2024, and a Form 25-NSE will be filed with the SEC, which will remove our securities from listing and registration on Nasdaq. On

September 24, 2024, we submitted a timely request for a hearing with the Nasdaq’s Hearings Panel to appeal the Staff’s

determination. The request stays the suspension of trading of our common stock and the filing of the Form 25-NSE pending the Hearing

Panel’s decision. The hearing is scheduled for November 12, 2024. The Hearings Panel typically issues its decision within 30 days

of the hearing.

After

giving effect to (i) the reclassification of the debt represented by the convertible notes to equity as a result of the exchange of the

convertible notes that occurred on October 29, 2024, (ii) the receipt of net proceeds we received at the closing of the October 2024

PIPE on October 29, 2024 and (iii) the reclassification of the debt represented by the bridge notes to equity as a result of the conversion

of the bridge notes into shares of our common stock or pre-funded warrants to purchase shares of our common stock that occurred on October

29, 2024, and after taking into account the savings resulting from the termination of our former sublease, our stockholders’ equity

exceeds $2.5 million, which we communicated in our pre-hearing submission of materials to the Hearing Panel on October 23, 2024.

At the hearing with the Hearings Panel scheduled for November 12, 2024, we will present our plan to demonstrate long-term compliance

with the Minimum Stockholders’ Equity Rule. No assurances can be given that Nasdaq will determine that we have regained compliance

with the Minimum Stockholders’ Equity Rule.

If

our common stock is delisted by Nasdaq, and we are not able to list our securities on another national securities exchange, we expect

our securities could be quoted on an over-the-counter market. If this were to occur, then we could face significant material adverse

consequences, including: a material reduction in the liquidity of our common stock and a corresponding material reduction in the trading

price of our common stock; a more limited market quotations for our securities; a determination that our common stock is a “penny

stock” that requires brokers to adhere to more stringent rules and possibly resulting in a reduced level of trading activity in

the secondary trading market for our securities; more limited research coverage by stock analysts; loss of reputation; more difficult

and more expensive equity financings in the future; the potential loss of confidence by investors; and fewer business development opportunities.

The

National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the

sale of certain securities, which are referred to as “covered securities.” If our common stock remains listed on Nasdaq,

our common stock will be covered securities. Although the states are preempted from regulating the sale of our securities, the federal

statute does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity,

then the states can regulate or bar the sale of covered securities in a particular case. If our securities were no longer listed on Nasdaq

and therefore not “covered securities,” we would be subject to regulation in each state in which we offer our securities.

SELLING

STOCKHOLDERS

Background

December

2022 Private Placement of Shares of Common Stock and Warrants

In

December 2022, we closed a private placement with certain selling stockholders (the “December 2022 private placement”) in

which we sold to such selling stockholders an aggregate of 2,184,950 units, each unit consisting of (i) one share of our common stock

and (ii) two warrants, each exercisable to purchase one share of our common stock (the “December 2022 warrants”), for an

aggregate purchase price of approximately $7.7 million, consisting of $3.53 per unit (inclusive of $0.125 per December 2022 warrant).

When

issued, the December 2022 warrants had an exercise price of $3.28 per share of common stock, subject to customary adjustments, and expired

five-and-one-half years from the date of issuance. In connection with the issuance of the December 2023 convertible notes (as defined

below), the exercise prices of the December 2022 warrants were reduced from $3.28 to $1.43 per share. The December 2022 warrants

became exercisable six months following the closing of the December 2022 private placement. The December 2022 warrants purchased by certain

of the selling stockholders had a provision pursuant to which such warrants may not be exercised if the aggregate number of shares of

common stock beneficially owned by the holder thereof would exceed 4.99% or 9.99% of our common stock immediately after exercise thereof.

As

described below under “—October 2024 Exchange Transactions,” other than one December 2022 warrant to purchase approximately

0.1 million shares of our common stock, all the December 2022 warrants were exchanged for shares of our common stock.

In

connection with the December 2022 private placement, we entered into a registration rights agreement with certain selling stockholders,

pursuant to which we agreed to register the resale of the shares of common stock issued in the December 2022 private placement and the

shares of common stock issuable upon exercise of the December 2022 warrants.

July

2023 Private Placement of Notes and Warrants

In

July 2023, we closed a private placement with certain selling stockholders (the “July 2023 private placement”) in which we

sold to such selling stockholders in the aggregate (i) $8,715,000 in principal amount of 6.0% senior convertible promissory notes due

July 2028 (the “July 2023 convertible notes”) and (ii) warrants to purchase 6,094,392 shares of our common stock (the “July

2023 warrants”).

When

issued, the July 2023 convertible notes were convertible into shares of our common stock at an initial conversion price of $2.86, subject

to customary adjustments. The July 2023 convertible notes were our general senior unsecured obligations and ranked equal in right of

payment with all of our existing and future unsubordinated indebtedness. The July 2023 convertible notes bore interest at 6.0% per annum,

payable quarterly in arrears on January 15, April 15, July 15 and October 15 of each year, commencing on October 15, 2023. At our election,

we could pay interest either in cash or in-kind by increasing the outstanding principal amount of the July 2023 convertible notes. The

July 2023 convertible notes were to mature on July 14, 2028, unless earlier converted or repurchased. The July 2023 convertible notes

purchased by certain of the selling stockholders had a provision pursuant to which such convertible notes could not be converted if the

aggregate number of shares of common stock beneficially owned by the holder thereof would exceed 4.99%, 9.99% or 19.99% immediately after

conversion thereof, subject to certain increases not in excess of either 9.99% or 19.99% at the option of such holder.

When

issued, the July 2023 warrants had an exercise price of $2.61 per share of common stock, subject to customary adjustments, were immediately

exercisable, and expired five years from the date of issuance. The July 2023 warrants purchased by certain of the selling stockholders

had a provision pursuant to which such warrants may not be exercised if the aggregate number of shares of common stock beneficially owned

by the holder thereof would exceed 4.99%, 9.99% or 19.99% immediately after exercise thereof, subject to certain increases not in excess

of either 9.99% or 19.99% at the option of such holder.

As

described below under “—October 2024 Exchange Transactions,” all the July 2023 warrants and July 2023 convertible notes

were exchanged for shares of our common stock.

In

connection with the July 2023 private placement, we entered into a registration rights agreement with certain selling stockholders pursuant

to which we agreed to register the shares of common stock issuable upon conversion of the July 2023 convertible notes and the shares

common stock issuable upon exercise of the July 2023 warrants.

December

2023 Private Placement of Notes and Warrants

In

December 2023 and January 2024, we closed a private placement with certain selling stockholders (the “December 2023 private placement”)

in which we sold to such selling stockholders in the aggregate (i) $9,193,000 in principal amount of 12.0% senior convertible promissory

notes due five years from issuance (the “December 2023 convertible notes” and together with the July 2023 convertible notes,

the “convertible notes”) and (ii) warrants to purchase 9,579,014 shares of common stock (the “December 2023 warrants”).

When

issued, the December 2023 convertible notes were convertible into shares of our common stock at an initial conversion price of $1.9194,

subject to customary adjustments. The terms of the December 2023 convertible notes were substantially similar to the terms of the July

2023 convertible notes except that interest on the December 2023 convertible notes was 12.0% per annum payable quarterly in arrears on

January 15, April 15, July 15 and October 15 of each year, commencing on January 15, 2024, and the December 2023 convertible notes matured

five years from the date of issuance.

When

issued, the December 2023 warrants had an exercise price of $1.43 per share of common stock, subject to customary adjustments, were immediately

exercisable, and expired five years from the date of issuance. The December 2023 warrants purchased by certain of the selling stockholders

had a provision pursuant to which such warrants may not be exercised if the aggregate number of shares of common stock beneficially owned

by the holder thereof would exceed 4.99%, 9.99% or 19.99% immediately after exercise thereof, subject to certain increases not in excess

of either 9.99% or 19.99% at the option of such holder.

As

described below under “—October 2024 Exchange Transactions,” all the December 2023 warrants and December 2023 convertible

notes were exchanged for shares of our common stock.

In

connection with the December 2023 private placement, we entered into a registration rights agreement with certain selling stockholders

pursuant to which we agreed to register the shares of common stock issuable upon conversion of the December 2023 convertible notes and

the shares common stock issuable upon exercise of the December 2023 warrants.

October

2024 Private Placement of Shares of Common Stock

On

September 24, 2024, we entered into a securities purchase agreement with certain selling stockholders pursuant to which we agreed to

sell to such selling stockholders in a private placement (the “October 2024 private placement”) an aggregate of 1,516,994

shares of our common stock (or, in lieu thereof, pre-funded warrants to purchase one share of our common stock) for a purchase price

of $0.75 per share of common stock and $0.75 less $0.005 per share of common stock subject to pre-funded warrants.

In

addition to the satisfaction or waiver of customary conditions to closing, in order to comply with Nasdaq rules and regulations, the

closing of the October 2024 private placement was subject to the approval by our stockholders of: (i) the issuance of the shares of our

common stock and pre-funded warrants (and the issuance of shares of our common stock upon exercise of the pre-funded warrants) in the

October 2024 private placement; (ii) the issuance of shares of our common stock in connection with the Exchange Transactions (as such

term is defined below); (iii) the issuance of shares of our common stock and/or pre-funded warrants upon conversion of the bridge notes

(as defined below); and (iv) all transactions related thereto. Such stockholder approval was obtained at our annual meeting of stockholders

held on October 29, 2024. The October 2024 private placement closed thereafter on the same day, and in connection therewith we issued

an aggregate of 1,401,994 shares of our common stock and a pre-funded warrant to purchase 115,000 shares of our common stock.

Each

pre-funded warrant issued in the October 2024 private placement has an exercise price of $0.005 per share of common stock, subject to

customary adjustments, is exercisable at any time, and will not expire until exercised in full. A holder may not exercise their pre-funded

warrant to the extent that the aggregate number of shares of our common stock beneficially owned by such holder, together with any other

person whose beneficial ownership of our common stock would or could be aggregated with such holder’s for purposes of Section 13(d)

of the Exchange Act, immediately after such exercise would exceed 9.99% of the number of shares of our common stock then outstanding.

October

2024 Exchange Transactions

Also

on September 24, 2024, we entered into exchange agreements with the holders of the convertible notes, the December 2022 warrants, the

July 2023 warrants, and the December 2023 warrants. The parties to the exchange agreements represented the holders of all the outstanding

convertible notes and all the outstanding December 2022 warrants, the July 2023 warrants, the December 2023 warrants except for the holder

of a December 2022 warrant to purchase approximately 0.1 million shares of our common stock.

Subject

to approval by our stockholders, under the exchange agreements (i) the holders of the December 2022 warrants, the July 2023 warrants,

the December 2023 warrants agreed to exchange all their warrants for shares of our common stock at an exchange ratio of 0.5 of a share

of common stock for every one share of common stock issuable upon exercise of the applicable warrant (rounded up to the nearest whole

number), and (ii) the holders of the convertible notes agreed to exchange all their convertible notes for shares of our common stock

at an exchange ratio equal to (A) the sum expressed in U.S. dollars of (1) the principal amount of the applicable convertible note, plus

(2) all accrued and unpaid interest thereon through the date the applicable convertible note is exchanged plus (3) all interest that

would have accrued through, but not including, the maturity date of applicable convertible note if it was outstanding from the date such

convertible note is exchanged through its maturity date, divided by (B) $1.00 (rounded up to the nearest whole number) (the “Exchange

Transactions”). Such stockholder approval was obtained at our annual meeting of stockholders held on October 29, 2024. The closing

of the Exchange Transactions occurred thereafter on that same date, and in connection therewith we issued an aggregate of 38,302,029

shares of our common stock.

September

2024 Private Placement of Bridge Notes and Conversion

Also

on September 24, 2024, we entered into a note purchase agreement with certain selling stockholders pursuant to which we sold to such

selling stockholders in a private placement (the “September 2024 bridge note private placement”) an aggregate principal amount

of approximately $3.9 million of 12.0% senior convertible notes (the “bridge notes”). The terms of the bridge notes were

substantially similar to the terms of the December 2023 convertible notes except that the bridge notes were not convertible except as

described below, payments commenced on October 15, 2024, and the bridge notes matured one year from the date of issuance.

As

a result of the stockholder approval being obtained at our annual meeting of stockholders held on October 29, 2024, in accordance with

the terms of the bridge notes, approximately $3.0 million of the principal amount of the bridge notes plus all accrued and unpaid interest

thereon, plus such amount of interest that would have accrued on the principal amount through December 24, 2024, was automatically converted

at a conversion price of $0.50 into 6,244,237 shares of our common stock, and approximately $0.9 million of the principal amount of the

bridge notes plus all accrued and unpaid interest thereon, plus such amount of interest that would have accrued on the principal amount

through December 24, 2024, was automatically converted at a conversion price of $0.50 into pre-funded warrants to purchase 1,764,000

shares of our common stock. The terms of the pre-funded warrants issued upon conversion of the bridge notes are substantially the same

as the terms of the pre-funded warrants issued in the October 2024 private placement described above.

Selling

Stockholder Information

Throughout

this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholders for offer and

resale, we are referring to the following shares:

| ● | 1,901,664

shares of common stock issued in, and up to 141,642 shares of common stock issuable upon

the exercise of a warrant issued in, the December 2022 private placement; |

| | | |

| ● | 9,950,832

shares of common stock issued in the Exchange Transactions in exchange for the December 2022

warrants, the July 2023 warrants, the December 2023 warrants; |

| | | |

| ● | 28,351,197

shares of common stock issued in the Exchange Transactions in exchange for the convertible

notes; |

| | | |

| ● | 6,244,237

shares of common stock issued upon conversion of, and up to 1,764,000 shares of common stock

issuable upon exercise of pre-funded warrants issued upon conversion of, the bridge notes;

and |

| | | |

| ● | 1,401,994

shares of common stock issued in, and up to 115,000 shares of common stock issuable upon

exercise of pre-funded warrants issued in, the October 2024 private placement. |

When

we refer to selling stockholders in this prospectus, we are referring to the selling stockholders identified in this prospectus and,

as applicable, their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus

or, if required, a post-effective amendment to the registration statement of which this prospectus is a part.

The

table below lists the selling stockholders and, to our knowledge, other information regarding the beneficial ownership of the

shares of our common stock by the selling stockholders as of October 31, 2024 (the “Measurement Date”). The information

in the table below with respect to the selling stockholders has been obtained from the applicable selling stockholder. As noted in

the footnotes to the table below, certain selling stockholders own pre-funded warrants to purchase shares of our common stock. Such pre-funded

warrants may not exercised by the selling stockholder to the extent that the aggregate number of shares of our common stock beneficially

owned by such selling stockholder, together with any other person whose beneficial ownership of our common stock would or could be aggregated

with such selling stockholder’s for purposes of Section 13(d) of the Exchange Act, immediately after such exercise would exceed

9.99% of the number of shares of our common stock then outstanding. The number reported in the “Number of Shares of Common Beneficially

Owned Prior to this Offering” column of the table below gives effect to such beneficial ownership limitation. The number reported

in the “Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus” column of the table below does not

give effect to such beneficial ownership limitation. Therefore, the number reported in the “Number of Shares of Common Beneficially

Owned Prior to this Offering” column may be less than the number reported in the “Number of Shares of Common Beneficially

Owned Prior to this Offering” column. The number of shares referenced in the “Number of Shares of Common Stock Owned After

this Offering” column in the table below assumes that the applicable selling stockholders sells all the shares of common stock

offered pursuant to this prospectus. The selling stockholders may sell all, some or none of their respective shares in this offering.

See “Plan of Distribution.” The percentage of beneficial ownership of our common stock is based on 51,374,716 shares of our

common stock outstanding as of the Measurement Date. Beneficial ownership is determined in accordance

with SEC rules, which generally provide that a person is the beneficial owner of a security if he, she or it possesses sole or shared

voting or investment power over that security, including derivative securities, such as options and warrants, that are currently exercisable

or exercisable within 60 days. In computing the number of shares beneficially owned by a selling stockholder and the percentage ownership

of that selling stockholder, all shares underlying derivative securities held by such selling stockholder are deemed outstanding if such

securities are currently exercisable or become exercisable within 60 days after the Measurement Date; however, such shares are not deemed

outstanding for the purpose of calculating the percentage ownership of any other selling stockholder.

| | |

| | |

| | |

Number of Shares of Common

Stock Owned After this Offering | |

| Name of Selling Stockholder | |

Number of

Shares of

Common

Stock

Beneficially Owned

Prior to this Offering^ | | |

Maximum Number of Shares of

Common Stock

to be Sold Pursuant to this

Prospectus | | |

Number | | |

Percent | |

| Charles Cherington(1) | |

| 16,642,183 | | |

| 16,333,414 | | |

| 308,769 | | |

| * | |

| Purchase Capital LLC(2) | |

| 4,095,436 | | |

| 4,095,436 | | |

| — | | |

| — | |

| Pacific Premier Trust, Custodian, FBO Nicholas Singer(3) | |

| 1,040,932 | | |

| 1,795,932 | | |

| — | | |

| — | |

| George Denny 2021 Trust(4) | |

| 4,729,036 | | |

| 4,591,273 | | |

| 137,763 | | |

| * | |

| Denny Family Partners II LLC(5) | |

| 270,583 | | |

| 270,583 | | |

| — | | |

| — | |

| John Halpern(6) | |

| 5,136,571 | | |

| 5,135,207 | | |

| 116,364 | | |

| * | |

| Beagle Limited(7) | |

| 567,618 | | |

| 567,618 | | |

| — | | |

| — | |

| Beaumont Irrevocable Trust(8) | |

| 1,559,821 | | |

| 1,559,821 | | |

| — | | |

| — | |

| ELF Investments, LLC(9) | |

| 127,092 | | |

| 104,493 | | |

| 22,599 | | |

| * | |

| Freebird Partners LP(10) | |

| 5,136,686 | | |

| 6,085,567 | | |

| 60,119 | | |

| * | |

| IAF, LLC(11) | |

| 2,679,214 | | |

| 2,679,214 | | |

| — | | |

| — | |

| Shameek Konar | |

| 162,933 | | |

| 141,642 | | |

| 21,291 | | |

| * | |

| Daniel Lyons | |

| 111,886 | | |

| 111,886 | | |

| — | | |

| — | |

| Stephen Older | |

| 222,865 | | |

| 222,865 | | |

| — | | |

| — | |

| Ashley S. Pettus 2012 Irrevocable Trust dated November 30, 2012(12) | |

| 283,286 | | |

| 283,286 | | |

| — | | |

| — | |

| Ashley S. Pettus | |

| 816,119 | | |

| 814,778 | | |

| 1,341 | | |

| * | |

| T & Z Commercial Property, LLC(13) | |

| 164,669 | | |

| 164,669 | | |

| — | | |

| — | |

| Yiannis Monovoukas Family 2013 Irrevocable Trust fbo Aresti(14) | |

| 48,158 | | |

| 48,158 | | |

| — | | |

| — | |

| Yiannis Monovoukas Family 2013 Irrevocable Trust fbo Christian(15) | |

| 48,158 | | |

| 48,158 | | |

| — | | |

| — | |

| Yiannis Monovoukas Family 2013 Irrevocable Trust fbo Alexi(16) | |

| 48,158 | | |

| 48,158 | | |

| — | | |

| — | |

| Samuel Bradford | |

| 212,463 | | |

| 212,463 | | |

| — | | |

| — | |

| Tucker R. Halpern Revocable Trust(17) | |

| 297,713 | | |

| 297,713 | | |

| — | | |

| — | |

| Warren Street Legacy, LLC(18) | |

| 419,829 | | |

| 297,713 | | |

| 122,116 | | |

| * | |

| Amos Denny Trust(19) | |

| 613,339 | | |

| 613,339 | | |

| — | | |

| — | |

| Peter F. Concilio | |

| 111,871 | | |

| 111,871 | | |

| — | | |

| — | |

| Regolith Capital Investments LP(20) | |

| 2,478,881 | | |

| 2,478,881 | | |

| — | | |

| — | |

| Amir Rozwadowski | |

| 304,236 | | |

| 304,236 | | |

| — | | |

| — | |

| Rory Holdings LLC(21) | |

| 232,794 | | |

| 232,794 | | |

| — | | |

| — | |

| David B Thompson Jr. | |

| 69,835 | | |

| 69,835 | | |

| — | | |

| — | |

| Pacific Premier Trust, , Custodian, FBO David B. Thompson(22) | |

| 149,563 | | |

| 149,563 | | |

| — | | |

| — | |

| ^ |

Unless

otherwise indicated in the footnotes below, the number of shares reported in this column are outstanding shares of common stock. |

| * |

Represents

less than 1.0%. |

| (1) |

Consists

of (i) 16,628,123 shares of common stock and (ii) 14,060 shares of common stock issuable upon conversion of Series A convertible

preferred stock (assuming a conversion rate of 5.0717). Charles Cherington is a former member of the Company’s board of directors,

from which he resigned on July 6, 2023. |

| (2) |

Nicholas

Singer, a former member of the Company’s board of directors, from which he resigned on July 6, 2023, has indirect beneficial

ownership of shares held by Purchase Capital LLC. Mr. Singer has sole voting and investment power over all shares. |

| (3) |

Mr.

Singer has indirect beneficial ownership of shares held by Pacific Premier Trust. Mr. Singer has sole voting and investment power

over all such shares. The maximum number of shares of common stock to be sold pursuant to this prospectus includes (i) 1,040,932

shares of common stock and (ii) 755,000 shares issuable upon exercise of pre-funded warrants. |

| (4) |

Consists

of (i) 4,714,976 shares of common stock and (ii) 14,060 shares of common stock issuable upon conversion of Series A convertible preferred

stock (assuming a conversion rate of 5.0717). The Denny Trust has four trustees who share voting and dispositive power over the shares

owned by the Denny Trust. Each of the trustees disclaims beneficial ownership of the shares held by the Denny Trust except to the

extent of their respective pecuniary interest therein, if any. |

| (5) |

Amos

Denny is the managing partner of Denny Family Partners II, LLC and in such capacity has the sole voting and dispositive power over

the shares owned by such entity. Amos Denny disclaims beneficial ownership of the shares held by Denny Family Partners II, LLC except

to the extent of his pecuniary interest therein. |

| (6) |

The

maximum number of shares of common stock to be sold pursuant to this prospectus consists of (i) 5,136,571 shares of common stock

and (ii) 115,000 shares of common stock issuable upon exercise of pre-funded warrants. Such shares of common stock and pre-funded

warrants are held by the John D. Halpern Revocable Trust, of which, Mr. Halpern and Katherine H. Halpern are trustees. Mr. Halpern

and Ms. Halpern share voting and dispositive powers. |

| (7) |

Beagle

Limited is a British Virgin Island corporation. Mr. Giovanni Pigozzi is the sole owner of Beagle Limited and in such capacity

has sole voting and dispositive power over the shares held by Beagle Limited. |

| (8) |

David

Neithardt is the trustee of the Beaumont Irrevocable Trust and has sole voting and dispositive power over the shares owned by such

trust. Mr. Neithardt disclaims beneficial ownership of the shares held by the Beaumont Irrevocable Trust except to the extent of

his pecuniary interest therein. |

| (9) |

Ross

Lienhart is the managing member of ELF Investments, LLC and has sole voting and dispositive power over the shares owned by such entity.

|

| (10) |

The

maximum number of shares of common stock to be sold pursuant to this prospectus includes (i) 5,136,686 shares of common stock and

(ii) 1,009,000 shares issuable upon exercise of pre-funded warrants. Freebird Investments LLC serves as the general partner of Freebird

Partners LP. Curtis Huff is the sole member and 100% owner of Freebird Investments LLC, the President of Freebird Partners LP and

the Managing Member of Freebird Investments LLC. By virtue of these relationships, each of Freebird Investments LLC and Mr. Huff

may be deemed to share beneficial ownership of the securities held of record by Freebird Partners LP. |

| (11) |

David

Laughlin is the manager of IAF, LLC and has sole voting and dispositive power over the shares held by such entity. Mr. Laughlin disclaims

beneficial ownership of the shares held by IAF, LLC except to the extent of his pecuniary interest therein. |

| (12) |

Stephen

Cherington is the trustee of Ashley S. Pettus 2012 Irrevocable Trust dated November 30, 2012 (the “Pettus 2012 Trust”)

and has sole voting and dispositive power over the shares owned by such trust. Mr. Cherington disclaims beneficial ownership of the

shares held by the Pettus 2012 Trust except to the extent of his pecuniary interest therein. |

| (13) |

Kenneth

Warren is the managing member of T&Z Commercial Property, LLC and has sole voting and dispositive power over the shares owned

by such entity. Mr. Warren beneficially owns the shares held by T&Z Commercial Property, LLC |

| (14) |

Michael

O’Connell is the trustee of the Yiannis Monovoukas Family 2013 Irrevocable Trust fbo Aresti (the “Aresti Trust”)

and has sole voting and dispositive power over the shares owned by such trust. |

| (15) |

Michael

O’Connell is the trustee of the Yiannis Monovoukas Family 2013 Irrevocable Trust fbo Christian (the “Christian Trust”)

and has sole voting and dispositive power over the shares owned by such trust. |

| (16) |

Michael

O’Connell is the trustee of the Yiannis Monovoukas Family 2013 Irrevocable Trust fbo Alexi (the “Alexi Trust”)

and has sole voting and dispositive power over the shares owned by such trust. |

| (17) |

Tucker

Halpern is the trustee of the Tucker Halpern Revocable Trust and has sole voting and dispositive power over the shares owned by such

trust. |

| (18) |

Ian

Halpern is the manager of Warren Street Legacy, LLC and has sole voting and dispositive power over the shares owned by such entity. |

| (19) |

Amos

Denny is the trustee of the Amos Denny Trust and has sole voting and dispositive power over the shares owned by such trust. Mr. Denny

disclaims beneficial ownership of the shares held by the Amos Denny Trust except to the extent of his pecuniary interest therein. |

| (20) |

Shameek

Konar and his spouse are the General Partner of Regolith Capital Investments LP. By virtue of these relationships, each of Mr. Konar

and his spouse may be deemed to share beneficial ownership of the shares held by Regolith Capital Investments LP. |

| (21) |

Milind

Desai is the manager of Rory Holdings, LLC and has sole voting and dispositive power over the shares owned by such entity. |

| (22) |

Mr.

Thompson has indirect beneficial ownership of shares held by Pacific Premier Trust and has sole voting and investment power over

all such shares. |

Certain

Relationships and Related Party Transactions

Except

as described below, none of the selling stockholders or any persons having control over such selling stockholders has held any position

or office with us or our affiliates within the last three years or has had a material relationship with us or any of our predecessors

or affiliates within the past three years, other than as a result of the ownership of our shares or other securities or as otherwise

disclosed in the footnotes to the table immediately above.

Charles

Cherington served on our board of directors from March 2021 to July 6, 2023, and Nicholas Singer served on our board of directors from

March 25, 2021 to April 16, 2021 and from June 2022 to July 6, 2023. Messrs. Cherington and Singer participated in each of the December

2022 private placement, July 2023 private placement, December 2023 private placement, Exchange Transactions, and September 2024 bridge

note private placement on the same terms and subject to the same conditions as all other investors in such transactions.

PLAN

OF DISTRIBUTION

Each

selling stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of their securities covered hereby on the principal Trading Market or any other stock exchange, market or trading facility on

which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may

use any one or more of the following methods when selling securities:

| ● | ordinary

brokerage transactions and transactions in which the broker dealer solicits purchasers; |

| | | |

| ● | block

trades in which the broker dealer will attempt to sell the securities as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| | | |

| ● | purchases

by a broker dealer as principal and resale by the broker dealer for its account; |

| | | |

| ● | an

exchange distribution in accordance with the rules of the applicable exchange; |

| | | |

| ● | privately

negotiated transactions; |

| | | |

| ● | settlement

of short sales; |

| | | |

| ● | in

transactions through broker dealers that agree with the selling stockholders to sell a specified

number of such securities at a stipulated price per security; |

| | | |

| ● | through

the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| | | |

| ● | a

combination of any such methods of sale; or |

| | | |

| ● | any

other method permitted pursuant to applicable law. |

The

selling stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available,

rather than under this prospectus. The selling stockholders will act independently of us in making decisions with respect to the timing,

manner and size of each sale. Such sales may be made on one or more exchanges or in the over-the-counter market or otherwise, at prices

and under terms then prevailing or at prices related to the then current market price or in negotiated transactions.

In

addition, a selling stockholder that is an entity may elect to make an in-kind distribution of securities to its members, partners or

stockholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus with a plan of distribution.

Such members, partners or stockholders would thereby receive freely tradeable securities pursuant to the distribution through a registration

statement. To the extent a distributee is an affiliate of ours (or to the extent otherwise required by law), we may file a prospectus

supplement in order to permit the distributees to use the prospectus to resell the securities acquired in the distribution. The selling

stockholders also may transfer the securities in other circumstances, in which case the transferees, pledgees or other successors-in-interest

will be the selling beneficial owners for purposes of this prospectus. Upon being notified by the selling stockholders that a donee,

pledgee, transferee, other successor-in-interest intends to sell our securities, we will, to the extent required, promptly file a supplement

to this prospectus to name specifically such person as a selling stockholder.

Broker

dealers engaged by the selling stockholders may arrange for other brokers dealers to participate in sales. Broker dealers may receive

commissions or discounts from the selling stockholders (or, if any broker dealer acts as agent for the purchaser of securities, from

the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction

not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup

or markdown in compliance with FINRA Rule 2121.

In

connection with the sale of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The selling stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each selling stockholder has informed the Company that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

The

Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company

has agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under

the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the selling stockholders