false

0001874097

0001874097

2024-05-08

2024-05-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): May

8, 2024

CYNGN INC.

(Exact name of registrant as specified in charter)

| Delaware |

|

001-40932 |

|

46-2007094 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1015 O’Brien Dr.

Menlo

Park, CA 94025

(Address of principal executive offices) (Zip Code)

(650) 924-5905

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

CYN |

|

The Nasdaq Stock

Market LLC (The Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition

On May 8, 2024, Cyngn Inc.

(the “Company”) issued a press release announcing its financial results for the fiscal first quarter ended March 31, 2024.

The full text of the press release is furnished herewith as Exhibit 99.1.

The information disclosed

under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be incorporated by reference into

any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act except as expressly

set forth in such filing.

Item 9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: May 9, 2024 |

CYNGN INC. |

| |

|

| |

By: |

/s/ Donald Alvarez |

| |

|

Donald Alvarez |

| |

|

Chief Financial Officer |

Exhibit

99.1

Cyngn

Reports First Quarter 2024 Financial Results

MENLO

PARK, Calif., May 8, 2024 – Cyngn Inc. (the

“Company” or “Cyngn”) (Nasdaq: CYN) today announced its financial results for the fiscal first quarter ended

March 31, 2024.

Recent

Operating Highlights:

| ● | Joined

John Deere supply base |

| | | |

| ● | Completed

initial DriveMod Tugger deployment with Rivian |

| | | |

| ● | Received

a notice of allowance for a 20th U.S. patent, with 19 U.S. patents granted to-date |

| | | |

| ● | RobotLAB

joined the Cyngn Distributor Network, establishing an initial fleet for sale to end customers |

| | | |

| ● | Released

first video footage of AI-powered autonomous DriveMod Tugger by Motrec |

| | | |

| ● | Renewed

deployment contract with U.S. Continental; 4x gains in efficiency achieved |

| | | |

| ● | Released

automatic unhitching capabilities for industrial autonomous vehicles |

| | | |

| ● | Announced

that the next-gen DriveMod Kit will harness Nvidia AI computers |

“During

the first quarter, we continued the momentum we made during 2023, marked by rapid strides toward broad commercialization,” said

Lior Tal, Cyngn’s CEO. “Our success is bolstered by the strength of our ecosystem partners, particularly with MCL Industries

who is positioned to build DriveMod Kits at scale, and Motrec as an OEM partner with a long history of providing vehicles to our target

markets in manufacturing and logistics.”

“In

my recent Business Update, I shed some light on the challenges of the industrial sales cycle—especially for a new, safety-critical

technology that offers the competitive advantages that automation does to large enterprises. We remain confident in our ability to grow

sales with our target customers, as was exemplified by our achievement of Deere selecting Cyngn to supply DriveMod Tuggers. Similarly,

we are working with several customers to advance through the pilot purchase phase and unlock the fleet purchases that will

establish our foundation for growth. In parallel, we continue to pursue new prospective customers. Advancements in our mapping and deployment

tools have streamlined the demonstration phase that is often required early in the sales process to just a few days, which significantly

lowers our customer acquisition costs and enables us to convert more customers to advanced sales discussions.”

Q1

2024 Financial Review:

| ● | First

quarter revenue was $5.5 thousand compared to $872.8 thousand in the first quarter of 2023.

First quarter 2024 revenue consisted of EAS software subscriptions from DriveMod Stock chaser

vehicle deployments whereas prior year revenue was primarily the result of NRE contracts. |

| | | |

| ● | Total

costs and expenses in the first quarter were $6.0 million, down from $6.7 million in the

first quarter of 2023. This decrease was primarily due to a $367.5 thousand reduction in

G&A expenses and a $502.9 thousand decrease in cost of revenue, offset by an increase

in R&D expenses of $124.6 thousand. The decrease in G&A expenses is due to a decrease

in personnel costs, reduced premiums for Director and Office Liability Insurance, and savings

on general office expenses. The decrease in cost of revenue is driven by the lower costs

associated with EAS revenue compared to the NRE contracts in 2023. The increase in R&D

expense was primarily driven by personnel costs incurred for additional engineering staff

and external contractor costs to support the development of Cyngn’s technology, offset

by $102 thousand of capitalized software. Headcount at the end of the first quarter of 2024

was 80 versus 73 from the first quarter of 2023. |

| | | |

| ● | Net

loss for the first quarter was $(6.0) million compared to $(5.6) million in the corresponding

quarter of 2023. First quarter 2024 net loss per share was $(0.08), based on basic and diluted

weighted average shares outstanding of approximately 77.1 million in the quarter. This compares

to a net loss per share of $(0.15) in the first quarter of 2023, based on approximately 37.7

million basic and diluted weighted average shares outstanding. |

Balance

Sheet Highlights:

Cyngn’s

cash and short-term investments at March 31, 2024 total $4.8 million compared to $8.2 million as of December 31, 2023. At the end of

the same period, working capital was $4.6 million and total stockholders’ equity was $8.0 million, as compared to year-end working

capital of $7.4 million and total stockholders’ equity of $10.6 million, respectively as of December 31, 2023. The Company had

no debt as of March 31, 2024 and December 31, 2023.

Subsequent

to March 31, 2024, Cyngn completed a $5.2 million public

offering of its common stock. After giving effect of the net proceeds of $4.6 million, Cyngn’s pro-forma cash and short-term investments,

working capital, and total stockholders’ equity was $9.4 million, $9.2 million and $12.6 million, respectively.

For

more information on Cyngn, visit the “Investor Relations” page of the Company’s website (https://investors.cyngn.com/).

About

Cyngn

Cyngn develops and deploys scalable, differentiated autonomous vehicle technology for industrial organizations. Cyngn’s self-driving

solutions allow existing workforces to increase productivity and efficiency. The Company addresses significant challenges facing industrial

organizations today, such as labor shortages, costly safety incidents, and increased consumer demand for eCommerce.

Cyngn’s

DriveMod Kit can be installed on new industrial vehicles at end of line or via retrofit, empowering customers to seamlessly adopt self-driving

technology into their operations without high upfront costs or the need to completely replace existing vehicle investments.

Cyngn’s

flagship product, its Enterprise Autonomy Suite, includes DriveMod (autonomous vehicle system), Cyngn Insight (customer-facing suite

of AV fleet management, teleoperation, and analytics tools), and Cyngn Evolve (internal toolkit that enables Cyngn to leverage data from

the field for artificial intelligence, simulation, and modeling). For all terms referenced within, please refer to the Company’s

annual report on Form 10-K with the SEC filed on March 7, 2024.

Find

Cyngn on:

| ● | Website:

https://cyngn.com |

| | | |

| ● | Twitter:

https://twitter.com/cyngn |

| | | |

| ● | LinkedIn:

https://www.linkedin.com/company/cyngn |

| | | |

| ● | YouTube:

https://www.youtube.com/@cyngnhq |

Investor

Contact:

Don

Alvarez

investors@cyngn.com

Media

Contact:

Luke

Renner

media@cyngn.com

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any statement that

is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expects,”

“anticipates,” “believes,” “will,” “will likely result,” “will continue,”

“plans to,” “potential,” “promising,” and similar expressions. These statements are based on management’s

current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results

to differ materially from those described in the forward-looking statements, including the risk factors described from time to time in

the Company’s reports to the SEC, including, without limitation the risk factors discussed in the Company’s annual report

on Form 10-K filed with the SEC on March 7, 2024. Readers are cautioned that it is not possible to predict or identify all the risks,

uncertainties and other factors that may affect future results No forward-looking statement can be guaranteed, and actual results may

differ materially from those projected. Cyngn undertakes no obligation to publicly update any forward-looking statement, whether as a

result of new information, future events, or otherwise.

CYNGN

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

Three Months Ended

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenue | |

$ | 5,513 | | |

$ | 872,800 | |

| Costs and expenses | |

| | | |

| | |

| Cost of revenue | |

| 113,776 | | |

| 616,694 | |

| Research and development | |

| 3,154,695 | | |

| 3,030,056 | |

| General and administrative | |

| 2,703,401 | | |

| 3,070,920 | |

| Total costs and expenses | |

| 5,971,872 | | |

| 6,717,670 | |

| | |

| | | |

| | |

| Loss from operations | |

| (5,966,359 | ) | |

| (5,844,870 | ) |

| | |

| | | |

| | |

| Other income, net | |

| | | |

| | |

| Interest income | |

| 1,327 | | |

| 46,902 | |

| Other income (expense), net | |

| (5,047 | ) | |

| 169,210 | |

| Total other income (expense), net | |

| (3,720 | ) | |

| 216,112 | |

| | |

| | | |

| | |

| Net loss | |

$ | (5,970,079 | ) | |

$ | (5,628,758 | ) |

| | |

| | | |

| | |

| Net loss per share attributable to common stockholders, basic and diluted | |

$ | (0.08 | ) | |

$ | (0.15 | ) |

| | |

| | | |

| | |

| Weighted-average shares used in computing net loss per share attributable to common shareholders’, basic and diluted | |

| 77,081,105 | | |

| 37,685,413 | |

CYNGN

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

(Unaudited) | | |

| |

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Assets | |

| | |

| |

| Current assets | |

| | |

| |

| Cash | |

$ | 2,192,398 | | |

$ | 3,591,623 | |

| Short-term investments | |

| 2,578,882 | | |

| 4,561,928 | |

| Prepaid expenses and other current assets | |

| 1,502,115 | | |

| 1,316,426 | |

| Total current assets | |

| 6,273,395 | | |

| 9,469,977 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,652,382 | | |

| 1,486,672 | |

| Right of use asset, net | |

| 821,144 | | |

| 992,292 | |

| Intangible assets, net | |

| 1,045,412 | | |

| 1,084,415 | |

| Total Assets | |

$ | 9,792,333 | | |

$ | 13,033,356 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 248,677 | | |

$ | 196,963 | |

| Accrued expenses and other current liabilities | |

| 720,239 | | |

| 1,201,142 | |

| Current operating lease liability | |

| 724,654 | | |

| 682,718 | |

| Total current liabilities | |

$ | 1,693,570 | | |

| 2,080,823 | |

| | |

| | | |

| | |

| Non-current operating lease liability | |

| 127,572 | | |

| 317,344 | |

| Total liabilities | |

$ | 1,821,142 | | |

| 2,398,167 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 12) | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Preferred stock, Par $0.00001, 10 million shares authorized; no shares issued and outstanding as of March 31, 2024 and December 31, 2023 | |

| - | | |

| - | |

| Common stock, Par $0.00001; 200,000,000 shares authorized, 88,454,654 and 64,773,756 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| 884 | | |

| 648 | |

| Additional paid-in capital | |

| 173,958,005 | | |

| 170,652,160 | |

| Accumulated deficit | |

| (165,987,698 | ) | |

| (160,017,619 | ) |

| Total stockholders’ equity | |

| 7,971,191 | | |

| 10,635,189 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 9,792,333 | | |

$ | 13,033,356 | |

CYNGN

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

Three Months Ended

March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities | |

| | |

| |

| Net loss | |

$ | (5,970,079 | ) | |

$ | (5,628,758 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 225,590 | | |

| 228,031 | |

| Stock-based compensation | |

| 654,024 | | |

| 924,898 | |

| Realized gain on short-term investments | |

| (39,938 | ) | |

| (169,209 | ) |

| Gain (Loss) on asset | |

| 52,723 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses, operating lease right-of-use assets, and other current assets | |

| (185,689 | ) | |

| (258,859 | ) |

| Accounts payable | |

| 51,714 | | |

| 287,656 | |

| Accrued expenses, lease liabilities, and other current liabilities | |

| (628,739 | ) | |

| (761,207 | ) |

| Net cash used in operating activities | |

| (5,840,394 | ) | |

| (5,377,448 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (214,238 | ) | |

| (447,739 | ) |

| Acquisition of intangible asset | |

| (19,634 | ) | |

| (44,745 | ) |

| Purchase of short-term investments | |

| (1,787,016 | ) | |

| (10,497,206 | ) |

| Proceeds from maturity of short-term investments | |

| 3,810,000 | | |

| 13,742,000 | |

| Net cash provided by investing activities | |

| 1,789,112 | | |

| 2,752,310 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from at-the-market equity financing, net of issuance costs | |

$ | 2,652,110 | | |

$ | - | |

| Proceeds from public issuance of common stock and pre-funded warrants, net of offering costs | |

| (53 | ) | |

| - | |

| Proceeds from exercise of stock options | |

| - | | |

| 6,844 | |

| Net cash provided by financing activities | |

| 2,652,057 | | |

| 6,844 | |

| | |

| | | |

| | |

| Net decrease in cash and restricted cash | |

| (1,399,225 | ) | |

| (2,618,294 | ) |

| Cash and restricted cash, beginning of period | |

| 3,591,623 | | |

| 10,586,273 | |

| Cash and restricted cash, end of period | |

$ | 2,192,398 | | |

$ | 7,967,979 | |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

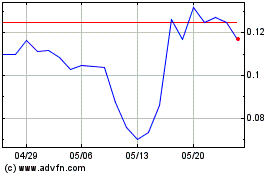

CYNGN (NASDAQ:CYN)

過去 株価チャート

から 5 2024 まで 6 2024

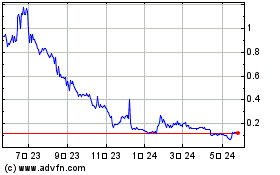

CYNGN (NASDAQ:CYN)

過去 株価チャート

から 6 2023 まで 6 2024