0001018724false00010187242024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

August 1, 2024

Date of Report

(Date of earliest event reported)

_________________________

AMAZON.COM, INC.

(Exact name of registrant as specified in its charter)

_________________________

| | | | | | | | | | | | | | |

| Delaware | | 000-22513 | | 91-1646860 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

410 Terry Avenue North, Seattle, Washington 98109-5210

(Address of principal executive offices, including Zip Code)

(206) 266-1000

(Registrant’s telephone number, including area code)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, par value $.01 per share | | AMZN | | Nasdaq Global Select Market |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company | ☐ |

| | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

TABLE OF CONTENTS

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On August 1, 2024, Amazon.com, Inc. announced its second quarter 2024 financial results. A copy of the press release containing the announcement is included as Exhibit 99.1 and additional information regarding the inclusion of non-GAAP financial measures in certain of Amazon.com, Inc.’s public disclosures, including its second quarter 2024 financial results announcement, is included as Exhibit 99.2. Both of these exhibits are incorporated herein by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

| | | | | |

Exhibit

Number | Description |

| |

| 99.1 | |

| |

| 99.2 | |

| |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AMAZON.COM, INC. (REGISTRANT) |

| | |

| By: | /s/ Brian T. Olsavsky |

| | Brian T. Olsavsky |

| | Senior Vice President and

Chief Financial Officer |

Dated: August 1, 2024

Exhibit 99.1

AMAZON.COM ANNOUNCES SECOND QUARTER RESULTS

SEATTLE—(BUSINESS WIRE) August 1, 2024—Amazon.com, Inc. (NASDAQ: AMZN) today announced financial results for its second quarter ended June 30, 2024.

•Net sales increased 10% to $148.0 billion in the second quarter, compared with $134.4 billion in second quarter 2023. Excluding the $1.0 billion unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 11% compared with second quarter 2023.

•North America segment sales increased 9% year-over-year to $90.0 billion.

•International segment sales increased 7% year-over-year to $31.7 billion, or increased 10% excluding changes in foreign exchange rates.

•AWS segment sales increased 19% year-over-year to $26.3 billion.

•Operating income increased to $14.7 billion in the second quarter, compared with $7.7 billion in second quarter 2023.

•North America segment operating income was $5.1 billion, compared with operating income of $3.2 billion in second quarter 2023.

•International segment operating income was $0.3 billion, compared with an operating loss of $0.9 billion in second quarter 2023.

•AWS segment operating income was $9.3 billion, compared with operating income of $5.4 billion in second quarter 2023.

•Net income increased to $13.5 billion in the second quarter, or $1.26 per diluted share, compared with $6.7 billion, or $0.65 per diluted share, in second quarter 2023.

•Second quarter 2024 net income includes a pre-tax valuation gain of $0.4 billion included in non-operating income (expense) from the common stock investment in Rivian Automotive, Inc., compared to a pre-tax valuation gain of $0.2 billion from the investment in second quarter 2023.

•Operating cash flow increased 75% to $108.0 billion for the trailing twelve months, compared with $61.8 billion for the trailing twelve months ended June 30, 2023.

•Free cash flow increased to $53.0 billion for the trailing twelve months, compared with $7.9 billion for the trailing twelve months ended June 30, 2023.

•Free cash flow less principal repayments of finance leases and financing obligations increased to $49.6 billion for the trailing twelve months, compared with $1.9 billion for the trailing twelve months ended June 30, 2023.

•Free cash flow less equipment finance leases and principal repayments of all other finance leases and financing obligations increased to $51.4 billion for the trailing twelve months, compared with $6.7 billion for the trailing twelve months ended June 30, 2023.

“We’re continuing to make progress on a number of dimensions, but perhaps none more so than the continued reacceleration in AWS growth,” said Andy Jassy, Amazon President & CEO. “As companies continue to modernize their infrastructure and move to the cloud, while also leveraging new Generative AI opportunities, AWS continues to be customers’ top choice as we have much broader functionality, superior security and operational performance, a larger partner ecosystem, and AI capabilities like SageMaker for model builders, Bedrock for those leveraging frontier models, Trainium for those where the cost of compute for training and inference matters, and Q for those wanting the most capable GenAI assistant for not just coding, but also software development and business integration.”

Some other highlights since the company’s last earnings announcement include that Amazon:

•Held its 10th Prime Day, the biggest Prime Day shopping event yet.

•Delivered to Prime members at its fastest speeds ever in the first half of the year.

•Expanded selection, including brands like Aéropostale, Bumble and bumble, and Kiehl’s.

•Announced that U.S. Prime members can enjoy a Grubhub+ membership worth $120 a year.

•Launched multiple AI-powered features for consumers, including shopping assistant Rufus for all U.S. mobile customers, playlist generator Maestro for Amazon Music, and a new search experience for Fire TV.

•Launched Amazon’s Stores business in South Africa with same and next-day delivery.

•Expanded Amazon Pharmacy’s RxPass program, which now offers Prime members on Medicare unlimited consumption of 60 broadly-used prescription medications for just $5 a month.

•Released 19 films and series from Amazon MGM Studios, including:

•Fallout, the second most watched Original title worldwide ever on Prime Video during its launch.

•Season 4 of The Boys, reaching No. 1 on Prime Video in over 165 countries in its first two weeks.

•The Idea of You, attracting ~50 million viewers in its first two weeks on Prime Video.

•Earned 62 Primetime Emmy Award nominations, including 17 for Fallout and 16 for Mr. and Mrs. Smith.

•Secured expansive streaming rights for the NBA for 11 seasons, starting in 2025-26.

•Became the exclusive home of Monday Night National Hockey League games in Canada.

•Launched Anthropic Claude 3.5 Sonnet, Meta Llama 3.1, and Mistral Large 2 models in Amazon Bedrock.

•Shared that companies like AXA, DoorDash, Nasdaq, Rocket Insurance, SAP, Thomson Reuters, Workday, WPP, and Zendesk announced new applications built on Bedrock.

•Delivered new AWS Graviton4-based compute instances, providing up to 30% better price-performance than the industry-leading AWS Graviton3 instances.

•Signed new AWS agreements with Commonwealth Bank of Australia, Databricks, Discover Financial Services, Eli Lilly and Company, Experian, GE HealthCare, NetApp, Scopely, ServiceNow, Shutterfly, and many others—as well as AI startups Perplexity, H Company, and Observea.

•Announced an AUD $2 billion strategic partnership with the Australian Government to provide a “Top Secret” AWS Cloud to enhance the nation’s defense and intelligence capabilities.

•Added Austin and Miami to where self-driving robotaxi Zoox is deploying its test fleet on public roads.

•Ranked No. 2 on LinkedIn’s Top Companies list and No. 1 in the technology sector.

•Announced that all electricity consumed by Amazon’s operations, including its data centers, was matched with 100% renewable energy in 2023.

•Replaced 95% of plastic air pillows in Amazon’s delivery packaging in North America with paper filler.

•Announced an additional $1.4 billion commitment to Amazon’s Housing Equity Fund for affordable homes.

For additional highlights from the quarter, visit aboutamazon.com/q2-2024-earnings.

Financial Guidance

The following forward-looking statements reflect Amazon.com’s expectations as of August 1, 2024, and are subject to substantial uncertainty. Our results are inherently unpredictable and may be materially affected by many factors, such as fluctuations in foreign exchange rates, changes in global economic and geopolitical conditions and customer demand and spending (including the impact of recessionary fears), inflation, interest rates, regional labor market constraints, world events, the rate of growth of the internet, online commerce, cloud services, and new and emerging technologies, and the various factors detailed below.

Third Quarter 2024 Guidance

•Net sales are expected to be between $154.0 billion and $158.5 billion, or to grow between 8% and 11% compared with third quarter 2023. This guidance anticipates an unfavorable impact of approximately 90 basis points from foreign exchange rates.

•Operating income is expected to be between $11.5 billion and $15.0 billion, compared with $11.2 billion in third quarter 2023.

•This guidance assumes, among other things, that no additional business acquisitions, restructurings, or legal settlements are concluded.

Conference Call Information

A conference call will be webcast live today at 2:30 p.m. PT/5:30 p.m. ET, and will be available for at least three months at amazon.com/ir. This call will contain forward-looking statements and other material information regarding the Company’s financial and operating results.

Forward-Looking Statements

These forward-looking statements are inherently difficult to predict. Actual results and outcomes could differ materially for a variety of reasons, including, in addition to the factors discussed above, the amount that Amazon.com invests in new business opportunities and the timing of those investments, the mix of products and services sold to customers, the mix of net sales derived from products as compared with services, the extent to which we owe income or other taxes, competition, management of growth, potential fluctuations in operating results, international growth and expansion, the outcomes of claims, litigation, government investigations, and other proceedings, fulfillment, sortation, delivery, and data center optimization, risks of inventory management, variability in demand, the degree to which the Company enters into, maintains, and develops commercial agreements, proposed and completed acquisitions and strategic transactions, payments risks, and risks of fulfillment throughput and productivity. Other risks and uncertainties include, among others, risks related to new products, services, and technologies, security breaches, system interruptions, government regulation and taxation, and fraud. In addition, global economic and geopolitical conditions and additional or unforeseen circumstances, developments, or events may give rise to or amplify many of these risks. More information about factors that potentially could affect Amazon.com’s financial results is included in Amazon.com’s filings with the Securities and Exchange Commission (“SEC”), including its most recent Annual Report on Form 10-K and subsequent filings.

Additional Information

Our investor relations website is amazon.com/ir and we encourage investors to use it as a way of easily finding information about us. We promptly make available on this website, free of charge, the reports that we file or furnish with the SEC, corporate governance information (including our Code of Business Conduct and Ethics), and select press releases, which may contain material information about us, and you may subscribe to be notified of new information posted to this site.

About Amazon

Amazon is guided by four principles: customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking. Amazon strives to be Earth’s Most Customer-Centric Company, Earth’s Best Employer, and Earth’s Safest Place to Work. Customer reviews, 1-Click shopping, personalized recommendations, Prime, Fulfillment by Amazon, AWS, Kindle Direct Publishing, Kindle, Career Choice, Fire tablets, Fire TV, Amazon Echo, Alexa, Just Walk Out technology, Amazon Studios, and The Climate Pledge are some of the things pioneered by Amazon. For more information, visit amazon.com/about and follow @AmazonNews.

AMAZON.COM, INC.

Consolidated Statements of Cash Flows

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, | | Twelve Months Ended

June 30, |

| | 2023 | | 2024 | | 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | | | | |

| | | | | | | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD | $ | 49,734 | | | $ | 73,332 | | | $ | 54,253 | | | $ | 73,890 | | | $ | 37,700 | | | $ | 50,067 | |

| OPERATING ACTIVITIES: | | | | | | | | | | | |

| Net income | 6,750 | | | 13,485 | | | 9,922 | | | 23,916 | | | 13,072 | | | 44,419 | |

| Adjustments to reconcile net income to net cash from operating activities: | | | | | | | | | | | |

| Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other | 11,589 | | | 12,038 | | | 22,712 | | | 23,722 | | | 45,724 | | | 49,673 | |

| Stock-based compensation | 7,127 | | | 6,722 | | | 11,875 | | | 11,683 | | | 23,037 | | | 23,831 | |

| | | | | | | | | | | |

| Non-operating expense (income), net | 47 | | | (95) | | | 581 | | | 2,639 | | | 2,754 | | | 1,310 | |

| Deferred income taxes | (2,744) | | | (785) | | | (3,216) | | | (1,723) | | | (7,408) | | | (4,383) | |

| Changes in operating assets and liabilities: | | | | | | | | | | | |

| Inventories | (2,373) | | | (3,085) | | | (2,002) | | | (1,309) | | | 1,910 | | | 2,142 | |

| Accounts receivable, net and other | (2,041) | | | (2,209) | | | 2,683 | | | 1,475 | | | (2,686) | | | (9,556) | |

| Other assets | (3,126) | | | (3,055) | | | (6,329) | | | (5,756) | | | (14,542) | | | (11,692) | |

| Accounts payable | 3,029 | | | 6,005 | | | (8,235) | | | (5,277) | | | 391 | | | 8,431 | |

| Accrued expenses and other | (1,938) | | | (4,147) | | | (7,701) | | | (7,075) | | | (1,944) | | | (1,802) | |

| Unearned revenue | 156 | | | 407 | | | 974 | | | 1,975 | | | 1,533 | | | 5,579 | |

| Net cash provided by (used in) operating activities | 16,476 | | | 25,281 | | | 21,264 | | | 44,270 | | | 61,841 | | | 107,952 | |

| INVESTING ACTIVITIES: | | | | | | | | | | | |

| Purchases of property and equipment | (11,455) | | | (17,620) | | | (25,662) | | | (32,545) | | | (58,632) | | | (59,612) | |

| Proceeds from property and equipment sales and incentives | 1,043 | | | 1,227 | | | 2,180 | | | 2,217 | | | 4,669 | | | 4,633 | |

| Acquisitions, net of cash acquired, non-marketable investments, and other | (316) | | | (571) | | | (3,829) | | | (3,925) | | | (5,545) | | | (5,935) | |

| Sales and maturities of marketable securities | 1,551 | | | 3,265 | | | 2,666 | | | 4,657 | | | 8,906 | | | 7,618 | |

| Purchases of marketable securities | (496) | | | (8,439) | | | (834) | | | (10,404) | | | (1,306) | | | (11,058) | |

| Net cash provided by (used in) investing activities | (9,673) | | | (22,138) | | | (25,479) | | | (40,000) | | | (51,908) | | | (64,354) | |

| FINANCING ACTIVITIES: | | | | | | | | | | | |

| | | | | | | | | | | |

| Proceeds from short-term debt, and other | 4,399 | | | 525 | | | 17,179 | | | 863 | | | 40,124 | | | 1,813 | |

| Repayments of short-term debt, and other | (7,641) | | | (229) | | | (11,244) | | | (633) | | | (34,957) | | | (15,066) | |

| Proceeds from long-term debt | — | | | — | | | — | | | — | | | 8,342 | | | — | |

| Repayments of long-term debt | (2,000) | | | (4,169) | | | (3,386) | | | (4,499) | | | (4,643) | | | (4,789) | |

| Principal repayments of finance leases | (1,220) | | | (538) | | | (2,600) | | | (1,308) | | | (5,705) | | | (3,092) | |

| Principal repayments of financing obligations | (77) | | | (79) | | | (134) | | | (169) | | | (244) | | | (306) | |

| Net cash provided by (used in) financing activities | (6,539) | | | (4,490) | | | (185) | | | (5,746) | | | 2,917 | | | (21,440) | |

| Foreign currency effect on cash, cash equivalents, and restricted cash | 69 | | | (312) | | | 214 | | | (741) | | | (483) | | | (552) | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 333 | | | (1,659) | | | (4,186) | | | (2,217) | | | 12,367 | | | 21,606 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD | $ | 50,067 | | | $ | 71,673 | | | $ | 50,067 | | | $ | 71,673 | | | $ | 50,067 | | | $ | 71,673 | |

| SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | | | | |

| Cash paid for interest on debt, net of capitalized interest | $ | 954 | | | $ | 680 | | | $ | 1,356 | | | $ | 949 | | | $ | 2,289 | | | $ | 2,201 | |

| Cash paid for operating leases | 2,528 | | | 2,844 | | | 4,995 | | | 6,176 | | | 9,173 | | | 11,634 | |

| Cash paid for interest on finance leases | 77 | | | 72 | | | 158 | | | 146 | | | 330 | | | 296 | |

| Cash paid for interest on financing obligations | 41 | | | 50 | | | 100 | | | 114 | | | 194 | | | 210 | |

| Cash paid for income taxes, net of refunds | 3,735 | | | 5,700 | | | 4,354 | | | 6,158 | | | 6,791 | | | 12,983 | |

| Assets acquired under operating leases | 4,104 | | | 3,911 | | | 7,730 | | | 7,664 | | | 19,254 | | | 13,986 | |

| Property and equipment acquired under finance leases, net of remeasurements and modifications | 240 | | | 181 | | | 248 | | | 223 | | | 696 | | | 617 | |

| Property and equipment recognized during the construction period of build-to-suit lease arrangements | 84 | | | 31 | | | 215 | | | 68 | | | 1,051 | | | 210 | |

| Property and equipment derecognized after the construction period of build-to-suit lease arrangements, with the associated leases recognized as operating | — | | | — | | | 720 | | | — | | | 4,766 | | | 654 | |

AMAZON.COM, INC.

Consolidated Statements of Operations

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | |

| | | | | |

| Net product sales | $ | 59,032 | | | $ | 61,569 | | | $ | 116,013 | | | $ | 122,484 | |

| Net service sales | 75,351 | | | 86,408 | | | 145,728 | | | 168,806 | |

| Total net sales | 134,383 | | | 147,977 | | | 261,741 | | | 291,290 | |

| Operating expenses: | | | | | | | |

| Cost of sales | 69,373 | | | 73,785 | | | 137,164 | | | 146,418 | |

| Fulfillment | 21,305 | | | 23,566 | | | 42,210 | | | 45,883 | |

| Technology and infrastructure | 21,931 | | | 22,304 | | | 42,381 | | | 42,728 | |

| Sales and marketing | 10,745 | | | 10,512 | | | 20,917 | | | 20,174 | |

| General and administrative | 3,202 | | | 3,041 | | | 6,245 | | | 5,783 | |

| Other operating expense (income), net | 146 | | | 97 | | | 369 | | | 325 | |

| Total operating expenses | 126,702 | | | 133,305 | | | 249,286 | | | 261,311 | |

| Operating income | 7,681 | | | 14,672 | | | 12,455 | | | 29,979 | |

| Interest income | 661 | | | 1,180 | | | 1,272 | | | 2,173 | |

| Interest expense | (840) | | | (589) | | | (1,663) | | | (1,233) | |

| Other income (expense), net | 61 | | | (18) | | | (382) | | | (2,691) | |

| Total non-operating income (expense) | (118) | | | 573 | | | (773) | | | (1,751) | |

| Income before income taxes | 7,563 | | | 15,245 | | | 11,682 | | | 28,228 | |

| Provision for income taxes | (804) | | | (1,767) | | | (1,752) | | | (4,234) | |

| Equity-method investment activity, net of tax | (9) | | | 7 | | | (8) | | | (78) | |

| Net income | $ | 6,750 | | | $ | 13,485 | | | $ | 9,922 | | | $ | 23,916 | |

| Basic earnings per share | $ | 0.66 | | | $ | 1.29 | | | $ | 0.97 | | | $ | 2.30 | |

| Diluted earnings per share | $ | 0.65 | | | $ | 1.26 | | | $ | 0.95 | | | $ | 2.24 | |

| Weighted-average shares used in computation of earnings per share: | | | | | | | |

| Basic | 10,285 | | | 10,447 | | | 10,268 | | | 10,420 | |

| Diluted | 10,449 | | | 10,708 | | | 10,398 | | | 10,689 | |

AMAZON.COM, INC.

Consolidated Statements of Comprehensive Income

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | |

| | | | | |

| Net income | $ | 6,750 | | | $ | 13,485 | | | $ | 9,922 | | | $ | 23,916 | |

| Other comprehensive income (loss): | | | | | | | |

| | | | | | | |

| Foreign currency translation adjustments, net of tax of $(22), $58, $(32), and $88 | 264 | | | (637) | | | 650 | | | (1,733) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Available-for-sale debt securities: | | | | | | | |

| Change in net unrealized gains (losses), net of tax of $(5), $(69), $(34), and $(227) | 17 | | | 241 | | | 112 | | | 777 | |

| | | | | | | |

| Less: reclassification adjustment for losses included in “Other income (expense), net,” net of tax of $(5), $(1), $(15), and $(1) | 12 | | | 3 | | | 45 | | | 4 | |

| | | | | | | |

| | | | | | | |

| Net change | 29 | | | 244 | | | 157 | | | 781 | |

| Other, net of tax of $0, $(1), $0, and $(2) | — | | | (2) | | | — | | | (1) | |

| Total other comprehensive income (loss) | 293 | | | (395) | | | 807 | | | (953) | |

| Comprehensive income | $ | 7,043 | | | $ | 13,090 | | | $ | 10,729 | | | $ | 22,963 | |

AMAZON.COM, INC.

Segment Information

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | |

| | | | | |

| North America | | | | | | | |

| Net sales | $ | 82,546 | | | $ | 90,033 | | | $ | 159,427 | | | $ | 176,374 | |

| Operating expenses | 79,335 | | | 84,968 | | | 155,318 | | | 166,326 | |

| Operating income | $ | 3,211 | | | $ | 5,065 | | | $ | 4,109 | | | $ | 10,048 | |

| | | | | | | |

| International | | | | | | | |

| Net sales | $ | 29,697 | | | $ | 31,663 | | | $ | 58,820 | | | $ | 63,598 | |

| Operating expenses | 30,592 | | | 31,390 | | | 60,962 | | | 62,422 | |

| Operating income (loss) | $ | (895) | | | $ | 273 | | | $ | (2,142) | | | $ | 1,176 | |

| | | | | | | |

| AWS | | | | | | | |

| Net sales | $ | 22,140 | | | $ | 26,281 | | | $ | 43,494 | | | $ | 51,318 | |

| Operating expenses | 16,775 | | | 16,947 | | | 33,006 | | | 32,563 | |

| Operating income | $ | 5,365 | | | $ | 9,334 | | | $ | 10,488 | | | $ | 18,755 | |

| | | | | | | |

| Consolidated | | | | | | | |

| Net sales | $ | 134,383 | | | $ | 147,977 | | | $ | 261,741 | | | $ | 291,290 | |

| Operating expenses | 126,702 | | | 133,305 | | | 249,286 | | | 261,311 | |

| Operating income | 7,681 | | | 14,672 | | | 12,455 | | | 29,979 | |

| Total non-operating income (expense) | (118) | | | 573 | | | (773) | | | (1,751) | |

| Provision for income taxes | (804) | | | (1,767) | | | (1,752) | | | (4,234) | |

| Equity-method investment activity, net of tax | (9) | | | 7 | | | (8) | | | (78) | |

| Net income | $ | 6,750 | | | $ | 13,485 | | | $ | 9,922 | | | $ | 23,916 | |

| | | | | | | |

| Segment Highlights: | | | | | | | |

| Y/Y net sales growth: | | | | | | | |

| North America | 11 | % | | 9 | % | | 11 | % | | 11 | % |

| International | 10 | | | 7 | | | 5 | | | 8 | |

| AWS | 12 | | | 19 | | | 14 | | | 18 | |

| Consolidated | 11 | | | 10 | | | 10 | | | 11 | |

| Net sales mix: | | | | | | | |

| North America | 61 | % | | 61 | % | | 61 | % | | 60 | % |

| International | 22 | | | 21 | | | 22 | | | 22 | |

| AWS | 17 | | | 18 | | | 17 | | | 18 | |

| Consolidated | 100 | % | | 100 | % | | 100 | % | | 100 | % |

AMAZON.COM, INC.

Consolidated Balance Sheets

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | |

| December 31, 2023 | | June 30, 2024 |

| | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 73,387 | | | $ | 71,178 | |

| Marketable securities | 13,393 | | | 17,914 | |

| Inventories | 33,318 | | | 34,109 | |

| Accounts receivable, net and other | 52,253 | | | 50,106 | |

| Total current assets | 172,351 | | | 173,307 | |

| Property and equipment, net | 204,177 | | | 220,717 | |

| Operating leases | 72,513 | | | 74,575 | |

| Goodwill | 22,789 | | | 22,879 | |

| Other assets | 56,024 | | | 63,340 | |

| Total assets | $ | 527,854 | | | $ | 554,818 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 84,981 | | | $ | 81,817 | |

| Accrued expenses and other | 64,709 | | | 60,351 | |

| Unearned revenue | 15,227 | | | 16,004 | |

| Total current liabilities | 164,917 | | | 158,172 | |

| Long-term lease liabilities | 77,297 | | | 78,084 | |

| Long-term debt | 58,314 | | | 54,889 | |

| Other long-term liabilities | 25,451 | | | 27,226 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

Preferred stock ($0.01 par value; 500 shares authorized; no shares issued or outstanding) | — | | | — | |

Common stock ($0.01 par value; 100,000 shares authorized; 10,898 and 11,005 shares issued; 10,383 and 10,490 shares outstanding) | 109 | | | 110 | |

| Treasury stock, at cost | (7,837) | | | (7,837) | |

| Additional paid-in capital | 99,025 | | | 110,633 | |

| Accumulated other comprehensive income (loss) | (3,040) | | | (3,993) | |

| Retained earnings | 113,618 | | | 137,534 | |

| Total stockholders’ equity | 201,875 | | | 236,447 | |

| Total liabilities and stockholders’ equity | $ | 527,854 | | | $ | 554,818 | |

AMAZON.COM, INC.

Supplemental Financial Information and Business Metrics

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Y/Y %

Change |

| Cash Flows and Shares | | | | | | | |

| Operating cash flow -- trailing twelve months (TTM) | $ | 54,330 | | $ | 61,841 | | $ | 71,654 | | $ | 84,946 | | $ | 99,147 | | $ | 107,952 | | 75 | % |

| Operating cash flow -- TTM Y/Y growth | 38 | % | 74 | % | 81 | % | 82 | % | 82 | % | 75 | % | N/A |

| Purchases of property and equipment, net of proceeds from sales and incentives -- TTM | $ | 57,649 | | $ | 53,963 | | $ | 50,220 | | $ | 48,133 | | $ | 48,998 | | $ | 54,979 | | 2 | % |

| Principal repayments of finance leases -- TTM | $ | 6,544 | | $ | 5,705 | | $ | 5,245 | | $ | 4,384 | | $ | 3,774 | | $ | 3,092 | | (46) | % |

| Principal repayments of financing obligations -- TTM | $ | 226 | | $ | 244 | | $ | 260 | | $ | 271 | | $ | 304 | | $ | 306 | | 25 | % |

| Equipment acquired under finance leases -- TTM (1) | $ | 285 | | $ | 269 | | $ | 239 | | $ | 310 | | $ | 306 | | $ | 425 | | 58 | % |

| Principal repayments of all other finance leases -- TTM (2) | $ | 625 | | $ | 631 | | $ | 694 | | $ | 683 | | $ | 761 | | $ | 794 | | 26 | % |

| Free cash flow -- TTM (3) | $ | (3,319) | | $ | 7,878 | | $ | 21,434 | | $ | 36,813 | | $ | 50,149 | | $ | 52,973 | | 572 | % |

| Free cash flow less principal repayments of finance leases and financing obligations -- TTM (4) | $ | (10,089) | | $ | 1,929 | | $ | 15,929 | | $ | 32,158 | | $ | 46,071 | | $ | 49,575 | | N/A |

| Free cash flow less equipment finance leases and principal repayments of all other finance leases and financing obligations -- TTM (5) | $ | (4,455) | | $ | 6,734 | | $ | 20,241 | | $ | 35,549 | | $ | 48,778 | | $ | 51,448 | | 664 | % |

| Common shares and stock-based awards outstanding | 10,625 | | 10,794 | | 10,792 | | 10,788 | | 10,788 | | 10,871 | | 1 | % |

| Common shares outstanding | 10,258 | | 10,313 | | 10,330 | | 10,383 | | 10,403 | | 10,490 | | 2 | % |

| Stock-based awards outstanding | 367 | | 481 | | 462 | | 406 | | 385 | | 381 | | (21) | % |

| Stock-based awards outstanding -- % of common shares outstanding | 3.6 | % | 4.7 | % | 4.5 | % | 3.9 | % | 3.7 | % | 3.6 | % | N/A |

| Results of Operations | | | | | | | |

| Worldwide (WW) net sales | $ | 127,358 | | $ | 134,383 | | $ | 143,083 | | $ | 169,961 | | $ | 143,313 | | $ | 147,977 | | 10 | % |

| WW net sales -- Y/Y growth, excluding F/X | 11 | % | 11 | % | 11 | % | 13 | % | 13 | % | 11 | % | N/A |

| WW net sales -- TTM | $ | 524,897 | | $ | 538,046 | | $ | 554,028 | | $ | 574,785 | | $ | 590,740 | | $ | 604,334 | | 12 | % |

| WW net sales -- TTM Y/Y growth, excluding F/X | 13 | % | 13 | % | 12 | % | 12 | % | 12 | % | 12 | % | N/A |

| Operating income | $ | 4,774 | | $ | 7,681 | | $ | 11,188 | | $ | 13,209 | | $ | 15,307 | | $ | 14,672 | | 91 | % |

| F/X impact -- favorable | $ | 139 | | $ | 104 | | $ | 132 | | $ | 85 | | $ | 72 | | $ | 29 | | N/A |

| Operating income -- Y/Y growth, excluding F/X | 26 | % | 128 | % | 338 | % | 379 | % | 219 | % | 91 | % | N/A |

| Operating margin -- % of WW net sales | 3.7 | % | 5.7 | % | 7.8 | % | 7.8 | % | 10.7 | % | 9.9 | % | N/A |

| Operating income -- TTM | $ | 13,353 | | $ | 17,717 | | $ | 26,380 | | $ | 36,852 | | $ | 47,385 | | $ | 54,376 | | 207 | % |

| Operating income -- TTM Y/Y growth (decline), excluding F/X | (37) | % | 10 | % | 99 | % | 197 | % | 252 | % | 205 | % | N/A |

| Operating margin -- TTM % of WW net sales | 2.5 | % | 3.3 | % | 4.8 | % | 6.4 | % | 8.0 | % | 9.0 | % | N/A |

| Net income | $ | 3,172 | | $ | 6,750 | | $ | 9,879 | | $ | 10,624 | | $ | 10,431 | | $ | 13,485 | | 100 | % |

| Net income per diluted share | $ | 0.31 | | $ | 0.65 | | $ | 0.94 | | $ | 1.00 | | $ | 0.98 | | $ | 1.26 | | 95 | % |

| Net income -- TTM | $ | 4,294 | | $ | 13,072 | | $ | 20,079 | | $ | 30,425 | | $ | 37,684 | | $ | 44,419 | | 240 | % |

| Net income per diluted share -- TTM | $ | 0.42 | | $ | 1.26 | | $ | 1.93 | | $ | 2.90 | | $ | 3.56 | | $ | 4.18 | | 229 | % |

______________________________

(1)For the twelve months ended June 30, 2023 and 2024, this amount relates to equipment included in “Property and equipment acquired under finance leases, net of remeasurements and modifications” of $696 million and $617 million.

(2)For the twelve months ended June 30, 2023 and 2024, this amount relates to property included in “Principal repayments of finance leases” of $5,705 million and $3,092 million.

(3)Free cash flow is cash flow from operations reduced by “Purchases of property and equipment, net of proceeds from sales and incentives.”

(4)Free cash flow less principal repayments of finance leases and financing obligations is free cash flow reduced by “Principal repayments of finance leases” and “Principal repayments of financing obligations.”

(5)Free cash flow less equipment finance leases and principal repayments of all other finance leases and financing obligations is free cash flow reduced by equipment acquired under finance leases, which is included in “Property and equipment acquired under finance leases, net of remeasurements and modifications,” principal repayments of all other finance lease liabilities, which is included in “Principal repayments of finance leases,” and “Principal repayments of financing obligations.”

AMAZON.COM, INC.

Supplemental Financial Information and Business Metrics

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Y/Y %

Change |

| Segments | | | | | | | |

| North America Segment: | | | | | | | |

| Net sales | $ | 76,881 | | $ | 82,546 | | $ | 87,887 | | $ | 105,514 | | $ | 86,341 | | $ | 90,033 | | 9 | % |

| Net sales -- Y/Y growth, excluding F/X | 11 | % | 11 | % | 11 | % | 13 | % | 12 | % | 9 | % | N/A |

| Net sales -- TTM | $ | 323,517 | | $ | 331,633 | | $ | 340,677 | | $ | 352,828 | | $ | 362,288 | | $ | 369,775 | | 12 | % |

| Operating income | $ | 898 | | $ | 3,211 | | $ | 4,307 | | $ | 6,461 | | $ | 4,983 | | $ | 5,065 | | 58 | % |

| F/X impact -- favorable (unfavorable) | $ | 41 | | $ | (7) | | $ | (27) | | $ | (13) | | $ | 8 | | $ | 8 | | N/A |

| Operating income -- Y/Y growth, excluding F/X | N/A | N/A | N/A | N/A | 454 | % | 58 | % | N/A |

| Operating margin -- % of North America net sales | 1.2 | % | 3.9 | % | 4.9 | % | 6.1 | % | 5.8 | % | 5.6 | % | N/A |

| Operating income (loss) -- TTM | $ | (381) | | $ | 3,457 | | $ | 8,176 | | $ | 14,877 | | $ | 18,962 | | $ | 20,816 | | 502 | % |

| Operating margin -- TTM % of North America net sales | (0.1) | % | 1.0 | % | 2.4 | % | 4.2 | % | 5.2 | % | 5.6 | % | N/A |

| International Segment: | | | | | | | |

| Net sales | $ | 29,123 | | $ | 29,697 | | $ | 32,137 | | $ | 40,243 | | $ | 31,935 | | $ | 31,663 | | 7 | % |

| Net sales -- Y/Y growth, excluding F/X | 9 | % | 10 | % | 11 | % | 13 | % | 11 | % | 10 | % | N/A |

| Net sales -- TTM | $ | 118,371 | | $ | 121,003 | | $ | 125,420 | | $ | 131,200 | | $ | 134,012 | | $ | 135,978 | | 12 | % |

| Operating income (loss) | $ | (1,247) | | $ | (895) | | $ | (95) | | $ | (419) | | $ | 903 | | $ | 273 | | N/A |

| F/X impact -- favorable (unfavorable) | $ | (174) | | $ | 32 | | $ | 228 | | $ | 160 | | $ | (3) | | $ | (94) | | N/A |

| Operating income (loss) -- Y/Y growth (decline), excluding F/X | (16) | % | (48) | % | (87) | % | (74) | % | N/A | N/A | N/A |

| Operating margin -- % of International net sales | (4.3) | % | (3.0) | % | (0.3) | % | (1.0) | % | 2.8 | % | 0.9 | % | N/A |

| Operating income (loss) -- TTM | $ | (7,712) | | $ | (6,836) | | $ | (4,465) | | $ | (2,656) | | $ | (506) | | $ | 662 | | N/A |

| Operating margin -- TTM % of International net sales | (6.5) | % | (5.6) | % | (3.6) | % | (2.0) | % | (0.4) | % | 0.5 | % | N/A |

| AWS Segment: | | | | | | | |

| Net sales | $ | 21,354 | | $ | 22,140 | | $ | 23,059 | | $ | 24,204 | | $ | 25,037 | | $ | 26,281 | | 19 | % |

| Net sales -- Y/Y growth, excluding F/X | 16 | % | 12 | % | 12 | % | 13 | % | 17 | % | 19 | % | N/A |

| Net sales -- TTM | $ | 83,009 | | $ | 85,410 | | $ | 87,931 | | $ | 90,757 | | $ | 94,440 | | $ | 98,581 | | 15 | % |

| Operating income | $ | 5,123 | | $ | 5,365 | | $ | 6,976 | | $ | 7,167 | | $ | 9,421 | | $ | 9,334 | | 74 | % |

| F/X impact -- favorable (unfavorable) | $ | 272 | | $ | 79 | | $ | (69) | | $ | (62) | | $ | 67 | | $ | 115 | | N/A |

| Operating income -- Y/Y growth (decline), excluding F/X | (26) | % | (8) | % | 30 | % | 39 | % | 83 | % | 72 | % | N/A |

| Operating margin -- % of AWS net sales | 24.0 | % | 24.2 | % | 30.3 | % | 29.6 | % | 37.6 | % | 35.5 | % | N/A |

| Operating income -- TTM | $ | 21,446 | | $ | 21,096 | | $ | 22,669 | | $ | 24,631 | | $ | 28,929 | | $ | 32,898 | | 56 | % |

| Operating margin -- TTM % of AWS net sales | 25.8 | % | 24.7 | % | 25.8 | % | 27.1 | % | 30.6 | % | 33.4 | % | N/A |

AMAZON.COM, INC.

Supplemental Financial Information and Business Metrics

(in millions, except employee data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Y/Y %

Change |

| Net Sales | | | | | | | |

| Online stores (1) | $ | 51,096 | | $ | 52,966 | | $ | 57,267 | | $ | 70,543 | | $ | 54,670 | | $ | 55,392 | | 5 | % |

| Online stores -- Y/Y growth, excluding F/X | 3 | % | 5 | % | 6 | % | 8 | % | 7 | % | 6 | % | N/A |

| Physical stores (2) | $ | 4,895 | | $ | 5,024 | | $ | 4,959 | | $ | 5,152 | | $ | 5,202 | | $ | 5,206 | | 4 | % |

| Physical stores -- Y/Y growth, excluding F/X | 7 | % | 7 | % | 6 | % | 4 | % | 6 | % | 4 | % | N/A |

| Third-party seller services (3) | $ | 29,820 | | $ | 32,332 | | $ | 34,342 | | $ | 43,559 | | $ | 34,596 | | $ | 36,201 | | 12 | % |

| Third-party seller services -- Y/Y growth, excluding F/X | 20 | % | 18 | % | 18 | % | 19 | % | 16 | % | 13 | % | N/A |

| Advertising services (4) | $ | 9,509 | | $ | 10,683 | | $ | 12,060 | | $ | 14,654 | | $ | 11,824 | | $ | 12,771 | | 20 | % |

| Advertising services -- Y/Y growth, excluding F/X | 23 | % | 22 | % | 25 | % | 26 | % | 24 | % | 20 | % | N/A |

| Subscription services (5) | $ | 9,657 | | $ | 9,894 | | $ | 10,170 | | $ | 10,488 | | $ | 10,722 | | $ | 10,866 | | 10 | % |

| Subscription services -- Y/Y growth, excluding F/X | 17 | % | 14 | % | 13 | % | 13 | % | 11 | % | 11 | % | N/A |

| AWS | $ | 21,354 | | $ | 22,140 | | $ | 23,059 | | $ | 24,204 | | $ | 25,037 | | $ | 26,281 | | 19 | % |

| AWS -- Y/Y growth, excluding F/X | 16 | % | 12 | % | 12 | % | 13 | % | 17 | % | 19 | % | N/A |

| Other (6) | $ | 1,027 | | $ | 1,344 | | $ | 1,226 | | $ | 1,361 | | $ | 1,262 | | $ | 1,260 | | (6) | % |

| Other -- Y/Y growth (decline), excluding F/X | 57 | % | 26 | % | (3) | % | 8 | % | 23 | % | (6) | % | N/A |

| | | | | | | |

| Stock-based Compensation Expense | | | | | | | |

| Cost of sales | $ | 165 | | $ | 251 | | $ | 193 | | $ | 227 | | $ | 174 | | $ | 266 | | 6 | % |

| Fulfillment | $ | 603 | | $ | 932 | | $ | 732 | | $ | 823 | | $ | 636 | | $ | 944 | | 1 | % |

| Technology and infrastructure | $ | 2,574 | | $ | 4,043 | | $ | 3,284 | | $ | 3,533 | | $ | 2,772 | | $ | 3,670 | | (9) | % |

| Sales and marketing | $ | 993 | | $ | 1,303 | | $ | 1,111 | | $ | 1,216 | | $ | 932 | | $ | 1,224 | | (6) | % |

| General and administrative | $ | 413 | | $ | 598 | | $ | 509 | | $ | 520 | | $ | 447 | | $ | 618 | | 3 | % |

| Total stock-based compensation expense | $ | 4,748 | | $ | 7,127 | | $ | 5,829 | | $ | 6,319 | | $ | 4,961 | | $ | 6,722 | | (6) | % |

| Other | | | | | | | |

| WW shipping costs | $ | 19,937 | | $ | 20,418 | | $ | 21,799 | | $ | 27,326 | | $ | 21,834 | | $ | 21,965 | | 8 | % |

| WW shipping costs -- Y/Y growth | 2 | % | 6 | % | 9 | % | 11 | % | 10 | % | 8 | % | N/A |

| WW paid units -- Y/Y growth (7) | 8 | % | 9 | % | 9 | % | 12 | % | 12 | % | 11 | % | N/A |

| WW seller unit mix -- % of WW paid units (7) | 59 | % | 60 | % | 60 | % | 61 | % | 61 | % | 61 | % | N/A |

| Employees (full-time and part-time; excludes contractors & temporary personnel) | 1,465,000 | | 1,461,000 | | 1,500,000 | | 1,525,000 | | 1,521,000 | | 1,532,000 | | 5 | % |

| Employees (full-time and part-time; excludes contractors & temporary personnel) -- Y/Y growth (decline) | (10) | % | (4) | % | (3) | % | (1) | % | 4 | % | 5 | % | N/A |

________________________

(1)Includes product sales and digital media content where we record revenue gross. We leverage our retail infrastructure to offer a wide selection of consumable and durable goods that includes media products available in both a physical and digital format, such as books, videos, games, music, and software. These product sales include digital products sold on a transactional basis. Digital media content subscriptions that provide unlimited viewing or usage rights are included in “Subscription services.”

(2)Includes product sales where our customers physically select items in a store. Sales to customers who order goods online for delivery or pickup at our physical stores are included in “Online stores.”

(3)Includes commissions and any related fulfillment and shipping fees, and other third-party seller services.

(4)Includes sales of advertising services to sellers, vendors, publishers, authors, and others, through programs such as sponsored ads, display, and video advertising.

(5)Includes annual and monthly fees associated with Amazon Prime memberships, as well as digital video, audiobook, digital music, e-book, and other non-AWS subscription services.

(6)Includes sales related to various other offerings, such as health care services, certain licensing and distribution of video content, and shipping services, and our co-branded credit card agreements.

(7)Excludes the impact of Whole Foods Market.

Amazon.com, Inc.

Certain Definitions

Customer Accounts

•References to customers mean customer accounts established when a customer places an order through one of our stores. Customer accounts exclude certain customers, including customers associated with certain of our acquisitions, Amazon Payments customers, AWS customers, and the customers of select companies with whom we have a technology alliance or marketing and promotional relationship. Customers are considered active when they have placed an order during the preceding twelve-month period.

Seller Accounts

•References to sellers means seller accounts, which are established when a seller receives an order from a customer account. Sellers are considered active when they have received an order from a customer during the preceding twelve-month period.

AWS Customers

•References to AWS customers mean unique AWS customer accounts, which are unique customer account IDs that are eligible to use AWS services. This includes AWS accounts in the AWS free tier. Multiple users accessing AWS services via one account ID are counted as a single account. Customers are considered active when they have had AWS usage activity during the preceding one-month period.

Units

•References to units mean physical and digital units sold (net of returns and cancellations) by us and sellers in our stores as well as Amazon-owned items sold in other stores. Units sold are paid units and do not include units associated with AWS, certain acquisitions, certain subscriptions, rental businesses, or advertising businesses, or Amazon gift cards.

Contacts:

| | | | | | | | |

| | |

| Amazon Investor Relations | | Amazon Public Relations |

| amazon-ir@amazon.com | | amazon-pr@amazon.com |

| amazon.com/ir | | amazon.com/pr |

Exhibit 99.2

Non-GAAP Financial Measures

Regulation G, Conditions for Use of Non-GAAP Financial Measures, and other SEC regulations define and prescribe the conditions for use of certain non-GAAP financial information. Our measures of free cash flows and the effect of foreign exchange rates on our consolidated statements of operations meet the definition of non-GAAP financial measures.

We provide multiple measures of free cash flows because we believe these measures provide additional perspective on the impact of acquiring property and equipment with cash and through finance leases and financing obligations.

Free cash flow is cash flow from operations reduced by “Purchases of property and equipment, net of proceeds from sales and incentives.”

Free cash flow less principal repayments of finance leases and financing obligations is free cash flow reduced by “Principal repayments of finance leases” and “Principal repayments of financing obligations.”

Free cash flow less equipment finance leases and principal repayments of all other finance leases and financing obligations is free cash flow reduced by equipment acquired under finance leases, which is included in “Property and equipment acquired under finance leases, net of remeasurements and modifications,” principal repayments of all other finance lease liabilities, which is included in “Principal repayments of finance leases,” and “Principal repayments of financing obligations.” All other finance lease liabilities and financing obligations consists of property. In this measure, equipment acquired under finance leases is reflected as if these assets had been purchased with cash, which is not the case as these assets have been leased.

All of these free cash flows measures have limitations as they omit certain components of the overall cash flow statement and do not represent the residual cash flow available for discretionary expenditures. For example, these measures of free cash flows do not incorporate the portion of payments representing principal reductions of debt or cash payments for business acquisitions. Additionally, our mix of property and equipment acquisitions with cash or other financing options may change over time. Therefore, we believe it is important to view free cash flows measures only as a complement to our entire consolidated statements of cash flows.

For a quantitative reconciliation of our free cash flow measures to the most directly comparable amounts reported in accordance with GAAP, see “Supplemental Financial Information and Business Metrics” in Exhibit 99.1 to this Current Report on Form 8-K.

The effect on our consolidated statements of operations from changes in foreign exchange rates versus the U.S. Dollar is also a non-GAAP financial measure. Information regarding the effect of foreign exchange rates, versus the U.S. Dollar, on our consolidated statements of operations is provided to show reported period operating results had the foreign exchange rates remained the same as those in effect in the comparable prior year period. We include various measures on both an as-reported basis and a basis showing the effect of changes in foreign exchange rates versus the U.S. Dollar in “Supplemental Financial Information and Business Metrics” in Exhibit 99.1 to this Current Report on Form 8-K.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

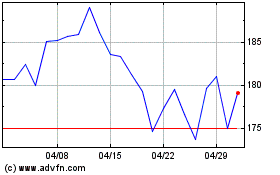

Amazon.com (NASDAQ:AMZN)

過去 株価チャート

から 7 2024 まで 8 2024

Amazon.com (NASDAQ:AMZN)

過去 株価チャート

から 8 2023 まで 8 2024