false

0001520697

0001520697

2024-07-31

2024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 31, 2024 (July 31, 2024)

Acadia Healthcare Company, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

001-35331

|

|

45-2492228

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

6100 Tower Circle, Suite 1000

Franklin, Tennessee

(Address of Principal Executive Offices)

|

|

37067

(Zip Code)

|

(615) 861-6000

(Registrant’s Telephone Number, including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

ACHC

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

☐ |

| |

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

|

| |

☐ |

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On July 31, 2024, Acadia Healthcare Company, Inc. (“Acadia”) issued a press release announcing, among other things, Acadia’s operating and financial results for the second quarter ended June 30, 2024. The press release is furnished herewith as Exhibit 99 hereto and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

| |

|

| (d) |

Exhibits.

|

| |

|

| 99 |

|

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ACADIA HEALTHCARE COMPANY, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: July 31, 2024

|

|

By:

|

/s/ Heather Dixon

|

|

|

|

|

Heather Dixon

|

|

|

|

|

Chief Financial Officer

|

|

Exhibit 99

ACADIA HEALTHCARE REPORTS SECOND QUARTER 2024 RESULTS

PROVIDES UPDATED GUIDANCE FOR 2024

FRANKLIN, Tenn. (July 31, 2024) – Acadia Healthcare Company, Inc. (NASDAQ: ACHC) today announced financial results for the second quarter and six months ended June 30, 2024.

Second Quarter Highlights

| |

●

|

Revenue totaled $796.0 million, an increase of 8.8% over the second quarter of 2023

|

| |

●

|

Same facility revenue increased 8.3% compared with the second quarter of 2023, including an increase in revenue per patient day of 5.6% and an increase in patient days of 2.6%

|

| |

●

|

Net income attributable to Acadia totaled $78.5 million, or $0.85 per diluted share

|

| |

●

|

Adjusted income attributable to Acadia totaled $83.6 million, or $0.91 per diluted share

|

| |

●

|

Adjusted EBITDA totaled $187.6 million, an increase of 7.6% over the second quarter of 2023

|

| |

●

|

Continued progress on the execution of the Company’s growth strategy, including the addition of 37 beds to the Company’s existing facilities and the opening of a 100-bed de novo facility in Mesa, Arizona.

|

Adjusted income attributable to Acadia and Adjusted EBITDA are non-GAAP financial measures. A reconciliation of all non-GAAP financial measures in this press release begins on page 8.

Second Quarter Results

Chris Hunter, Chief Executive Officer of Acadia Healthcare Company, remarked, “Acadia delivered another strong financial and operating performance for the second quarter of 2024. With solid execution of our strategy, we achieved top line revenue growth of 8.8% and Adjusted EBITDA growth of 7.6% compared with the second quarter of 2023. These results reflect continued strong demand across our business, and we remain on track to add approximately 1,200 beds in 2024 to meet the growing need for our services. Looking forward, we expect the second half to benefit from further volume growth as the facilities and beds added over the past several quarters continue to ramp.”

“We commend our dedicated employees and clinicians across our facilities who continue to provide safe, high-quality care for the growing number of patients seeking help with behavioral health and substance use issues. With service lines across the continuum of care, strong clinical quality, and a focused operating model, we are well-positioned to continue to lead the behavioral health industry and address these critical needs across the United States.”

Strategic Investments for Long-Term Growth

During the second quarter of 2024, the Company continued to advance its growth strategy. This includes the addition of 37 beds to existing facilities during the quarter, and the opening of a new 100-bed acute care hospital, Agave Ridge Behavioral Hospital, in Mesa, Arizona.

For the full year, the Company remains on track to add approximately 1,200 beds, including over 400 new beds to existing facilities, and add up to 14 new Comprehensive Treatment Centers (CTCs).

ACHC Reports Second Quarter 2024 Results

Page 2

July 31, 2024

The Company expects to open four additional inpatient facilities in the second half of 2024, including two new joint venture facilities. Acadia has 21 joint venture partnerships for 22 hospitals, with 11 hospitals already in operation and 11 additional hospitals expected to open in the coming years.

Cash and Liquidity

Acadia has continued to maintain a strong financial position with sufficient capital to make strategic investments in its business. As of June 30, 2024, the Company had $77.2 million in cash and cash equivalents and $371.5 million available under its $600 million revolving credit facility with a net leverage ratio of approximately 2.5x.

Net leverage ratio is a non-GAAP financial measure. A reconciliation of all non-GAAP financial measures in this press release begins on page 8.

2024 Financial Guidance

Acadia today revised its previously announced financial guidance for 2024. Revised guidance reflects the closure of two facilities during the second quarter(2).

| |

|

2024 Guidance Range

|

|

|

Revenue (1)

|

|

$3.180 to $3.225 billion

|

|

|

Adjusted EBITDA (1)

|

|

$735 to $765 million

|

|

|

Adjusted earnings per diluted share (1)

|

|

$3.45 to $3.65

|

|

|

Interest expense

|

|

$110 to $120 million

|

|

|

Tax rate

|

|

|

24.5% to 25.5% |

|

|

Depreciation and amortization expense

|

|

$150 to $160 million

|

|

|

Stock compensation expense

|

|

$40 to $45 million

|

|

|

Operating cash flows

|

|

$525 to $575 million

|

|

|

Expansion capital expenditures

|

|

$425 to $475 million

|

|

|

Maintenance and IT capital expenditures

|

|

$90 to $110 million

|

|

| |

|

|

|

|

|

Total bed additions, excluding acquisitions

|

|

Approx. 1,200 beds

|

|

|

(1)

|

Includes one-time state payments of approximately $10 million (or $0.09 per diluted share) for the year, of which approximately $7 million (or $0.06 per diluted share) was received in the first quarter of 2024.

|

|

(2)

|

Prior full-year guidance assumed approximately $25 million of revenue and approximately break-even EBITDA from two facilities that were closed during the second quarter.

|

The Company’s guidance does not include the impact of any future acquisitions, divestitures, transaction, legal and other costs or non-recurring legal settlements expense.

Conference Call

Acadia will hold a conference call to discuss its second quarter financial results at 8:00 a.m. Central/9:00 a.m. Eastern Time on Thursday, August 1, 2024. A live webcast of the conference call will be available at www.acadiahealthcare.com in the “Investors” section of the website. The webcast of the conference call will be available for 30 days.

ACHC Reports Second Quarter 2024 Results

Page 3

July 31, 2024

About Acadia

Acadia is a leading provider of behavioral healthcare services across the United States. As of June 30, 2024, Acadia operated a network of 258 behavioral healthcare facilities with approximately 11,400 beds in 38 states and Puerto Rico. With approximately 23,500 employees serving more than 75,000 patients daily, Acadia is the largest stand-alone behavioral healthcare company in the U.S. Acadia provides behavioral healthcare services to its patients in a variety of settings, including inpatient psychiatric hospitals, specialty treatment facilities, residential treatment centers and outpatient clinics.

Forward-Looking Information

This press release contains forward-looking statements. Generally, words such as “may,” “will,” “should,” “could,” “anticipate,” “expect,” “intend,” “estimate,” “plan,” “continue,” and “believe” or the negative of or other variation on these and other similar expressions identify forward-looking statements. These forward-looking statements are made only as of the date of this press release. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Forward-looking statements are based on current expectations and involve risks and uncertainties and our future results could differ significantly from those expressed or implied by our forward-looking statements. Factors that may cause actual results to differ materially include, without limitation, (i) potential difficulties in successfully integrating the operations of acquired facilities or realizing the expected benefits and synergies of our facility expansions, acquisitions, joint ventures and de novo transactions; (ii) Acadia’s ability to add beds, expand services, enhance marketing programs and improve efficiencies at its facilities; (iii) potential reductions in payments received by Acadia from government and commercial payors; (iv) the occurrence of patient incidents, governmental investigations, litigation and adverse regulatory actions, which could adversely affect the price of our common stock and result in substantial payments and incremental regulatory burdens; (v) the risk that Acadia may not generate sufficient cash from operations to service its debt and meet its working capital and capital expenditure requirements; (vi) potential disruptions to our information technology systems or a cybersecurity incident; and (vii) potential operating difficulties, including, without limitation, disruption to the U.S. economy and financial markets; reduced admissions and patient volumes; increased costs relating to labor, supply chain and other expenditures; changes in competition and client preferences; and general economic or industry conditions that may prevent Acadia from realizing the expected benefits of its business strategies. These factors and others are more fully described in Acadia’s periodic reports and other filings with the SEC.

ACHC Reports Second Quarter 2024 Results

Page 4

July 31, 2024

Acadia Healthcare Company, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(In thousands, except per share amounts)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

796,040 |

|

|

$ |

731,337 |

|

|

$ |

1,564,091 |

|

|

$ |

1,435,604 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries, wages and benefits (including equity-based compensation expense of $8,869, $7,348, $17,547 and $14,977, respectively)

|

|

|

419,757 |

|

|

|

386,633 |

|

|

|

837,280 |

|

|

|

777,810 |

|

|

Professional fees

|

|

|

48,050 |

|

|

|

43,803 |

|

|

|

93,738 |

|

|

|

84,928 |

|

|

Supplies

|

|

|

27,878 |

|

|

|

26,144 |

|

|

|

54,530 |

|

|

|

52,165 |

|

|

Rents and leases

|

|

|

11,889 |

|

|

|

11,725 |

|

|

|

23,752 |

|

|

|

23,149 |

|

|

Other operating expenses

|

|

|

109,690 |

|

|

|

95,912 |

|

|

|

210,763 |

|

|

|

186,750 |

|

|

Depreciation and amortization

|

|

|

36,066 |

|

|

|

32,012 |

|

|

|

72,413 |

|

|

|

63,581 |

|

|

Interest expense, net

|

|

|

29,159 |

|

|

|

20,910 |

|

|

|

56,373 |

|

|

|

40,909 |

|

|

Loss on impairment

|

|

|

1,000 |

|

|

|

8,694 |

|

|

|

1,000 |

|

|

|

8,694 |

|

|

Transaction, legal and other costs

|

|

|

6,091 |

|

|

|

9,074 |

|

|

|

8,938 |

|

|

|

15,545 |

|

|

Total expenses

|

|

|

689,580 |

|

|

|

634,907 |

|

|

|

1,358,787 |

|

|

|

1,253,531 |

|

|

Income before income taxes

|

|

|

106,460 |

|

|

|

96,430 |

|

|

|

205,304 |

|

|

|

182,073 |

|

|

Provision for income taxes

|

|

|

25,643 |

|

|

|

22,881 |

|

|

|

45,717 |

|

|

|

41,966 |

|

|

Net income

|

|

|

80,817 |

|

|

|

73,549 |

|

|

|

159,587 |

|

|

|

140,107 |

|

|

Net income attributable to noncontrolling interests

|

|

|

(2,335 |

) |

|

|

(1,250 |

) |

|

|

(4,722 |

) |

|

|

(1,793 |

) |

|

Net income attributable to Acadia Healthcare Company, Inc.

|

|

$ |

78,482 |

|

|

$ |

72,299 |

|

|

$ |

154,865 |

|

|

$ |

138,314 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to Acadia Healthcare Company, Inc. stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.86 |

|

|

$ |

0.79 |

|

|

$ |

1.69 |

|

|

$ |

1.53 |

|

|

Diluted

|

|

$ |

0.85 |

|

|

$ |

0.79 |

|

|

$ |

1.68 |

|

|

$ |

1.51 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

91,628 |

|

|

|

91,044 |

|

|

|

91,495 |

|

|

|

90,691 |

|

|

Diluted

|

|

|

92,043 |

|

|

|

91,546 |

|

|

|

92,051 |

|

|

|

91,640 |

|

ACHC Reports Second Quarter 2024 Results

Page 5

July 31, 2024

Acadia Healthcare Company, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(In thousands)

|

|

| |

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

77,167 |

|

|

$ |

100,073 |

|

|

Accounts receivable, net

|

|

|

389,374 |

|

|

|

361,451 |

|

|

Other current assets

|

|

|

178,673 |

|

|

|

134,476 |

|

|

Total current assets

|

|

|

645,214 |

|

|

|

596,000 |

|

|

Property and equipment, net

|

|

|

2,497,856 |

|

|

|

2,266,610 |

|

|

Goodwill

|

|

|

2,261,395 |

|

|

|

2,225,962 |

|

|

Intangible assets, net

|

|

|

73,348 |

|

|

|

73,278 |

|

|

Deferred tax assets

|

|

|

2,741 |

|

|

|

6,658 |

|

|

Operating lease right-of-use assets

|

|

|

123,273 |

|

|

|

117,780 |

|

|

Other assets

|

|

|

74,225 |

|

|

|

72,553 |

|

|

Total assets

|

|

$ |

5,678,052 |

|

|

$ |

5,358,841 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$ |

66,574 |

|

|

$ |

29,219 |

|

|

Accounts payable

|

|

|

159,520 |

|

|

|

156,132 |

|

|

Accrued salaries and benefits

|

|

|

134,503 |

|

|

|

141,901 |

|

|

Current portion of operating lease liabilities

|

|

|

27,010 |

|

|

|

26,268 |

|

|

Other accrued liabilities

|

|

|

158,915 |

|

|

|

532,261 |

|

|

Total current liabilities

|

|

|

546,522 |

|

|

|

885,781 |

|

|

Long-term debt

|

|

|

1,774,556 |

|

|

|

1,342,548 |

|

|

Deferred tax liabilities

|

|

|

37,031 |

|

|

|

1,931 |

|

|

Operating lease liabilities

|

|

|

104,706 |

|

|

|

100,808 |

|

|

Other liabilities

|

|

|

150,641 |

|

|

|

140,113 |

|

|

Total liabilities

|

|

|

2,613,456 |

|

|

|

2,471,181 |

|

|

Redeemable noncontrolling interests

|

|

|

111,878 |

|

|

|

105,686 |

|

|

Equity:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

917 |

|

|

|

913 |

|

|

Additional paid-in capital

|

|

|

2,665,215 |

|

|

|

2,649,340 |

|

|

Retained earnings

|

|

|

286,586 |

|

|

|

131,721 |

|

|

Total equity

|

|

|

2,952,718 |

|

|

|

2,781,974 |

|

|

Total liabilities and equity

|

|

$ |

5,678,052 |

|

|

$ |

5,358,841 |

|

ACHC Reports Second Quarter 2024 Results

Page 6

July 31, 2024

Acadia Healthcare Company, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| |

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(In thousands)

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

159,587 |

|

|

$ |

140,107 |

|

|

Adjustments to reconcile net income to net cash (used in) provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

72,413 |

|

|

|

63,581 |

|

|

Amortization of debt issuance costs

|

|

|

2,034 |

|

|

|

1,651 |

|

|

Equity-based compensation expense

|

|

|

17,547 |

|

|

|

14,977 |

|

|

Deferred income taxes

|

|

|

39,017 |

|

|

|

347 |

|

|

Loss on impairment

|

|

|

1,000 |

|

|

|

8,694 |

|

|

Other

|

|

|

(3,942 |

) |

|

|

1,086 |

|

|

Change in operating assets and liabilities, net of effect of acquisitions:

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

|

(26,114 |

) |

|

|

(23,397 |

) |

|

Other current assets

|

|

|

(14,182 |

) |

|

|

(8,743 |

) |

|

Other assets

|

|

|

842 |

|

|

|

(322 |

) |

|

Accounts payable and other accrued liabilities

|

|

|

(399,619 |

) |

|

|

21,518 |

|

|

Accrued salaries and benefits

|

|

|

(8,525 |

) |

|

|

(13,889 |

) |

|

Other liabilities

|

|

|

9,805 |

|

|

|

2,568 |

|

|

Net cash (used in) provided by operating activities

|

|

|

(150,137 |

) |

|

|

208,178 |

|

| |

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Cash paid for acquisitions, net of cash acquired

|

|

|

(50,722 |

) |

|

|

— |

|

|

Cash paid for capital expenditures

|

|

|

(296,652 |

) |

|

|

(157,359 |

) |

|

Proceeds from sale of property and equipment

|

|

|

10,209 |

|

|

|

621 |

|

|

Other

|

|

|

(2,933 |

) |

|

|

(940 |

) |

|

Net cash used in investing activities

|

|

|

(340,098 |

) |

|

|

(157,678 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Borrowings on long-term debt

|

|

|

350,000 |

|

|

|

— |

|

|

Borrowings on revolving credit facility

|

|

|

160,000 |

|

|

|

40,000 |

|

|

Principal payments on revolving credit facility

|

|

|

(15,000 |

) |

|

|

(20,000 |

) |

|

Principal payments on long-term debt

|

|

|

(25,605 |

) |

|

|

(10,625 |

) |

|

Payment of debt issuance costs

|

|

|

(1,518 |

) |

|

|

— |

|

|

Repurchase of shares for payroll tax withholding, net of proceeds from stock option exercises

|

|

|

(1,668 |

) |

|

|

(45,904 |

) |

|

Contributions from noncontrolling partners in joint ventures

|

|

|

2,970 |

|

|

|

2,516 |

|

|

Distributions to noncontrolling partners in joint ventures

|

|

|

(1,500 |

) |

|

|

(1,983 |

) |

|

Other

|

|

|

(350 |

) |

|

|

20 |

|

|

Net cash provided by (used in) financing activities

|

|

|

467,329 |

|

|

|

(35,976 |

) |

| |

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and cash equivalents

|

|

|

(22,906 |

) |

|

|

14,524 |

|

|

Cash and cash equivalents at beginning of the period

|

|

|

100,073 |

|

|

|

97,649 |

|

|

Cash and cash equivalents at end of the period

|

|

$ |

77,167 |

|

|

$ |

112,173 |

|

| |

|

$ |

- |

|

|

$ |

- |

|

|

Effect of acquisitions:

|

|

|

|

|

|

|

|

|

|

Assets acquired, excluding cash

|

|

$ |

55,678 |

|

|

$ |

— |

|

|

Liabilities assumed

|

|

|

(3,456 |

) |

|

|

— |

|

|

Contingent consideration issued in connection with an acquisition

|

|

|

(1,500 |

) |

|

|

— |

|

|

Cash paid for acquisitions, net of cash acquired

|

|

$ |

50,722 |

|

|

$ |

— |

|

ACHC Reports Second Quarter 2024 Results

Page 7

July 31, 2024

Acadia Healthcare Company, Inc.

Operating Statistics

(Unaudited, Revenue in thousands)

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

% Change

|

|

|

2024

|

|

|

2023

|

|

|

% Change

|

|

|

Same Facility Results (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

776,145 |

|

|

$ |

716,653 |

|

|

|

8.3 |

% |

|

$ |

1,532,401 |

|

|

$ |

1,409,073 |

|

|

|

8.8 |

% |

|

Patient Days

|

|

|

773,499 |

|

|

|

754,099 |

|

|

|

2.6 |

% |

|

|

1,531,489 |

|

|

|

1,495,810 |

|

|

|

2.4 |

% |

|

Admissions

|

|

|

49,091 |

|

|

|

48,727 |

|

|

|

0.7 |

% |

|

|

97,249 |

|

|

|

97,733 |

|

|

|

-0.5 |

% |

|

Average Length of Stay (2)

|

|

|

15.8 |

|

|

|

15.5 |

|

|

|

1.8 |

% |

|

|

15.7 |

|

|

|

15.3 |

|

|

|

2.9 |

% |

|

Revenue per Patient Day

|

|

$ |

1,003 |

|

|

$ |

950 |

|

|

|

5.6 |

% |

|

$ |

1,001 |

|

|

$ |

942 |

|

|

|

6.2 |

% |

|

Adjusted EBITDA margin

|

|

|

29.5 |

% |

|

|

29.5 |

% |

|

0 bps

|

|

|

|

29.1 |

% |

|

|

28.5 |

% |

|

60 bps

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Facility Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

796,040 |

|

|

$ |

731,337 |

|

|

|

8.8 |

% |

|

$ |

1,564,091 |

|

|

$ |

1,435,604 |

|

|

|

9.0 |

% |

|

Patient Days

|

|

|

791,673 |

|

|

|

771,955 |

|

|

|

2.6 |

% |

|

|

1,560,351 |

|

|

|

1,526,813 |

|

|

|

2.2 |

% |

|

Admissions

|

|

|

50,511 |

|

|

|

50,029 |

|

|

|

1.0 |

% |

|

|

99,569 |

|

|

|

99,935 |

|

|

|

-0.4 |

% |

|

Average Length of Stay (2)

|

|

|

15.7 |

|

|

|

15.4 |

|

|

|

1.6 |

% |

|

|

15.7 |

|

|

|

15.3 |

|

|

|

2.6 |

% |

|

Revenue per Patient Day

|

|

$ |

1,006 |

|

|

$ |

947 |

|

|

|

6.1 |

% |

|

$ |

1,002 |

|

|

$ |

940 |

|

|

|

6.6 |

% |

|

Adjusted EBITDA margin

|

|

|

28.1 |

% |

|

|

28.6 |

% |

|

-50 bps

|

|

|

|

27.8 |

% |

|

|

27.6 |

% |

|

20 bps

|

|

|

(1)

|

Same facility results for the periods presented include facilities we have operated for more than one year and exclude certain closed services.

|

|

(2)

|

Average length of stay is defined as patient days divided by admissions.

|

ACHC Reports Second Quarter 2024 Results

Page 8

July 31, 2024

Acadia Healthcare Company, Inc.

Reconciliation of Net Income Attributable to Acadia Healthcare Company, Inc. to Adjusted EBITDA

(Unaudited)

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(in thousands)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Acadia Healthcare Company, Inc.

|

|

$ |

78,482 |

|

|

$ |

72,299 |

|

|

$ |

154,865 |

|

|

$ |

138,314 |

|

|

Net income attributable to noncontrolling interests

|

|

|

2,335 |

|

|

|

1,250 |

|

|

|

4,722 |

|

|

|

1,793 |

|

|

Provision for income taxes

|

|

|

25,643 |

|

|

|

22,881 |

|

|

|

45,717 |

|

|

|

41,966 |

|

|

Interest expense, net

|

|

|

29,159 |

|

|

|

20,910 |

|

|

|

56,373 |

|

|

|

40,909 |

|

|

Depreciation and amortization

|

|

|

36,066 |

|

|

|

32,012 |

|

|

|

72,413 |

|

|

|

63,581 |

|

|

EBITDA

|

|

|

171,685 |

|

|

|

149,352 |

|

|

|

334,090 |

|

|

|

286,563 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity-based compensation expense (a)

|

|

|

8,869 |

|

|

|

7,348 |

|

|

|

17,547 |

|

|

|

14,977 |

|

|

Transaction, legal and other costs (b)

|

|

|

6,091 |

|

|

|

9,074 |

|

|

|

8,938 |

|

|

|

15,545 |

|

|

Loss on impairment (c)

|

|

|

1,000 |

|

|

|

8,694 |

|

|

|

1,000 |

|

|

|

8,694 |

|

|

Adjusted EBITDA

|

|

$ |

187,645 |

|

|

$ |

174,468 |

|

|

$ |

361,575 |

|

|

$ |

325,779 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA margin

|

|

|

23.6 |

% |

|

|

23.9 |

% |

|

|

23.1 |

% |

|

|

22.7 |

% |

See footnotes on page 10.

ACHC Reports Second Quarter 2024 Results

Page 9

July 31, 2024

Acadia Healthcare Company, Inc.

Reconciliation of Net Income Attributable to Acadia Healthcare Company, Inc. to

Adjusted Income Attributable to Acadia Healthcare Company, Inc.

(Unaudited)

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(in thousands, except per share amounts)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Acadia Healthcare Company, Inc.

|

|

$ |

78,482 |

|

|

$ |

72,299 |

|

|

$ |

154,865 |

|

|

$ |

138,314 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction, legal and other costs (b)

|

|

|

6,091 |

|

|

|

9,074 |

|

|

|

8,938 |

|

|

|

15,545 |

|

|

Loss on impairment (c)

|

|

|

1,000 |

|

|

|

8,694 |

|

|

|

1,000 |

|

|

|

8,694 |

|

|

Provision for income taxes

|

|

|

25,643 |

|

|

|

22,881 |

|

|

|

45,717 |

|

|

|

41,966 |

|

|

Adjusted income before income taxes attributable to Acadia Healthcare Company, Inc.

|

|

|

111,216 |

|

|

|

112,948 |

|

|

|

210,520 |

|

|

|

204,519 |

|

|

Income tax effect of adjustments to income (d)

|

|

|

27,643 |

|

|

|

28,271 |

|

|

|

49,654 |

|

|

|

51,191 |

|

|

Adjusted income attributable to Acadia Healthcare Company, Inc.

|

|

$ |

83,573 |

|

|

$ |

84,677 |

|

|

$ |

160,866 |

|

|

$ |

153,328 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding - diluted

|

|

|

92,043 |

|

|

|

91,546 |

|

|

|

92,051 |

|

|

|

91,640 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted income attributable to Acadia Healthcare Company, Inc. per diluted share

|

|

$ |

0.91 |

|

|

$ |

0.92 |

|

|

$ |

1.75 |

|

|

$ |

1.67 |

|

See footnotes on page 10.

ACHC Reports Second Quarter 2024 Results

Page 10

July 31, 2024

Acadia Healthcare Company, Inc.

Footnotes

We have included certain financial measures in this press release, including those listed below, which are “non-GAAP financial measures” as defined under the rules and regulations promulgated by the SEC. These non-GAAP financial measures include, and are defined, as follows:

| |

• EBITDA: net income attributable to Acadia Healthcare Company, Inc. adjusted for net income attributable to noncontrolling interests, provision for income taxes, net interest expense and depreciation and amortization.

|

| |

|

|

| |

• Adjusted EBITDA: EBITDA adjusted for equity-based compensation expense, transaction, legal and other costs and loss on impairment.

|

| |

|

|

| |

• Adjusted EBITDA margin: Adjusted EBITDA divided by revenue.

|

| |

|

|

| |

• Adjusted income before income taxes attributable to Acadia Healthcare Company, Inc.: net income attributable to Acadia Healthcare Company, Inc. adjusted for transaction, legal and other costs, loss on impairment and provision for income taxes.

|

| |

|

|

| |

• Adjusted income attributable to Acadia Healthcare Company, Inc.: Adjusted income before income taxes attributable to Acadia Healthcare Company, Inc. adjusted for the income tax effect of adjustments to income.

|

| |

|

|

| |

• Net leverage ratio: Long-term debt (excluding $10.5 million of unamortized debt issuance costs, discount and premium) less cash and cash equivalents divided by Adjusted EBITDA for the trailing twelve months.

|

The non-GAAP financial measures presented herein are supplemental measures of our performance and are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). The non-GAAP financial measures presented herein are not measures of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as measures of our liquidity. Our measurements of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies. We have included information concerning the non-GAAP financial measures in this press release because we believe that such information is used by certain investors as measures of a company’s historical performance. We believe these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of issuers of equity securities, many of which present similar non-GAAP financial measures when reporting their results. Because the non-GAAP financial measures are not measurements determined in accordance with GAAP and are thus susceptible to varying calculations, the non-GAAP financial measures, as presented, may not be comparable to other similarly titled measures of other companies. Our presentation of these non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items.

The Company is not able to provide a reconciliation of projected Adjusted EBITDA and adjusted earnings per diluted share, where provided, to expected results due to the unknown effect, timing and potential significance of transaction-related expenses and the tax effect of such expenses.

(a) Represents the equity-based compensation expense of Acadia.

(b) Represents transaction, legal and other costs incurred by Acadia primarily related to legal, management transition, termination, restructuring, acquisition and other similar costs.

(c) During the three months ended June 30, 2024 and 2023, we recorded non-cash impairment charges totaling $1.0 million and $8.7 million, respectively, related to the closure of certain facilities.

(d) Represents the income tax effect of adjustments to income based on tax rates of 24.9% and 25.0% for the three months ended June 30, 2024 and 2023, respectively, and 23.6% and 25.0% for the six months ended June 30, 2024 and 2023, respectively.

Investor Contact:

Patrick Feeley

Senior Vice President, Investor Relations

(615) 861-6000

v3.24.2

Document And Entity Information

|

Jul. 31, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Acadia Healthcare Company, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 31, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35331

|

| Entity, Tax Identification Number |

45-2492228

|

| Entity, Address, Address Line One |

6100 Tower Circle, Suite 1000

|

| Entity, Address, City or Town |

Franklin

|

| Entity, Address, State or Province |

TN

|

| Entity, Address, Postal Zip Code |

37067

|

| City Area Code |

615

|

| Local Phone Number |

861-6000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ACHC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001520697

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

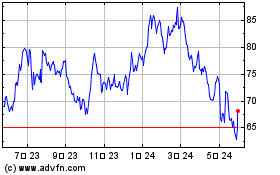

Acadia Healthcare (NASDAQ:ACHC)

過去 株価チャート

から 7 2024 まで 8 2024

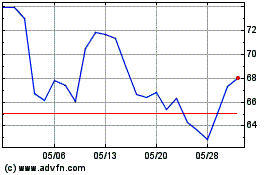

Acadia Healthcare (NASDAQ:ACHC)

過去 株価チャート

から 8 2023 まで 8 2024