UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month

of August 2024

Commission File

No. 001-38691

AURORA

CANNABIS INC.

(Translation of registrant's name into English)

2207 90B St. SW

Edmonton, Alberta T6X 1V8

Canada

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☐

Form 40-F ☒

SUBMITTED HEREWITH

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AURORA CANNABIS INC.

/s/ Miguel Martin

Miguel Martin

Chief Executive Officer

Date: August 12, 2024

Exhibit 99.1

Aurora Cannabis Announces Results of 2024 Annual

General and Special Meeting

NASDAQ | TSX: ACB

EDMONTON, AB, Aug. 12, 2024 /CNW/ - Aurora

Cannabis Inc. (the "Company" or "Aurora") (NASDAQ: ACB) (TSX: ACB), a leading Canada-based global medical

cannabis company, is pleased to announce the voting results from its Annual General and Special Meeting of Shareholders (the "Meeting")

held Friday August 9, 2024 by virtual webcast. The total number of shares represented by shareholders present in person (virtually) and

by proxy at the Meeting was 14,855,306, representing 27.23% of Aurora's issued and outstanding common shares as of the record date.

All of the matters put forward before shareholders

for consideration and approval, as set out in the Company's Management Information Circular dated June 26, 2024, were approved by the

requisite majority of votes cast at the Meeting. The details of the voting results for the election of directors are set out below:

| Name of Nominee |

Votes FOR |

% votes FOR |

Votes WITHHELD |

% votes WITHHELD |

| Ron Funk |

3,616,439 |

79.26 % |

946,218 |

20.74 % |

| Miguel Martin |

4,256,348 |

93.29 % |

306,310 |

6.71 % |

| Chitwant Kohli |

4,214,368 |

92.37 % |

348,289 |

7.63 % |

| Theresa Firestone |

3,658,118 |

80.18 % |

904,540 |

19.82 % |

| Norma Beauchamp |

4,082,278 |

89.47 % |

480,380 |

10.53 % |

| Michael Singer |

3,864,639 |

84.70 % |

698,020 |

15.30 % |

| Rajesh Uttamchandani |

3,906,540 |

85.62 % |

656,118 |

14.38 % |

Shareholders also approved the following matters:

- the appointment of Ernst & Young LLP as auditors of the Company

for the ensuing year;

- amendments to the Company's RSU Plan, PSU Plan, DSU Plan and Share

Option Plan;

- the renewal of the Company's Shareholder Rights Plan; and

- a non-binding advisory resolution on the Company's approach to

executive compensation.

The Company has filed a report of voting results on

all resolutions voted on at the Meeting under its profile on www.sedar.com.

About Aurora

Aurora is opening the world to cannabis, serving both

the medical and consumer markets across Canada, Europe, Australia and South America. Headquartered in Edmonton,

Alberta, Aurora is a pioneer in global cannabis, dedicated to helping people improve their lives. The Company's adult-use brand portfolio

includes Drift, San Rafael '71, Daily Special, Tasty's, Being and Greybeard. Medical cannabis brands include MedReleaf, CanniMed, Aurora

and Whistler Medical Marijuana Co, as well as international brands, Pedanios, Bidiol, IndiMed and CraftPlant. Aurora also has a controlling

interest in Bevo Farms Ltd., North America's leading supplier of propagated agricultural plants. Driven by science and innovation,

and with a focus on high-quality cannabis products, Aurora's brands continue to break through as industry leaders in the medical, wellness

and adult recreational markets wherever they are launched. Learn more at www.auroramj.com and follow us on X and LinkedIn.

Aurora's common shares trade on the NASDAQ and TSX

under the symbol "ACB".

Forward Looking Statements

This news release includes statements containing certain

"forward looking information" within the meaning of applicable securities law ("forward-looking statements"). Forward-looking

statements are frequently characterized by words such as "plan", "continue", "expect", "project",

"intend", "believe", "anticipate", "estimate", "may", "will", "potential",

"proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur.

These forward-looking statements are only predictions.

Forward looking information or statements contained in this news release have been developed based on assumptions management considers

to be reasonable. Material factors or assumptions involved in developing forward-looking statements include, without limitation, publicly

available information from governmental sources as well as from market research and industry analysis and on assumptions based on data

and knowledge of this industry which the Company believes to be reasonable. Forward-looking statements are subject to a variety of risks,

uncertainties and other factors that management believes to be relevant and reasonable in the circumstances could cause actual events,

results, level of activity, performance, prospects, opportunities or achievements to differ materially from those projected in the forward-looking

statements. These risks include, but are not limited to, the ability to retain key personnel, the ability to continue investing in infrastructure

to support growth, the ability to obtain financing on acceptable terms, the continued quality of our products, customer experience and

retention, the development of third party government and nongovernment consumer sales channels, management's estimates of consumer demand

in Canada and in jurisdictions where the Company exports, expectations of future results and expenses, the risk of successful

integration of acquired business and operations, management's estimation that SG&A will grow only in proportion of revenue growth,

the ability to expand and maintain distribution capabilities, the impact of competition, the general impact of financial market conditions,

the yield from cannabis growing operations, product demand, changes in prices of required commodities, competition, and the possibility

for changes in laws, rules, and regulations in the industry, epidemics, pandemics or other public health crises, and other risks, uncertainties

and factors set out under the heading "Risk Factors" in the Company's annual information form dated June 20, 2024 (the

"AIF") and filed with Canadian securities regulators available on the Company's issuer profile on SEDAR at www.sedarplus.com and

filed with and available on the SEC's website at www.sec.gov. The Company cautions that the list of risks, uncertainties and other

factors described in the AIF is not exhaustive and other factors could also adversely affect its results. Readers are urged to consider

the risks, uncertainties and assumptions carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance

on such information. The Company is under no obligation, and expressly disclaims any intention or obligation, to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable

securities law.

View original content to download multimedia:https://www.prnewswire.com/news-releases/aurora-cannabis-announces-results-of-2024-annual-general-and-special-meeting-302219499.html

SOURCE Aurora Cannabis Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2024/12/c6414.html

%CIK: 0001683541

For further information: Contacts: For Media: Michelle Lefler, VP,

Communications & PR, media@auroramj.com; For Investors: ICR, Inc., aurora@icrinc.com

CO: Aurora Cannabis Inc.

CNW 07:00e 12-AUG-24

Exhibit 99.2

ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

OF

AURORA CANNABIS INC. (the “Company”)

August 9, 2024

REPORT

OF VOTING RESULTS

Pursuant to Section 11.3 of National Instrument

51-102 Continuous Disclosure Obligations (“NI 51-102”)

In accordance with section 11.3 of NI 51-102

and following the annual general and special meeting of the holders of common shares (“Shares”) of the Company held

on August 9, 2024 (the “Meeting”), we hereby advise of the following voting results as tabulated at the Meeting:

| Total Shares issued and outstanding at record date (June 17, 2024): |

54,548,700 |

| Total Shares represented at the Meeting in person and by proxy: |

14,855,306 |

| Percentage of total Shares represented at the Meeting: |

27.23% |

1.

Number of Directors

Based on proxies received and votes calculated

by ballot during the Meeting, the ordinary resolution fixing the number of directors at seven (7) was approved with the following results:

| Votes

FOR |

%

Votes FOR |

Votes

AGAINST |

%

Votes AGAINST |

| 14,129,272 |

95.11% |

726,029 |

4.89% |

2.

Election of Directors

Based on proxies received and votes calculated

by ballot during the Meeting, the following individuals were elected as directors of the Company to serve until the next annual shareholders’

meeting or until his or her successor is duly elected or appointed, with the following results:

| Name of Nominee |

Votes FOR |

% votes FOR |

Votes WITHHELD |

% votes WITHHELD |

| Ron Funk |

3,616,439 |

79.26% |

946,218 |

20.74% |

| Miguel Martin |

4,256,348 |

93.29% |

306,310 |

6.71% |

| Chitwant Kohli |

4,214,368 |

92.37% |

348,289 |

7.63% |

| Theresa Firestone |

3,658,118 |

80.18% |

904,540 |

19.82% |

| Norma Beauchamp |

4,082,278 |

89.47% |

480,380 |

10.53% |

| Michael Singer |

3,864,639 |

84.70% |

698,020 |

15.30% |

| Rajesh Uttamchandani |

3,906,540 |

85.62% |

656,118 |

14.38% |

3.

Appointment of Auditors

Based on proxies received and votes calculated

by ballot during the Meeting, the ordinary resolution appointing Ernst & Young LLP as independent auditors of the Company until the

Company’s next annual meeting of shareholders and authorizing the directors to fix the auditor’s remuneration was approved

with the following results:

| Votes

FOR |

%

Votes FOR |

Votes

WITHHELD |

%

Votes WITHHELD |

| 14,374,818 |

96.77% |

480,481 |

3.23% |

4.

Amendment to Restricted Share

Unit Plan

Based on proxies received and votes calculated

by ballot during the Meeting, the ordinary resolution with respect to an amendment to the Company’s Restricted Share Unit Plan,

as more particularly described in the Information Circular, was approved with the following results:

| Votes

FOR |

%

Votes FOR |

Votes

AGAINST |

%

Votes AGAINST |

| 3,871,847 |

84.86% |

690,809 |

15.14% |

5.

Amendment to Performance Share

Unit Plan

Based on proxies received and votes calculated

by ballot during the Meeting, the ordinary resolution with respect to an amendment to the Company’s Performance Share Unit Plan,

as more particularly described in the Information Circular, was approved with the following results:

| Votes

FOR |

%

Votes FOR |

Votes

AGAINST |

%

Votes AGAINST |

| 3,862,694 |

84.66% |

699,961 |

15.34% |

6.

Amendment to Deferred Share

Unit Plan

Based on proxies received and votes calculated

by ballot during the Meeting, the ordinary resolution with respect to an amendment to the Company’s Deferred Share Unit Plan, as

more particularly described in the Information Circular, was approved with the following results:

| Votes

FOR |

%

Votes FOR |

Votes

AGAINST |

%

Votes AGAINST |

| 3,922,184 |

85.96% |

640,472 |

14.04% |

7.

Amendment to Share Option Plan

Based on proxies received and votes calculated

by ballot during the Meeting, the ordinary resolution with respect to an amendment to the Company’s Share Option Plan, as more particularly

described in the Information Circular, was approved with the following results:

| Votes

FOR |

%

Votes FOR |

Votes

AGAINST |

%

Votes AGAINST |

| 3,837,976 |

84.12% |

724,679 |

15.88% |

8.

Renewal of Shareholder Rights

Plan

Based on proxies received and votes calculated

by ballot during the Meeting, the ordinary resolution with respect to the renewal of the Company’s Shareholder Rights Plan, as more

particularly described in the Information Circular, was approved with the following results:

| Votes

FOR |

%

Votes FOR |

Votes

AGAINST |

%

Votes AGAINST |

| 4,034,553 |

88.43% |

528,104 |

11.57% |

9.

Advisory Vote on Executive Compensation

or “Say-on-Pay”

Based on proxies received and votes calculated

by ballot during the Meeting, the non-binding advisory resolution on the Company’s approach to executive compensation, as more particularly

described in the Information Circular, was approved with the following results:

| Votes

FOR |

%

Votes FOR |

Votes

AGAINST |

%

Votes AGAINST |

| 3,094,601 |

67.82% |

1,468,053 |

32.18% |

Each of the matters

set out above is described in greater detail in the Information Circular provided to the Company’s shareholders prior to the Meeting

and is available under the Company’s profile at www.sedarplus.ca and www.sec.gov/edgar.

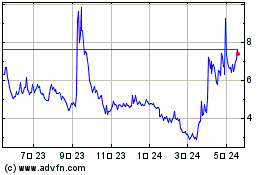

Aurora Cannabis (NASDAQ:ACB)

過去 株価チャート

から 3 2025 まで 4 2025

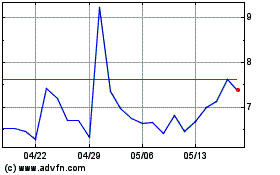

Aurora Cannabis (NASDAQ:ACB)

過去 株価チャート

から 4 2024 まで 4 2025