TIDMBID3 TIDM3BID

RNS Number : 1273Z

Leverage Shares PLC

09 January 2024

`

Leverage Shares plc

09 Janua ry 2024

N otice to the E TP Sec urityh o lders of a Mee t i ng of the

Leverage Sha res 3x Baidu E TP Securi t ies

TH IS N O T I CE IS I M PORTANT AND RE Q U I R ES THE I M M ED I

ATE A TTENTION OF THE H OLDERS OF THE ETP SECUR ITIES. IF ANY ETP

SECUR ITYH OLDER IS IN ANY D O UBT AS TO THE AC T ION TH EY SH O

ULD TAKE, TH EY SH O ULD C O N SULT TH E IR OWN I NDEPENT PR O F

ESS IO NAL ADV I SERS I M M ED I ATELY. TH IS N OTICE M AY C O NTA

IN I NS I DE I NFORMAT ION F OR THE PURP O SES OF THE M ARKET ABUSE

RE G ULATION ( EU) 596/2014.

I f you have recent ly so ld or o the r wise trans ferred your

en t ire ho lding (s) of E TP Securi t ies referred to be low, you

shou ld i mmedia tely for ward t h is document to the purchaser or

trans feree or to the stock broke r, bank or other agent through

whom the sa le or trans f er was e f fec ted for transmiss ion to

the purchaser or trans feree

Leverage Sh a res PLC

2 n d Floo r, Block 5

Ir i sh Li fe Cent re Abbey Street Lower Dublin 1

D 01 P767

Ir eland

(t he " Issue r " )

Leverage Sh a res 3x Baidu ETP Secu r i t ies ( I S I N:

XS2337092808)

(t og e ther the " R e levant Series" )

N O TICE IS HEREBY G I VEN t hat the mee t ing of the ETP Secu r

i tyholde rs of the Relevant

S eries convened by the Issuer on 8 Janua ry 2024 ( the " O r

iginal Mee ti n g ") by Notice da ted

11 Dece mber 2023 published in acco rdance wi th the ter ms of

the Trust D eed const i tuting t he Relevant Series was ad jou rned

t h rough lack of quo rum and that an ad jou rned m e e t ing ( the

"A d journed Mee t ing ") of the ETP Secu r i t yholde rs of the

Relevant S e r ies will be held at 2 nd Floo r, Block 5, Ir ish Li

fe Cent re, Abbey S treet Lower, Dublin 1, D01 P 767, I reland on

25

Janua ry 2024 at 2.30 pm Dublin t i me ( which is not less than

14 nor m o re than 42 calendar days a ft er the da te of the O r

iginal Mee t ing ). Such Adjou rned Mee t ing will be held f or the

pu rpose of conside r ing and, if thoug ht f it, passing the

resolution set out in Annex 1 he r e to, which will be proposed as

an Ext rao rdina ry Reso lution, in acco rdance with the p

rovisions of Schedule 6 ( P rovisions for Mee t ings of the ETP

Secu r i tyholde rs ) of the master trust deed originally da ted 5

Dece mber 2017 as most rece n t ly amended and restated on 16

August 2022 and as supplemen ted by a supplemen tal t rust deed da

ted 15 June 2021 ( the "Trust Deed" ) made be t ween t he Issuer

and Apex C o rpo r a te Trustees ( UK) Li m i ted ( the "Trus tee "

) and const i t u t ing the Relevant Series.

C api talised ter ms use d, but not de f ined, in this Notice

shall have the meaning given the reto in the Condi t ions of the

ETP Secu r i t ies set out the rein.

B A CK G R O UN D

O n 18 O c tober 2023 the ETP Secu r i ty Value of t he ETP Secu

r i t ies of the Relevant Series fell below 2% of the P r incipal A

mount.

C ondi t ion 8.5( A )( 1) p rovides "I f on any Valua t ion Date

(a " Thresh o ld Event Dat e ") the ETP Secu r i ty Value falls to

less than 2.00 per cen t. of the P r incipal A mou nt of t he ETP

Secu r i t ies... The Issuer shall give no t ice convening a mee t

i ng of the ETP Secu r ityholde rs on a da te not less than 30

calendar days af ter the Th reshold Event Date f or the pu rpo se

of conside r ing an Extrao rdina ry Resolution which would have the

ef fect of red ucing the P r inc ipal A mount of the ETP Secu r i t

ies to an a mount which is not less than 2.00 per cent of the E TP

Secu r ity Value as at the t i me of suspension of redemp t ions,

in which event the suspension will cease only if such Extrao rdina

ry Resolution is passed ". To da te, the Issuer has not suspen ded

red e mptions of ETP Secu r i t ies of the R e levant Series, nor

has t he Issuer convened a m eeting refe rred to in Condi t ion

8.5( A )( 1) wi thin 30 days of the Th resh o ld Rede mption Da te

(the " Fir st Mat ter " ).

C ondi t ion 8.7 ( B) p rovides " if on any Valua t ion Date

falling on or af ter t he 60 th calendar day following a Th reshold

E ven t, the ETP Secu r i ty Value is less than 2 .00 per cen t. of

the P r incipal A mount of such ETP Secu r i t ies, the Issuer

shall designate a Manda t o ry Redempt ion D a te in respect of the

ETP S ecuritie s " . To da t e, the Issuer has not designated a

Manda tory Redempt ion Event wi th respect to the Relevant Series (

the " Second Matter " ).

The Issuer is proposing to consolida te the ETP Secu r i t ies

of the Relevant Series into E TP Secu r i t ies wi th a propo rt

ionately higher value, as de tailed below. S uch consolida t ion is

reasonably exp ected to i mprove the liquidi ty of t he ETPs of the

Relevant Series for second a ry market inve s tors.

PR O P O SE D C O N S OLI DA T I ON OF T HE E TP S ECUR I T I ES

OF T HE R ELEV A NT SER I ES

The Issuer is proposing to consolida te all of the ETP Secu r i

t ies of the Relevant S e r ies into ETP Secu r i t ies wi th a p

roport ionately larger ETP Secu r i ty Value of approxi mately US$

30 .00 per ETP Secu r i ty (the "Target E TP Sec uri ty Value "),

so that for eve ry ETP Secu r i ty of the Relevant Series held by

an ETP Secu r i tyholde r, they will hold a smaller nu mber of ETP

Secu r i t ies a ft er the con solida t ion such that the resul t

ing ETP Secu r i ty Value is as close as possible to the Ta rget

ETP Secu r ity Value. The nu mber of ETP Secu r i t ies resul t ing

fr om t he consolida t ion relative to the nu mber of ETP Secu r i

t ies be f o re the consolida t ion (the " Conso lida tion R a ti o

") would be de term ined by the Issuer by refe rence to the ETP

Secu r i ty Value of the Relevant Series on a Valua t ion Date

following approval of the Consolida t ion, as shall be no t i f ied

to ETP Secu r i tyholde r s, using t he following for mula:

C onsolida t ion Ratio = Ta rget ETP Secu r ity Value / V t

Where:

V t i s the ETP Secu r ity Val ue on t; and

t i s the Valua t ion D a te determ ined and no t i f ied by the

Issuer in accordance wi th the

C ondi t ions.

The Consolida t ion Ratio will be rounded down to the nearest

full integer. If as a result of the Consolida t ion of the ETP Secu

r i t ies, an ETP Secu r i tyholder would become entitled to a fr

act ion of an ETP Secu r i ty, the Issuer will redeem such f

ractional ETP Secu r i ty. The Issuer will no t i fy the Consolida

t ion R a t io and any resul t ing f r act ional sha r es to ETP

Secu r ityholde rs in acco rdance wi th the Condi t ions no later

than t wo (2) Business Days i m m ediately following V t . (t he "

Consol ida t ion " ).

E TP Secu r i tyholde rs should be aware that it is not p

roposed to amend the P r incipal A mount applicable to the Relevant

Series propo rt ion a te to the Consolida t ion. As the Consolida t

ion wi ll result in an ETP Secu r ityholder holding less ETPs

(albeit at a p ropor t i ona tely higher ETP Secu r i ty Value ),

this will i mpact the r e turn an invest or would receive on a

Manda t o ry Redempt ion, O p t ional Redempt ion or Final Redempt

ion (a " Red emp tion Eve n t " ), if the P r incipal P rotec t ion

A m ount is higher than the P r o -r a ta Liquida t ion a mou nt at

the t i me of t he Redempt ion Event (assu m ing that the same nu m

ber of ETPs a re held at the Redempt ion Event as held im mediately

a ft er the Consolida t ion ).

The below exa mples de monst rate the i mpact t he Consolida t

ion would have ( i) on an ETP Secu r i tyholde r 's econo m ic

interest in a Series of ETP Secu r i t ies; and ( ii) on the value

of the P r incipal P rotec t ion A m oun t.

E xample 1 - i mpa ct of consolida t ion ( wi th no frac t ional

ETP Secu r i t ies) on an ETP

S ecu r i tyholde r 's economic inter est in a Series of ETP

Secu r i t ies - for illustration pu rposes only

# ETP Secu r i H ypo the t ical V alue econo m

t ies Value ic

held by an ETP per ETP Secu r i nterest

i ty

S ecu r i tyholder

------------------- ----------------- ---------------

P r e consolida 600,000 US $0 .006 US $3 ,600

t ion

------------------- ----------------- ---------------

effec t ive da

te

------------------- ----------------- ---------------

C onsolida t ion 2,000 US $1 .80 US $3 ,600

---------------

effec t ive da [ =600 ,000/300] [ 0.006*30 0]

te

------------------- ----------------- ---------------

E xample 2- i mpact of consolida t ion ( wi th f ractional ETP

Secu r i t ies) on an ETP

S ecu r i tyholde r 's econo m ic inte rest in a S e r ies of

ETP Secu r i t ies- f or illustr a t ion pu rposes only

# ETP Secu r i H ypo the t V alue econo

t ies held by ical m ic

an ETP Secu r

i tyholder

V alue per ETP i nterest

S ecu r i ty

--------------- -------------

P r e 605,000 US $0 .006 US $3 ,630

consolida t

ion

effec t ive

da te

------------

C onsolida N ew ETP 2,016 US $1 .80 US $3 ,628.80

t ion

--------------

effec t ive S ecu r i [ =605 ,000/300 [ 0.006*30 0]

da te t ies

--------------

r ounded down]

------------ ----------------- --------------- --------------

Fract ional 200 US $0 .006 US $1 .20

--------------- --------------

E TP

--------------- --------------

S ecu r i [ =605 ,000-

t ies

( 2,016*30 0 )]

------------ ----------------- --------------- --------------

E xamples 1 and 2 de m onstr a te in t wo hyp o the t i cal con

texts how a consol ida t ion would have

no i mpa ct on an inve s tor's econo m ic inte rest in a Series

of ETP Secu r i t ies.

E xample 3 - i mpact of consolida t ion on the P r incipal P

rotect ion A mount - f or illustration pu rposes only

# ETP P r i ncipal P r i ncipal To tal Value

of

P r i ncipal

P rotec t ion

A mount

S ecu r i t A m ount P r otec t ion

ies

A m ount per

ETP Secu r i

ty

------------ ------------- ---------------

P r e 600,000 US $20 US $0 .40 US $240 ,000

------------ -------------

consolida t

ion [ 2% of $20] [ 600,000*$0.40]

------------ ------------- --------------- -------------------

P ost 2,000 US $20 US $0 .40 US $800

------------ -------------

consolida t

ion [ 2% of $20] [ 2,000*$0 .40]

------------ ------------- --------------- -------------------

E xample 3 illust rates in a hypothe t ical con text t he i mpa

ct a consolida t ion would have on the total value of the P r

incipal P r o tection A mou n t. The P r incipal P rotect ion A

mount is releva nt as it would be the amount payable per ETP Secu r

ity on a Red e mption Event in ci r c u m s tances whe re the P r

incipal P rotection A mount is higher than the P ro-r a ta

Liquidation amoun t. Such a scenario m ight a r ise whe re a signi

f icant decr ease in the value of the Refe rence Asset unde r lying

the Relevant Series has occur red.

The Consolida t ion would be e ffec ted by a deed supplemental

to the Trust Deed prepa red by the Issuer and in such form as the I

ssuer conside rs necessa r y, approp r iate or expedient to give

eff ect to the Consolida t ion ( the " Consol ida t ion Supplemen

tal Trust Dee d ").

PR O P O S A L

The pu rpose of the Adjou rned Mee t ing is for the ETP Secu r i

tyholde rs to consider and, if thought f it, approve the Consolida

t ion and to waive any breaches of the Condi t ions which have occu

rred to date in relation to the Fi r st Mat ter and the Second Mat

ter ( the " Proposa l" ):

T he Issuer is a ware of 2 ho lders of E TP Secur i t ies,

together ho l d ing 2000 E TP Securi ties of the Relevant S eries,

who have ind ica ted the ir inten tion to vo te in favour of t he

Proposa l. Accord ing ly, if such ind ica t ions are co rrect and

if no other E TP Securityh o lders of the Relevant Ser ies choose

to vo te, it is an ti c ipa ted that t he Proposal w i ll ul t imat

e ly be approved.

I f the P roposal is approved by the Adjou rned Mee t ing, the

Consolida t ion would become effec t ive on such da te as shall be

no t i f ied to the ETP Secu r i tyholde rs of the Relevant S e r

ies by the I ssue r.

FORM OF T HE E X T RA O RD I N A RY RES OLU T I ON

The resolution that will be put to t he ETP Securityholde rs of

the Rel evant Series at the Adjou rned Mee t ing in o r der to pass

the P roposal is set out in Annex 1 he r e to. The P roposal is set

out in a single Ex trao rdina ry Resolutio n.

D O CU M EN TATION

T he Trustee has not been inv o lved in the formulat ion or nego

ti a tion of the Proposal (as de fined here in) an d, in accordance

w ith normal pract ice, the Trustee expresses no op inion on the

meri ts of the Proposal ( w h ich it was not involved in nego ti a

ting) or t he Extraord inary Resolu t ion (as set out here i n) and

no op i n ion on whe ther the E TP Securityh o lders wou ld be ac

ting in the ir best interests vo t ing for or aga inst the Proposal

or the Extraordinary Resolut ion but on the bas is of the informat

ion conta ined in this Notice has au tho r ised it to be s tated

that it has no ob jec tion to the Extraordinary Resolution be ing

su bmi t ted to the E TP Securityh o lders for their cons iderat

ion. T he Trus tee makes no rep resen tat ion that all relevant

informat ion has been disc losed to the E TP Secur ityh o lders in

connec tion w ith the Proposal in this N o tice or other w ise. The

Trus tee is not respon s ible for the accuracy, compl e teness, va

l idi ty or correc tness of the sta temen ts made in this Notice or

omi ssions therefrom. Noth ing in this N o tice shou ld be cons

trued as a recommenda tion to the E TP Secur ityh o lders from the

Trus tee to vo te in favour o f, or against, any of the Proposal or

the E x traord i nary Res o lut ion. The Trus tee reco mmends that

the E TP Secur ityh o lders take their own independent profess ion

al advice on the mer its and the consequences of vo t ing in favour

o f, or against, each of the E x traord inary Resolut ion and the

Proposal.

N o person has been authorised to make any recommenda tion on

beha lf of the Issue r, the Trus tee or the Issuing and Pay ing

Agent as to whe ther or how the E TP Securityh o lders shou ld vo

te pursua nt to the Proposa l. No person has been au tho r ised to

give any i n form a ti on, or to make any represen tat ion in

connec t ion there w i th, o ther than those co n tained herein. If

made or g i ven, such reco mmend a tion or any such informat ion or

representation must not be relied upon as having be en au thorised

by the Issuer, the Trus tee or the Iss u ing and Pay ing Agent.

T h i s N o tice is issued and directed on ly to the E TP Sec

uri tyholde rs of the Relevant Series and no other pe rson shall,

or is en t i t led to, rely or act on, or be ab le to re ly or act

on, its conten ts.

E ach person rece iving t h is N o tice must make i ts own an a

lys is and inves tiga tion regarding the Proposal and make i ts o

wn vo t ing decis ion, w ith pa r t icu lar ref erence to its own

inves tment ob jec t ives and expe r ien ce, and any other fac t

ors which may be relevant to it in conn ection w ith such vo t ing

decis ion. If such person is in any doubt about any aspect of t he

Proposal an d /or the ac tion it shou ld take in respect of i t, it

shou ld consu lt i ts professional advisers.

Q U O RU M A ND VOTING

The provisions gove rni ng the convening and ho lding of the

Adjou rned Mee t ings a re set out in

S chedule 6 to the Trust Deed ( P rovisions f or M eetings of

ETP Secu r i tyho lde rs ).

Q uorum

The quorum requi red at the Adjou rned Mee t ing ca lled to pass

the Ext rao rdina ry Resolution is t wo or m o re ETP Secu r i

tyholde rs or agen ts present in pe rson holding or rep rese n t

ing E TP Secu r i t ies, wha tever the nu mber of ETP Secu r i t

ies so held or rep resented.

I f a quo r um is not present wi thin 15 m inu tes f rom the t i

me ini t ially f ixed for the A d jou rned

M ee t ing, the A d jou rned Mee t ing will be dissolved.

V oting

The provisions for mee t ings of the ETP Secu r i t yholde rs is

set out in Schedule 6 of the Mas ter Trust Deed. A holder of an ETP

Secu r i ty may appoint a p roxy in acco rdance wi th the relevant

rules and p rocedu res of the Relevant Clea r ing S ystem.

I n order to exe rcise vot ing instr uct ions an ETP Secu r i

tyholder must r equest the Relevant Clea r ing Syst em to block the

ETPs of the Relevant S e r ies in his own account and to hold the

same to the order or under the cont rol of a Paying Agent not later

than 48 hou rs be f o re the t i me f ixed f or the Adjou rned Mee

t ing in order to give vot ing instructions to the relevant Paying

Agent in respect of the votes att r ibu table to the blocked

Relevant ETP Secu r i t ies. Unless an ETP Secu r i tyholder ins

truc ts other wise, the cha i rman of the Adjou rned Mee t i ng

shall be deemed to be appointed as the ETP Secu r i t yholde r 's

proxy for the A d jou rned Mee t ing. The Relevant ETP Secu r i t

ies so blocked will not be released un t il t he ea r lier of ( i)

the conclusion of the Adjou rned Mee t ing; and ( ii) in resp ect

of a form of proxy, not less than 48 hours be fore the t i me f or

which the Adjou rned Mee t ing is convened or the revo cation of

such form of p roxy whe re no t ice of such r evoca t ion has be en

given to the relevant Paying Agent. Any vo t ing instruc t ions r

eceived by the Registr ar wi th respect to the Or iginal Mee ting,

shall, unless revoked in acco rda nce wi th the p rovisions set out

he rein, remain valid f or the Adjou rned Mee t ing.

V oting instruc t ions must the r e fore be received by the Regi

s trar by 2 .30 pm on Tu esday, 23

Janua ry 2024. The de adlines set by any i n ter mediary,

broker, dealer, com mercial bank, custodian, t rust co mpa ny or o

ther no m inee institution and each Relevant Clea r ing Sys tem for

the sub m ission and ( in the li m i ted ci rcumstances whe re pe

rm it ted) revocation of voting instruc t ions may be ea r l ier

than the relevant dead lines speci f ied above. Y ou should check

wi th your relevant custodian or no m inee i m mediately to unde

rstand what ea r lier deadlines are set by your no m inee inst i t

u t ion or institu t ions.

A ny proxy so appointed or rep resenta t ive so appointed shall

so long as such appointment remains in full f o rce be dee med, for

all pu rposes in conne c t ion wi th the A d jou rned Mee t ing of

the ETP Secu r i tyholde r s, to be the holder of the ETP Secu r i

t ies to whi ch such appoint ment relates and the holder of the ETP

Secu r i t ies shall be deemed for such pu rposes not to be the

holder or owne r, respectively.

E ach question sub m i tted to the A d jou rned Mee t ing shall

be decided by a show of hands unless a poll is (be fore, or on the

declara t ion of the result o f, the show of hands) de manded by

the

chai rman, the Issue r, t he Trustee or one or m o re pe rsons

rep resenting 2 per cen t. of the aggregate nu mber of the ETP Secu

r i t ies outstan d ing.

U nless a poll is de manded, a declarat ion by the chai rman

that a r esolution has or has not been passed shall be conclusive

evidence of the fact, wi thout proof of the nu mber or propo rt ion

of the vo tes cast in favour of or against it.

I f a poll is de manded, it shall be taken in such manner and

(sub j ect as provided below) ei ther at once or af ter such ad j

ournment as the chai r man di rects. The result of the poll shall

be de e med to be the resol u t ion of t he Adjou rned Mee t ing as

at the da te it was taken. A de mand for a poll shall not prevent

the Adjou rned Mee t ing con t inuing for the t ransac t ion of

business other than the ques t ion on which it has been de mande

d.

A poll de manded on the election of a chai rman or on a ques t

ion of ad jou r n ment shall be taken at once.

O n a poll, eve ry such pe rson has one vo te in respect of each

ETP Secu r i ty of such Series of ETP Secu r i t ies so produced or

rep rese n ted by t he voting ce rt i f ica te so p roduced or for

which he is a proxy or rep rese n tative. Wi thout pre judice to

the obliga t ions of p roxies, a pe rson en t i t led to more than

one vote need not use them all or cast them all in the sa me

way.

To be passed at t he Adjou rned Mee t ing, an Ext rao rdina ry

Resolution requi res a m a j o r i ty of at least 75 per cent. of

the votes cast.

A n Extrao rdina ry Resolution shall be binding on all the ETP

Secu r i tyhol ders, whe ther or not present at the A d jou r ned

Mee t ing and each of them shall be bound to give e ff ect to it

acco rdingly. The passing of an Ext rao rdina ry Resolution shall

be conclusive evidence that the ci rcums tances jus t i fy i ts

being passed. The Issuer shall give no t ice of the passing of an

Extrao rdina ry Resolution to ETP Secu r ityholde rs wi thin 14

calendar days but failure to do so shall not invalida te such an

Ext rao rdina ry Resolut ion.

S ub ject to the qu o r um for the Adjou rned M eeting being

satis f ied and the E x trao rdina ry Resolution being passed at

the A d jou rned Mee t i ng by a m a jority of at lea st 75 per cen

t. of the votes cast and all relevant documen ts being executed,

the P roposal will become ef fec t ive and the ETP Secu r i tyholde

rs will be no t i f ied the reof by the Issuer in acco rdance wi th

the Condi t ions.

This no t ice is given by: Leverage Sh a res plc

___________________

D ated 09 J a n u a ry 2 0 24

C on tact de tai ls:

A pex IFS Li m i ted

2 n d Floo r, Block 5

Ir i sh Li fe Cent re Abbey Street Lower Dublin 1

D 01 P767

A NNE X 1

FORM OF E X T RA O RDIN A RY RES OLU T I ON

" TH AT this mee t ing of the holde rs of the Leve rage Sha res

3x Baidu ETP S ecurities of Leve rage Sha res plc cu rren t ly out

s tanding ( the " E TP Sec u r ityh o lders", the " E TP Securi t

ies"and the "Issue r" respec t ively) constituted by the master t

rust deed o r iginally da ted 5 December 2017 as most rece n t ly

amended and resta ted on 16 August 2022 and as supplemented by a

supplemental tr ust deed da ted 15 June 2021 ( the "Trust Deed" )

made be t wee n, a mong other s, the Issuer and Apex Corpo rate

Trus tees ( UK) Li m i ted (the "Trus tee " ) as tr ustee f or the

ETP Secu r i tyholde rs he reby resolves by way of E x trao rdina

ry Resol u t ion t o:

1 . assent to the Consolida t ion and to waive any breach or de

fault of the Condi t ions or any of the P rog r a mme Docu men ts

occu rr ing up to the da te he reof which has a r isen in relation

or as a consequence of the Fi r st Mat ter and/or the Second Mat

ter ( collectively the " Proposed Amendment s ") and au tho r ise

and di rect the T rus tee to concur and ag ree to the P roposed A

men d m ents and au tho r ise and di rect the Trus tee and the

Issue r, whe re applicable, to execu te t he Consolida t ion

Supplemen tal T rust Deed ( the m a tt e rs r e fer r ed to above,

the " Proposa l " );

2 . sanct ion eve ry ab rogation, modi f ication, varia t ion,

co mpro m ise or a r range ment in respect of the r igh ts of the

ETP Secu r i tyholde rs appe r taining to the ETP Secu r i t ies,

whe ther or not such r igh ts arise under the T rust Deed, involved

in or resul t ing fr om or effec ted by the P r oposal and its i

mplemen tation;

3 . au tho r ise, di r ect, reque st and e mpower the Trustee

and the Issuer to concur in the P roposal an d, in o rder to give

ef fect the reto and to i mpl e ment the same, to execu te the

Consolida t ion Supplemental T rust Deed and to execute and do, all

such other deeds, instrumen t s, acts and things as may be necessa

ry, expedien t, desi rable or ap p rop r iate to car ry out and

give ef fect to this E x trao rdina ry Resolution and the i

mplement a t ion of the P rop osal;

4 . discha rge and exonera te the T rus tee and the I ssuer fr

om all and any liabili ty for which they may have beco me or may

beco me respon s ible under the Trust Deed or the ETP Secu r i t

ies in respect of any act or o m ission in conne c t ion wi th the

P roposal, i ts i mplementa t ion or this Extrao rdina ry

Resolution and i ts i mplemen tation;

5 . i rr evocably and unconditionally waive any claim that we

may have against the Trus tee as a result of anything done or o m i

tted to be done by the Trustee in good fai th in connect ion wi th

this ( i) E x trao rdina ry Resolut ion, ( ii) the Consolidation, (

iii) the Consolida t ion Supplemental Trust Dee d, ( i v) the P

roposed A m end men ts and/ or (v) the P roposal;

6 . i ndemni fy t he Trus tee, on de man d, against any cost,

loss or liabil ity incu r red in connect ion wi th ( i) any act (or

o m ission to act) or step i mplement ing this Extrao rdina ry

Resolution, ( ii) the Con solida t ion, ( iii) the Consolida t ion

Supplemental Trust Deed, ( iv) the P roposed A mendments and/ or

(v) the P roposal; unless such cos t, loss or liabili ty has been

caused by t he Trustee's f raud, gross negligence or wil ful de fau

l t; and

7 . acknowledge that cap i talised ter ms used in this E x trao

rdina ry Resolution have the sa me meanings as those de f ined in

the Notice of Adj ourned Mee t ing an d/ or t he Trust Deed (

including the Condi t ions of the ETP Secu r i t ies ), unless o

the r wise de f ined he rein or unless the con t ext other wise

requi res."

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBDGDBRDGDGSC

(END) Dow Jones Newswires

January 09, 2024 07:28 ET (12:28 GMT)

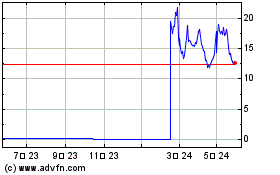

3x Bidu (LSE:BID3)

過去 株価チャート

から 10 2024 まで 11 2024

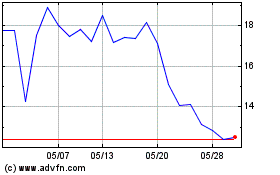

3x Bidu (LSE:BID3)

過去 株価チャート

から 11 2023 まで 11 2024