Bitcoin ETF Options Set To Supercharge Price Volatility, Expert Warns

2024年10月8日 - 11:00PM

NEWSBTC

The Bitcoin price volatility is likely to surge in both directions

following the recent approval of options for spot Bitcoin ETFs,

according to Jeff Park, head of Alpha Strategies at Bitwise

Investments. In an interview with Anthony Pompliano, Park explained

how these newly available options differ from existing crypto

derivatives and why they could significantly impact the Bitcoin

market dynamics. Why Bitcoin ETF Options Are A Game Changer Park

outlined a comprehensive thesis in the interview, noting,

“Volatility is not just a static measure of past performance; it

reflects the distribution of potential outcomes and the severity of

those outcomes.” He emphasized that the introduction of Bitcoin ETF

options will bring new dimensions to how traders interact with

Bitcoin, potentially amplifying both price rises and falls. This

volatility, he argued, stems from the unique characteristics of

options as financial instruments. Related Reading: Bitcoin’s Puell

Multiple Signals A Bullish Surge: Could A New ATH Be Near? While

Bitcoin options are not entirely new—offshore platforms like

Deribit and LedgerX already offer similar instruments—ETF options

introduce a regulated market overseen by US authorities like the

CFTC and SEC. This makes a profound difference, according to Park,

because “removal of counterparty risk is something that crypto has

not fully solved offshore.” He noted that the clearing mechanisms

provided by the Options Clearing Corporation (OCC) bring added

security to these trades, which institutional investors have long

demanded. More importantly, Park highlighted the advantage of

cross-collateralization, which is not available on existing

platforms that cater exclusively to crypto.

“Cross-collateralization allows traders to use non-correlated

assets, such as gold ETFs, as collateral in Bitcoin trades,” he

explained. This flexibility increases liquidity and efficiency in

the market. “You can’t do this on Deribit or any purely

crypto-focused platform,” Park emphasized, calling it a “huge

unlock” for the Bitcoin derivatives market. Park anticipates that

the introduction of these options will magnify Bitcoin’s price

swings. “For any well-functioning and liquid market, you need

organic buyers and sellers to create natural demand and supply,” he

explained. However, the real impact comes from how dealers hedge

their positions, especially when they are “short gamma,” a

condition where their hedging activities can intensify price

movements. In practical terms, Park said, “Dealers who are short

gamma must buy more Bitcoin as prices rise and sell more as prices

fall, thereby adding to the volatility.” This dynamic is crucial to

understanding how ETF options could push Bitcoin’s price to

extremes in both directions. He also pointed out that,

historically, most Bitcoin options activity has been driven by

speculation, rather than risk management strategies like covered

calls, which tend to reduce volatility. Related Reading: Here’s

Where We Are In The Bitcoin Bull Cycle According To The Wall Street

Cheat Sheet One of Park’s key points was the dramatic growth

potential for Bitcoin’s derivatives market. In traditional markets

like equities, the derivatives market is often 10 times larger than

the underlying spot market. In contrast, Bitcoin’s open interest in

derivatives currently represents just 3% of its spot market value,

according to Park’s figures. “The introduction of ETF options could

lead to a 300x increase in Bitcoin’s derivatives market size,” Park

predicted. This growth would bring substantial new liquidity but

would likely also drive volatility higher, due to the larger volume

of speculative trades and the structural leverage introduced by

options. “That’s an astronomical number for which there’s going to

be new flows and liquidity coming into this market which will

likely therefore add volatility,” Park stated. “In the global

economy, derivatives markets are far larger than the spot markets,”

he added, pointing to the fact that in traditional asset classes

like equities and commodities, derivatives play a critical role in

risk management and speculation. “Bitcoin is moving toward a

similar structure, and that’s where we’ll see the most significant

price movements and liquidity,” Park concluded. At press time, BTC

traded at $62,334. Featured image from YouTube, chart from

TradingView.com

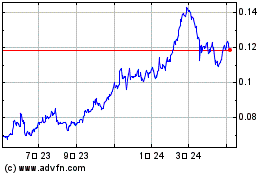

TRON (COIN:TRXUSD)

過去 株価チャート

から 10 2024 まで 11 2024

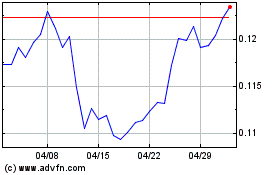

TRON (COIN:TRXUSD)

過去 株価チャート

から 11 2023 まで 11 2024