Memecoin Mayhem: ‘Hawk Tuah’ Girl Hailey Welch Faces Lawsuit After 95% Crash

2024年12月20日 - 5:30PM

NEWSBTC

Hailey Welch, popularly known as the “Hawk Tuah Girl,” has been

absent from public view for two weeks, igniting a wave of

controversy surrounding her cryptocurrency project, the Hawk Tuah

(HAWK) memecoin. Welch, who gained fame through her podcast

“Talk Tuah,” last communicated with her audience by stating she was

“going to sleep,” shortly before the value of her memecoin

plummeted by a staggering 95%. Investors Sue Hailey Welch Over

Alleged Memecoin Fraud The fallout from the rapid decline in the

Hawk Tuah token has been swift, with disappointed investors taking

legal action against Welch and several associated entities.

The lawsuit, filed on behalf of affected investors, accuses Welch,

the Tuah The Moon Foundation, OverHere Ltd., its executive Clinton

So, and coin promoter Alex Larson Schultz of orchestrating a

fraudulent “rug pull.” Related Reading: Interest Rate Cut

Impact: Bitcoin Price Reaction Unraveled With Future Projections

According to court documents obtained by Newsweek, the complaint

alleges that the “unlawful promotion and sale” of the Hawk Tuah

memecoin resulted in significant financial losses, particularly

impacting those new to cryptocurrency investing. The lawsuit

emphasizes that many investors were attracted to the Hawk Tuah

project due to Welch’s public endorsement and her influential role

in its development roadmap. It states, “The rapid decline in the

token’s value caused substantial damages to investors who relied on

Welch’s participation and the project’s stated roadmap.” Initially,

the Hawk Tuah token captured attention as part of a wave of

community-driven memecoins, buoyed by Welch’s “aggressive

promotion” across social media platforms and her podcast.

However, allegations of mismanagement and deceptive practices soon

surfaced after the token’s value collapsed almost overnight,

erasing millions of dollars in investor funds. Insider Trading

Allegations Bitcoinist reported two weeks ago that on-chain

investigator Coffeezilla accused Hailey Welch and the Hawk Tuah

team of scamming investors following the token’s launch. On

November 26, Welch had announced her partnership with the Web3

platform OverHere to launch the Hawk Tuah memecoin, claiming it

would “set to redefine the crypto space.” Upon its launch on

December 4, the token’s market capitalization skyrocketed to $500

million, only to plummet 88% within minutes as major holders

rapidly sold off their assets. As the token’s value collapsed,

investors and market analysts raised alarms about potential insider

trading and a coordinated rug pull orchestrated by the project’s

creators. Many of the affected investors were Welch’s fans, many of

whom were new to the crypto landscape. Related Reading: Ethereum To

Outpace Solana In 2025, Bitwise CIO Asserts In the wake of the

backlash, Welch revealed the token’s “Hawkanomics,” which indicated

that only 2% of the total supply was allocated for public

distribution, while 17% was designated for a “strategic allocation”

that was fully unlocked at launch and allegedly funneled to insider

wallets. During an X Space discussion, Coffeezilla confronted

the Hawk Tuah team about over $1 million in fees generated from the

token and questioned their handling of the situation. He suggested

that the sell-off was not merely the result of market snipers but

rather linked to insider trading related to the creators’ accounts.

Despite the team’s denials, Coffeezilla criticized the launch as

one of the worst he has reviewed, labeling the tokenomics as

“horrible” and calling for accountability regarding the presale

funds, which amounted to approximately $16.69 million. Featured

image from Yahoo, chart from TradingView.com

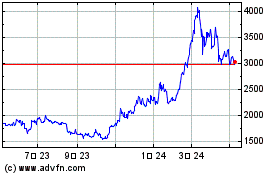

Ethereum (COIN:ETHUSD)

過去 株価チャート

から 11 2024 まで 12 2024

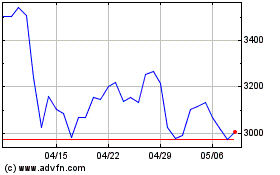

Ethereum (COIN:ETHUSD)

過去 株価チャート

から 12 2023 まで 12 2024