Ethereum ETFs Record Largest Inflows Since August Amid ETH’s Rally To $2,900

2024年11月9日 - 5:00PM

NEWSBTC

Ethereum (ETH) registered a remarkable performance following Donald

Trump’s victory in the November 5 US elections. The second-largest

cryptocurrency by market capitalization has jumped 21.9% in the

past three days, reigniting investors’ bullish sentiment for the

crypto and ETH-based investment products. Related Reading: Ethereum

L2 Project Spark Launches On-Chain Order Book On Fuel Network To

Enhance Trading Ethereum ETFs See Third Best-performing Day Amid

ETH’s price rally, spot Ethereum exchange-traded funds (ETFs) have

recorded their best-performing day in 13 weeks. Launched in late

July, ETH ETFs have seen a shaky performance in the past few

months. The crypto investment products surpassed experts’

expectations during its first two days. However, ETH ETFs recorded

massive outflows amid Q3 market retraces. Ethereum-based products

saw their second-largest single-day inflow since launch during the

early August correction. As the market recovered from the crash,

Ethereum ETFs registered $98.4 million in positive net flows, led

by Blackrock’s ETHA. Since then, the crypto products have struggled

to break past the $20 million mark, only registering inflows above

that range five times in three months. ETH’s current rally has

seemingly improved sentiment around the cryptocurrency and the

investment products based on it, as it has recorded a notable

performance during the last two days. Ethereum ETFs recorded their

best-performing day in six weeks, seeing $52.3 million in inflows

on Wednesday. Meanwhile, the investment products saw their

third-largest single-day performance on Thursday and their best day

since August 6, with $79.7 million in inflows. ETH Rallies 16%, Is

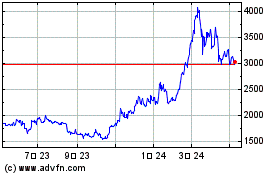

$3,500 Next? Ethereum has seen a massive 16.6% surge in the last

seven days, jumping from the $2,500 support zone to the $2,900 mark

lost mid-Q3. The “King of Altcoins” lost the $3,000 support zone in

early August, recording a 23% correction during the market

retraces. The cryptocurrency struggled to break past the crucial

$2,800 resistance level, being rejected from this level for the

past three months. However, Republican candidate Donald Trump’s

victory in the Thursday presidential elections has given the whole

crypto market a renewed push toward the second leg of the bull run.

In the last three days, the flagship cryptocurrency, Bitcoin (BTC),

has entered price discovery mode, setting its latest all-time high

(ATH) at $76,800 on Thursday. Meanwhile, Ethereum saw its price

move from the $2,400 range to near the long-awaited $3,000

resistance. Crypto analyst Rekt Capital noted that ETH’s recent

performance filled its GME gap, which formed in early August. The

gap saw ETH’s price go from $3,000 to $2,700 before crashing on

August 5. Related Reading: Solana (SOL) Looks ‘More Bullish Than

Before’ After Flipping BNB As 4th Largest Crypto Per the analyst, a

weekly close above the current levels, followed by a retest, would

confirm ETH’s breakout from the 3-month range. Moreover, reclaiming

the $2,900 resistance would “set ETH up for a move to $3,500 over

time,” which could further propel Ethereum’s rally toward its

yearly high above $4,000. As of this writing, Ethereum is trading

at $2,925, a 4.2% increase in the last 24 hours. Featured Image

from Unsplash.com, Chart from TradingView.com

Ethereum (COIN:ETHUSD)

過去 株価チャート

から 12 2024 まで 1 2025

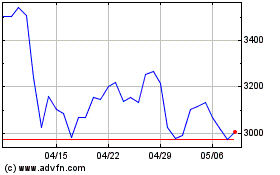

Ethereum (COIN:ETHUSD)

過去 株価チャート

から 1 2024 まで 1 2025