Over 33 Million ETH Staked As Spot Ethereum ETFs Roll Out: Up Next $4,000?

2024年7月31日 - 4:30AM

NEWSBTC

Ethereum is outperforming Bitcoin at spot rates, holding firm above

the support zone between $3,000 and $3,300. Although prices

retraced yesterday, with the July 29 bar closing with a long upper

wick pointing to weakness, ETH holders are upbeat, expecting gains

above $4,000. Roughly 30% Of All ETH Staked, Validators Stand At

Over 1 Million As Ethereum rejects lower lows and cements its place

at second in the market cap leaderboard, other developments could

spark demand in the coming sessions. Related Reading: Avalanche

(AVAX) Continues Freefall, Sheds 12% In Last 7 Days – Can It

Recover? Taking to X, analyst Leon Waidmann noted that a record 28%

of all ETH in circulation has been locked, an all-time high.

According to CryptoQuant data, as of July 29, 33.3 million ETH were

locked. Parallel data from Beaconcha.in reveals that there are over

one million validators. At the same time, over 33.6 million ETH

have been staked. Additionally, of all the validators helping

secure and process transactions, each operating node has locked

32.06 ETH on average. Holders Pulling ETH From Exchanges, Demand

From Spot Ethereum ETF Issuers While more ETH continues to be

staked, on-chain data also reveals that holders are concurrently

pulling more coins from leading exchanges. As of July 30,

CryptoQuant data shows that all crypto exchanges held just 16.6

million ETH. It is down from the 32.5 million under their control

three years ago in July 2021. Usually, the more ETH is pulled from

exchanges, the more confident holders are. Through Binance or

Coinbase, users can easily swap tokens for other assets, including

Bitcoin or stablecoins. Given this, that they are moving their

coins away from these platforms means either they are keen on

holding or engaging in other ecosystem activities like

decentralized finance (DeFi) via portals like Maker or even staking

for an annual yield. Related Reading: Bitcoin Eyes $63,000: Key

Indicators Signal Further Decline – Time To Sell? The combination

of ETH moving from exchanges and holders choosing to stake makes

the coin more scarce. Moreover, the availability of spot Ethereum

ETFs in the United States is also expected to increase the demand

for ETH. Therefore, as the coin becomes scarce, demand from this

derivative product may push prices higher. From the daily

chart, ETH has found resistance at $3,500. If the coin finds

support from around the $3,000 to $3,300 zone, ETH may likely float

higher. Feature image from DALLE, chart from TradingView

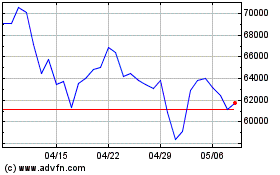

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 7 2024 まで 7 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 7 2023 まで 7 2024